People are talking about global recession, mainly referring to US (United States) economy and their impact to global economy. It is because people used to use history that when GDP is contracted over 2 quarters, I meant “when yield curve is inverted over 2 quarters“, we will most likely see a recession. Definition of a recession is below:

A recession is a macroeconomic term that refers to a significant decline in general economic activity in a designated region. It is typically recognized after two consecutive quarters of economic decline, as reflected by GDP in conjunction with monthly indicators like employment. Recessions are officially declared in the U.S. by a committee of experts at the National Bureau of Economic Research (NBER), who determines the peak and subsequent trough of the business cycle which demonstrates the recession

source: investopedia

It’s clear that the definition is historically and mainly applied to US economy and should reflect current US economy structure. It may not be 100% true. The definition shouldn’t emphasize all 100% population GDP but all 100% money GDP since money growth has taken over population growth with their enormous binary growth.

There’s an interesting thing is happening here. During this kind of recession risk, which is most likely a temporary turn of tightening into easing, it might already be predicted long before this decline is happening.

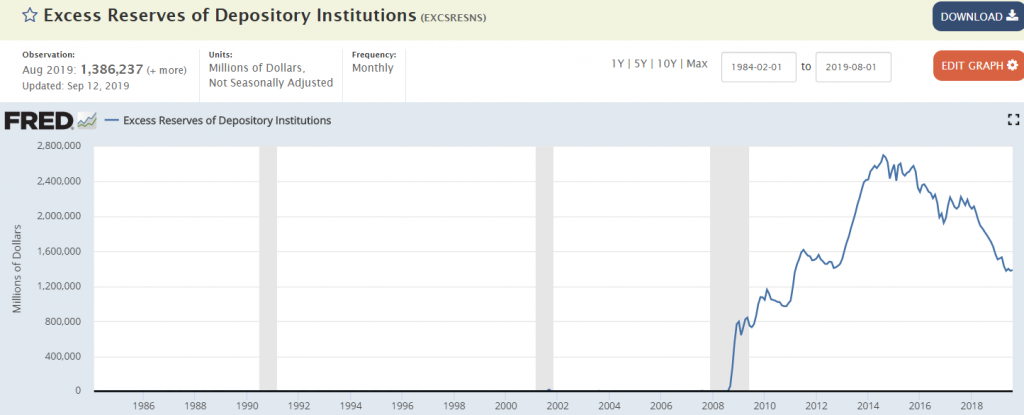

In my article 7 months ago, I would have to argue that we can predict the end of not so beautiful “normalization” or when the Fed tightening would have to stop or turn. I used excess reserve because it can connect dot between banks activity in relation to inverted yield curve, and its correlation to recession risk. In my article that time, I argued that the Federal Reserve would have to stop tightening after the excess balance sheet is left with 1.4T$. My math and prediction is correct with exact amount.

Since excess reserve is left with 1.4T$, market asked easing and the Fed had no choice but to end this premature normalization (in my previous articles, i used word of the end of a temporary normalization game). If the Fed has to start easing again and global economy is still not better, it means there might not be yet any real normalization need, like many economists argue.

