It’s time for us to shift our focus solely to short-term investments and avoid any potential long-term investments. As the sun sets, we’re already ready to reallocate any possible long-term investments to prepare for a long night’s sleep, as thieves are poised to steal everything overnight.

Recession is what gives investment meaning. To know our days are numbered. My investment is now mostly short term or strategic blow off.

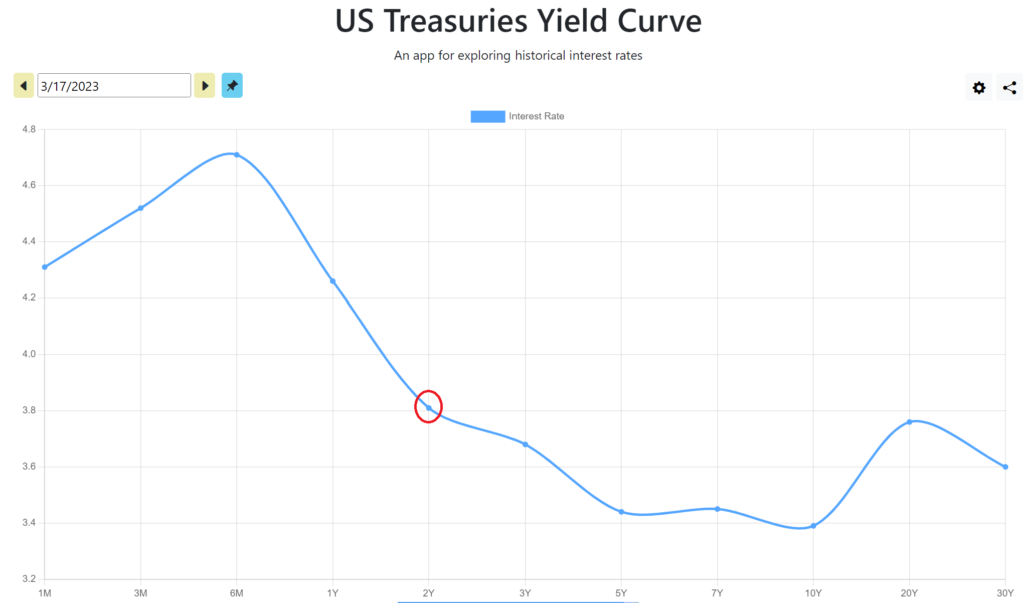

Our solid view since early January 2023 has prepared us for this. The peak rate is pricing in starting from this month in March 2023, and money should start to concentrate on short-term investments. As we mentioned in previous articles, we have removed almost all commodity investments since they are most sensitive to long-term investment. Today, we can see that banks are exposing their fragility to medium-term investment as well, due to the same issue. This is a solid confirmation that our current strategies are correct.

Learning from medium term view investment banks:

- Banks have categorized their investments into HTM (Hold-To-Maturities) and AFS (Available For Sale).

- Most of HTM investments were made when the rate was very low, mostly to toxic MBS securities, resulting in mostly long-term duration while AFS investments are of short-term duration.

- The Fed and government have given up their position to help avoid bank runs and more systemic issues. This is very important because market participant number one has disclosed their position.

- In reality, this is actually helping AFS (short-term duration) to avoid their fire sale rather than fire-sale of their HTM (long-term duration). Why? Because the HTM price is already so low, and there’s no incentive in the market at the moment to attract their demand during this fully inverted yield.

- The troubled banks are actually getting more difficult because they have to continue holding their HTM (1.3%) with the current high rate (4.5%) and continue taking care the loss with new loans. Therefore this Fed injection doesn’t really make the small banks better. They are just getting more loans/liquidity at par value with the current high rate, to keep their HTM until maturity.

- This is different from QE in terms of: (1) yield curve (2) actual impact on investment. For (1), in QE, the yield curve is steepening that the Fed could give a lower rate (to zero) to invest in purchased assets. Current inverted yield made it impossible because central banks only have control over short-term rates rather than long-term. For (2), as mentioned above, this injection is more beneficial to short-term AFS to avoid their fire sale rather than selling their long-term HTM.

