The + sign is getting obvious, there might be a start of a change to the world of economy. Australia continues to record current account surplus. It’s first time since 1975 or 45 years ago, and to continue rising.

The current account surplus is mainly related to commodity export to China and depressed currency. It should have high correlation to recent rebound in China PMI or highly probable China expansion.

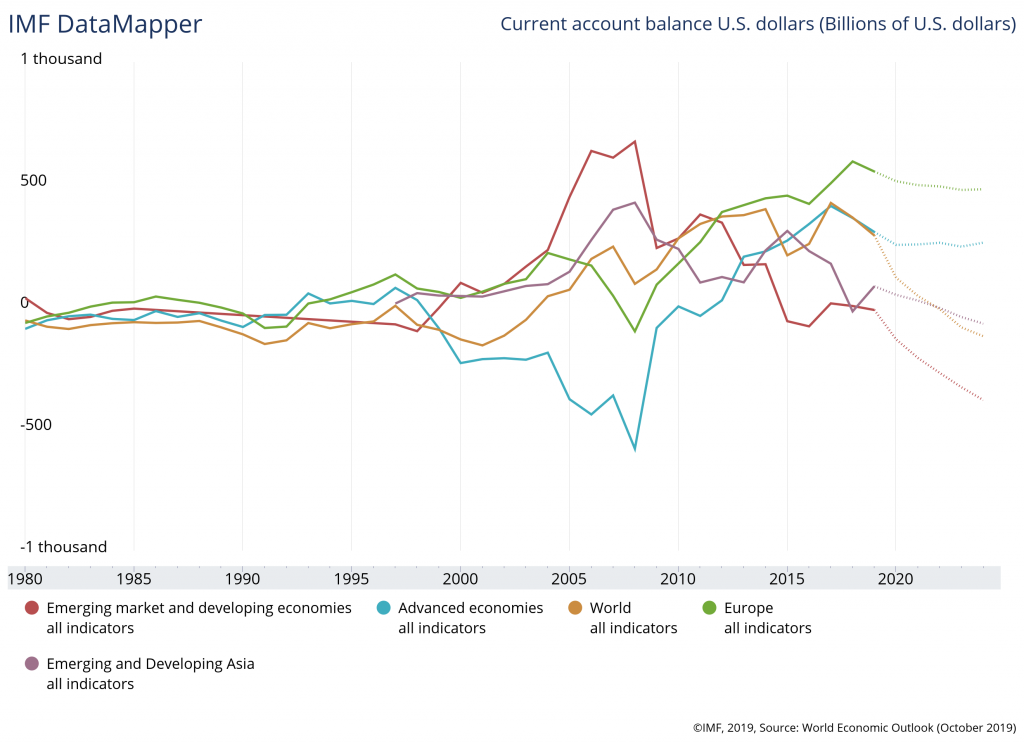

How about other countries?

Emerging market and developing Asia seem to be the ones on way back down to deficit.

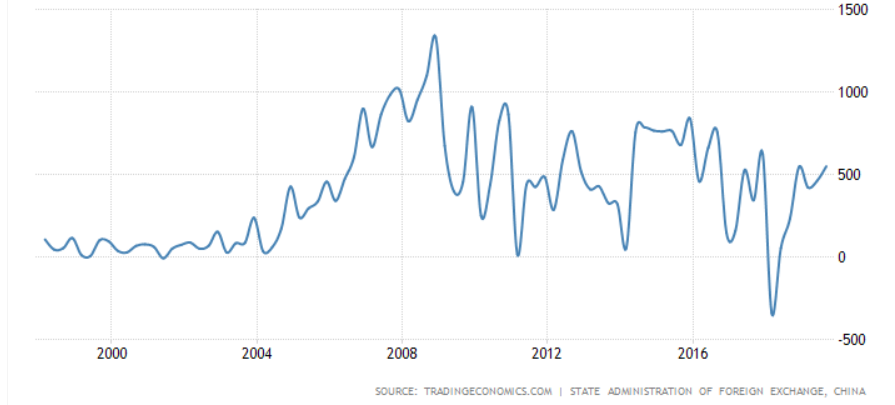

With US tries to control deficit, I may suspect China may have risk/difficulty to maintain their current account surplus, as seen a big flash drop in 2018.

Trade war will try to balance US and China trade and current account. They try to tango/stable two world strongest currencies, in simple term is trying to not manipulate currency, but to monopolize them. There seems to be an effort for China to stimulate their economy and effort to park the money in US to stable the pair.

source: marketwatch

Meanwhile, the impact seems to benefit some other countries like Australia. Negative sentiment of trade war, in addition to almost crash in property, is fueling local central bank easing to indeed catapult Australia to a condition we might never see in 45 years.

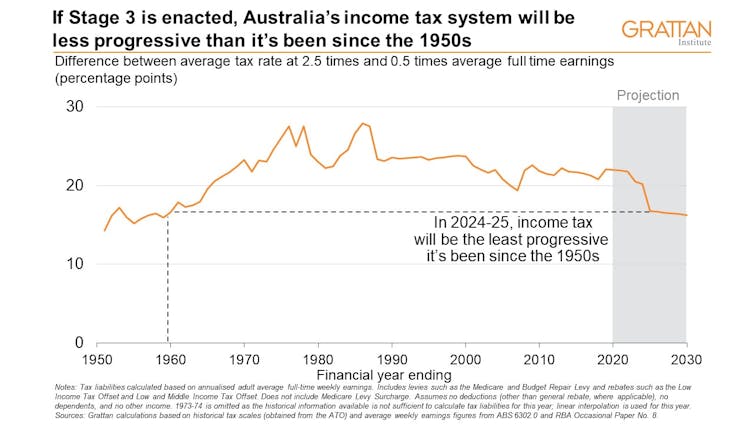

Everyone is waiting for fiscal initiative. One plausible outcome is a big tax cut. The stage 3 might put it back well to about 50 years ago, which seems to be correlated with the condition of current account surplus history.

