The Power of Heaven

Since early year 2020, human lives have been living fearlessly with:

- Bio CoVid

- Bio Omicron

- Geopolitical issue (might be statistically due to excessive money printing?)

Despite all drama in past 2 years, our democratic inflation thesis should fearlessly stand strong. We can’t invest (take long commitment) in things we believe in fear. Luckily, lady luck may still be in our side, in regard to the Fed tightening argument. Yes the Fed was clearly behind the curve, but they may always find an opportunity to continue to do so. It’s not without reason to fearlessly face the mighty Fed, when other side of the government fiscal interests is still with us.

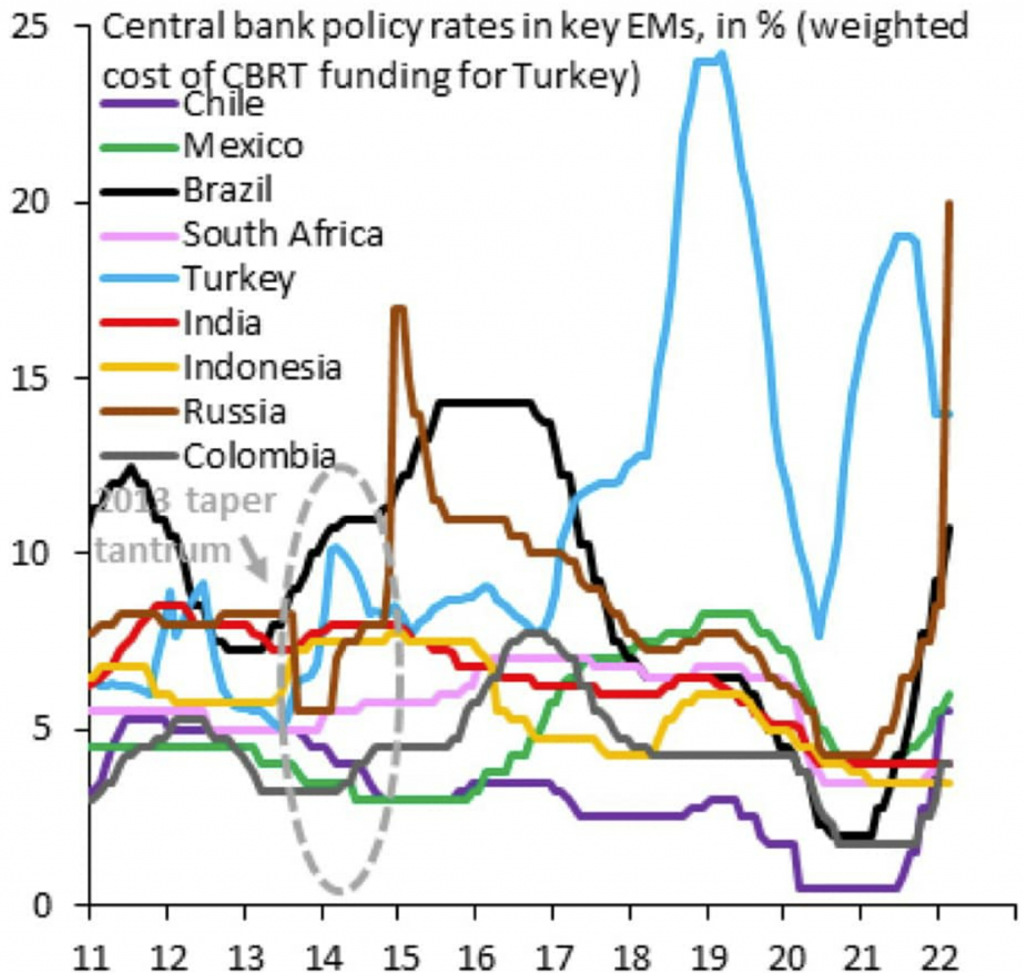

However, this action is not without any cost. It may continue to spill excessive inflation trouble into emerging economies. Explained in previous article with my strong personal background in emerging countries, I’ve been decades living in uncomfortable high inflation environments and always get interested to research their stories of war, riot and slavery. Example of countries with high inflation are countries with higher growth and less margin, a.k.a emerging ones. Do we still remember Venezuela and Turkey? Russia as well is not immutable.

Interesting to see from this picture, there are still few countries which may come late, e.g.: India, Indonesia and South Africa. I’m not saying that they must go through same fate, but based on my research in early 2020, I should fearlessly hold their inversed emerging data well to next few years as a hedging strategy into inflation vehicles numbers.

