Based on an unbelievable true story, America achieves remarkable economic growth during a period of global tightening of the US dollar. This favourable situation/story should be safeguarded at any expense, while also ensuring a smooth landing for intelligent financial investments.

We have welcomed over 80% of fund allocation to America since the beginning of the year, based on our thesis. Our belief was that America would achieve exceptional success with a peak in interest rates, causing global currency to tighten and creating a strong demand for USD to fuel economic growth. This thesis is based one of our foundational money principles.

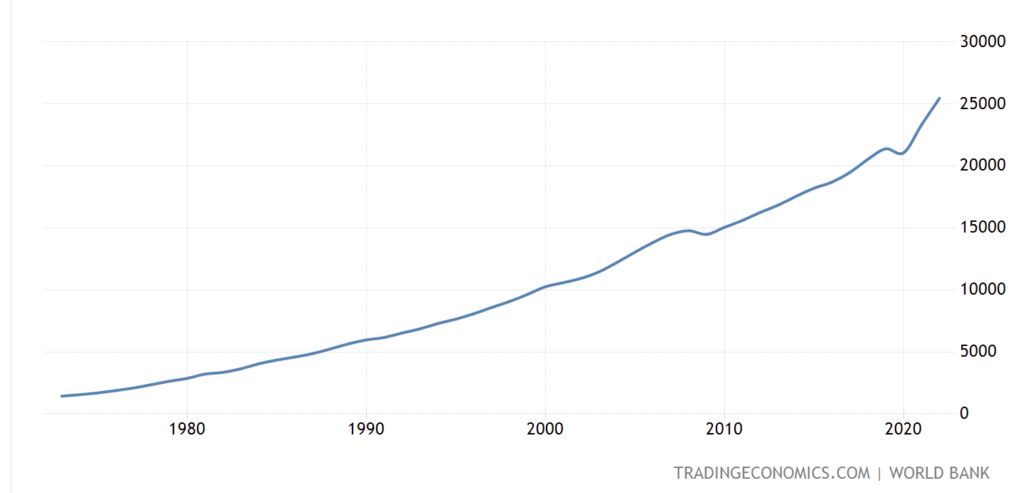

Firstly, let’s examine the growth of GDP. The US GDP is currently expanding at an unprecedented rate. According to our theory, this is a highly valuable asset that must be safeguarded at any expense, disregarding any other conflicting economic indicators. This is especially crucial considering the presence of smart money that has become trapped within the US economy, which we will discuss further later on.

It is not surprising that over the past few decades, the US had experienced a shift from a predominantly industrial and manufacturing-based economy to one focused on services and finance, with a significant portion of manufacturing activities being outsourced to China. However, since 2022, there has been a substantial resurgence in manufacturing and industrial activity, particularly in sectors related to sustainable energy and artificial intelligence, such as electric vehicle (EV) manufacturing, EV infrastructure development, battery production, and computing chips. These industries have received substantial support from the US government and are showing strong growth, which should be sustained and protected at all costs.

As we have previously highlighted in our articles, these sectors have the potential to generate a new economic capacity exceeding 10 trillion US dollars.

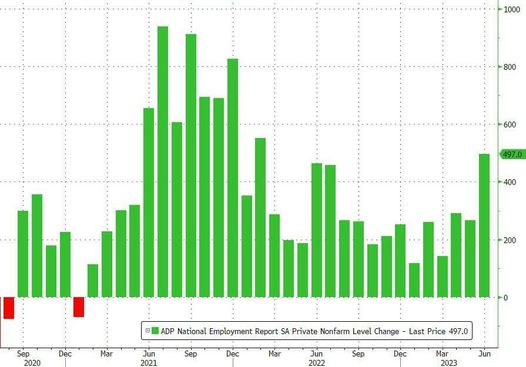

While the manufacturing and industrial sectors may not directly lead to job growth, the substantial government support they receive, particularly in terms of financial investments, has had a positive impact on job openings in other sectors. This support has helped boost employment opportunities in industries such as hospitality, finance, and services.

To ensure sufficient liquidity for economic growth in an era of low new bank loans due to high interest rates, the main source of liquidity is currently the fiscal deficit, which has reached 1 trillion dollars per year. This is one of the main reasons why we significantly increased our investment in the big QQQ portfolio by almost 10 times in January. This decision was influenced by the portfolio’s significant cash holdings in the form of treasuries, which provide substantial benefits.

