With China and the US being the two largest economies in the world, as they work on resolving their differences, we should expect to see an improvement in the global economy, which was on the verge of decline.

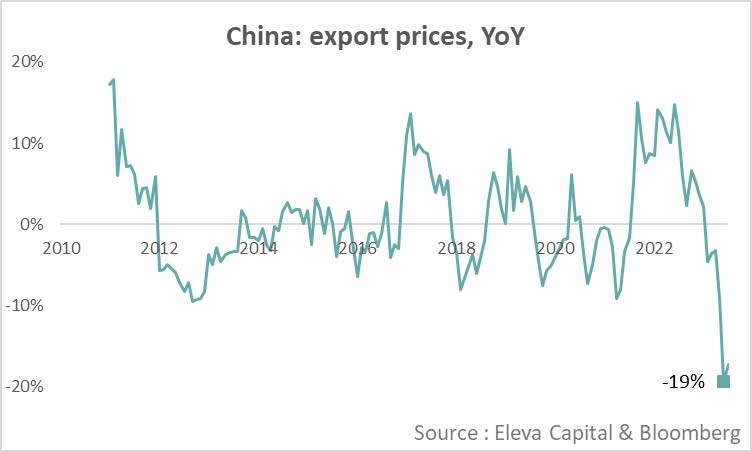

Inflation has reached its peak, and emerging economies have experienced their maximum level of pain. It’s not surprising that China would now take measures to ease the situation. For an emerging country like China, very high inflation could lead to the trouble of riots. On the other hand, if inflation is too low, their companies would have much lower profit margins. If we take note, the export prices from China have significantly dropped, posing a risk of deflation to the global economy. This is because the pace of economic activity has been very strong in the past decades. Therefore, when China fails to stimulate this pace, prices tumble, which in turn threatens their own profit margins and economy.

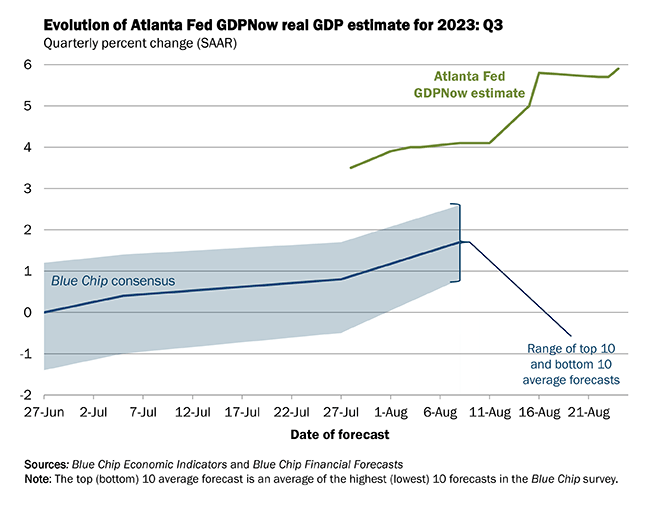

Yields are now expected to decrease, which could potentially create an ideal situation for the Fed to manage inflation. As I have demonstrated in the past, if policymakers are able to sustain this situation (not necessarily low rate), it could result in the most optimal growth.

There’s no need to look beyond the GDP target provided by the Atlanta Fed. Let’s avoid going against the Federal Reserve’s stance.

I believe one of the most crucial factors here is China’s ability to sustain deflation, which would subsequently enable the US to keep their long-term yield stable, as observed in $TLT.

In the final moments, it’s anticipated that the DXY will experience further decline. If this is confirmed over the next few days, it would indicate a strongly bearish outlook for the USD. This reasoning becomes more logical when considering that China manages to revitalize at least a portion of its economy, consequently boosting the growth of emerging economies. These economies have been relatively subdued in the past few years due to inflation.

We have observed that numerous other currencies have undergone a decline of nearly 50% over the last decade. USDCNY, on its own, has reached its highest point since the Global Financial Crisis in 2008. This situation has the potential to result in significant price increases or a resurgence of inflation but manageable (6+ months in advance thesis), provided that they manage to rejuvenate their economy. In such a scenario, before inflation strikes too high, there is a possibility of experiencing a Goldilocks / soft-landing moment, a moment where the economy performs better than the level of inflation.

During Jackson Hole, Powell mentioned that the Fed is navigating by the stars under cloudy skies. We interpret the stars as the R star. “R* is the real short term interest rate that would pertain when the economy is at equilibrium, meaning that unemployment is at the natural rate and inflation is at the 2 per cent target. When interest rates are below R*, monetary policy is expansionary and vice versa.” . Anticipating low inflation until that point and China’s contribution to global growth, we rather foresee a shift towards more expansionary policy (fiscal or monetary).

If this trend continues to perform positively, I anticipate witnessing a “teaming up” between US and China which could change everything, a more pronounced and accelerated increase in risk assets, often expressed as “higher further faster.” It’s possible that we might encounter the swiftest growth in risk assets over the next few months, resembling something akin to the rally observed in 2007-2008, yet with a more robust fundamental foundation (thanks to 5.5% Fed rate).

In the previous month, we accurately forecasted a correction after being fully leveraged since the beginning of the year. This correction was short-lived, lasting for approximately 3 weeks. After that period, we began to reinstate our full leverage, in line with our thesis here.

Please note that all ideas expressed in this blog and website are solely my personal opinions and should not be considered as financial advice.