Imagine there’s no countries

It isn’t hard to do

Nothing to kill or die for

And no religion, too

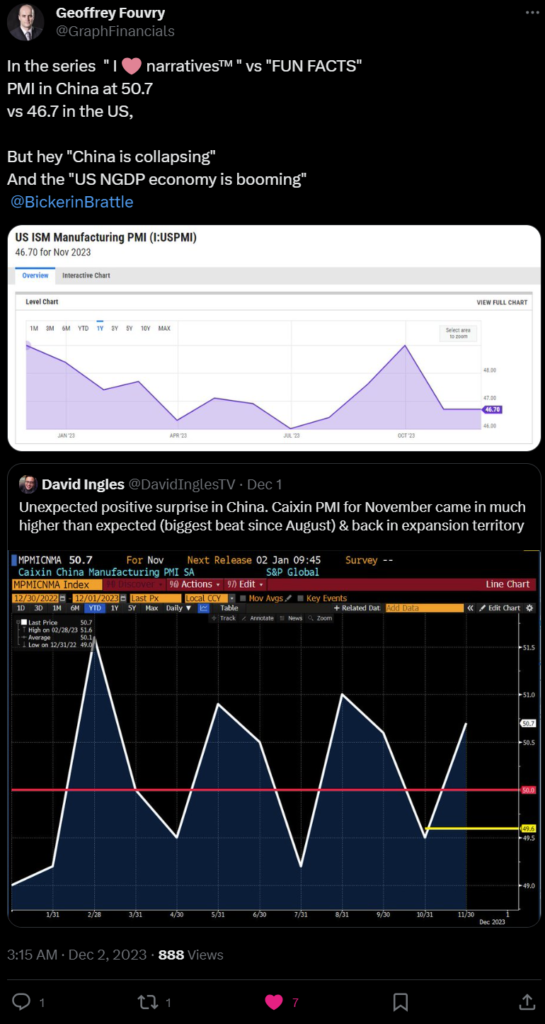

Since development has been progressing significantly since my thesis at the end of September, reiterated in both October, October and November, I may be able to share correlation evidence. I consistently present a comprehensive thesis on the recovery of China and the potential for cooperation between the US and China. I may be one of the few economists providing evidence of $DXY from global trade/economy perspective, without succumbing to the brainwashing of some media activists in recent years.

As a fun fact, global animosity towards China among some influential media activists have been intensifying since 2019, unfortunately, blinding and brainwashing many who are supposed to be experts in global economics rather than advocates for a particular powerful economy. Elon Musk’s recent media drama has highlighted how the media has been significantly corrupted to manipulate human emotions and distract them from their tasks in this world. You may say I’m a dreamer, but as John Lennon said, I’m not the only one. I hope that soon more and more people will join us, and together, we can derive greater insights from our accurate economic theses.