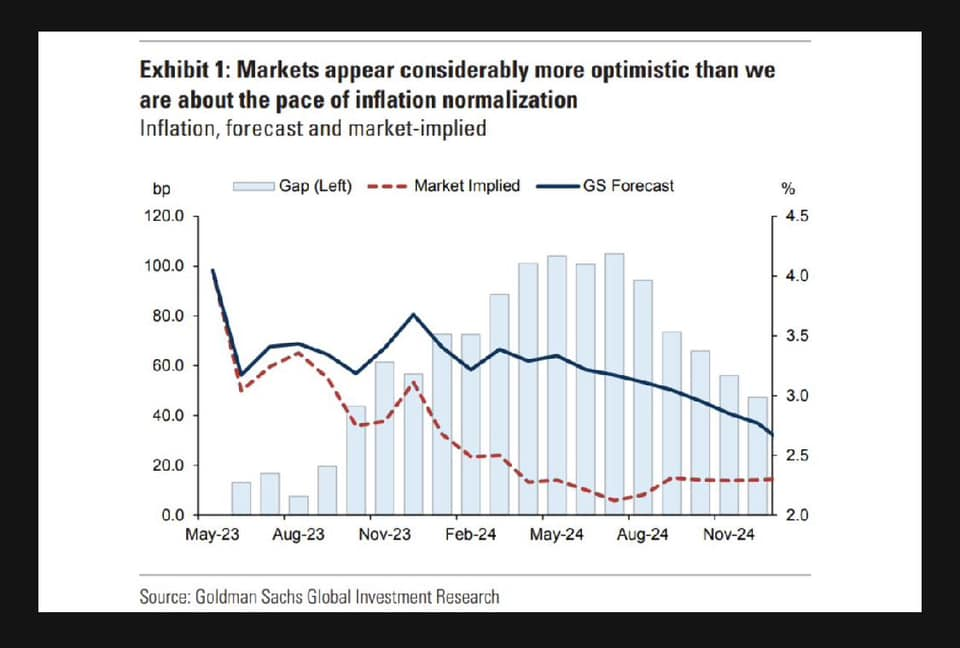

The robust growth of the US economy poses challenges for the rest of the world and its own long-term yields. The US dollar was in short supply until US leaders visited China to negotiate undisclosed additional agreements. As a result, business and mortgage rates are expected to remain elevated for an extended period. While high interest rates can have negative implications for businesses and the economy, as we previously mentioned in our article last month, it can be seen as a positive factor. The scarcity of global funds is preventing excessive concentration in long-term investments such as bonds and instead supporting short-term economic growth. This approach is necessary as allowing money to become too abundant could lead to the resurgence of inflationary pressures.

The “smart money,” represented by the RRP (Reverse Repurchase Agreement) and Bank Reserve, is currently focused on short-duration investments. I suspect that these entities will begin to transition into shorter-term debt, a phenomenon that is currently unfolding. The Treasury General Account (TGA) is essentially funded two-thirds by RRP and one-third by Bank Reserve, with less other sources of funding. This leaves the decision on the duration in the hands of the Treasury. This shift is expected to increase the price of high-risk assets, such as shares and commodities. As the economy approaches its peak growth later in the future, short-term investments are anticipated to benefit the most from anticipating the Federal Reserve’s interest rate changes.

The inflation figures, particularly the Consumer Price Index (CPI) and the Producer Price Index (PPI), have experienced a significant drop. However, this decline is primarily attributed to technical factors. In early 2022, inflation numbers rose significantly due to massive support provided to the economy, as discussed earlier. Given the rapid growth at that time, it became challenging to achieve comparable year-on-year rates, resulting in a narrow window of opportunity to boost the flow of money into the economy. As mentioned previously, it is expected that inflation will remain relatively stable until early 2025. This view is also supported by the increase in the debt ceiling to around $35 trillion until approximately March 2025.