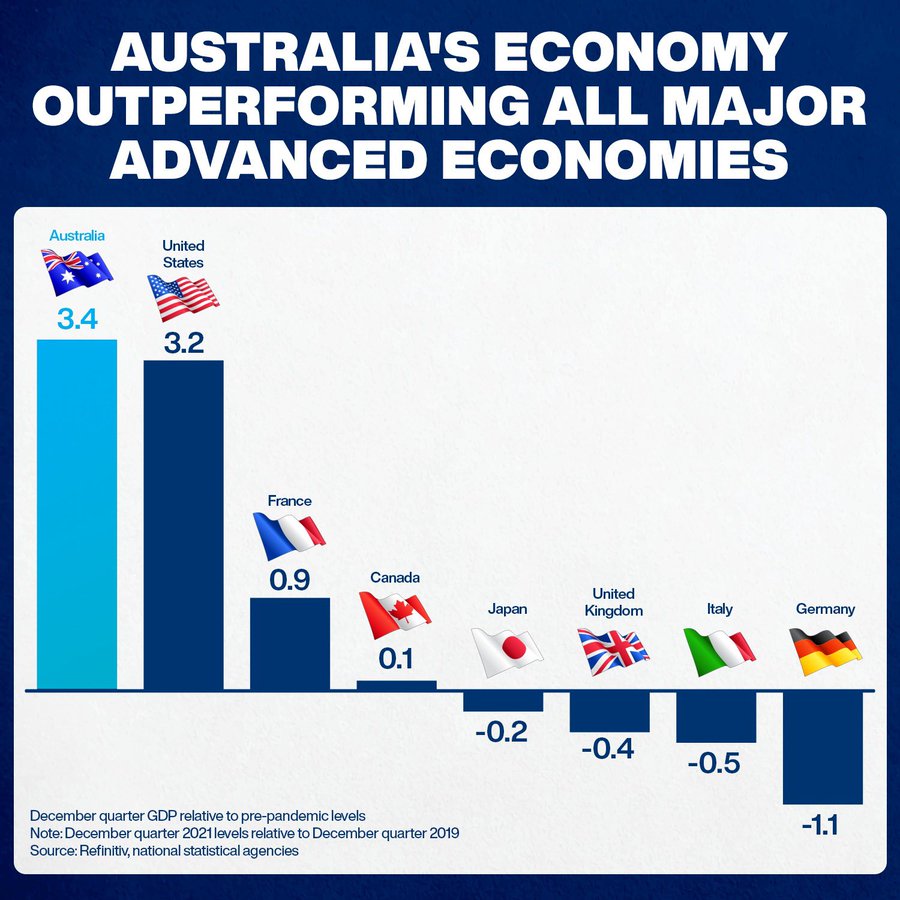

To amplify this strategy and to hedge with 2nd largest economy, China, I would rather take commodity currency, such as AUDIDR or CADIDR. Fearlessly, China was envy enough to intimidate Australia and fearlessly enough many emerging economies may continue to hang into USD swap life line.

Logically, in my theory, it would be just a matter of time, in next few years, before their relatively pegged currency will break; since emerging rate has been running at higher gear for years and at same time, advanced countries would rather continue to push global inflation, due to their interests.

Our commodity market dynamics is now changing. Russia is one of largest commodity exporters of:

- mineral fuels @13B$

- precious metals and stone @2B$

- 3rd largest world steel exporter @1.4B$

- fertilizer @1B$

- inorganic chemicals @700M$

which are suddenly taken out from democratic economies. The numbers above are still supporting our top investment picks, e.g.: energy, steel/iron ore, food/fertilizer etc. It also supports our 2nd top pick of the USA infrastructure. Biden said, Russia sanctions was months in making. Conspiracy theory wise, the inflation driven commodity pie was supposed to be shared among democracy economy (our investment commitment) and less with major competitors. Even China, is willing to cut their massive amount of steel production through property/GDP growth sacrifice. In result, as expected in previous articles, some of US infrastructure projects may seem to benefit from this and continue their run.

