Recession might be inevitable! We don’t choose our time. We prepare, we fight.

Following our previous plans, we are expecting to sail recession with our own strategies.

Fed research found 3 strong historical correlations in regards to recession:

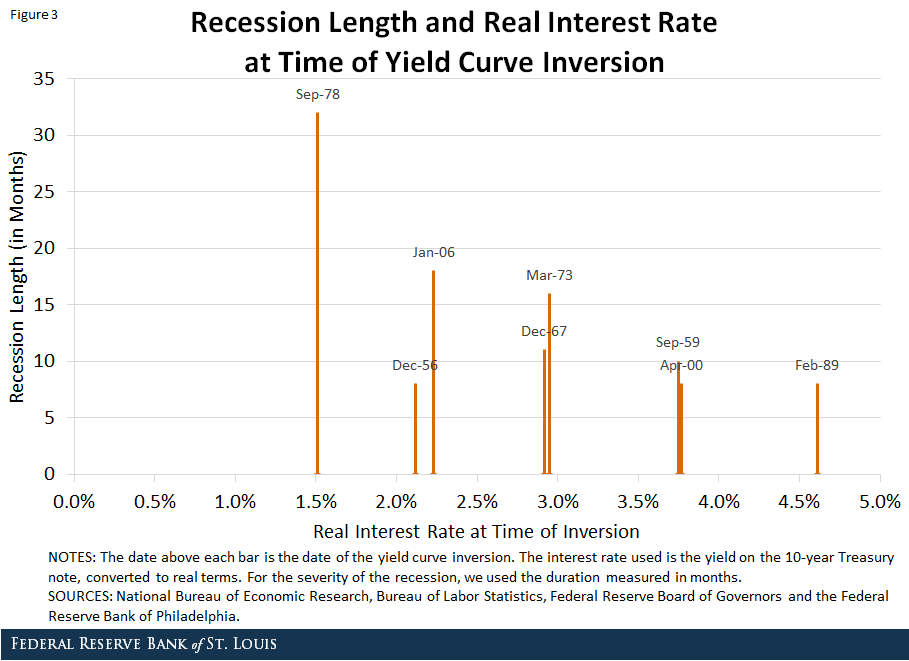

- #1: Figure 3. The lower the level of the real interest rate, the longer or deeper the recession that follows a yield curve inversion.

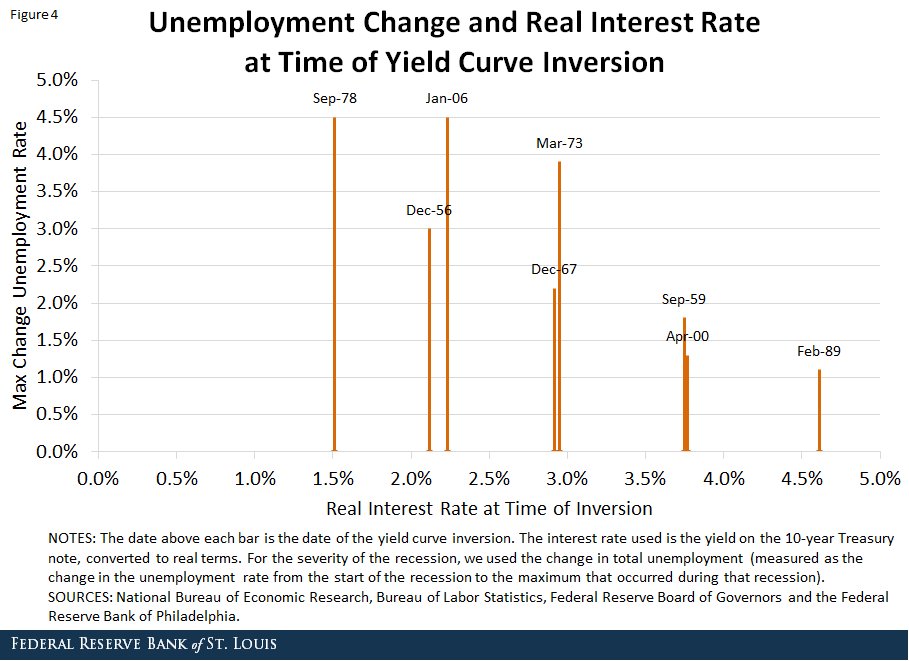

- #2: Figure 4: The lower the level of the real interest rate, the bigger maximum employment. However there’s a tendency that max unemployment is being capped, unlike recession length/severity.

