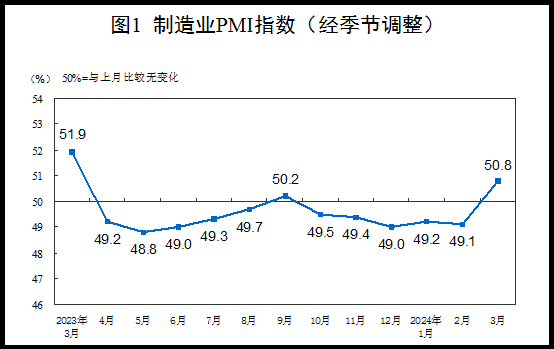

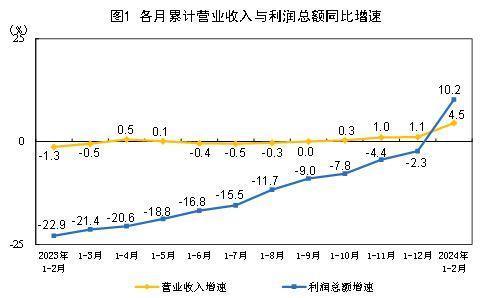

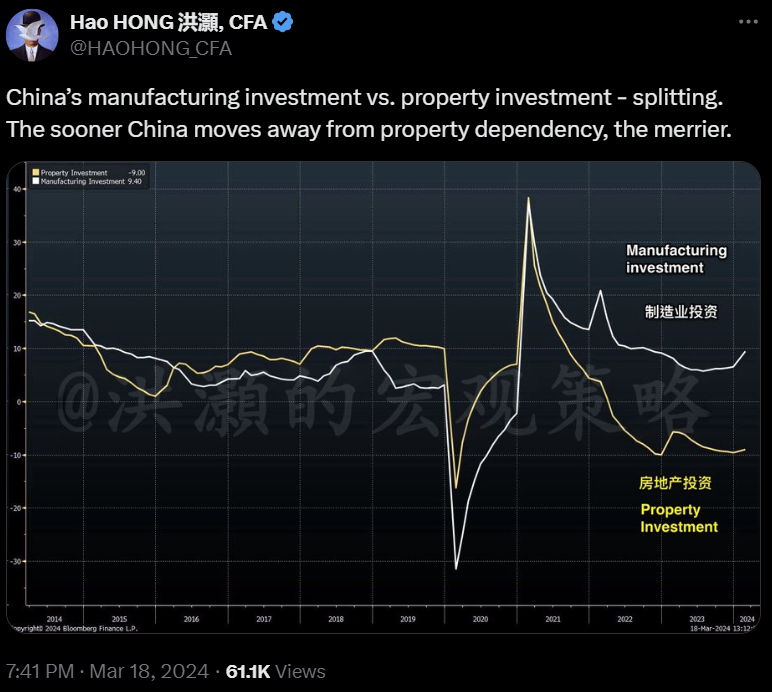

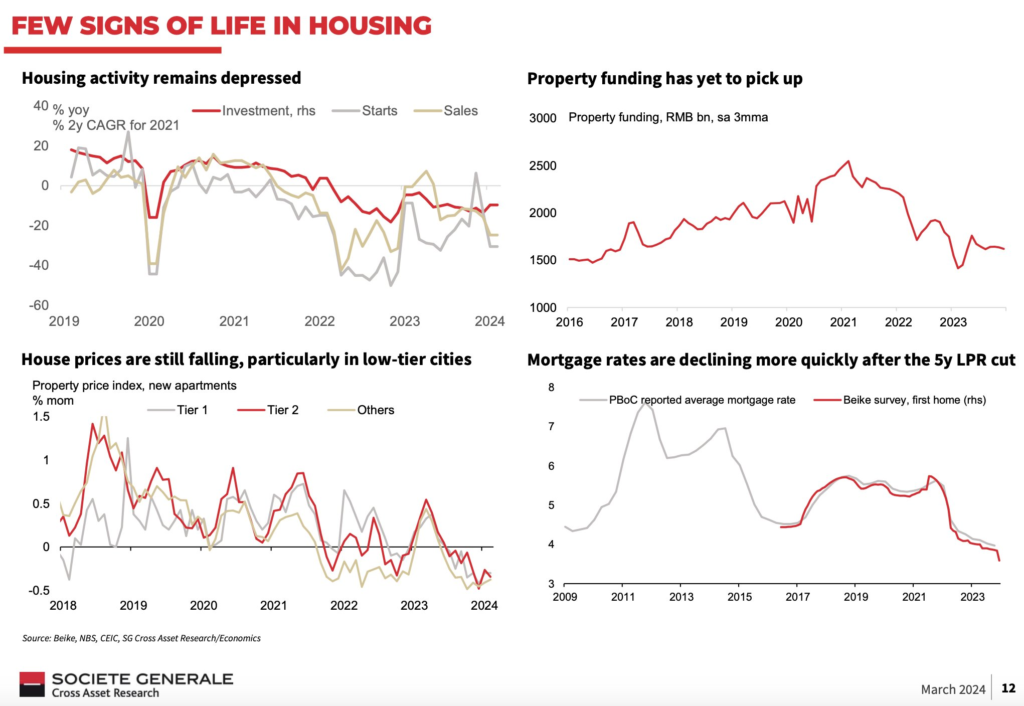

Following my previous articles, it is clear that China has shifted its focus from property to manufacturing. In March, policymakers chose not to concentrate further on the recovery of the property sector, instead directing their attention towards manufacturing, where their Purchasing Managers’ Index (PMI) has significantly risen from contraction to expansion.

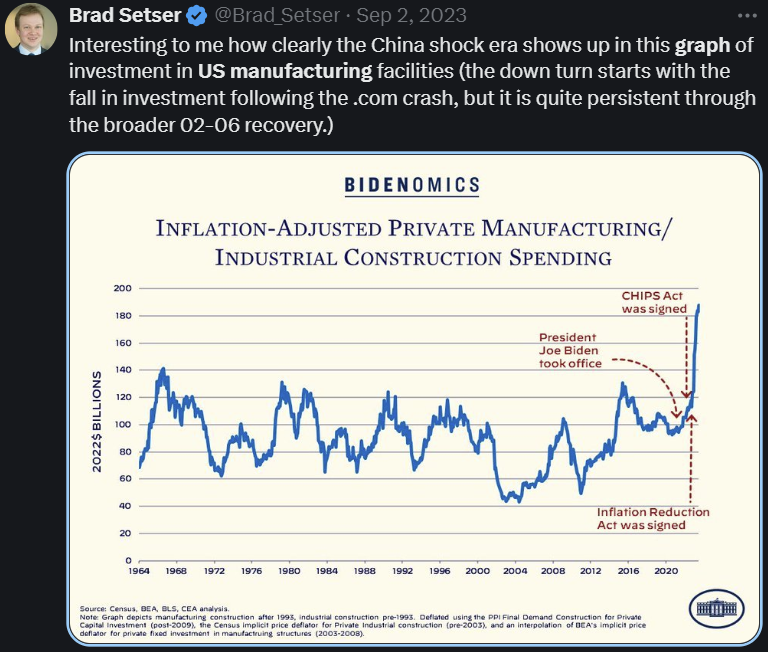

This shift occurs simultaneously with competition in manufacturing between China and the United States. The U.S. has observed that its inflation is buoyed by a significant increase in manufacturing and construction activities, accompanied by a high level of activity in the semiconductor industry.

The increasing profitability and dominance of Chinese manufacturing can be attributed largely to the strength of the USD. For many years, the world has been sailing through high inflation, a situation supported by the Bank of Japan (BOJ) through its purchases of US debt, which has helped sustain the USD. This arrangement is now expected to decrease. The global reliance on inexpensive manufacturing, a closely guarded secret, is beginning to come to light.

