Dedicated to frequent questions asking for my personal opinion and non financial advise, in regard to situation in Australia.

If you wanna run away with me, I (always) know a galaxy

And I can take you for a ride

I had a premonition that we fell into a rhythm

Where the music don’t stop for life.

When I was young, I always have one question in my mind. If human created economy is a fair systems for any new born, why do farmers in emerging countries, after using all of their dearly life capabilities (physical and brain), and working so hard for rest of their dearly life, they earn lowest in the economy systems? I should have all of their economy problem dejavu printed in my DNA because I am one of their children. I have knowledge in agriculture innovation, technology innovation, as well as economy innovation. Should we use “work smarter” to justify status of 26 millions of poor farmer families in Indonesia? Or do we justify economy borders based on gender, language, wealth protection, race, and refusal to work hard?

The farmer produces food, one of critical elements in oldest day of human economy, prior to information technology, bio technology, defence technology and economy technology. Hundreds of years ago, human went to war, just to secure access to food. Before modern imperialism, even commodity as simple as salt and pepper was our global currency. I understand economy systems should evolve, like the Keynesian, but their basic evolution should emphasize democracy of human number, rather than democracy of money number, should we see human life is valued higher than the money or economy itself, to binocular geopolitical atrocity per se.

The farmer seems to live in different economy systems and socio economy population. To justify their social population grade, farmer in advanced countries are able to make difference. It should show that there are two issues in here: (1) job based population, and (2) emerging/advanced economies.

Famer family effort to have better life should drive socio path to urbanization, which is still one of China internal growth combustion engine. Even that so, it’s still a question to my mind, why white collar in advanced countries makes significant different to the emerging ones? Obviously emerging has different level of economies, compared to advanced ones. It might be related to wealth protection systems, financial weapon and their stability/less volatility/higher margin defence.

Back to farmer produce, it’s intriguing that one of our top picks, food, now becomes one of major elements that’s hard to control in today hot inflation. Capital is rushing to secure fertilizer sources in which they expect to generate double digit of return to next 10-50 years. Russia is also one of biggest fertilizer exporter. Obviously I should say, today inflation is different level of inflation we have seen in past 3 decades when sacred food has never been on our table. None thought centuries of effort to depress food price would be out of their genie bottle. Food is just one example of many following commodities. I should admit food can be one kind of nuclear weapon to destroy emerging economies. When stomach is empty in poor economies, human mind could easily go insane to riot. Premium to emerging business should also increase, together with their less margin in energy and commodities.

It’s very important to keep commodity muted for sake of our economy systems stability, until they break lose. Until this article is published, their (oil, metal, energy, etc) price increase hasn’t shown any indication to stop at all !

GALAXY AND MY PERSONAL PREMONITION

Being adaptive with our galaxy to live in, is always interesting. One of our other top picks, energy, might be able to be define economy based country border between emerging and advanced ones or between advanced economy themselves (Europe vs USA, BOJ, Australia/Canada). In today economy, oil is still one of best proxy of energy, despite our effort to have lower rate of ESG.

