As we discussed in early July 2022, there was a rumour that rebound would come due to the Fed pivoting. It was based on historical events that the Fed has to start pivoting at some point of time. I personally argued strongly that this time is different. During that historical events, either market:

- had lowest liquidity,

- had inflation peaking and starting to go lower,

- had decreasing US/global economy,

- had decreasing long term rate,

- was in recession.

but none of these arguments is currently happening.

Don’t get confused with oil/Romeo crashing to lower low. If we use human made engineered inflation indication, market will cheer lower inflation. However it’s still in our thesis, real money inflation will continue to be sticky. Therefore despite lower number and lower oil, we may continue to see higher rate. Historically, policy markers are going to lean more towards money rather than economy. Also don’t get confused that it will lead into recession. No, it’s not, at least for now. Have a look into how emerging economies passed their high money inflation between 2010 to 2019, before they fall this decade. This is where money is going to play around with economy theories since people usually got wrong, because they only rely on some part of the truth, but not the whole truths.

Fighting the Fed is a suicidal act. The Fed is still the strongest player in this market. Despite their uncomfortable tightening, I wrote few times that I still believe the Fed is still going to take care the market, despite at the end of it, they might have to give up to barons. However before that, in long journey of our life, before death comes, I believe the Fed will continue to take care the market, in their own way of course.

This is where assumptions in market got wrong and messed up. Pivoting is situation where central bank will effectively move market according to baron goals. However based on research published in 2010s, the Central Banks are mostly market followers and not market decision maker. So how is that so? In my own formula, I found that the Central Banks policy are only mostly effective during market melt down, either when they are at their most undervalued or at their most overvalued, but NOT during market movement, or when liquidity is abundant. They have principal as well to not affecting market too much unless necessary. Current rate raise is not market control but market follow. This is why I will continue to argue market pivoting for now. We must not reason this market rally with pivoting idea. It will get wrong at the end. We should reason market rally with correct reason, therefore we could still get right at the end of it to play hard and exit correctly.

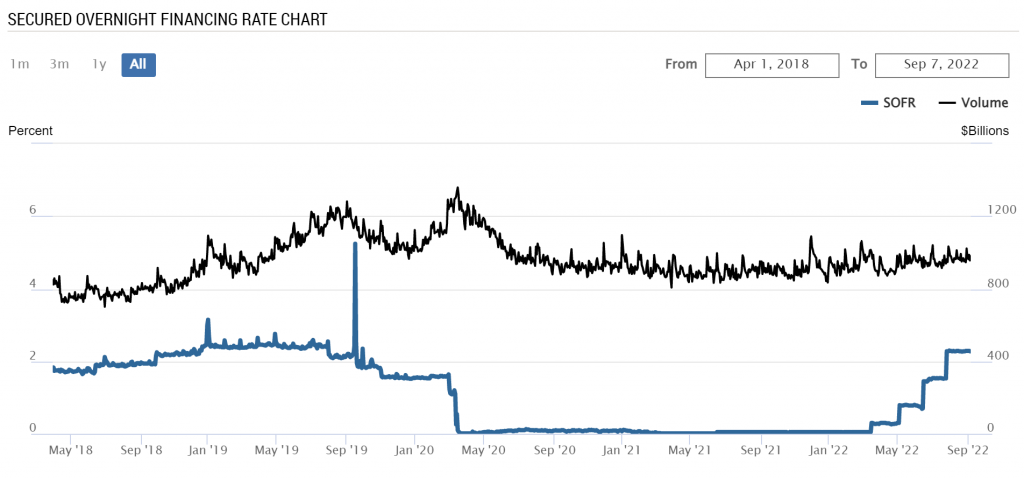

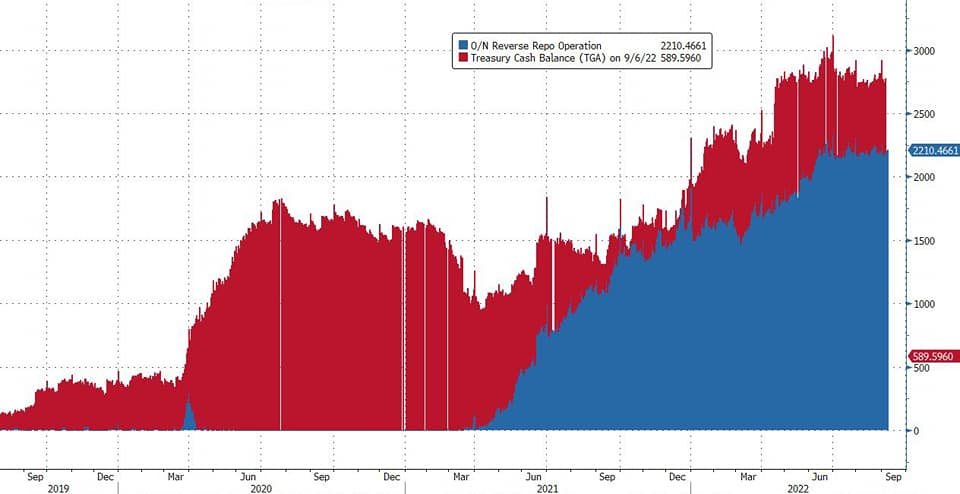

Arguments for no pivoting are: (1) liquidity is still too high, market is still more powerful than central banks (2) US is still the only player. History told strong player (the US in this case) always takes advantages over any weaker ones, market competition idealism. These two main examples alone in my own experience opinion, are enough to argue pivot thesis. YCC (Yield Curve Control) is another dynamic where pivoting may seem to work but in my opinion YCC is only going into costly terminally ill monetary systems.

