Tiger is a symbol of “strong, fierce and powerful“, a resemblance of year 2022 strong inflation and powerful commodity. It’s fierce enough to force the Federal Reserve to raise rate at fastest in history. Rabbit, year 2023, on the other side, is a “gentle, tender, kind, yet clever“, which is becoming our investment strategy during this year.

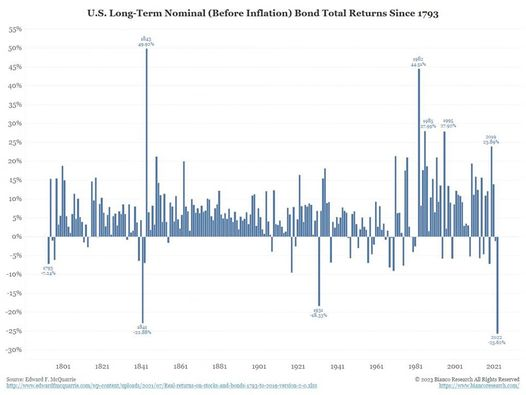

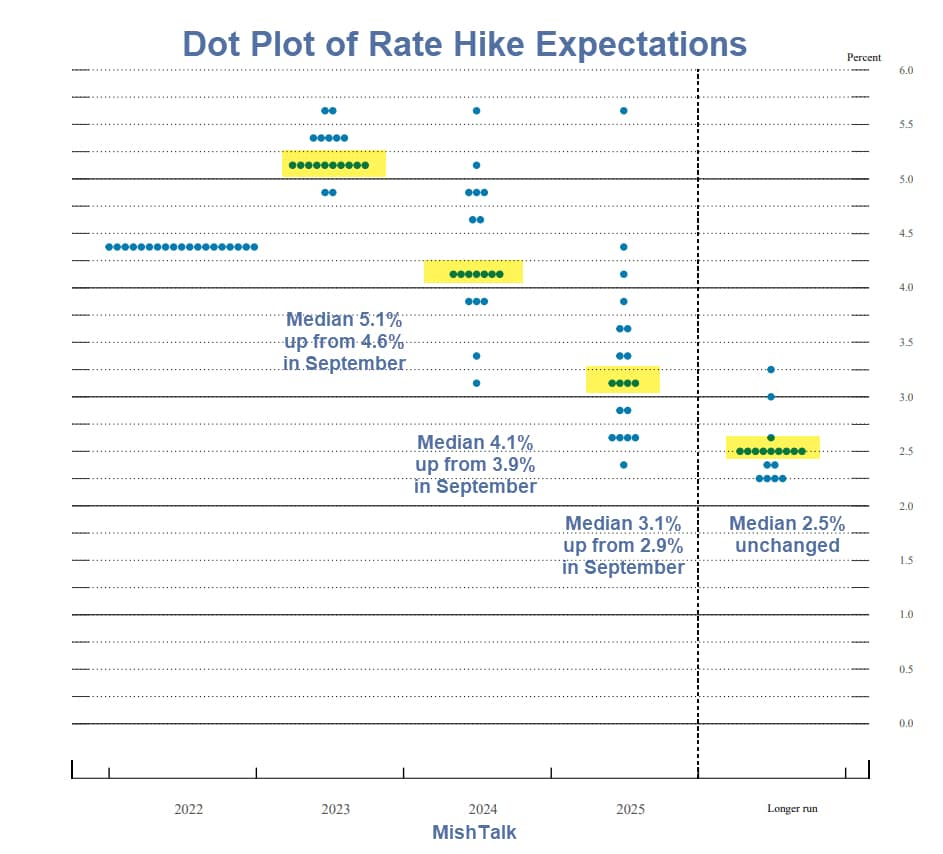

Neel Kashkari recently telegrammed his view. It’s quite clear that the Fed is trying to tell: (1) inflation is manageable (2) Fed is still going to push few more little 25 bps rate above market. Following our last article, unfortunately few little rate increase will cross 3m to 2y, which could nail down inflation coffin but also starting to deleverage economy. Their historical side effect to put inflation Gennie back to its bottle, usually causes very uncomfortable investment experience. As shown below, US bond performance has been in their worst of centuries, not just decades.

