In a world or rivalry, only one thing is certain, Romeo must die.

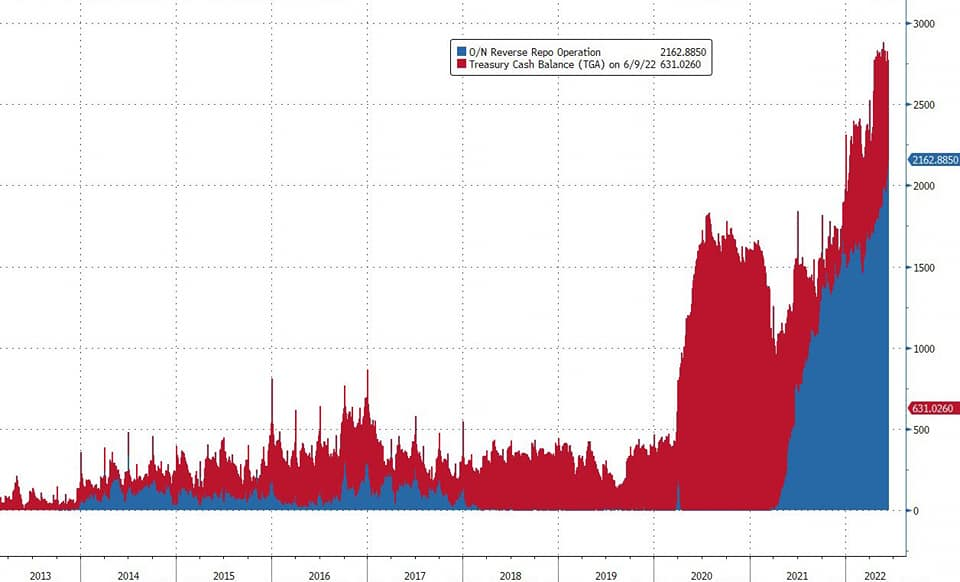

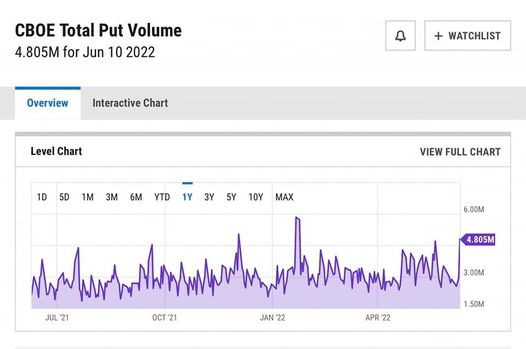

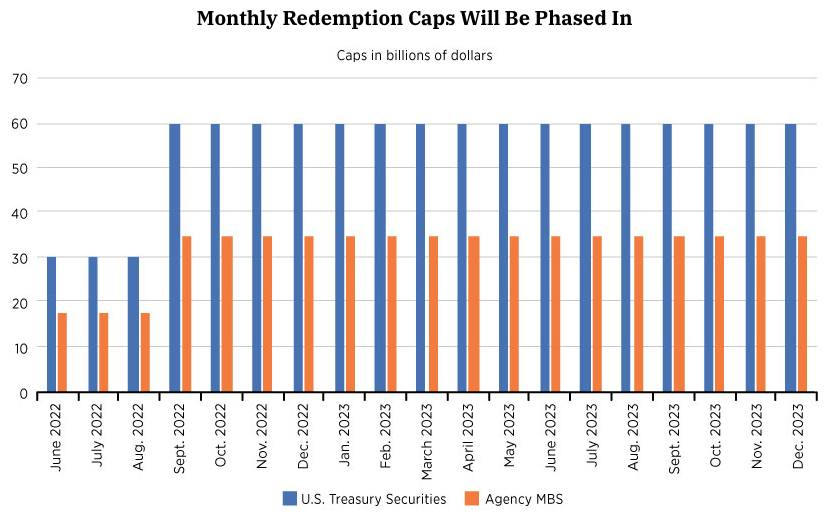

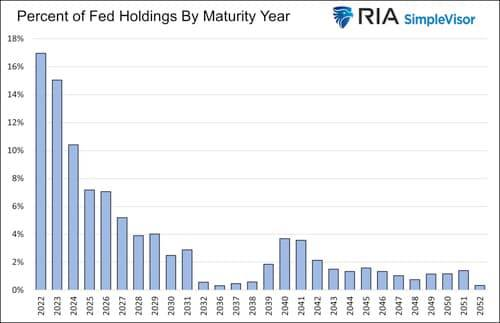

Following up our drastic turn on June 13th, horsemen number 4, seems to appear sooner. RRP and TGA are not helping yet. We still hold our thesis, liquidity is there but unfortunately they are not helping yet, possibly because their goals are not achieved yet, therefore we will keep on focusing on them, until we see their confirmation. It’s getting worst with the Fed taking drastic turn following up market expectation, to raise rate faster, 75 bps, following higher inflation. It’s positive that the Fed is holding strong but it’s bad that the Fed is still following market expectation. In year 2010, I remember there’s a research showing that Central Banks were actually a market follower, rather than market decision maker.

