In September 2024, I decided to start making a major overhaul of my investment strategy and outlook. Our Heavenly Father gave me two powerful pieces of music and song.

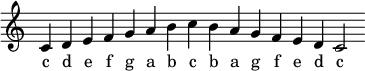

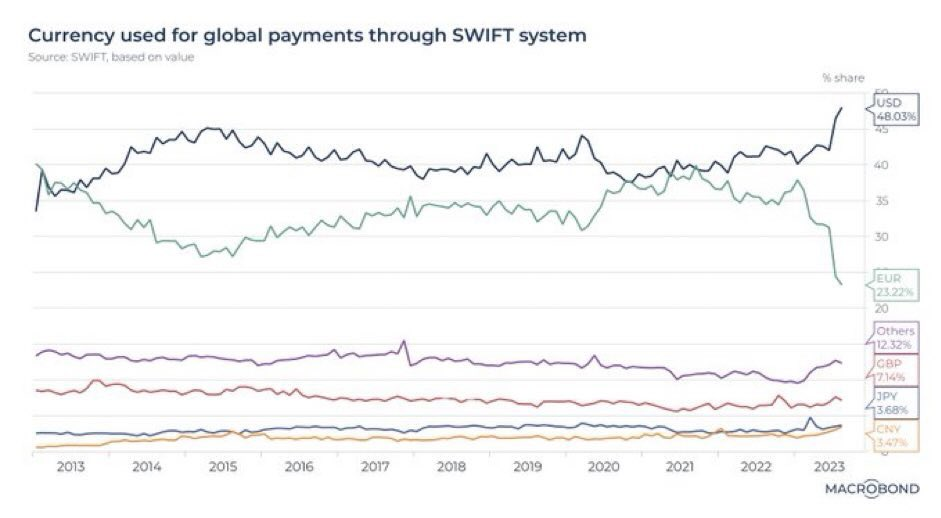

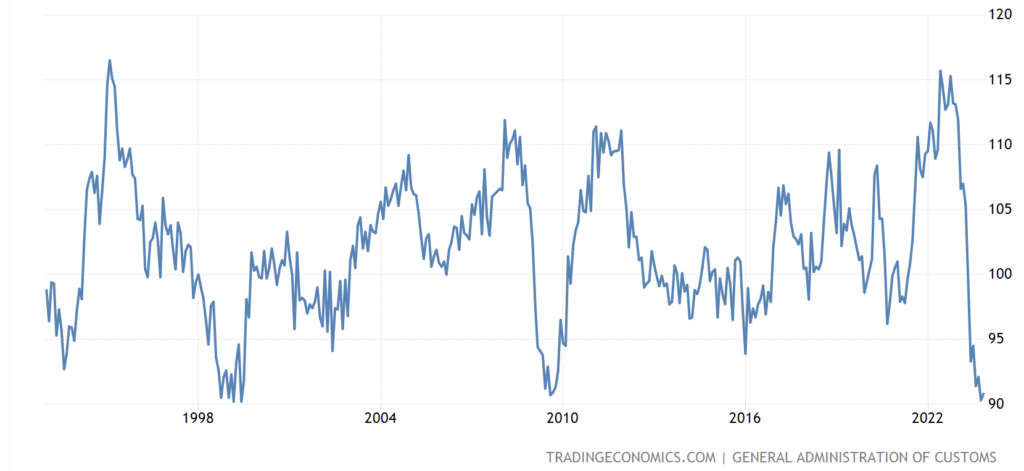

The first was the one I referenced in my “Whiter Shade of Pale” article. It’s a very famous song, deeply ingrained in my mind for decades since I was very young. The magic of this music, for me, lies in the simplicity of its C-major scale—moving from C to C and back again—symbolizing the major global investment shift I foresee that time. The song also tells a story about a time when I still believed that the EUR/USD exchange rate could hold steady, despite the very negative views prevailing at the time. Investors were anticipating a stronger USD, broken European systems, deteriorating economic indicators, and a parity target for Q4. My view, although delayed by a few months, was ultimately proven to be correct, despite massive EUR printing and not US.