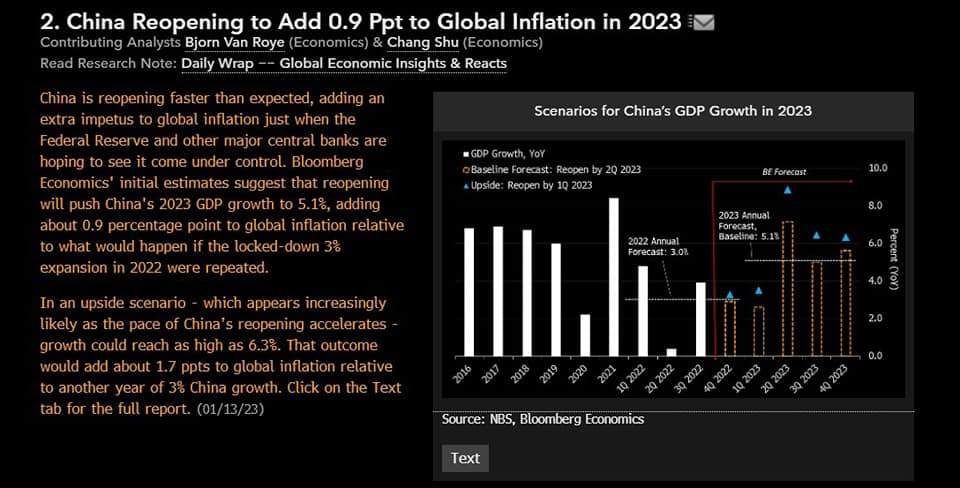

In next few months of China opening, if there’s no massive easing, it is expected to add about 0.9% global inflation which is still manageable by the Fed funds, and supporting our thesis to start diversifying fierce commodity shares into gentle bonds or fixed income cleverly, from tiger to rabbit.

Our strategy thesis is supported with below considerations:

- HSI and SHCOMP indicate growing money supply and their potential credit impulse.

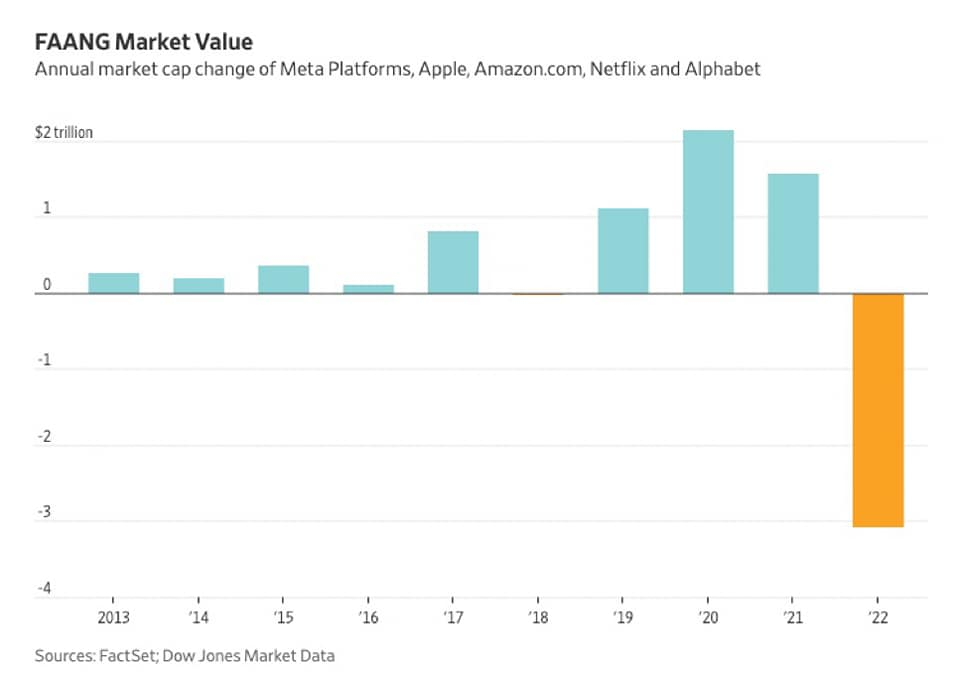

- Nasdaq which is correlated strongly with lower yield and stronger USD, is offering good potential.

- Bond and fixed income which had been performing worst since 2020, is now offering very attractive potential with current huge 4-5% p.a. interest.

- Inflation is expected to be manageable with short term interest rate is expected to peak in mid 2023.

