When a plane is about to land and raises its nose, it is typically referred to as the “flare” or “roundout” phase of the landing. During this phase, the pilot gradually increases the pitch angle of the aircraft, lifting the nose to arrest the descent rate and transition smoothly from descent to a level attitude just before touchdown. The flare is a crucial part of the landing process, helping to ensure a smooth and controlled touchdown on the runway.

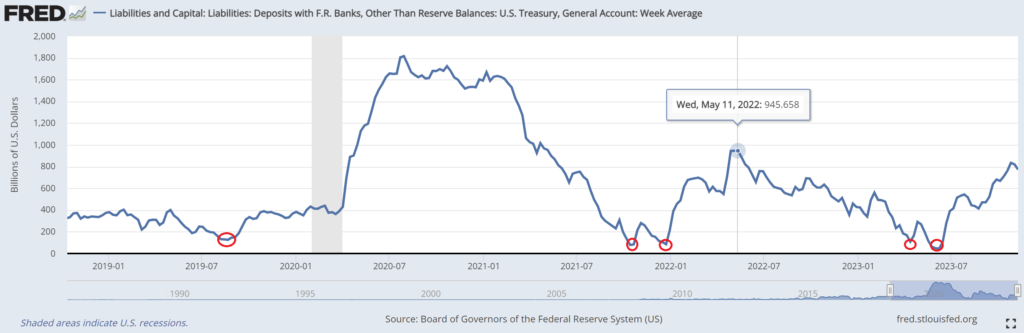

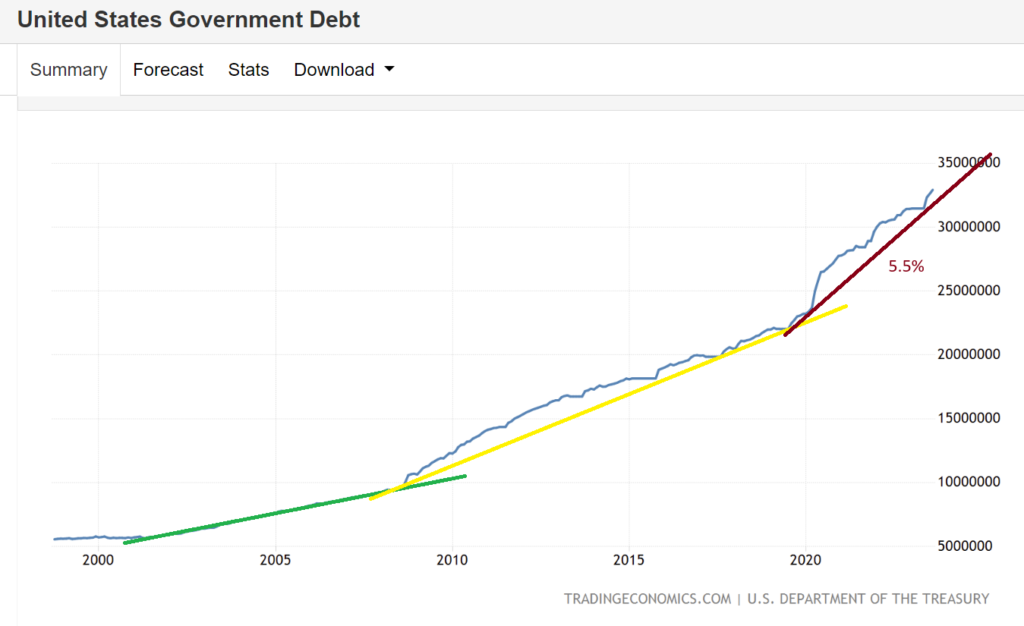

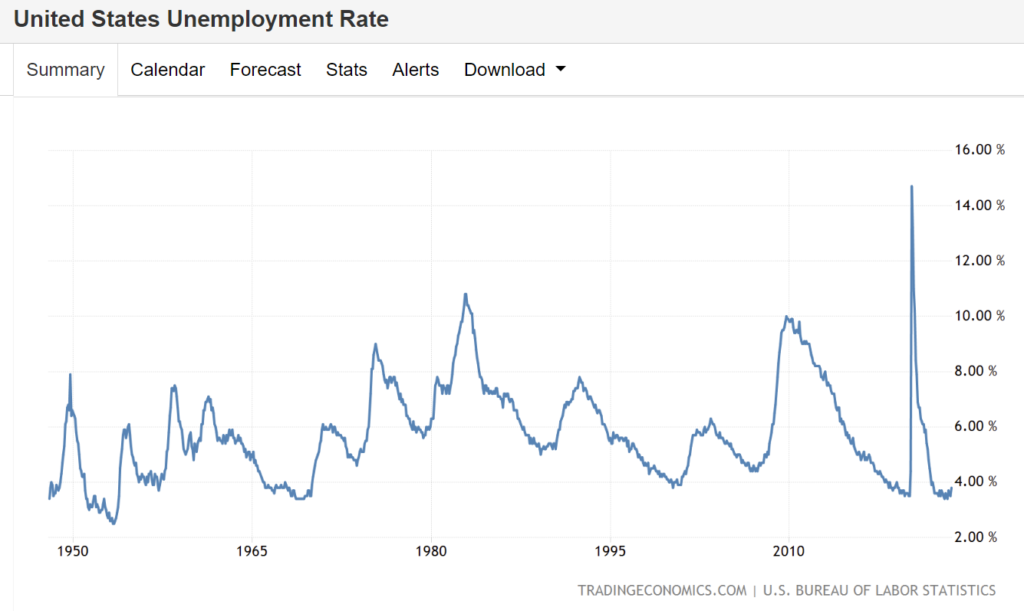

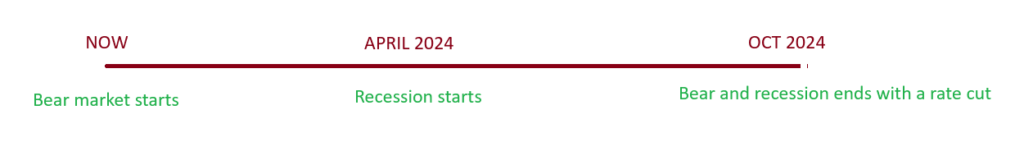

