What if you don’t understand what he saw?

Then you better figure it out, because it was coming for you!

We don’t talk about Bruno, no, no, no!

We don’t talk about Bruno…

There wasn’t a cloud in the sky

No clouds allowed in the sky

Everything looked fine! No crisis was and is and will be allowed!

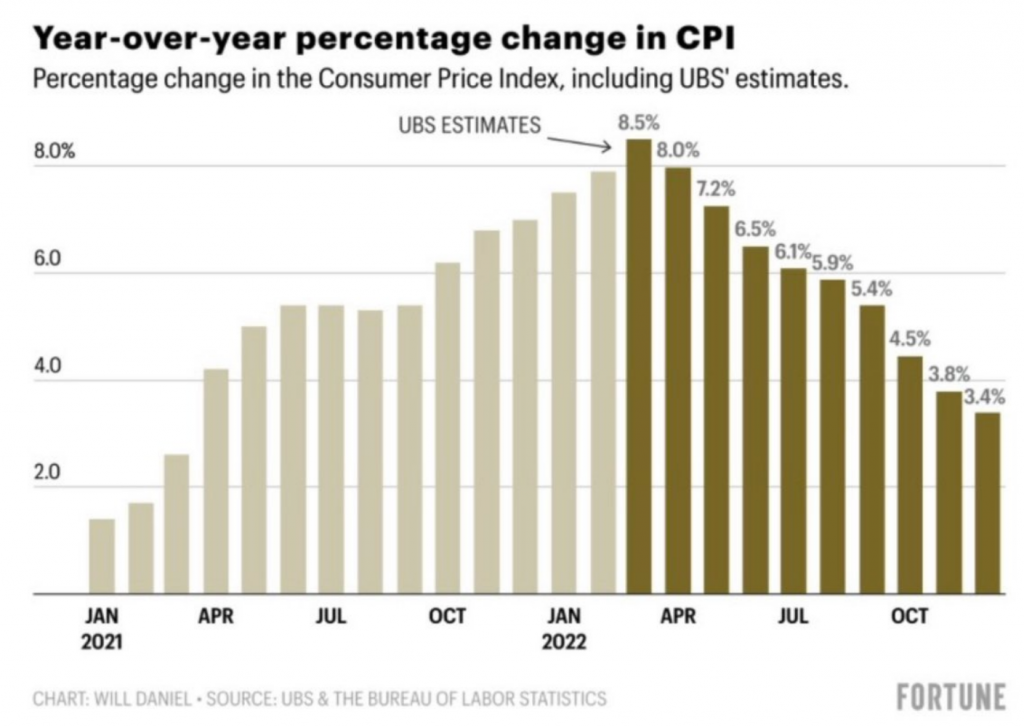

If we looked back at history, World Bank research, inflation fell sharply from 2008 to 2018 or for 10 years. “Inflation has declined sharply around the world since the global financial crisis. Global inflation—defined as median consumer price inflation among all countries—fell from 9.2 percent (year-on-year) in the second quarter of 2008 to 2.3 percent in the second quarter of 2018.” Let’s say average inflation prior to 2008 was half of it or 4.6%, the inflation fell down 2x.

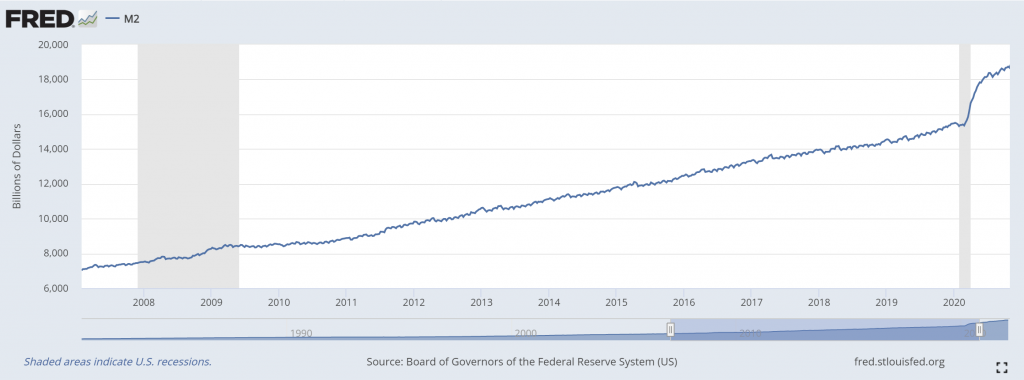

Fed balance sheet from 2008 to 2022 is nearly triple (3x) with significant increase from 2020.

