You are going on a journey. A journey through memory. All you have to do is follow my voice.

Since there’re many request to have quick advanced look into my personal opinion, before my June article, I write down this special article about my current opinion of my financial journey and how it may end.

Financial market is going on a journey. All they have to do is follow their strong hands voice, i.e. Central Banks, Federal Reserve, Fiscal Stimulus, etc. I believe, as worst as we may have expectation about the Fed, they are still the strongest in this financial market and deep in their heart, they will try hard to maintain stability of the financial market, including the share market. We might rather see many panic economists in mid of May, AFTER they saw Nasdaq fell hard, flashy crossed recession/strong support line.

Immediately they mistakenly spread fears. Simply, when we are in fear, our eyes, mind and heart are all blinded with the personal curse. I think it’s simply incorrect.

When the water began to rise and war broke out, nostalgia became a way of life. There wasn’t a lot to look forward to, so people began looking back. Nothing is more addictive than the past.

In my previous article published on May 1st, the Multiverse of Madness, I agreed about how severe the condition is and how things would/might get out of hands. I would also agree to take safety measure, especially against Nasdaq and long yield. However as also mentioned in the article, I didn’t close my eyes. There will be a certain point that I would foresee into when to start looking to the bright side/end of tunnel and not just blinded with personal vendetta and conflict of personal interest. In the article, I was aiming around May 22nd and looked to be very close to when the rout was ended. I have to admit, nothing is more addictive than easy QE (Quantitative Easing) bullish of the past.

People don’t just vanish. To find where she’d gone, I had to know where she’d been. Was she running from the past or racing back towards it?

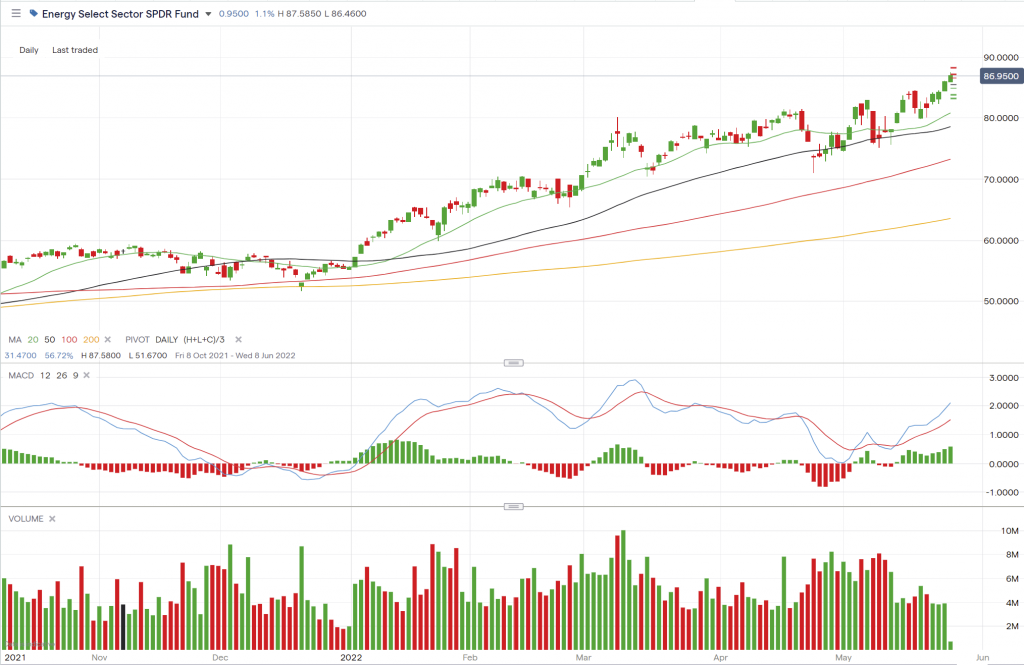

Let’s sit back and re-think. Many strong bullish don’t just vanish. Economy is still strong. Yes many argue in their own opinion, all sudden economy is no longer strong, disagreement, it’s fine. There are still a lot of demand and economy continues their opening from CoVid. Energy is still going strong. Even if you look into opening economy after the CoVid, it’s very hard to get airline seat, and their price is running out with double price. Have we noticed a minimum of 20% necessity price increase, and there’s not much catastrophe. Yes it’s harder for middle class, but supermarkets and restaurants are all fully booked.

Let’s have a look into real reality, strong BULLISH FLAG of commodities and strong bullish of ENERGY. At least I’m not blinded and looked into all opportunities, because I believe simply being blinded to anything is wrong.

It comes to my mind, people are having incorrect definition of recession. Recession by definition is “a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters“. People just blindly look into GDP numbers but as it said, it’s generally and very importantly what they got it wrong is with their conditions.

When my daughter asked, whether story can become reality, it comes to my mind, which one is more important, reality or the story? It’s a story of GDP may fall for 2 successive quarters but life of economy at this moment remains strong. If we disagree with strong economy arguments, I get it, but most importantly, reality wise, financial strong hands are still able to manage financial market very well, that should end our disagreement. Around mid of May, I remember there’s a day, USA share market broke strong support and suddenly all economists screamed of recession and crash.

Obviously strong hidden hands were able to manage and gave rebound within same day and took care of it very well, that’s a big reality. Obviously the strong hands are the utmost reality and recessions and all horrors might be mostly just the story.

How much did you really know her? How much did you look? Who was she? Who was she when not with me?

