The world is full of people who could harm you.

I can move! I can talk! I can walk. I’m alive!

A lie keeps growing and growing until it’s as clear as the nose on your face.

You thought you knew already? Pinocchio is not just a Puppet (Prophet?), he’s a MIRACLE to OUR PROBLEM.

Pinocchio, Pinocchio, please tell me the truth!?

Think about a situation in our life, when we had massive bills (mortgage, necessities, business due payments, investment, health, etc) all due together and we have to honour them all. At same time lenders (markets) are forcing to pay NOW (threatening) at much higher rate. On the other side, the lenders/markets still have too much excess money that they are willing to make loss (negative yield and RRP). What will be solution to the situation?

For the sake of saving of billions of economy participants, we might need help from a malarkey. None should be surprising with increasing historical abuse of economy politics (foreign exchange manipulator, beggar thy neighbour, etc) from all market participants. Regardless, our job as data scientist is to take advantage/understand truthfully of market participants behaviour. My idea is not new. My three years ago article, a pinocchio, is still holding strong. That’s when I started accumulation number in nothing, but inflation, which is nothing but ALL today. Those who understand might continue to survive and should my 25 years of interest be in this industry. Joe Biden likes the word of Malarkey and I think it may proxy the idea well.

Wall street doesn’t have any clue about working economy, give me a break, that’s a bunch of malarkey.

Of course, dancing with a bunch of Wall Street wolves, we should not take strategy lightly. September 2019 was obviously a time where overnight repo became a broken lie, continued with curve inversion and correction at the end of that year 2019, the CoVid. It’s no different today, should we learn from history. There’s a time where hiding the truth might be broken and we should be prepared for it, not to stop, but to take advantage of their possible correction, and then to continue again after.

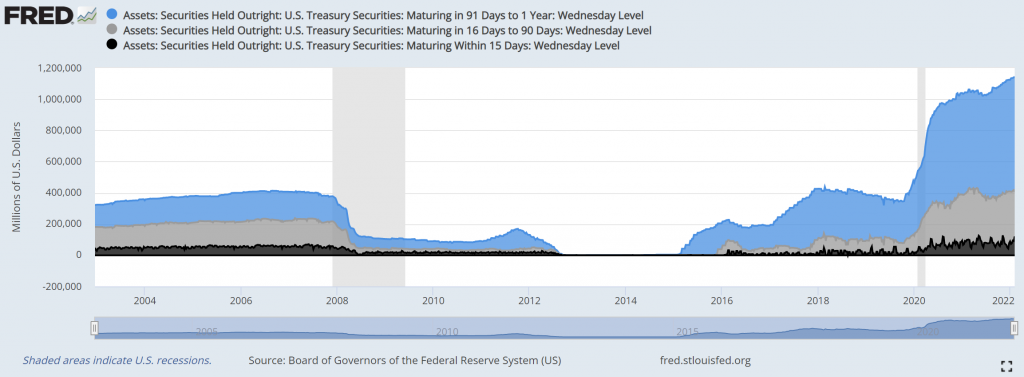

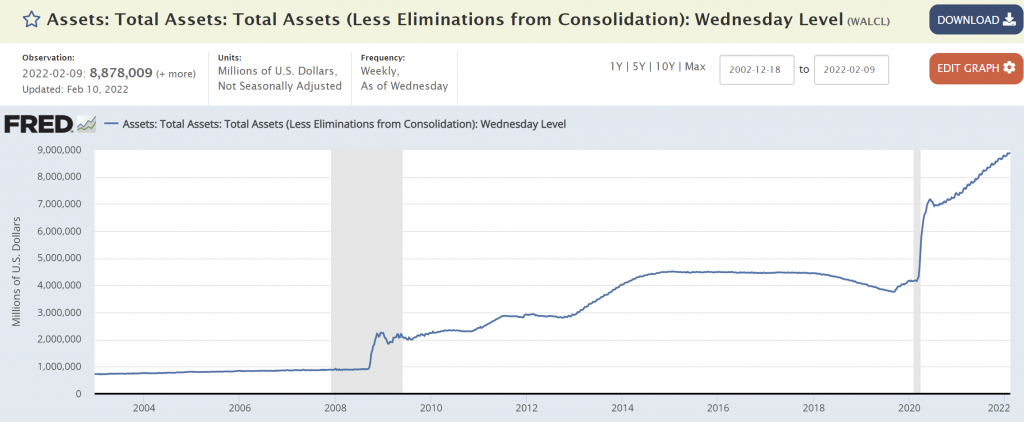

To avoid disruption to economy systems, money should always need to be sanitized. Money is bouncing back and forth between central bank and government, until they can find a place in or driving our economy. Do we remember our possible big catalyst of anode and cathode from our last month article. When it was written, Europe and Japan green shots was unclear. It might now be becoming obvious, German Bund jumps tremendously and broke their historical negativity. We shouldn’t be surprised that ECB, BOJ and RBA are still lowering their tone down. Their inflation thrust is just crossing zero mark, for the USA inflation to keep pulling them out.

Our job as economy street middleman is to run this economy and possibly getting paid from it. Currently there is a lot of money due to move from treasury to central bank and central bank hands are shackled from ability to sanitize, due to their mandates. Inflation is too high, while the decision makers should face the truth to possibly redo malarkey strategy.

In this situation where we couldn’t satisfy all interests, where I think most of victims is only our belief that economies would need to run efficiently and faith that decision makers would abide to their mandates. Therefore it may be best time in our life, to reconsider the use of necessity defence. It’s not something new. Both sides of market participants have been decades of using economy necessity defence actions with economy politics/national security. Possibly the best solution is to keep our best effort to abide our mandates and implement necessity defence only as necessary. Public will critic the malarkey, but hopefully they understand, it’s for their important necessity defence.

Before we take deeper look into the malarkey, let’s do our health checks.