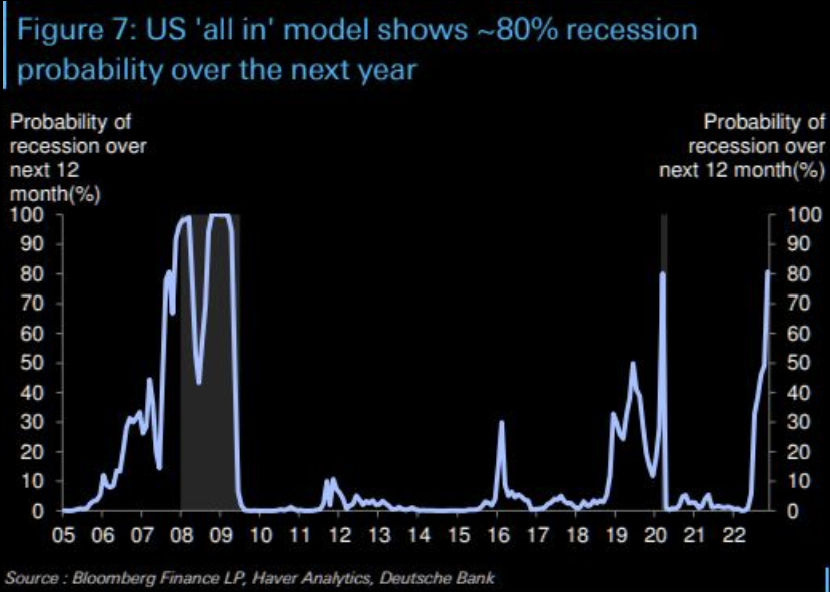

- #3: The lower the level of the real interest rate at time of inversion, the recession is likely inevitable.

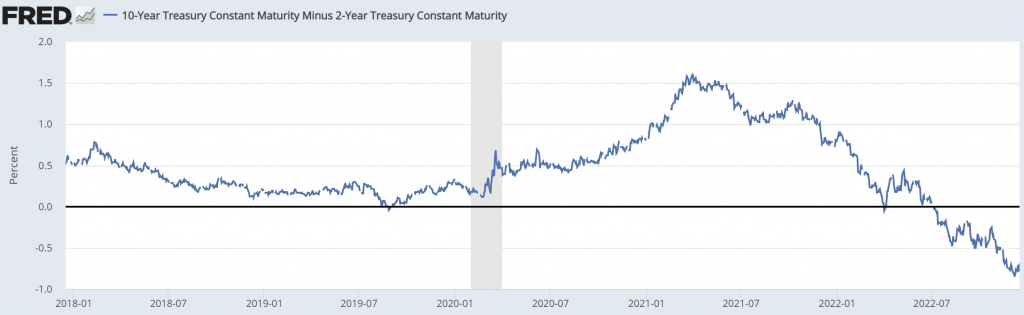

Yield curve was inverted around early July 2022 with 10y real interest rate that time was around 1%. Therefore based on this historical correlations:

- We might see hard/long recession which may last 3 years, unless there’s a crash in economy. The 3 years number looks to match yield curve recovery.

- We might see maximum unemployment of 4.5% over 3 years of period. Unemployment may rise slowly.

- The recession is likely inevitable.

While people are expecting easing from RRP and TGA, in my opinion, they shouldn’t.