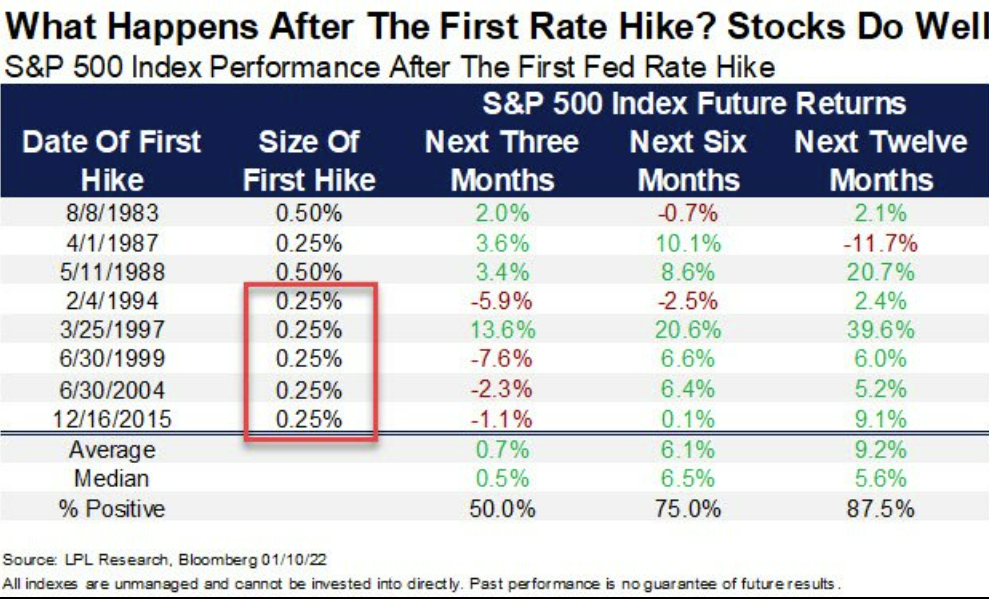

Statistically, based on 30 years of data, after first hike, share market index had increasing probability to continue performing better to next 12 months (50% in first 3 months to 88% in 12 months). In this case, we don’t really need to see a real rate hike, market pricing to it is real enough already.

In my theory, current biggest threat to our investment thesis is not the eastern Europe geopolitical issue, nor CoVid, but the Fed tightening. However due to bigger fiscal interests, I believe in some way, the invisible hand is trying to somehow cancel or reduce this tightening effect and lower down the inflation at same time. We might notice this asynchronization between the Fed and other Central Banks readiness to embrace higher rate environment.

With intertwined Russia financial suddenly taken out from the world, decades of Russia economy growth supported inflation was also suddenly removed from this ecosystems. Monetary policy may find this as a temporary solution to their difficult situation. At same time, our top pick of EV (Electric Vehicle) evolution, not necessarily NASDAQ, which has been threatened with high inflation, may find some support.

If the high inflation was due to excessive money printing (CoVid for example, rather than high economy activity), sanctioning Russia might be able to slam the break of negative effect of money printing inflation excess, without having to stop liquidity support internally. This might lead to what I was expecting in previous articles, a drop in inflation, without having to reduce liquidity and affecting fragile financial market where sustainable economy growth is not there yet. I am expecting incoming drop in inflation with arguments of:

- lower inflation to sustainable level of high inflation (not a deflation),

- geopolitical issue may significantly reduce global growth and reduce negative effect of liquidity excess (~10%),

- cancellation or lower than expected the Fed tightening (from its 7-9 market pricing hikes),

- acceptance of higher energy price with support of nationalism/democracy,

- flight to safety assets like treasury, drop in their 10y to lower this monetary supported inflation at sustainable level,

- etc.