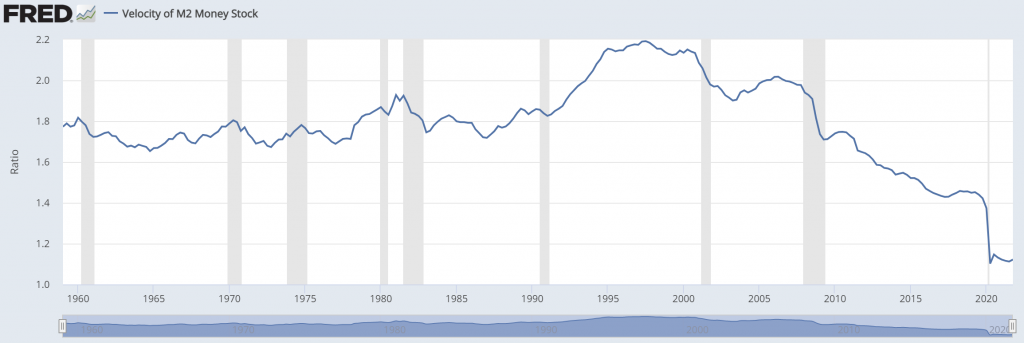

People may argue money velocity has halfed (2x) with potential revert back to decade average of 1.7 (1x).

Something doesn’t add up. Inflation is way too low, even for today inflation. It’s either we have very much supportive liquidity (3x/2x to 3x) or inflation to catch up ( 2 x (1.5 to 3) = 3 to 6 ) or an artificial monetary. This is where Bruno came in. Please don’t talk about potential inflation of 4x or 250 bps rate raise, that’s simply impossible to afford without any kind of crisis terms, e.g. recession, stagflation, and any scary words!

Bruno walks in with a mischievous grin- Thunder!!

Grieving prophecies!

You telling this story, or am I?

I’m sorry, mi vida, go on

Let’s go on. One of our simple proxy is energy. Even if we use lowest median range of 50$, not many could afford oil at 4x or ~200$, especially emerging countries. Oil at current 103$ is simply still way too cheap compared to past 10 years of wealth creation.

Economists already warned similar to my emerging data short thesis in year 2020.

Bruno says, “It looks like rain”

Why did he tell us?

In doing so, he floods my brain

Abuela, get the umbrellas!