- RRP is mostly owned by big banks and funds, in which in previous history of 2009-2019 printing cycle, they preferred to circle money among themselves, rather than to inflate people. Therefore we think they would rather use the RRP saving for their own good (avoid crash in economy), receiving free high interest, rather than to support deflated economy.

- TGA may find their support, just like recent 1.7T$ omnibus budget approval. With US debt limit at sky high and interest is expected to stay high for long years, their interest is exploding. Therefore I think there will be a rather tendency to have debt limit drama, limiting current democrats ability to inflate economy further.

With our main thesis that inflation will be sticky high for many years, the easiest way to support market is to use public economy number one or their currency. We may see DXY to stay weaker to maximum 95, unnecessary to fall quick.

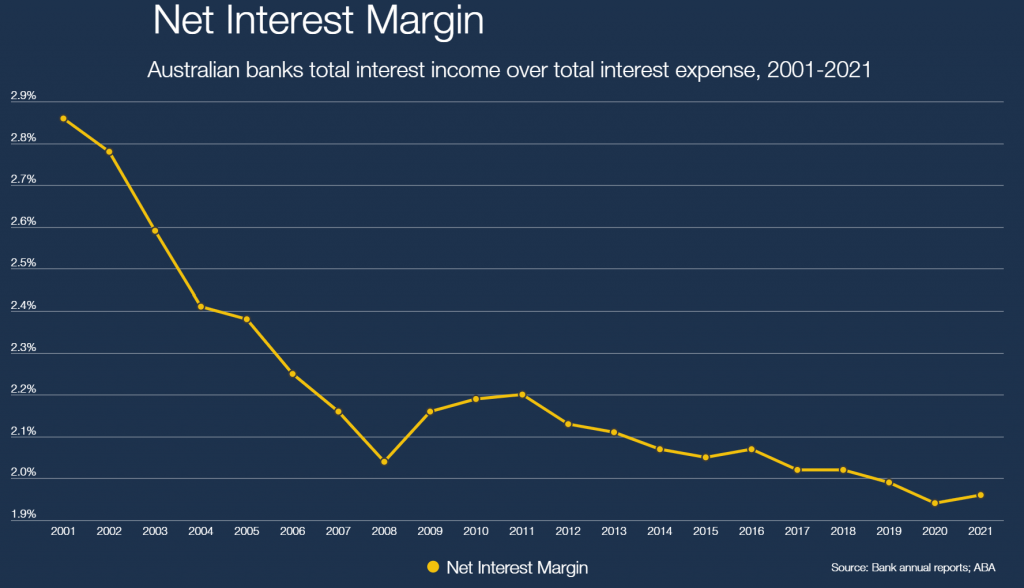

Would it cause GFC? It doesn’t look likely. Banks enjoy higher margin from higher interest. As long as recession is “affordable”, banks are still making profit. This supports our above thesis that the recession will be long and severe. Once economy is unable to afford recession, bank NMI will drop further low. That’s when I expect Central Banks to start pivoting, which is expected to be around year 2024-2025. During that time, people will lose their asset value over interest payment to the banks.