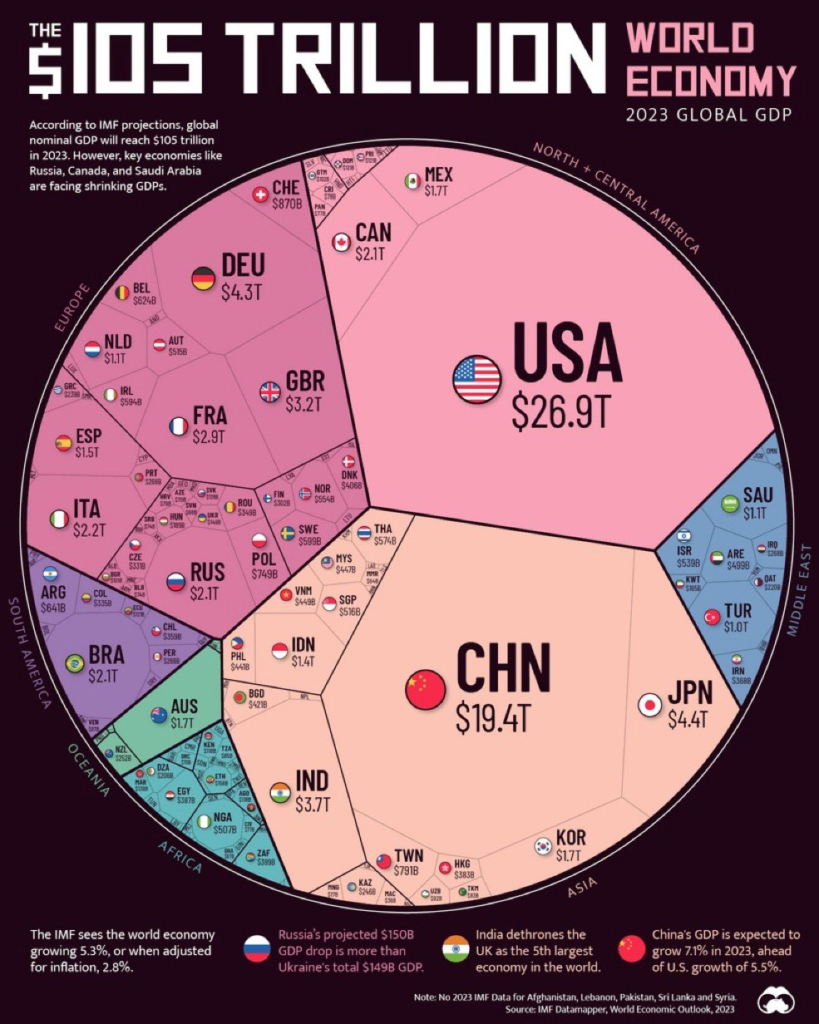

My past three months thesis can be encapsulated in one graph, which is comparing the Baltic Dry Index (BDI) and the US Dollar Index (DXY), which I believe are two of the most influential charts for assessing risky assets. When global trade contracts, there is reduced demand for the US dollar ($USD) supply. Consequently, when global trade flourishes, there should be a substantial demand for $USD. In a situation where there is sufficient credit capacity in USD, like the current scenario, the $DXY should decrease concurrently with the rise of global trade, and there may be a rebound in commodity growth and risk assets support, especially if economic growth is a focal point.

I would emphasize that the $DXY remains my primary focus, as I reiterated in last month’s article. Despite all our doom, gloom, and pessimistic theories, in my article last month, when there is enough liquidity, they held no power against the $DXY movement of flourishing global trade. I’m looking at the positive aspects of a lower USD.

When disharmony exists between the two largest economies in the world, we often witness the eruption of local wars in various regions, such as Russia, Ukraine, Israel, etc. People endure suffering, and this plight is likely to persist without a peace treaty among the world leaders who wield the greatest power—namely, the United States and China. My greater concern lies in the suffering of the impoverished next generation, transcending the debate of who is right or wrong.

Listen to Michael Jackson’s message: “Heal the world.” Both of you, the United States and China, as the two most powerful countries, bear the utmost responsibility for world peace and both of you should be held accountable when there is not.

A clear statement from President Xi last month has indicated that China is not pursuing any new wars in the near future. Swift acceptance from the US could expedite the process of making this world a better place. As I’ve mentioned for many years, differences may keep persisting in our daily lives, forever, and that’s normal, but there should be no exceptions when it comes to working towards world peace.

