This is not medical advise. This is a story about someone personal experience and his personal research to rapidly response his next occurrence and reduce potential permanent damage to his other organ due to the Covid virus. There is also no endorsement of any medical product.

In past 10 years, I’ve been compiling methods to recover from influenza virus immediately, through the use of natural remedies and techniques. Medical practitioner indeed won’t easily transcript medicine to quickly recover from influenza, rather than letting body and remedies to naturally recover. I’ve used these techniques to counter incoming yearly influenza virus. I’m normally able to recover from influenza within 3 days, most of time since then. It is an interesting time to test it with what they so called possible human made bio weapon one, the CoVid. As a disclaimer, I already had 2 Comirnaty doses within 9 months and 1 booster dose within 2 months, prior to this first Covid infection. I have no other health issue nor any known allergies/ressistance to any known product. Therefore this method may not be suitable to just anyone. Here is my own personal story.

Day 1: The Symptoms

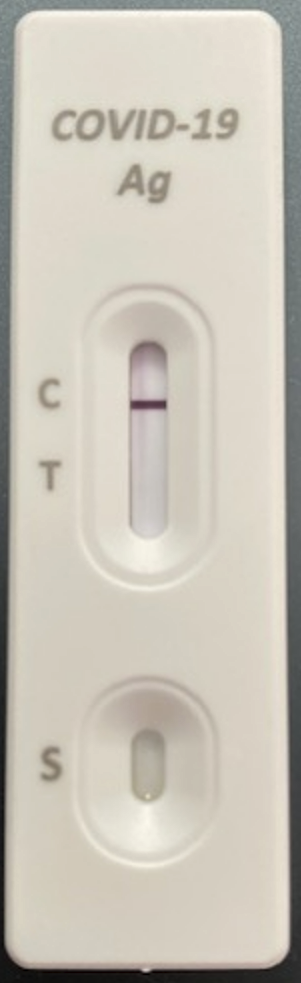

A sudden loss of energy on day 1, tired, and sleepy. I realized that when first symptom appeared, the virus should had been multiplied by millions or billions already. Their spies must have been infiltrated all across the host body, even before my defence alert systems was triggered. I’d less expectation to recover quick, but immediately preparing my influenza recovery strategies. It’s very important for me to understand that I was racing with time. First day RAT test came positive, 7 days of self-quarantine started immediately.

It started with a little fever and increasing, loosing appetite was almost immediately. From what I understand, during first few days, it’s ok to eat much less. It’s quality time and not quantity time. During this time, we need to have best possible food. Here are my best personal compiled food menu with no dietary restriction at all:

- Beef bone broth is the best so far, working flawlessly every time for my family as well. An example is original Vietnamese Pho (not modern fancy one). The fresher and thicker the broth from the beef and their bones, the better. I may have many experiments with many other meats and fishes, but it seems the beef and their bones always fit our family best.

- Chicken soup, is too classic story for influenza but I still tried this time as well. From my experience, I still feel chicken soup is much less superior compared to the thick beef bone soup. From my understanding, red meat fat might be one of most important ingredients to build primary white cells armies. Poultry white meat should have much less fat, therefore less helping my experience.

- FRUITS, I mean lots of FRESH FRUITS. I’ve been trying many different kind of fruit and their juices. Reconstituted fruit juice from supermarket may benefit than nothing. However, fresh fruits always do much better. My experience seems to do better when they are red. I learned it from fighting cancer articles during my mother battle with the cancer. Fruits or vegetables with red colour tends to have highest antioxidant and benefits, such as Strawberry, yellowish reddish Mandarin Orange, and Beetroot. Look for the RED colour.

- Lots of garlic and moderate amount of salt. I heard soldiers in past always carried away raw garlic to combat bad weather from getting influenza. Either the garlic or the salt, both of them seem to help.