The strong USD, crucial for maintaining US debt supremacy, has significantly subdued material costs. However, it is anticipated that these costs may surge in the future. In Asia, the ongoing dispute between Nickel Tsing Hua and JPMorgan has led to overproduction in Indonesia, with protective measures for their tin resources.

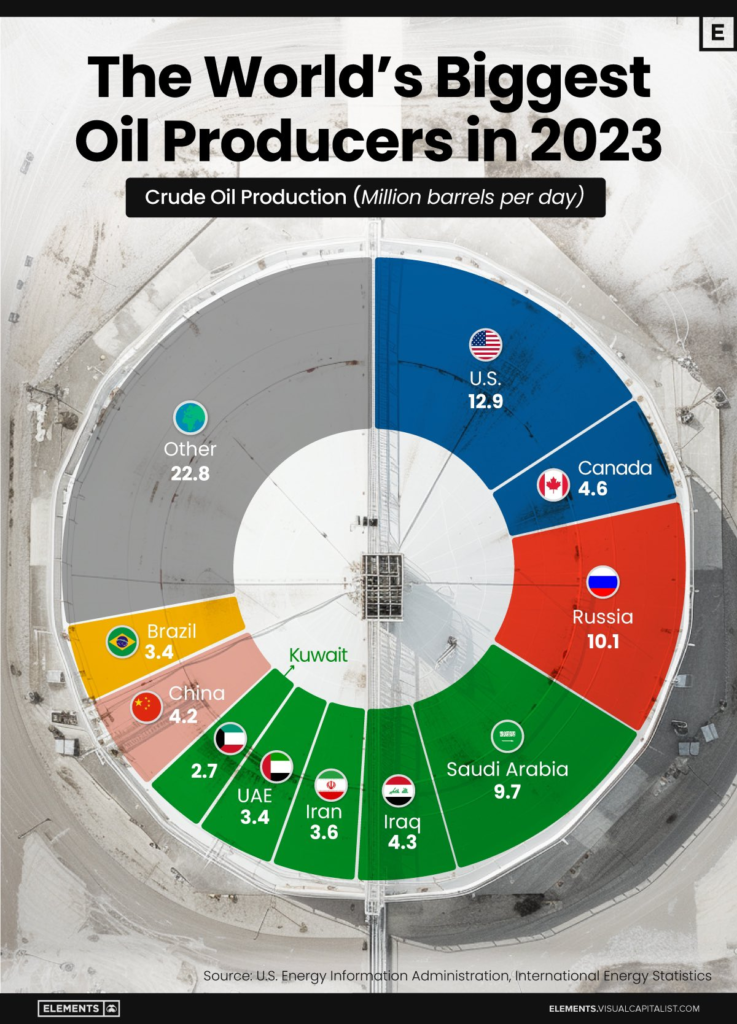

China’s global manufacturing prowess has long been bolstered by the green sector, leading to energy and copper being among the first commodities to emerge. I believe that the energy sector will continue to receive strong support in the coming years, especially given the US’s dominant role in this industry.

This coincides with the Bank of Japan’s (BOJ) move to exit its negative interest rate policy, initiated last year. The transition period in March witnessed volatility, during which the purchase of ultra-long U.S. bonds played a crucial role in supporting recovery efforts and exerting pressure against global deflation. This situation prompted national teams across various countries to recommence their efforts:

- Gensaki from BOJ

- The Fed to initiate taper talk

- Plenty of national teams to save their favourites

- etc.

The global banking sector, a fundamental part of our financial portfolio, has been showing strong fundamentals since the beginning of the year, potentially fuelling or navigating the next market rally. It appears we still have sufficient debt capacity, stable Treasury General Account (TGA) balances above 500B, and short-term liquidity. For Q2, borrowing is expected to decrease to $250 billion, down from $750 billion in Q1, but with higher coupons and net issuance anticipated.