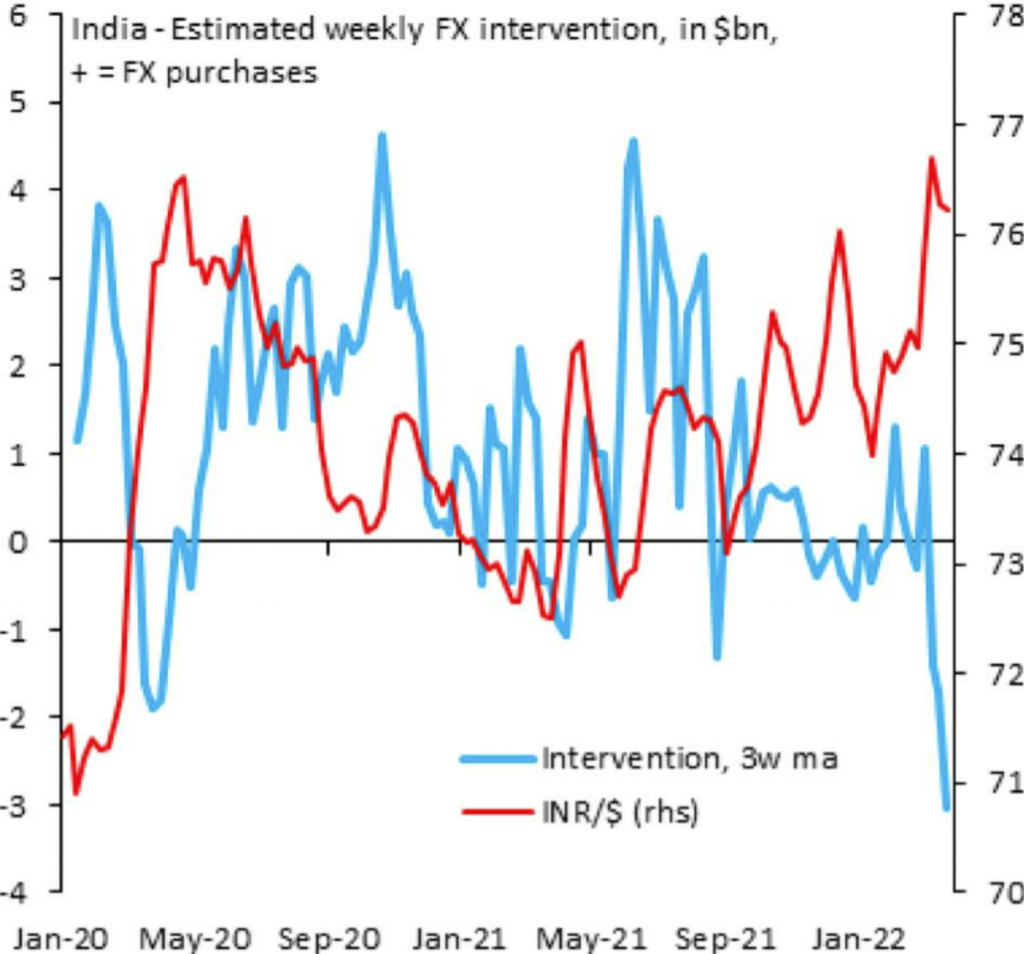

Which is great! Many big emerging economies are well prepared (China, India, and Asia). Emerging countries like Venezuela, Turkey, Russia, Sri Lanka, and Peru hyperinflation issues are well contained from global economies. India and China indeed are benefiting from deep discounted Russia commodities to save themselves. Let’s keep consequences of this like the sound of falling sand, ch-ch-ch.

Grew to live in fear of Bruno stuttering or stumbling

I could always hear him sort of muttering and mumbling

I associate him with the sound of falling sand, ch-ch-ch

Could it be anticipated? Yes it should, by normally raising rate following the curve. However Russia and powerful emerging market response, together with powerful US treasury refinancing interest themselves, all combined, brought into unprecedented Federal Reserve response from their already behind curve in September 2021, into much further behind curve in 2022, unless they start with an action that I will call later an artificial yield curve.

It’s a heavy lift, with a gift so humbling

Always left Abuela and the family fumbling

Grappling with prophecies they couldn’t understand

Do you understand?