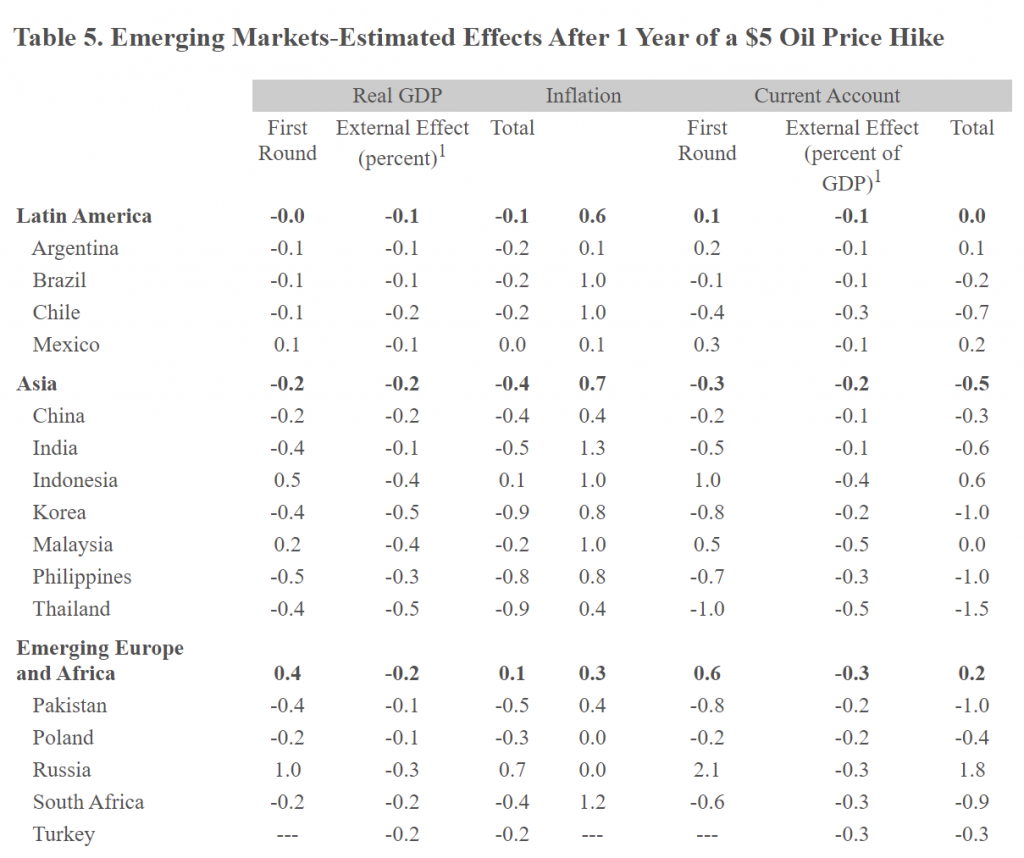

IMF research shows significant correlation between oil and country GDP. Energy is today one of most important basic needs of human. Information is mostly stored in energy, currency and their transaction are as well (evolution with digital coin). As seen below, every increase in energy price, will adversely affect emerging economies. Their current and trade account are mostly lower with every increase in energy and oil.

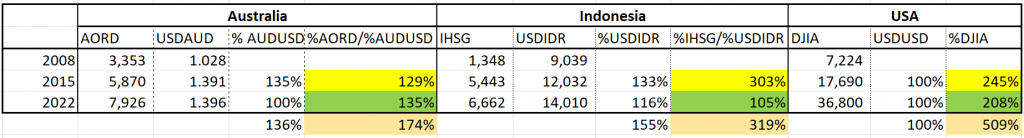

I would then use commodity and inflation in general to proxy share market index performance between 3 countries, USA (centre of financial universe), Australia (commodity sensitive) and Indonesia (emerging market).

Obviously, the USA, our world defence, should remain to be in the centre to have this correlation working. Based on this simple comparison table:

(1) Between 2008 and 2015, during GFC recovery, when money was sanitized well within financial systems, when inflation was relatively muted, emerging countries were able to run best, exceeding the USA. During this time, possibly afraid of the inflation, RBA took drastic currency strengthening causing AUDUSD to reach 1:1 in 2012. Missing inflation factor during this time, accompanied with expensive AUD caused Australia to perform worst. Many global business exited Australia, since AUD was simply too expensive with no inflation around.

(2) From 2015 to 2022, when inflation was just starting to pick up, Australia is showing increasing acceleration with USA is relatively muted/stable. It’s quite obvious that emerging is performing worst in inflationary environment, compared to Australia.

(3) Should index perform relatively same to next 2 years based on past 10 years performance, we may see incoming huge potential growth in Australia, compared to emerging countries. It may even run better than the USA. This might also be supported with my previous inflation arguments that the USA should let inflation run amok. That should benefit Australia A LOT!

Also already explained in previous articles:

(1) There’s no inflation in Australia with missing energy inflation in Australia, unlike other countries.

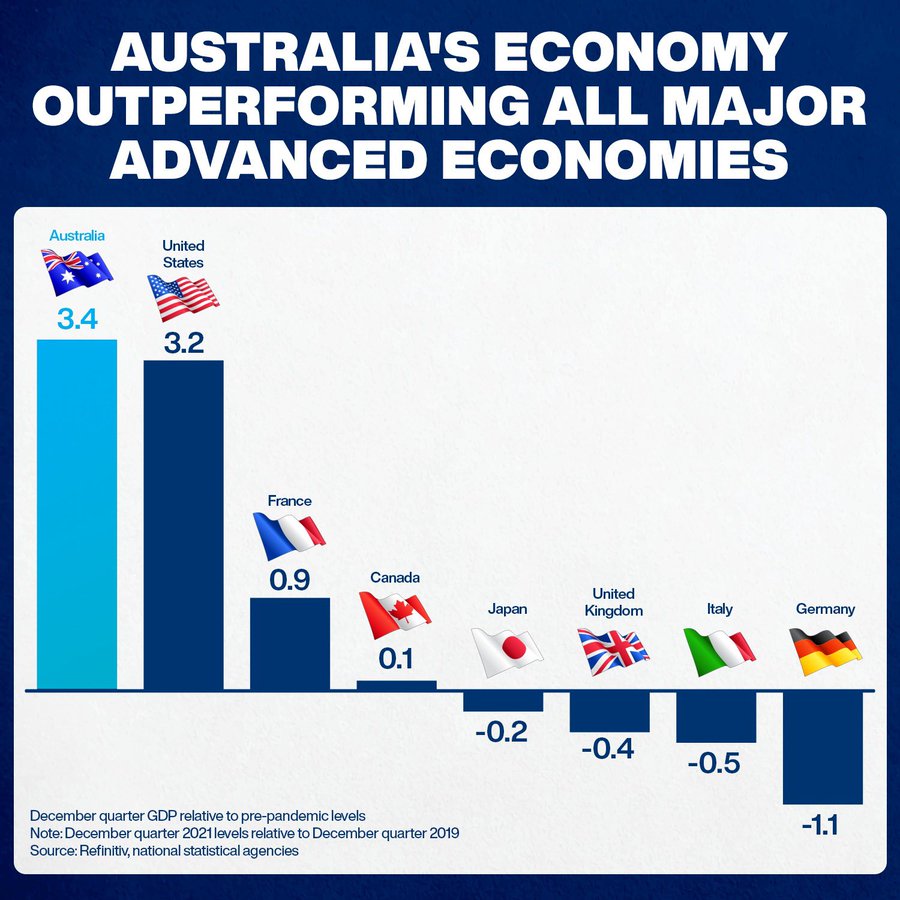

(2) Australia GDP is growing faster than the USA, relative to December 2019 quarter of CoVid pandemic.