- This situation also has made it even more difficult for banks because the market knows that banks are trying to unload their medium-long-term assets and therefore will not be interested in taking other bank HTM without any deep discount (30-40% loss).

- Due to the concentration on short-term investment, we expect there will be an asset misallocation issue (asset blow off). Due to all factors mentioned above, at the end, the only way to solve the issue is to give general recession to the market.

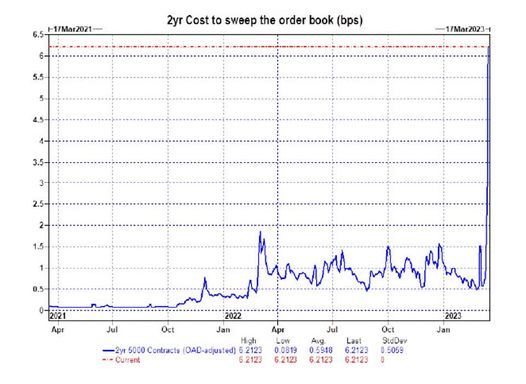

How much does it cost to undo this curse? The 2y cost to sweep has spoken.

Sustainable Energy

Let’s keep our horror story aside and look at the brighter side for a moment. Why was I so excited in early January 2023 with real numbers in AI (Artificial Intelligence) and Sustainable Energy? I would speak about Sustainable Energy economy at this opportunity because their numbers are real important.

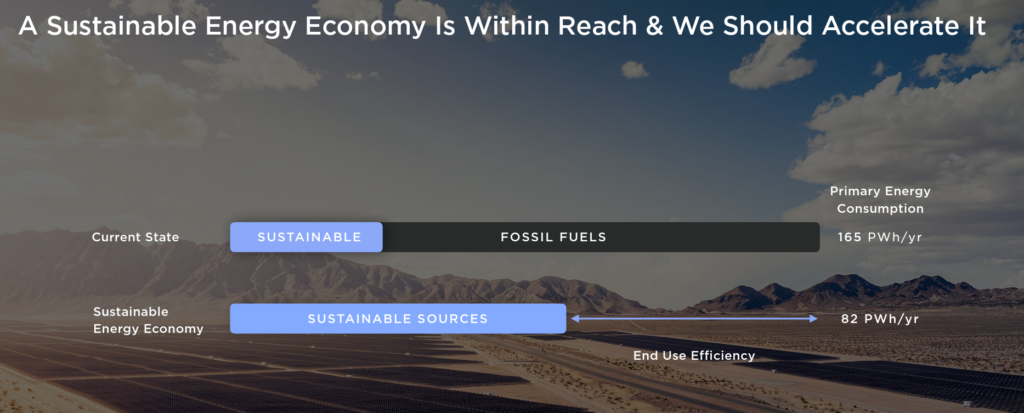

Our energy economy is so wasteful. Two-thirds of the energy generated is wasted.

Sustainable energy economy is still left behind and has a lot of capacity and offers much higher efficiency to eliminate the above waste.

