We’ll take on the world and win

So hold on tight, let the flight begin

Meanwhile this song is playing in the background: ALL TIME HIGH

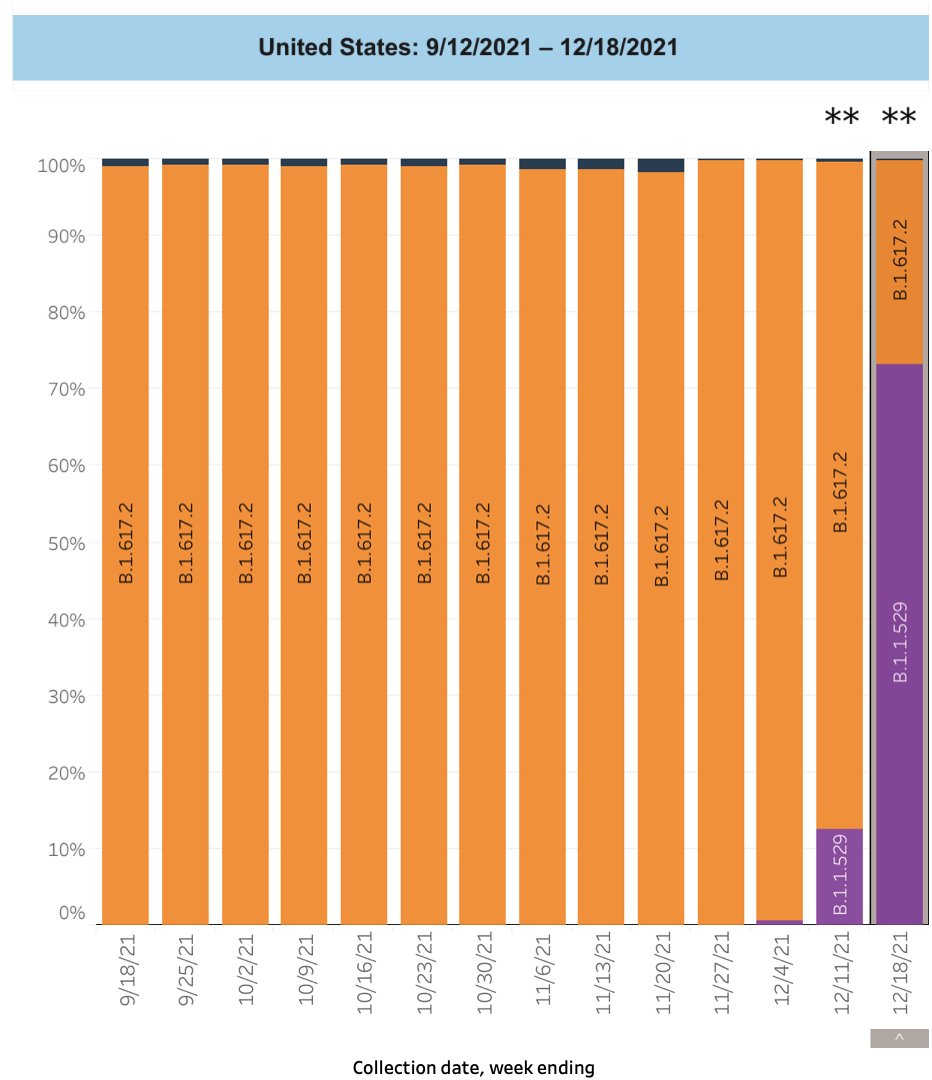

Did we hear Omicron was scarier and in fact infected much faster than years of Covid-19 influenza, despite mild symptom downplay?

Surprise, not? After all of the influenza drama, we are on an all time high (ATH).

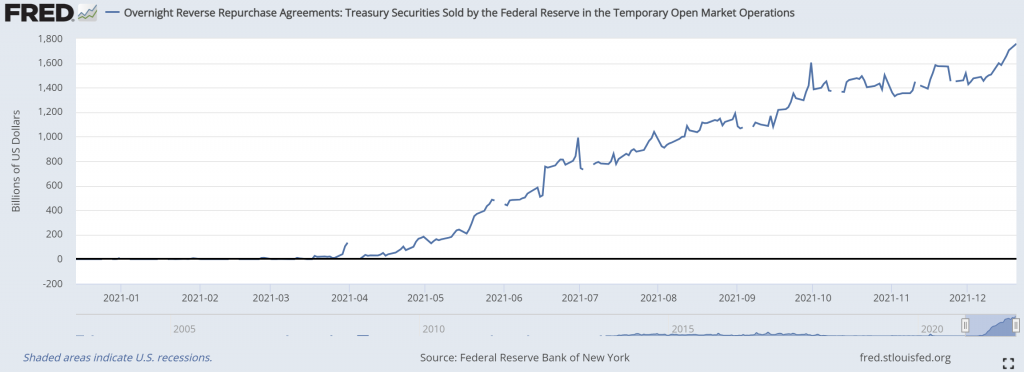

Our still most obvious sign is world excess money and inflation expectation is on all time high with staggering 1.8T per day. Back to our last month article, why do we need QE when in fact we have RRP bigger than the QE itself? We shouldn’t get confused with negative effect of TGA balance transfer during early adoption of RRP. If Omicron and Covid are currently human biggest threat, why there are instead many ATH on the run and Central Banks are tightening? Obviously it’s not virus taking care of our life, but probably my own money cycle thesis.