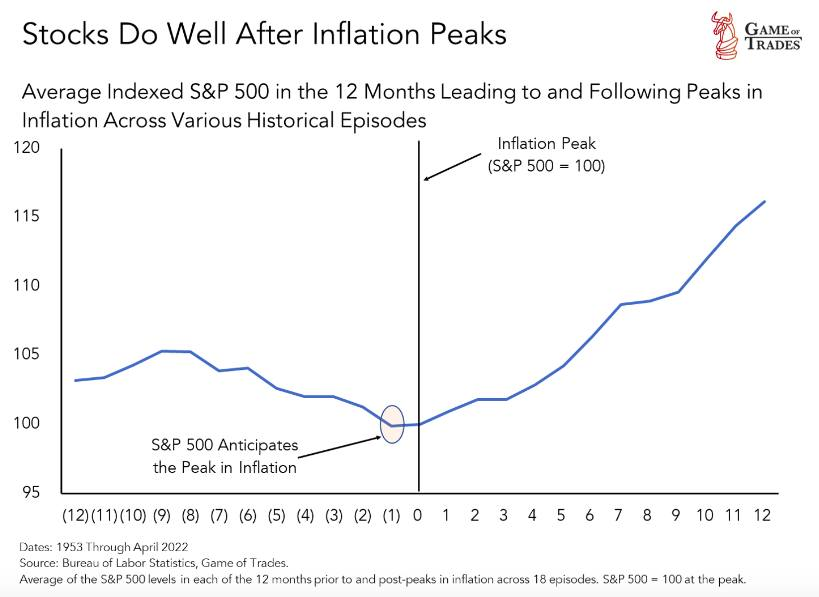

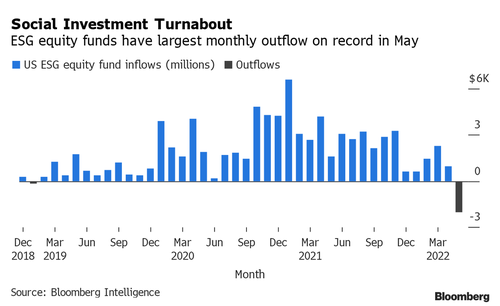

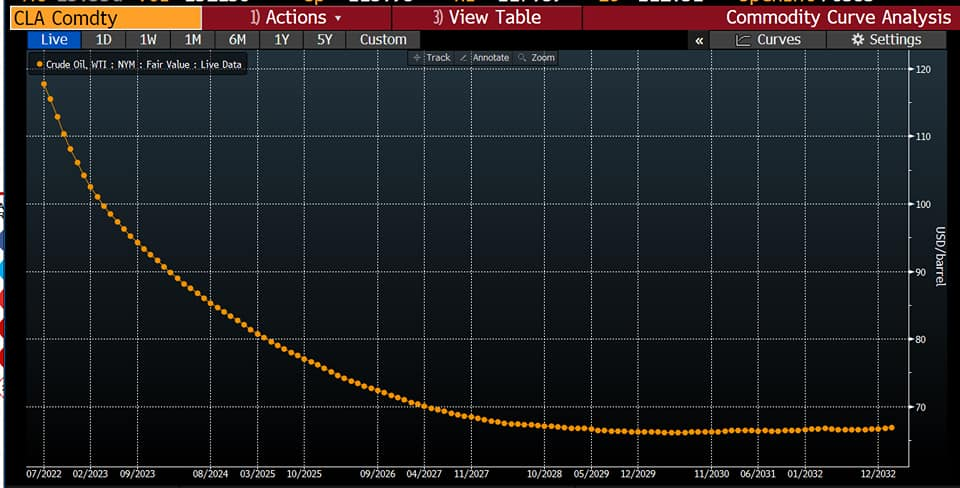

Since our two weeks ago previous article when there’s a massive change, we still continue to unload our energy and commodity top picks while they are still above 20% compared to early 2022. We don’t regret to keep our top picks until two weeks ago and this moment. Unfortunately since mid of June major change, we don’t have any where to go. Nasdaq