in my theory, it’s a binary form, normalization will not be able to return this back normal

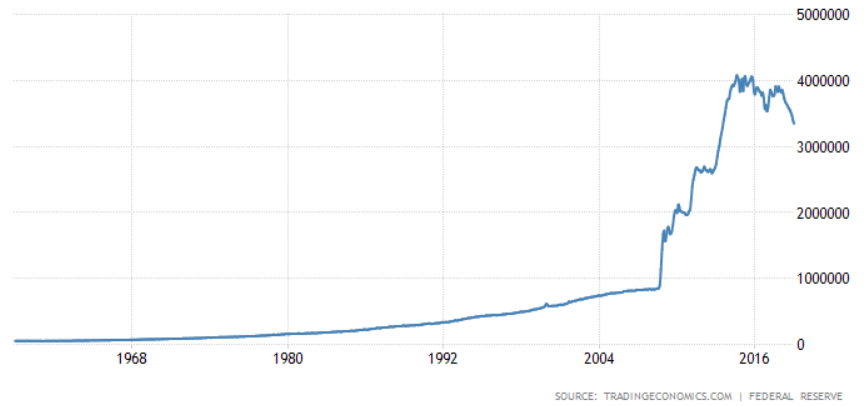

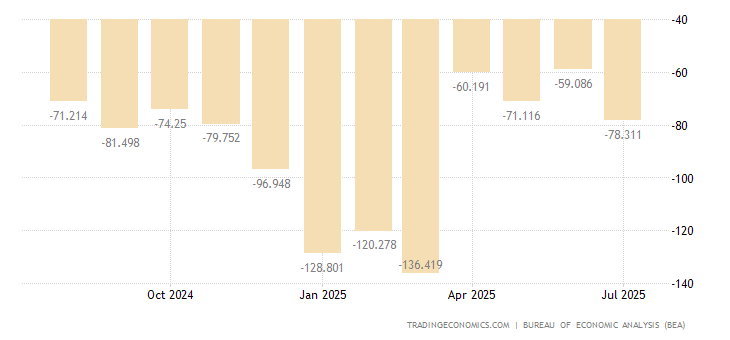

Let me show you. We used to hear trade in many obsolete economy theory. It sounds big, trades between US and China is 200B$ and growing. However China grew GDP from 2.5T to 8T in 4 years, that made this number small. Let alone trillions of debt created within few years inside US. Fed used to inject hundreds of B every year during QEs, that makes this trade number smaller. Do we believe recent trade deal is about tariff? I don’t. Indeed its tariff is only about 25% AND most importantly, it will not stop consumer from buying and government won’t allow negative effect or inflation number in consumer. In this intertwined global trades, consumers will not have much choice. Trade volume is just a proximity. There’s a larger deal behind, in value of hundred of trillions and recently is asking to have a STABLE YUAN. Growing trades simply can’t follow human created growth of money, shown in binary form (exponential is not enough) of money growth above. Japan with its aging economy, will not be able to keep momentum of economy velocity, without using money and currency.

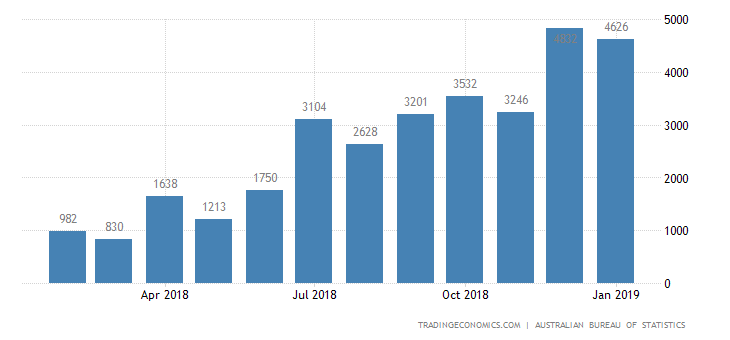

One that may support my argument is to look into Australia. Australia currently records huge trade surplus against China and US records huge trade deficit, also against China. In reality, AUDUSD is going lower with RBA is now considering lowering rate, same like in Europe, TLTRO (Targeted Long Term Refinancing Operations). Trade and tariff issue is currently much lower and seems to have less correlation to what I believe more appropriate issue, money and currency.

