JEKYLL: “Can’t you see It’s over now? It’s time to die! HYDE: No, not I! Only you! JEKYLL: If I die, You die, too! HYDE: You’ll die in me I’ll be you!” – Jekyll & Hyde – Confrontation

A Treasury bill (T-Bill) is a short-term debt obligation of the U.S. government. It is backed by the Treasury Department and has a maturity period of one year or less. On the other hand, a T-Bond has a much longer maturity period, typically 20 years, or even longer. It is important to note the differences between these two types of government debt. Although they are associated with the same entity, the U.S. government, they have significant distinctions in terms of risk.

(1) Due to their shorter maturity period, T-Bills, such as those with daily maturities like RRP, offer more precise returns and have a more controllable level of risk to predict. If both the T-Bill and the 2T$ RRP have reached maturity at the same time, the savings of 2 trillion dollars from the RRP could be used to quickly replenish the T-Bill in case its interest rate suddenly increases.

(2) T-Bonds with longer maturities are more affected by inflation since their holders have to wait until their maturity date to receive their returns. In contrast, T-Bills with shorter maturities are less affected by inflation because their holders can sell them the next day. The difference in maturity time (ΔT) significantly impacts their vulnerability to inflation.

These distinctions become even more important when considering the topic of inflation and building upon our previous article. In early May 2023, inflation started to make a strong comeback. Soon after, the Reserve Bank of Australia (RBA) and the Bank of Canada (BOC) raised their rates, and it is expected that the Federal Reserve (Fed) will follow suit with a surprising rate hike rather than maintaining the status quo. This change in narrative from lower to higher rates has the potential to significantly affect the future trajectory of interest rates.

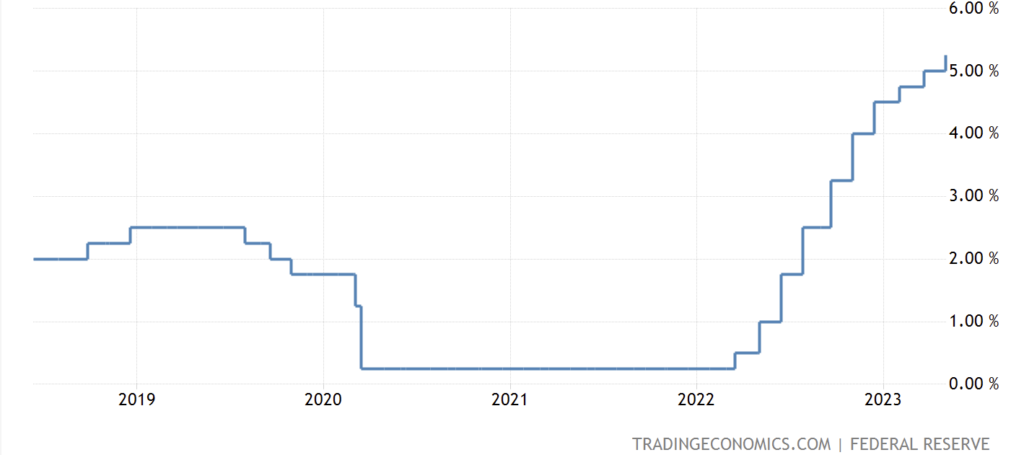

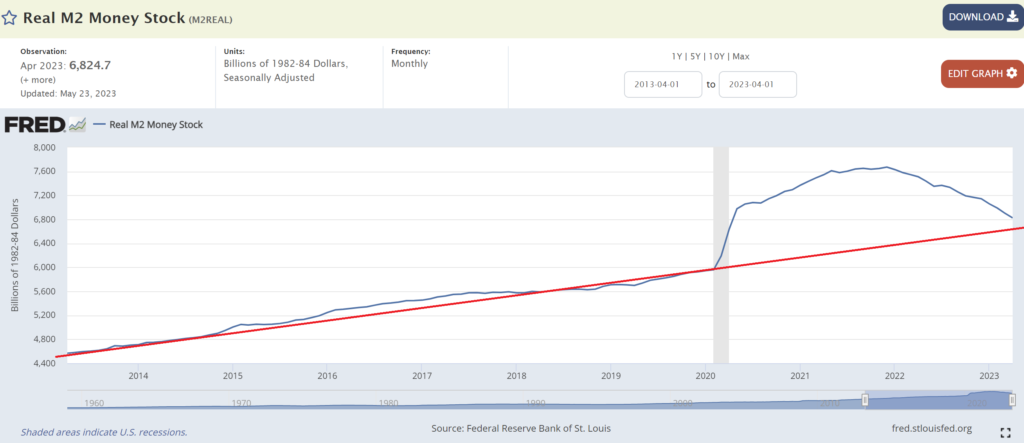

If we look back at December 2021, interest rates were beginning to anticipate higher inflation, which proved to be true in the following 3-6 months. This anticipation caused a decline in the QQQ rally. Interest rates increased from near zero to their highest level in over 5%, accompanied by a decrease in the supply of M2 money. It is worth noting that the performance of QQQ is not only necessarily directly related to lower inflation (such as the 10-year Treasury yield or TNX), but rather more influenced by factors such as liquidity levels and the ability of the Fed and the Treasury to inject money into the financial systems.

