Dead reck·on·ing is the method of determining one’s position, particularly in the financial market, by estimating the direction and distance travelled for each position, instead of relying solely on one position or widely known economic indicators. The chaotic yield curve results from a collection of misguided policy decisions, and we are unable to distance ourselves from the consequences of our previous actions. If this destiny were to be scripted, does one life hold greater significance than the others?

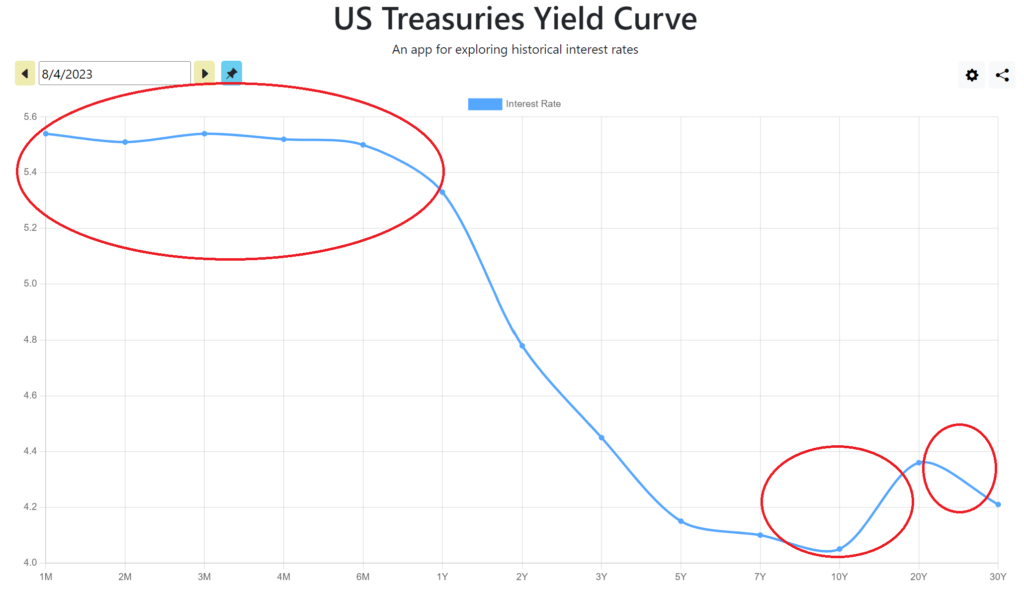

Upon examining the present yield curve, we have pinpointed three irregularities, based on their 5-year belly:

- high short term yield ~ up to 2y ~ abundant liquidity – flat yield momentum

- 7-10y ~ $TNX ~ weaker commodity and Emerging Market (EM) growth – bearish yield momentum

- high long end yield, 20+y ~ $TLT ~ long end collateral risk – bullish yield momentum

As the ETF $TLT is currently approaching its maximum pain point around 90, as part of its final destination in wave 5:

- Bond holders are once again nearing their maximum pain point, resembling the situation at the end of 2022.

- Given the weakness in commodities and the emerging market space, along with the TNX also being weak,

- Short-term assets are now susceptible to profit-taking. Are you not entertained with the QQQ rally?