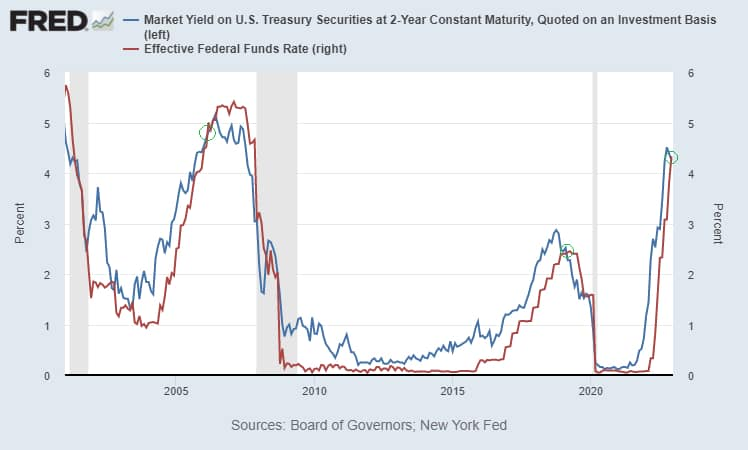

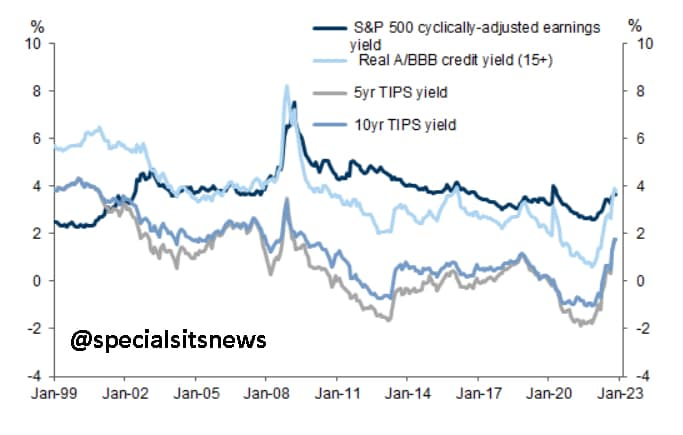

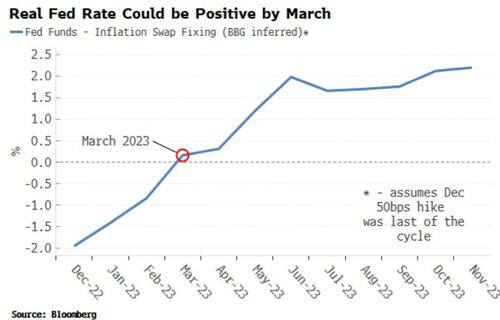

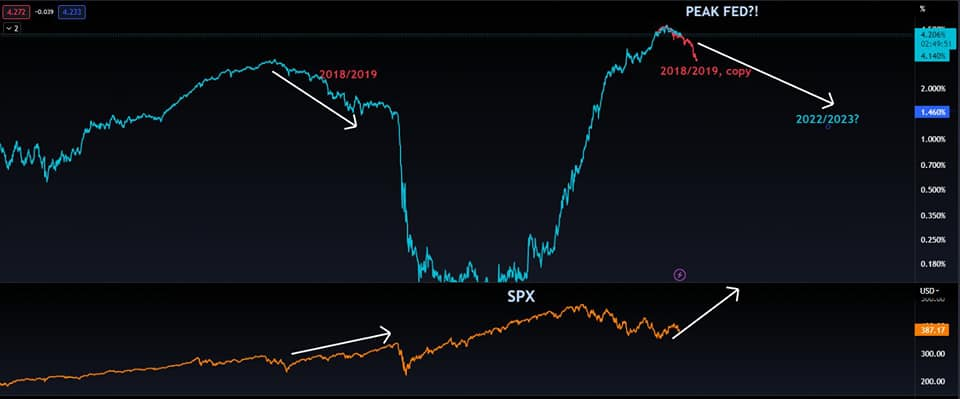

We may also look into 2y vs short term or how much money will move from market into banking systems in advanced countries. If Fed short term 3m ~ overnight exceeds 2y, then we start to see economy takes impact from the Fed move, because money will start flowing from economy to the bank. S&P is only returning 3.5%, therefore if Fed continues to increase rate (3.25%) or 2y is falling with Fed holds rate, money will move from economy and shares into bond/risk off. We can also look into our previous article that government bonds are currently on their face value. If inflation is higher, then gov bonds will be under their face value, offering guarantee to make money beyond their coupon. We expect to see real rate becoming positives in March 2023 or bond is performing better vs inflation.