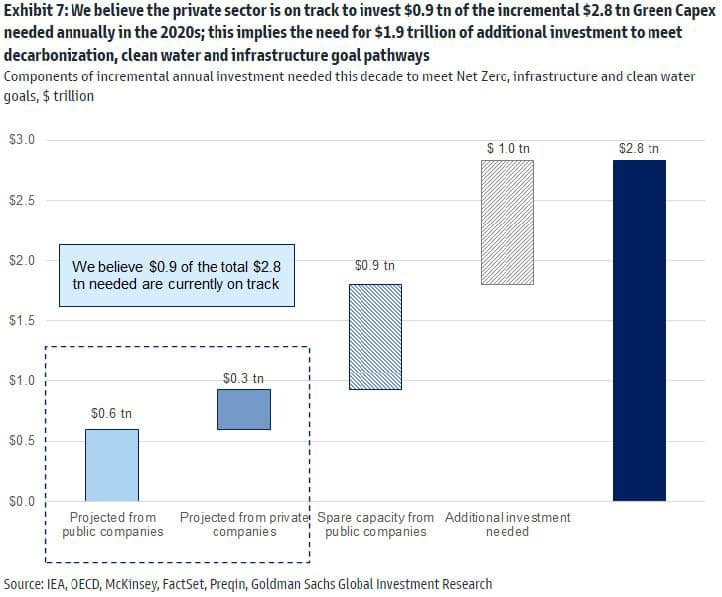

Should we like to be contrarian to capture opportunity, we may be interested to look back into ESG narrative. The ESG, during their initial offering few years back, got so much crowded and not having enough vehicles. Their bubble was busted with many frauds (which were not invested in green initiative). We believe ESG may attract potential interest again with current massive government supports. We don’t believe ESG is dead, but we are starting to believe ESG theme could survive during next years of very high interest and limited liquidity, mainly with support of governments. ESG can offer higher quality/margin of investment in less crowded space, rather than old lower margin of crowded fossil fuel related.

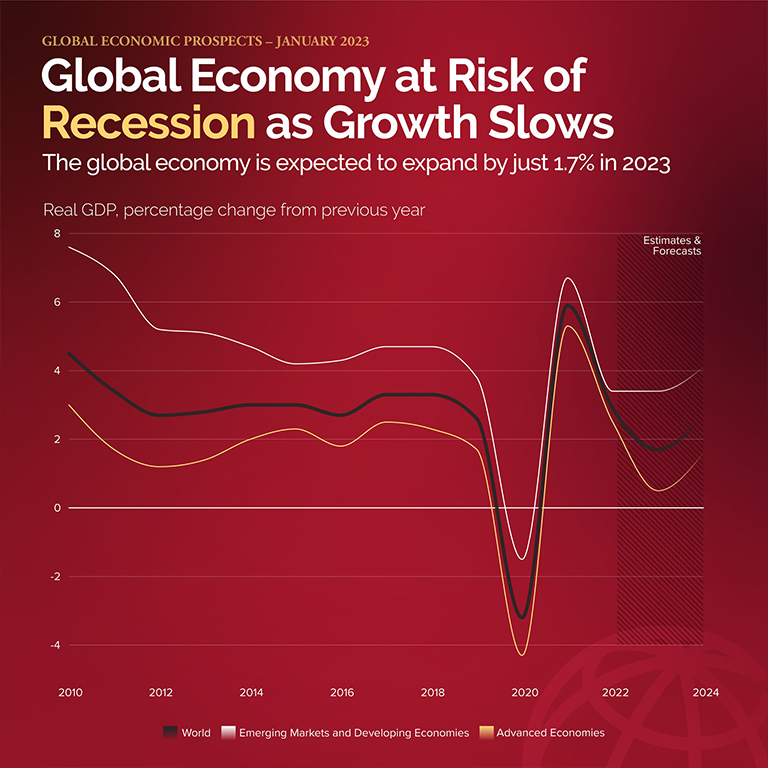

World bank warned 2023 recession and lowered global growth quite significantly. It means they asked policy makers to support their internal home economies, rather than merely focusing on inflation combat. The World bank clearly advised policy makers should be “flexible” which means they should be very supportive with economy growth liquidity/avoid recession when combating inflation.

