Continuing our previous article of blow off bounce indication, we were looking to pump and dump more, at least half of our risky assets between Christmas New Year to possibly peak around Easter 2023. We are looking for incoming Christmas Santa Clause rally (blow off) to stay until around Easter. Hopefully the rally is very strong to unload most of our risky assets and fantastic return opportunity as well for those who purchased during past one year windows time.

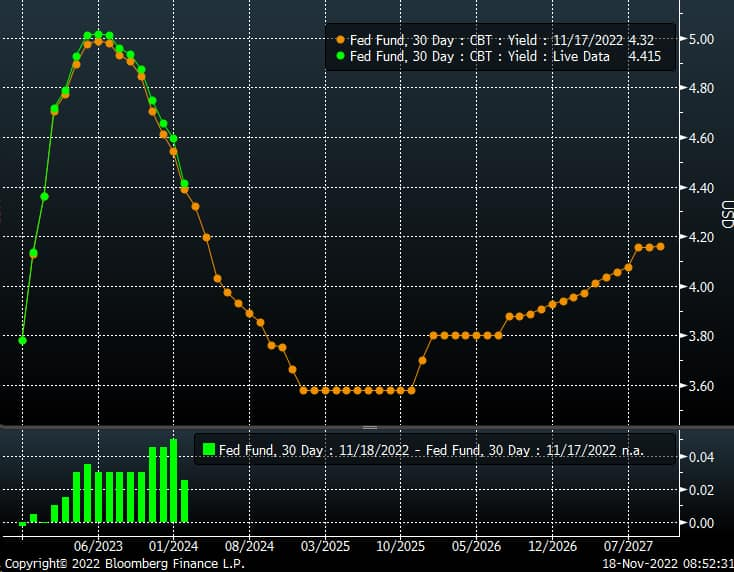

I still believe in sticky high inflation for years with 5% top terminal rate.

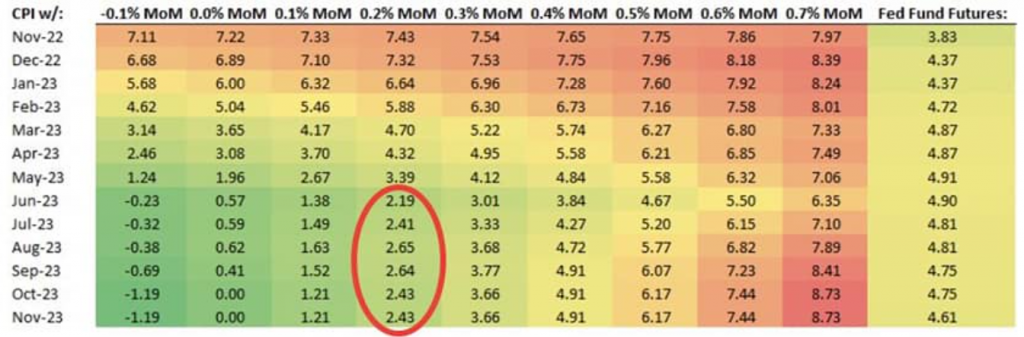

This month, after lower than expected 0.2% mom US inflation, which might give hope of Fed soft landing (2.5% target), the terminal rate is back stable at 5%, accompanied with rebound in risky assets, lower USD and RRP withdraw. It’s stable, which may give impression that 5% is the terminal rate to stay for quite sometime.

It’s supporting with few factors:

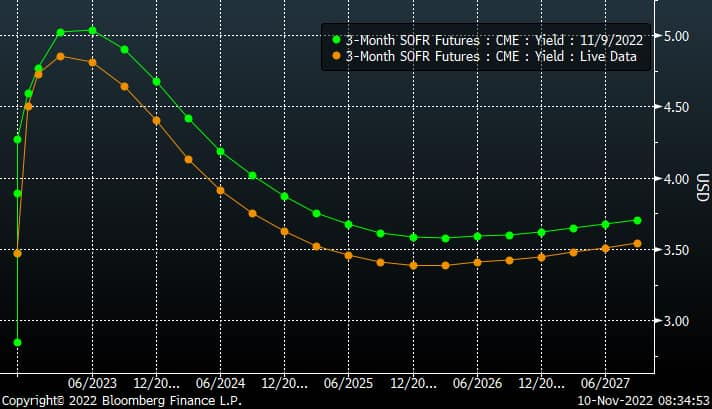

- SOFR is starting to go beyond 10y yield, risk off.