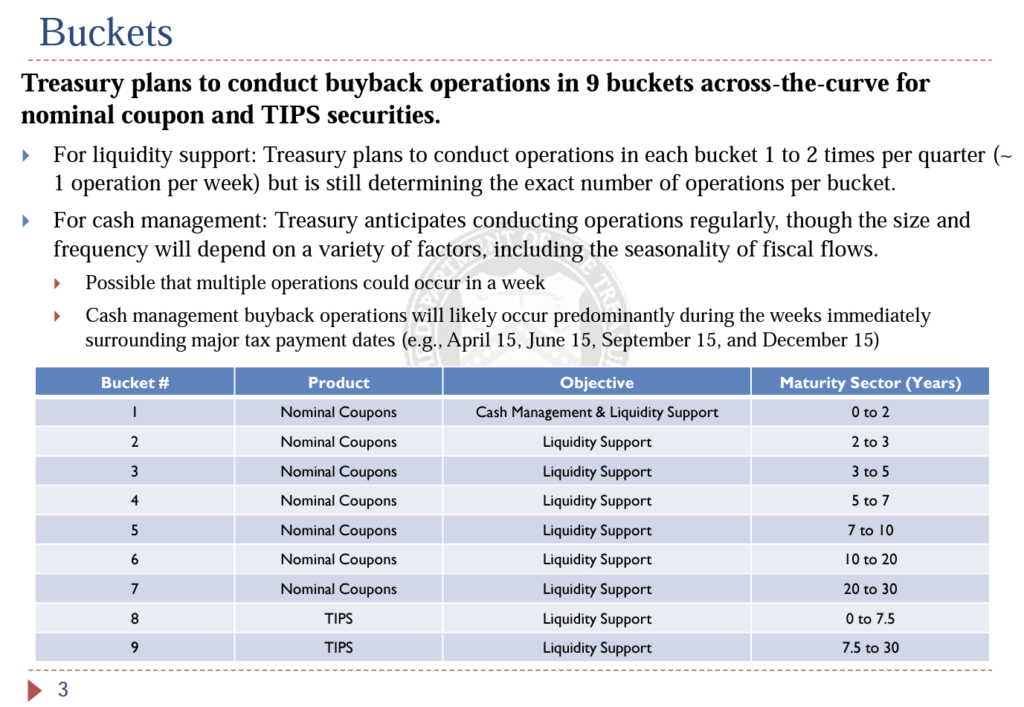

I’m not stating that a bond crash is certain as we closely observe TLT. What I want to highlight is the precarious point for possible profit taking. The Treasury itself has acknowledged this risk for the coming year with its buyback program. They’ve indicated a gradual start next year, indicating confidence that this matter may not escalate into a bigger concern just yet. We might anticipate the longer-term segment to be affected sooner.

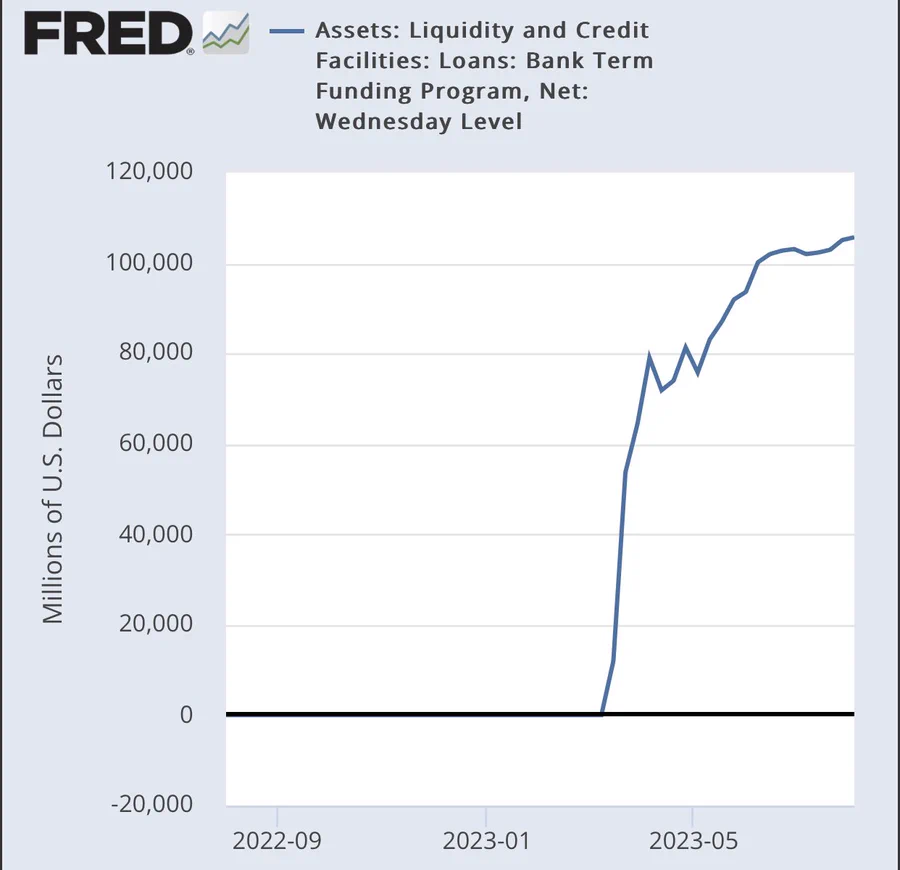

This aligns with our observation from the previous month regarding the interaction between BTFP and Discount Windows.

Upon conducting a thorough analysis of a substantial number of mortgage holders who have sizeable mortgages from the last five years, a pattern has emerged. Many of them are now either selling off their equity portion or increasing their borrowing to maintain ownership of their property. This is driven by their anticipation of lower interest rates in the near future, whereas my perspective suggests a likelihood of higher and more persistent interest rates in the coming years.