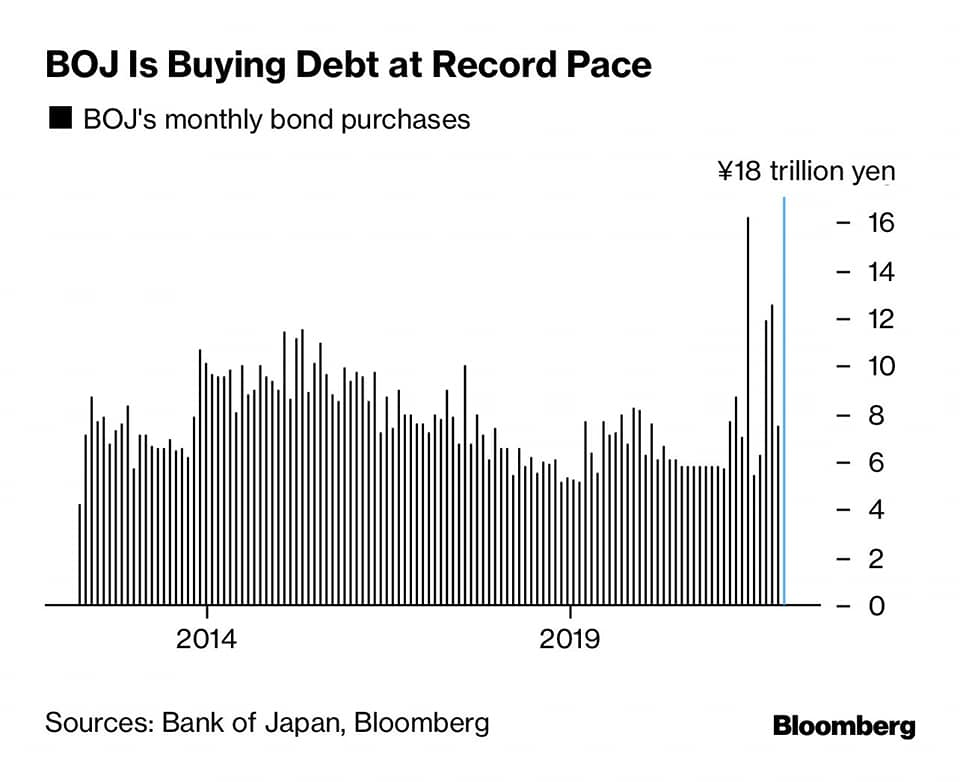

I think it works. Gold almost crashed in November 2022 to their long term trend and it’s very obvious, there’s a significant “invisible hand” move to pump up liquidity. We could also see massive fiscal incentive in US and massive liquidity from BOJ. Should it continue to break 1940$, it may create a massive bull flag which means strong hands may decide to combat recession narrative which may cause inflation being sticky but less recession impact. This drama might be sanitized with debt ceiling debate in coming weeks.

Market yield expects Federal Reserve to continue raising rate to maximum of 2 more points, which is below Fed expectation above 5% (3-4 points). I think it means there is bigger commitment from policy maker side, above market expectation to fight recession, as shown in gold as well. Obviously, it may change recession correction expectation in June 2023. With economy number is still strong, there’s less chance not to support economy.

