There comes a time when we heed a CERTAIN CALL

When the world must come together as one

The greatest gift of all

If a dead cross occurs in $DXY, we might see it drop to 101, with a further possibility of reaching 96. It’s possible that people underestimate the impact of $DXY falling to 96, which may cause very high inflation to the world. In line with my previous article, there’s a substantial effect backlog of money accumulated over the past decade of quantitative easing, which I’ve been observing for the past 5 years.

I believe the $DXY dead-cross possibility might be linked to the outcome of the US China restoration progress, determining whether they can successfully address their decades-long issues. Few people are aware of the extent of potential from the restoration. I will continue to monitor the situation over time.

I suspect that bringing China’s rebound into reality is crucial, especially considering that the Bank of Japan and Europe have continuously been reaching their limits and are beginning to shift their policies. China would require USD to facilitate their easing and rebound, and the US needs China to absorb a portion of the inflation that could impact their economic systems. This collaboration could reduce the severity of USD easing, support long-term debt, and revive their long-lost long-term economic vehicles. Although differences (e.g. Taiwan and South China Sea) may continue to persist, the economic dynamics of the old days could bring peace to the world through the bond between the two largest economies.

I am still focusing on the magnificent seven and specific commodities to be my top picks, mainly ones with strong financial supports, and I may rather want to elevate these to another higher level. The commodities still remains largest (>90%) since early October as explained in here and here. There is a high potential for a massive bull flag from the magnificent seven, supported by a strong positive divergence and a rare golden cross in the premium area. This suggests that a very strong force is currently in the making. My primary reasons for the elevation are:

- My own thesis since September, the Fed has concluded its rate increases. Another rate hike would only unnecessarily bring down the entire market while navigating short-term turbulence of inflation.

- Recent change in Treasury issuance distribution.

- Lower official inflation number. If the real inflation in the market is higher and it suggests/conditions unchanged or lower interest rate, current rate may be perceived as effectively too low, potentially only supporting further market easing condition.

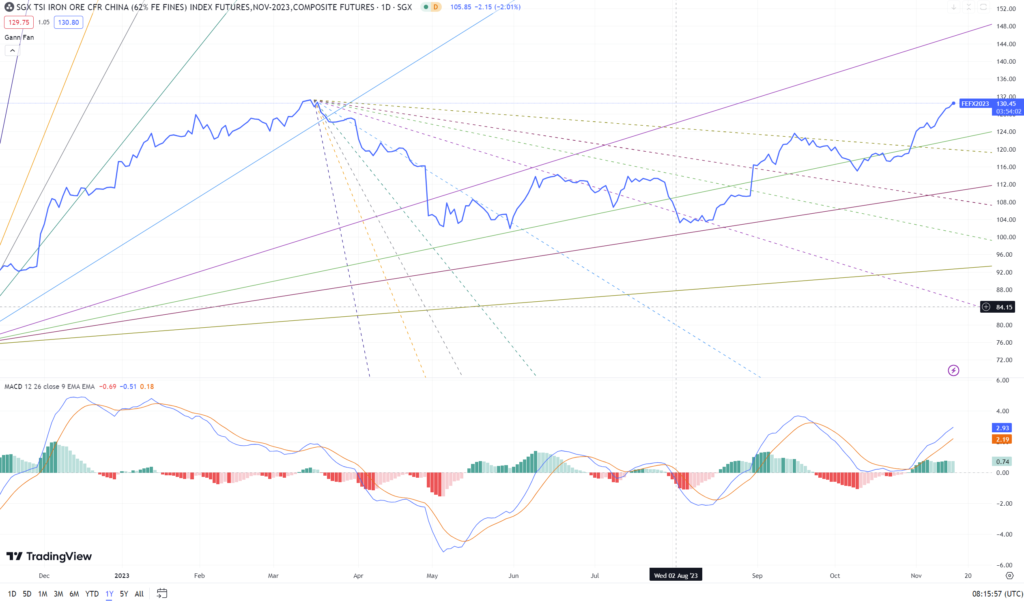

Even though I suspect there will be some kind of deal and control over Iron Ore to prevent it from spiralling out of control further, this price of $130 may likely already offer one of the decade’s very high profit margins, supported by the current AUDUSD situation.

I’m not particularly concerned about the interest growth from the existing debt in the US. It is consistently refinanced internally, so the additional interest in the next 1-2 years is not substantial, perhaps around only 200-300 billion US dollars per year. The recent Treasury decision to shift their distribution from more bonds to more bills suggests that they may have struck a new deal, limit or made a decision to support risk assets. I would not be surprised if the Fed is also willing to provide additional support with a reduced Quantitative Tightening (QT). However, as indicated in an article from a few months ago, the Fed might be hesitant to take such action.

