Microorganism is always evolving. Corona virus is like an influenza virus but it’s not like that. It carries new characters. One of few similar characters is they are evolving over time, in which is under a spell of frequency or cycle.

The corona virus is like an influenza virus but not like that.

A possible similar situation is like in 1930s. It could be a reflation but I will argue if it ignites high inflation with their money expansion. I don’t think is because of long easing but simply anything times zero is just zero. This might arguably fit with value vs growth hunting theme/arguments. Negative or near zero rate has failed to perform its inflation targeting. It should be true that market participants have learned and anticipated possibility of recession with monetary polices but unfortunately its number power has gone zero. I like the idea of using yield control targeting but it must come to opposite of monetary policy or long waited fiscal initiatives.

The reflation is like in 1930s but not like that.

Hugh Hendry argued we should instead raise the interest. We know it’s not possible in massive debt. Currently we don’t have any issue with massive debt because the massive debt times zero is also just zero. However we might be able to raise its real interest, like in spread, but still just not like that.

Real rate might increase, but not like that.

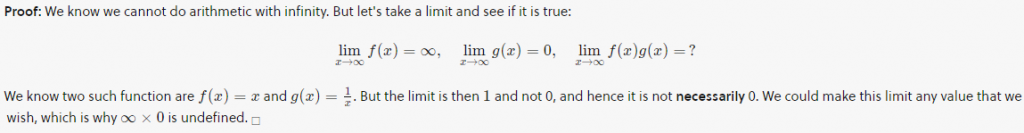

The times zero event unleashes a new characteristic of economy theory, that may never be found in any economy literature. Let’s imagine, if money and debt continue going exponential to infinity, is infinity times zero still zero? The answer is false as indicated here but undefined. It will unleash another new characteristic of new economy event. The “undefined” moment will allow more freedom for money to go to whatever it likes. We should start seeing wild gravity of economy theory and mathematics.

I also like the idea that money would need to come to the opposite of its value. The supremacy of USD is being challenged by China rise. Its value depreciation might flow to its opposites like assets but not many countries are able to challenge US. Warren Buffett and Jerome Powell reminded not to challenge America.

The depreciation of USD or any of their peers is like loosing their value but not like that.

I like the idea from Hugh Hendry, other countries will not allow their currency to appreciate and they will do monetary policy (or even better in mixture with fiscal policy). They would increase reserve but at same time buying anything else. Countries will run currency war but it won’t allow their currency to win.

Countries will try to win currency war but not like that.

However I would notice one thing similar. They are all under a curse of time, born, grow and die, a cycle. Time is always an opposite of a period, opposite plays. Anything we do in time zone, should also be seen in frequency zone, in this case is the cycle. Five and 10 year cycles are still looked likely repeating with quite similar sign of their reversal, such as extreme volatility during their rise.

Cycle repeats but not like that.

I would have to argue that assets might run like in year 2005 to 2008 but the zero and negative rate has pushed it to the opposite side.

Assets may rise similar to year 2005-2008 but not like that.

We should also see discrepancy between rich and poor. If we could explain this phenomena, why should we argue high growth of selected shares like FAANG and TESLA? The demand of money opposite should go to not just everything else but very distinct-ed or special assets or equities.

Learning above, I like the idea of being opposite sides. If monetary policies are printing money like no-end, the growth will go to the opposite, asset in value, in a distinctive way.

Opposite works like in a supply and demand theory but not like that.

I’m fond of adaptive theories in which its mathematical frequency characteristic is a base of learning. I think that could explain a “correlation but not like that” event. It can follow market participants without foolishly following just like that.

This is just my own opinion and not in any case of financial advise.