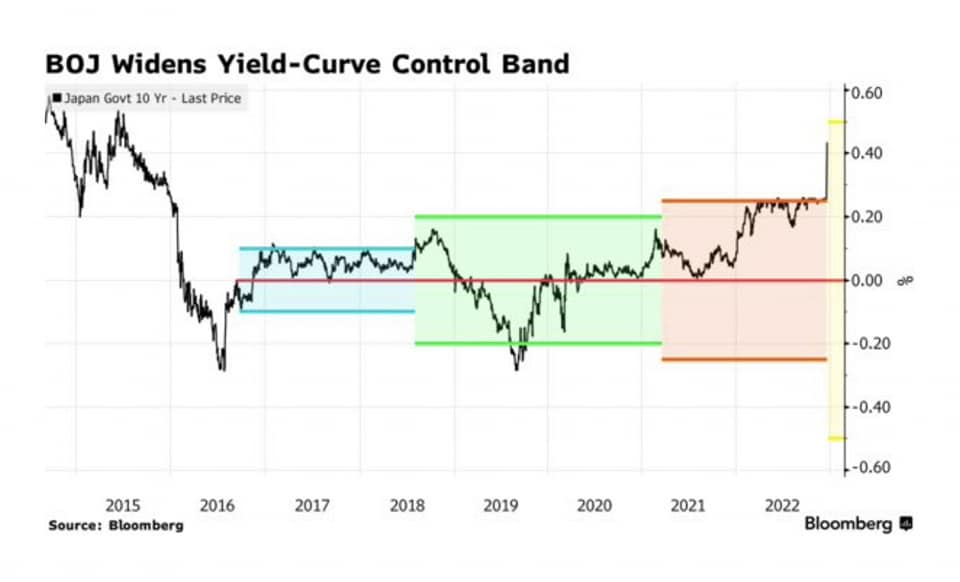

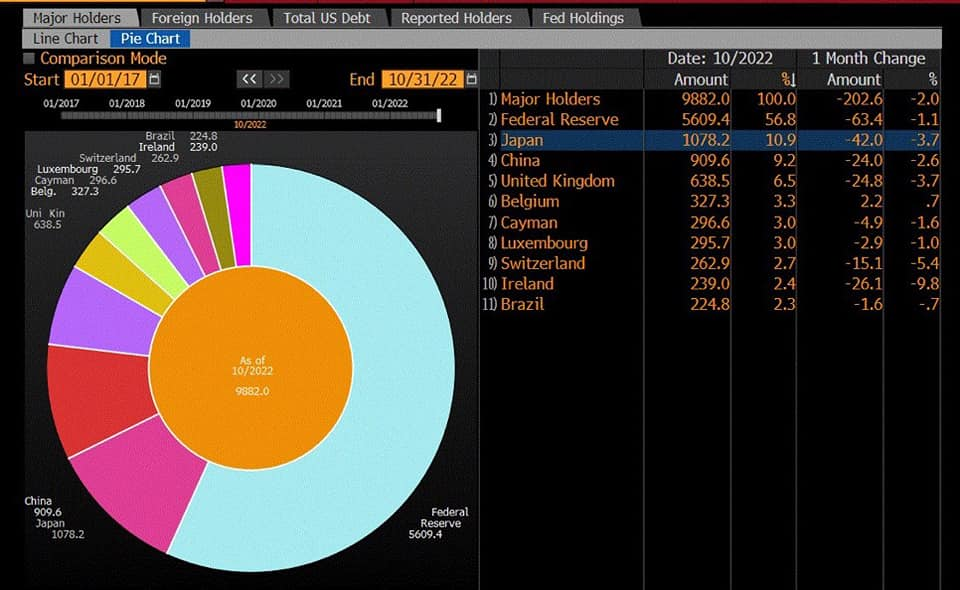

With BOJ recent moves, advanced countries other than Fed has started to push DXY just below their possible weaknesses. With RRP comfortably sit well above 2.2T$ and 1.7T$ approved omnibus, we believe US financial is well prepared enough to sail through possible recession.