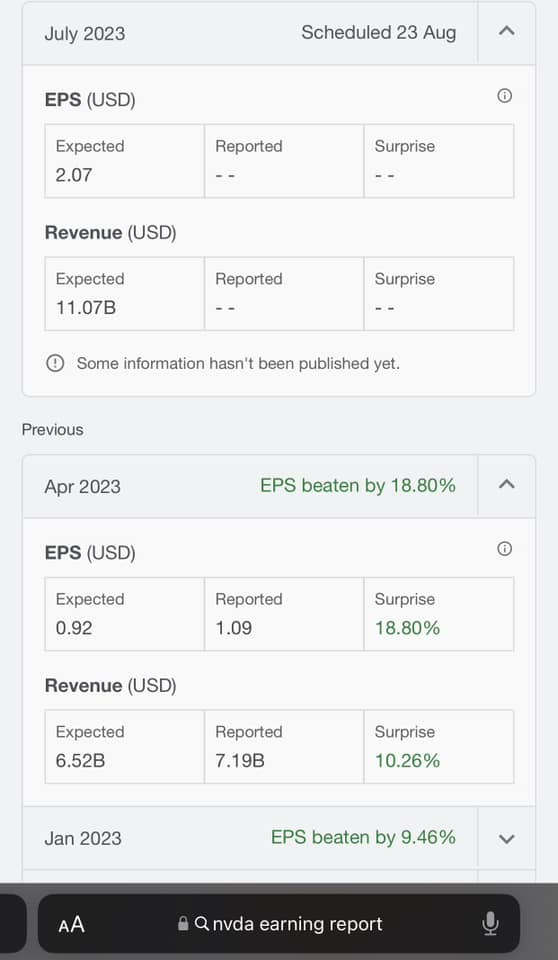

The bond industry is currently experiencing a comparable situation. This situation is likely to provoke concern among bond holders, prompting them to urgently seek protection and engage in more comprehensive risk management. A significant area of concern is the vulnerability of short-term assets that have shown impressive performance over the past six months, particularly the QQQ. An evident illustration of this is the disrupted trend in AAPL and double Quarter over Quarter (QOQ) performance in NVDA’s revenue and earnings consensus expectation. Achieving such results in such a short timeframe (one quarter) seems highly improbable.

As we had anticipated in the article from the previous month, we are currently foreseeing an unexpected increase in inflation. This presents a less than desirable scenario, especially given the fact that the Bank of Japan (BoJ) has adjusted their Yield Curve Control (YCC) from 0.5 to 1.0% on their 10y yield, indicating reduced support for Treasuries.

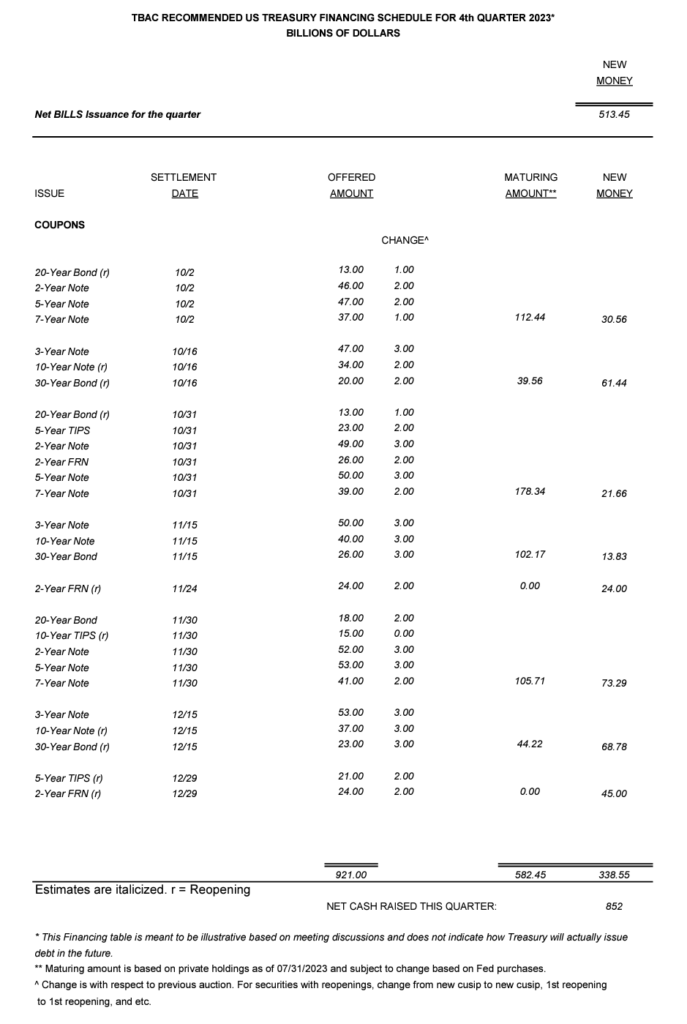

Upon examining the Q4 treasury issuance schedule, the planned issuance of $338 billion appears to be considerably higher than what is typically observed.

