1st Horsemen: Pestilence – CoVid and many more diseases

2nd Horsemen: War – Russia and China War

3rd Horsemen: Famine and Inflation

4th Horsemen: Death

It’s quite fascinating how we see opening of the 4 horsemen. We have seen 1st, 2nd, and 3rd. We will see the 4th of course in future. Death is what gives life a meaning, to know our time is numbered, we can utilize the time better. At the end, everything will die, including cash, by the high inflation. During that time, there’s usually investment that delivers substantial amount of return for those who seek and do them well.

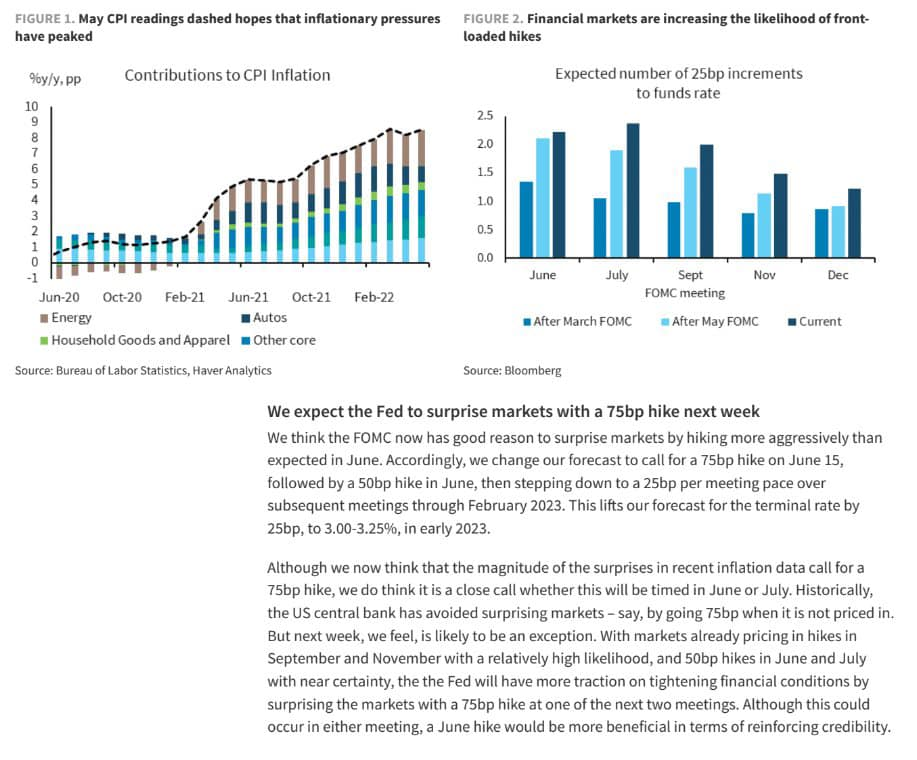

Let’s have a look into what is happening on last Friday, June 10th 2022. As usual, many should notice significant amount of insiders moves on previous day. One piece of information changes the way financial players think and move. It’s a higher inflation, 8.6%, higher than expected 8.4%. The problem is, it was announced at the time where market is very sensitive to rate hikes and tightening issue. FOMC and first QT will be held on June 15th, along with largest Option expiry ~2T$ a day after, suddenly terrifies anyone who expects higher rate/faster tightening from 50 bps to 75 bps or 100 bps.

The economy and liquidity are still moving according to the Fed plans, but market makers need to move them around to keep them alive, reduce weaker hands and keep market healthy. Also to show competitors, who is mightier.

There’s two businesses that haven’t been completed from May 2022 carnage, which are cryptos and debt market. There are still quite a lot of issue with crypto and techno due to higher rate and inflation. We have advised to stay away from any of this since December 2021. Bitcoin is still above their overrated value, if any.

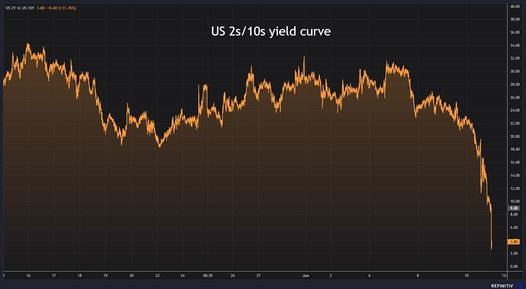

Treasury also seem to catch the flue. This move has caused 2y10y to go zero, which is starting to flash a risk of crash to entire global banking. We have to admit, debt has been increasing much faster than producing GDP, therefore rate hike will be more sensitive than any past.

If we still have time to extend life, the main issue, energy should be sacrificed, i.e. the OIL. Their bull flag is already very close to technical target and may not able to break their double top formation. Therefore we believed it might be wise to start unwinding/correct some our top commodity, with energy mostly due to this risk. We don’t see yet long term energy bull over, however this extreme move has raised much to our concern. If inflation is expected to raise much higher in future, oil should have been breaking double top, but they don’t. It might be one of comforting sign to overall market but significant sign that energy might need to be corrected soon.

