When The Fed started to raise rate at the end of 2021, negative yield, (reflected in strong commodities), tried to support market price until mid of the year (leaving only commitment ones). It was ended with a bang in CPI/inflation number, a beauty of delayed market expectation, an architect in play.

It should be easy to understand current financial situation. If current bank deposit is offering 4%-5% pa, all secondaries should already be beyond 8% or 10% pa. Their returns are so compelling, making any new equity and property investment no longer attractive.

- plenty of multi years equity investment with dividend below 4% pa is no longer attractive. In matured companies, their dividend may reflect true value of their operation return.

- plenty of multi years property investment with net return below 4% pa is no longer attractive. Low rate has made property investment returning below 3% pa in past decade. Recently, mortgage rate has jumped to nearly 100%, while rental income in premier location such as CBD is hardly making 18% increase.

What does make them no longer attractive? Multi years of easing has caused their price, their denominator, expensive. Equity investment to borrow and personal loans are now going higher than 8.6% pa. Due to the condition, many funds are now offering 8% pa, even a simple strategy to pay off mortgage itself is on track to 7%-8% pa return. It makes no sense for almost all of investors, including us, to take such high risk since early this year. We also have no interest to return back our 25% deleveraged portfolio since June 2022. We will continue to allocate them into high return safer vehicles, possibly in very long years, next 3 years or so.

Please be very careful with any investment offering 10-12% pa return, which is tied up with any risky assets, including property. We strongly advise to avoid any of these because they have very high probability of going bankrupt. Most medium to small companies will be struggling to survive, even with interest rate as much as 8% pa.

We keep holding our thesis that high interest rate will stay for multi years. We believe most investors have biggest mistake in mind at the moment. They are still thinking that Central Banks and authorities will pivot again or help them again nearly soon, just like happening in past decades. I think current situation is much different to past, which most people don’t realize. I believe inflation this time will be very sticky, high interest will be here to stay, not only a year or two, but may be over 3 or 5 years. My two biggest arguments are:

- there’s no indication of pain in real economy numbers like in previous cases. Unemployment is still very low, big companies are still making money.

- there’s no indication of low liquidity from the biggest holders of this game, like banks and funds. Banks are still holding too much liquidity, reverse repo is still not indicating any requirement of the market to seek help, indeed front end treasury is still offering very attractive value.

Oh yes, I truly understand market in general is in pain, seeking for help. However in my experience, this argument is not enough for the authorities to pivot. It’s the hidden reset. To explain in a simple math; if mortgage rate is running just 7% pa for 5 years, property price doesn’t increase and barely make return on their depreciation advantage, it will loose over 40% of their property value, in form of interest. I was living in Asian country during Asia crisis 1997, current 7% pa inflation is nothing, compared to what I experienced.

Therefore since June 2022, since commodities were no longer able to support aggressive rate increase to terminal, we have been deleveraging our position to around 25% from all of our general investments. We should not fight the Federal Reserve in our general investments, whether they are in bonds, fixed incomes, equities or properties. Of course, there’s no need to be panicking, even though we are still planning to offload another 10%-20% of our investments, which could mark our fastest deleveraging across the board. Once completed, we would be near to borrowing free to grow fundamentally better with much less risky assets.

Of course since there’s no pivot, there is still some selected investments to grow, reasons below.

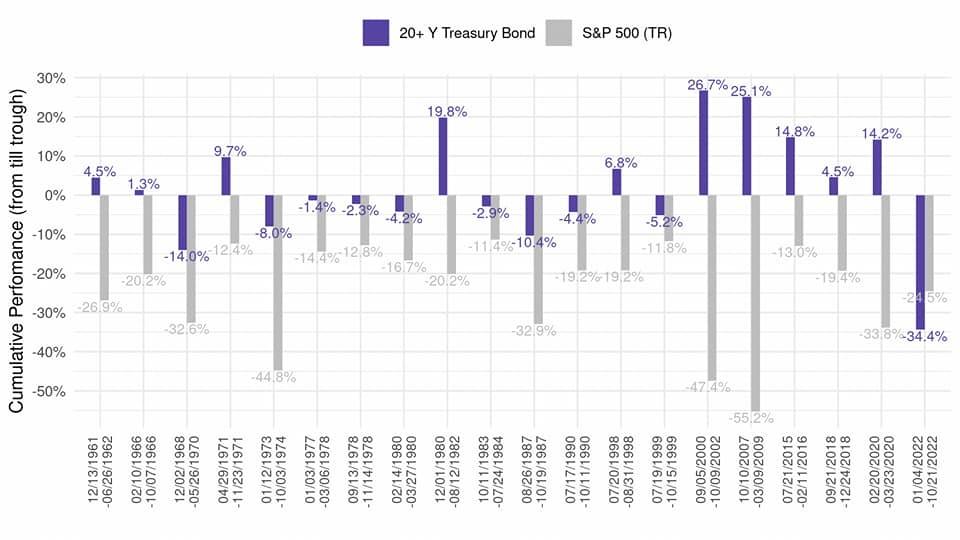

In previous financial crisis, bonds and debts were mostly performing much better than equities or risky assets. This is not the case at the moment. This should support our initial argument in which inflation issue is quite severe, which caused bond to suffer much harder (bond is sensitive to inflation/loss value of money), rather than equities (real economy or sufficient liquidity). It’s more making sense to support our second argument, high rate may last much longer and cause longer pain. Therefore it’s our strategies to reduce most of our leveraged investments. As much as high inflation may instead reduce debt value, we believe the situation may come after inflation is near to their end, not when inflation is still on rise. I’ve been studying inflation for many decades and this is in my own opinion only.