We would think to seek barometer from western counterpart strategy, especially China. In our opinion, there could be 3 options:

#1 China opens up their economy big time, less likely

If China opens up their economy big time, we may see spike in global inflation, which will rather excessively spurred emerging money to rather flow into advanced countries bonds. We may see 2007-2009 commodity boom bust cycle repeated in this scenario. In our opinion, this is less likely.

#2 China spurs economy just enough, high likely

This option is supported with few facts:

- China continues to mention they will not ease too much like in 2000s.

- Australia miners continue to see support every time they run below technical correction.

- HSI and SHCOMP continues to see support.

- Developers and miners in China continues to receive recovery and support.

- AUD, which is sensitive to China economy, looked likely to find support. AUDIDR seemed to bottom few months back and showing emerging ability to ease to support their economy.

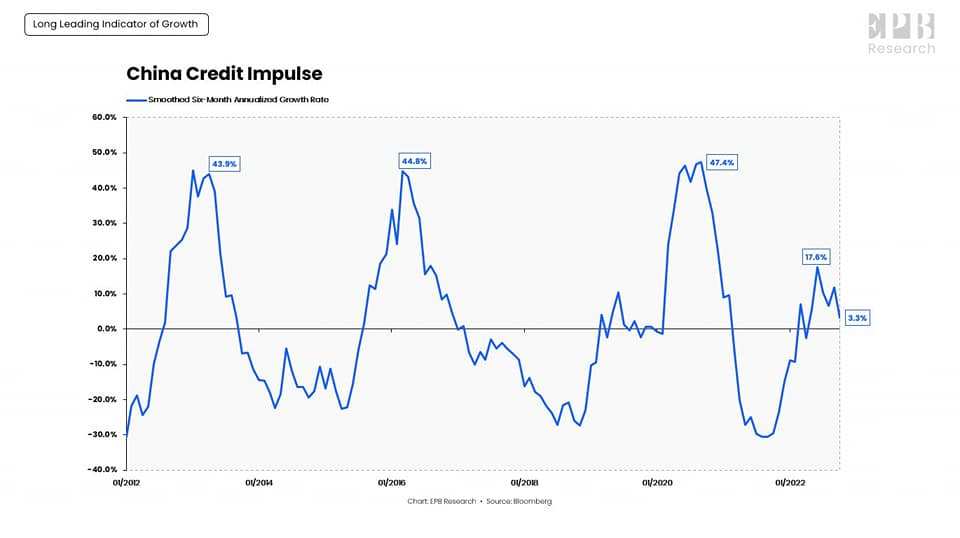

- Chinese credit impulse starts kicking in BUT not in a big way like before, just enough.