- government bonds are trying to find face price floor around end of April 2023.

Of course with bond continue to perform weaker, there’s still a possibility of a bond crash, therefore risk profile in here is not low. However with recent USD, RRP, CPI and PPI moves, we do believe our above thesis might have higher degree.

Even though bonds look to be very compelling, long years of sticky high inflation thesis might easily corrupt their performance in next few years. We will look that inflation threat closer in mid 2023.

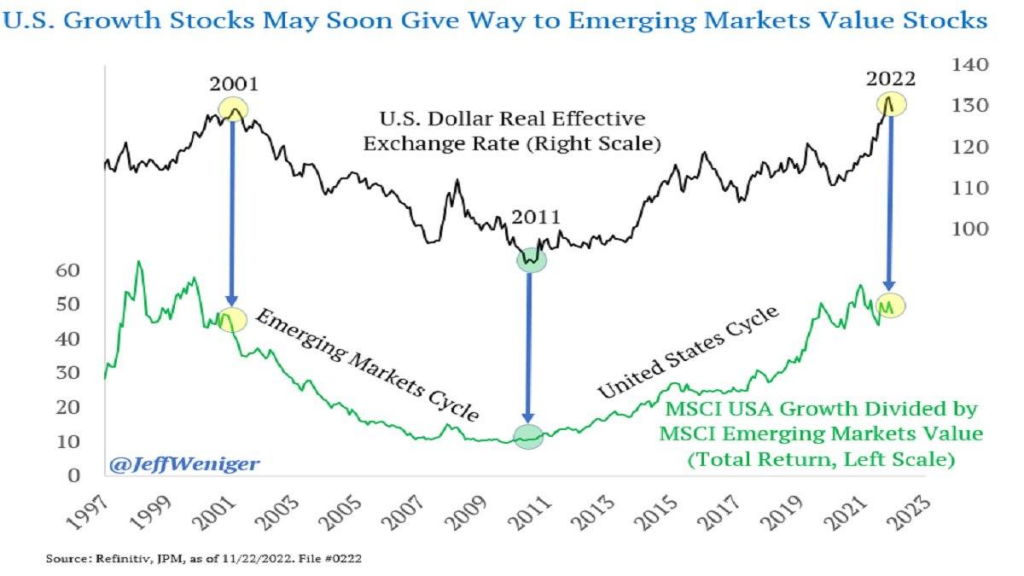

This is also supported with significant emerging market moves which could indicate emerging would need to spur their due economies. On Nov 6th, we spot very strong emerging rally.

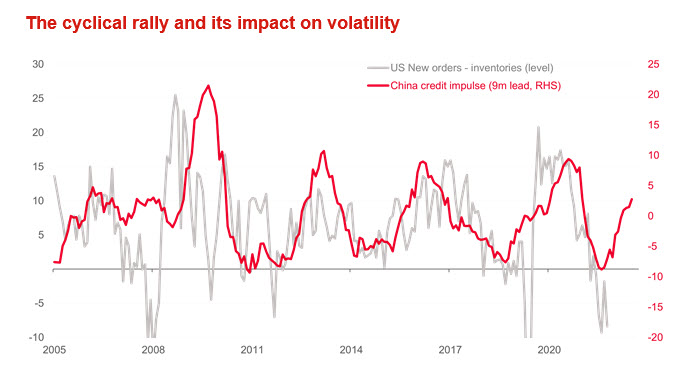

Let’s not forget due China credit impulse:

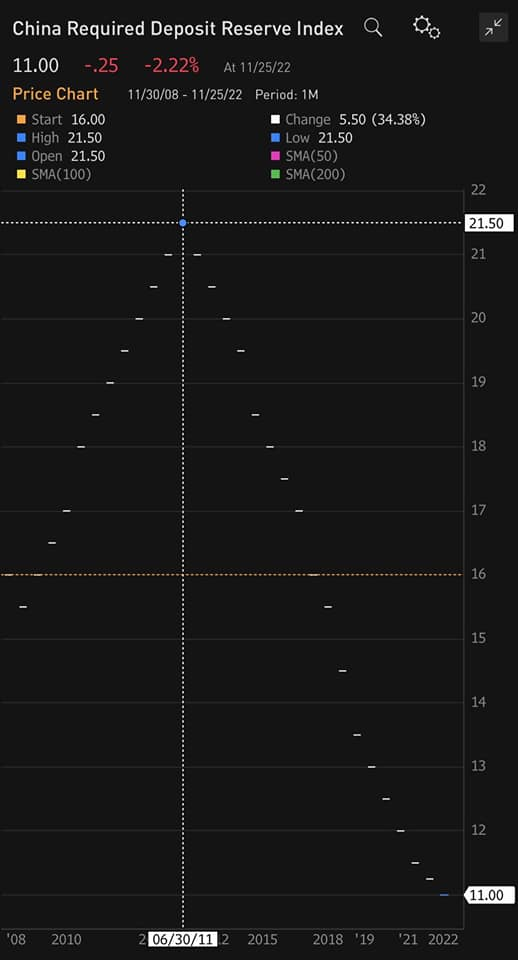

China continues to cut RRR:

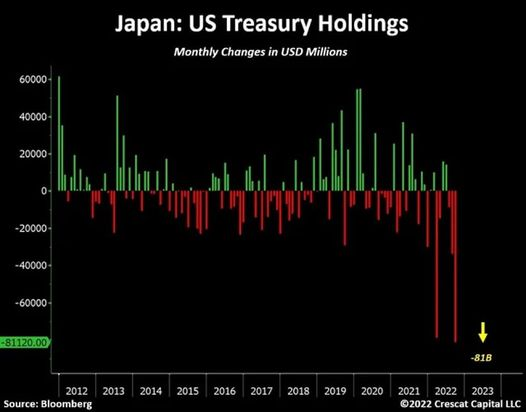

And record selling of US debts from Japan and China:

Swinging into emerging/cycle might introduce volatility which usually is not pleasant.

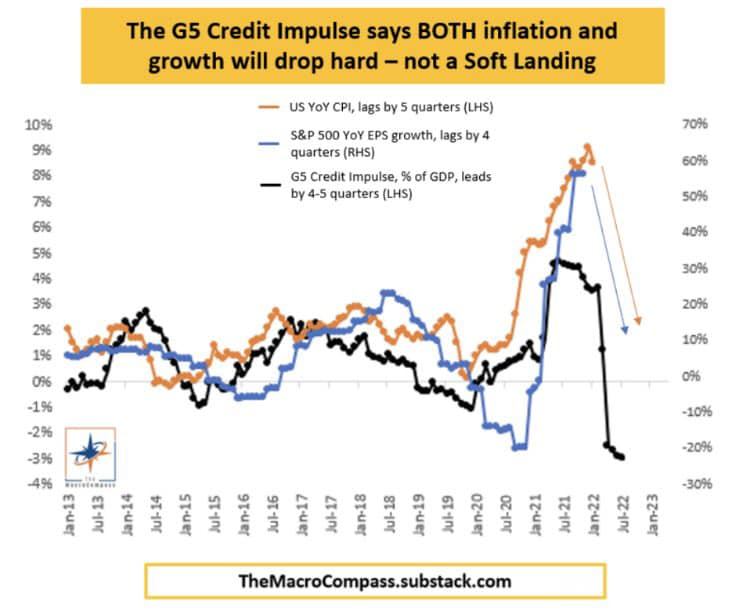

Looking into advanced countries side, G5 credit impulse might not yet be due like China, therefore I would think it’s a growth transfer from advanced to emerging. With inflation to peak, we may have 6 months for emerging to start their credit impulse to ripe. This thesis might support our main strategy plan.