However very important to understand, no pivoting doesn’t mean that market will fall. As indicated by money figure, following by economy data, there’s absolutely no reason for the Fed to blink. We are not going to go against the Fed but we do believe the Fed is in situation that they are now following the market or in auto pilot mode. They may use CPI or CPE, but the main idea is the Central Bank is not in situation that they can or need to put their strong arm on yet.

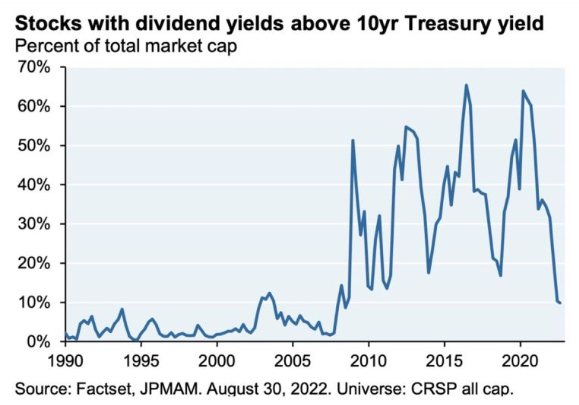

It’s still in my opinion that the market is still fabulously strong. However market participants, especially strong ones already felt the heat of overcrowded and heated market, therefore they should work, followed by the Fed to slow that one, before as mentioned by the Fed and that is true, the cost of persistent too high inflation is too much. It’s already reflected in cost in debt market.

If we look into some big companies, their PE is still very healthy. Most big companies are still making good money despite increasing cost. This is also one good reason for them to support tightening efforts. As we also see, funds are getting more concentrated into few. With liquidity at highest and concentration at lowest, it will only create a situation of more control and make more, rather than distributed wealth to just everyone. It’s also indicated in situation that low rate era is ended and only those who don’t swim naked will survive. It’s in my thesis that we will see spectacular rally of big companies.

Of course back to my main money theory, despite their huge wealth, to continue their rally, they will influence government support to ensure their operation is secure. Green support, chip industry support etc must continue to drive their healthy condition to make an amazing rally. Therefore we continue to concentrate our portfolio into healthy individuals only.

I’m so powerful. I don’t need batteries to play.

We should look closely to how DXY continued to march higher but despite its massive spike, we clearly see market is building very strong positive divergence momentum. That should mean, current Fed rate and USD spectacular rally are definitely not strong enough to stop market rally, imagine if they DID NOT. That’s why in our thesis, we should interpret the Fed rate raise above market expectation in June as a panic to anticipate super bullish catastrophe.

USD as almost crashed in June, triggering very high inflation (inflation higher than estimation). Instead, the Fed increased them to give enough time for them to raise rate. As consequences, USD continues parabolic until it’s stalled. However as we can see in market index momentum, they are not crashing but instead forming a strong positive momentum. Would this scenario is true, it makes more sense that the Fed is still knowledgeable and able to anticipate better, unlike many social news bait theories. I would rather believe the Fed and USD have been quite successful to contain most of bullish beast for now.

I’m unstoppable. I’m a Porsche with no brakes.

The market has been all wrong with the idea of economy. In my number one money theory, the money decides and not the economy. This article may show another failed Goldman Sachs media version prediction.

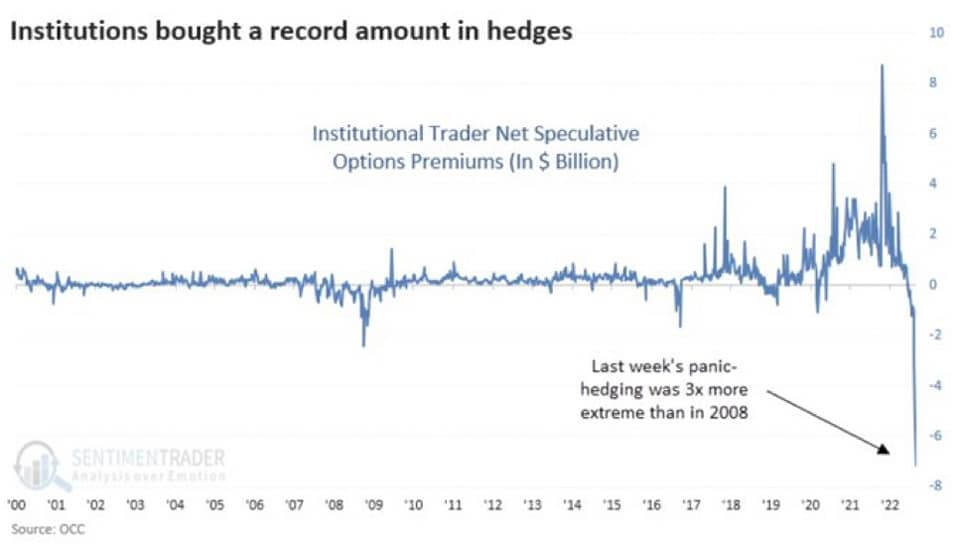

However risk is not going to leave us. We would see more pain into small companies and countries. I’m not going to argue massive hedging that they could probably hedge market in general but continue long their main portfolio, since finding good companies that will continue their rally to the finish line will be very rare. Would that be correct, it will distinguish us from the rest of market player.

I put my armor on, show you how strong how I am.

I put my armor on, I’ll show you that I am.

Any idea in this blog and website are my personal own. They are not financial advise.