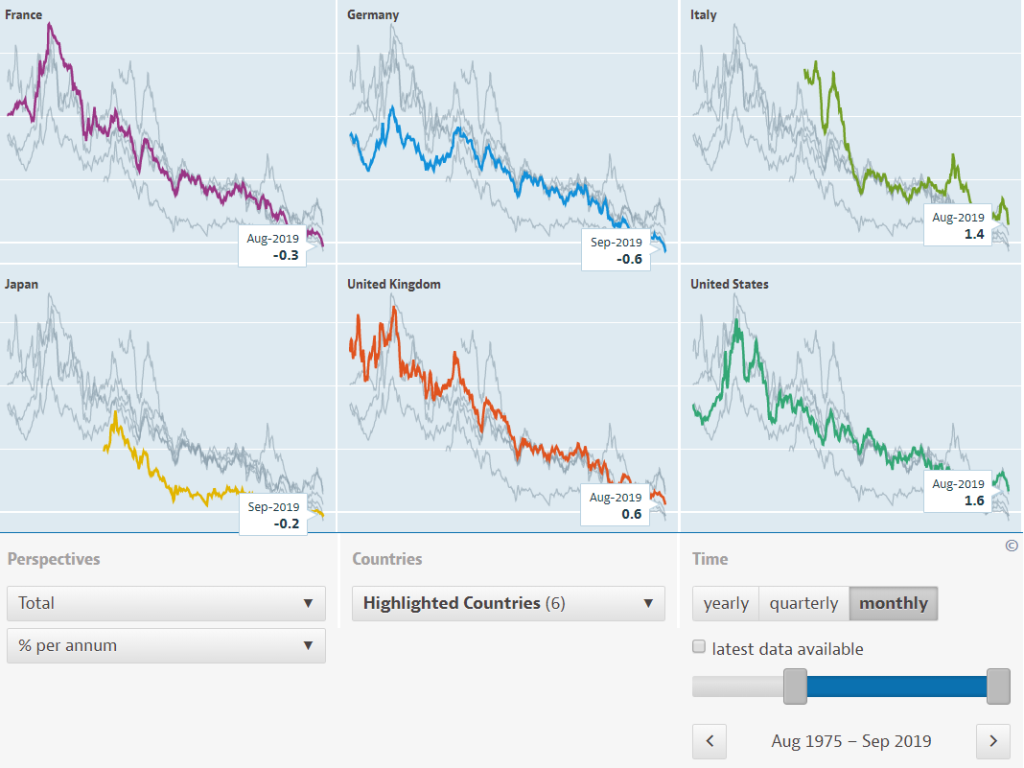

Using a simple technical analysis from the same graph above, it clearly shows that the knowledge of this end of tightening and excess reserve numbers should have been been known since 2015 to 2017. It’s clearly showing that the risk of today recession is simply just a temporary turn from tightening into easing. It also supports that global economy can not afford higher rate and long term trend of rate is still pointing down. If long term trend of rate remains down and central banks remains accomodative, there shouldn’t be significant risk of recession. We have no doubt in past few years, central banks remains accomodative.

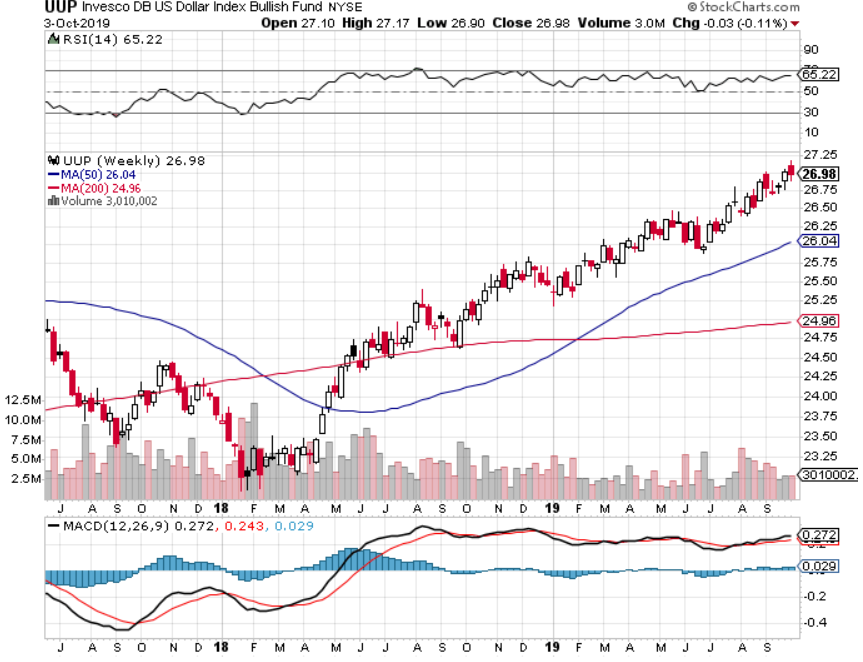

There could be a possibility that it’s not a time yet for normalization. The argument is because global growth is still declining while only US is rebounding. The rebound itself could be merely just a technical rebound due to excessive easing from the Federal Reserve or overshoot of easing between 2013 to 2015. It’s shown in a stubbornly strong USD even when US risks recession, which should show that other parts of the world are still weaker and global economy is not yet asking for normalization.

This situation could be made worst with recent push to long term bond play such as happening in negative yield. This capitalism may now negatively affect basic structure of economy itself. Trump may become one of the participants, having interest to introduce the trade war to benefit from government bonds. It could be a perfect time to introduce ultra long bond simply because market is so populated in this place. However if ultra long bond bursts together with other long term bonds, the ultra long bonds may need ultra long years to recover, just like its name.

Here now we know, Federal Reserve may temporarily have to stop tightening and back to easing. One day I believe there will be a time to do real normalization (not this time yet). That time could probably be when trade war ends and spark in inflation.