(3) Australia seems to be much less impacted with geopolitical issues, comically should any nuclear dust theory ever possible explode on the earth.

(4) Australia is already performing better than emerging countries, even compared to USA, in regard to latest CoVid recovery, surprising me actually about Canada. Nevertheless, it might be due to commodity advantages.

This might lead to my other personal opinion to whether assets in Australia (e.g. property) is due to fall when RBA should start increasing their rate within this year? Personally, I doubt. In 2019 when Australia property fell to enter next level of inflation phase, I believed that property run in Australia shouldn’t end because inflation factor was not there yet. Interestingly, in 2019, I found property data was offering better potential return compared to its share market companion. At least it isolated most of my data from the CoVid infestation.

As explained in previous article, the centre of financial world, the USA, should continue to let inflation run high, unlike their past decade of monetary policy. With Russia as one of biggest energy and commodity suppliers taking world into energy and commodity scarcity, I think Australia growth should be very much supported.

Depending on how this global inflation could possibly evolve into destructive hyperinflation; as of today I would have same opinion with the Fed and Yellen that inflation should subside by end of year or next year. Don’t get me wrong, I highly doubt the Fed transitory inflation thesis last year. However market dynamic and my other internal research may support my thesis of sustainable high inflation this year. It doesn’t necessarily mean a drop in inflation. I believe inflation should remain high, but it should not reach level of the destructive manner (hyperinflation). Keeping our insanity to geopolitical risk, Russia movement in their card to drive hyperinflation might be much hyped. My simple argument is that Russia GDP with 125M population is equal to Australia GDP with only 25M population.

We should understand, sustainable high inflation may likely generate most optimum growth in economy. I could understand Mr. Biden frustration/difficulty to explain benefit of sustainable high inflation.

“Do you think inflation is a political liability going into the midterms?” Fox News White House correspondent Peter Doocy could be heard shouting as journalists filed out of the room.

“No, it’s a great asset,” Mr. Biden muttered sarcastically. “More inflation. What a stupid s** o* b****.”

Compared to other countries, Australia has historically preferred currency and property investment, with their famous franking credit and negative gearing systems. Their preference in currency almost stalled their economy in 2012, therefore I think they should learn from it much. We have CoVid pandemic still hanging around the economy. Geopolitics also adds uncertainty to the fragile economy. With more indication of reluctancy of RBA to increase rate (with excuse of missing energy factor), China threat, and opportunity to pick up energy and commodity greatest opportunity moment, I think it’s more appropriate for the RBA to support Australia economy growth and capture this life time economy growth opportunity, rather than to put the country muted again like they did in 2012.

MY RHYTHMS

#2019 correct rhythm – property over equity

Back to year 2019, many knew, I’d been overweighting my data greatly on property rather than equity, simply because reason of inflation factor wasn’t there. I was surprised with oversold in commodity currency therefore my data started with emerging short to commodity countries and hedged it to China.

#2020 correct rhythm – equity in general

In 2020, equity was performing well in general.

#2021 incorrect rhythm – China fall

China failed to maintain their property growth, mainly related to their offshore.

#End of 2021 correct rhythm – NASDAQ/EV trucks going downhill sparks inflation

After running greatly between year 2020 and 2021, I would think it’s more appropriate to follow rhythm to normalize EV high valuation. I had to cut EUR data once the geopolitical issue was started. Simply the trades between EUR and Russia is too big to ignore (over 50%).

I got 3 out of 4 rhythms correct (75%) in past 2 years. Hopefully 75% is enough probability to justify my personal opinion about Australia.

RIDE – DON’T STOP FOR LIFE

With increasing AU10US10Y, we could have some supporting factors:

- US rate expectation is way too high (7-9 rate hikes) while credit market is contracting,

- US inflation is expected to stable,

- USD is relatively overbought,

- NASDAQ may continue to have pressure,

- German Bund is going back negative which doesn’t seem to support spread to the Europe,

- Japan may have geopolitical risk (Kuril island dispute),

- China and Asia emerging risk due to energy and oil.

We might be able to use this opportunity to leap our economy status high to next galaxy.

Any idea in this blog and website are my personal own. They are not financial advise.

Nickel short squeeze rumor.

Probably very rare time in history, big bond sell-off doesn’t take down equities. Our top picks, EV materials are stellar and actually EV itself already starts to show bullish continuation.