War does not determine who is right – only who is left – Bertrand Russell

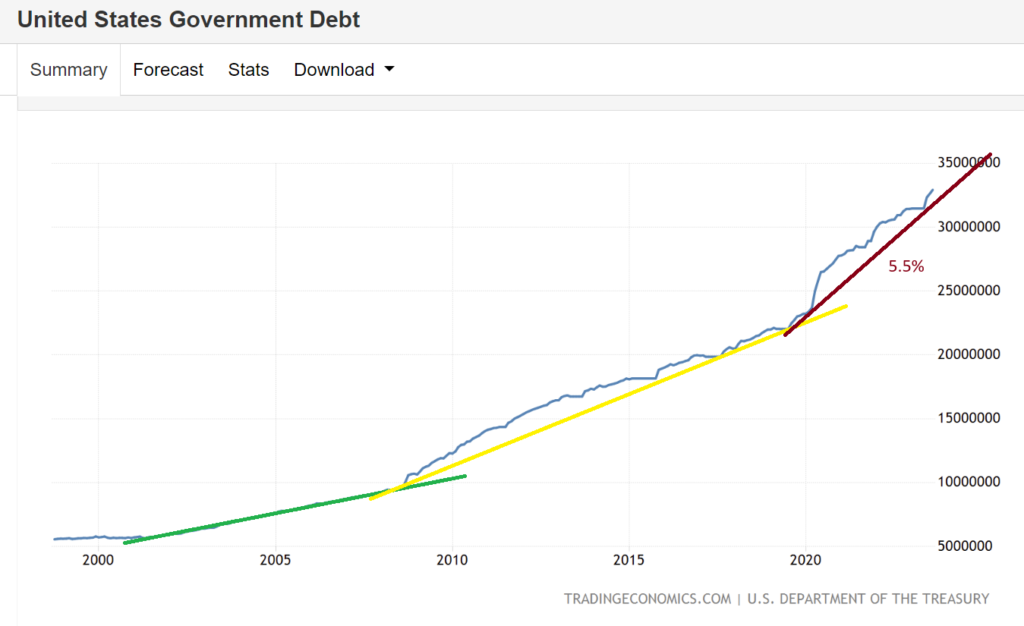

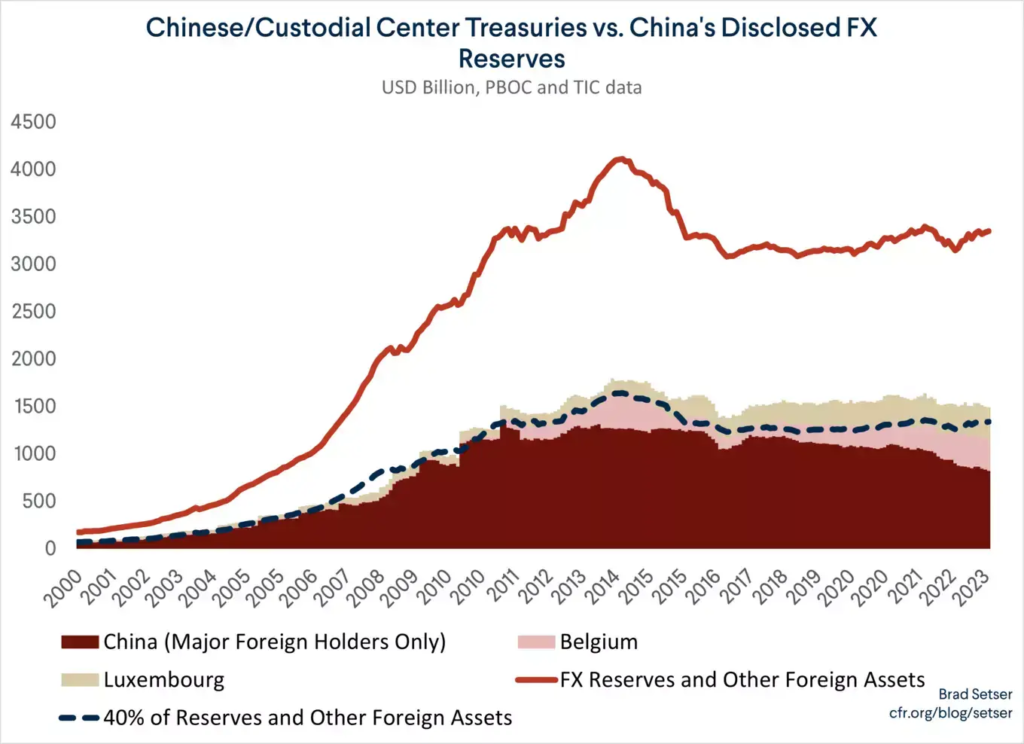

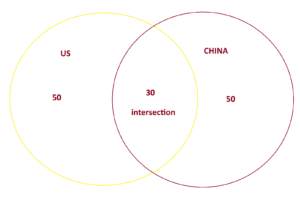

I’ll begin with my own speculative theory (an unverified assertion) regarding the decoupling of the United States and China. Prior to the Global Financial Crisis of 2008, China reinvested the proceeds from their exports into the United States. The crisis in 2008 disrupted their financial relationship due to reckless money management. We may recall the substantial losses suffered by a Norwegian investor in the U.S. mortgage market. Following the 2008 crisis, there was a mutual lack of confidence between them in managing financial resources. To illustrate this simply, let’s imagine they initially had built up $30 of mutual trust in terms of financial investments.

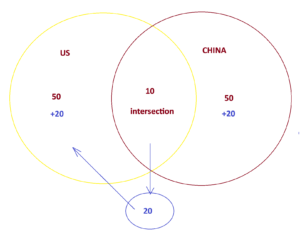

Now, let’s assume that $20 of this trust is dissipating due to this lack of confidence. In response, each of their respective central banks had to generate $20 (and of course some extra greedy money) to inject liquidity into the funds that were leaving the mutual investments.

Subsequently, the global economy was left with an additional $40 in liquidity (2 times the initial $20). The other $20 would likely gravitate towards a more supportive U.S. economic policy and a greater role as a global reserve currency, adding another extra liquidity on top of some extra and extra. Meanwhile, China would have to continue with monetary easing measures to compensate for the $20 exiting their systems and combating massive amount of real estate deleverage. This issue is further compounded with Emerging Market sensitivity issue to inflation. Notice the difference.