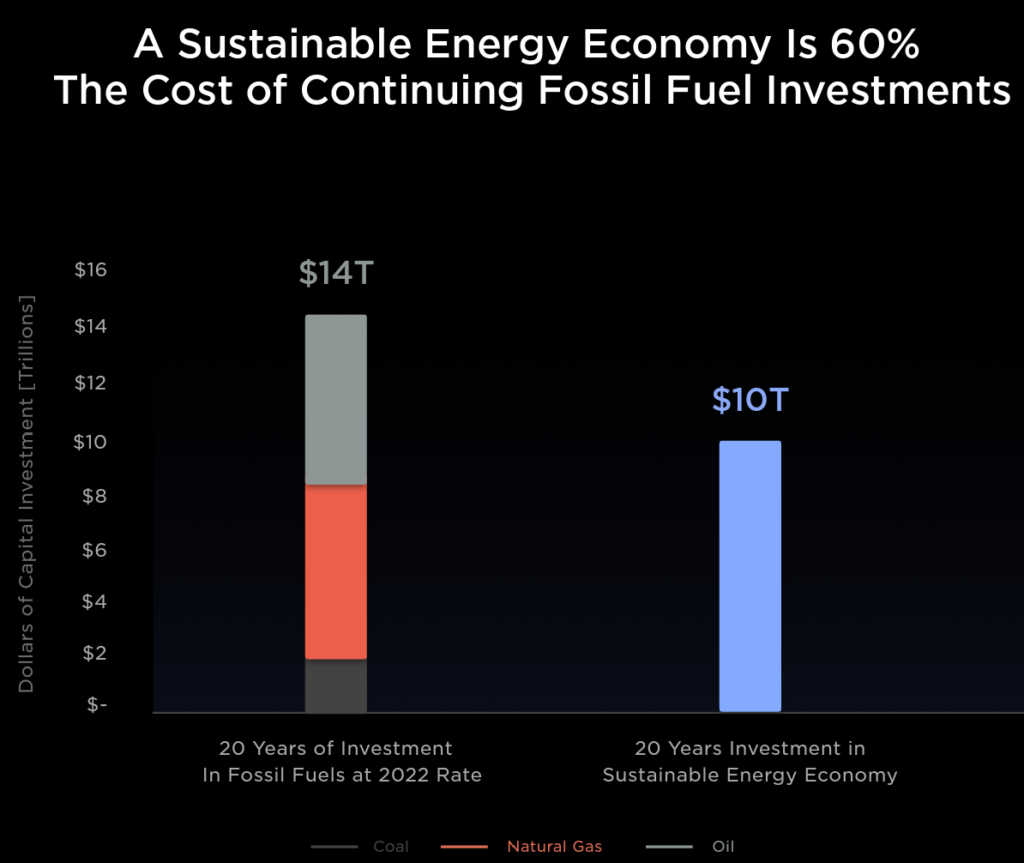

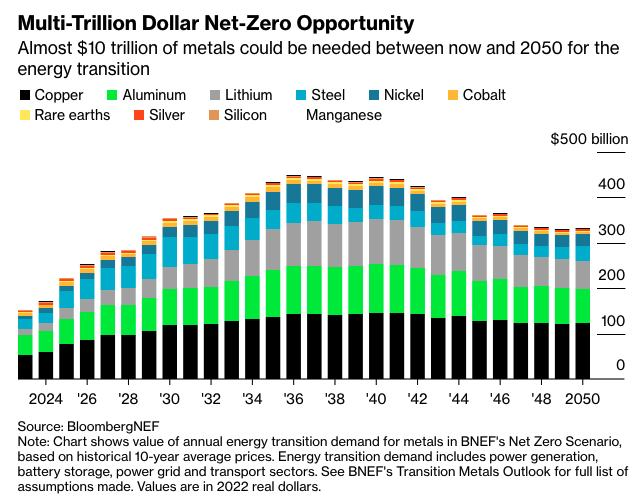

The amount of investment capacity is $10 trillion in 20 years and could immediately give high value.

Ten megawatts are estimated to cost $12.7 million (~65% margin). We would need 240TW. The available economy capacity is 240,000,000 / 10 x 12,000,000 $, and we could only target a small portion of it to fix the current economy issue.

As mentioned previously, our economy has too much short-term liquidity, which has outpaced long-term capacity and return (inflationary). This sustainable economy could actually solve the problem to reallocate this excess into long term investment, but it will require huge amount of money in very short time to incentivize the movement, which could only come from the government and central banks.

Looking at the commodity side, $10 trillion worth of metals are needed until 2050. Therefore, we will return our 95% commodity reallocation back once dawn has come.