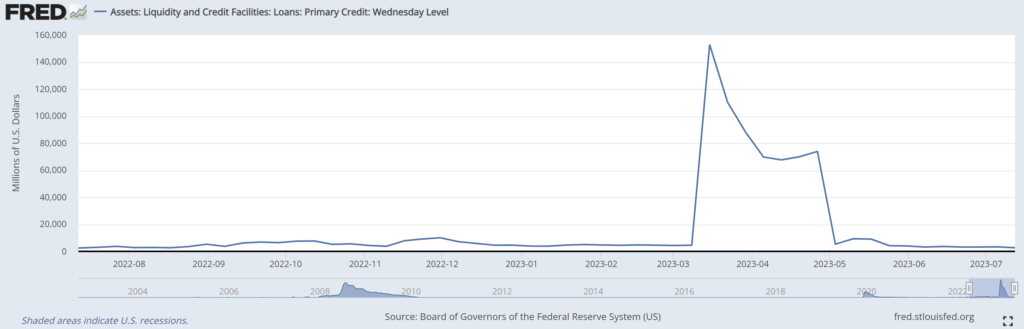

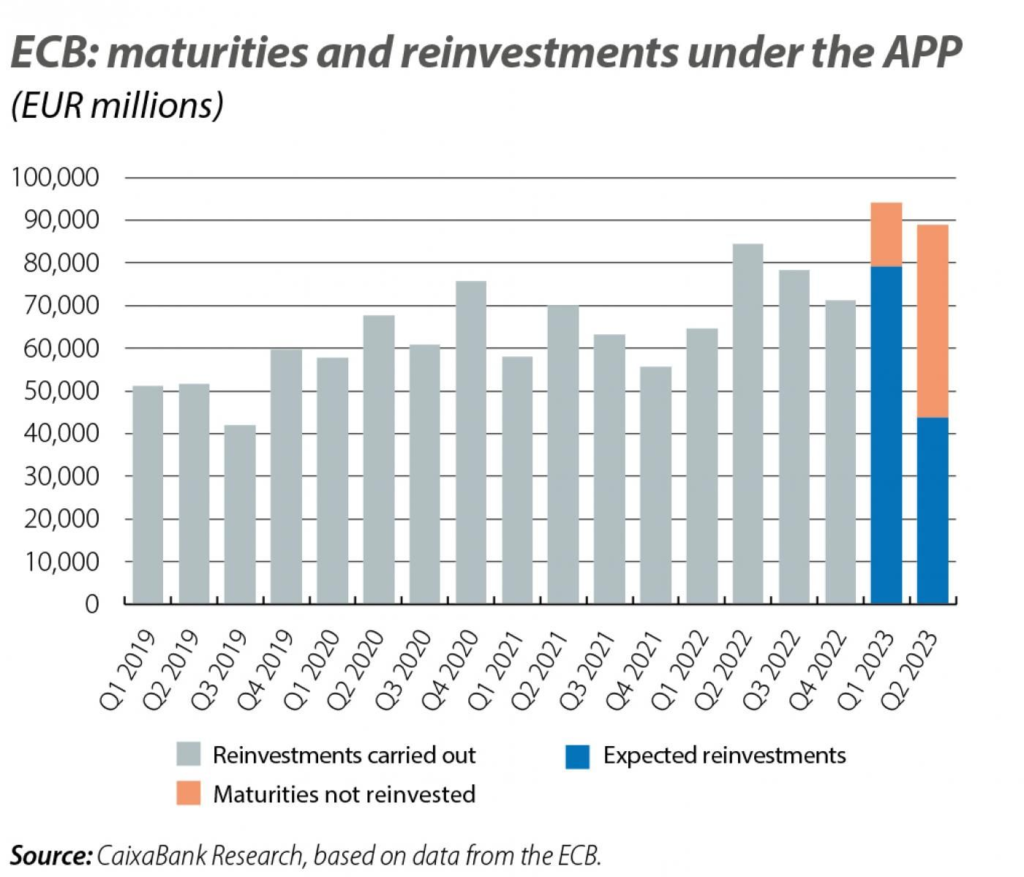

In order to mitigate the risk of uncontrollable inflation, similar to what we have observed in the balance sheet of the European Central Bank (ECB), the Federal Reserve should also indicate a lower balance sheet through the use of QT. However, to avoid the negative effects of reducing the balance sheet, as we discussed in our previous article, I expect Treasury to focus on short-duration investments rather than selling long-duration assets and Federal Reserve to not shuffle around balance sheet duration. Participants should also then support long term recycle into short term. This scenario is supported with fact that higher rate Bank Term Funding Program (BTFP) – collateral being valued at par, unlike Discount Window – collateral being valued at market, is being held up within its capacity to 2T$. It tells importance of credit accessibility and risks for longer durations. Once again, this aligns with our expectation to facilitate the smooth transfer of wealth for the smart money in the future.

Within the limited windows of supportive environments to soft land the economy, we can observe several supportive factors:

- Inflation numbers (CPI and PPI) showing a decrease due to technical reasons.

- An increase in the debt ceiling/deficit, serving as a means to control the flow of money.

- New short duration treasury issuance expectation to counteract the impact of Federal Reserve quantitative tightening (QT).

- Strong employment figures – “any sector, regardless of manipulation or guess”.

- Strong backbone banking sectors outlook and financial figures – “through possibility of the Fed balance sheet holding and deficit subsidy”.

- Less effort for the Federal Reserve to shuffle around balance sheet duration.

Given these circumstances, it is anticipated that Wall Street should continue to experience upward momentum until the completion of these money flows, at least over the next few months. Therefore, based on our risk assessment, we have decided to maintain our double offensive leveraged positions. Please be mindful of the subtle differences in risks and conflicting economic indicators within our approach to my money theory.

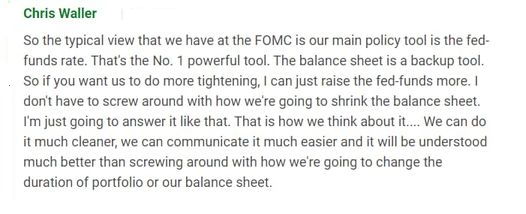

In support of our thesis and interpretation of the current situation, we believe that the comments made by Chris Waller may further reinforce our perspective.

Please note that all ideas expressed in this blog and website are solely my personal opinions and should not be considered as financial advice.