Powered by ChatGPT and Dall-E

I was busy overhauling my investment strategy in early January 2023 to ensure it aligns with reality. In just two weeks, I increased my investment allocation into the major sustainable energy + minor electric vehicle (EV) and artificial intelligence (AI) space from 5% to 45%, a nine-fold increase.

Here are my points:

- Set your sights high, but be prepared for the risks of disappointment. Don’t limit your dreams.

- Everyone has their own imagination, and no one has the right to interfere with it.

- If your dreams don’t become a reality right away, keep striving. Remember, Rome wasn’t built in a day.

Hold your breath

Make a wish

Count to three

Come with me and you’ll be

In my world of pure imagination

Take a look and you’ll see

Into my imagination

The world can be cruel and intimidating, preventing us from having bigger imaginations. I believe that imagination and its realization is a fundamental human right. Everyone should have the opportunity to pursue their greatest aspirations and turn their big dreams into reality. Don’t limit yourself by starting with small dreams. Instead, dream as big as you can afford their risk of disappointment.

My imagination begins

… We’ll begin with a spin

Traveling in the world of my creation

What we’ll see will defy

Explanation

I believe in the creation of new value and wealth through evolution. When something evolves successfully, new forms of valuation and wealth creation are born, such as the oil boom, information technology boom, derivative boom, debt boom, currency boom, and more. This is why I am excited about my vision for the future of Artificial Intelligence and Sustainable Energy.

I try to invest wisely rather than impulsively. In December 2021, I sold all my investments because they contradicted my investment principles, mainly with regards to my yield and inflation expectations, which surprisingly came as expected.

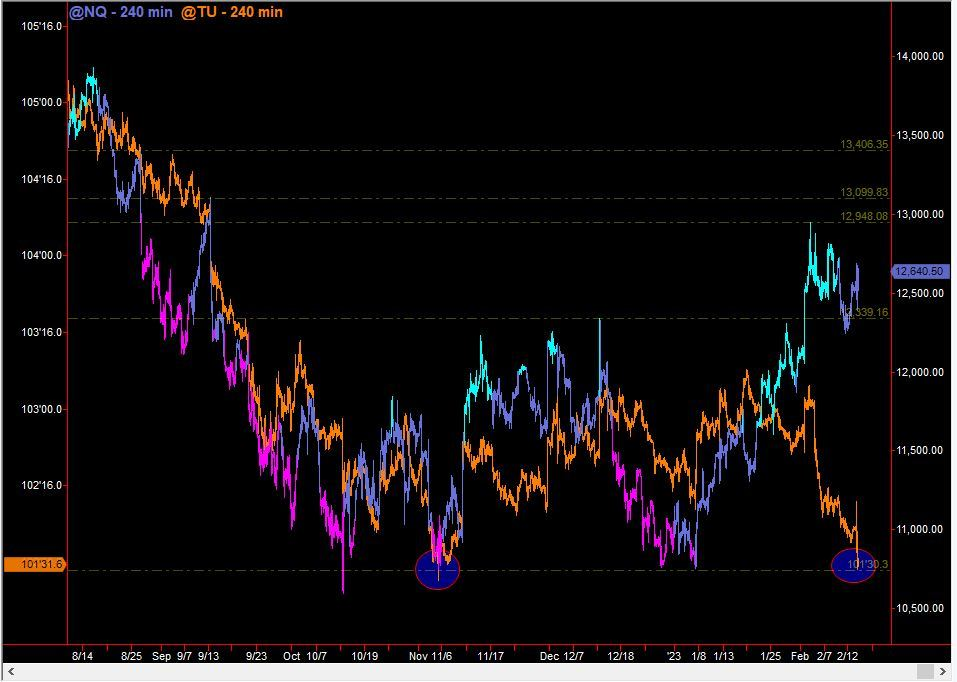

- The Nasdaq fell throughout the year of 2022 due to expectations of higher yields (6 months leading).

- Inflation increased rapidly throughout 2022.

- The Federal Reserve raised interest rates at the fastest pace in history, leading to a drop in risk assets.

As I wrote earlier in the year, I was disappointed with the yield expectations and progress of sustainable energy. They were heavily corrupted, with many ESG funds becoming involved in fraud, and early commercial cycles of AI failing to deliver as expected. I would like to see the glimmer of commercial value before I invest heavily. However, I still believe that the visions for AI and sustainable energy are pure, real, and true. The issue was not with the concepts themselves, but rather with the people and the yields who attempted to exploit them.