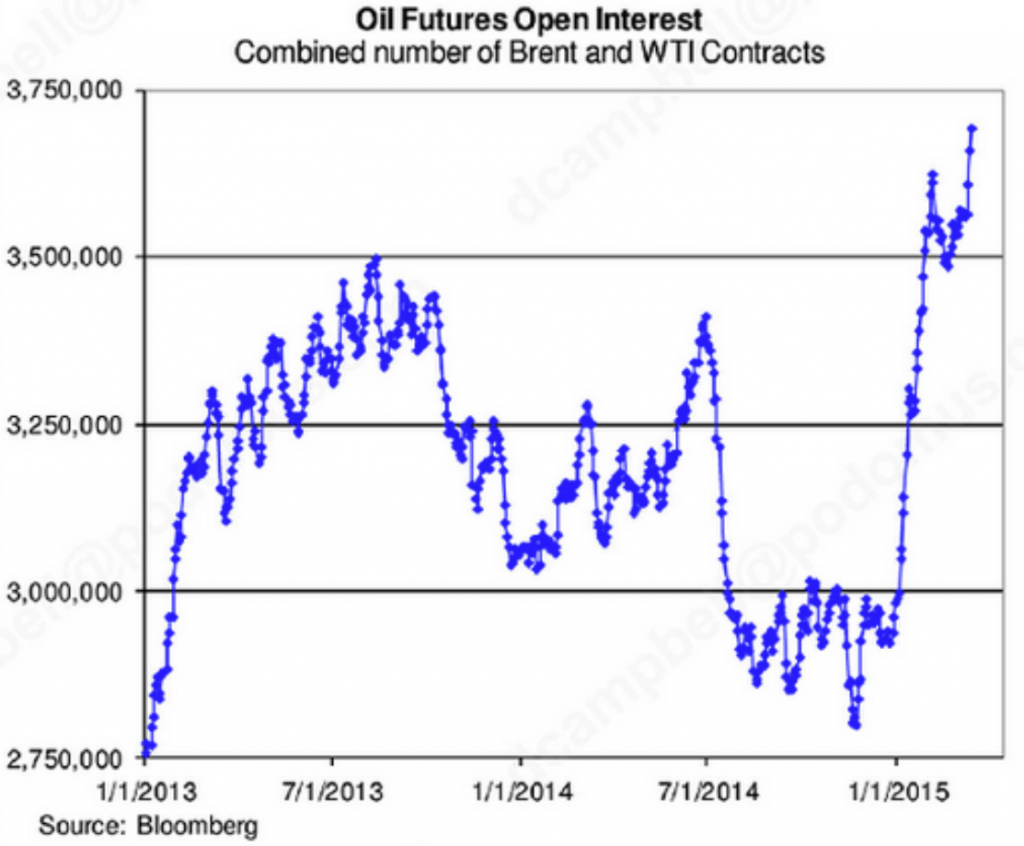

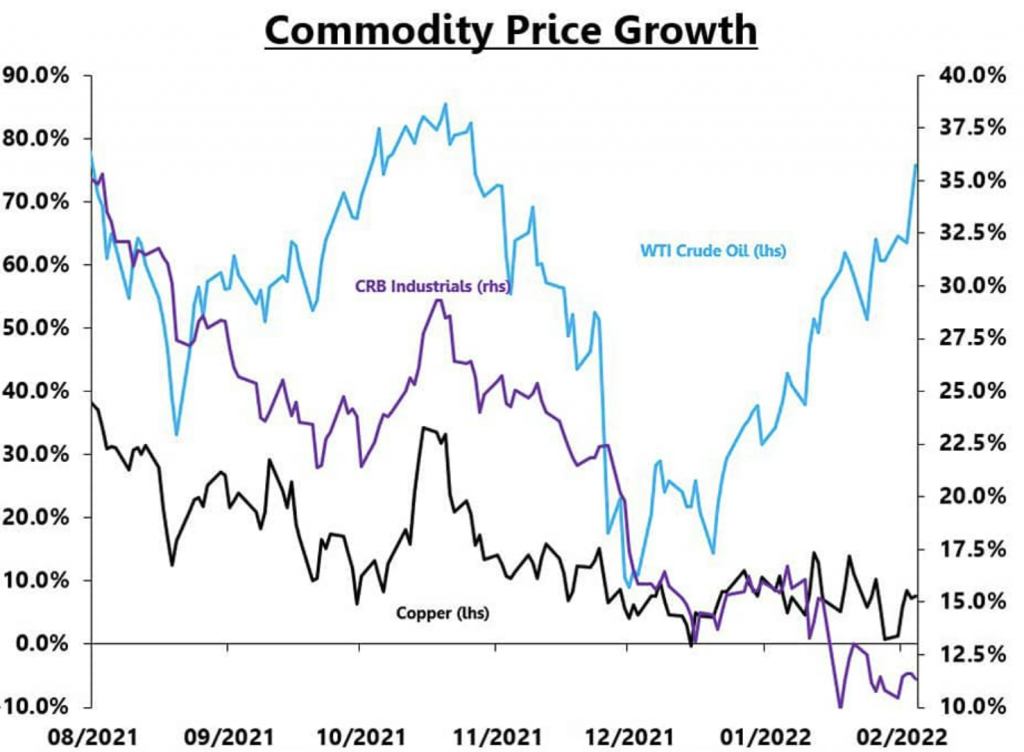

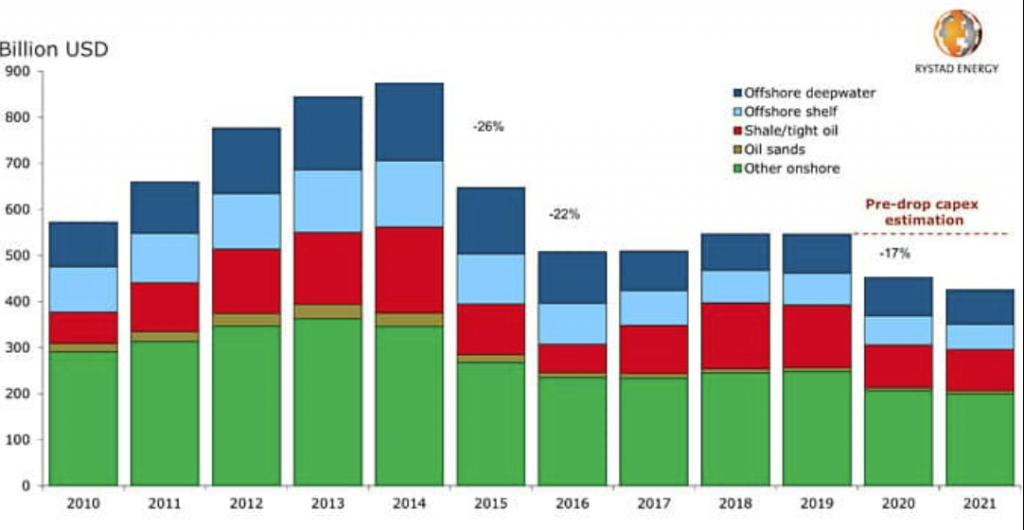

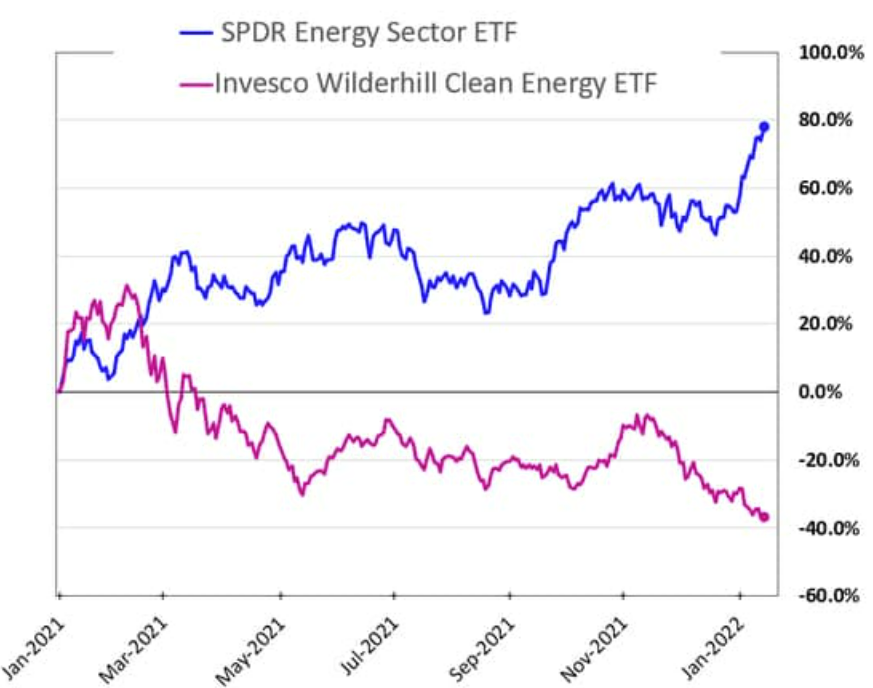

- Since our article 3 moths in November 2021, NASDAQ heavy trucks still continues rolling down hill and sparking very high inflation. Commodities (EV infrastructure) and Oil (one of our top energy pick) are burning high and takes massive toll of interest in early February 2022. It does seem look similar to 2015. Please be aware.

