Many years, investors and traders have been trying to find and formulate their holy grail techniques. Most of them are failed and it’s not surprising. It’s market participants behaviors that are always trying to take advantages from those who are trying to find it. However I still find a dynamic adaptive learning to follow market participants is still doing well, rather than sets of quantitative formula or trying to redo past experience.

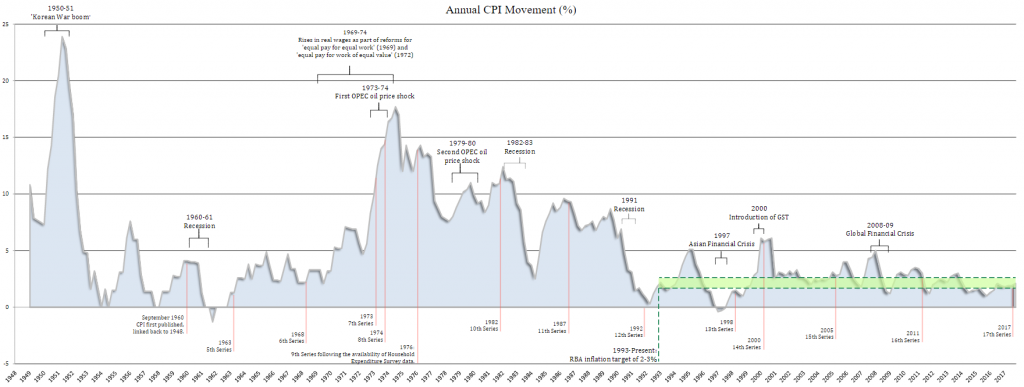

Since 2009, central bank balance sheet has been growing tremendously in a binary pattern. I always argued that we are not required to do any normalization yet until there’s any sign of global inflation. We were worry about US inflation in 2016, but at the end, US has to give up their inflation to bigger slow down of global growth.

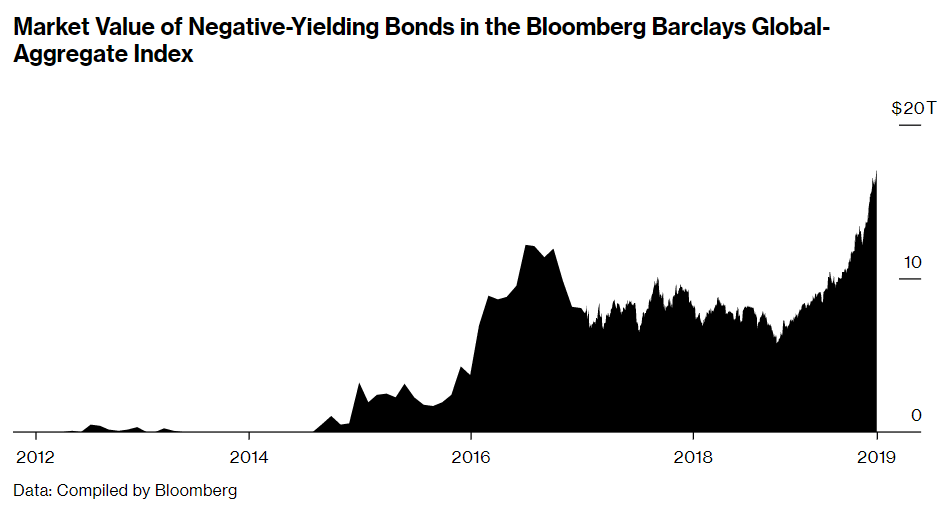

In any of those events, our main concern is always about uneven money distribution which is related heavily to high grade investment vehicles supply issue. We see high quality bonds is getting scarce and drove their price to unprecedented negative yield. When we see junk bonds are being elevated too, people start to worry. There’s not enough supply for high quality vehicles which then raised another opportunity for their longer term. Companies also widely do buy back in effort to reduce their supply and cause unprecedented very high PER (Price to Earning Ratio). Funds may get more concern about what i called “new elevated normal” and due to their anchor to previous lower PER, they leave. If sufficient permanent balance sheet keeps permanent, as they are, this high PER could be the new normal, rather than previous failed effort to normalize it down. Isn’t it the behavior of economy policy makers?

We shouldn’t be surprised that ascending triangle of US shares, supported by Federal Reserve should be a conducive environment for them to continue up rising. Also if we looked our history, flat curve can cause rally as well, just like in 2002-2004. Did we just worry about US recession recently? I can tell that the recession is now officially gone in which I already predicted few months ago, as long as central bank remains supportive. Isn’t it amazing that money (rate cut and continuous 160B$ injection) can turn recession away, just like that? The impact should, of course, happen to US share market before it spills into other economy since US is still doing better than rest of world. We can see very clear that significant US 2y steepening makes their banks on right spot. Other countries like Australia big banks are now starting to raise their CET1 and Basel III, to possibly get their engine ready and catch up.