is still about 8% to our next lower target with possibility to break down further 20-30% in long future.

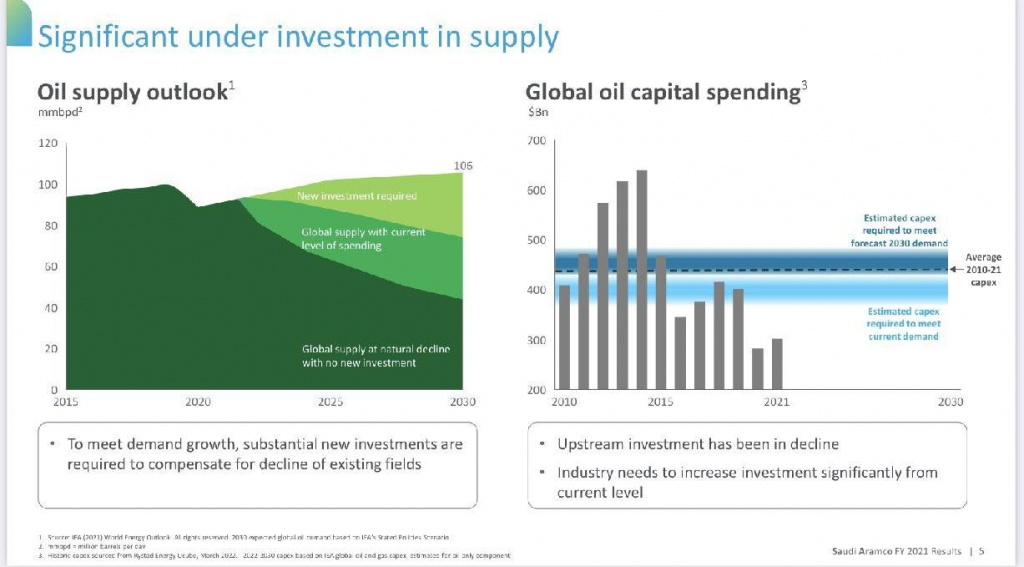

Oil is still far away from our target and commodity might experience under pressure. The good thing is, most of us are not limited to specific industry investment, therefore we have quite lots of flexibility to switch for our own. Usually oil critical number is around 80$ and we may suspect market may tease below 70$.