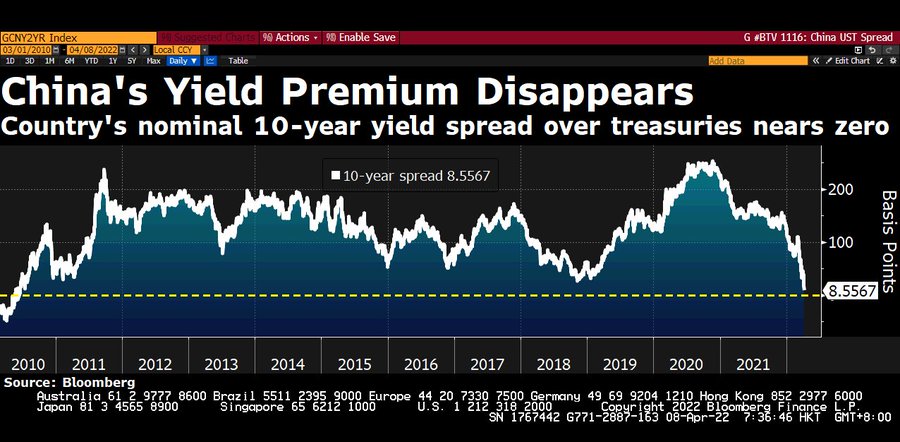

It’s powerful market response to challenge petrodollar or US reserve status that will only draw higher response from the mightiest Federal Reserve. China less interest to recycle their trades, UAE interest on holding their peg to dollar, China treats to their property and technology, are few other of things that will only drag this further down economies behind curve and delay darker prophecies few years back.

I’m fond of the Fed Guy, Joseph Wang. I mostly agree with his view but his negativity to equity. Since last year, I still believe my top picks (Energy, EV, EV materials, food, etc) will continue to be shinning stars this year. As we are already going through half year of it, I’m interested to use Joseph Wang The Great Steepening article which I think is simple yet has very strong message to tweak my strategy going forward. With recent Federal Reserve minutes to aggressively do QT (Quantitative Tightening) and rate raise at same time, I may have my own prophecies and strategy.

I think:

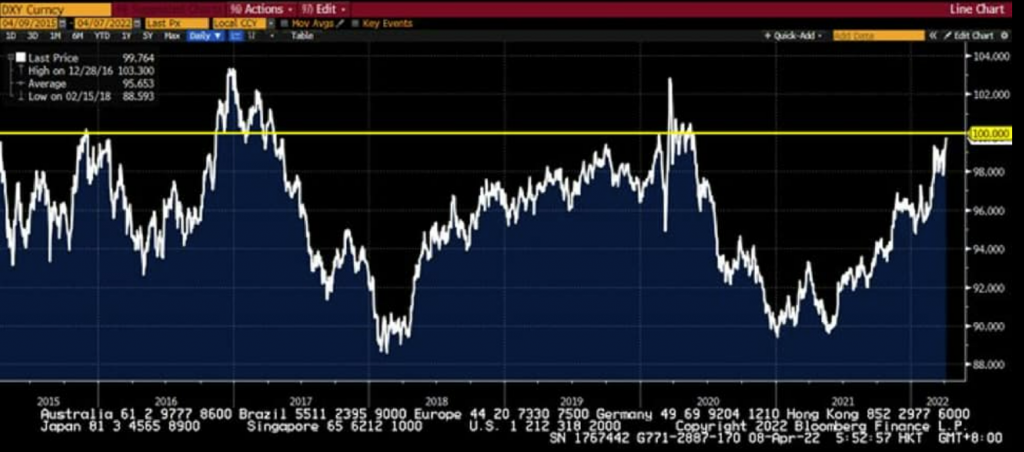

- Foreign may continue to hold treasury at modest pace. My reasons are:

- There’s less interest to park foreign reserve in USA due to event like Russia asset freeze.

- Necessity and requirement to sync with greatest economies and avoid unnecessary disturbance.

- Foreign has been holding most of the treasury.

- With emerging countries are expected to juice their economy due to higher price, US Dollar is expected to continue to be strong, making the treasury less affordable to foreigners.

- Treasury should be sold at cheaper price/discount. Therefore for sake of the USA assets interests, they should be firstly sold locally.

- Federal Reserve is expected to reduce treasury holding. This should go to non Fed and unfortunately that means much less liquidity challenge to the market.

