Death is what gives life meaning. To know your days are numbered. Your time is short.

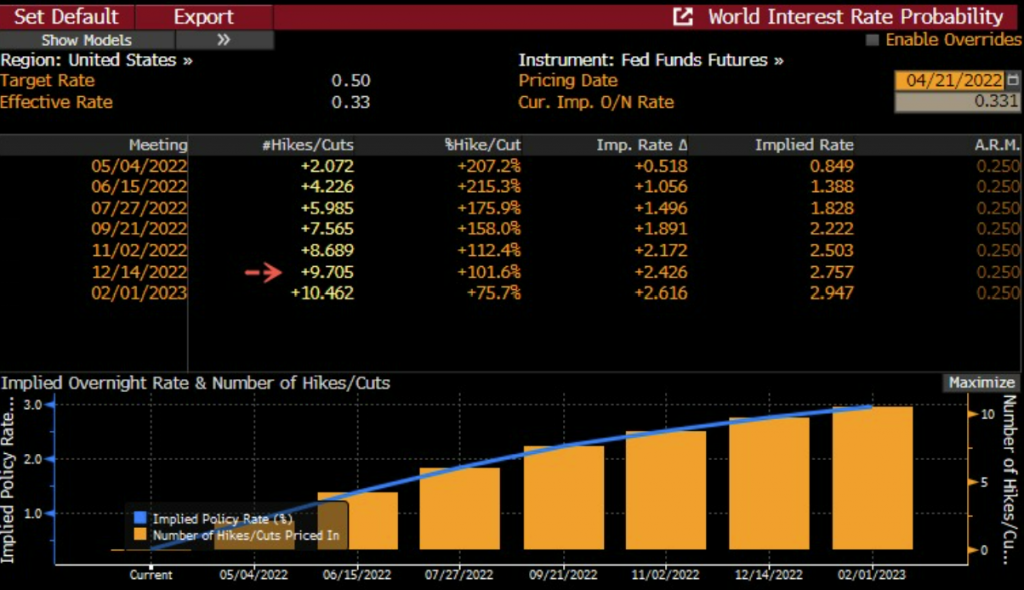

Following our previous articles, I’ve shown that Federal Reserve has never been in most difficult situation. They are behind the curve and trying to soft land economy at most difficult time. They have to tighten big and rapidly, and market already believes that the Fed will have to raise, not just one or two, but TEN in only 1 year, on top of QT (Quantitative Tightening) or reducing balance sheet which is just increased about 3x in past 3 years, just to show how severe their situation is.

Wong (our common sense): (Fed) don’t cast that spell (tightening that much and sanitized with new multiverse). It’s too dangerous!

(Fed):Why?

Wong (our common sense): We tampered with stability of spacetime (economy and market).

We all know, that every tightening is negative to price appreciation. It may normally cause market crash when it’s extreme, possibly at this huge challenge, in their most dire situations:

- Federal Reserve balance sheet has raised almost 3x (3.6T$ to 9T$), in just 3 years, from 2019 to 2022.

- Many governments have been going big deficit, raising much more debt to stimulate economy.

- Many governments are currently reducing tax to stimulate economy.

- Many governments are starting and will continue to subsidize consumption to combat/reduce inflation effect.

- This year, US government will most likely issue their biggest new debt to refinance about 2T$ of maturity (plus minus run-off).

Even-though, it looks likely that there’s no hope, I hold 2 things of my investment principles:

- economy is human made systems with more power in money and have been long years being corrupted by their creator. Simply, if human created the economy, they can alter the economy.

- strong market participant may mostly take opposite to this situation, for the sake of their bigger interests.

The Fed and The Treasury may need to do first and big experimental strategies with their soft landing, which they never experienced before.

Multiverse (new experimental strategy) is a concept about which we know frighteningly little.

We shouldn’t be surprised if we see traditional/scholar economists predicting more dire situation. “The sky is falling. It’s OUVER” said Chicken Little.

Dr Strange (Fed): It’s the only way. We must take the experimental actions and open the multiverse.

(Fed): But I never meant for any of this to happen.

The Fed was previously just trying to do their duty (unnecessary related to their mandates) to save stability of markets many times. Now they have to face their consequences.