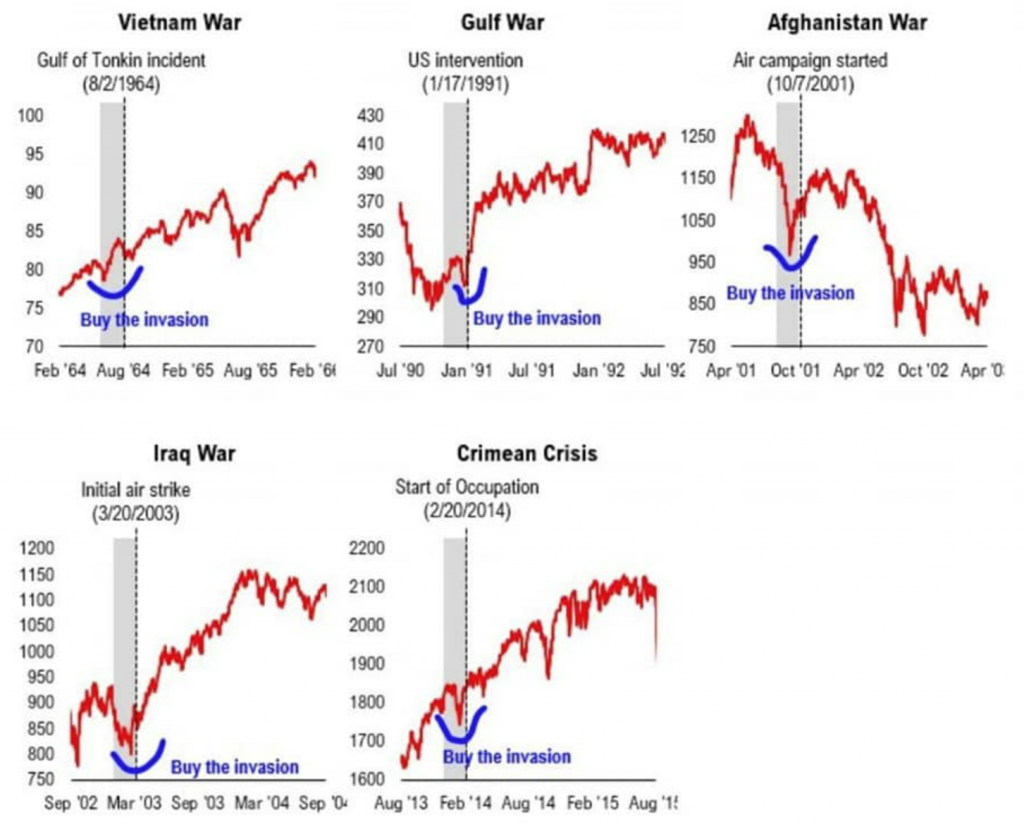

Once this geopolitical issue is over (just like a sudden disappearance of CoVid), I will expect a continuation support of liquidity, lower than expected tightening, and massive economy development (to rebuild and increase defence) in eastern Europe, together with southern part of China like Asia, India, Taiwan, Afghanistan, to participate in future global growth. War financing may historically support global economy growth.

Central banks attempts to increase shock buffer/margin to geopolitical issue may also support current supportive liquidity with more focus into sustainable economy growth, rather than combating inflation narrative. Would that be the case, our investment growth might be able to continue to grow fearlessly.

Fearlessly, our democracy in investment must stand strong.

Fearlessly, we’ll defend ourselves, You’ll See Our Faces, Not Backs.

Any idea in this blog and website are my personal own. They are not financial advise.

Expensive food fearlessly got limit up.

Definitely coal is fearless of gravity and ESG, up 40%.

I may have relatively same target with one of the Fed members for year 2022 and 2023, even though my range is a bit higher, which is 3%-5%. We may try to follow inflation thesis, but don’t get blindly caught into current inflation rally hype. I may disagree with year 2024 but it’s too far away to predict. (1) inflation may likely reduce (2) inflation will remain at sustainable level of high inflation.

I’m pleased to know that the Fed has exactly same idea with me. I wrote that “In this case, we don’t really need to see a real rate hike, market pricing to it is real enough already.” which means we don’t have to wait for real Fed hike. Market expectation of the hike is real enough. The outcome of this market expectation is pleasing enough, which might give an indication of increasing probability of better return to next 12 months.

Happy being synch-ed with the FED.

FED’S POWELL: THE NEUTRAL RATE IS BETWEEN 2 AND 2.5%.

FED’S POWELL: E TALK ABOUT REACHING A NEUTRAL RATE OF 2% TO 2.5%, BUT IT MAY BE NECESSARY TO GO HIGHER.

FED’S POWELL: THE FED CAN ACCOMPLISH A SOFT LANDING.

FED’S POWELL: RATE-HIKE RHETORIC HAS TIGHTENED FINANCIAL CONDITIONS

FED’S POWELL: MONETARY POLICY IS BASED ON EXPECTATIONS; RATE HIKES HAVE ALREADY OCCURRED AND MUST BE RATIFIED.

FED’S POWELL: WE DON’T YET KNOW IF INTEREST RATES WILL NEED TO RISE OVER NEUTRAL.

FED’S POWELL: I EXPECT THE FED FUNDS RATE TO RISE IN TWO WEEKS, FOLLOWED BY A SERIES OF INCREASES THIS YEAR, BUT GIVEN THE UKRAINE SITUATION, WE WILL PROCEED WITH CAUTION.

In relation to political issue. BIDEN ADMINISTRATION LOOKING WHETHER TO APPLY OR WAIVE SANCTIONS ON INDIA UNDER ‘COUNTERING AMERICA’S ADVERSARIES THROUGH SANCTIONS ACT’ (CAATSA): US DIPLOMAT