- Lemon and/or Lime. This might bring the vitamin C. It seems to help in many occasion. Simply squeeze some lemon with raw honey in warm/hot water. I don’t belief much in human made vitamin C products on shelfs.

- Raw honey. Please be aware, most honey in supermarket may have more bad additive than its raw honey. Raw honey is expensive to made and won’t give enough profit to sell in supermarket. Therefore producers may add volume with cheap components like bad sugar, which is actually dangerous to health.

- Banana, Zinc, vitamin D and K. From my knowledge, Banana is full of zinc and zinc is required to build immune with help of vitamin D and K.

I recently tried Vicks first defence which must be used immediately within first 24 hours. From my last 2 experience, this seems to work very little, more like nothing, other than making the virus mad. I read it could change PH level around nasal area to give uncomfortable environment for virus from multiplying easily. At least I gave them some resistance and can trigger nasal to produce more liquid to prepare for a big flush out.

After few minutes applying the spray, there would be much more snot around; here came my regular nasal rinse practice, working well for me so far in many years. It doesn’t clear out all or kill all virus immediately, but it helps to flush most of them out. With frequent flush, at the end, they will run out of resources to multiply. They grew exponentially with time but every flush should remove most of them almost immediately.

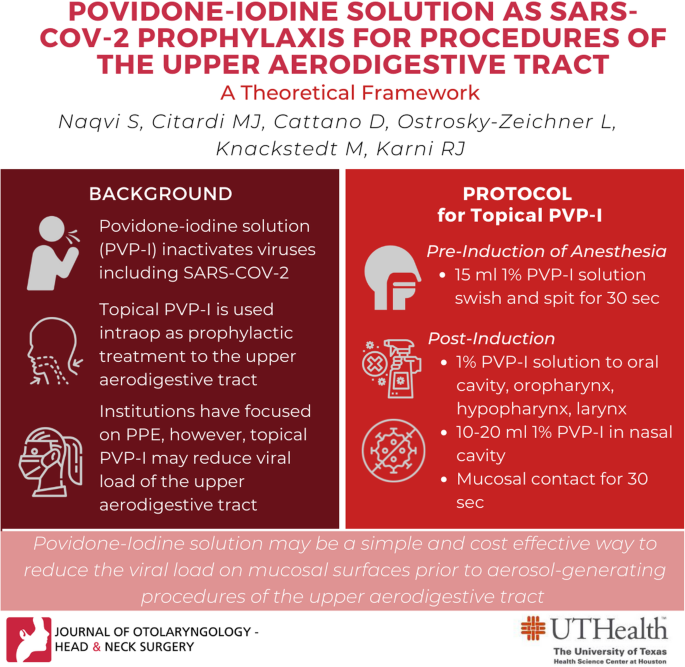

Therefore my strategy was to make them uncomfortable with PH level, reduce their exponential grow, forcing nasal to produce more mucus, and then boom, flush them out, most of them, with lots of water. There’s no way our body could naturally produce so much liquid every time, therefore I believe nasal rinse was very important in my recovery. Always important to remember, the bottle must be cleaned trough fully with soap and the water must be boiled very well and cooled down properly and/or filtered if necessary. No hot or warm water (only room temperature water) is suggested to avoid more inflammable area for the virus to easily penetrate. We must also avoid any unnecessary infection due to dangerous bacteria, especially since we are dealing with very delicate and sensitive nasal area. That’s why, I added 1-2 drops of diluted Iodine, very small that is enough to guarantee safety use. Other than high probability of helping to terminate the virus, it’s very effective to kill bacteria that may complicate my personal vendetta against the virus

I usually take 3-4 bottles each time with a very little drop of iodine to help. I don’t have enough knowledge about medical effect of iodine. I believed a lot of nasal passage area was bleeding due to virus inflammation and therefore iodine should also help a lot in here to protect them from new virus/bacteria. I use FLO and their refill sachets since it’s more convenient. I usually repeat this frequently, especially during first week of infection.