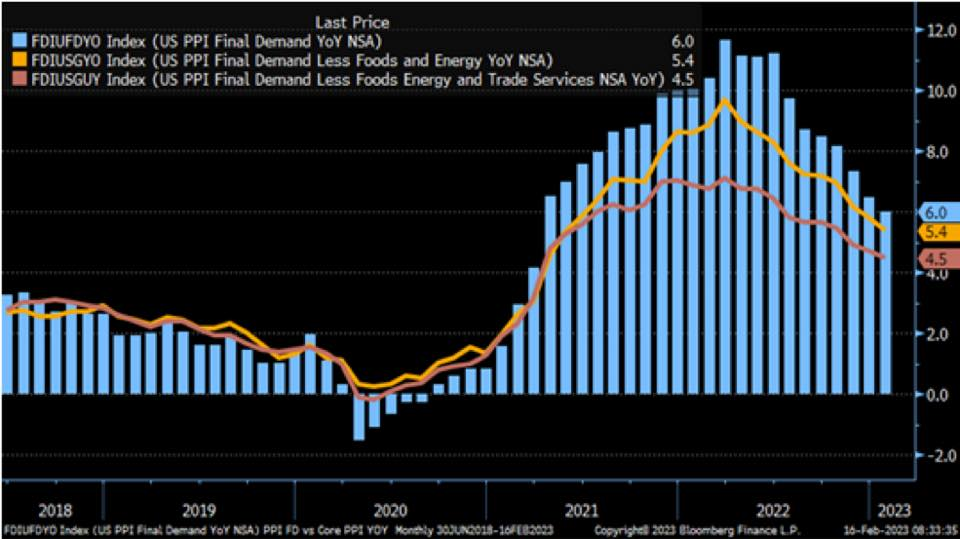

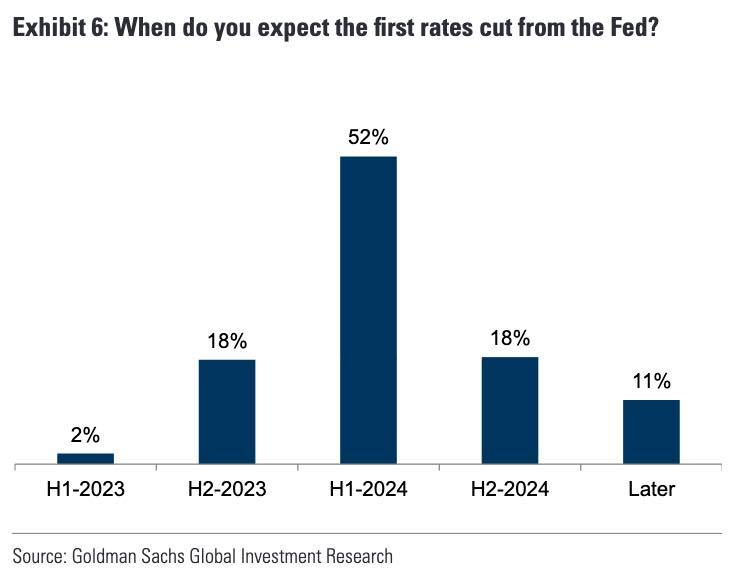

This year, since my future yield expectations have changed, I repurchased all my investments, some at a multiple amount and much lower price. However, this doesn’t necessarily mean that I think they will skyrocket in the near future. My investment philosophy still anticipates high yields and high inflation to persist, but the current situation is different than before.

My expectation is for a sticky inflation target of 3%-4% in the next 12-18 months. This should lead to the most optimal GDP and equity growth, as long as it is well supported, until GDP and equity become significantly overvalued.

- Inflation is expected to remain high, around 3-4%, over the next 12-18 months. This level of inflation will be sustained primarily by fiscal ease.

- An inflation rate of 3-4%, higher than the Federal Reserve’s 2% target, is likely to result in the most optimal GDP growth.

- Inflation rates below 2% may lead to unnecessary disinflation risks.

- Inflation rates above 5% or below 1% may result in much higher financial risks.

In simple terms, keeping inflation at 3-4% (a relatively high rate) can lead to the most optimal GDP growth. At some point, when GDP growth reaches its maximum output, I believe that the Federal Reserve and Fiscal will halt this engine, causing inflation to immediately fall back to 2%. We can expect this landing to be an unpleasant experience. However, for now, my focus is on opportunities for high GDP growth or high equity returns.

Imagination is becoming reality

… If you want to view paradise

Simply look around and view it

Anything you want to, do it

Want to change the world?