I’m working to navigate my current top fantastic four investment lieutenants within the context of the economic war dynamic and extra liquidity movement:

- QQQ (Sustainable Energy and Artificial Intelligence)

- Commodity (Copper and Iron Ore)

- The Bill and

The Bond Property

Over the past year, we have scaled back massively on our investments in Property, and Bonds for various reasons. This has led us to engage in more active hands-on combat management between our holdings in QQQ and Commodities. It’s important to remember that each individual has their own unique circumstances and investment strategy, so what works for me may not be suitable for everyone.

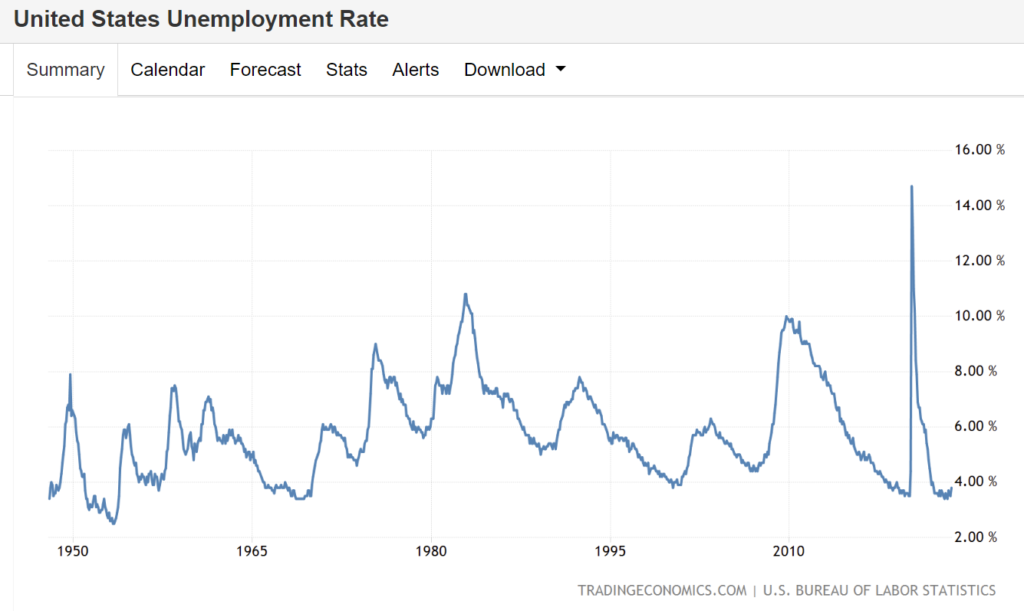

In a December 2021, we accurately abstained from taking any positions in QQQ (after it was driven by too much extra liquidity) and correctly predicted the onset of high inflation. Inflation means there is too much extra money than economy can absorb in the foreseeable future. In my opinion is due to too much and long near zero rate easing and the decoupling money. Take note of the correlation between QQQ, liquidity, and inflation, regardless of which one is the cause. Six months later, due to the looming threat of high inflation, the Federal Reserve had to implement the fastest rate hike in history.