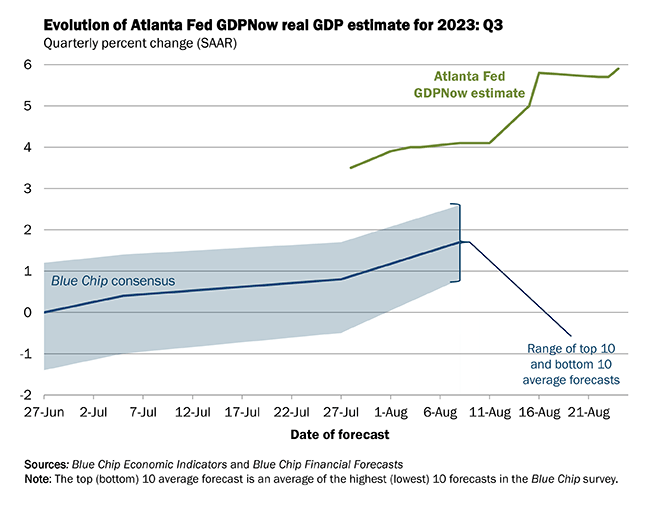

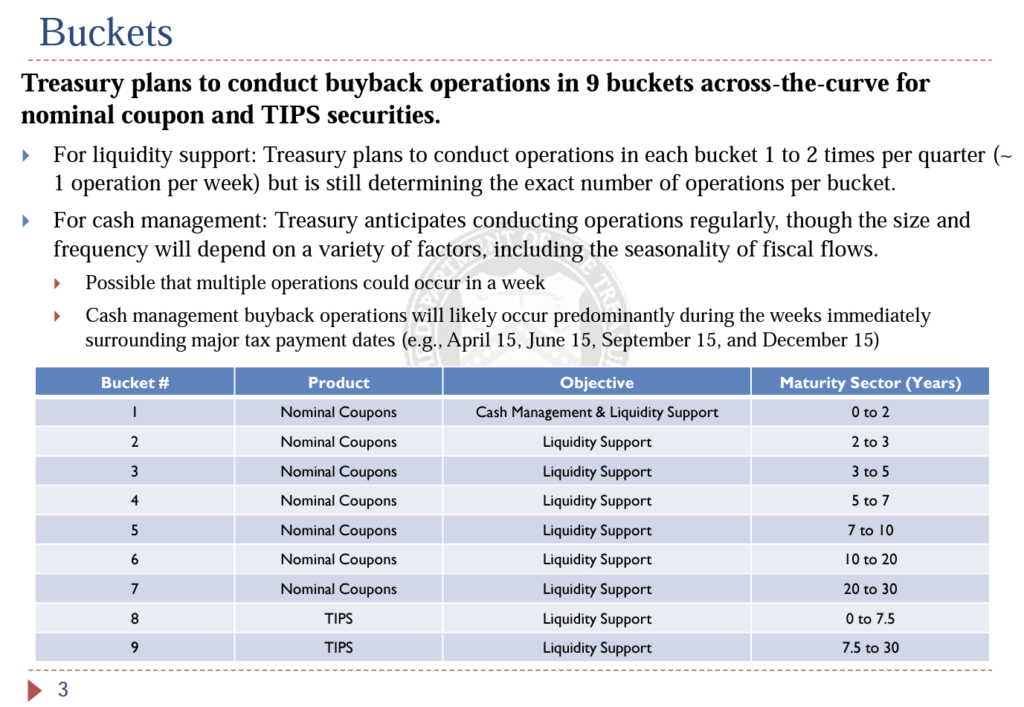

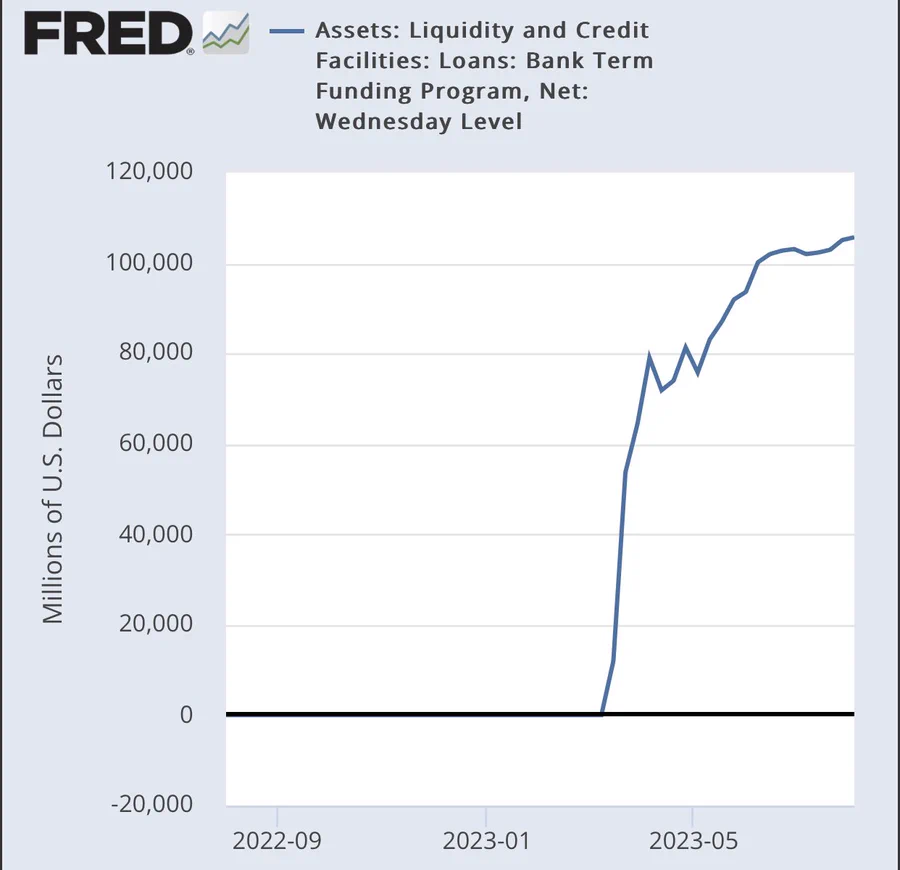

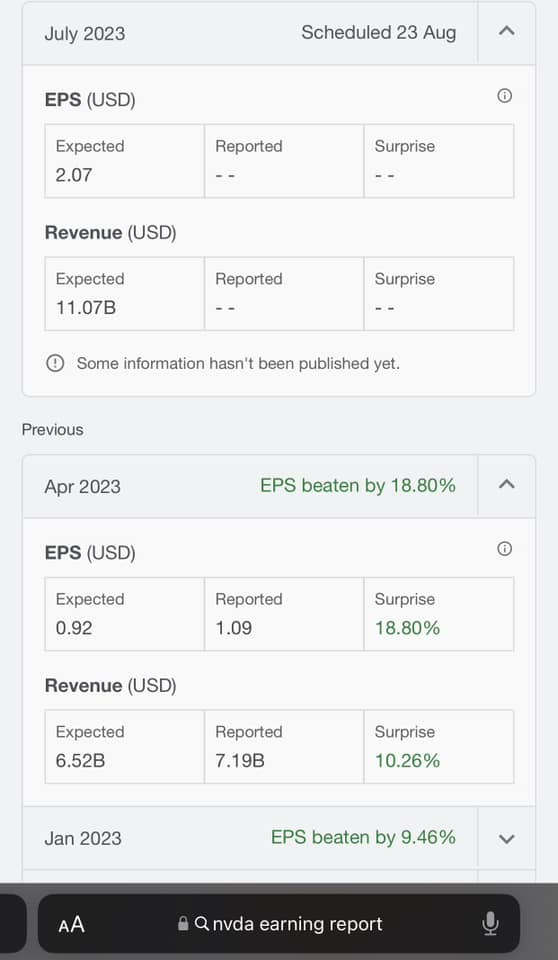

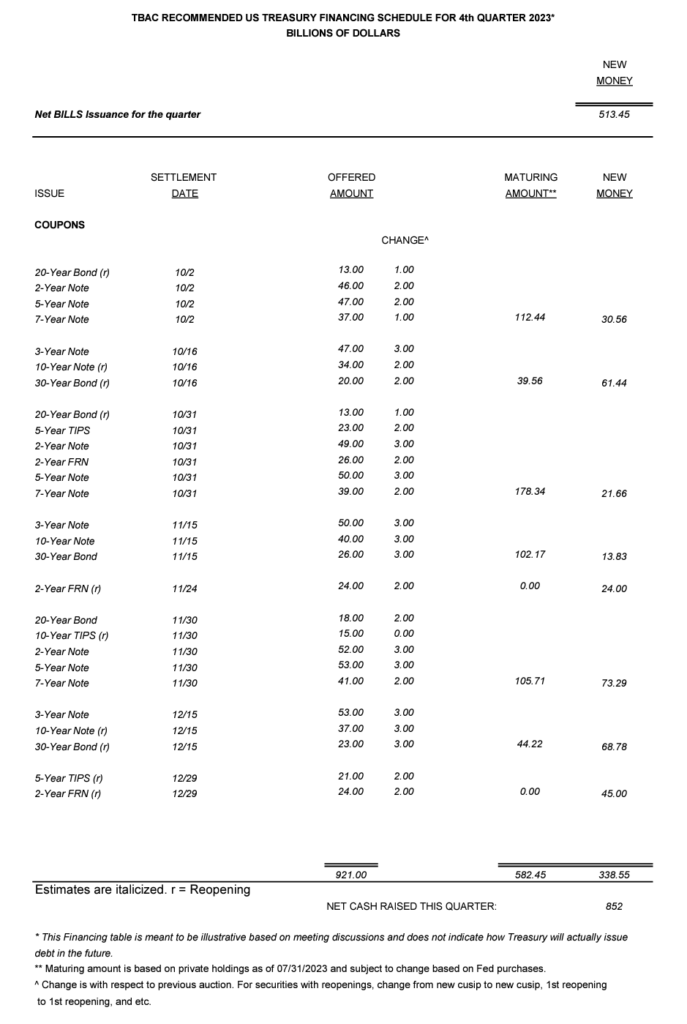

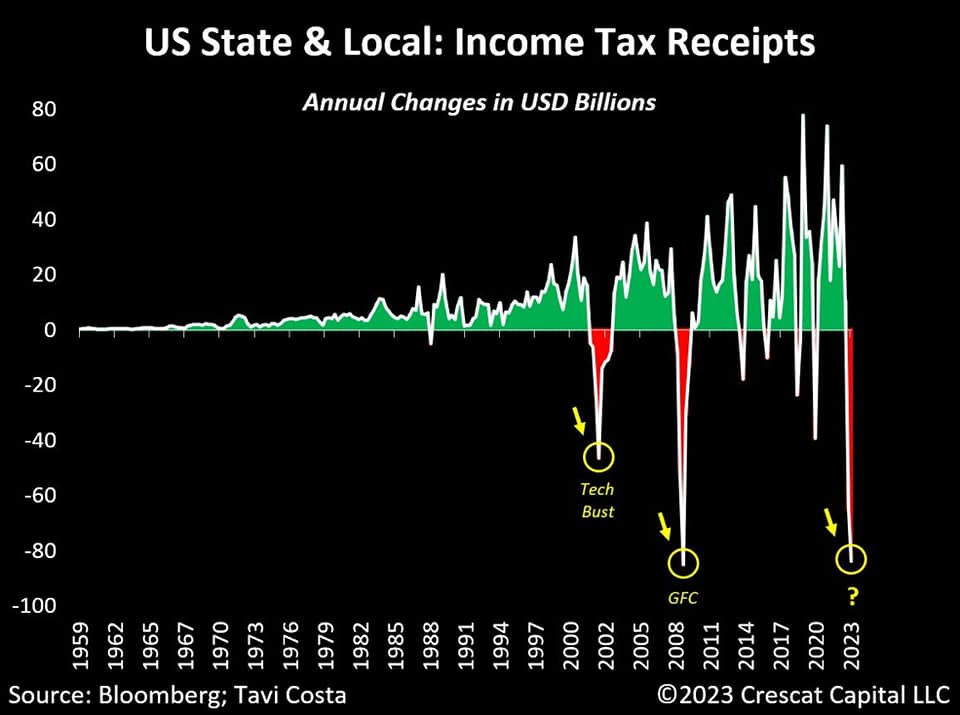

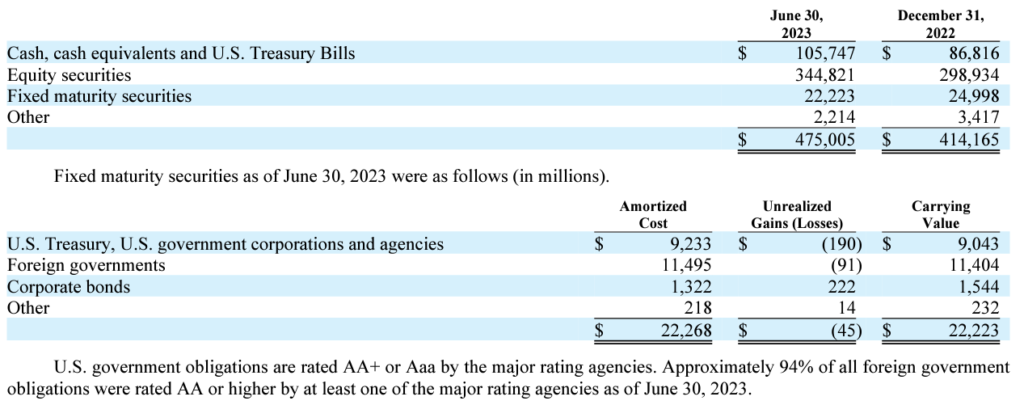

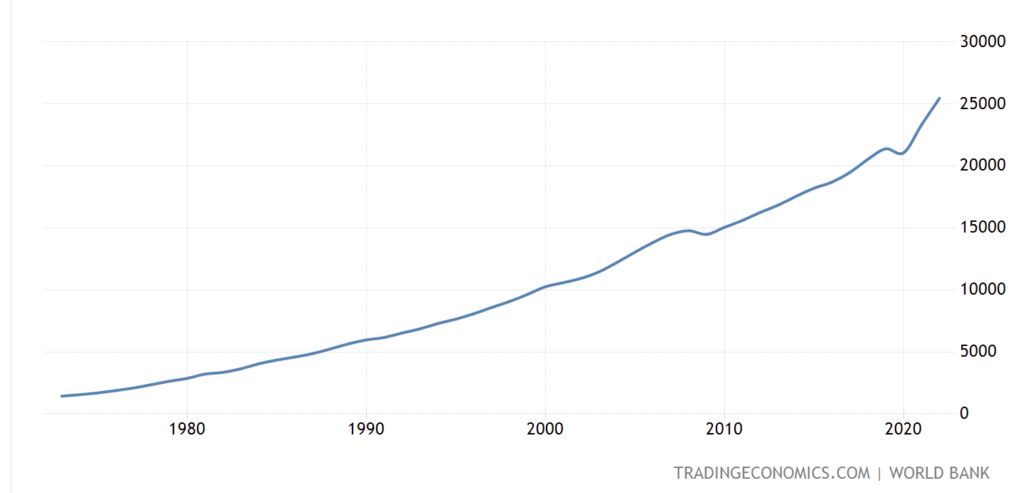

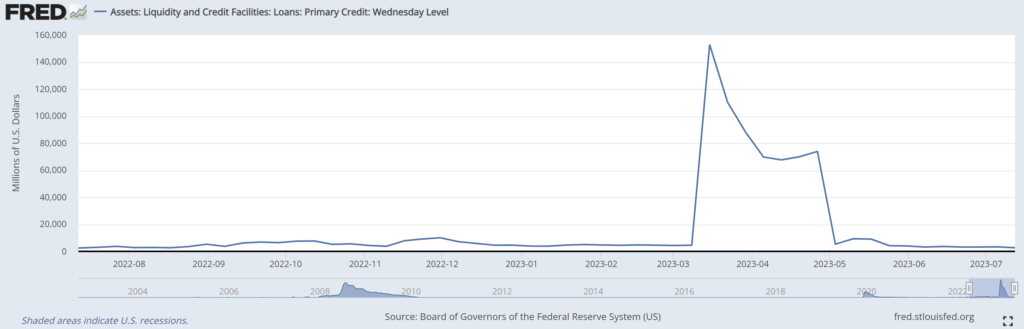

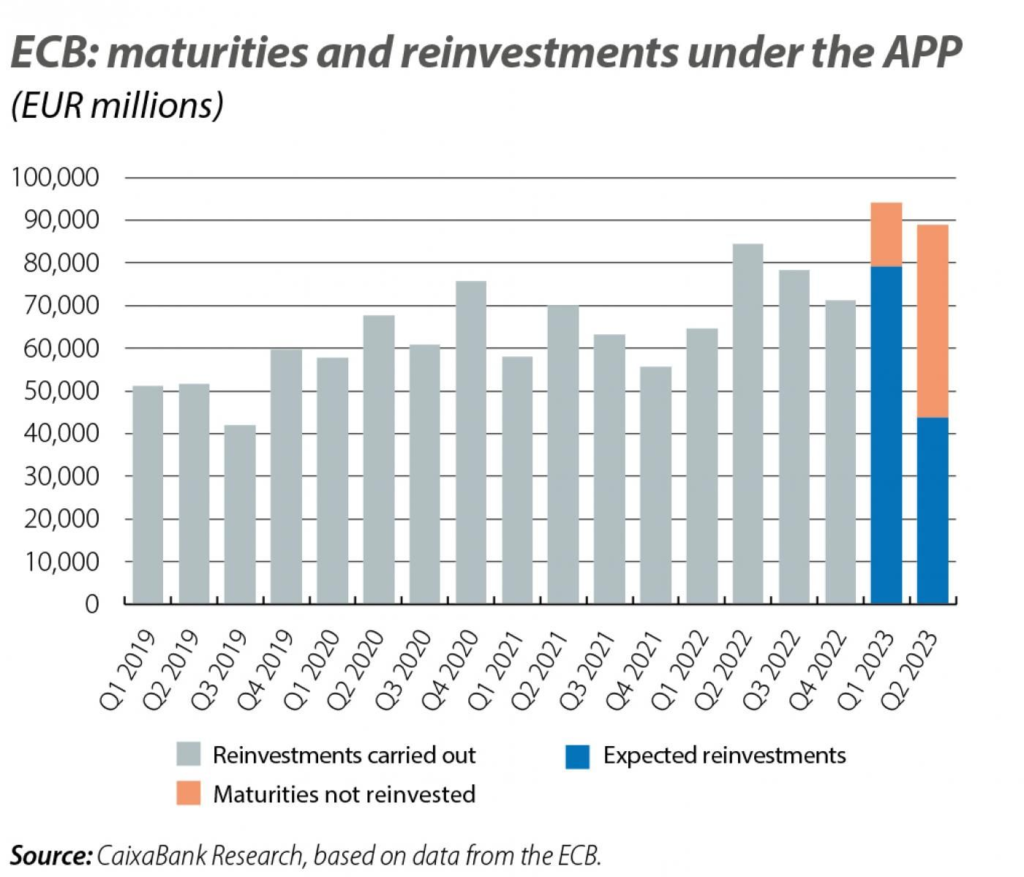

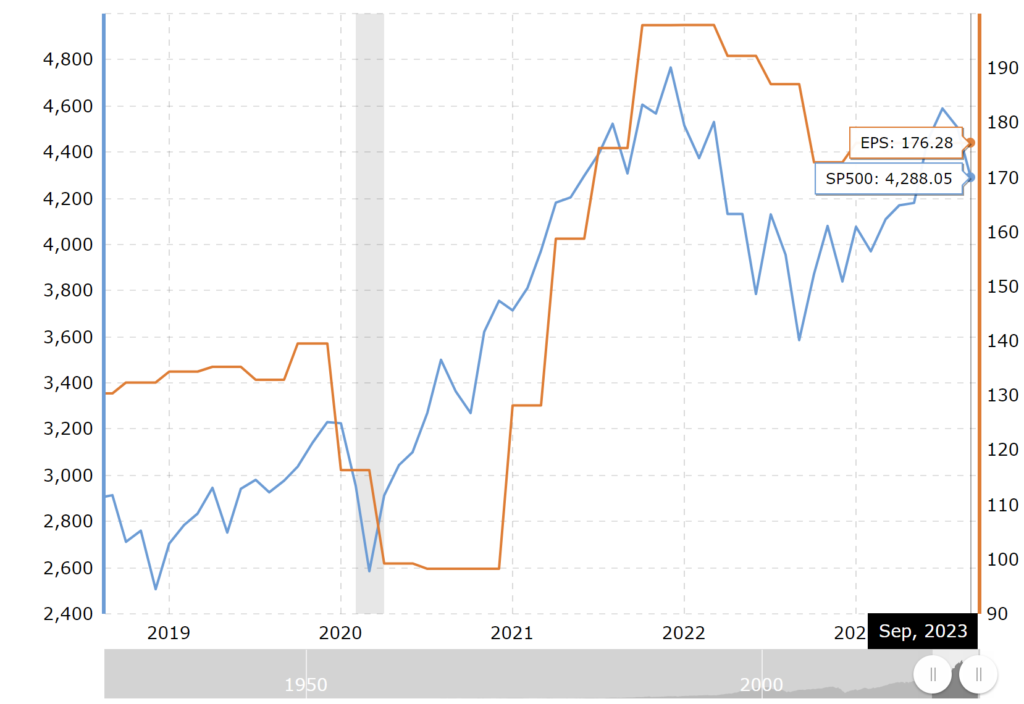

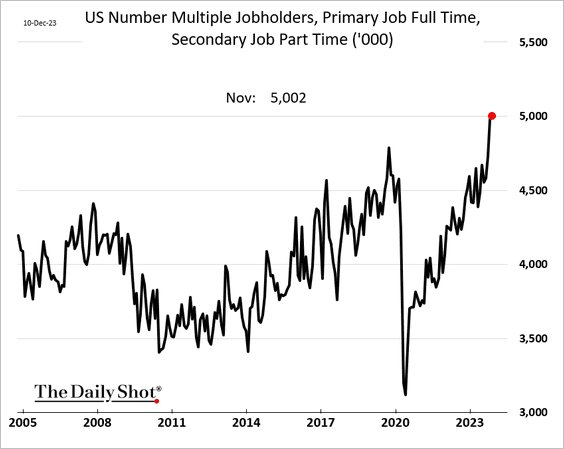

Financial markets are likely not adhering to conventional wisdom because of the challenges in generating profits. In our thesis, despite the Federal Reserve raising interest rates to a maximum of 5.5%, the earnings of the S&P index are remarkably robust and increasing. Liquidity remains ample on the sidelines, with Reverse Repurchase Agreements (RRP) likely flowing either to the Treasury General Account (TGA) or Bank Reserves, with only little to pay interest and operation. This raises questions about when the tightening measures will take effect or when we can identify the peak. As we demonstrated in a previous article, it typically takes eight months from the last rate hike, but I suspect it could endure for a much longer period.