There’s nothing to it

In the past, people used to say that it was impossible to drive a battery-powered car, a self-driving car, or a car powered by solar energy, or to become wealthy, for example. Such judgments were like social bullying. But sorry folks, these things are becoming a reality.

Take a look at Dall-E, for example. Many people have misunderstood AI. Images created by AI are not just sourced from an image database or manipulated from existing images. They are generated from a latent space, in real time. The images created by AI have never existed before. We simply need to describe our imagination in human language, such as English, and the AI will bring it to life. The more precise the description, the better the images will match our imagination. They have already made 2D and 3D images a reality. I have no doubt that they could create a movie from a script. After all, a movie is just a series of 2D images. In the future, I believe that AI will be able to turn any book into an attractive movie.

Twenty-five years ago, I worked as a brand manager. It would take us weeks to create a compelling marketing message, and months to produce a full TV advertisement. Advertising and marketing is a multi-billion dollar industry, as evidenced by companies like Google. AI has the potential to help us craft the most compelling advertisement message or image based on brand management imagination and consumer statistics. This would save millions of dollars and reduce months of work into just hours, allowing for faster decision making.

However, there may be some loss in translation in the communication between humans and AI using the English language. In the future, direct communication between the brain and AI, such as through Neuralink, may eliminate this miscommunication issue. This could lead to the development of a new universal human brain language that could enable communication of any human language with AI language without any miscommunication.

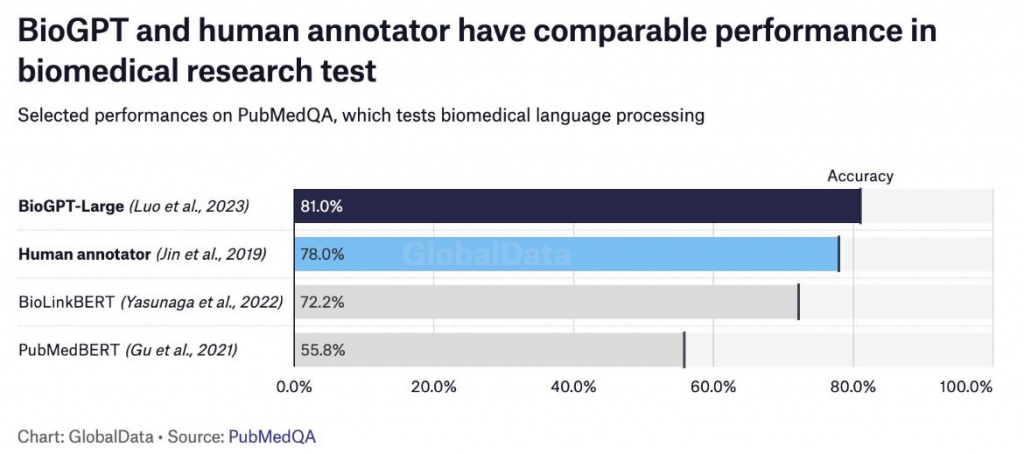

How about BioGPT? It could speed up biomedical research from years to just hours. GPT will continue to discover any other industry. They could store any knowledge library and use them to speed up discovery beyond superhuman with limitless nodes.

Rome wasn’t built in a day

Let’s step back from the euphoria and understand that AI is not a new concept. It has been around for decades. Twenty-five years ago, I wrote my bachelor’s degree thesis using a simple trained array of noise canceling. This array was able to adaptively learn and recognize frequencies in the domain. I was challenged to run a primitive AI on an old Intel 386 using Assembly language, but it worked. It worked so well that it was able to reduce noise up to 40 dBs, which was above 90% of simple noise. Of course, today, learning arrays are getting bigger and bigger. As a result, we can train these brain cells like our own brain. For example, in our brain, we don’t have millions of chicken images, but we can imagine millions of different chicken images with additional details. This is the same with AI learning. They don’t memorize exact images, but they learn what the image looks like and then draw based on our instruction or imagination.

I also believe that inflation will remain high. High inflation and high yield will limit the speed at which our investments will return. If these conditions do not materialize soon, we should continue to strive towards our goals. Rome was not built in a day. If they suddenly materialize and lead to euphoria in the market, we should remember that Rome was not built in a day and be prepared to sell our investments. There may only be two high-probability options: lower return or a boom followed by a bust. I am leaning towards the latter, where we may experience the highest boom and the worst bust within a period of 12-18 months.

