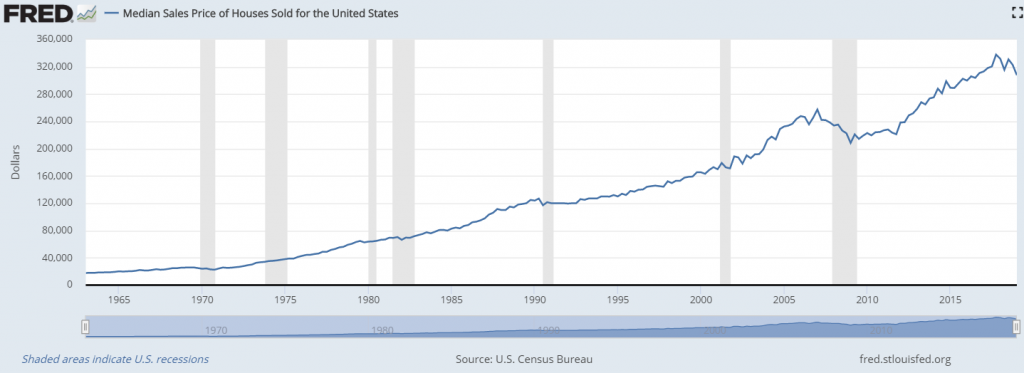

More than a decade ago, I might be a bit lucky that emerging and Australia properties were running very well until next decade. There were few arguments during that time that emerging might not follow US property price. Let’s fast forward, in 2012, many people were so afraid and RBA research did support the fear. It still didn’t fear me enough.

In 2014, just a year before a major change is happening to emerging properties, I did feel property might have a chance to run out from its course. During that time I predicted that commodities would rebound when dark pool of US properties closed its gap within a year and half, which might mean the bullish cycle of emerging property might finish soon. My strategies that time was to hedge half of the properties with 3 years fixed rate and as much amount of commodities. There were a lot of arguments and theories behind commodities rally in relation to where the money will go and property hedging but I’m not going to discuss here.

The commodity and money theory did work well. However fixing rate was failed miserably. The central bank continued to lower interest rate again in 2015 after standing still in 2014. And one that I failed to see most is the Australian dollar crashed from its trend in 2015/16 until today. I did see strong Australian dollar before 2015 as a reason that Australian property wouldn’t crash but I didn’t expect Australian dollar to crash back to year 2008/2009. The market is always smart, that it lowers expensive price in a very fast and hard-to-predict way. Unfortunately commodity rebound didn’t help the currency.

I always fancy math. Before 2015, I have my own equilibrium formula:

i (interest to bank) = r (rental income) + t (tax benefit)

I only consider investment properties and ignore owner occupier properties, because that is where my money theory will work well most. The formula is only working in effective healthy market. It basically says that in very competitive market, investor will not make any profit from just buying the property (Rf = risk free) because their rental income and tax benefit is just barely enough to pay the interest. Market will do its own way that supply and demand will make sure investor is taking risk from the investment properties.

Moving forward to past few years. Here comes the interesting part. Currency devaluation is not enough to hold price, and price is starting to fall and so is the i. This environment will cause a shock to the formula to response and it would take few years before it can find a new equilibrium.

Australian property is still a biggest weight in inflation formula. In my theory it means market players still use property as an important investment or trading factor. When the weight is lower, and in my money theory is possible, it would mean property is no longer important in money market portfolio.

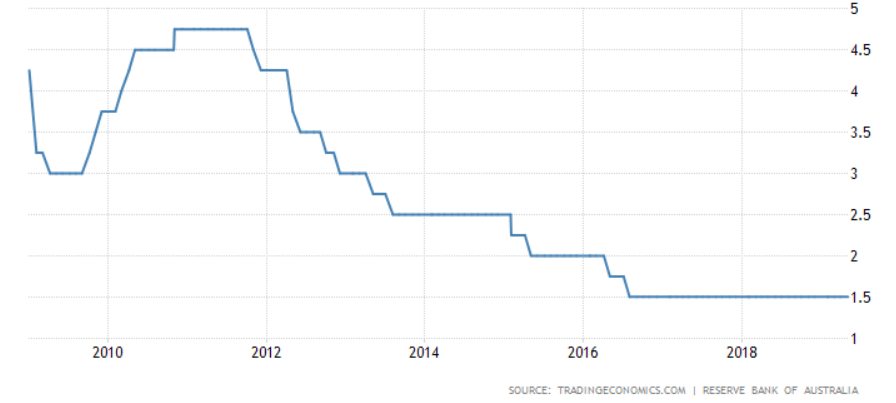

Due to this importance, RBA did lower interest rate in 2015 to 2016/17.

Back to the formula, i=r+t, when interest rate is lower, i and t should also go lower. However the magnitude of t is much lower than i. Therefore r must go lower even-though might not be as much as i. We have to remember that price was peak in 2016/17 where there’s hardly chance to cut more rate because dispersion between Australian rate and US rate is going higher due to Federal Reserve aggressiveness and RBA effort to save their boat. It caused money to flow from Australia to US and causing more pressure to Australian property price.

Based on my money theory as well, the not so invisible hand would sacrifice currency and at same time is trying to save their boat. If those money is not the major player, rental should have been falling since 2015 but it didn’t. r is just falling from early 2019, and not since 2015. We can see from this number. Property rental price is just starting to fall from early 2019.

In any shock, there’s an opportunity and the opportunity will get lower after market responses. When r is not responsive, there’s an opportunity to make money. Currently the r is quite high. It’s almost equal to i and money is trying to benefit from t. I found it quite interesting that they debated negative gearing and many business benefit. If the negative gearing is abolished, in my theory, property will crash. Even if the negative gearing is grand-fathered in this situation, we won’t see any recovery. I’m not surprised with result of election.