From mid-March, I was expecting lower yields for both the Treasury Note (TNX) and Ultra-Long Bonds, which could further help in alleviating inflationary pressures. In my view, the Bank of Japan (BOJ) would need to continue its decade-long practice of easing US debt. Exiting the negative interest rate policy may not be as straightforward as it appears.

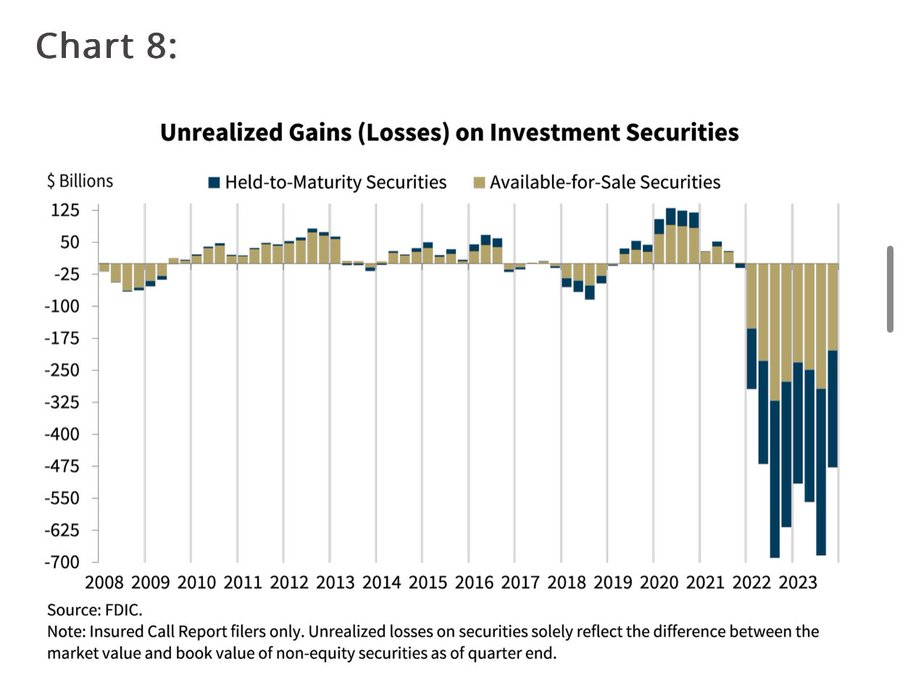

The data from early March indicates that the banking sector remains resilient and is in a better condition compared to the previous year. To improve this hold-to-maturity (HTM) situation, I believe policymakers in both regions should continue to prioritize maintaining the strength of US debt as this thesis ultimate goal.

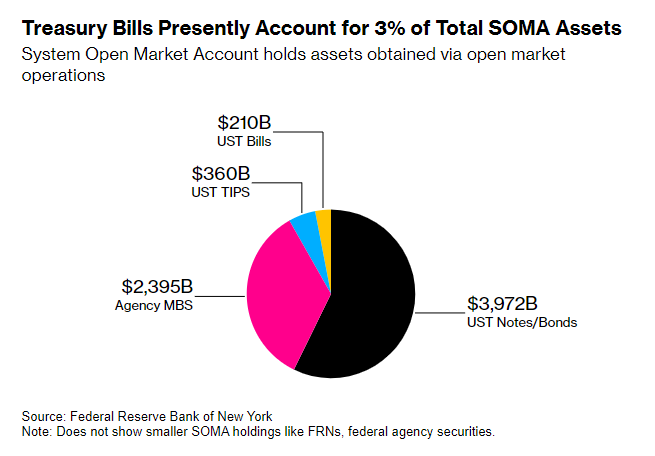

Besides tapering, the Federal Reserve has the flexibility to implement Operation Twist, a strategy to redistribute its bond holdings towards shorter maturities. It’s possible that they might continue to execute a balance sheet runoff, incorporating a strategy that involves shortening the maturity of their holdings, effectively ‘twisting’ the composition of their balance sheet.