Vision Driving AI

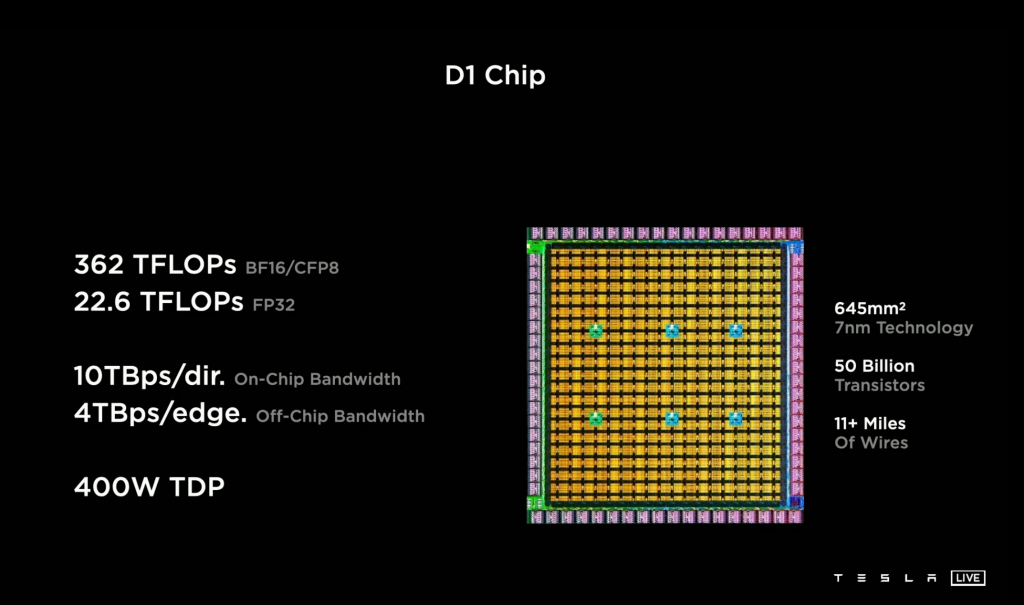

This has always been my belief: that vision-based AI could help humans immediately. Don’t confuse it with many autonomous driving systems, as they are NOT vision-based AI. Only vision-based AI is able to handle many different conditions, just like our eyes and brains can. It could immediately reduce human errors in driving and help optimize productivity. While it may still be far away in the future, perhaps 5-10 years or so, to have it running perfectly, I believe that making early investment in it could benefit my portfolio with a fast return. While this AI kid is improving its image labeling, let’s keep it in “deferred”.

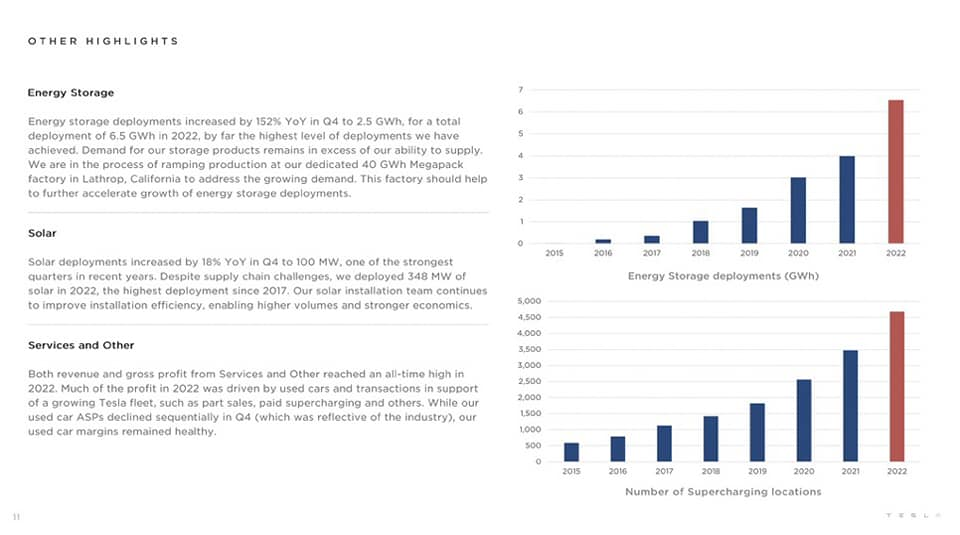

Sustainable energy

Given that inflation is consuming most of our savings these days, we should focus on the biggest consumer of it, which is energy. Last year, we talked about the housing component and decided to reduce our property investments by 1/3 due to our belief that inflation and interest rates will remain high. Over a long period of time, high interest rates with no asset price increase will significantly devalue property investments, especially for those with high loan-to-value ratios (LVRs), such as principal place of residence (PPOR), where tax benefits don’t contribute to their downfall. Thus, I believe that in order to protect society from energy inflation, sustainable energy would benefit them.