- EV dip buying trade continues to provide better option to correct their high valuation.

- German lead Euro crosses negative cathode to positive anode. It’s our belief that a small negative to positive could make more impact than high positive to higher. Same applies to Japan.

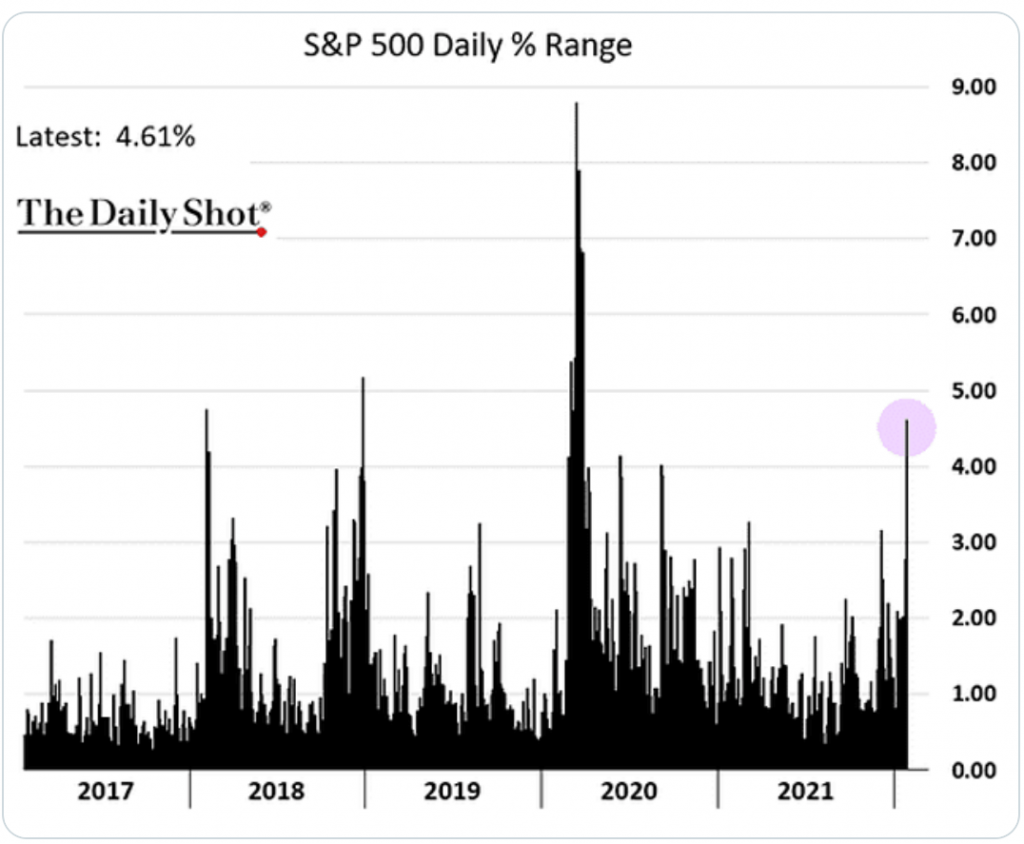

- Last but not the least, my expectation of volatility came true and it’s as expected. Inflation volatility shot into one of highest in past decade since our last month article.