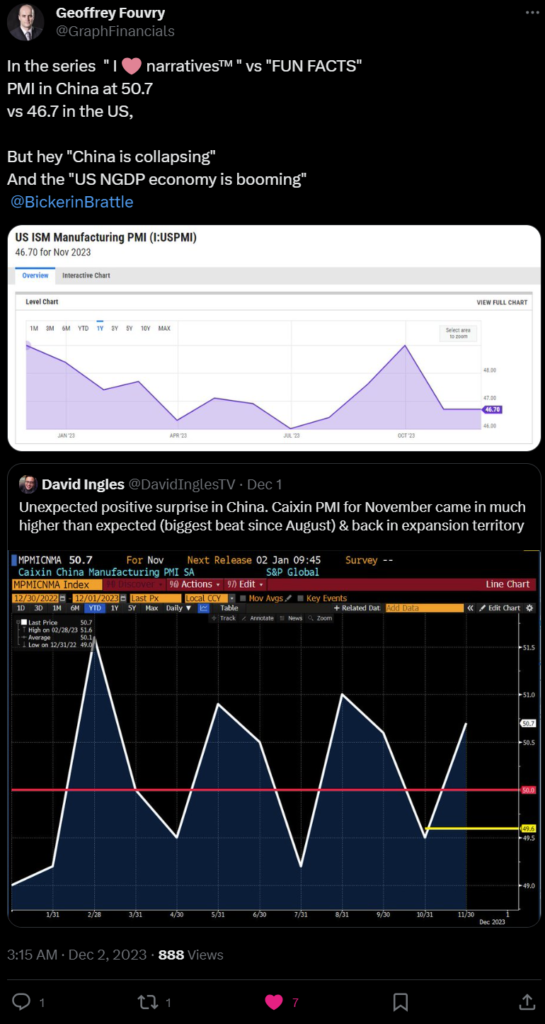

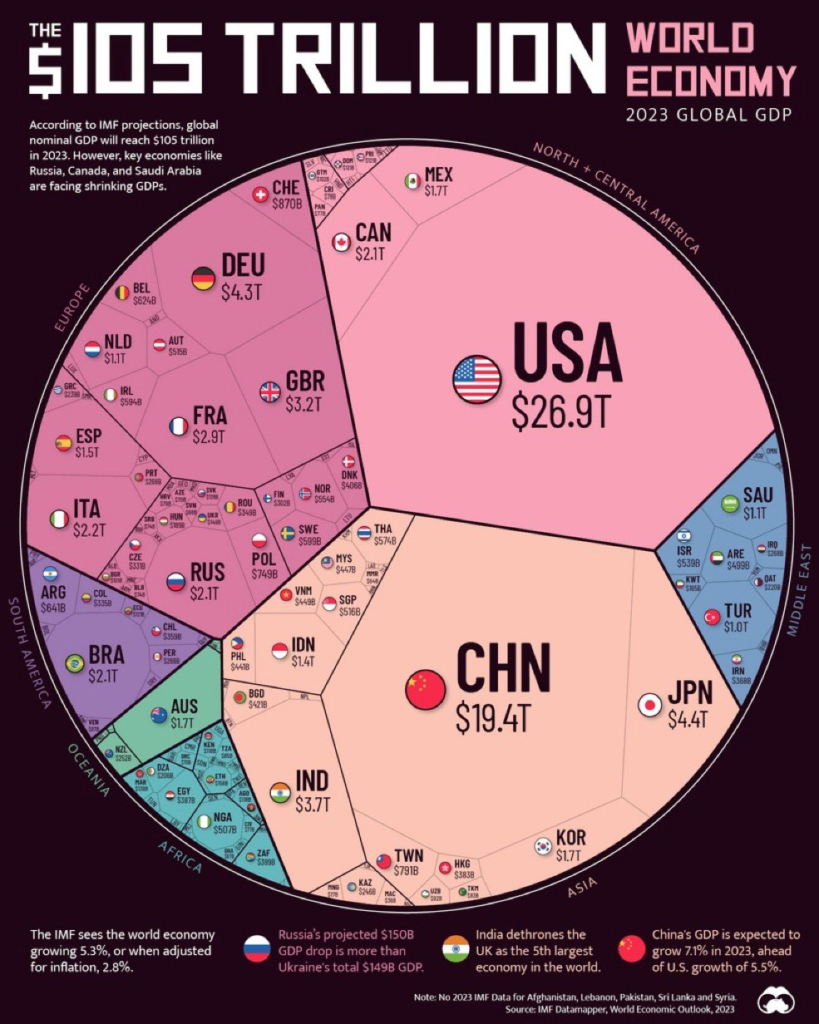

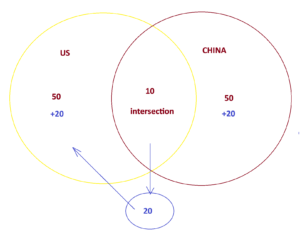

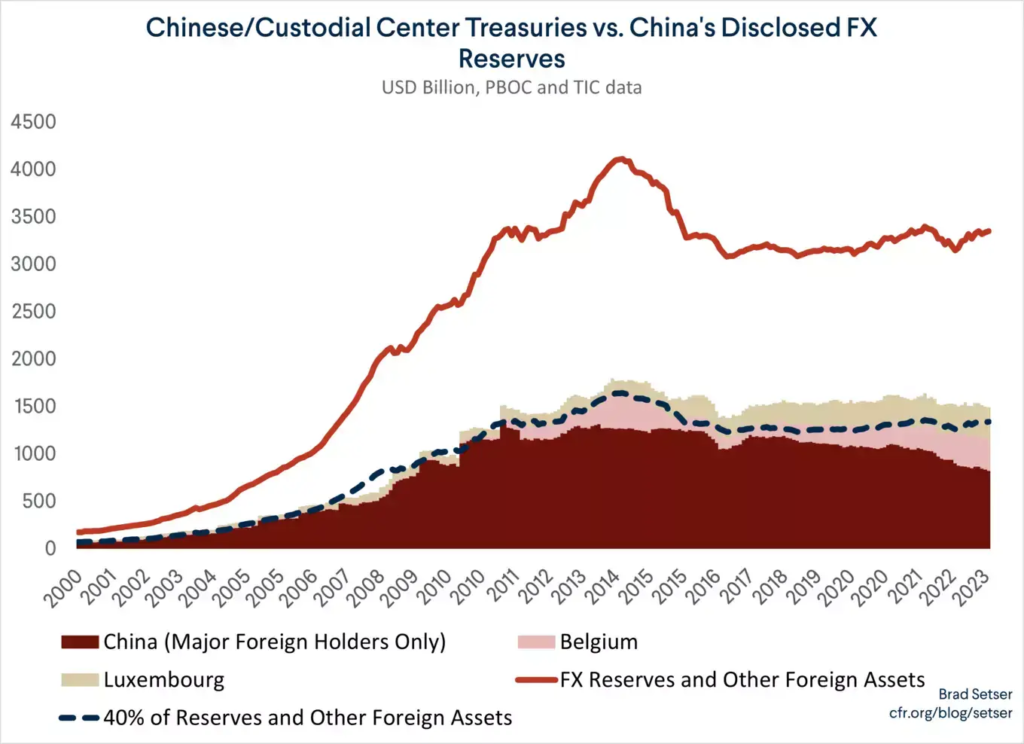

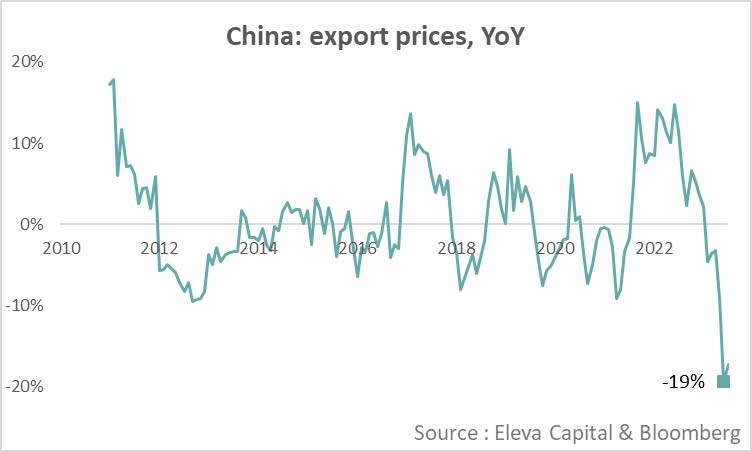

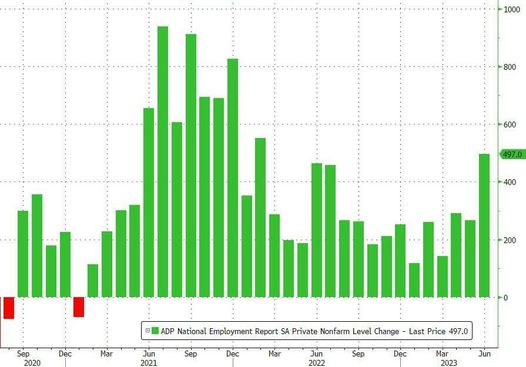

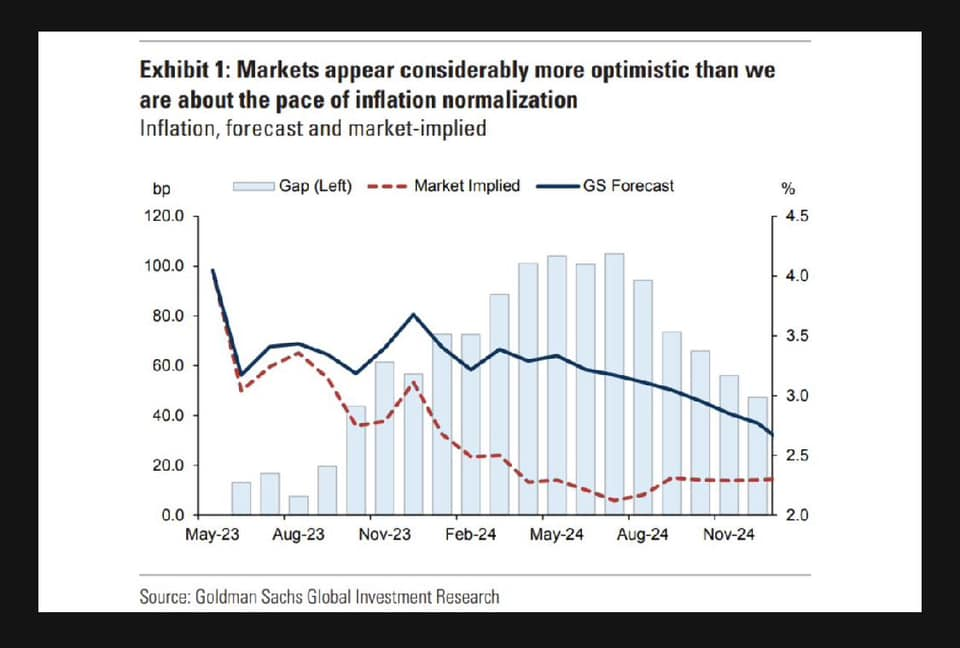

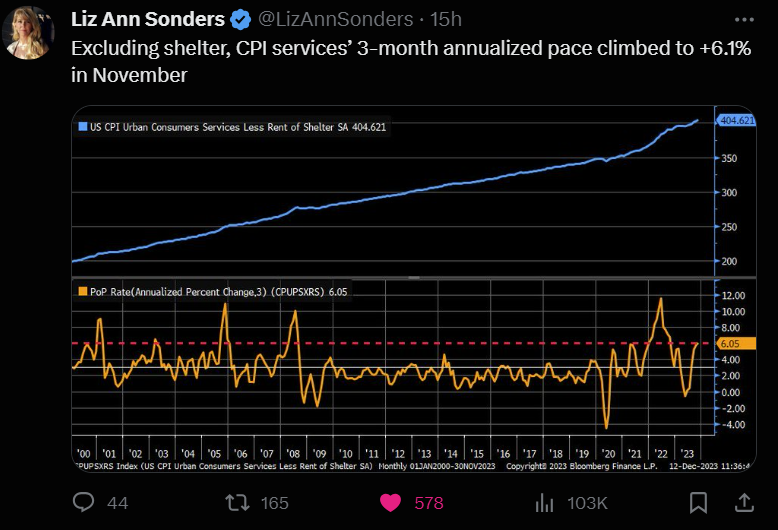

In our thesis last month, we anticipated a rebound in inflation growth within the next six months, especially as the USD is expected to lose value against the majority of other currencies such as JPY, EUR, and CNY. The CPI services, which significantly influences Fed policy, are showing a strong rebound. Coupled with spectacular Cyber Monday sales, this indicates that the US economy is undeniably very robust. The substantial amount of