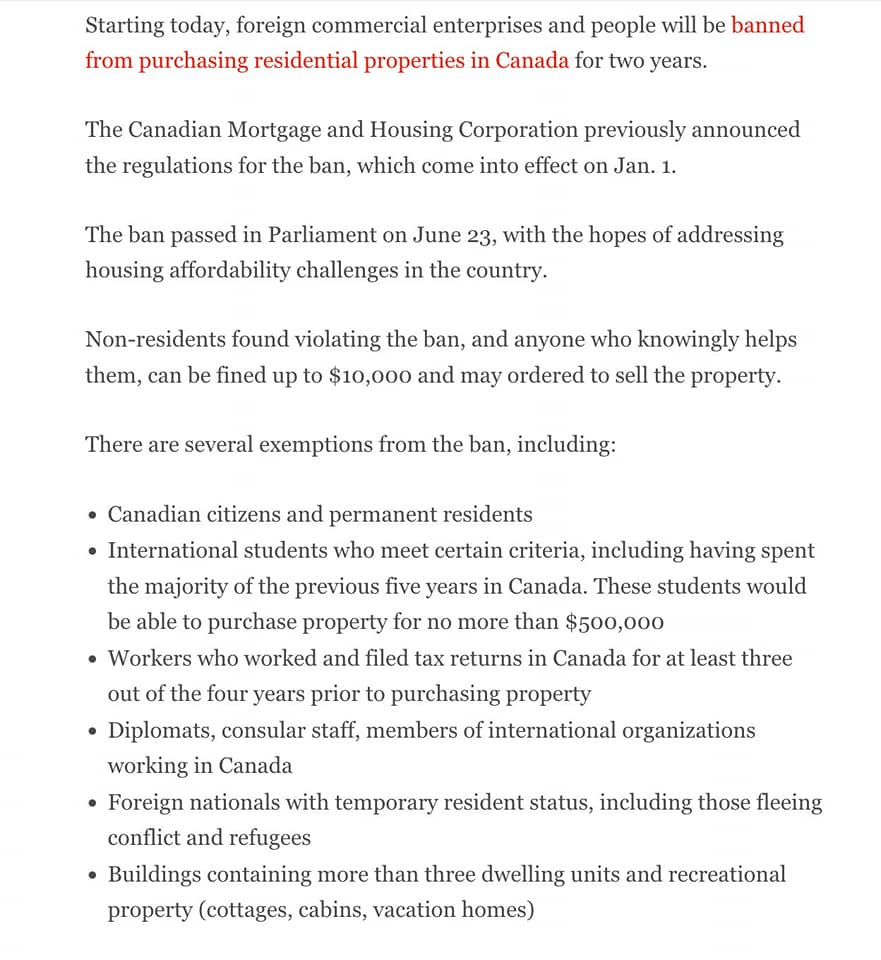

Another indication is in highly overbought property market in Canada and Australia. Canada banned foreign purchase while Australia continues to provide more and more support to first home buyer in this inflation environment. It means, policy makers are overweighting economy/recession rather than inflation.

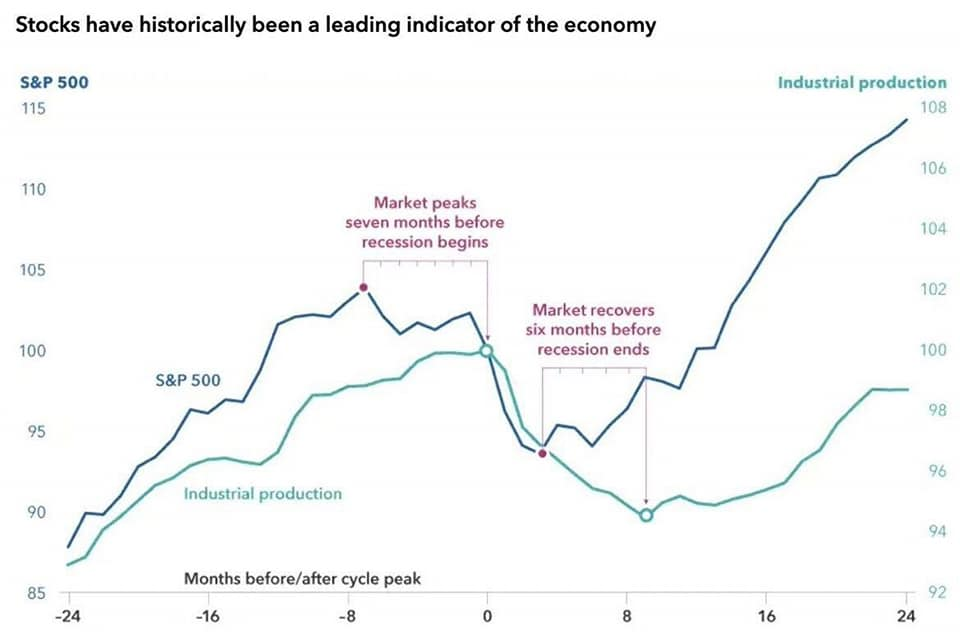

US share markets dropped in Nov 2021, about 6 months before US GDP turned negative in mid 2022. Since we expect recession to bite from June 2023, policy makers should start fighting it now in January 2023. Combined with previous article in which the recession may last until end of 2024, I expect policy makers to fight recession until June 2024 when the recession is about to end. Their support may have a big challenge starting from mid 2023 due to massive inversion in short term yield, therefore I expect they will give much more support between June 2023 to June 2024, a big volatility is still expected in June 2023 until they come again with much bigger liquidity programme.

In summary, as indicated in (1) gold very strong movement (2) fed rate expectation above market expectation (3) strong economy numbers (4) confident from policy makers (5) recession schedule expectation, I think we may see a rally until around at least mid of this year, while we hear a lot of scary recession narrative during the time. After mid 2023, I expect big volatility until policy makers decide/come back again with much bigger liquidity programme to fight for one year long of REAL recession.

Happy Chinese New Year and wish our rally wish comes true.

Any idea in this blog and website are my personal own. They are not financial advise.