Mordo: Your desecration of reality will not go unpunished.

So what should they do? The Fed is looking for help.

I’d know soon or later, you will show up. (Looking for help).

The Federal Reserve had been ignoring necessities to raise rate last year

Wanda (market and Treasury/Yellen), I need your help!

What do you know about the multiverse (new experimental things, including policy mix) ?

People think the Federal Reserve might have less clue, but I prefer to say to have less choice by force. Yes The Fed can continue to run inflation party to hyperinflation, but they better start seeking help to avoid free fall from the hyperinflation cliff. Obviously to tackle single dimension of hyperinflation issue, we would need help or seeking help from other dimension/multiverse. Unfortunately, we may already break our 3 multiverse:

- broken central bank in printing money, explained in Bretton Woods 1 and 2 and 3. Zoltan predicted commodity is the latest standing asset in Bretton Woods 3.

- broken government with much more debt, much more subsidies, and much less tax/income.

- broken banks with much less reserve to withstand volatility/higher inflation. Could we allow relaxed banking systems with more borrowing/much less reserve, to support our curve strategy?

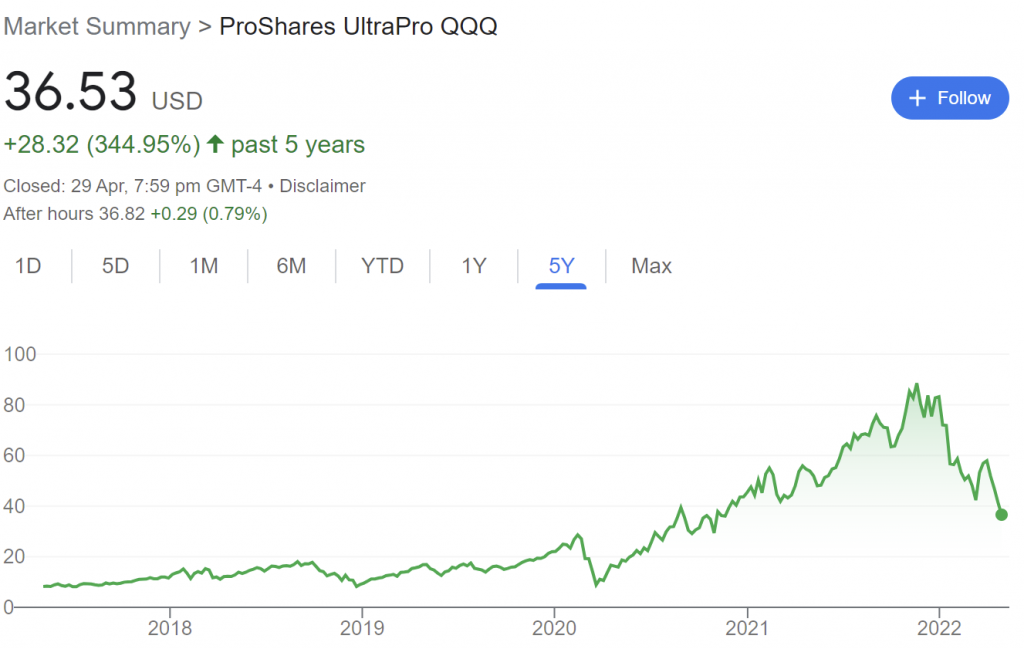

We either continue to break these 3 verses at higher degree, or break/open another universe to save our investments party. We may put hedge funds and more funds into our broken list of multiverse (similar to QQQ and TQQQ).

Regardless of what they chose, there’s a possibility to go through peak inflation into what I mentioned in previous month as a sustainable high inflation (going down from 8.6% to normal high around 3%). We just need to allow more broken verse, that’s all. Adding one more into already broken/corrupted 5 won’t matter much, wouldn’t it? Once inflation momentum is back on normal rate and market fund like NASDAQ high PER is flushed down/sanitized well, we can continue our party. All I would like to say, let’s take this high rate hikes and high inflation hype as a kid sugar rush market (tantrum). The authorities must show their stronger hand, bring high PER down, and be patient. Once the kid sugar level is back to normal, they can lower down their tone. I strongly believe we don’t need 10 hikes, once the inflation tantrum kid is behaving normally. Will that be good news (same effect as easing) when future reality is better than what was priced in (10 rate hikes)?