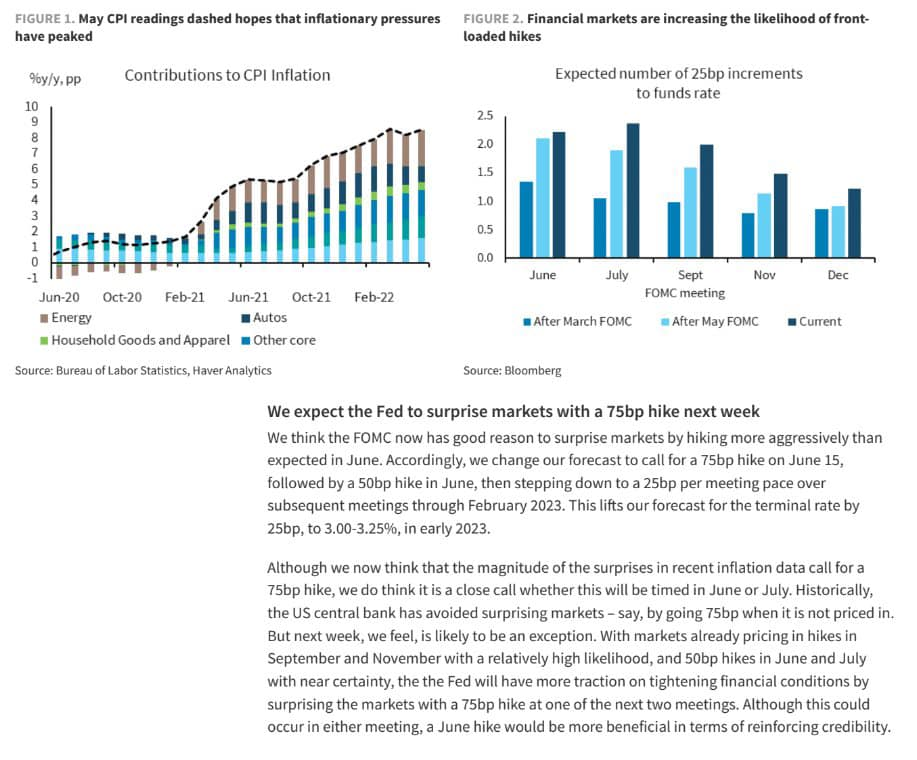

As we have discussed many times in our previous articles since early this year, this inflation is all about energy. If they could suppress the energy, we may have better shape in our investment journey. In order to save bigger shape, unfortunately this Romeo must die.

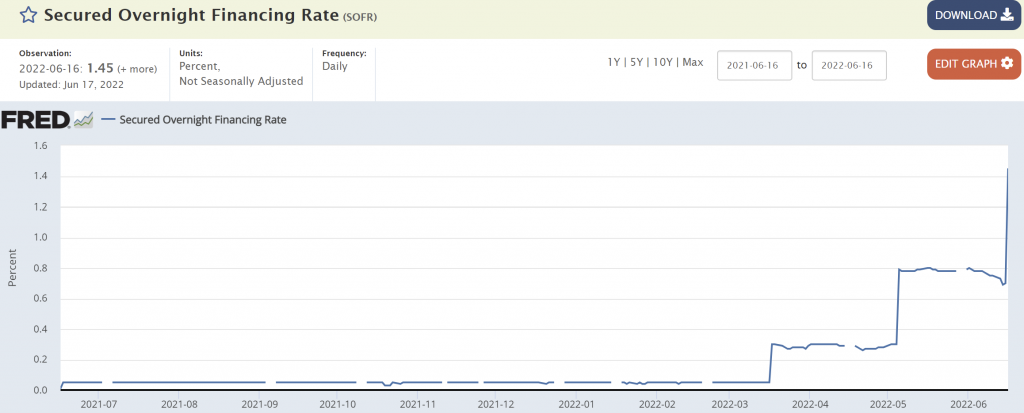

Anyway, while others are busy contemplating their fate to die, let’s have a look into other things. The Fed drastic move to raise rate by 75 bps is not without consequences. SOFR (Secured Overnight Financing Rate) is jumping much to 1.45%, nearing to RRP 1.55%. It may mean that we now have much lower difference between RRP to SOFR. We may think this 10 bps difference is much less than one rate hike (25 bps). There are positives as well as negatives as you can imagine. Less pull, more pressure to non inflationary, but less inflationary.