Treasury Bonds

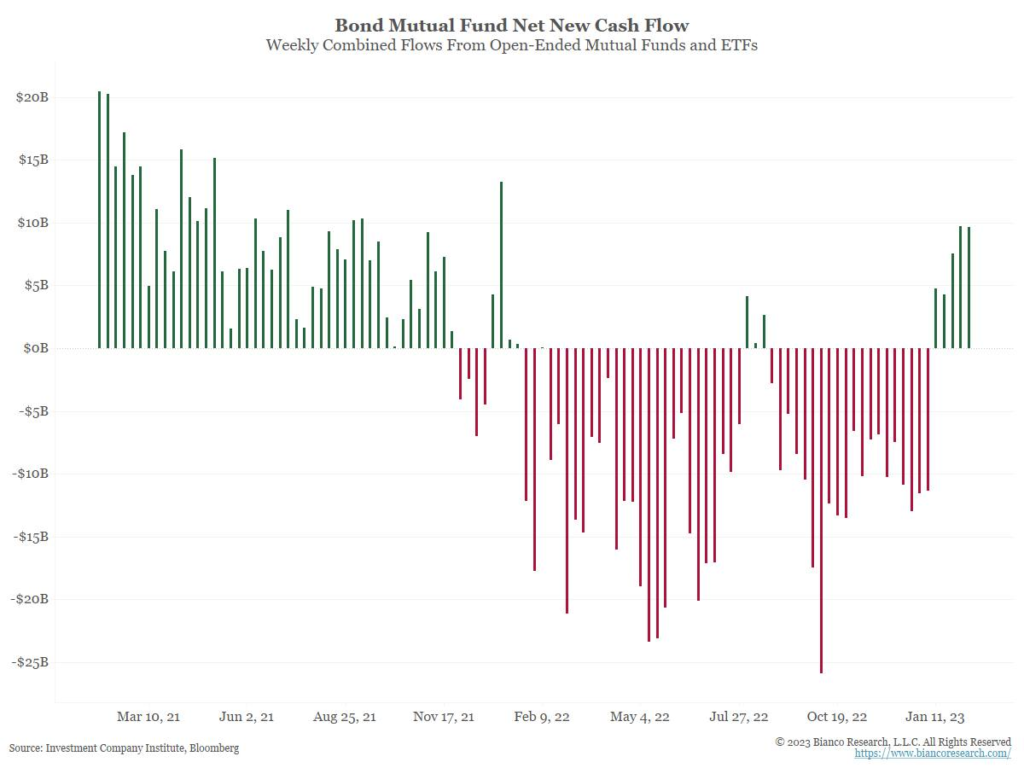

I have overweighted too much on equities since early 2020, no secret due to the massive GFC-Covid recovery. Since then, early 2023, we have reallocated 40-50% of our portfolio in short-term treasury bonds (3-5 years maturity and returning about 5% pa) at their face/par value due to the scary inflation narrative. Luckily, the world is with us, and we saw massive recovery in January 2023. I became more confident and tend to maximize leverage on it. My main reason was to target the next 6-month inflation peak, around June 2023 or so.

Timing Statistics

Below are what I think is very important statistics:

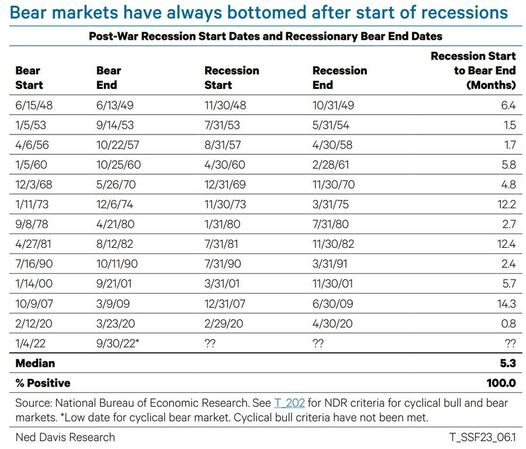

- 100% probability of bear market to bottom after the start of a recession.

- Bear market to bottom about 5.3 months after recession start.

- 81.3% probability bear market ends about 13.6 months after the last rate hike.