Mordo: I’m sorry Stephen (Fed). I hope you understand.

The greatest threat to our universe (economy) is YOU (The Fed)!

Meanwhile, we are starting to see opening multiverse of madness.

I may think of several madnesses.

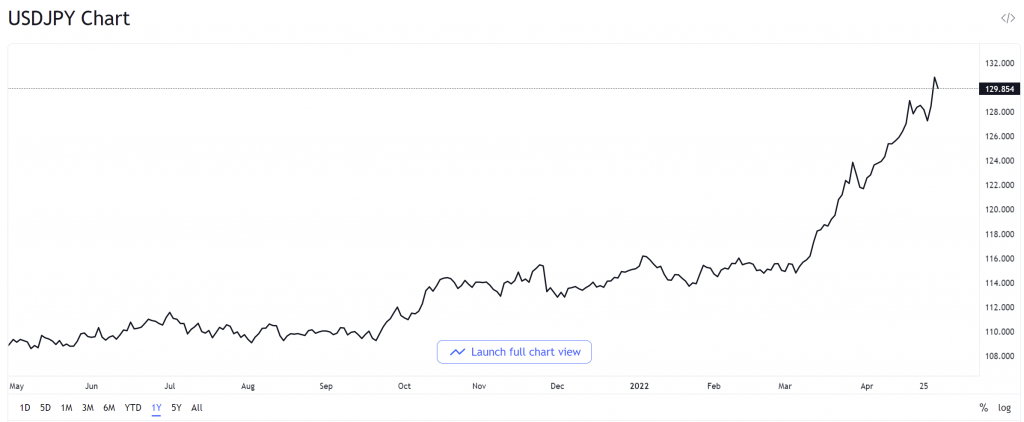

Madness #1: YEN is experiencing rapid depreciation.

Yen has been decade long of experiencing depreciation. Yen is also one of prominent currency in the world. Changing its course, may effect huge accumulated Yen carry trade. They have been long used to borrow in cheap rate/deflation, to invest in other higher interest countries.

Reversing the carry trade may spell trouble to countries with high interests such as emerging countries. They would need to replace capital outflow or opening newly hedging activities.

Madness #2: NASDAQ heavy trucks continue to run down hill, sparking inflation.

NASDAQ/technologies have been running with high PER (Price Earning Ratio) and geared with yield decrease. Increasing inflation or long yield will only spell troubles to NASDAQ/technology companies. We may have warned this since our December 2021 article. We haven’t seen any indication of bottoming, please continue to be beware.

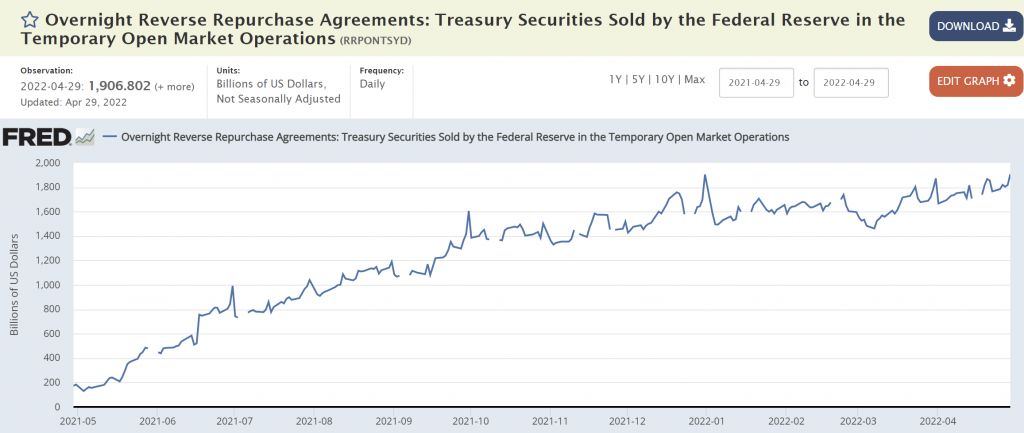

Madness #3: RRP is not drained yet.