Last year 2022 M2/QQQ correction event was the outcome of significantly higher inflation, which caused limitations in the money supply systems and consequently led to a correction in the QQQ (an ETF that represents the Nasdaq 100 Index, commonly traded). The question now arises: has this correction in the M2 (a measure of money supply) ended? In January 2023, we threw idea for the QQQ (as we typically do, leading 3-6 months), making a substantial investment in it and completely divesting from commodities in favor of the QQQ and Treasury Bonds (TBonds). However, approximately two months ago, as mentioned in our previous article, we noticed the resurgence of increased inflation, which made us question our position in TBonds due to their high sensitivity to inflation. Consequently, we shifted all of our TBonds back into a commodity position, leaving us fully invested in both leveraged QQQ and Commodity, double offensive positions since last month.

Now, something very interesting comes into play if we are concerned that raising the debt ceiling and issuing new debt will lead to inflation and correction, like in year 2022 above. Treasury Bills (TBills) are not as affected by inflation as TBonds, this is the magic potion! This phenomenon is quite remarkable considering that both are U.S. government bonds. While one is highly impacted by inflation, the other is not affected to the same extent. As the M2 money supply mentioned earlier aligns with its long-term trend, it is expected that the U.S. authorities will allow for more money and liquidity in the system. This observation also supports our previous article, which highlighted the increasing correlation between the need for higher inflation and a rally in the stock market indices. Given the limitations imposed by higher inflation and the absence of any visible peak, the authorities are left with limited alternatives and should consider turning to Treasury Bills due to the reasons mentioned above. It is worth noting that unemployment, which is an important gauge of inflation, does not indicate that inflation has reached its peak.

The difference in duration between Treasury Bills and Treasury Bonds can have a significant impact. Increasing the money supply through Treasury Bills will not disrupt liquidity as much, especially since their maturity is closer to the existing $2 trillion Reverse Repurchase Agreement (RRP) with an overnight maturity. When auction becomes a concern and 1 month rate is higher than the RRP rate, it could use the $2 trillion RRP facility.

Both the Treasury and the Fed still have the ability to influence the market through their actions:

(1) The Treasury can choose to allocate the issuance of the new 1-2 trillion $ between Treasury Bills and Treasury Bonds. Increasing the issuance of Treasury Bonds would lead to higher long-term interest rates or potentially more inflation, but much less with the Treasury Bills.

(2) The Fed still has the authority to implement Quantitative Tightening (QT) measures, raise interest rates, or take additional actions as a lender of last resort, which could affect its balance sheet. A higher balance sheet could provide additional support for the ongoing market rally.

The first point mentioned is related to the current hot topic of refilling the Treasury General Account (TGA).

The current debt has been growing at a rate of $5 trillion over three years, which translates to an annual increase of at least $1.7 trillion, or a minimum of 5.5%. Despite the current rate of return being 5%, it is still challenging to sell the debt to private entities. Therefore, I believe that the interest rate should exceed 6% before we can observe inflation becoming controllable and starting to decline. The Treasury Bills should have no difficulty covering the $1.7 trillion with the $2 trillion Reverse Repurchase Agreement (RRP) facility on its side. I anticipate that the RRP funds will start flowing into the Bills once the rate surpasses 5.5%, or if there is an unexpected increase in the Federal Reserve’s rate. There is also an argument suggesting that there is a possibility of recycling expired long-term debt into shorter-term debt, which could support/lessen effect of new Treasury Bill issuance.

The recent debt ceiling deal should have shifted the trajectory of future interest rates from decreasing to remaining higher for a longer period. Based on the numbers mentioned above, there shouldn’t be any issues navigating through the year 2024, unless a major unforeseen incident occurs, which is currently unpredictable.

Although the recession and inverted yield curve are signalling high-risk conditions, they should hold no power against the sheer amount of money available.

Please note that all ideas expressed in this blog and website are solely my personal opinions and should not be considered as financial advice.