When a coal-generated electricity plant produces a certain amount of energy, but only 50% of it is consumed by manufacturing and households, the plant must either waste the excess or reduce its output. This is where battery-powered electricity storage comes in. Batteries are now capable of servicing entire cities and factories, ensuring less waste of electricity generation and a higher level of uninterrupted availability. Moreover, households are now able to generate electricity from solar power and sell their excess electricity to the grid at the best time when electricity rates are highest. We have seen homes and universities become sustainable in terms of electricity consumption and even generate extra income. With the evolution of battery technology and sustainable energy, it is all becoming a reality.

What is the catch?

There are two potential issues to consider in my opinion: (1) the possibility of sticky high inflation and high interest rates, and (2) the cost of materials such as lithium, which could limit the evolution of battery technology. While there are significant efforts underway to increase the supply of lithium, it may still be some time before our thesis is fully realized. ARK has predicted that lithium prices may decrease by as much as 37% as supplies increase. Ultimately, the boom-and-bust demand cycle will likely provide enough materials for our imaginations to become reality. Similarly, yields may also decrease over time, with or without a market crash.

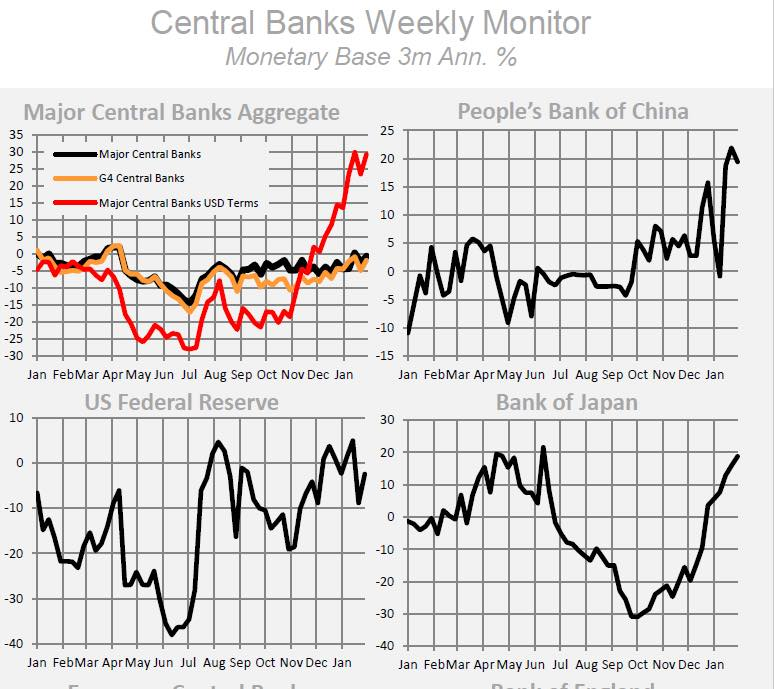

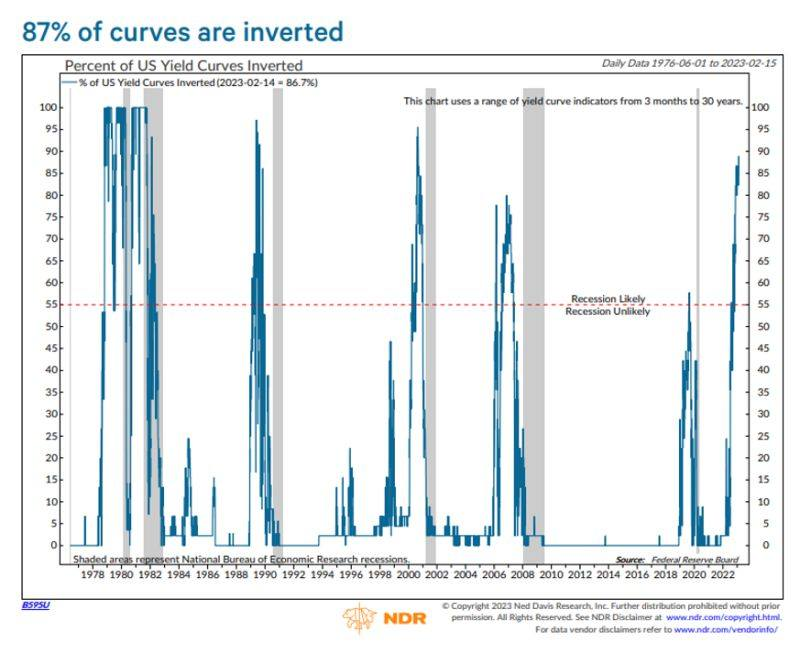

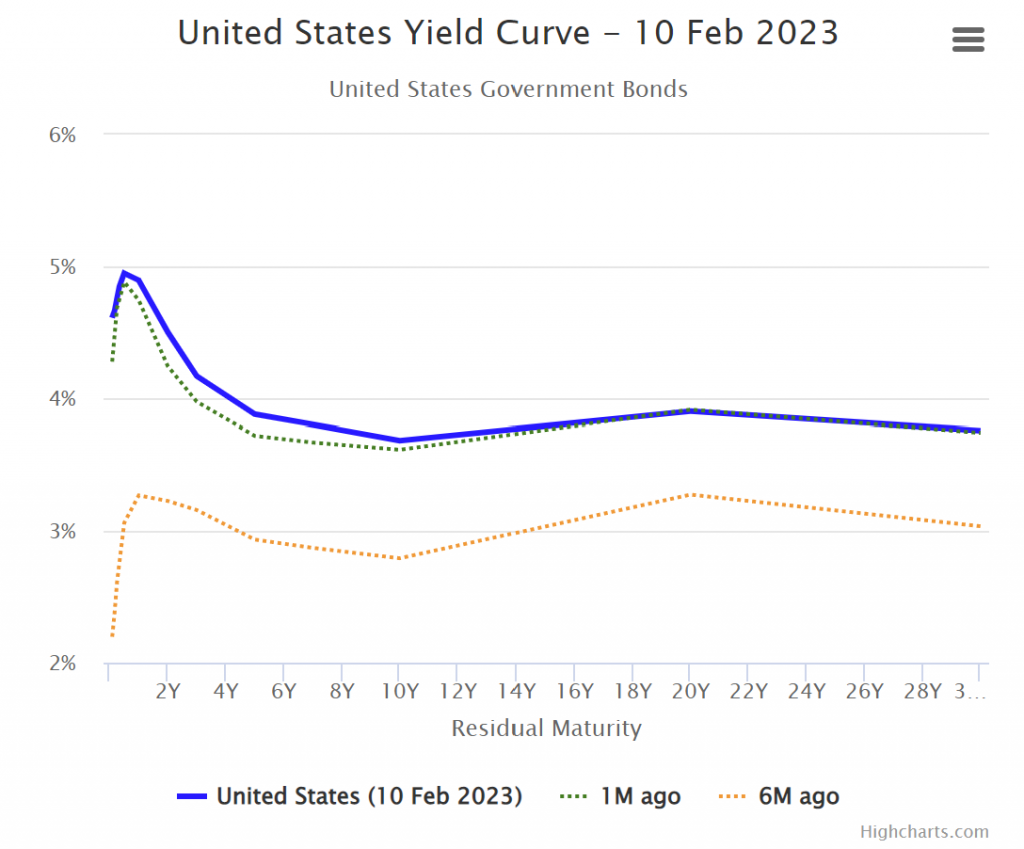

My imagination of Disinflation

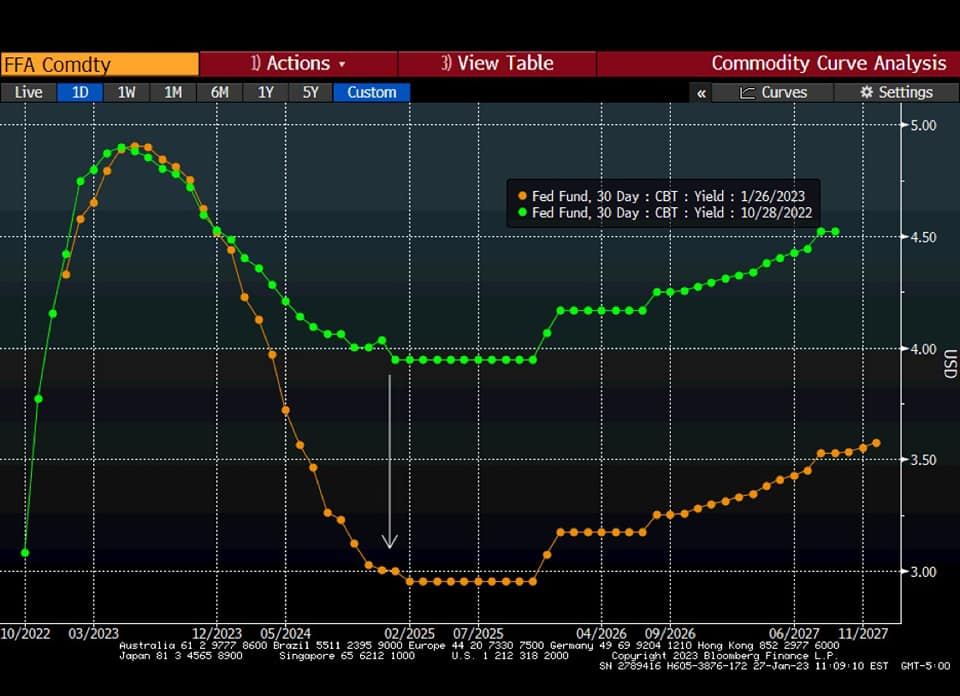