Many economists including my article last month, predicting RRP drain. Unfortunately at the moment, it’s NOT, at least yet. RRP continues to reach 2T$. In simple term, it may indicate that market still expects higher inflation or persistent course in yield. In this case, I may believe authorities may support my last month article of YCC (Yield Curve Control) to break this stubborn risk-off.

Madness #4: USD continues to go stronger

If later USD can go weaker, it may compensate negative effect of big tightening. With China PMI going into contraction, it only spells more troubles with stronger USD and currency wars. However looking at this chart, USD may technically have higher probability to change its course soon. Get your popcorn ready.

Madness #5: Higher PUT

Whilst high put/call ratio may indicate higher safety from market participants on the street, dried liquidity may spell bigger trouble to market maker if they run out of control.

Madness #6: Money may not flow easily from RRP to Treasury

Joseph Wang wrote a nice article that may show money flow from RRP into Treasury. However I may doubt that they can flow easily because intermediaries may have restriction in place.

Madness #7: SOFR indicates much higher rate on sight

Hopefully 2019 flash rate incident is not happening again when repo demands liquidity.

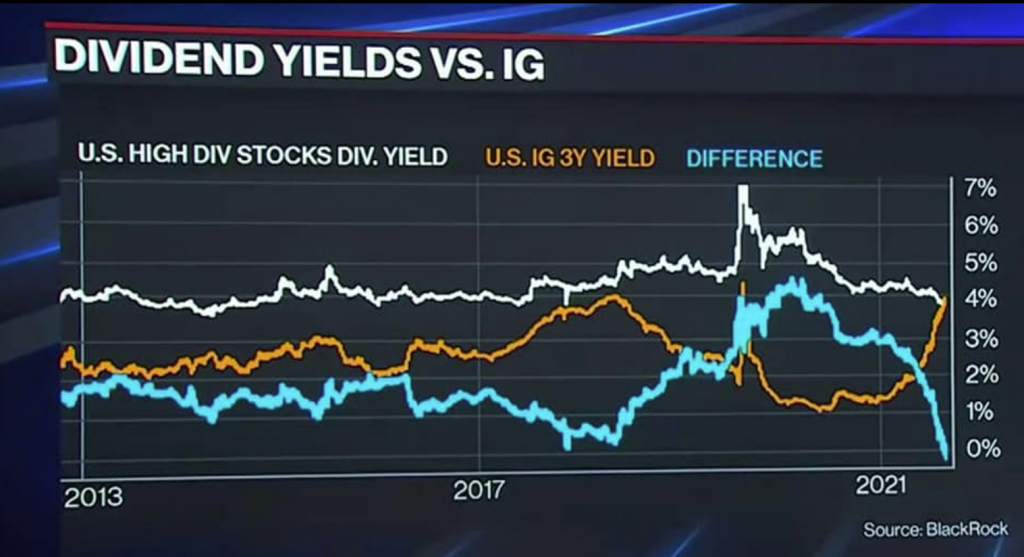

Madness #8: Yield may start to offer higher return than dividends

This may cause risk-off to the economy and discourage street to take more risk and run economy. It may cause companies to either distribute higher dividends (less capital) or taking much more risk with higher interest (risk and cost).

Madness #9: EUR may continue their next parity

This may indicate stronger USD and more troubles in European area.

Despite all madness in the market that may later drag down our thesis, our thesis seems to still remain strong. We started to speak last month through our Bruno article to possibly try to reduce or hedge them well, while they were and are still strong.

- Commodities continues to be strong, despite lower demand indication.

- Energy continues to show higher price and demand.

- Food continues to be critical commodities.

- Electric Vehicles continues their fundamentally higher demand and higher production.

I may predict, lower ESG (Environmental Social and Governance) rate or subsidised act may soon become an important survival guide to companies starting from H2 2022. That could help companies to navigate well in higher rate normalisation era. I would think the lower rate of fund may become one of new verse possibilities to save our investment and economy party.

Of course, once the liquidity tide is dried out, we may soon see bankruptcy. However from what I saw in past 25 years, I believe many critical and big ones may find their way out from these madness troubles, such as utilizing and creating new fund to finance them well. It’s currently our most important filter to our investment top picks.

