“The Sun is dying. Our sunset has arrived. Let’s rest.”

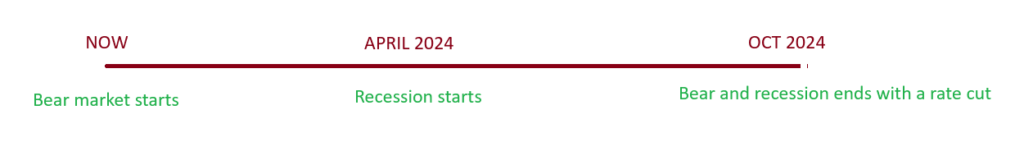

Let’s refer back to our previous article from March 2023, which discussed bear market and recession estimation. At that time, we lacked sufficient data regarding the timing of the last rate hike. Let me summarize my findings:

- Focus solely on short-term investments and steer clear of potential long-term commitments.

- Recession statistics:

- There is a 100% likelihood of a bear market hitting its lowest point (bottom) after the onset of a recession.

- A bear market tends to reach its lowest point approximately 5.3 months following the commencement of a recession.

- There is an 81.3% likelihood that a bear market concludes (ends) roughly 13.6 months after the last rate hike.

- It is virtually certain (100% probability) that the transition from a bear market to a recession occurs after about 6.2 months.

Now that we have the data with no more rate hike in September 2023 and yields continue to hold strong, we know that the last rate hike occurred in August 2023. Therefore, based on the recession statistics provided:

- We anticipate that the Federal Reserve will no longer be in a position to implement any rate hikes. This implies that the last rate hike took place in August 2023.

- Using the 13.6 month estimate (with 81.3% accuracy), we can predict that the bear market will conclude (end) around October 2024.

- The recession is projected to commence roughly 5.3 months before October 2024, which would be around April 2024.

- We can assert that the bear market is currently underway, starting approximately 6.2 months before April 2024, which is NOW.

Engaging in trading and investment during a bear market presents greater challenges due to intensified competition among market participants. A bear market can be likened to slicing a delicate piece of sashimi, where assets undergo a gradual and precise reduction. It exhibits clear signs of struggling to achieve higher highs, often leading to a sustained downward trend.

One example is the QQQ. There is a compelling indication that the rally in September is lower than the one in August, providing a stronger suggestion that it may not surpass the high reached in December 2021.

The most evident sign is the US ISM. Despite significant fiscal stimulus, the ISM shows no signs of improvement. This typically occurs when the market is on the brink of recession.

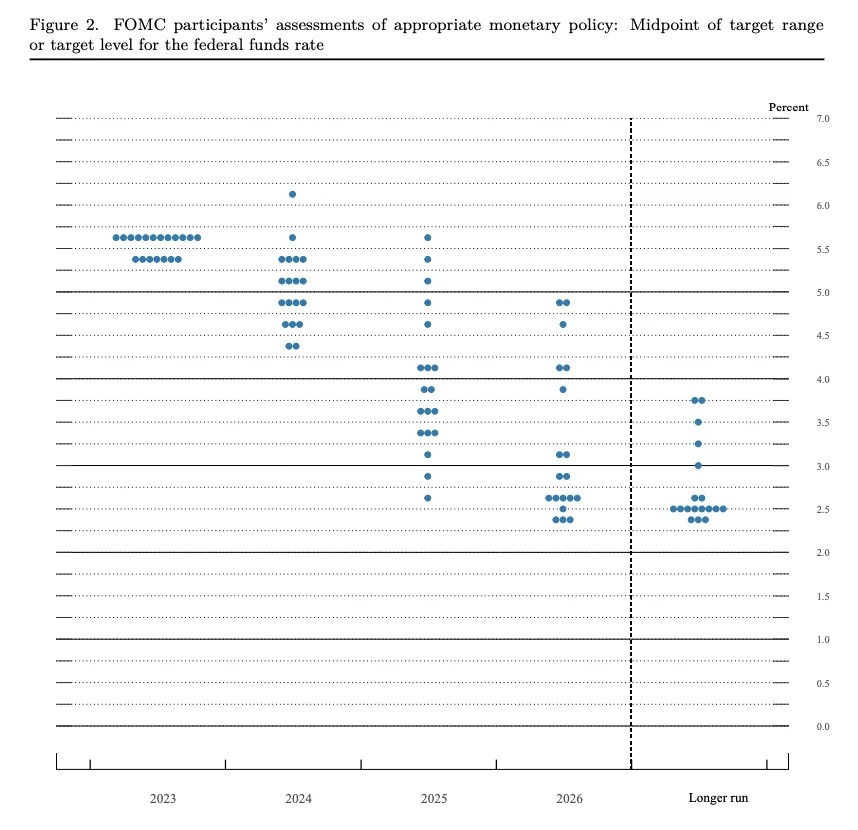

Powell made it clear during the FOMC meeting last night:

- He expressed uncertainty about many things, suggesting he is concerned about something significant.

- He stated that a soft landing is no longer the most favorable scenario, indicating that the Fed is no longer anticipating such a condition.

- Despite the dot-plot pointing to a stronger situation, Powell remains the key decision-maker.

- In fact, the dot-plot is more indicative of the conclusion of the bear market in Q4, 2024, potentially accompanied by a rate cut.

We began to observe that our profit trailing stop was being triggered. We are unsure where we should reallocate, as most assets, including bonds and gold, in our opinion would not perform well during this recession possibility. Although a soft landing is still a possibility, we are no longer expecting such a scenario. I may have noticed this from the relentless increase in yields and the strength of the USD. It may rather go directly into a bear market and recession. We anticipate a 20% market correction to align with their daily moving average of 200. Later, we plan not to sell below the DMA 200 since it’s still in bear market and not yet in recession. There is still a possibility of a bear market rally or even a blow-off between now and April 2024, perhaps with a correction in USD. However, we want to make sure that we are not navigating this path with leverage and with an insufficient cash position (indeed we already hold 50% of cash). We will keep a close watch on the market conditions and may continue with our deleveraging strategy. We anticipate that the bear market will be quite lengthy.

Good night.

Please note that all ideas expressed in this blog and website are solely my personal opinions and should not be considered as financial advice.