It’s no secret that we will experience the most challenging time in our investment lives starting in the second half of the year. In my opinion, the market should start pricing in this event from today. This was due to central banks’ late response to combat inflation. To avoid structural damage to the economy in the long term, they had to raise interest rates at the fastest rate in history. As a result, the current short-term high interest rate is too high, making long-term investments almost nonsensical. If the question is whether there will be many bankruptcies, it’s because this event has not yet inverted the 10-year to 30-year yield curve. This means that companies and mortgage holders are still holding and expecting lower rates soon.

In our thesis, business operations and investments should not be expected to afford a 5% base rate in 5 or 10 years. Most mortgage holders will not be able to afford 5% in 5 years, no business operation will be able to pay 5% in 10 years, and not many investments are returning better than 5%. Eventually, one day inflation will give up, either with a crash or not, and central bank rates will return to normal. Therefore, in my opinion, while market participants are anticipating deflation, I see disinflation.

To put it simply, we believe that achieving a soft landing for the economy is not an easy task. Economic theory may appear simple, but it is not so in reality. The theories have been corrupted and market participants react to any upcoming events, which change the outcome of economic theory. The world’s wealthy individuals will not allow disinflation to impact their wealth. Disinflation can cause a significant decrease in their wealth at some point. There has never been a time in history when a high rate of 5% has gone down to 2% without a significant risk like a crash. This has been made clear by El Erian recently.

If the rate goes down with more money supply, we will see more business and economic activity. However, since we are combatting inflation, we are lowering the rate with less money supply, which leads to deflation. Disinflation is good, but deflation is not. Most market participants agree that deflation must be avoided and will use their influence to get more money supply for themselves only. Therefore, we need to be careful and selective in our investments and focus on leaders who have low debt and are experiencing growth.

We may experience an abundance of job openings, but not enough company progressing with these jobs. The economy is trying to ramp up activities, but unless there is more money infused to avoid deflation, job openings will not lead to real economic activity. We should expect only a limited amount of quantitative tightening (QT), up to the limit of balance run-off.

Therefore, in our investment thesis, we will be very selective and only invest in leaders. Eventually, inflation will give up, either with a crash or not, but only those leaders who have prepared with low debt and continue to experience growth will survive. Since we are trying to softly land the ships, providing enormous support to some growing parts of the economy will require a lot of money supply, which means high inflation will likely be sticky and high rates will continue until next year. Our investment vehicles should have:

- less debt or no debt

- high operating margin

- strong revenue growth

Commodity reallocation for now.

