“Try not. Do or do not. There is no try.” —Yoda, Star Wars Episode V: The Empire Strikes Back

Like TNX, TLT also exhibits weaknesses, indicating that the inflation we have overlooked might resurface. The intensity of this resurgence is uncertain and may only become clear once the amount of the associated debt ceiling is determined in the coming weeks. This supports our previous articles and beliefs from last year, suggesting that inflation will persist at a high rate.

The high rate undoubtedly has caused a substantial fiscal deficit, and reversing this trend in the next few months is likely to be challenging. Federal Reserve members have also acknowledged that it is premature to claim victory. The current concern revolves around the impending exhaustion of the debt ceiling, which is projected to occur around June 9th, 2023.

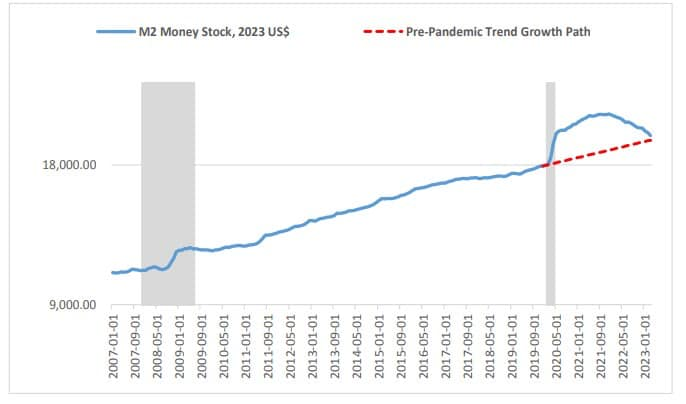

On a positive note, M2 is back on track. M2 is expected to increase once again, but not immediately. Our previous analysis demonstrated that relying on year-over-year M2 growth over the past year is an inaccurate indicator. YoY growth does not provide a reliable indication of M2 behavior. With the high rate in place, money growth is anticipated to resume with reduced inflationary pressures. Additionally, recessions tend to occur when M2 falls below its trend, and the end of a recession typically coincides with a significant increase in M2.

Therefore, we believe that liquidity is currently normal, unless M2 continues to decline below its trend. If a recession were to occur, it would likely come to an end once M2 starts to increase significantly.

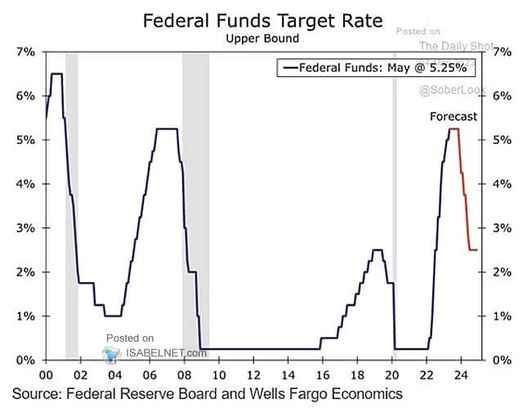

The Federal Reserve emphasizes that it is premature to consider a pause. Consequently, a pause in interest rate adjustments is not currently observed, and it may be several months before any rate cuts are implemented. A rate cut would only be considered in the event of a significant market force, such as a force majeure. It should be noted that the bankruptcy of small banks alone is not sufficient to qualify as a force majeure that would warrant a change in the rate trajectory. I can provide further explanation on this topic if desired.

Based on CPI expectations, we anticipate a return of inflation volatility (likely to be mild) over the next six months before it subsides again.

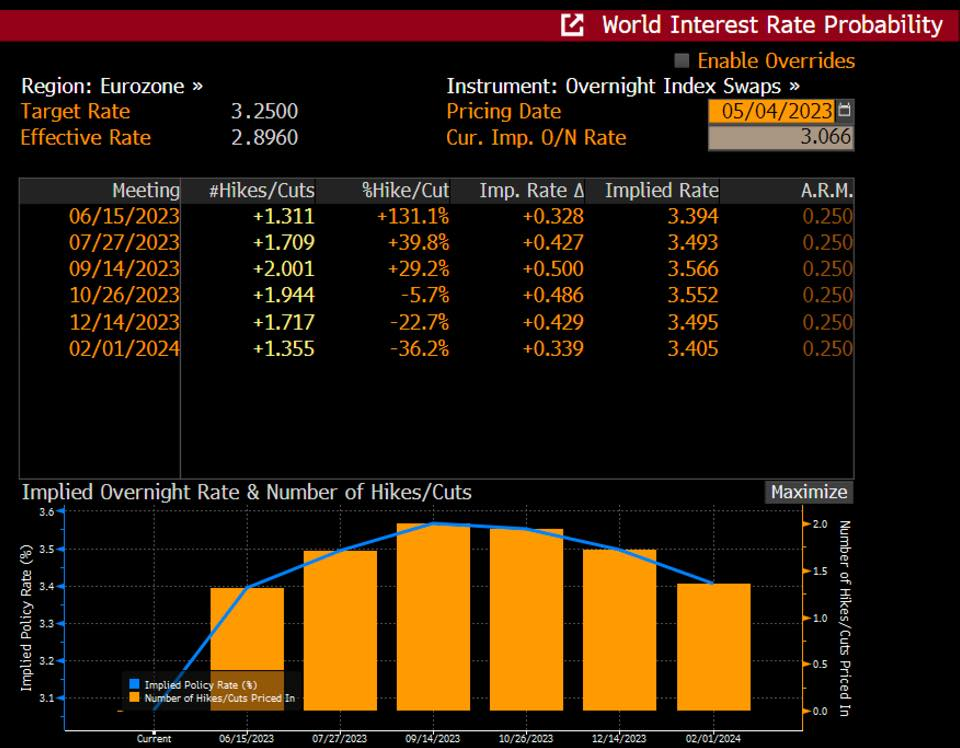

This aligns with the European Central Bank’s projection of raising rates towards the end of this year. Additionally, the European index continues to deliver impressive returns.

A reduction in rates may occur once the expectations regarding net global CPI are met or when net global CPI is officially declared to have concluded. In such a scenario, I would anticipate a potential resurgence in global CPI, which would necessitate keeping the rates elevated until we are genuinely certain that the threat of high inflation has subsided.

Emerging markets, which are closely tied to commodities, appear to have experienced a significant stabilization since April 2023. However, it is important to exercise caution, particularly in light of significant changes in the debt ceiling.

The lack of correlation between interest rates and the index reached its peak in November 2022. However, with the correlation now expected to increase in the coming months, both variables will likely move in the same direction—either both moving up or both moving down. Taking into account all the indications mentioned, it is anticipated that inflation will make a comeback, accompanied by a rise in risky assets, primarily driven by commodities.

Since our decision in January to shift our overweight position from commodities to US technology leaders and Treasury Bills, commodities have experienced a correction of 10-15%, while US technology stocks have surged by 40-65%. This represents a significant outperformance of 50-80% compared to the overall market return, achieved in just five months. Given the substantial spread within this short timeframe, we have decided to reallocate some funds back into commodities to mitigate the volatility of our portfolio returns. This adjustment does not signify a strategic change but aims to smooth out the portfolio’s performance.

We will closely monitor the anticipated resurgence of inflation and strive to eliminate any remnants of hidden inflation definitively within the next six months, even if it requires employing drastic measures such as an “atomic recession” scenario, which unfortunately may have severe consequences. We hope for divine intervention to protect us all from such a catastrophic event, similar to the Noah moment.

Please note that all ideas expressed in this blog and website are solely my personal opinions and should not be considered as financial advice.