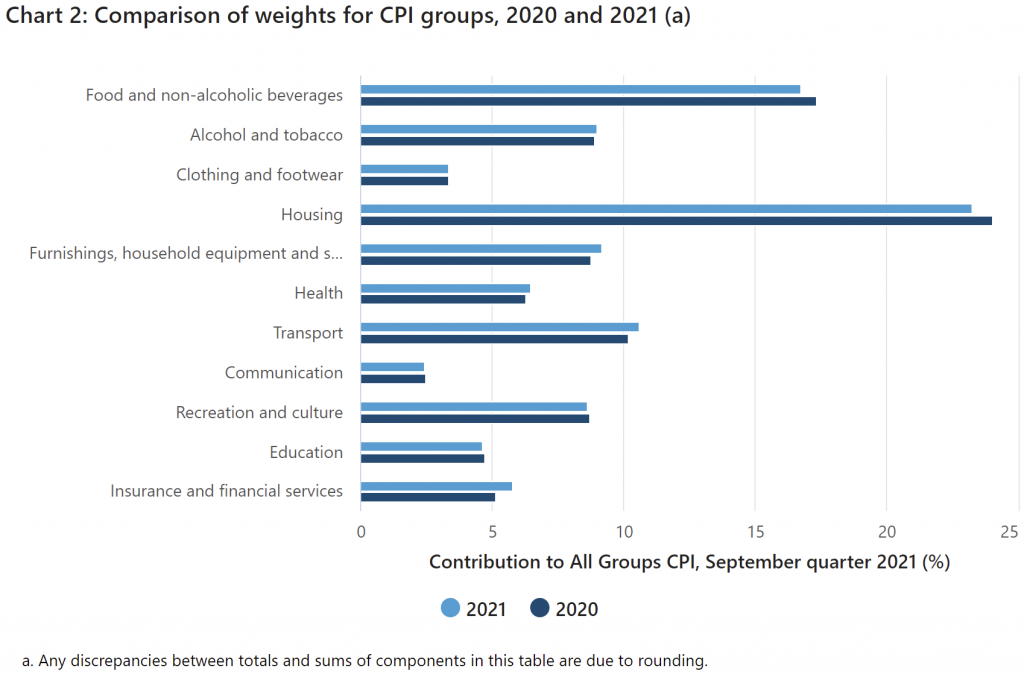

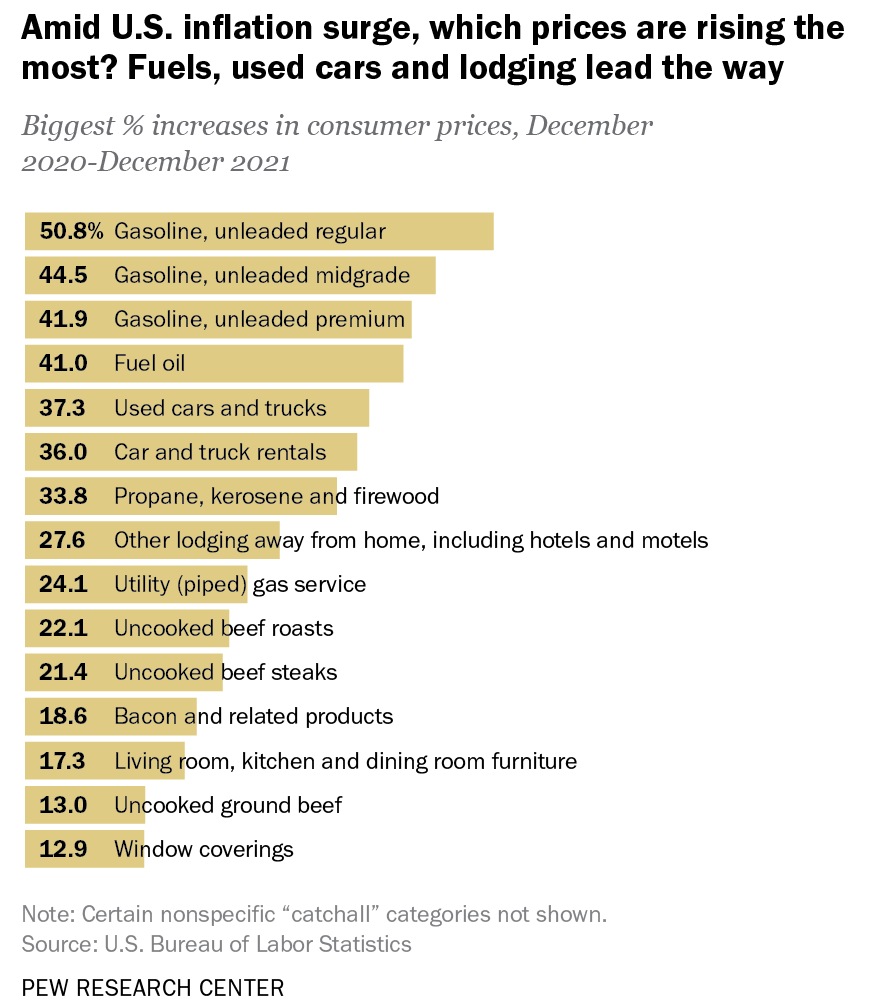

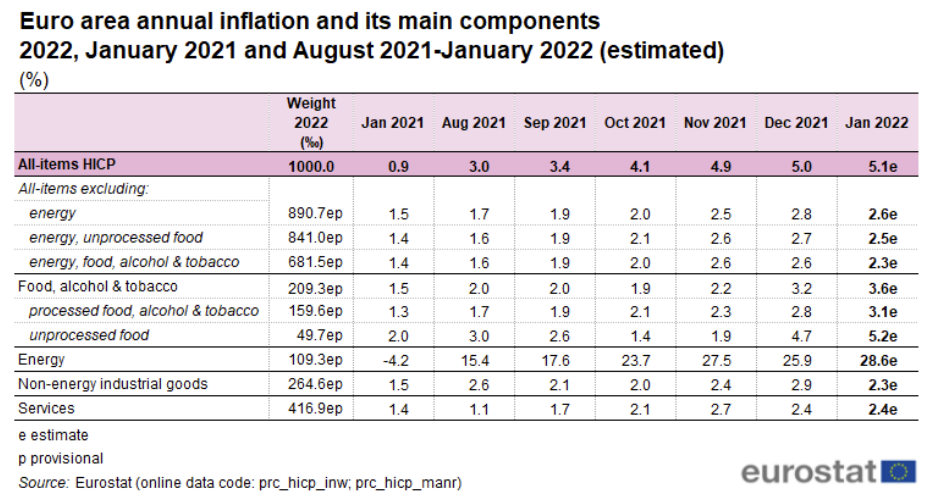

Lets have a look into inflation components where they should take priority and do any possible re-engineering.

For Australia, biggest weights are housing (23%), food (16%) and transport (11%). With China and Asia property in slower growth, and already in expensive property cycle, it makes it hard to raise inflation number further. With good food resource and location near to resources, this shouldn’t make lots of increase.

USA looks likely to have same weights. However it has quite substantial increase in energy and fuel, which Australia doesn’t have.

