What a life in past few weeks. It is indeed more love/QE and thunder/volatility. Let’s review back.

MORE LOVE

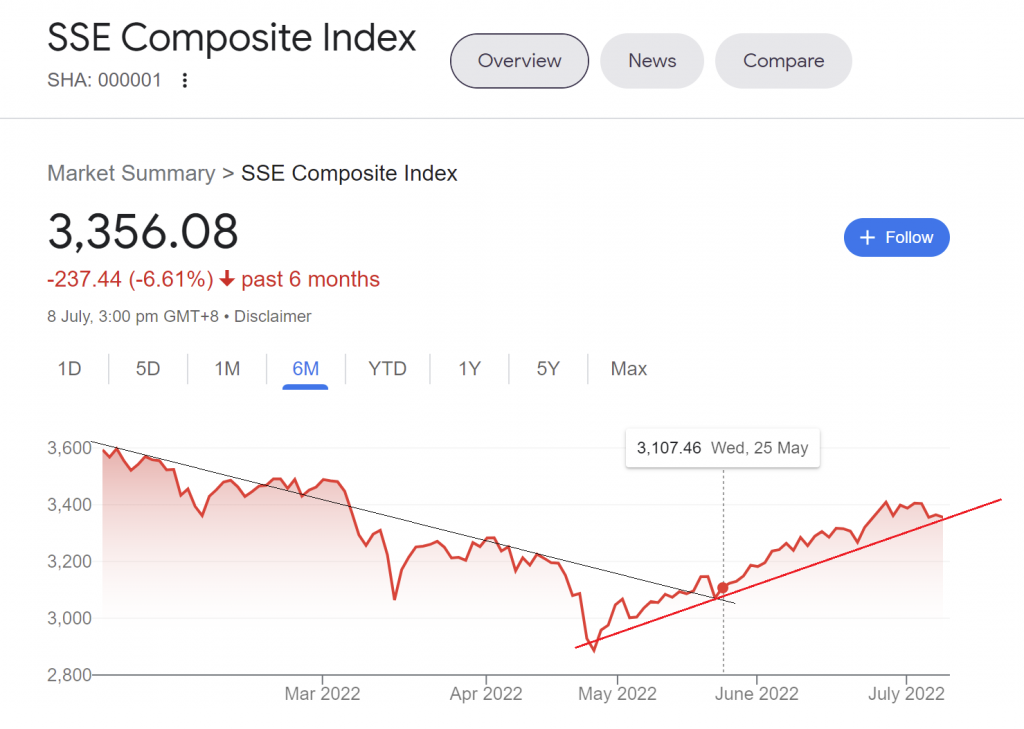

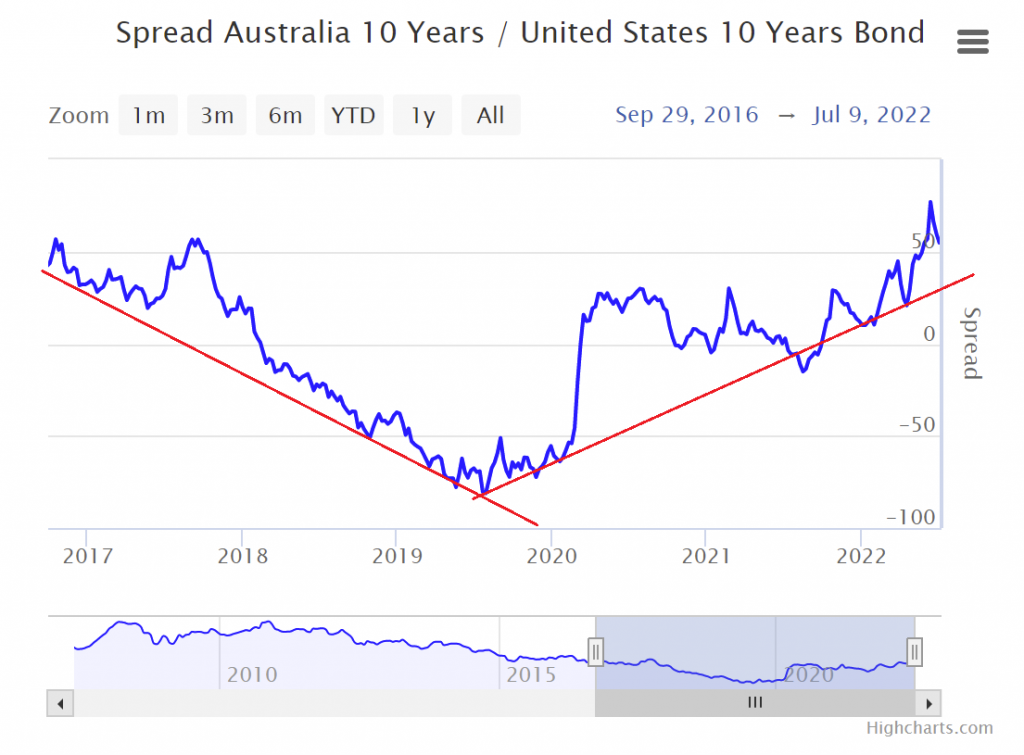

#1. China. In early June, we predicted maverick should come to emerging, especially China. It seems China has no choice but to keep easing their property (22% of GDP) which is just picking up after lots of depressed normalization since mid 2021. Amazingly, with the USA tightening hard and China easing this big, their currency pair is stable. Therefore we do still believe in our thesis, the USA and the China are still a couple to tango the world, with love and thunder.