Above thesis is also supported with very bearish VIX, as well as weak USD, despite China and Japan easing. As seen below the risk of VIX and USD rebounds are pretty high, therefore high risk assets may find their very high risk condition to have their possibility to return well.

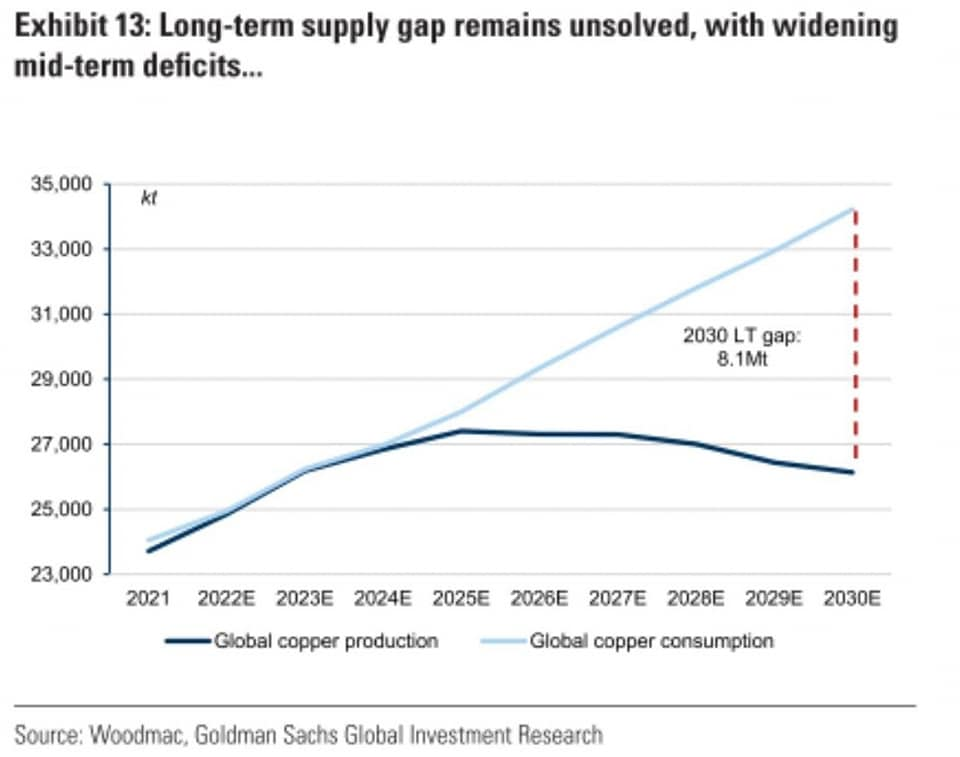

Despite of this situation, in medium 5 years, we should see global growth to continue being strong, indicated by copper. It’s following our long term growth in electrification and EV. We declared top of NASDAQ in November 2021 article and should now be starting again to collect back technologies, including our EV thesis, which may find some ground in December 2022 with early 2023 US government supports. It’s however without risk, please be extra careful with increasing high risk, which is due next year.