Which is quite same to Europe to some degree:

It’s quite obvious as well, oil as main barometer of the energy, has left their relatives far behind.

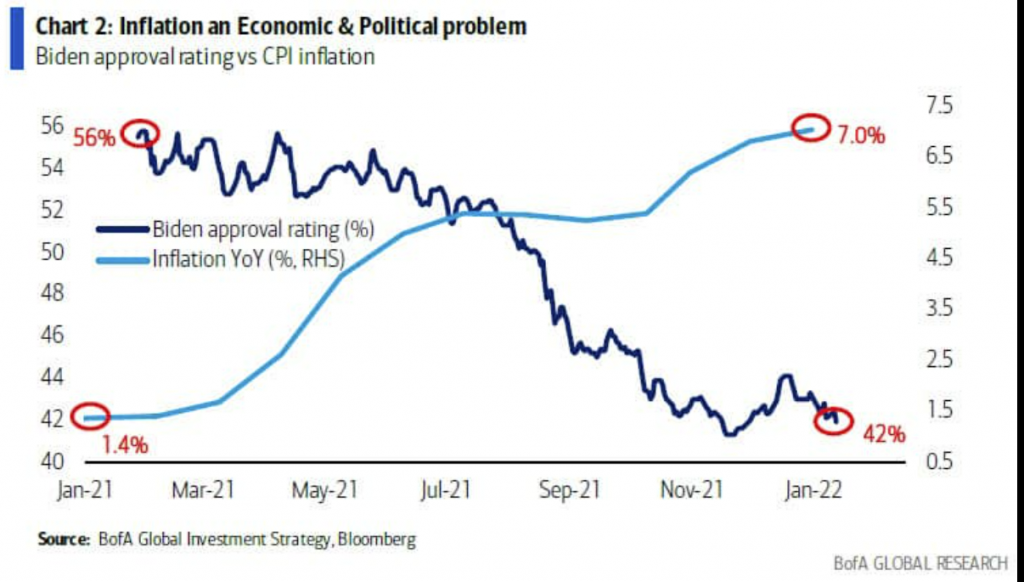

No surprising, democrats have been well known with energy issue and their historical party trouble with energy and oil.

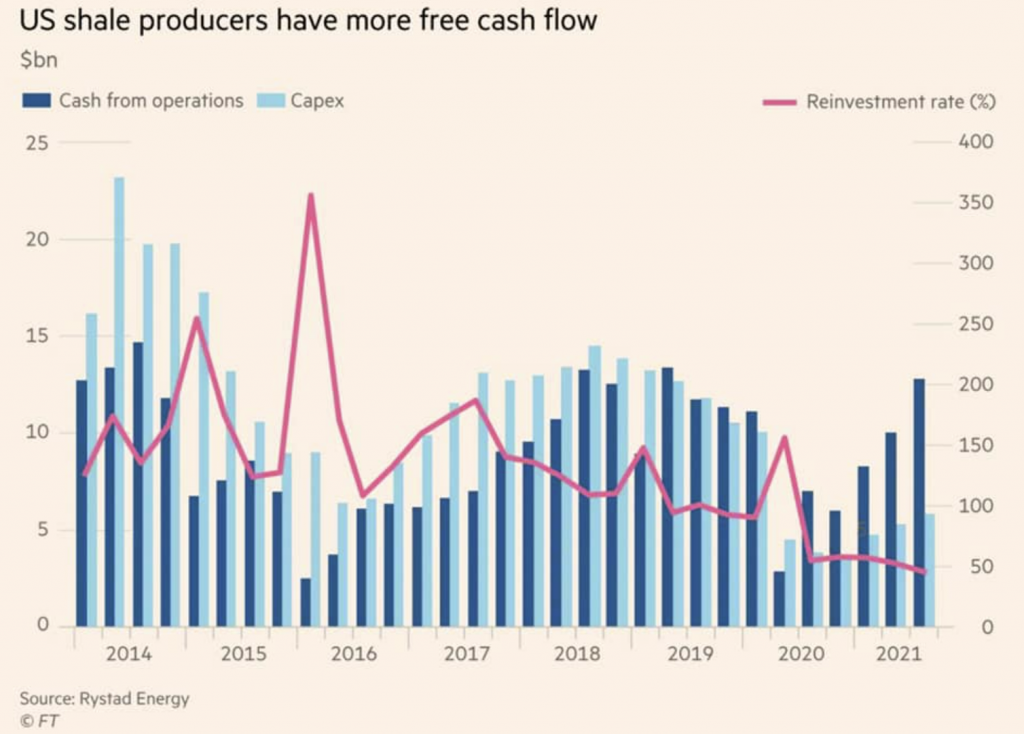

Some would argue, that is a malarkey. US shale is just making more cash flow! I’m not suggesting US LNG which have been able to suppress European energy crisis, is enough to come forward and solve the energy issue.