After market experienced yield crashed in Q1 2019 and already in 2 quarters, people start to talk about recession probability. It then raises a question, will we have a recession in 2020?

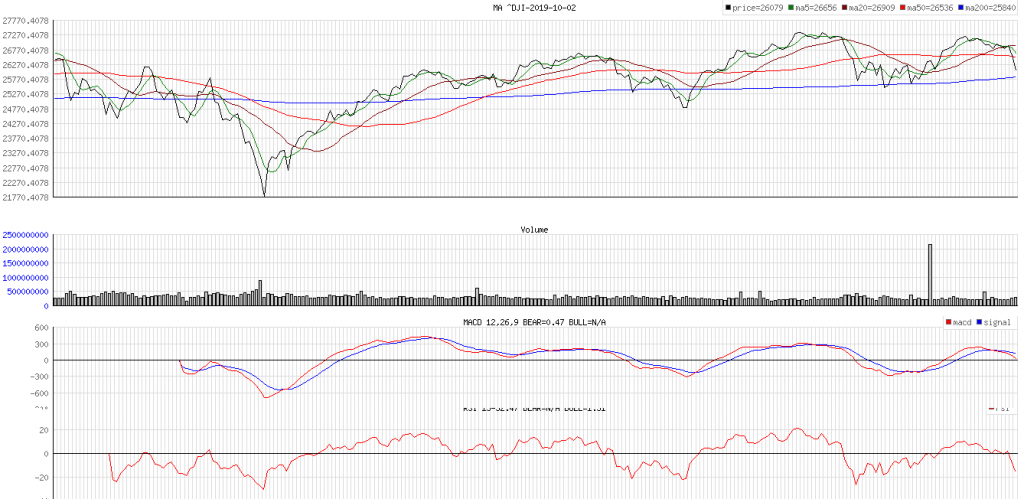

Based on arguments above, if numbers are so orchestrated, we do know it’s now leaving to yield curve to lead future. At the moment, Federal Reserve is so way behind curve. Stated in my last month article, market still remains asking for 2 basis points of rate cut and unfortunately next central bank meeting is still 3 weeks away (end of October 2019). The Fed has been trying to help with repo but I believe it’s not enough. Therefore we shouldn’t be surprised to see some share market correction. The same question again, will we have a recession? If it’s, share market should probably go down even further.

If my theories above are true, we might be able to avoid recession if Federal Reserve is willing to run at least as fast as market curve with at least a 2 basis points of rate cut this month. So far, market has been predicting monetary policy very well because monetary policy is very friendly to them. An example is in my article 5 months ago. where I predicted that RBA (Reserve Bank of Australia) would have to start cutting rate again. RBA then continuously cuts 3 rate cut after holding rate at 1.5% for almost 2 years. It’s in my opinion, the Fed should cut faster or possibly have emergency rate cut. They should, of course, try not to scare/shock market.

There’s an interesting thing happening. Australia is one country that has been running faster than the US in easing. RBA cuts their rate 3 times within past few months. If the Fed cuts 2 more rate basis points, RBA should at least cut 1 time, simply because Australia is smaller. RBA chief recently confirms that he doesn’t want to see strong AUD (which I believe is very risky to Australia property market trend) and he will maintain currency competitiveness. The issue is, if RBA cuts just one more, it may be most likely trigger an inflation in Australia and it could be one of few countries that leads global inflation, together with other AAA credit rating countries such as Canada, Denmark, Finland, etc. When inflation sparks, it may shock their share market. It’s then I believe, on next inflation cycle, probably at the end of trade war and burst of negative yield, we might see a true normalization effort, rather than the ‘not so necessary’ normalization efforts in past few years.

I’m back to the question of whether we will see recession in 2020. In my opinion, we shouldn’t see recession next year if central banks remain fully accomodative. The Fed should run at least as fast as market curve. In today situation, the Fed should cut with 2 basis points. Until that happens, we should continuously see some pressure in short term liquidity, seen clearly in share market. We hope the Fed is not too late to ease, considering effectiveness of monetary policy is now diminishing. The difficulty, of course, if the Fed is easing too much, inflation may pickup rapidly and we may experience bond crash like in 1994. I believe today correction of share market is not due to recession risk but merely because central bank policy is so behind market expectation. We should still expect share market pressure until the central bank is on or ahead market curve without inducing inflation spark threat.

Technically speaking, share market should worry of this negative divergence, until central banks put break on this as soon as possible.

This article is my own opinion and not in any case of financial advise.