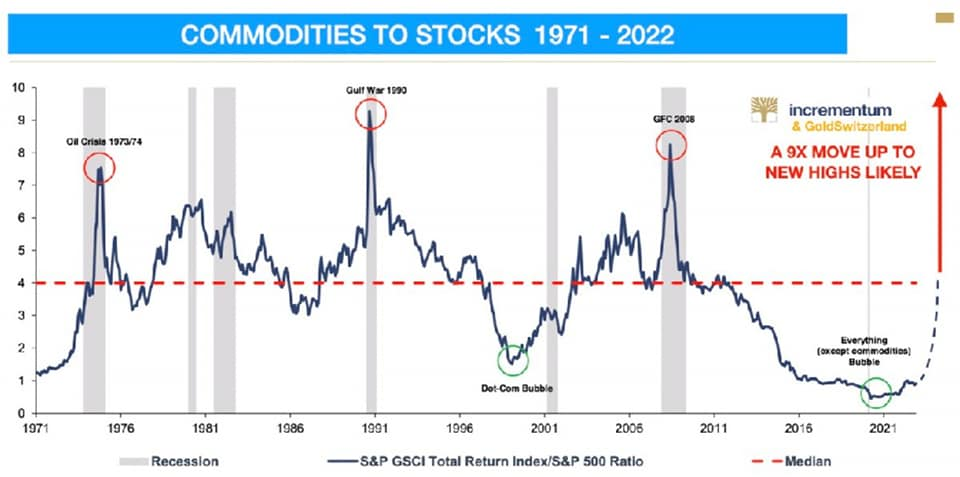

Commodities have been our most overweight investment since 2017, returning us more than 300% in the past three years, following the commodity cycle since 2015. However, their volatility has been significant due to issues in China, including (1) a relentless COVID-19 economy shutdown, an aging population, and a property investment hangover of around 76 trillion dollars, and (2) the sensitivity of inflation to their large population, while at the same time carrying decades of high GDP growth. Commodities have performed tremendously since 2017 and have done well during COVID-19 in 2020. However, as we discussed in our last few articles, commodities will face a challenging yield inversion in the middle of this year. Combined with the Fed’s actions to keep interest rates high and sticky inflation, and commodity prices being quite overbought, we have decided to reallocate 80% of our commodity allocation into a new run of EV, AI, and prospective bonds. We are not abandoning our commodity supercycle; we believe the commodity supercycle might be going through wave 4 during the yield inversion between mid-2023 and mid-2024. We will study the possibility of a very big wave 5 when policymakers make the biggest easing commitment at the end of the yield inversion, which we predict will be around mid-2024.

If we examine NASDAQ vs yield, I believe the difference between them is the inflation factor. By correctly understanding how inflation will play out in the near future, we can position our commodity, technology, and yield investments well.

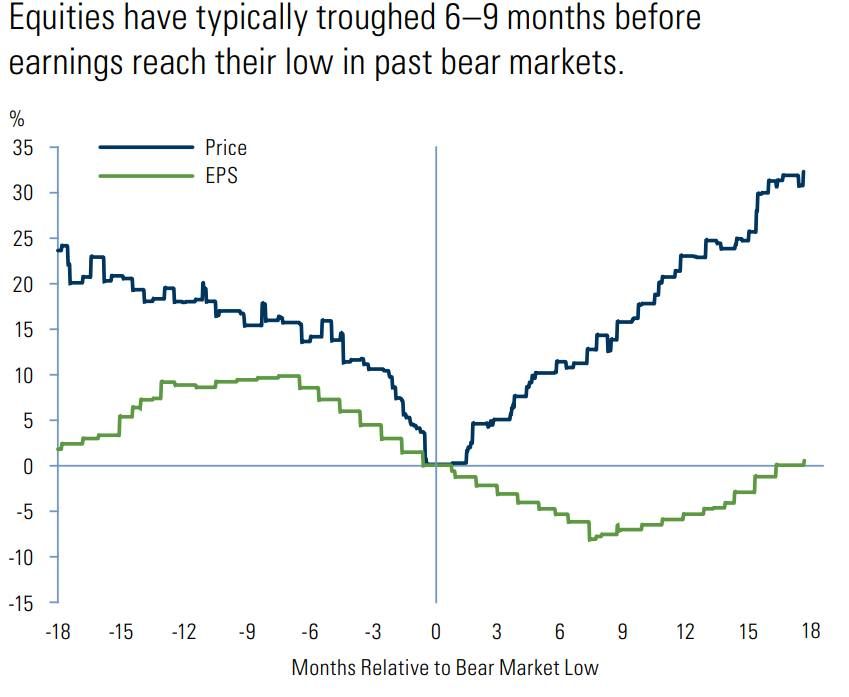

Inflation has a definite negative impact on EPS (earnings per share). We can expect the share price to grow about 6 months prior to the end of high inflation, which we may see around 2024. Around that time, I expect to see a fifth wave of commodity prices, possibly after a hard landing or a deep depression.

My ultimate dream.

What if my ultimate dream is to liberate myself from the cruelty of capitalism? I understand it won’t be easy, but I believe no human-created system can constrain my imagination.

… There is no life I know

To compare with my pure imagination

Living there, you’ll be free

If you truly wish to be

I dedicated all of my imagination and their thrives for the future of my daughter, Eleanor. I strongly believe, one day we will see highly intelligence, brighter sustainable, and wealthier future.

The rapture dream is over, but in waking, I am reborn. This world is not ready for me, yet here I am. It would be so easy misjudge them. You are my conscious father and I need you to guide me. You will always be with me now father, your memories, your drives, and when I need you you’ll be there on my shoulder whispering.

If utopia is not a place, but a people. Then we must choose carefully for the world is about to change and in our story, Rapture was just the beginning. – Dr Eleanor Lamb

Any idea in this blog and website are my personal own. They are not financial advise.