#3 China continues not opening their economy, unlikely

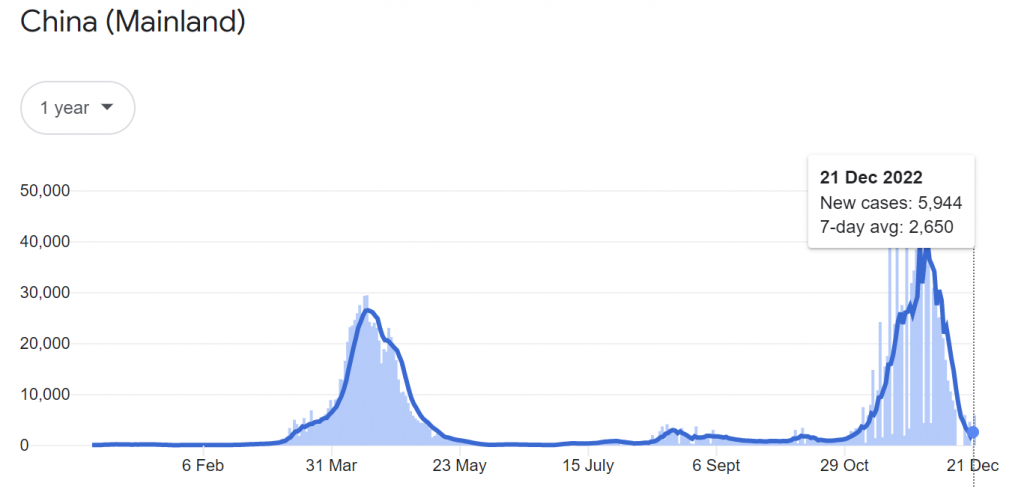

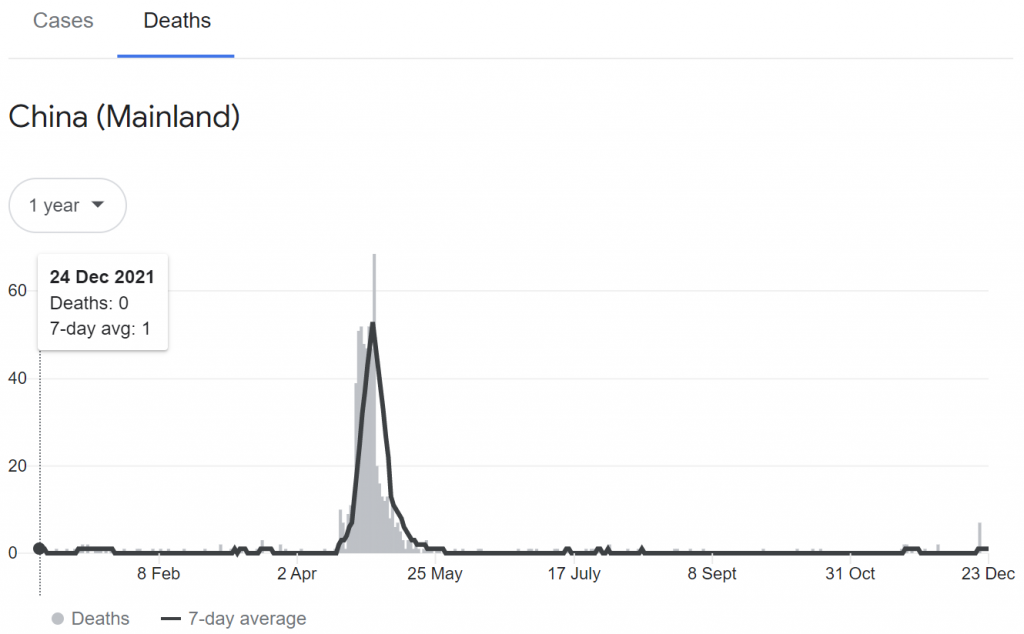

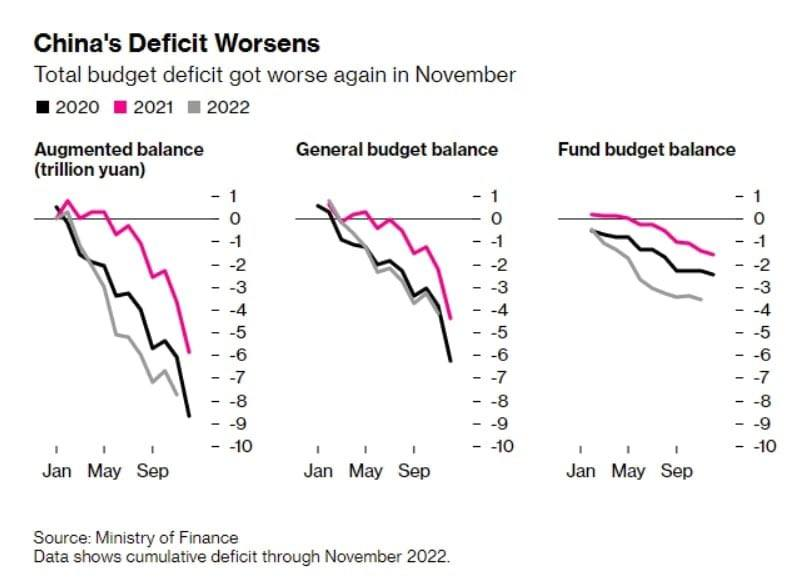

With Covid starts to drop to zero and mass infection, it seems Covid will be gone soon. Current numbers don’t support this option yet unless Chinese government suddenly changes their course overnight, breaking trends. China is also experiencing budget deficit.