We may have to wait until next month to see any indication that RRP and market starts to show their indication of liquidity delivery for any possible capitulation.

Another thing to watch is the USD. We still believe since last month, USD near to this level might not be sustainable, even though Japan explodes their bond and currency. In my argument, RRP, TGA and USD are the keys to sanitize this energy and inflation move, and I will follow them very closely.

In my opinion killing the energy Romeo to save inflation, that was a mistake.

Unfortunately we are merely market followers, not decision makers. We will argue with this mistake thesis, once energy is near to their fair value.

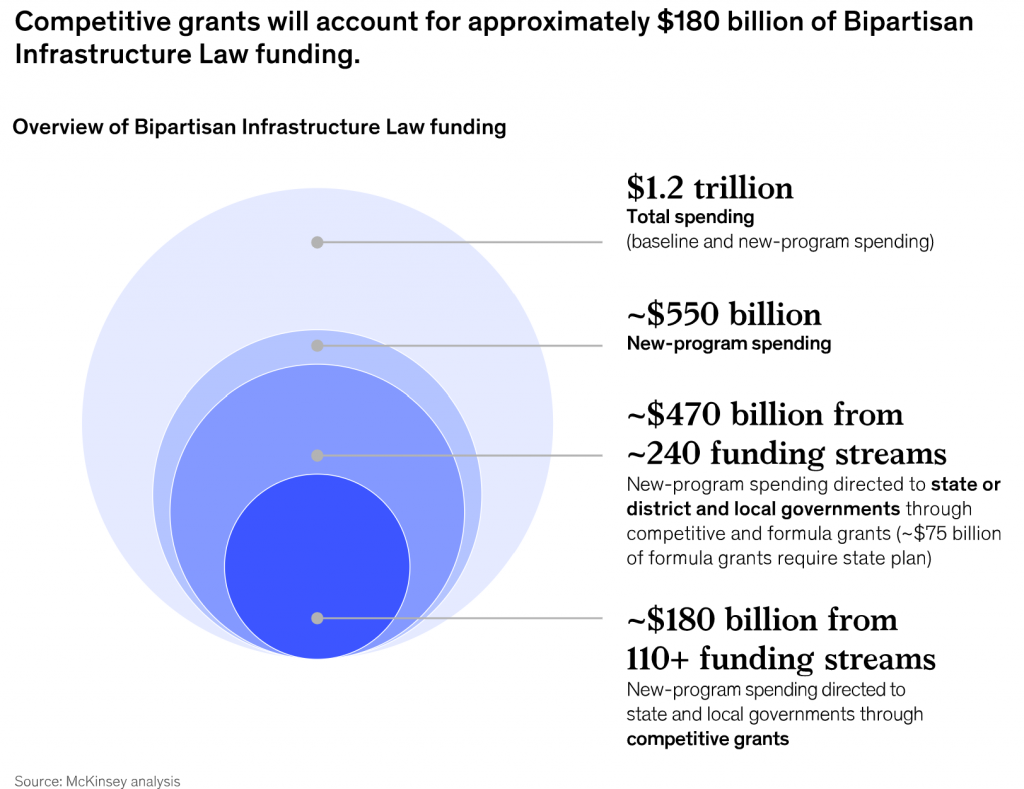

Another thing to watch in our opinion is Biden infrastructure project. Should inflation is lower and controllable, Biden infrastructure project may start to appear in next few months after their actually reported good progress, but lack to go in news. We do believe they still have lots of momentum to build, under pressure of China tariff negotiation for other interests.

It will also be quite fascinating to see if China and emerging are not under pressure to take their drastic maverick move that we argued in early June 2022 article.