#2. Apocalypse is coming in mid of June. Stock market, bond, inversed USD are having their worst bad days from mid of June when the Federal Reserve started to lift up rate higher than expected, following market CPI.

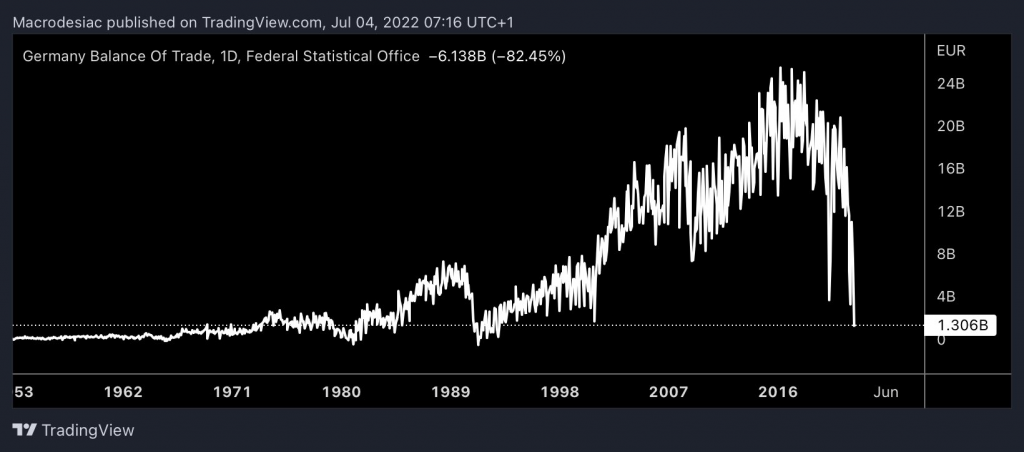

#3. Oil is becoming the Romeo to die. Europe and the USA inflation is becoming more related to energy and oil. German itself lost their years of trade balance surplus to higher price of oil import (mainly from Scandinavia and Russia).

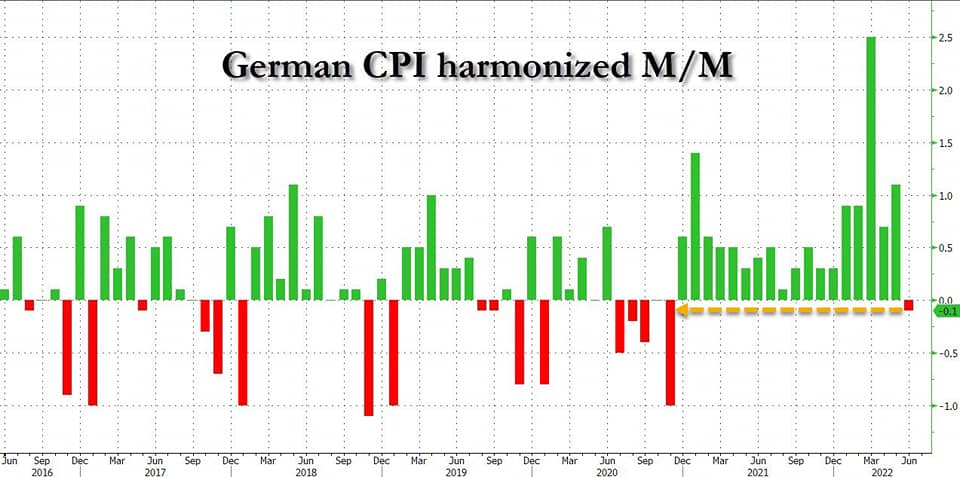

But despite high oil price and their import, surprisingly German CPI may have peaked.