In a January 2023, we made a precise reallocation, moving nearly all of our commodity holdings and one-third of our property holdings into QQQ with substantial leverage. We believe it is excessively oversold and undervalued given the amount of available liquidity at that time. Our preference was towards the advancements in sustainable energy and Artificial Intelligence (AI).

Moving ahead to September 2023 and very early October 2023, in our current portfolio strategy, we decided to shift all of our QQQ holdings back into commodities (at a 15% discount) due to the following reasons:

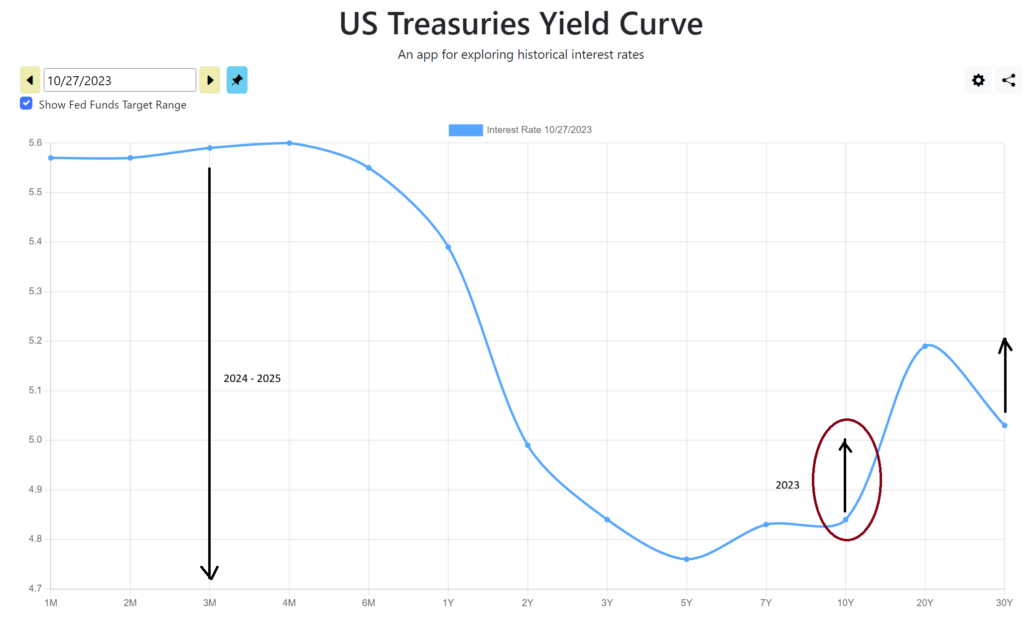

- QQQ appeared way overvalued based on both fundamental and technical analysis. In the September article, we strongly believe that the Fed has completed the rate hike at 5.25-5.5%, indicating that there is less likely additional liquidity to fuel much further impressive QQQ rally. Of course, we both understand that there is still about 1 trillion dollars in RRP (Reverse Repurchase Agreement) and 1 trillion dollars in bank reserves in the ecosystem, which can have various unintended effects. We are also uncertain about how far the US and China will resolve their mutual trust and economic trade barrier issues, which could potentially provide additional momentum to QQQ.

- Previously (early October 2023) we held the theory that the U.S. 10-year Treasury yield at 4.2-4.7% was too low while other economists at that time believed it had peaked. Shortly after, there was a rally in the 10-year yield to near and above 5%. A rally in the U.S. 10-year yield may also indicate something is less supporting QQQ.

- However in my opinion, the rally in the US 10-year Treasury yield may indicate something is supporting commodities. While the prevailing common view attributes it to potential supply, I would like to consider it from this context, the perspective of China. Commodity positions seemed more appealing, especially given (in my own belief, others may disagree) the increased cooperation between the U.S. and China, following with higher economy activity in China, and may cause some degree of higher consumer price inflation in future.

