see no evil, hear no evil, talk no evil, and do no evil

Economy is a protection of wealthy. It’s always be mysterious, otherwise it won’t work. We might sometimes need to see no market, hear no market, talk no market and do no market. It’s true, market and communication have been long used to make money and protect the wealth. The only way to know the real market is using math, because 1+1 is still 2. No surprise that technical is still playing well, until a strong hand does poison it to monetize and protect their interests.

Recently we should be surprised that central banks outside US, have been orchestrating easing. They are who are US allies. Can we see the evil here? Can we hear the evil here? Can we talk the evil here? Or can we do the evil here? No matter why yield is inverted, let the issue stay here.

Greece, land of Russians billionaires to park their money, fell down a decade ago. Italy and other PIGS who try to save it, are still enduring longest economic depression, longer than US depression in 1929. It’s the cost of austerity where Greece central bank is unable to supply Euro, which is under monopoly of ECB, which is under influence of bigger shark.

HongKong, land of Chinese billionaires is starting to shake when China tries to put extradition law to this biggest tunnel of money out flow from China. Could it be part of global yield inversion? I see HongKong has one main big issue. It pegs its currency to USD while it should go together with other countries to depreciate against USD. Similar to Greece, HongKong is highly dependent to US and its USD. What do billionaires in HongKong think about their money in such extreme high risk when this country can go bankrupt at any time? Eerie is everywhere and exit door is too small.

Who is going to bail out HongKong? US or China? If they go to China, people may get instructed to riot. If they go to US, they can easily get overpowered by Chinese army. HongKong issue seems to already spread into Singapore economy and two of them dictate premium property in Asia. Does it scare RBA enough? RBA rate cut is showing how they respond to risk of biggest surplus of Australia, which is coming from China, both in trade and account. It could stem into overdue Asia Pacific correction since 1997, when I self-experienced scary social unrest and first time I did deep study of GFC to many different business views. It was due to company debts bubble and could now be property and government debts bubble, through trade war, currency, and policy changes.

There should be no safer place to park your money unless you pay for its safety. Negative yield everyone? Trump always emphasizes that US won’t protect anyone money unless they pay or would US have such an ability to make more money unless everyone pays? Monopoly tends to work well.

Of course this issue is much complicated than what we ordinary can see. At the end, we are just market opportunist who is trying to follow where those money is moving. We do not need to see who is that evil, or hear that evil. We do not need to talk about that evil nor do the evil too. I think global money is starting to morph into something new and I would be just following money using my own money theories.

It leads me to classic technical play. An example of technical play is below. We did know well why we were doing big short to this company in May 2018. It broke both fundamentals (loosing arm of Veritas and Verisign, attacked by Google, long contract cheats, high debt, etc) and bad technical. We recently hear so many drama and mysteries, but seeing technical below in few seconds is enough to answer our curiosity, about what will happen to this company. There’s a Geisha make up by activists. Fundamental may not go better soon but activist play may draw stock price.

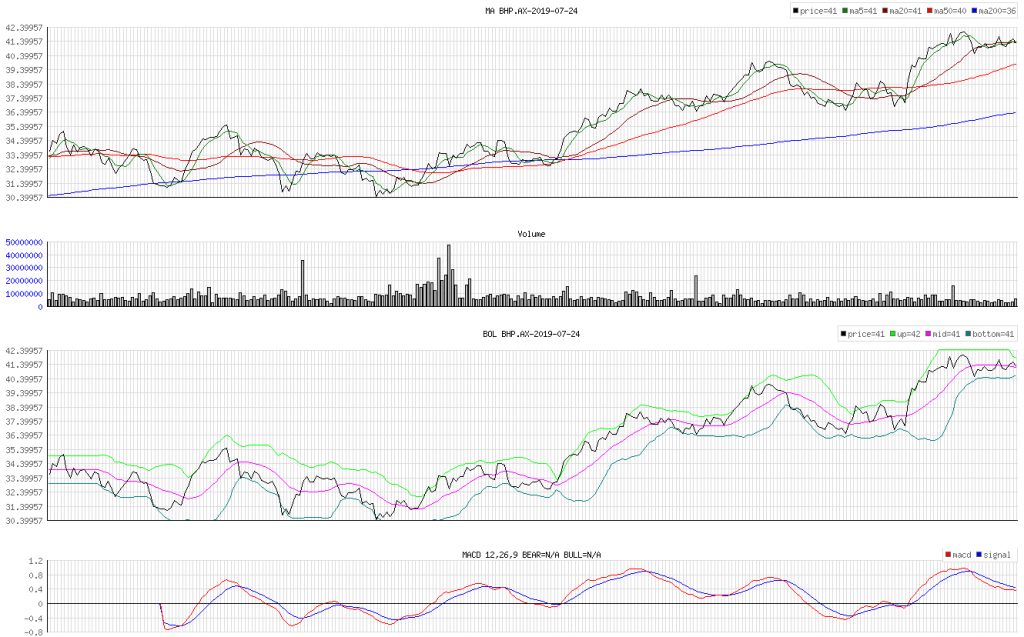

Another example, we do not need to hear any recent good news about fundamental of this company as well. We just need to know that easing is on play. It may not be favorable in short term but long term play should be strong enough. Who can win against central bank monopoly of their currency? Let traders try and we will do play with both of them.

I am a fan of any play and behavior of market participants, but recently the 4 wise monkeys inspires me much to overweight technical. When we can’t see in dark, don’t forget to always turn on the light.

I may have personal interest in any part of my article, therefore it’s not in any case of financial advise.

What you see/hear/do here and when you leave here, let it stay here.