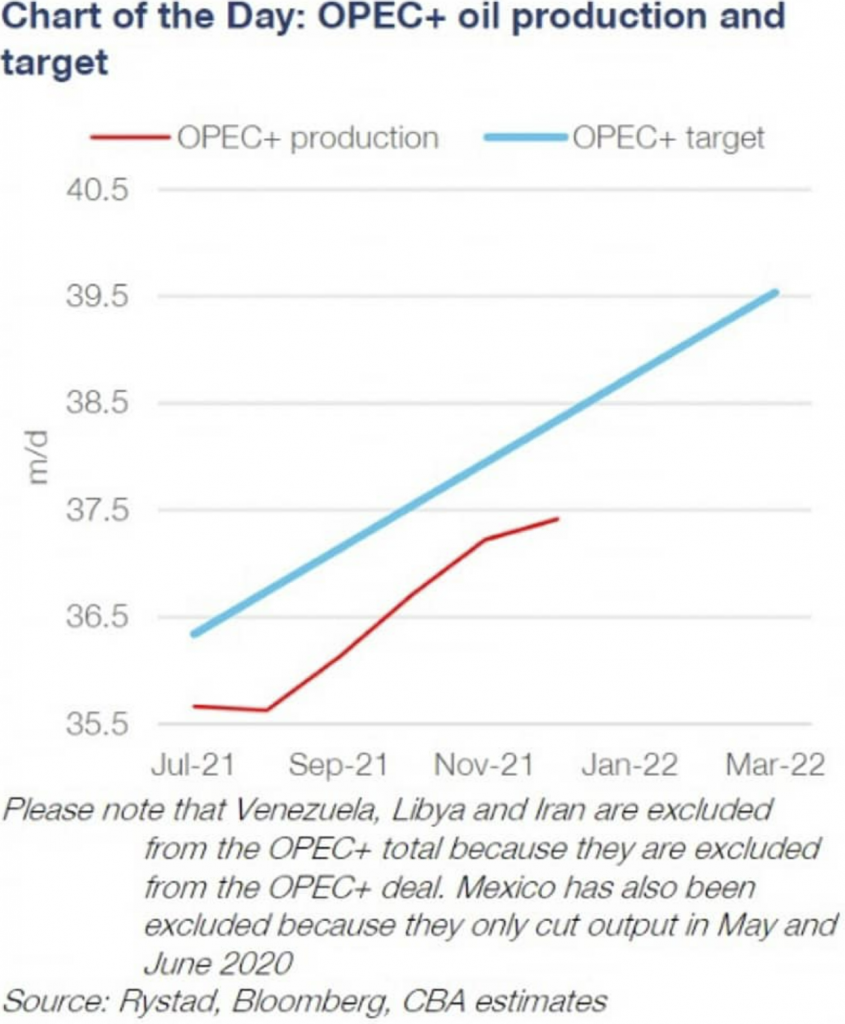

Despite UAE under pressure to keep their weight increase, other OPEC members seem to be muted. It’s no surprising, only UAE can weather costly green initiatives, while other OPEC members should stay quiet. Good for UAE, they can be one of few players in Oil and Gas and bring their troubled economy and ARAMCO back to shine again.

I narrow down all of this madness to only ONE question:

Are the USA and Europe, biggest countries in this world, currently with huge capital excess, be able to bring energy cost down?

We should know that if the answer is NO, that’s a bunch of malarkey!