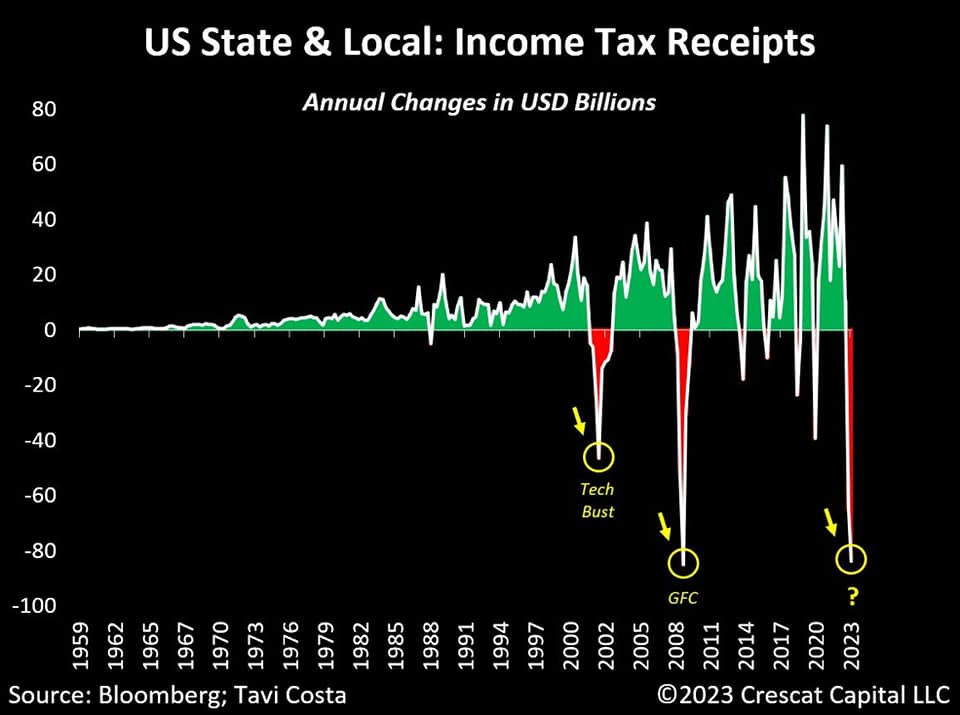

The significant deficit primarily stems from a substantial decline in tax revenue.

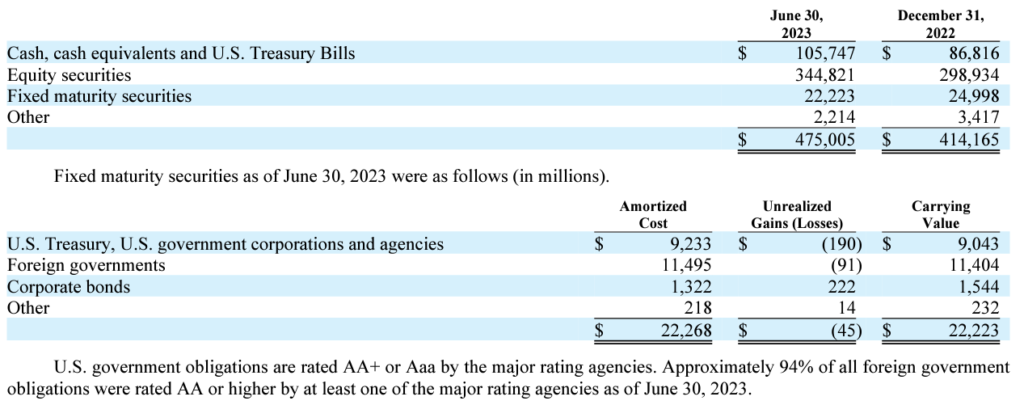

BRK has also disclosed a significantly larger investment in the bill compared to fixed income.

Because of the elevated risk conditions, we have chosen to eliminate any leveraged positions by capitalizing on robust financial report events, securing profits to the fullest extent possible. Additionally, we are closely monitoring for any indications of a market correction as the month draws to a close. Furthermore, we are employing various strategies to safeguard our positions from potential downsides associated with our equity holdings.

Please note that all ideas expressed in this blog and website are solely my personal opinions and should not be considered as financial advice.