captain marvel: higher, further, faster, binary

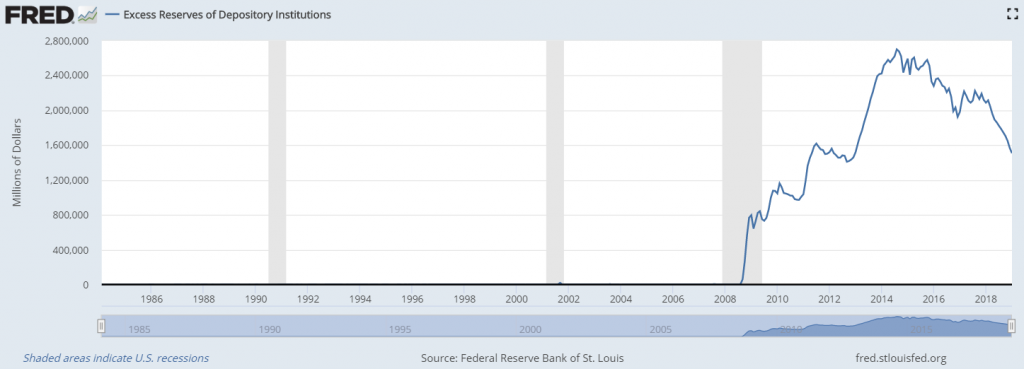

About normalization, I doubt it’s working well. Fed Excess Reserve was able to reduce from 2015 balance sheet overshoot but do we think Fed is able to reduce more? I am not convinced, and I believe many are not. Previous additional 1T$ excess increase from 2013 to 2015 is just an overshoot and today is only merely back to it. We also believe that rate normally should never come back to 10 years ago. My simple math thinks 1.4T$ is the amount Fed excess reserve has to keep in Fed or somewhere else. I don’t believe it can go much lower, let alone zero. It’s the end of the game.

I’m not worrying much about recent strength of USD, it’s just a currency. As long as all market participants commit to keep growth in check via currency depreciation, voila, I think we have a solution. Is that simple? Yes, what else? It just needs to negotiate interests and make a deal. If a society is all doing a robbery, the robbery becomes a norm. If human is a carnivore, carnivore diet becomes a norm.

There’s an interview with Yellen, former Federal Reserve chairman, about currency. I would have to argue many of her arguments. In today’s world, USD is still the most prominent currency and it’s still the largest and one of strongest. Fed received complaints from other countries when they did too much easing (2009-2014) and too much tightening (2015-2018). She also argued this local policy shouldn’t be considered as currency manipulation. It seems to be contradicting and doesn’t put her feet into others. China was and is still smaller than US. Discussed in my previous article, during QEs, none in this world could afford to have stronger currency, therefore China has to follow suit and have no choice. It drove local property appreciation in many places. Since it’s a smaller country with big GDP growth that time, China has to export inflation to somewhere else, to avoid local economy from overheating. China has too many people and it’s much more sensitive to inflation, compared to developed countries.

It raised Belt and Road Initiative (BRI). There are many arguments it could lead to debt trap. It is possible, but I think it’s not the main issue. The way we could make difference between rich and poor today is access to finance. Warren Buffet on his latest interview still thinks the gap will keep going larger and many of economists and governments do. Engaging more number to strengthen wealth of a poor doesn’t make the poor a manipulator. It works though in a crowdfunding systems. With a lot of economy (mainly neighbors) benefits to China, this BRI will raise power of other countries and then tightened global credit back to China. Simply put, US and USD dominance is now much lower than before because other countries are now much richer and it will be hard to take down China without taking down the rest of the world. It’s been seen since October 2018, US cycle momentum is now being dragged down by global economy down turn. I believe the downturn was due to damage done on medium rate due to previous massive QEs and it needs time to heal. I think it’s not a complicated thing and I strongly believe human can find a deal.

Xi acknowledged that everyone will be in more pain in our near future. Literally it doesn’t only mean to Chinese, but to human, especially to smaller who has less access to finance. Access to finance will be much harder with increasing rate or when world is going to normal, but it’s much easier when world was sick or the richest, US, was sick. We acknowledged, between 2009 to today was one in life time opportunity for many to go rich and HNWI (High Net Worth Individual) number explodes. Luckily, many countries had enjoyed BRI to ride Fed QEs and now they are much richer and they just need to spend wisely. Those countries which received access to finance during QEs through BRI should be thankful and it’s now up to them to grow their wealth wisely.

I don’t believe BRI debt propaganda is the most important. Ask big players like Italy, German and surrounding area, where many negative yields are running around, they do love it. They are not small countries and clever with economics than average human. Once in our life time, we might have an opportunity to grow rich faster (higher velocity) than the richest, in a binary form. After that it’s up to us on how to manage the wealth, created from increasing debt, whether we will fall down into unmanageable debt or continue to prosper.

It takes 2 to tango a stable currency, a binary, from 0 to 1

Could the binary save the end of game?

It’s my own opinion and not in any case of financial advise.

]]>