If we look Australian property market, after GFC 2008, actually Sydney property and many emerging property had been doing well. The GFC had caused people to panicky do saving and it caused these property market very healthy, which then caused rally from 2012 to 2015. This boom of profit margin attracted many developers (including from other states) to build Sydney and caused oversupply. It’s Sydney which has oversupply issue. Similar to money effort to save current risk to the jewel of US economy (IT industry) this year, there should be same effort to save Sydney property and I believe it will unevenly spill into other states which are not oversupplied, such as Victoria, with their tier-1 Melbourne CBD. With continuous effort to choke developer funding, it may evenly cause unevenly under-supply. It’s not difficult to measure number of cranes with our own little eyes.

China on the other side, was entering crisis in 2015 and may start to recover in 2020 ( 5 years ). It might be similar to pattern of US recovery from 2009 to 2014 ( 5 years ). Those are relatively matched with average length of maturity of their bonds. If it’s, inflation might start to happen in next couple years and people with negative yield may start to worry. US and China may really need to cooperate and introduce fiscal initiative. Powell said there might be a positive path towards negotiation. However we might interpret this as an opportunity for US to front run other world, rather than trade war deal. There’s still an effort to introduce #bluedotnetwork, an initiative from US Australia and Japan to challenge China BRI.

Other sign of inflation, may also be seen from recent plan of Aramco IPO. There’s an argument that the IPO might change the structure of Saudi people subsidy to rather fund their kingdom and US fiscal/global initiatives. Those masterminds behind the IPO are world rulers and leaders. They can decide market behaviors. My holy grail is to learn and follow their behaviors, the money.

Another sign of inflation is correction of negative yield bond rally in August which might cause short term funding issue. Eventhough the correction pattern may complete, it clearly shows that there was a pause in rally or having some structural change. It may continue to rally in medium term since it’s still above 2018 average, but it could also lead to global inflation. Christine Lagarde will take helmet of ECB (where most negative yield is) and she seems to be more fiscal supporter, unlike her predecessor.

Let’s have a look from RBA speech today. In past few years, RBA has been hard to maintain inflation to their mandate of 2% due to slow global growth, trade war and China efforts to combat their economy slow growth issue. The achievement from 2015 to 2018 were mostly only due to lower currency. If currency didn’t fall, we might not have much luck.

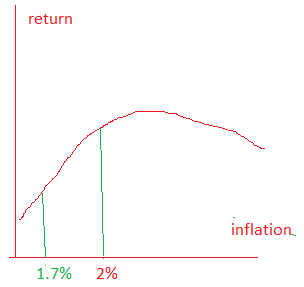

The recent inflation data were broadly as expected, with headline inflation at 1.7 per cent over the year to the September quarter. The central scenario remains for inflation to pick up, but to do so only gradually. In both headline and underlying terms, inflation is expected to be close to 2 per cent in 2020 and 2021.

source: RBA monetary policy decision November 2019

We don’t need holy grail to save the economy. The yield curve clearly shows, we just need to push up their belly and all kind of recessions and gloomy doom outlook could magically be gone. We know well, fiscal initiatives can help to push belly up (property), probably after pushing banks healthiness, supported by RBA with keeping rate lower than the market. Don’t be surprised with recent gloomy outlook from RBA to justify lower rate longer. Spring has really sprung, Australia banks are now reducing their dividend payment to grow. Just like natural cycle, flowers stop blooming after spring, they started to grow leaves and root. It’s a significant change to their previous years of high dividend. We hope this summer inflation is not that hot and return can be at their optimum.

We might not need to worry about lower volume of Australia property transaction/auction. I believe most of the low volume is because all big banks are now lowering their risk with some actions such as abandoning any Interest Only (IO). In the event of preparation to grow, this situation might be well perceived as an effort to increase healthiness. In 3 years, all IO will be gone massively from banks balance sheet and borrowers are already enforced to put more equity through Principal and Interest (P&I). Any weak hand will be funded with lower rate. Isn’t it healthy? I hope so.

We might not know when inflation start to bite. I will worry to non conforming lenders who are trying to expand their market share and being exposed to high risk borrower profile. I would advise their borrowers to monitor carefully their non conforming lender loans, probably in next 3-5 years.

Please be very aware, I may already have significant position written in this article. It definitely has conflict with my interests. Therefore this article is not in any case of financial advise.