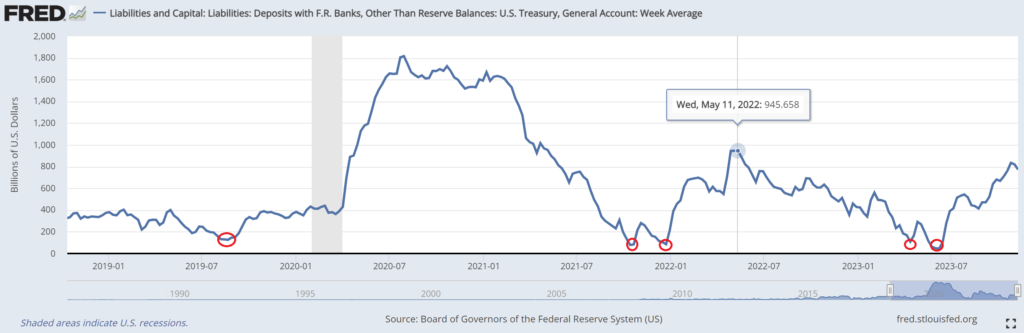

I suspect that a significant amount in the Treasury General Account (TGA) is also likely offering ample reassurance to both my mindset and the decision-makers among global leaders, disregarding debates about the appropriate levels of Reverse Repurchase Agreements (RRP) and reserves within the systems.

The amount of debt interest can also easily decrease if the Fed decides to cut the interest rate. However, I suspect that the economy will remain robust for a much longer period, especially with the emergence of a new potential cooperated economy, and the lower USD is likely to persist for an extended duration. Of course, the possibility of a recession, hard-landing, and a soft-landing, all still exists. Currently, I maintain an optimistic outlook and stay vigilant in monitoring its progress. In my opinion, a recession and a hard landing, during a robust economy, simply hold no sway against the sheer power of a lower denominator USD.

I observe similar indications with $TLT. It demonstrates a high potential for positive divergence across the bottom of wave 3. If $TLT establishes a golden cross and breaks the bottom of (3), there is a strong possibility of it becoming the long-awaited number (5). Although I’m still not actively participating in long bonds, I view this as an indicator of much fewer issues for a risky asset rally.

Over the past four decades, I have lived and studied emerging countries and have witnessed numerous attempts to manipulate their economic data, particularly regarding inflation. Between 2010 and 2015, there was a notable instance where a country experienced housing inflation of over 100% within five years, yet officially reported an inflation rate of 0.07% year on year, resulting in a memorable laughable moment among economists. They couldn’t be more serious because, coincidentally, it was announced at the same time as the release of one of James Bond 007 movie series. I believe that official economic figures are considered a matter of national security, especially concerning national debt purchases, leading to the routine practice of re-engineering these numbers.

Whether one likes it or not, a persistent weaker currency strength is a fundamental indicator of higher inflation. Inflation is heightened due to limited resources. Over the past 10 years, when the AUDUSD dropped by 36%, we witnessed a massive increase in prices, yet the official inflation numbers remain relatively low. The inflation of certain products does not need to occur immediately; it may take a number of years and varies among different products. However, the impact is obviously inevitable. Hence, to mitigate their impact or conceal them from economic activity, a stable pairing with other countries is necessary, while losing value.

To bolster my scepticism, we can readily observe substantial inflation in everyday consumer spending, even as the official inflation rate remains lower, irrespective of any debate over their respective weights. In environments characterized by high inflation, it is common to employ special treatments to compensate for losses indicated by the inflation numbers. In my personal theory and observation, during such times, these numbers are often re-engineered to align with the legal aspects of the deal. Typically within the high echelons of official ranks.

In summary, in my opinion, we should distinguish between a high-quality rally and less quality one. The QQQ performance in H1 2023 impressed me significantly, especially because they were rallying with a stronger USD currency. A current rally with a weaker currency does not impress me as much, as even an item like a ham and cheese croissant can experience multiple price rallies. It is much easier to drive up asset prices by simply devaluing the currency. However, regardless, a rally is still a rally, and hope to continue into Christmas.

There’s a place in your heart

And I know that it is love

And this place could be much

Brighter than tomorrow

Please note that all ideas expressed in this blog and website are solely my personal opinions and should not be considered as financial advice.