liquidity still aligns with our thesis since the beginning of the year, suggesting that the concept of “Higher For Longer” (H4L) should take more time than initially anticipated by many.

Based on my experience, I typically observe that tightening measures usually started taking effect with a front running and continuous deleveraging process. However, when the economy remains robust and liquidity is abundant, there comes a point where strong investors and fundamentally sound companies opt to compete in raising their asset prices instead. This phenomenon is quite noteworthy. In certain scenarios, perhaps in this case, assets could instead be appreciating at a faster rate than before.

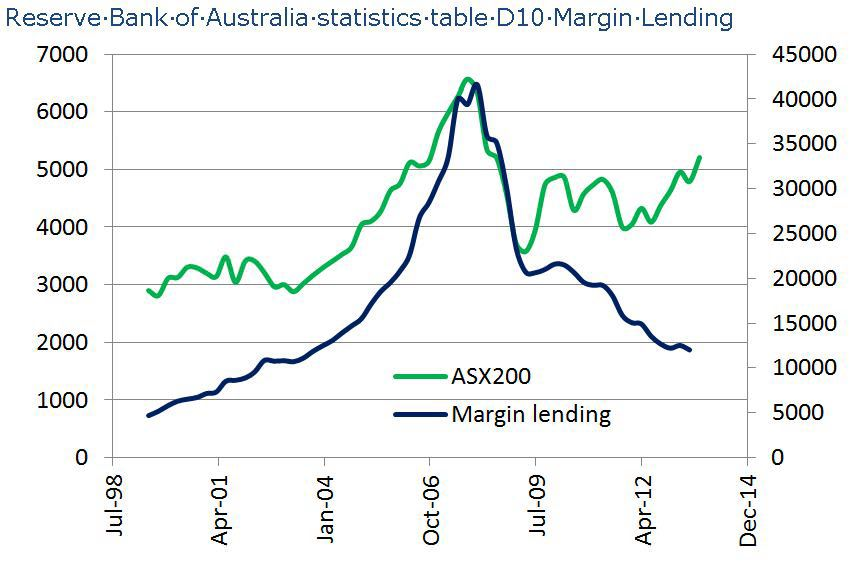

Let’s have a look an example in 2009:

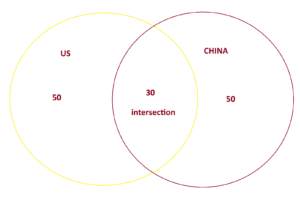

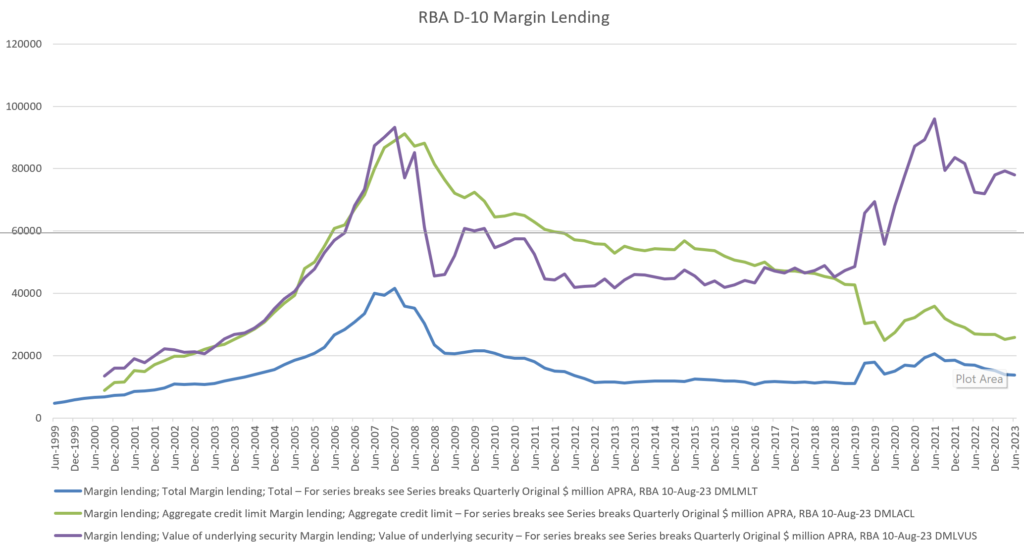

- When the margin lending condition does not favour (either due to a high rate or a perceived risk to investors), the amount of margin lending continues to decrease.

- However, a lower margin lending amount, after taking some time, actually then boosts the index price faster, the flare, as demonstrated below. This is the main idea.

- I have observed similar phenomenon many times with other assets.

I might debate this due to:

- A healthier financial situation, in which the amount of lending risk has actually been decreasing.

- Investors are now demanding higher investment returns.

- An ideal situation for the money maker to drive asset prices higher with much fewer weak hands involved.

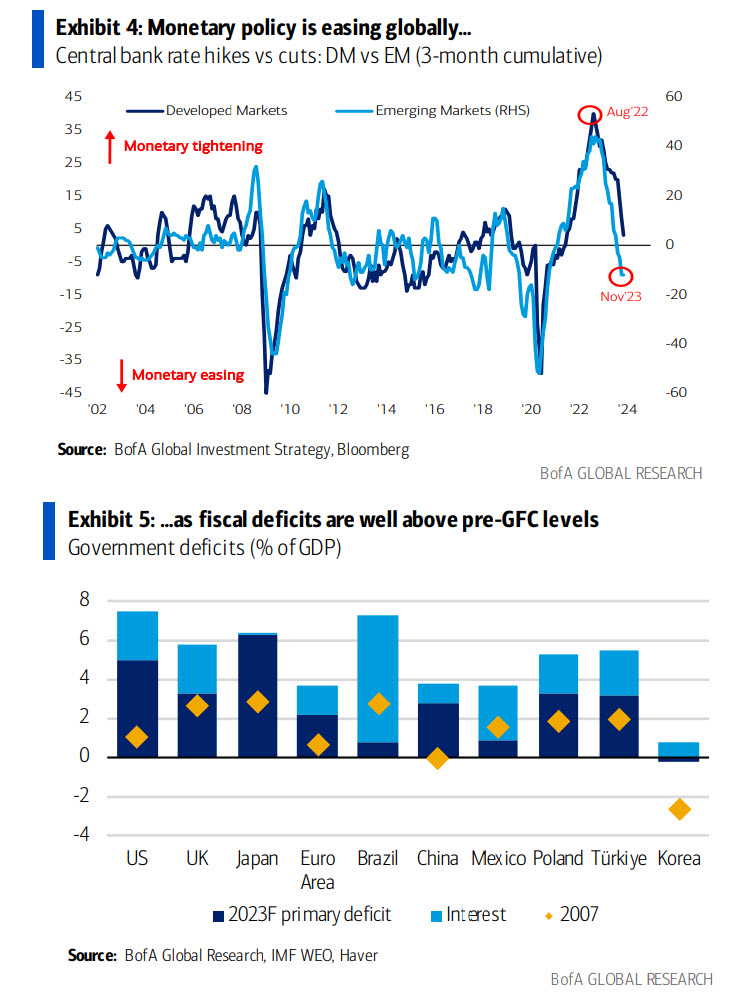

I understand there was quantitative easing (QE) after 2009, but there’s always a kind of QE-like situation, e.g. the current fiscal deficit and hefty liquidity conditions. Also, the Fed could always stimulate market pricing with promises, preventing market excessive caution in maintaining a sideline cash position.

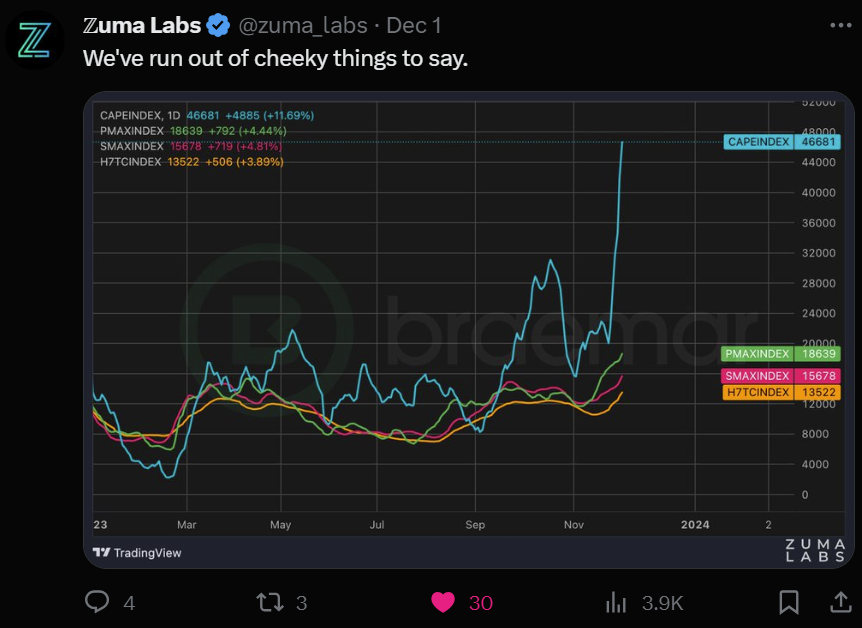

Of course, in our theory, this is applied to fundamentally sound investment vehicles only, where investors are more sophisticated. Now lets have a look at current situation and apply similar after 18 months of tightening period, will we see the flare/blow-off? The recent D-10 below is actually showing an increasing value underlying versus total margin lending. Funds are actually still moving toward safety, which is healthier. This supports our confidence in the economy and the ability of the market to drive their asset prices much higher.

In early October, within reasoning above, we took an opposite approach than the market, maximizing our margin lending in the hope that the substantial difference in value will capitalize, with much less concern about much higher cost of lending that we have to pay. For instance, we may observe that margin lending in Australia is currently ranging between 8-12% per year, quite significant increase from last year. Of course, this is not an easy thesis that we can apply to just anything without proper study and risk management.

When the risk, due to a higher rate, is clearly on the rise, and the asset price is increasing much faster, I agree that this is not an ideal situation to leverage, the high cost investment will become much riskier. However, our focus on the flare/blow-off phenomena thesis revolves around identifying which assets, when to start, and when they will end. In our thesis, the end might occur when the growth of the asset return has peaked to satisfy investor return expectations, typically marked by:

- Lower EBITDA/margin.

- Lower dividends.

In our observations, I have often raised my eyebrows, questioning why market funds remain very pessimistic about the liquidity and fundamental conditions of both managed and market funds and the economy. Are they genuinely knowledgeable about current numbers? Could this be an opportunity for me to take a position against the market? Of course, they have the power to exert downward pressure on the index. However, my optimistic confidence always increases whenever Treasury and the Fed are on my side.