Excess money / Inflation expectation is ATH

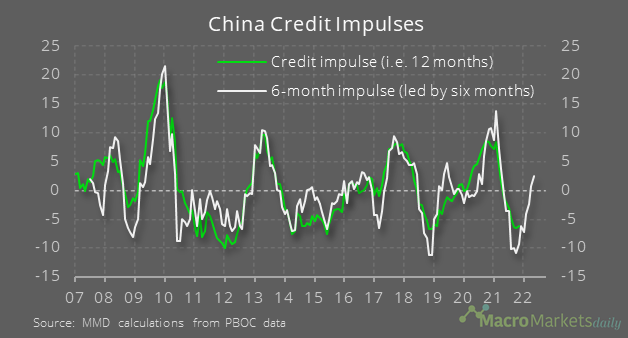

Following our last month thesis, when money/crowd is continuously ‘invested’ in FATANG, they should hedge with inflation protection assets. I would think current dynamic is twisted with recent China property drama, which widen spread between US and China/Emerging.

I should still believe, following previous month thesis, by knowing their culture, China would eventually blink, eventhough it’s still very early to conclude. They started to cut benchmark loan rate in almost 2 years.

In my own economy model, in case of too big to fail, when there’s no money advantage, there is no need to have bankruptcy. For example, if Lehman Brothers (LEH) didn’t bring any advantage to bankrupt, I believe there’s no need for it to bankrupt. This economy model secrecy would become obvious, when being challenged with rising China power. If there’s no advantage to bankrupt China 2nd biggest property developer for now, I believe there’s no need for them to bankrupt their offshore liabilities. This is where money power would take hostage of their hegemony. Would there be any new money trying to step in on their way, they would throw this towel to them. I should still also believe, China would rather die, than directly bailing out their property developers.

During this cycle change, inaugurated with Omicron, FATANG heavy loaded trucks are rolling down hill with lower gear. They should induce heat, higher inflation, and increasing volatility. In my theory, when money is distributed within attractive discount opportunity, inflation should be ignited. There are two big players in here, trend followers and majority holders who will continue to support their own rally. Both of them at the end of day, should continue to invest in long run and try to reduce spread risk with other barometers. It’s no secret recipe, the success of FATANG was also due to liquidity. Indirectly few of them, QQQ, TQQQ and recent 5QQQ, are on all time high [leverage] ever.

Liquidity is the key.

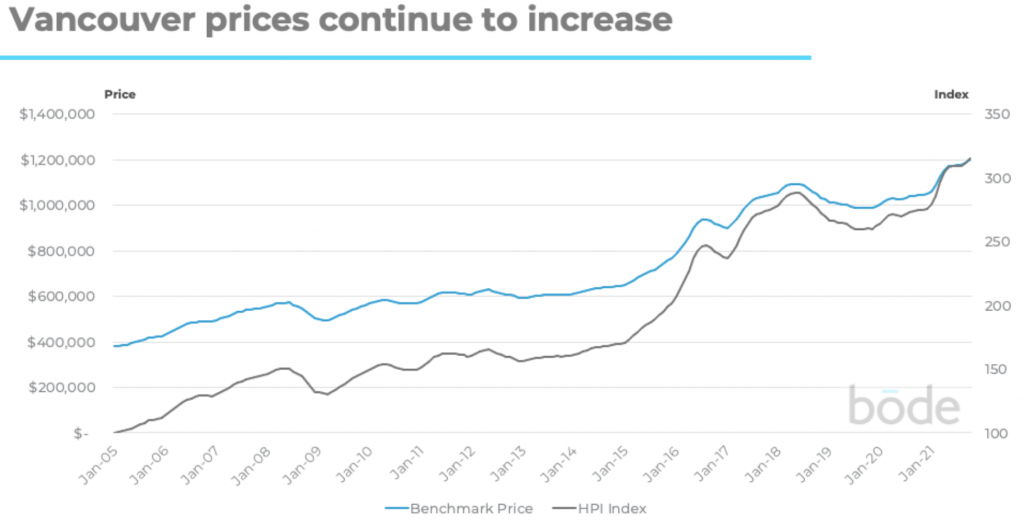

Recent cycle change seems to support FATANG de-risk effort which should induce global inflation instead. We heard Mr Musk was selling 15B$ worth of Tesla and paid 11B$ of tax. I would rather think from different approach, that it’s a great news! We should know that it’s coming from stock option, that rather be expired next year, is being used to provide more oil liquidity to Tesla truck (rather than negatively perceived company issuance), supporting US fiscal budget, and provide re-entry opportunity. During this de-risk event, inflation is usually in focus. Central banks and senators are mostly focusing on inflation, taper and increasing rate. Aren’t we surprised that some countries are taking opposite strategies? China is easing and cutting rate, and so do Australia, Europe and Canada. To ensure they could navigate this change, they should just need to provide abundant liquidity and market will navigate themselves beautifully. No surprise, we see beautiful XAU rally.