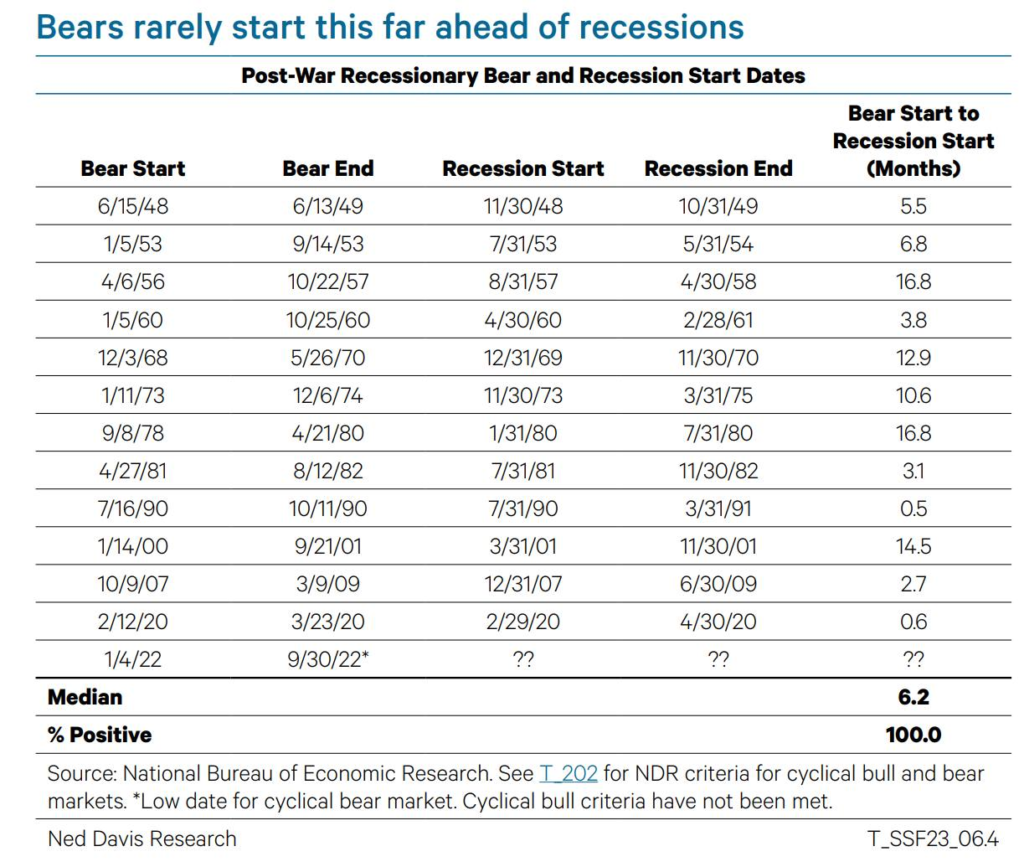

- 100% probability bear market to recession start at about 6.2 months.

Therefore, based on these statistics, probability-wise (60-80% probability):

- If the last rate hike is in Feb 2023, the bear market tends to end in April 2024.

- The recession will start about 5.3 months before April 2024 = Oct 2023.

- The bear market will start about 6 months before Oct 2023 = May 2023.