It’s very clear from above arguments that r must go lower. However if it goes lower, it will hurt the economy and retailer will suffer most because property is still a cash machine of most investors to stay afloat in an increasing global rate. Lower r means lower income or deflation, a big issue to the portfolio.

When i is going lower and r is not responding quick, we can see market is now doing:

i = r

The math does its magic because the t is free from the equation. It means we might be able to get the t with very low risk.

Rather than owning a property, it might be more beneficial to go renting and might benefit from the t for almost free. I’ll show you a case. A owns a property and pay 4% of interest. Since r is equal to i, A can rent in market and paying same amount of 4%. A can then benefit t by switching his property into investment property and go renting. Of course r must be securely located and maintained to get the high r. A will pay same amount of interest but enjoy the t for almost free. It’s not 100% free and 0% risk though because anything can happen to the property. What is the different? If A keeps his property as owner occupier, A won’t benefit from the t. Since market is now doing i=r and r is starting to fall, i is expected to start falling to help r or the economy. Lower i previously causes or due to lower price and hopefully it won’t cause a snowball to drag the price further down.

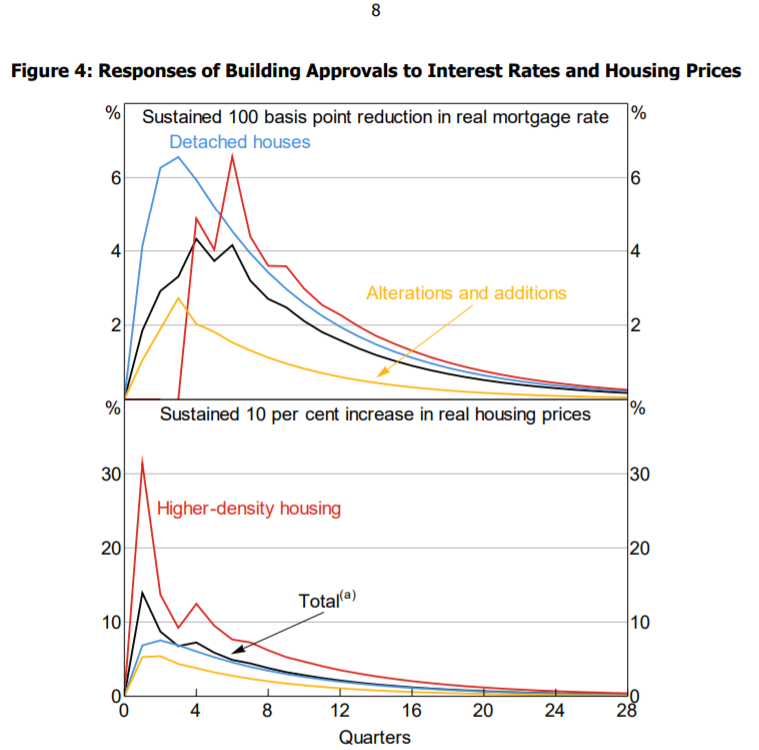

If people think lower r is not worrying, let’s see what RBA will do. RBA may race the falling r with reducing i until they find a bottom. It’s because money growth/velocity may go slower with lower r. During that time, currency may continue to suffer most. If i doesn’t go down with lower r, investors will start paying more and see less and less benefit to own investment properties and may cause more property to sell and less property to build. It doesn’t need to abandon negative gearing. If r drops a lot, maintaining higher i may cause investment property selling. With raising payment behind schedule, it should raise enough alarm for RBA to lower rate. It may also pressure APRA decision to reduce buffer in effort to stop this bleeding and boost more investment in properties. I only worry it would cause price to further down.

Current numbers (might change) show that within 3-6 months RBA should start lowering rate up to 0.375% within 3 years. i is expected to fall a bit further from 1.5% to 1% thus causing r to fall at about 12.5% (lenders are passing 0.5% or from 4% to 3.5%). If r is falling at above 10%, that will be catastrophic enough. The not so invisible money hand should help this from falling. If A switches to investment property, A will benefit high r and get t for almost free. I won’t surprise if at the end, outcome will benefit the investors. What it does hide is, going renting will pay more money because r tries to stay high. Let’s look 2015 to 2018. Isn’t it more beneficial to go renting rather than owning a property? If we own a property at 20% deposit, 10% fall in price is equal to 50% loss in deposit asset. Sometimes it can be better at paying a bit more money to save the bigger money. We should realize that Australian dollar has been falling more than 30%. If we add 12% price correction on top of the 30%, Australians have lost 42% of equity wealth from their property price. If they maintain 80% LVR, it means, unfortunately, they already loss 5 x 42% of value which may already lead to bankruptcy (over 2x of 100% loss) if currency does not fall down. It would then need many decades to bring the equity wealth back, unless of course, the price and currency rebounds. This graph is good but also tells it won’t happen soon.

I still don’t think Australian property will crash anytime soon. However I have my own theory of when bigger issue may come. There’s sign where authorities will start giving hands to weak hand instead of investors. It’s just a matter of time when the weak hand falls with holding asset. However, for now, I may expect price to rebound within 3-6 months to the next 3 years if RBA is willing to cut rate as soon as in June 2019. It can be wrong and may change tomorrow, but that’s what my numbers can say for now.

When I would expect price to rebound in conjunction to strong rental? I think this research, A Model of the Australian Housing Market, does provide many good numbers and formula. I would be more interested to see the impact from building approval (in relation also to bank lending) and interest rates changes.

Property is the dream of many citizen. Unfortunately they are exposed to their weakness for others to make money.

Above is just my theory and should be debated. It’s definitely not in any case of financial advise.

]]>