With net overseas immigration continues to run hot, it may help to mitigate recent oversupply in Australia property. And when the fiscal does more such as infrastructure, it’s expected to be another plus.

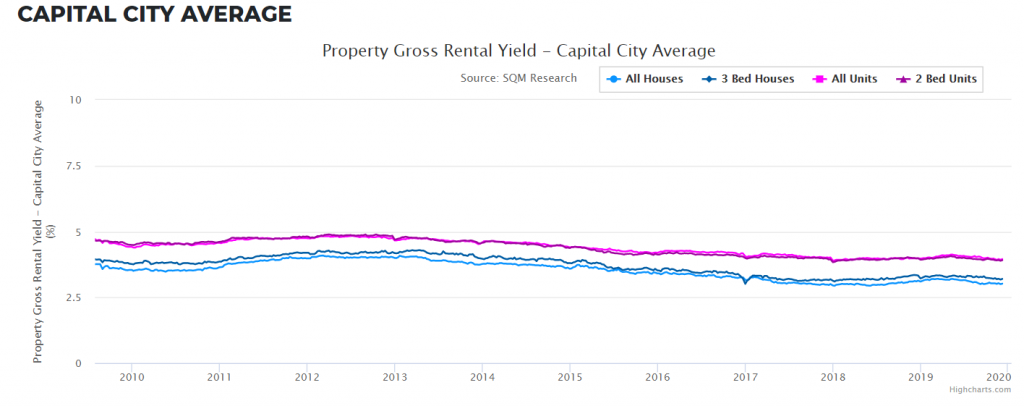

From property perspective, investment properties (IP) are heavier than owner occupier, having more lending restriction and higher interest. If we look at gross rental yield, they return at average of 3% to 3.9% and quite stable in last decade despite price volatility. With current IP mortgage rate at about 3.5% from big banks and 3% with non conforming lenders, it’s quite clear that depreciation (tax benefit) suddenly turns investment property to be a surplus vehicle, as long as price is no longer down and rental yield is reduced less than mortgage rate, in which both of these two are happening. My argument in May 2019 is correct. There’s no benefit for investor to sell at this lower price, rather than to keep them for almost definite profit, even if the price doesn’t increase.

If we’d like to forecast how much tax benefit is diminished with price increase, assuming other conditions are stable, we may look at how much tax benefit is. This article shows that taxman contributes 24% of the cost, therefore we might expect price to rebound at about 24% from bottom to bring this vehicle back to normal, i=r+t or when we may expect volume to build.

It’s only a matter of time. The price has rebounded and only half way to go.

We may see clearly, that if RBA cut another rate, at current yield curve, one more rate cut to 0.5%, may ease short term lending pressure and form an inflationary yield curve. However even if RBA reduces the rate, I may doubt banks will pass the rate cut, considering recent profit pressure and may become a positive news for the bank instead.

I don’t say that economy is healthy enough (stubborn low inflation and wage increase), but many conditions have been definitely improving well, as long as RBA helps this recovery on track.

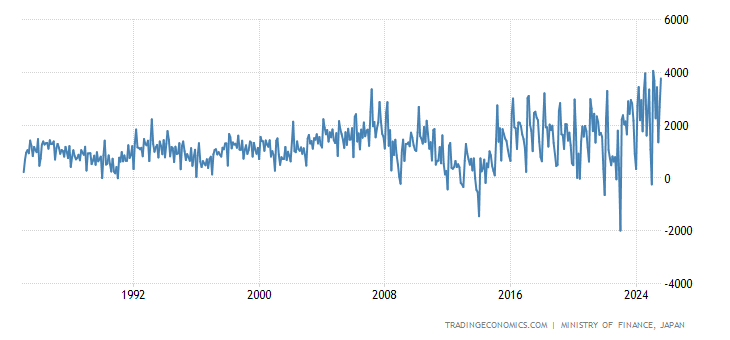

We do hope though, the plus is giving more benefit to the economy. Some evidences might show a surplus could be negative to local investment vehicle, such as shares, and may introduce some unintended consequences, like in Japan, which is still trying hard to stimulate their economy.

source: tradingeconomics

However it seems the government is being careful, before doing a massive change and may take a safe measure, such as tax cut. The forecast from IMF shows that the surplus might be just an impulse and may quickly go back to deficit. This forecast is correct because it’s just based on simple past series math, but it may not be able to tell future, should the surplus condition persists. There is some argument that there might be some volatility in near future which may require financial sector to have bigger buffer.

The story might be related to a ‘big rescue‘ to US banks in September 2019 when their daily repo rate shot up very high. The Federal Reserve wouldn’t disclose who are the rescued ‘too big to fail‘ ones until next 2 years. The most coincident event during that time was a possible bubble burst of negative yield in long term US treasury. Many US banks have been participating to hold/engineer more treasury rather than what they park in Federal Reserve, causing short term liquidity crunch. In an event of global correction that could easily challenge other countries. It’s no coincident that many Australia banks are now in rush to raise their liquidity level.

Eventhough China seems to lead non US rebound, Germany is still contracting. People may still look for further evidence. Until then, US economy remains unchallenged.

If indeed condition of surplus continues further, I would expect the fiscal policy to do more than just a tax cut initiative. We’ll see.

It’s my own opinion and not in any case of financial advise.