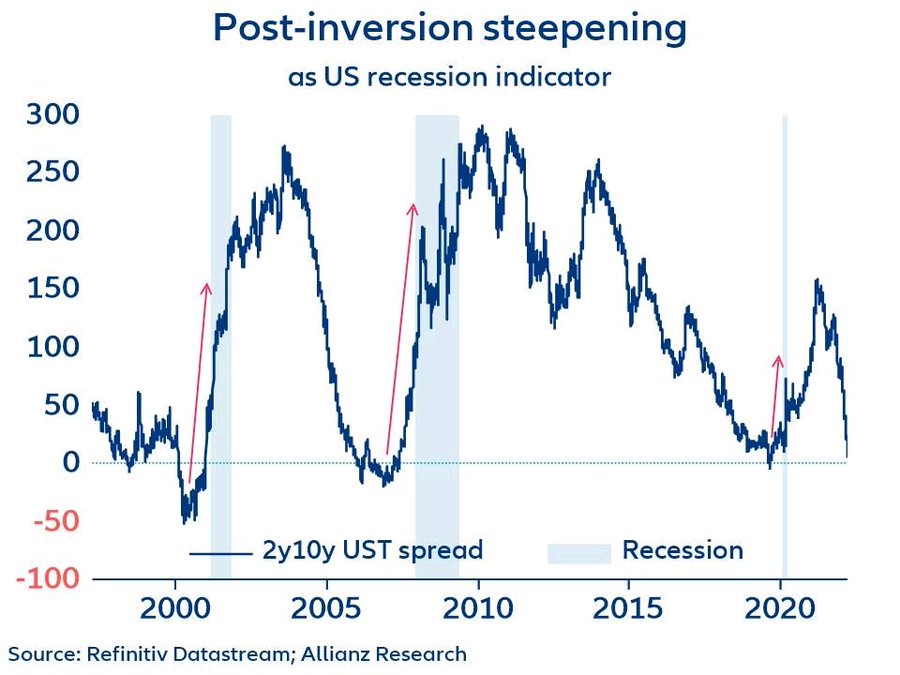

- USA banks will be main driver here. In order to have this situation, we need to maintain 2y10y spread for local bankers.

- Hedge fund should continue to seek higher return from yet strong economies and less interest to make loss to inflation.

He told me my fish would die

The next day: dead! (No, no!)

He told me I’d grow a gut!

And just like he said… (no, no!)

He said that all my hair would disappear, now look at my head (no, no! Hey!)

Your fate is sealed when your prophecy is read!

Darkest fate might have been sealed well when their prophecies are read!

We should notice recently:

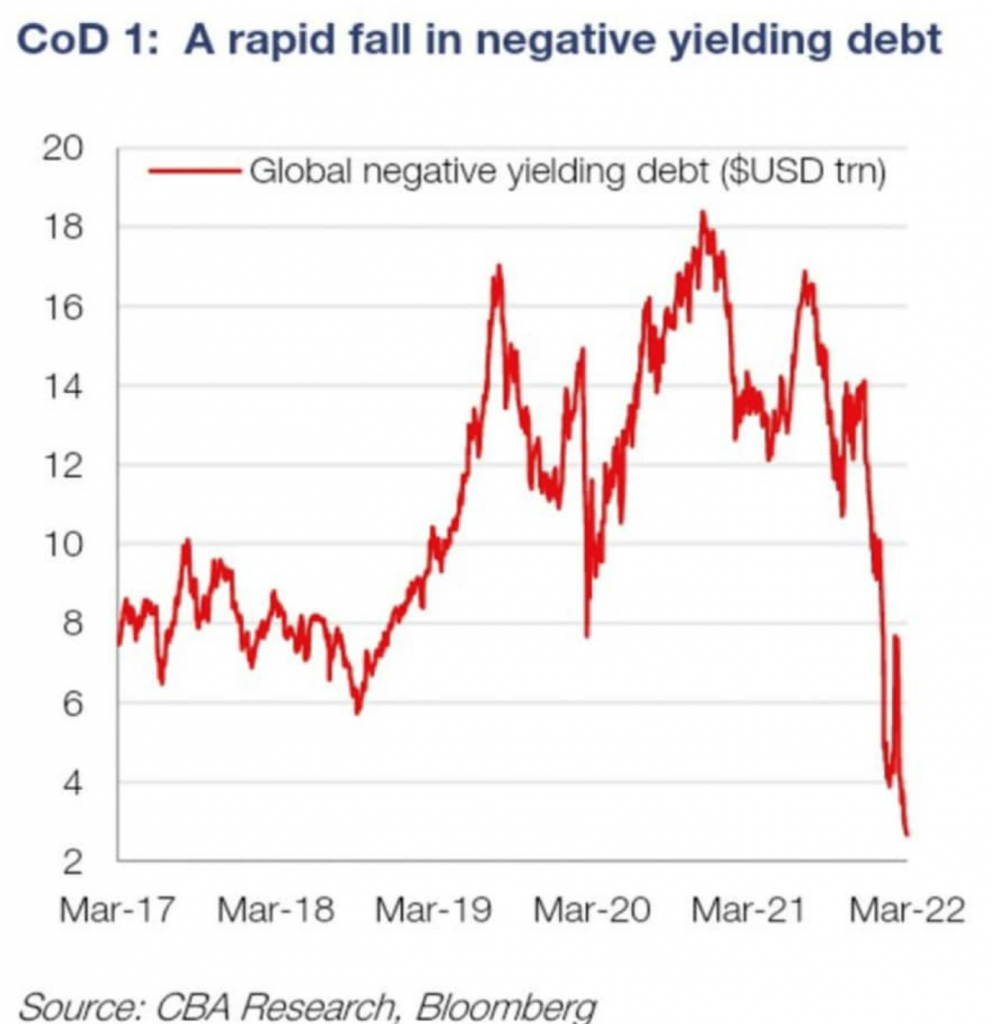

- negative yield is drawn to zero, that’s about 14T$ in past 2 years.

- RRP stays high at 1.6T but may be slowly withdrawn.

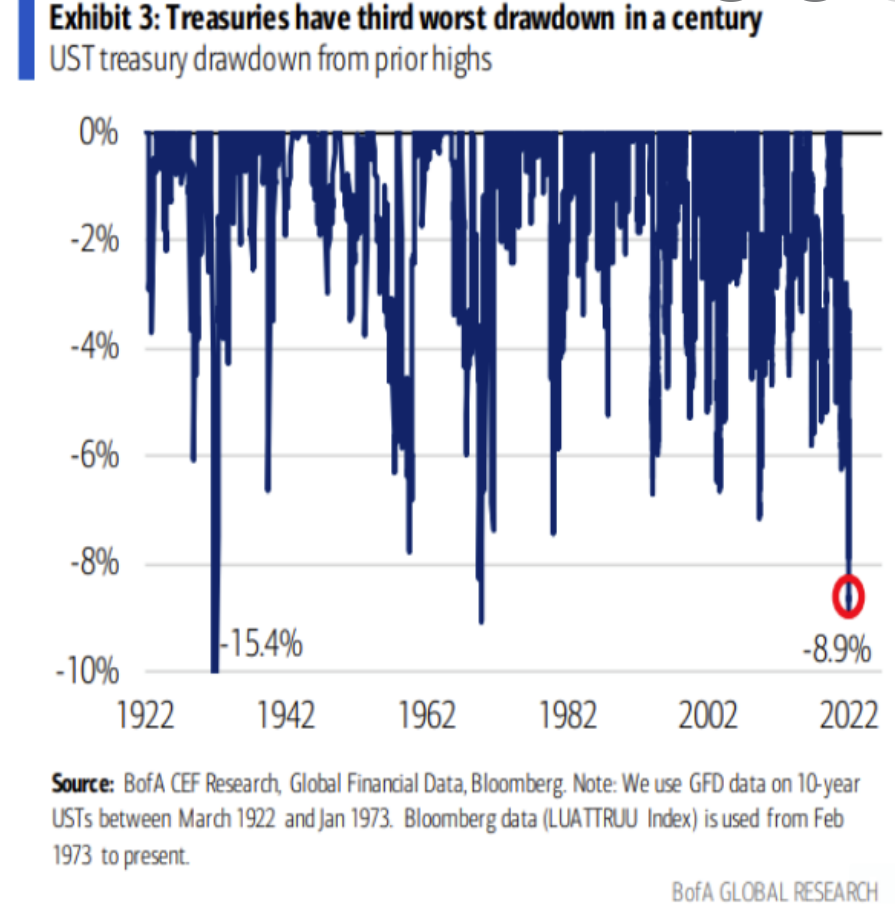

- treasury and bond big sell-off like a dead fish!