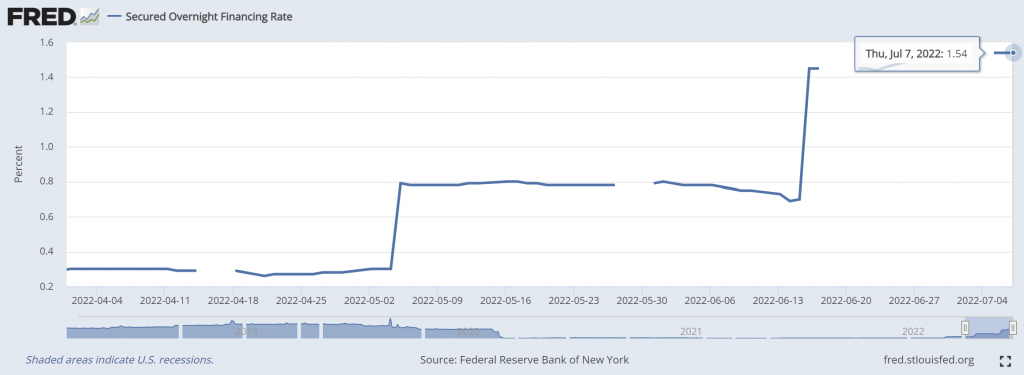

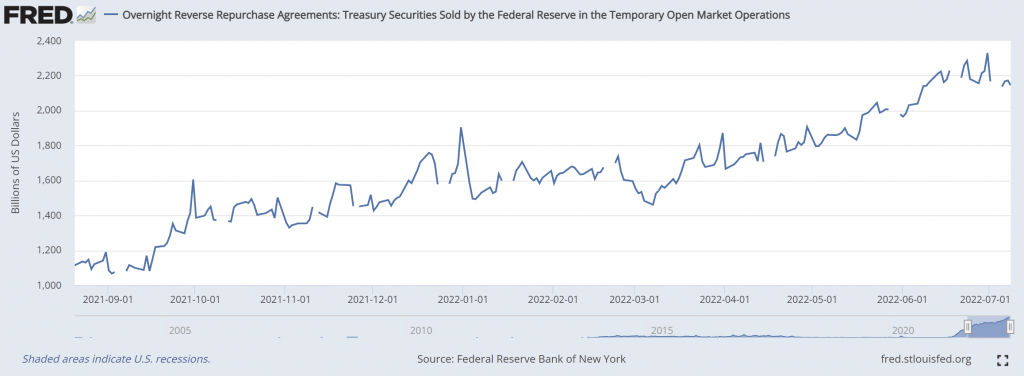

#4. SOFR may release RRP. On June 19, 2022 article, we predicted that as the Fed is raising rate, SOFR is now very close to the RRP rate 1.55%, it should start to release 2.3T$ of Reverse Repo money back to market. China has recently committed 220B$, which is still much lower than the available USA 2T$. We believe more incoming China easing to the market, which unfortunately also means more volatility to have it. With current SOFR 1.54% is so close to RRP 1.55%, in our opinion, further Fed tightening may likely ease the market. We do expect this MAGIC MIRACLE!