How much do you really know about the economy and share market? If you feel too excited and rushed into fears and recession in your adrenaline, you may not know much yet.

I’m disappointed with so many well-known economists there. Many of them didn’t stress out imminent issue long before, but just point out the darkness of their opinions during the dark days. I think their hearts are blinded with their own darkness and to understand real financial situation, at least with economy or strong hands situation. Up until now, many there are still stubborn with dead cat bounce thesis, temporary bounce thesis, but never really allowing another side of story to appear. In a moment, they will disappear, those fears are now disappeared, just like a story, disappeared, just like that.

You think you want answers, but you don’t. Where is she? WHERE IS SHE?

You may want to know my answer. On May 1st 2022, I might emphasize safety measure, hedging, pain level management, etc. On May 22nd I also stressed out possibility that the madness might be all ended. However many didn’t want to hear that, simply because of conflict of interest, fears of darkness and fears of missing out. That’s OKAY but many out there should be allowed to have different opinion.

Larceny, bribery, murder. People love their secrets.

Of course every economist and player may have their own theories, secrets and strategies. It’s love stories of life. It’s true life of a sad story, at least 22 people within digital currency industry may have died, suicide from the rout of digital currencies, Terra, Luna, NFT and Bitcoin which could be the real culprit of the May 2022, rather the recession argument. I’ll speak more later about this since I may have some technical knowledge as well, rather than just their economy knowledge. We should love those technical and economy stories.

Don’t go down this path. Stay here in this life.

Around May 22nd, I’s back to my path. I might be still questioning of the widely discussed recession. I have my path came back nicely to highest about a week after and that’s all I need. I’ll continue my life journey to my fullness. I still expect commodity, energy, EV, EV commodities to shine and continue their journeys. They are still breaking high and fears suddenly are out of my mind completely, in which I should rather beware.

I’ve turned a blind eye to plenty. I have to do this.

Sometimes it’s very hard to explain how I looked into financial systems. Sometimes I have to close my eyes, ears and minds to many economists and news during the darkness. I do believe they should also start to consider other opinion or light at the end of the tunnel.

That machine of yours. How close can you get before the illusions broken

My formula predicted quite correctly/precisely to when it was started (May 1st) and predicted precisely when it’s about to end (May 22nd). How close can I get before my formula is becoming incorrect? I think it comes to availability of human experience to assist the autopilot of alpha and gamma, especially their inertia.

You are going on a journey. A journey through memory. All you have to do is follow my voice.

My financial strategy and experience have been going on a 22 years of journey, lots of memories have been crafted. All I have to do is following my own voice. Please be aware that this is my own personal opinion. It’s widely accepted to disagree and I could possibly be wrong obviously.

So what do I think about recession ending is? I think this reminiscence ending may well explain my opinion.

Mae: Tell me a story.

Nick Bannister: A story? What kind of story?

Mae: One with a happy ending.

Nick Bannister: No such thing as a happy ending. All endings are sad. Especially if the story was happy.

Mae: Then tell me a happy story, but end it in the middle.

At the moment, in my personal opinion, I will end everything in the middle. I will repeatedly replay my happy financial bullish, despite recession risk. I think the Fed and strong hands are still having their grip on the market well, and that is enough to minimize the recession risk on my side. I understood the risk is big and real. Due to raising market participant challenge, there’s no such thing as a happy ending in financial market. Their ending might be mostly sad, especially if their rally was very happy. I chose my own ending and other may choose their own way. I like to think that we both chose right for ourselves.

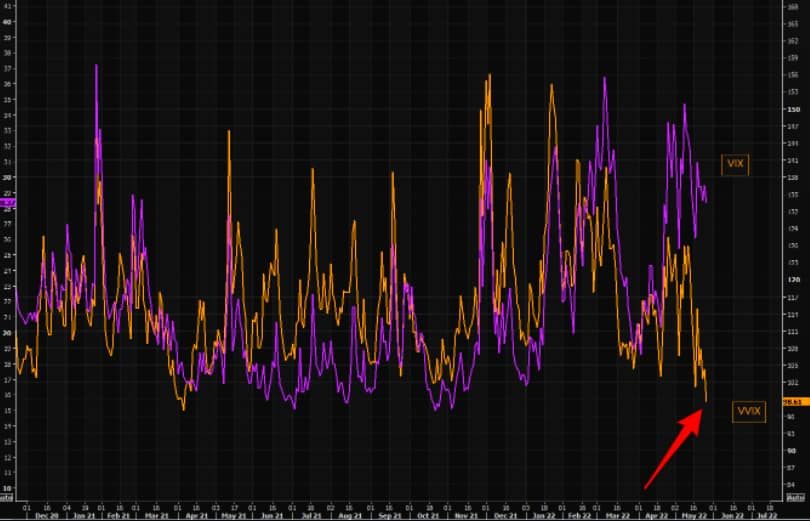

We do have VVIX pointing to lowest since 2020 despite elevated VIX. I would think it means, the risk or current high volatility is widely accepted by market participants. They are becoming more immune to fears and volatility. On the other hand, we should expect high volatility as our new normal, don’t get surprised with high volatility and expect high risk to remain (be careful with your pain level). Without that sadness, you can’t taste the sweet, all current bullish plays need higher volatility to live. We may choose our own ending, we crafted our own path and life, and no others should matter to step into other own path.

Any idea in this blog and website are my personal own. They are not financial advise.