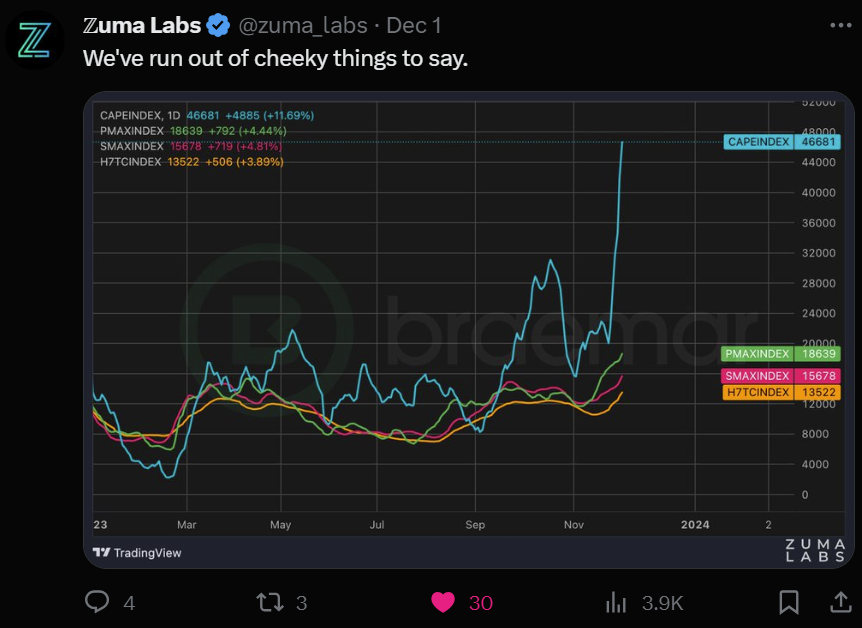

I sensed the shift in the course of world leaders around mid-year, prompting me to invest in their growth commodities, and their BDI, keeping it as straightforward as possible. During that time, I believed these three could exhibit distinct developments, potentially securing substantial profits after being all in on QQQ from January to September. Naturally, various hedge vehicles were involved, including foreign exchange.

The primary and most evident factor was the BDI, reflecting trade shipping. I emphasized that this involved colossal vessels transporting the most substantial commodities, not just small-scale shipping or seasonal trade like Thanksgiving or Christmas. Reflecting on the 2000s, there was a surge in vessel supply due to a trade boom. However, after the 2008 Global Financial Crisis, when tensions escalated between the US and China, the surplus vessels led to corrosion, sinking, and bankruptcies among global shipping companies. Looking 15 years later, what if the US and China successfully rekindle their global trade? We might face a shortage of vessels. What concerns me is how we can address the threat of inflation when we lack sufficient sea infrastructure.

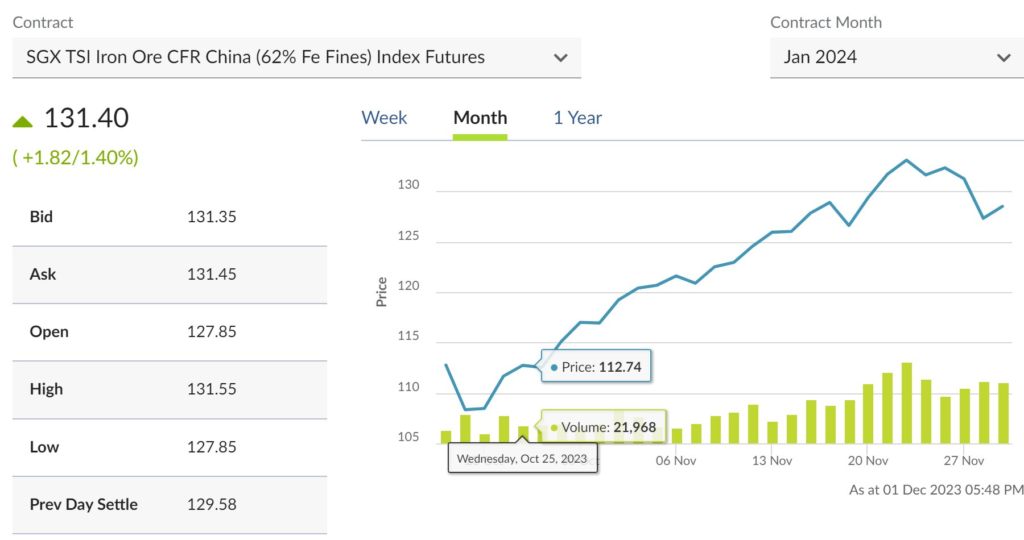

The ongoing rebound in China and the global shift towards more growth and sustainable energy has significantly fueled my October thesis on Iron Ore and Copper. It’s important to note that future performance is not guaranteed by past or current trends, but there is a possibility that they may continue to follow a similar rhythm.

Imagine no possessions

I wonder if you can

No need for greed or hunger

A brotherhood of man

Again, you might say I am a dreamer, but I will continue to dream of world peace, prioritizing it above any financial gain or profits I have made or could potentially make from the pursuit of peace.

Please note that all ideas expressed in this blog and website are solely my personal opinions and should not be considered as financial advice.