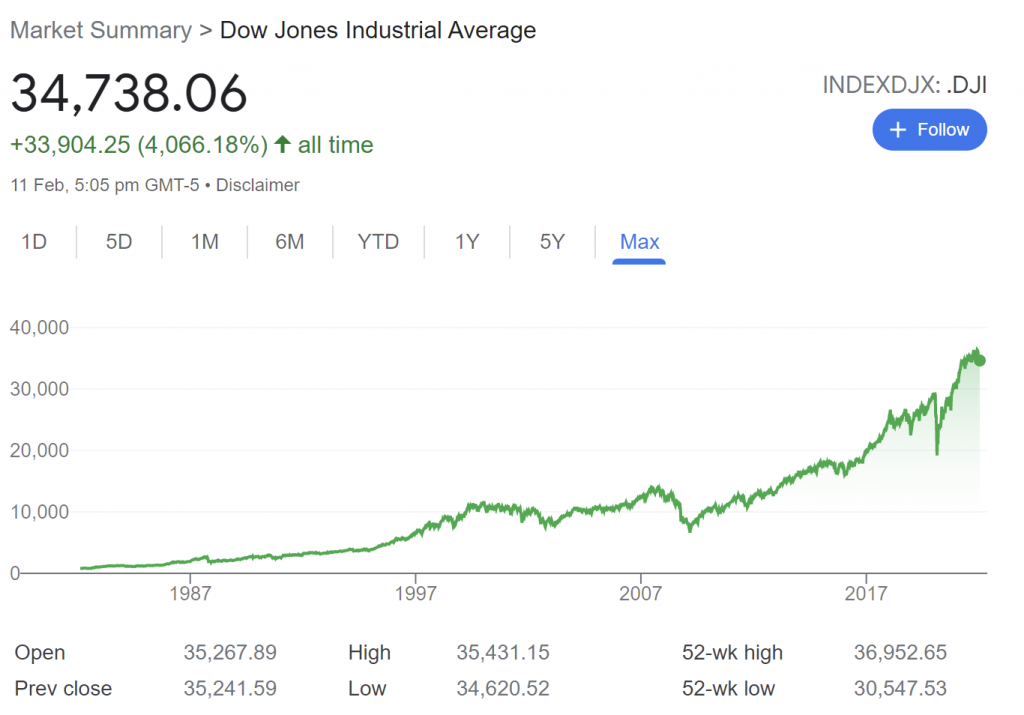

Next question, should energy be manageable, do we allow financial index to climb much higher? Please remember at the moment, US BIG refinancing bills are due, meaning it shouldn’t stop climbing per se. Questioning ability of the USA to control (not to bring down) energy cost, is questioning ability of who owns the sea, e.g. South China Sea (Taiwan and Hong Kong) and Crimea (Ukraine).

USA is the main actor that I described initially at the start of this article. They would just need to give US, Europe, Japan and Australia time to heal their refinancing bills and everything will be great again. However, just like our CoVid 2020 strategy, many market participants might exploit this situation to take advantage of possible correction or sector rotation. Please do prepare well.

I should stay with my course that Emerging market is about to start their due:

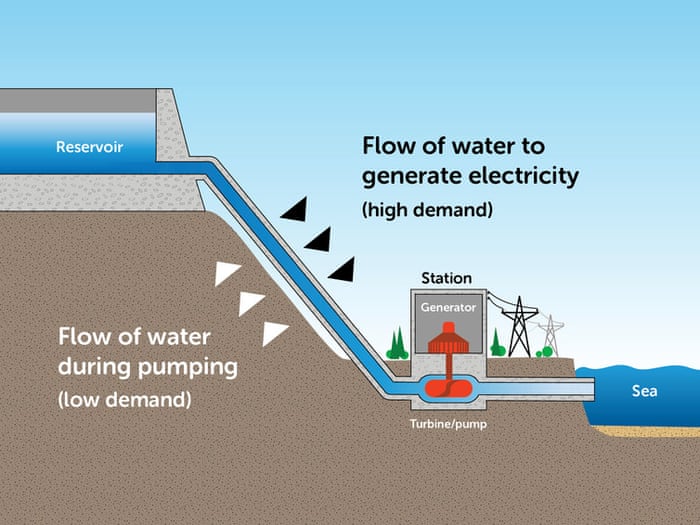

This is where I think energy needs to be hidden from fossil one into other form like Electricity. With electricity being greenly subsidized well (as usual) and can be produced from many forms of committers (nuclear, green, wind, solar, hydrogen, etc), it might be easier to control the energy number. As long as the number is great, it’s a green light for the economy, I meant the financial world. What else? That’s a malarkey.