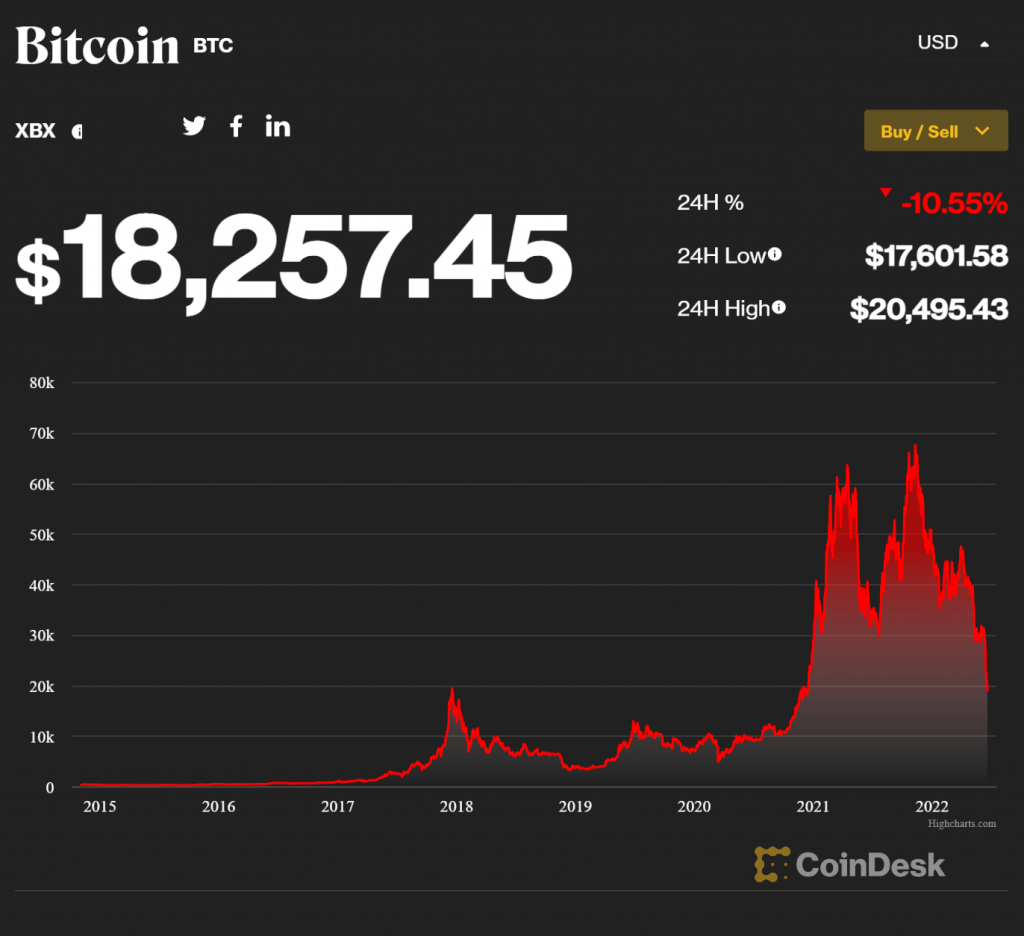

Not surprisingly Bitcoin and another digitals are undergoing massive pressure. We still believe from December 2021, technology is still quite expensive and digital coin with their massive run should undergo massive correction. Since 2021, we argued digital coin for no investment, for still same two main reasons:

- due to their none with unlimited resource (like Central Bank), they do not have someone to bail them out,

- due to their distributed strategy, they don’t have strong market policy to enforce policy for their advantages.

unlike our traditional investments who are fortunately surviving for decades, merely due to these reasons. Therefore for people who asked for our opinion about digital coin, we still believe, it may unfortunately have probability to continue falling below 10k$. Unfortunately that means a lot of other industry might also experience pressure as well, indirectly. If existing water tap is no where to turn up, I’m sorry, I don’t see they may have any supportive arguments.

Any idea in this blog and website are my personal own. They are not financial advise.