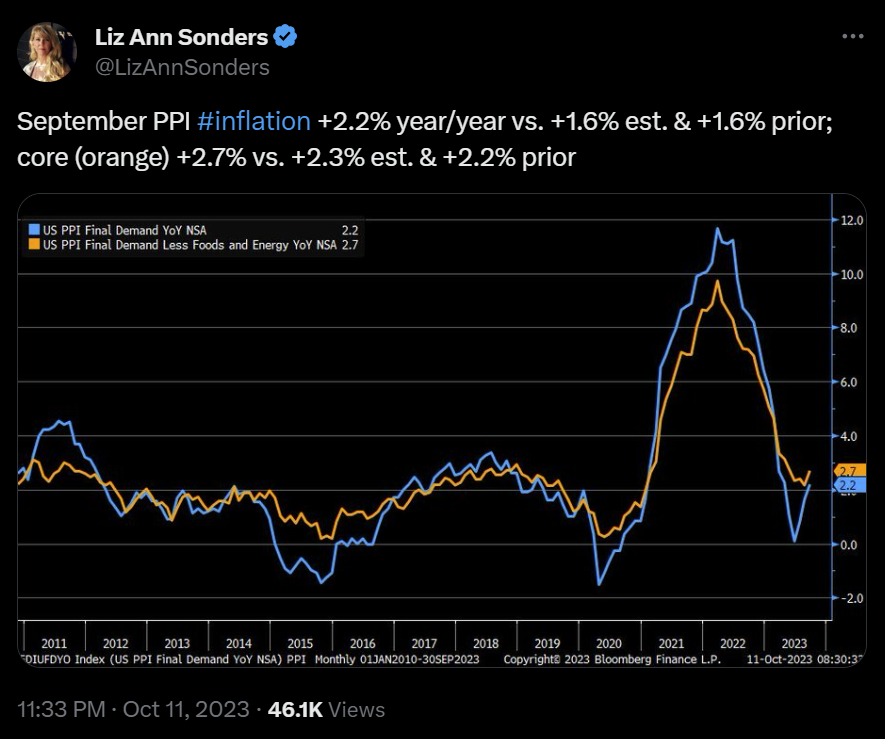

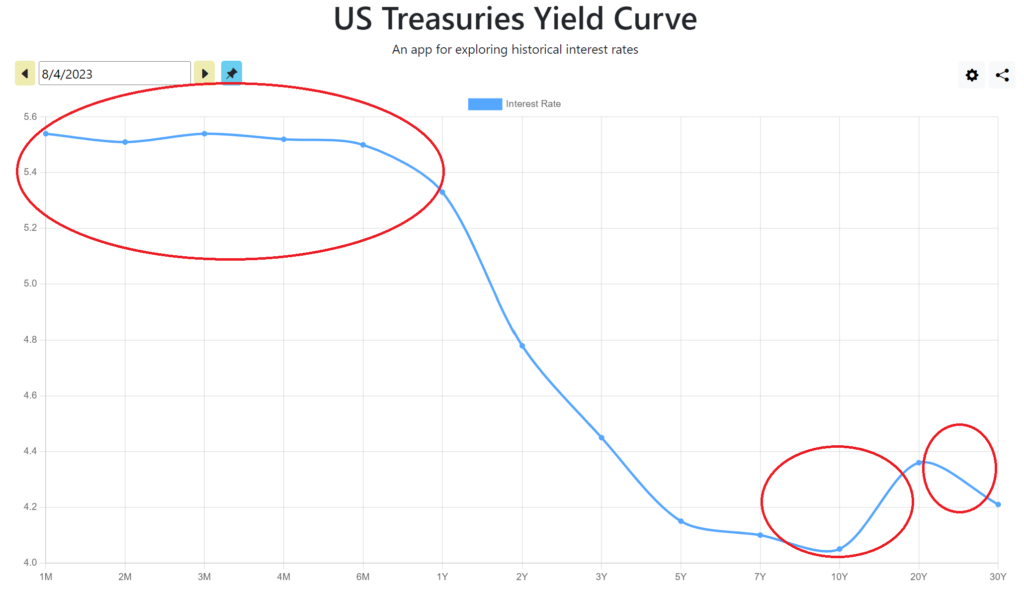

One notable aspect that is reaching an extreme in all of our theses is yields. The US economy and employment remain strong, and in addition to that, monetary and fiscal policy is still very supportive. Logically and typically, this should translate into higher yields for a longer duration.