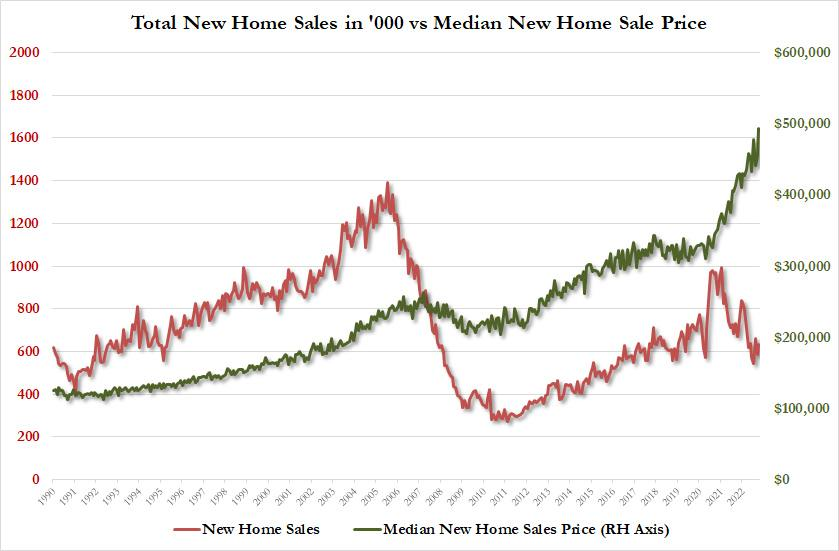

Our research in future numbers in economy basically indicates lower volume and higher price. It will put pressure to economies who are failed to adapt. It’s similar to new home sales of US house, lower sale volume but higher price, indicating strong fundamental, land plus development cost, and not crazy price increase bonanza past 3 years due to relative zero rate. Please be aware, not to be confused with premium house price few years back due to very low rate.

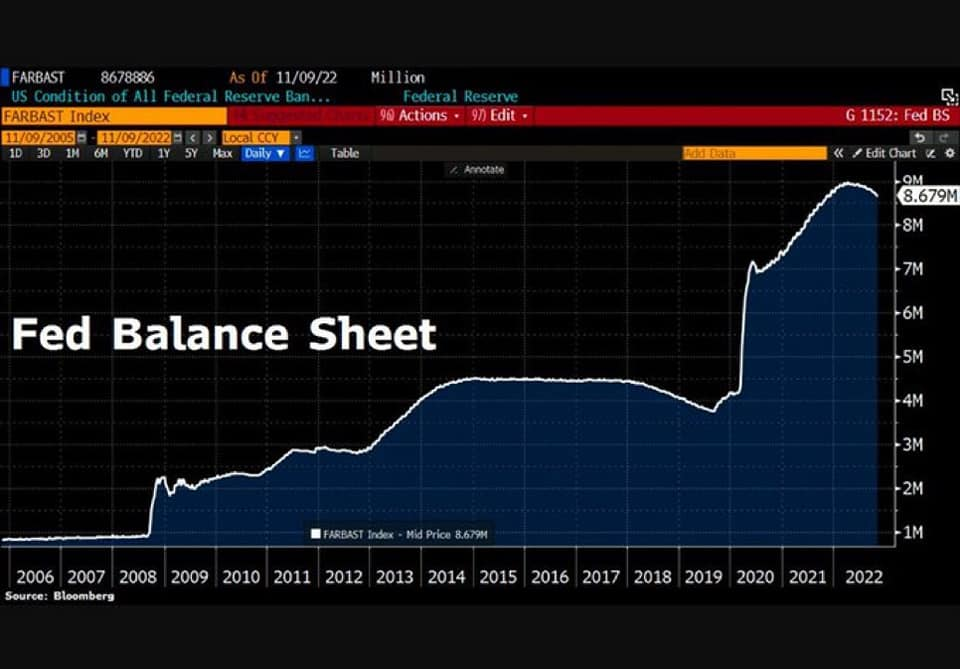

In term of balance sheet, I would reiterate our previous articles. Fed balance sheet might start to fall by little which should be offset with RRP. In this money transfer, it’s usually a transfer of wealth with easing to those front running them.

I wish you Christmas luck in every avenue and look forward into life change challenge next year!

It’s beginning to look a lot like Christmas

Toys in every store

But the prettiest sight to see is the holly that will be

On your own front door

Sure, it’s Christmas once more

Any idea in this blog and website are my personal own. They are not financial advise.