I would say, the new fund could become a new central bank kind of fund for selected companies, such as in critical commodities and continue with our evolution towards green energy. This sector may not be crowded yet and their leverage is not yet broken/corrupt as others, therefore in our thesis, they may continue to survive well.

Unfortunately, if this thesis becomes true, we may see less incentive to fossil fuels capital expenditure and their price may continue to spell trouble to economy who has reliance to fossil energy and emerging ones.

Our other thesis to save market is to have stronger Fed hands to bring important fallen things back to their hands/control. It means we might need to worry about non fundamentally secured thesis. It may also mean, more hands/intervention are required from the authorities, such as the use of YCC strategy.

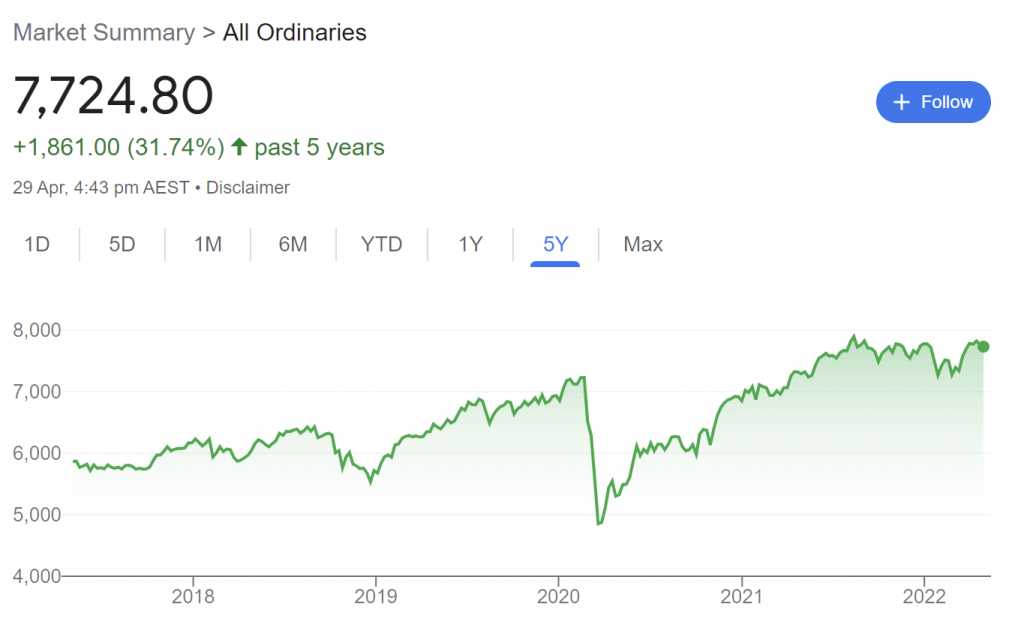

Our thesis about Australia at early March 2022 seems to be correct. Australia hasn’t experienced troubles like their peers, S&P and NASDAQ. It doesn’t mean Australia is completely isolated from the risk. It may have some effect if things got severe. Please be prepared. However if USD may peak soon, that may turbo charge Australia GDP or put Australia into preferred currency investment. Indeed China just vowed heaven and earth movement to support their GDP growth with infrastructure spending. I may also believe in USA infrastructure.

Our internal research may predict opening of a new multiverse from around May 22nd (coincidentally happening at around same time this movie is released). Let’s see if this new experimental formula is able to open our new internal multiverse formula. Regardless of being right or wrong, we are just human being, which need to accept wrong concept and should always strive and continue to adapt and learn.

Any idea in this blog and website are my personal own. They are not financial advise.

I just watched. Despite dire outlook, Warren Buffet just said yesterday “Fed can do whatever necessary” to save market when economy stops. It’s a very strong message and answered all, other than 40B$ of Energy they added in Q1, 2022.

Whist technically correct, from my 25 years of investment experience, I would still suggest to continue very beware with NASDAQ this year. I don’t easily buy fundamental analysis of the high PER when situation like this is happening, based on my experience working in the industry professionally for over 22 years.

It’s starting, in cinema at May 22nd. I’m sticking to date I wrote in my article based on our internal research formula. Same time as Fed starting to raise rate for 50 bps and QT starting in June. Please watch USD.