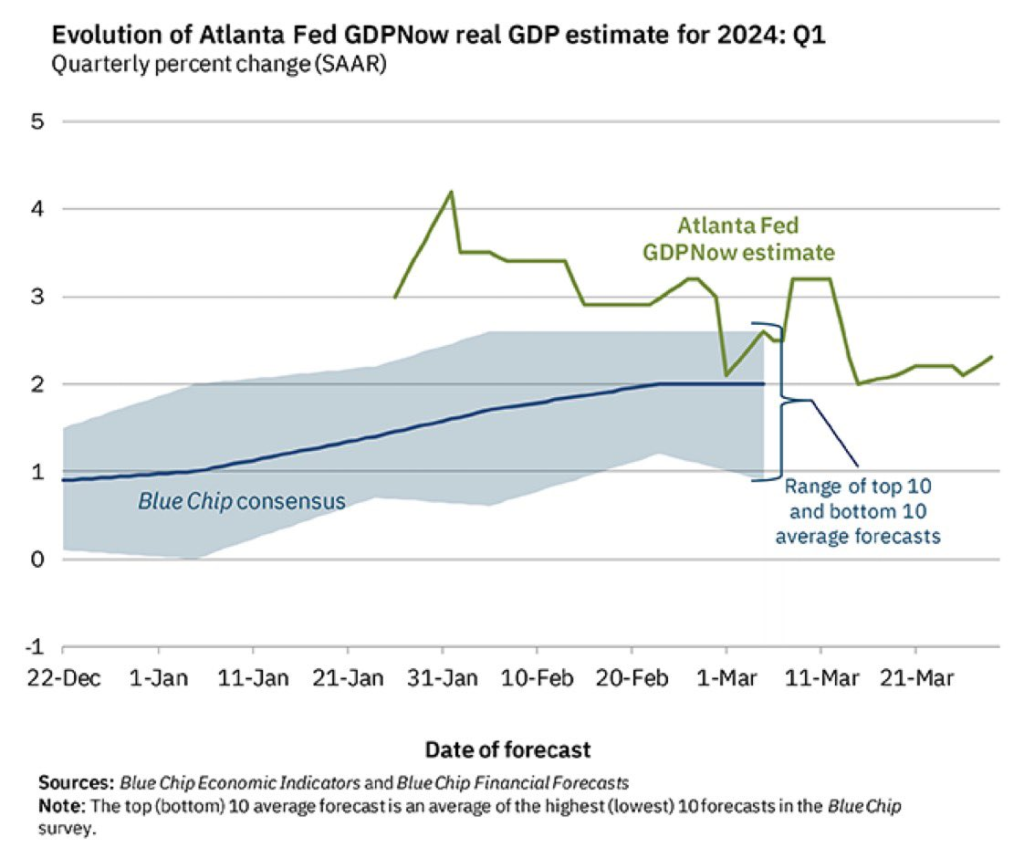

It appears that the policy will continue to support the supremacy of the USD’s strength. This suggests a reduced likelihood of rate cuts, a greater chance of global monetary easing, and a probable initiation of tapering. In my January analysis, I anticipated that tapering would precede any rate cuts, with the aim of safeguarding US debt and preventing global deflation, with GDP which may likely to ease with inflation.

Simultaneously, the Bank of Japan (BOJ) is expected to attempt to support its domestic economy, facing challenging dynamics between the US and China. The primary goal would likely be to uphold the strength of US debt supremacy (distinct from the strength of the USD, in my view) and to maintain the dominance of Chinese manufacturing. I hope for cooperation between these entities to restore their original roles and functions, allowing for a return to natural economic conditions rather than persisting in their current artificially sustained operations. Given the objectives outlined above, untangling global economic decoupling should indeed be manageable. Let’s begin with lifting the ban on some wines and toast to a brighter future.

Please note that all ideas expressed in this blog and website are solely my personal opinions and should never be considered as financial advice.