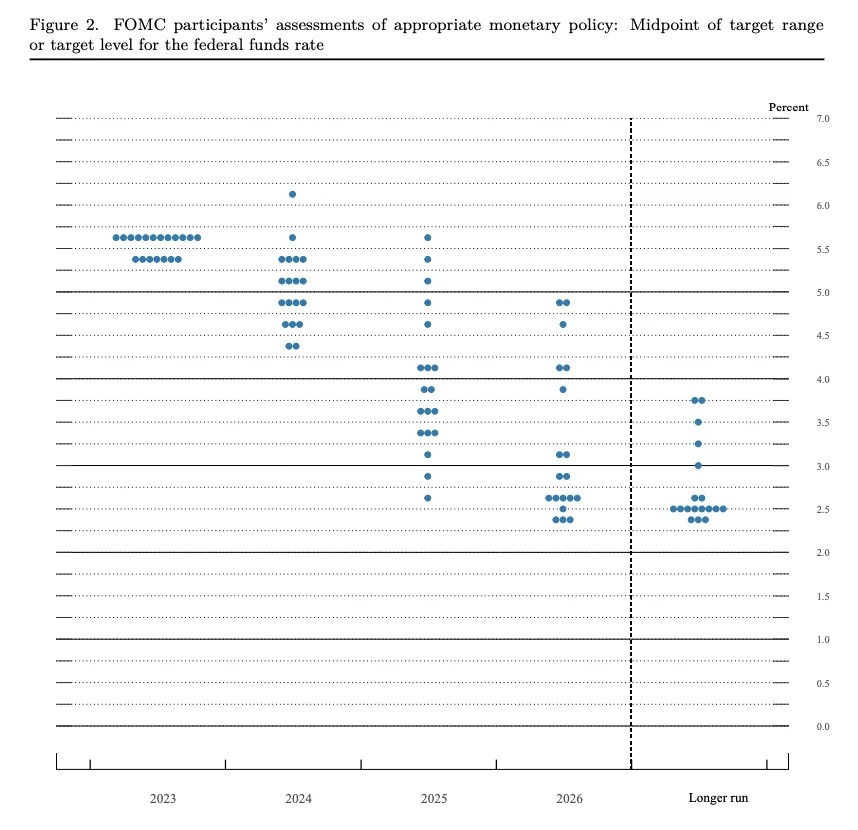

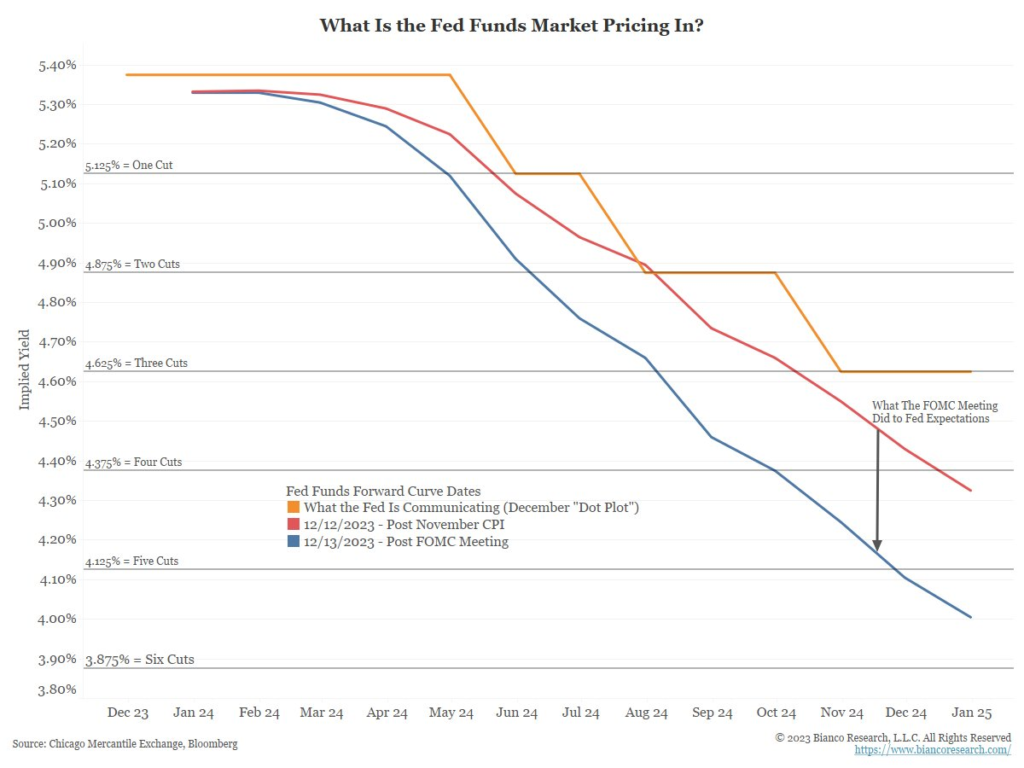

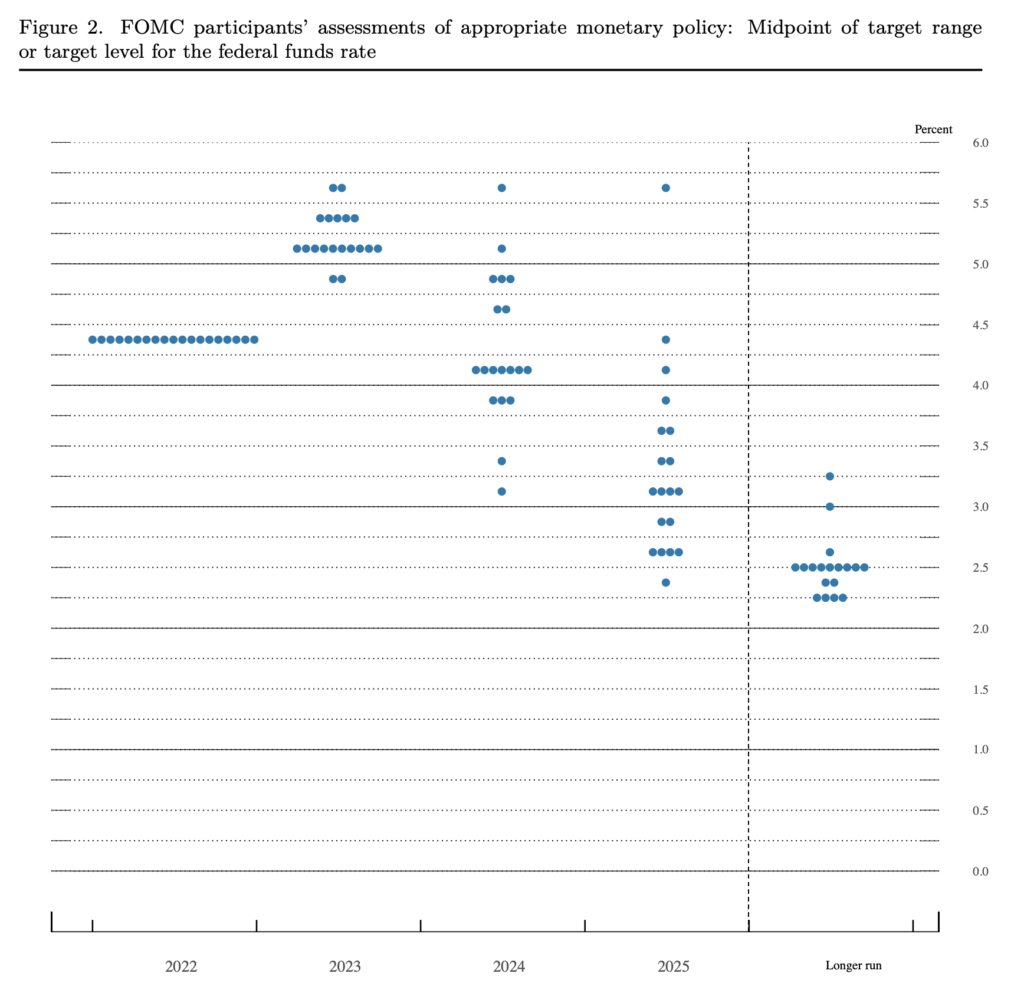

However during the last FOMC meeting, the Fed rapidly changed their dot-plot and joined the flare and bandwagon of treasury easing. The market is now expecting more than six rate cuts in 2024, bringing it down to around 4%. This represents a very significant change. As a result, yields across the board are falling, including the 10-year yield which should remain elevated for the reasons described above. This raises the question of whether the Fed is overlooking the strength of the economy or if they are telegraphing the depth of the next year’s recession or a potential hard landing. This development has contributed to our DXY moving closer to our target.

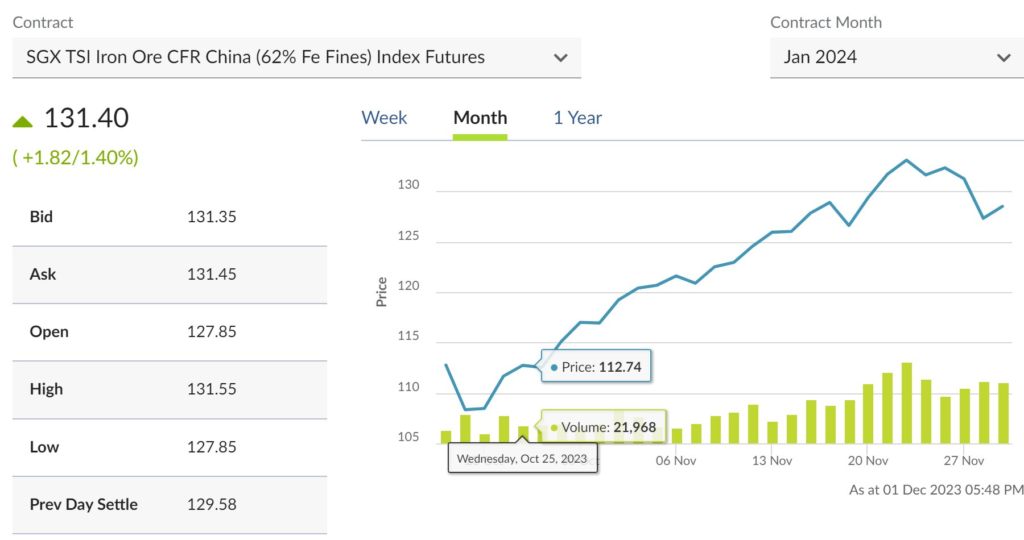

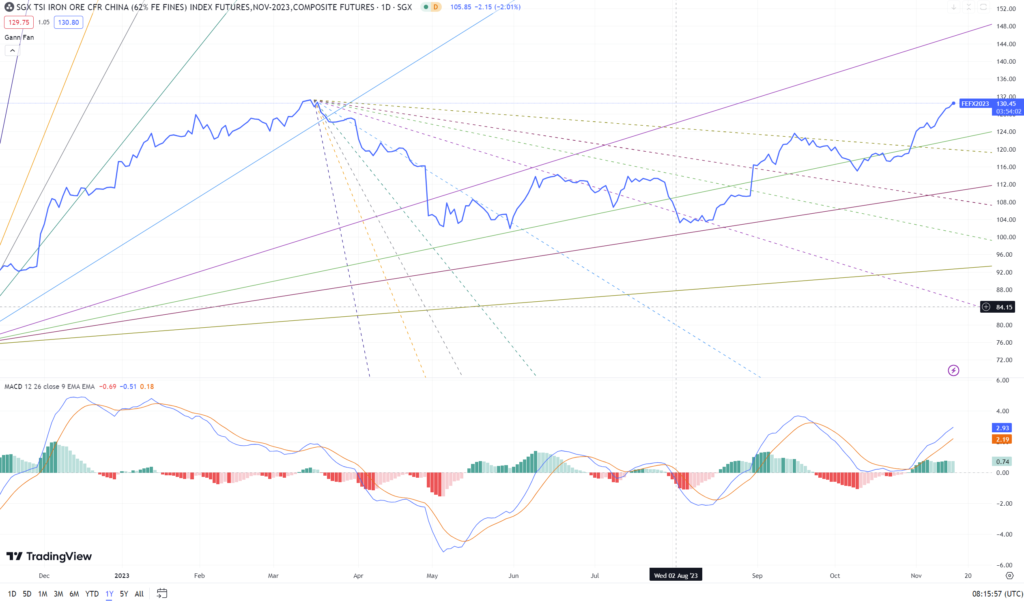

There hasn’t been much change in our strategy since early October, and we anticipate a positive Christmas and flare/blow-off rally. We prefer to stick with our dormant strategy since October 2023, as sometimes the best approach is to refrain from too much trading. Over the past three months, we have maintained a fully leveraged position in selected commodities, the BDI, and have consistently sought to accumulate any significant corrections within our selected “magnificent 7”.

It’s always a question of whether the flare rally would end up to be a hard, soft, or no landing. It’s beyond our control, because The Treasury and The Fed pilots are always able to change the plane course. Therefore for now, I’ll worry about that next year, and continue concentrating on the current fast flare-up/rally. As our saying goes, ‘Let tomorrow be tomorrow’s problem.’ Look at the birds of the air; they do not sow or reap or store away in barns, and yet our heavenly Father feeds them.

Since we barely made any changes to our strategy in the past 3 months, we’ll conclude with our favourite song, unchanged melody, to the open arms of the sea / limitless sky …

And time goes by so slowly

And time can do so much

And you are still mine.

To the sea, to the sea

To the open arms of the sea, …

Last but not the least, all we can do now is a lot of pray, God speed Your love to me.

Please note that all ideas expressed in this blog and website are solely my personal opinions and should not be considered as financial advice.