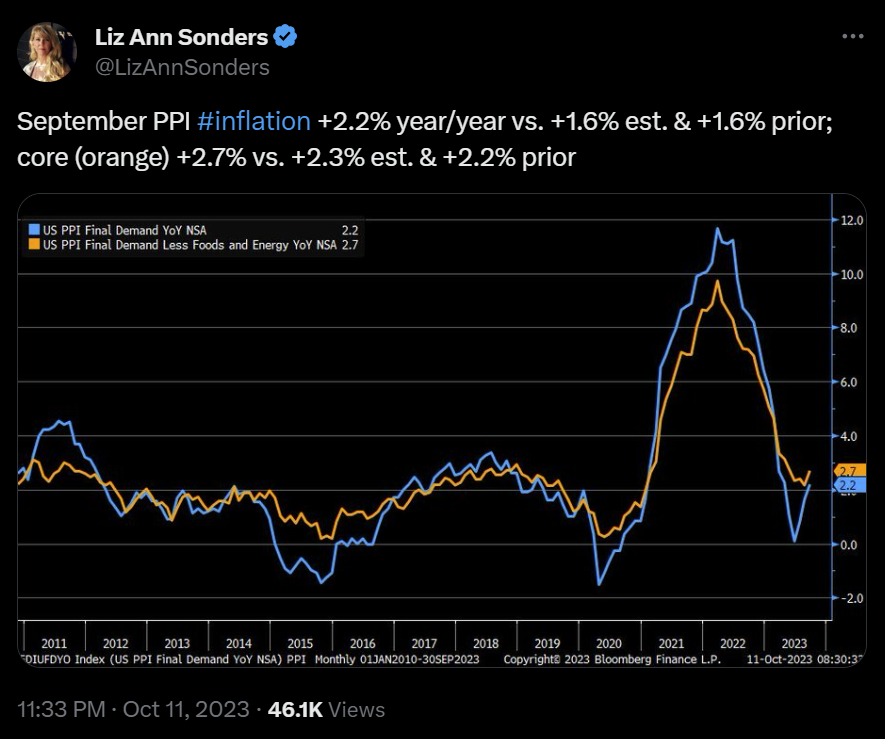

- Due to that reasoning, also, on October 6th, 2023, we initially theorized that consumer-related inflation (CPI and PPI) might begin to show signs of a rebound, while others believed they would continue trending lower. Shortly after on October 11th, both CPI and PPI indeed indicated an initial rebound, and the US 10-year Treasury yield continued their rally from 4.2-4.7% to 5%. While people commonly attribute this to China exporting inflation, in my opinion, it’s due to the Chinese economy, which has undergone tightening over the past three years, suddenly consuming more resources and exporting more. If this is indeed the case, it should drive consumer prices higher.

Our top two picks in commodities are copper and iron ore, as we believe these two materials have the highest volume in economic growth and renewable evolution. Please note that we are not endorsing direct investment in commodities, ETF, or any specific stocks or investment vehicles. We leave that to the financial advisor. Our purpose here is to focus solely on discussing the thesis and theory that can closely predict the future and not according to popular opinion.

From our perspective, iron ore continues to be an attractive prospect considering its favourable price and substantial volume. If the current volume keeps increasing, the unit cost could potentially dip below $20. Furthermore, when factoring in the Australian Dollar (AUD) sale cost, it logically provides a 22% higher profit margin.

As for graphite and rare earth, we have reservations due to:

- A high level of uncertainty regarding their production and market control.

- Limited profit margins.

Regarding lithium, we are cautious due to its price volatility, which presents a higher risk to our risk management. In fact, we believe that the current price of lithium is still overvalued after the recent “tulip mania” event, similar to the situation with copper after the technology boom in the year 2000, and it may take a few more years to normalize.

We are still navigating a very complex yield curve dynamic and its associated liquidity challenges. However, as indicated in a previous article, we would like to concentrate on the short-term US10Y. Our position in commodities is also influenced by our suspicion that there will be a continuing imminent shift in $TNX, backed by the just recent more stability of $TLT.

What do we think will happen IF the U.S. and China had real issues in the past and are now genuinely moving towards better economic cooperation? Would there be better resolution of US liquidity? Would there be increased of commodity consumption? Would there be higher consumer price? We leave that up to each individual’s superpower skill, imagination, and portfolio strategy.

The outcome of a global economic war is not a measure of which side was morally or ethically justified in their cause. Instead, it emphasizes that the side with superior resources, and strategic advantage often emerges as the victor, rather than the righteousness of a particular cause. Furthermore, the phrase highlights the tragic and devastating toll that war takes on both sides, leading to high inflation, high mortgage rate, costly living cost, volatility and investment loss. Overall, this saying underscores the futility of resolving complex economy issues and encourages the pursuit of alternative means, such as diplomacy and dialogue, to achieve lasting and just solutions.

Please note that all ideas expressed in this blog and website are solely my personal opinions and should not be considered as financial advice.