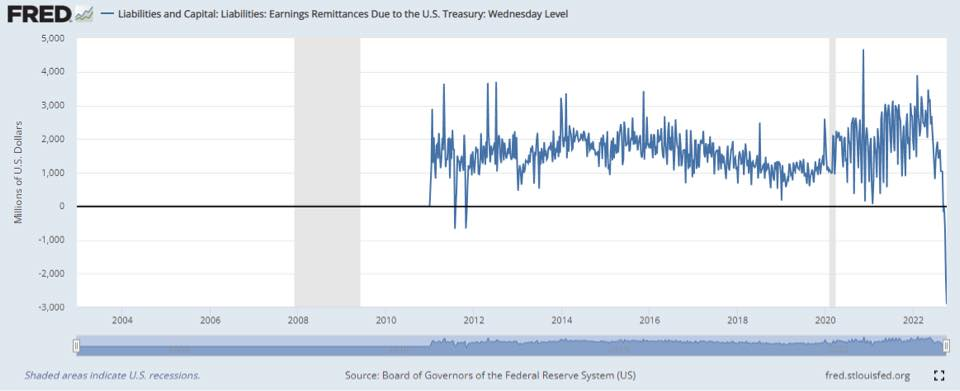

There should be lots of big dead cat bounce in equities, but some of them may perform well, since they are still performing better than bonds. If the Fed is not supporting banks with their treasury holding loss, US might have similar bad condition, just like happening with GILT and JGB.

We can also proxy from gold price. As much as authorities are trying to save market price, the bottom is still far away from gold normal price. It’s also our thesis in 2019, we believed gold and inflated price were so overvalued, and it requires lots of efforts, pain, and MULTI YEARS to normalize them.

Of course, we should acknowledge that the US is still having quite a lot of liquidity in their USD currency, bank deposits, RRP and TGA. Sometimes we also need to question why the Central Banks are targeting financial tightening in general, rather than targeted ones. Treasury and green money may then support big companies, it’s not just too big to fail, but it’s also too big to not winning their competition. These companies may then have enough ammunition to conduct merger and acquisition, a situation to see, before we decide to take commitment again in big investment.

Let’s track again when it’s all started. Last year, one year ago, we wrote in our article that the investment windows would be closed in one year. Easing was exciting, then came the Fed compromises with tightening. Then good became bad and bad becomes worst.

- The Federal Reserve to run multi years of front-end high rate will make them the most hated villain in this financial world. The greatest threat to our universe (economy) is YOU (The Fed)! – Explained in our May 2022 article: Multiverses of madness.

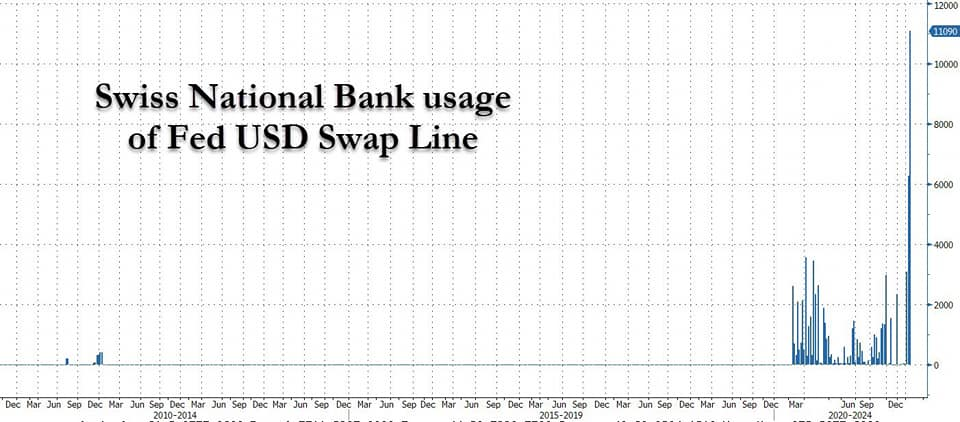

- We suspected in May 2022, treasuries around the world might start opening another multiverse/central bank kind of help. Treasuries should do targeted easing, if the Central Banks are doing tightening in general, sanitizing systems, just like what BOE and BOJ do recently. Wanda (market and Treasury/Yellen), I need your help! What do you know about the multiverse (new experimental things, including policy mix) ? . This October 2022 released video might explain better – a possible diabolical act from treasury of reserve. There’s also possibility that targeted easing should be conducted by company itself, e.g. buyback. It means, small medium company with limited return and ability to help themselves, may suffer well.

A possible short-lived Nasdaq bounce.

A possible short-lived peaked inflation thesis, which may lead to slowing down of rate raise expectation.

There is an indication that raising rate rise may no longer be effective to support USD. Therefore I believe, the Fed may soon reach their terminal rate.

We shouldn’t expect Central Bank to pivot. Painful multi years of high rate and inflation are instead deciding our fate. High rate is what gives value investment a meaning. To know it would be painful, we should hold our deleveraged assets and running short. It’s our strategy to keep our deleveraged assets into longer term fundamentally strong vehicles and may take short term trade position only, if any, with much smaller size. High inflation and rate will wipe out 50% of our living financial creatures. We will patiently wait, until there is a lot of merger and acquisition from big companies.

No one ever is. We don’t get to choose our time.

Death is what gives life meaning. To know your days are numbered. Your time is short.

Any idea in this blog and website are my personal own. They are not financial advise.