BUT! We should notice despite the hilarious (for who don’t know historical effect of bond) bond sell-off:

- Equity rebounds strongly!

- GDP continues to grow.

- Employment and economy numbers continue to raise.

- Higher price should attract higher credit to run economies, especially in emerging economies.

- Selected industry and commodities demand continue to be strong.

- There is still a lot of opportunity for technology and EV (Electric Vehicle) to continue their evolution.

History shows recession may be seen after the steepening is back, not during lowest. This may give enough hedging strategy whether we will endure recession or banks loosing its value driven during this time.

Which tells me that the strongest hands actually haven’t lost their grip. Or in simple term, Bruno is actually telling his grievance with good intention, just like in his Encanto.

He told me that the life of my dreams would be promised, and someday be mine

He told me that my power would grow, like the grapes that thrive on the vine

I will continue to hold strong my stellar charms, despite of liquidity risk crisis ahead and thrive!

He told me that the man of my dreams would be just out of reach

Betrothed to another

It’s like I hear him now

But I may reach my targets and goals sooner.

Hey sis, I want not a sound out of you !!!

In summary, my prophecies are:

- Real economy numbers should continue to support strong economy growth, regardless of possible weak future numbers and challenge of liquidity crisis. I believe real economy is still working at discount to future and no clouds are allowed in the sky.

- We may fear of monetary liquidity crisis with even greater challenge during fiscal supply (e.g. BBB – Build Back Better) after current refinancing is completed or during low inflation.

- Long term yield should continue to raise higher, especially the 10y, artificially.

- Belly and butterfly should continue offering attractive spread and growth, even though they may be artificially driven.

- QT should run faster than its front end rate to maintain the artificial steepening of curve. To maintain steepening from running out of course, treasury refinance (1$-2T$ and another possible 2T$ of BBB) could sanitize steepening over effect.

- Spread should continue to offer benefit to local bankers.

- I still maintain my previous thesis of sustainable high inflation, inflation in long run to neutral rather than zero (hard landing).

- Whilst there’s a probability that commodity is under pressure, it may still offer attractive dividend return from continuing profitable market operation (not from future numbers).

- USD might continue to stay strong which may restrict foreigners from entering this artificial money distribution and may reduce capital carry trade outflow from the USA.

- RRP should continue to decrease very slowly (or relatively flat) due to lower/sustainable high inflation. My important message is that it may continue to support financial market from sudden inflation drop or hidden fuel for a rally (yeah I know it might be a crazy idea).

Let me introduce you, my own first thesis/study of possible first idea of artificial yield curve (currently available to my own internal only). Yeah I know, I have lots of proactive crazy ideas, but not to worry, we can always tweak/adapt along the way to follow market dynamic. This idea is not impossible with liquidity is currently at about 4x of real economy required liquidity (shown in first part of this article). As its consequences, it may spell trouble to those who are against this alliance. On the good side, it’s possible to break decades of grieving long term trend, without igniting crisis earlier, reflected in current strong real economy numbers (rather than current crazy future trade) and ample of liquidity. To avoid long term yield from running its course, treasury refinancing issuance should be able to sanitize/limit possible QT effect over run. It requires co-operation between monetary and fiscal in their best possible time to create and maintain the artificial yield curve and possibly avoid recession. Remember, participant response (based on past learning and economy theory) frequently rewrites history, therefore past performance never guarantees its future. But it’s in my vein/principal, money mostly does!

Um, Bruno…

Yeah, about that Bruno…

I really need to know about Bruno…

Gimmie the truth and the whole truth, Bruno

Time for dinner!

Any idea in this blog and website are my personal own. They are not financial advise.

Don’t forget your dishes after the dinner!