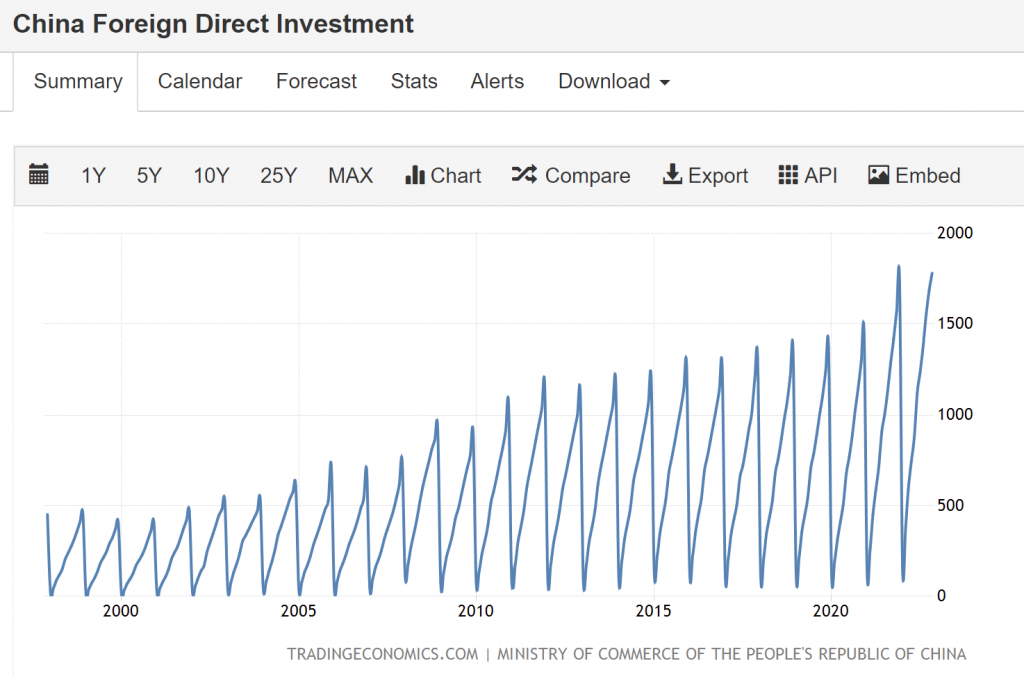

We also see commitment from advanced countries to China tends to increase, therefore it’s unlikely there’s a big change/deterioration.

With Fed holds meeting until early February, they will have enough time to see what China will bring into their economy until their Chinese new year on January 22, 2023. Usually China continues to start piling up import prior to Chinese new year.

Therefore our strategy is still same. We had unloaded 30% of our long risky assets during H2 2022, reduce any possible high interest loans, and will continue to unload another 30% during H1 2023. We are expecting to sail 3 years possible recession comfortably. Since we are expecting high inflation to be very sticky and China just enough to spur global growth:

- Our strategy is to start with very small investing in 2-3-5 years advanced countries government bonds using our unused cash or cash from property, reasonably.

- Continue to hold our commodity thesis with China opening/easing. We expect this to be slow, unlike 2007-2009 commodity spike. There is possibility of sudden “risk-on” in emerging participants, which may cause overshoot and stop Chinese government from easing further. We are expecting the spike to cause a drop in commodity and at around same time government bonds to fall below their face value briefly, in which we will move from commodity into this bond narrative in big size. We could potentially see another 20% return in commodity return before that is happening.

What will we do Cap? We fight!

I assure you brother, the Sun will shine on us again, even if it takes more than a year but not today.

Any idea in this blog and website are my personal own. They are not financial advise.