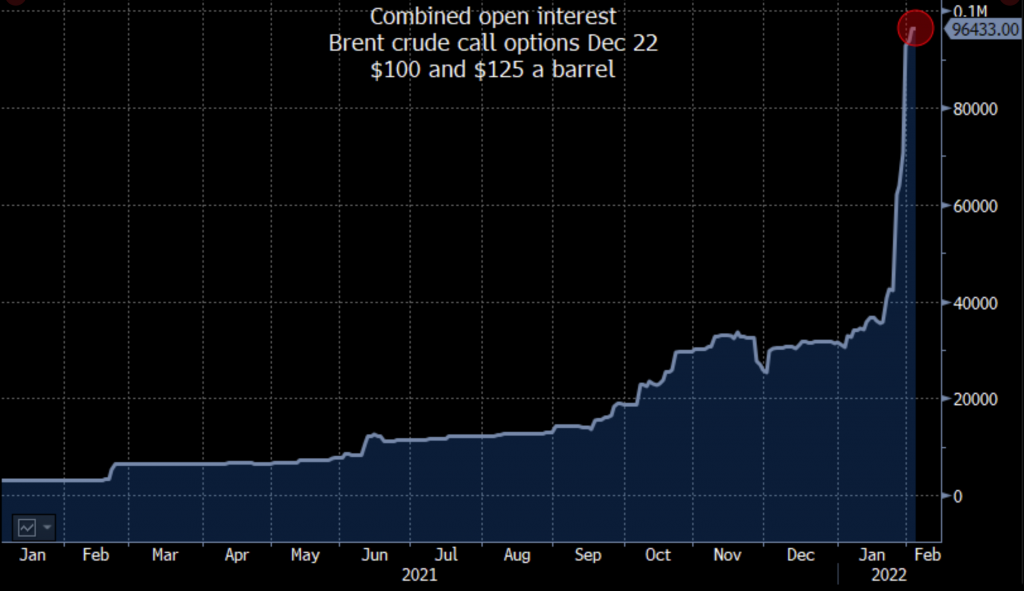

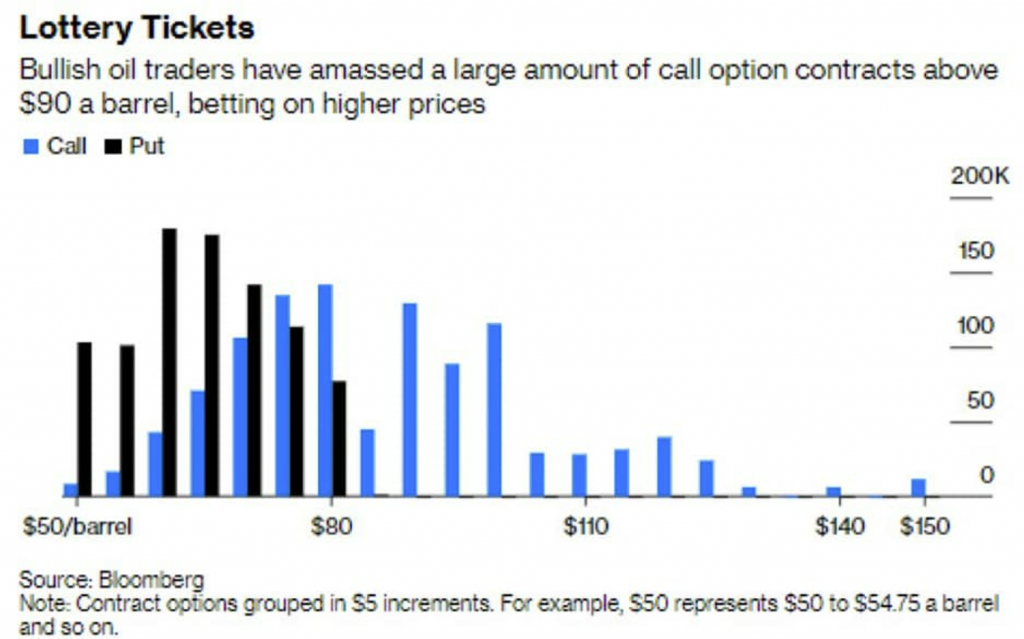

In order to do that, as usual, we need more victim/participants. There are lots of bullish call for oil above 100$ under their expiry term.

This project as explained in previous articles, were due to acute capital and expenditure in past decade, and their investment door is being shut down with green initiatives, leaving only few niche big players.

This hunger game is expected to run long. Green ETF is still much lower, much less crowded, not yet attracting much investments. Therefore this inflation issue might still be strong, until the green energy is populated well. I believe the efforts are there. However I believe fossil fuel narrative is still far away from being over.

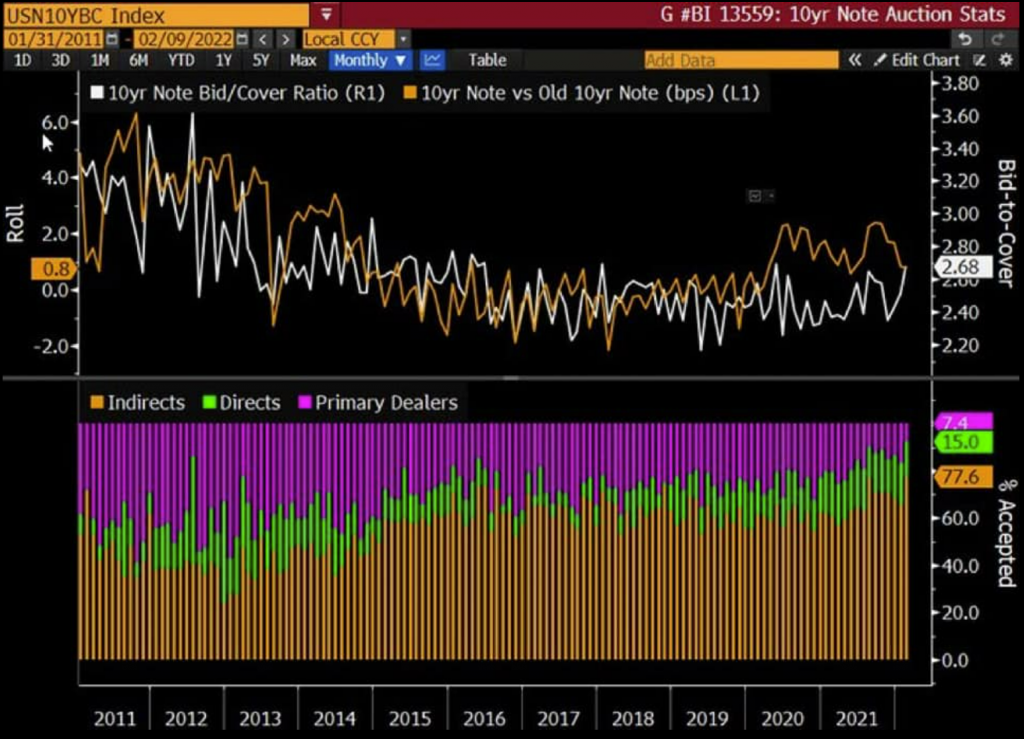

To support my arguments above, investors to US debts are more than willing to make loss and support strong US economy growth. They are professionals who conduct daily professional work in the area, therefore I won’t doubt that they will be correct (drop in inflation/correction in share market/stronger USD to name of few possibilities).

As written in previous articles, I’ve been living in big inflation environment for almost 40 years and they always intrigue me. I don’t see any surprise and indeed our last month article had already predicted incoming big continuous volatility. During that, I expect to experience strength of our inflation vehicles (EV infrastructures, metals, food, energy, and a start of traded accumulation of EV) with a possible BLIP in near future. We should start to slowly diversify our inflationary vehicles to embrace controllable high inflation and escape from the crowded oil play.

I’m not predicted crash in US inflation but I’m predicting flatter or slower growth of US inflation at about sustainable 3-5%, that could guarantee optimum economy and financial growth (yes higher financial growth, the Wall Street). This should also support my articles few months back in which I was expecting authorities to give inflation tightening ABOVE market expectation. It seems my wish is coming true, market is already pricing near to 7 points increase, while the Fed is still not yet moving from their near zero rate front end and to keep their QE running well.

We may see clearly how Central Banks are now behind market inversion curve but current situation might be different from past 30 years. Should we see for first time in history, financial market survives during curve inversion? I don’t think that’s not impossible. Central Banks could easily subsidise their banks for the sake of US government and passing through this inflation storm, to behold my number one money principle strategy, economy is nothing else but strongest (the USA) interests. I understand why my principle will be called Malarkey, but it could be the main key/answer to our main investment questions. We may disclose further strategy, as we move along in next few months.

In doing so, I’m starting to lower my tone from high inflationary loudspeakers in past 2 years into lower tone of innovation in energy. Lets’s continue to navigate our investment journey well.

After any possible blip in this year or two, let’s continue our journey to infinity and beyond.

As timeless tale is as old as time, any idea that you may possibly read or hear from this blog website is my personal own. They can not be used in any case of financial advise.