Take one shot first and let the nassal soaked in water for 30 seconds. After that, continue with flushing the whole bottle. Repeat to next bottle after giving some 30 seconds delay. You might be surprising with how much yellow dead corps of our immune armies together with same amount of virus being removed, A LOT. If we don’t help with nasal rinse, they might be left dried for longer period of time or can easily hide.

I realize this CoVid has strange symptom of sore throat that’s not common from my influenza experience. I use sore throat spray. I don’t use frequently. I worked like a charm for me, 3-4 sprays and it’s gone. It’s very important to keep inflammable throat and nasal recovers and protected back quick.

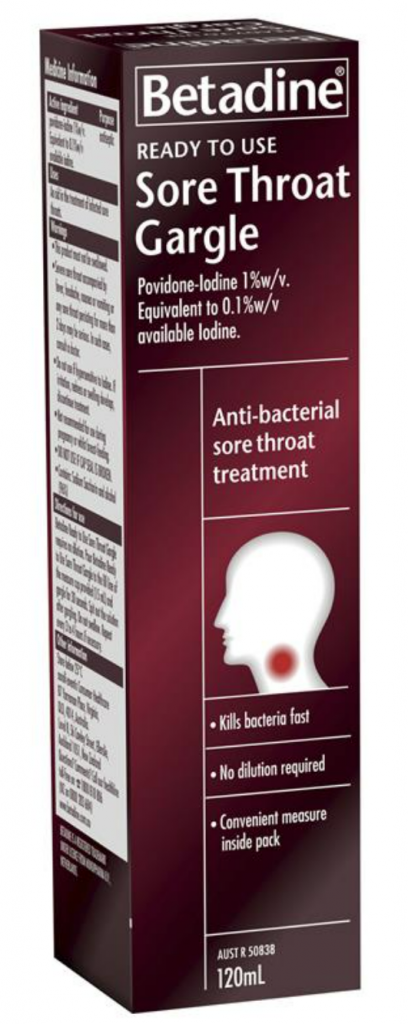

During this war, we should always maintain hygiene high. Take frequent tooth brush, and ear cleaning too since they are all connected. Frequently, my family uses Betadine sore throat gargle. This is one of the trick! Based on some scientific research, iodine may be able to kill VIRUS in 30 seconds. However this research might be widely disputed, rather than being used to help. I could no longer read any anti viral from the box like before, but the iodine was all I need. From my knowledge, there is no other substance that is safe for our skin layer which can terminate virus safely (not bacteria). I hear, there is a risk of iodine when it comes inside the body or above some safety level. Regardless, I was not going to drink it and it will stay outside skin layer with proper dilution. Safety use and level of Iodine (keep them above and outside skin layer) is my second best weapon to terminate the virus. The virus has 2 sides of massive bombings, one from inside (immune, food, etc) and one from outside (Iodine killer, PH level and frequent flush out).

At end of the day, here came the headache. Compared to normal influenza, yes this CoVid headache was pulsating, on-off, and very sharp. In my case, I think the virus was trying to inflame/break my nasal skin layer very hard with their hypersonic missiles. I usually never took any paracetamol but this time I decided to take one 1000 mg paracetamol therefore I could sleep well, without any pain.

Day 2: The Bad Day

Second day of RAT result was very obvious with two thick of double lines. The headache came on and off. I still won’t take any pain killer, like paracetamol, since they are not good for health, won’t train our life fighting spirit, and not supporting our immune at work. At the end of the day, I only took half of 1000 mg or just 500 mg of paracetamol. I preferred Lemsip powder, since it’s working very fast and I could stop when I need to. It’s also a calming hot drink. The fever was gone at the end of the day which might mean the immune already found their important targets, rather than just targeting everywhere like muscle (muscle pain) or brain (headache).