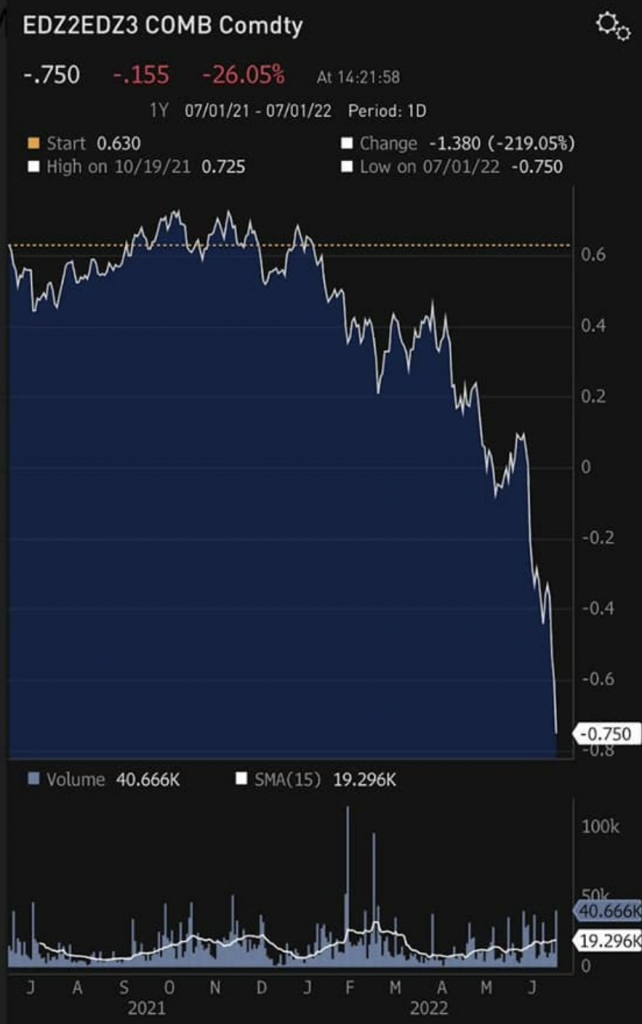

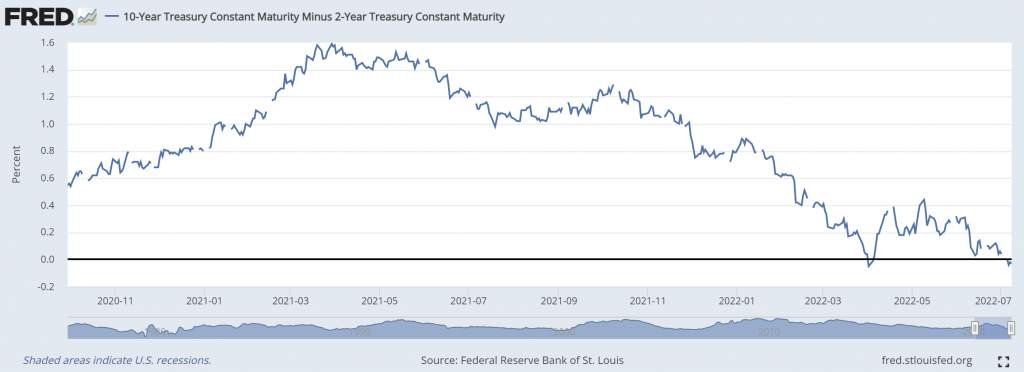

Therefore we will come back to world most important question. Back to our May 2022 discussion, is recession is really going to happen as indicated in yield inversion?

We still argue, there’s a higher chance that it’s most likely not a recession. Yes the Federal Reserve can technically put the global finance into recession with raising front rate much higher while having longer term much lower and forbidding money release like from RRP. However we do still believe, as worst as they are doing now, in deep of the Fed heart, I still believe they don’t want to danger global finance stability.

As time goes by, we argue more about recession thesis:

- Employment is still very strong. That’s not an indication of a recession.

- Our basic principal that recession is only happening when strong hands lost their grip. We still argue the Fed still has enough liquidity in the market. Crisis is commonly only used to take advantage over weaker ones.

- PMI is still improving and so does momentum. That’s also not an indication of a recession.

And it’s back to our most important thesis. We believe we may soon see accommodative condition instead, either if:

- the Federal Reserve is no longer raising rate, indicates much better condition from current 75 bps to 100 bps rate hike expectation.

- any small one rate hike should release 2T$ RRP money back to market.

If this thesis should happen, we should see 2Y10Y back positive. Meanwhile, we keep ourselves from being too much aggressive like in past 2 years, until we see more evident.

MORE THUNDER

Are you packed/ready for thunder? YES!

To have more love, we should see more thunder!

- Europe situation is getting worst with EUR may likely reach parity with USD,

- DXY may continue to rise,

- The Romeo oil and energy assassination attempts may negatively impact commodity market,

- Weaker earning release in Q3.

We are still keeping our GOLD thesis since year 2020 and emphasized again in 2021 and 2022, in which we are still not interested with GOLD BUG thesis. We don’t think GOLD will perform well in this inflation tightening cycle. Indeed if this tightening fails to land softly at around 1700$, it may break into 1600$ level to indicate the tightening is too much and may affect broader market, please be prepared well. We may have greatest threat, the Fed, in which unfortunately is still one of strongest hands.

Therefore we removed quite a lot of our leverage that we built heavily since 2020, until we see more evident of the Federal Reserve accommodative policies and lower risk of the thunder risks thesis. We are not worrying much about recession since we think global momentum is still here.

We seemed to be correct to predict, that current biggest threat to the global finance is not about recession, inflation and deflation, because the economy is still strong. The biggest threat of our current global economy stability is really the Fed, predicted in our May 2022 article:

The Fed years of huge easing and late tightening will not go unpunished. Sorry the Fed, I hope you understand. The greatest threat to our financial universe is You!.

It’s still a mystery to why the Federal Reserve comments are still very negative. It’s either that they thought the soft landing requires more threats to the inflation risk or they are confident that they still have enough support. We may soon see.

Our thesis is still running towards releasing money from Reverse Repo money. Let’s see.

You said it’s going to be a relaxing holiday. I said it’s going to be like a relaxing holiday!

As our always disclaimer, human shake and guardian shake always turn into a snake promise that you should never trust.

Any idea in this blog and website are my personal own. They are not financial advise.