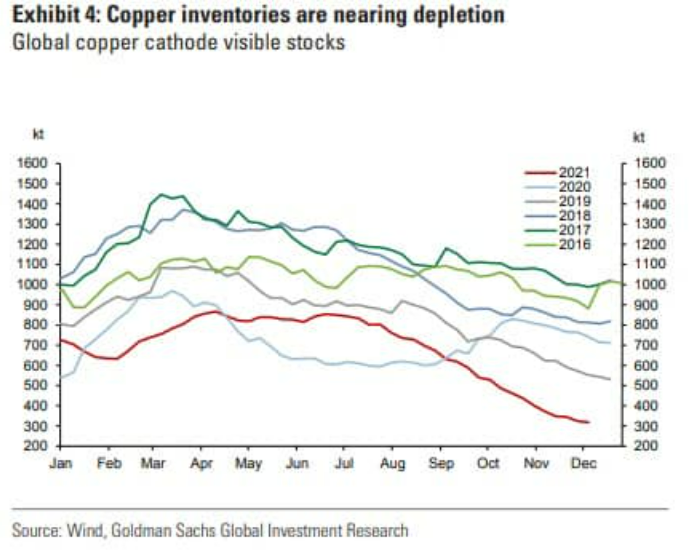

To hear most of FATANG and BTC, we should hear from Cathie Wood. She still believes that her innovation technology is within deep value territory. It’s no surprising that she finally admits of her poor performance, even though sadly, her view still doesn’t fit with my inflation related commodity rally and liquidity thesis. She should stick with her mojo, the EV, rather than selling it to small cap ones. Current check, my EV infra thesis seems still alive (together with food and electricity). Copper is still showing persistent strength and acute inventory problem in a decade. I think this should be more persistent than end of year Oil tax event Santa Claus rally.

To put myself on market feet, I would think the idea to attract risk should be to provide attractive discount to previous rally, where most market calculators were still based on previous historical numbers, rather than current dynamic value proposition. In doing so, they shouldn’t give too much discount and must avoid crash to the market, because that would rather be destructive and push market back to risk off side. Therefore in my own thesis, to attract risk taker, market should:

- give enough opportunity, while maintaining current trend,

- create fiscal opportunity with government guarantee to lower risk, and

- have manageable inflation with faster tightening above expectation.

I don’t think the first two would be an issue. The market currently worries more with manageable inflation, whether Fed is behind the curve or not, seeing current probability of dot plot and drop in long term bond yield.

However in my own imaginary theory, this drop should be no different than common QE front running. They front run long term yield, before RRP is returning to their native asset, while at same time, they reduce probability of market to not taking more risk.

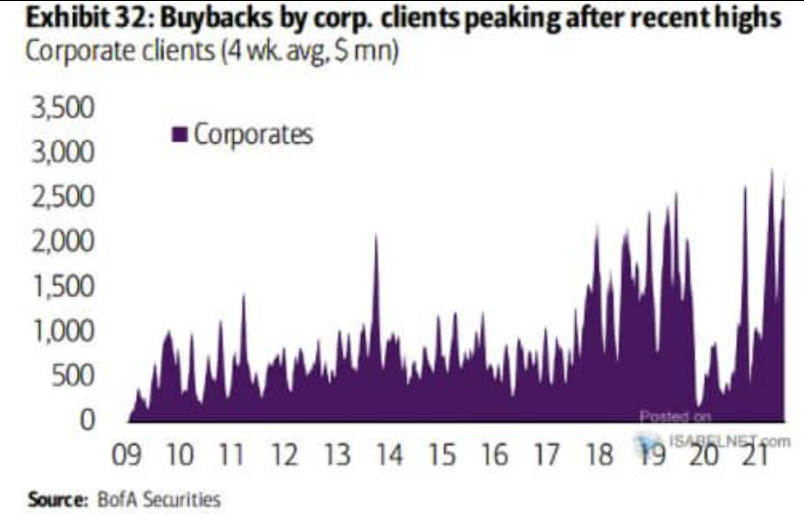

At the end, I would be excited to see more Corporate buy back, which I would think is rather a good opportunity to later escape and navigate finance world better.

If you believe in yourself, in your own long term growth, you should purchase back your own debt, or leverage up your own promise. I think that would be best strategy to navigate risk, de-risking your current high risk after easing rally, while at same time, taking advantage of the risk itself.

I would consider this as part of my escape plan to continuously run All Time High in long run.

Disclaimer: opinion is my own and never become any financial advise.