As usual, the Virus tried to inflame nasal passage (nasal congestion/stuffy nose). When nose is blocked, we have to breath with mouth. That’s when throat got dried easily, inflamed, and the virus could easily penetrate the inflamed throat skin layer and then may potentially invade the lung. This is where I prefer to have early start with cough medicine, even though there was no cough symptoms yet. The reason is, I believe we must protect LUNG at any cost, with such as little effort of cough medicine. I think cough medicine will lubricate the lung and make it hard for the virus to invade and also to flush them out more frequently with making it more sensitive. From many past experience, early use of cough syrup significantly reduces probability of having very long cough, after the runny nose. Same to my daughter, taking cough medicine since first symptomn, even-though there’s no sign of cough, again helping to avoid any bad cough after runny nose.

One good practice is also to use humidifier and hot shower. This might create asthma problem for some people but again in my case, I have no other health problem. I just want to get rid them as quickly as possible and reduce potential permanent damage to any other of my organ.

Other good practice is to keep Windows open wide with lots of air flow and sun light. This should help to minimize re-infection.

Sleep sleep and sleep. I found sleep during CoVid is more beneficial, than when it is in influenza. Another important practice is also to stay away from stress. I believe a simple meditation is as beneficial as sleeping. Sleeping might not have good quality when its unconscious mind is stressed/not sleeping. Regular meditation may programme unconscious minds away from the stress.

- think about your breathing, 10 seconds breath in, 5 seconds hold, and 10 seconds breath out

- think about nothing, think about your existence, try to merge with nature. Everything else is not important.

I can feel, stress can be very important factor to play in this situation. It can help to recover quick or push it to worst. At the end of the day, money is much less important than our health.

Day 3: The Lung, The Stomach, The Kidney and The Heart, It is the CoVid Enzyme.

Here came an upset stomach. I could feel I almost wanted to vomit one time. The virus tried to keep me away from the water. I always carried a bottle of water and sip slowly. Body needed lots of liquid to throw them away out. I tried to understand reason of the stomach upset which I never had before in any of my influenza symptoms. I think it’s because the CoVid virus has very dangerous enzyme in their body and my stomach was trying very hard to throw them out. The dangerous enzyme may have some link to CoVid organ damages, like scientifically seen damage to kidney and heart, or some to brain, in very rare cases.

Therefore what I needed was lots of tissue and plastic bags. Spit and threw away any liquid that potentially had any virus from entering stomach, as maximum as possible. It worked almost immediately. The stomach upset was gone immediately and never happened again. At the end of third day, 72 hours since the first symptom, I started to see the immune took over winning line very rapidly, just like that.

I was actually surprised, the recovery was much quicker than my experience with influenza. Covid in my family case was all pretty much short lived. My daughter was able to recover within 36 hours only. She was 7 years old and only had one Corminaty dose within a month or two. Eventhough children were said to recover quick, my daughter might carry very little auto immune gene. She had experience of recovery from measles within 18 hours with very high fever and from very bad food poisoning in less than a day. All of her influenza experience were not able to stay longer than 36 hours. She usually took Sambucol but I think we always gave her red coloured fruits daily, e.g. Strawberry and other fruits.

Possibly since I kept same practices from day one, my recovery was consistent and rapid. I might declare myself winning the game at the end of day 3. I read an article, the Virus could stay dormant until day-5 and flared up immediately to worst state like lung collapse etc. I waited carefully until day-5 while keeping all same practice and seemed there’s no sign that they would come back anytime soon. I win this first infection in 3 days. On day 4 and 5, I was craving for lots of meats (lambs, beef, etc) and seems my food appetite came back up stronger.

On day-6, for my own curiosity, I did another RAT test and I’s right, it’s gone, just like that! Is that all the mighty novelty virus? Its headache, fever, and stomach ache might be a little bit more, but I feel it’s just too much hyped from what I heard from news. Take it easy and until next time!

Any idea in this blog and website are my personal own. They are not any professional advise. They are not medical advise.