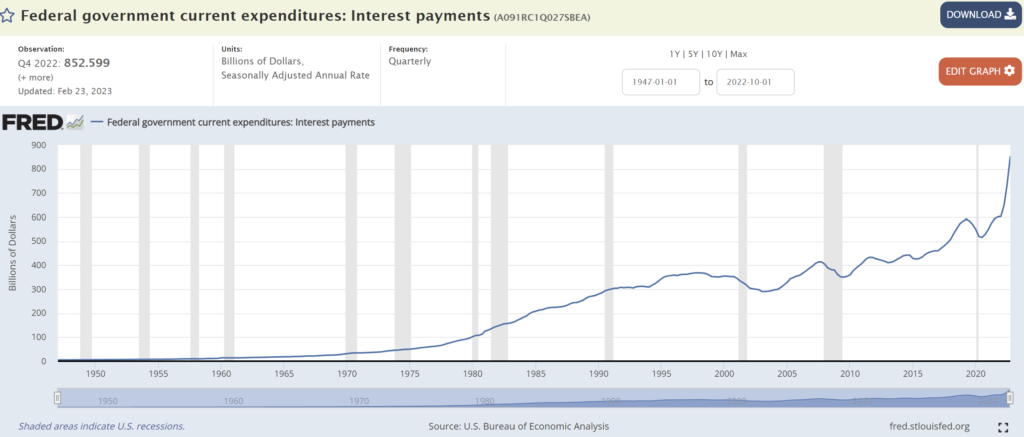

It’s my view that the market is supported by money, either from the central bank or fiscal and nothing else. While the Fed is only able to reduce $600 billion of balance sheet, it’s interest payment from fiscal about $900 billion that keeps this market floating.

It’s then the market decides how far interest rates can go up. The issue that I see here is that even though economists say the Fed is reducing the balance sheet too slowly, it’s my view that the Fed is actually selling the balance sheet faster than the market can afford. The Fed has really tried hard to reduce inflation, not through the use of higher interest but the use of more balance sheet QT.

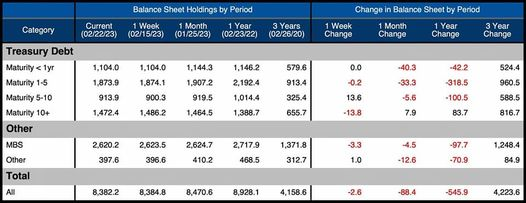

This is where I have to look into Fed balance sheet selling:

- The Fed couldn’t sell the MBS (Mortgage Backed Securities) because it’s toxic debt with a very low rate, around 1.3% pa.

- The Fed balance sheet reduction is highly concentrated in the short term.

- The concentration of the Fed’s selling is actually between 1 to 5 years of maturity. Please remember my old theory that central banks always transfer wealth to their 8 big banks through front running, using any event of QE (Quantitative Easing) or OT (Operation Twist). I expect a similar case to occur here.

- I may estimate that this biggest belly will expire around the end of 2024.

- The current 5-year rate yield is about 3.5% pa.

This seems to support our previous conclusions:

- We may have a lot of maturity around the end of 2024.

- Six months leading to it is when the recession will end, ~ April 2024.

- It means there will be less money injection towards April 2024, which could probably start from the recession in October 2023.

- The Fed is going to keep interest rates high and could probably overdo it by May 2023.

We can see that the Mortgage-Backed Securities (MBS) have caused trouble not only for the Federal Reserve but also for small banks like SVIB.

JPMorgan estimated that the Fed will require around $2 trillion to combat this effect, which could increase the current debt from $8 trillion to $10 trillion. Historically, the market crashes once the Fed’s balance sheet grows near the previous high (9T$). If the market is unable to absorb more than $1.7 trillion from the $2 trillion to normalize the long maturity issue, with its interest being only $100 billion per annum, I would expect severe market pressure. This is another reason why I see at least a disinflation, and its risk is a very severe impact on commodities since commodities are high-risk assets. If the Fed reduces rates, it would only hasten the crash because the interest payment is going down massively while the market still needs to absorb a high amount of long maturity loss.

So where does the money go? In my opinion, the money will eventually go into Treasury bills with lower maturity, 1-5 years. This is why I have massively bet on Treasury bonds with maturities of 1-4 years with maximum leverage at the beginning of 2023. If the question is whether I am worried about the possibility of additional $2 trillion supply of low maturity debt, I am not. It’s because it’s only 6% of the total US debt and we have RRP+reserve. Eventually, when the market stalls, the quickest way to save financial systems is by cutting the rate, which will eventually expand the central bank quicker and hasten the market crash. During an event where the central bank cuts rates, I estimate that they will make massive purchases of our short-term duration, because the yield curve has been severely inverted.

The sunset can be a scary moment when you realize that your days are numbered and there is probably no escape.

Please always remember that any ideas on this blog and website are my own personal opinions and are not financial advice.