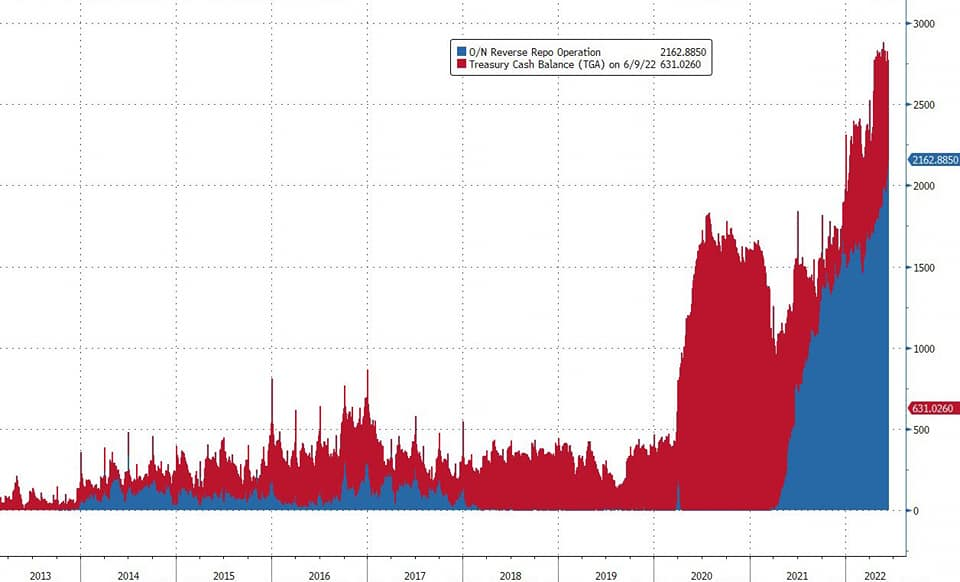

When energy or inflation is much more controllable, liquidity from RRP and TGA should comfort market for time being, but we haven’t seen them yet. It seems market hasn’t yet seem to see inflation to peak. Unfortunately, it might be complicated with recent moves of crypto and bond market. We might see crash in crypto market, where another 12B$ or Celsius and MSTR might still carry very big problem. From our previous articles, I don’t get surprised with bond market issue. Even though it’s quite challenging, I think treasury strong hands might still be able to handle treasury market well, unfortunately unlike crypto ones.

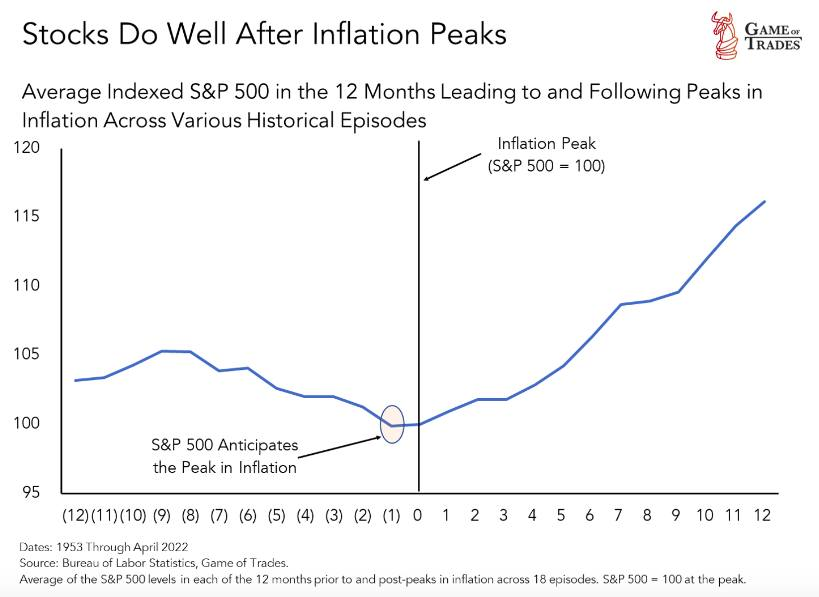

The biggest question is when inflation/energy to peak? Looking at above, as long as the Fed and strong hands keep their head cool and keep their hands strong, not easily intimidated by market expectation, I think they can pass their difficult time and landing economy softly.

I should agree that risk is currently high. We have lowered down significantly our tone last week. I think it’s unwise to emphasize much of internal conflict of interest for lower price expectation. We should still maintain pain level and take quite substantial amount away from the market until we have further confirmation that energy has at least peaked/controllable for time being.

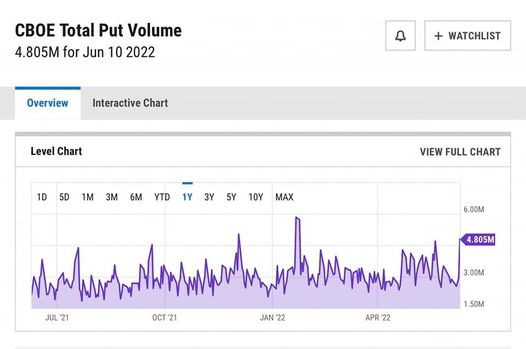

We still have quite a lot of positive components. It’s just when it’s moving to the other side for some reason, there will be quite a lot of negative sentiments. It’s not that excessive fears not driving market. Significant increase of put volume compared to call, obviously is moving price lower, like a rubber. The bottom might not be far, but we should always remember, bottom call normally has long overshoot, therefore we should have protected our investment to that risk while we were on upper level of the channel. I would leave safety position to the end of the week or so.

I will update further as it’s progressing.

Any idea in this blog and website are my personal own. They are not financial advise.