After Japan reached its debt capacity, I believed Germany still had a relatively large debt-to-GDP ratio of 60%, compared to other major European countries and the US, which had a ratio of 120%. The music, with its haunting tones, conveyed to me the nuances of a dying corporate structure in the financial markets, even back in those days—”her face at first just ghostly, and then turned a whiter shade of pale.“

The second piece of music that inspired me most during that time was Vivaldi’s L’Inferno. I’ve mentioned many times and consistently shared its basic views since.

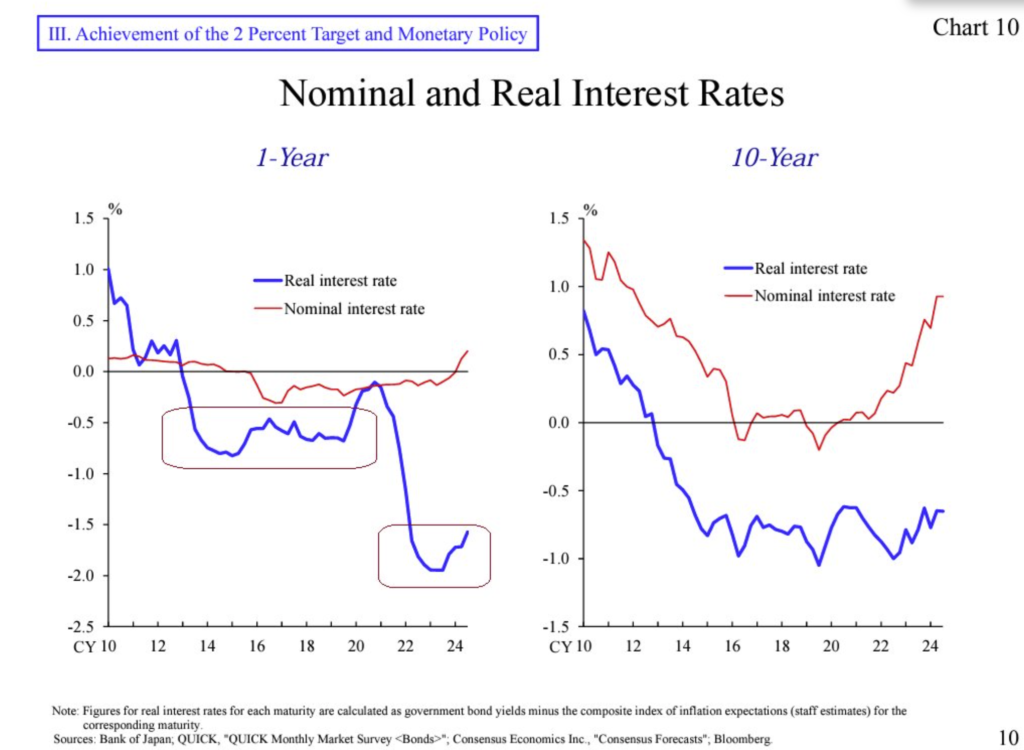

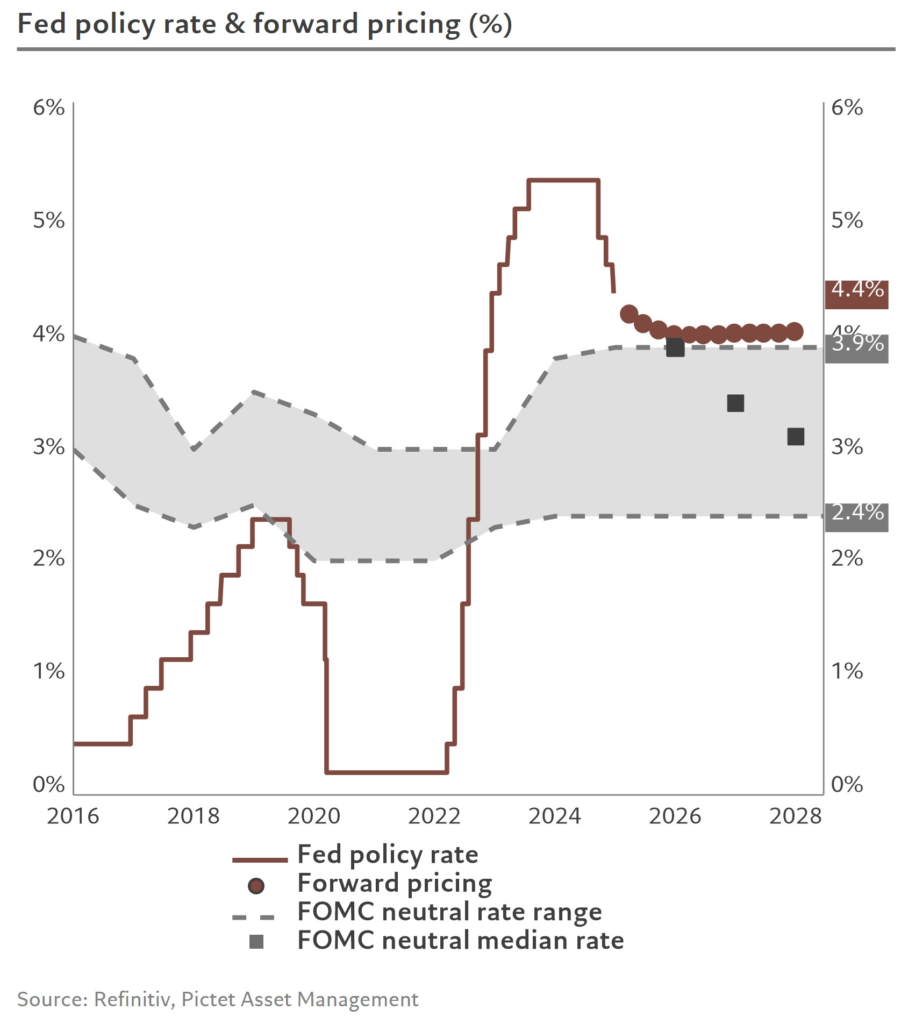

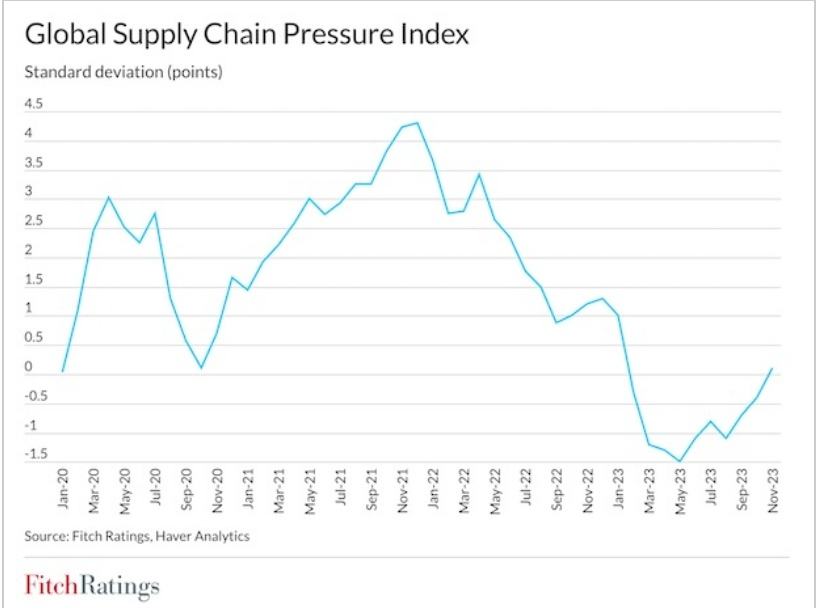

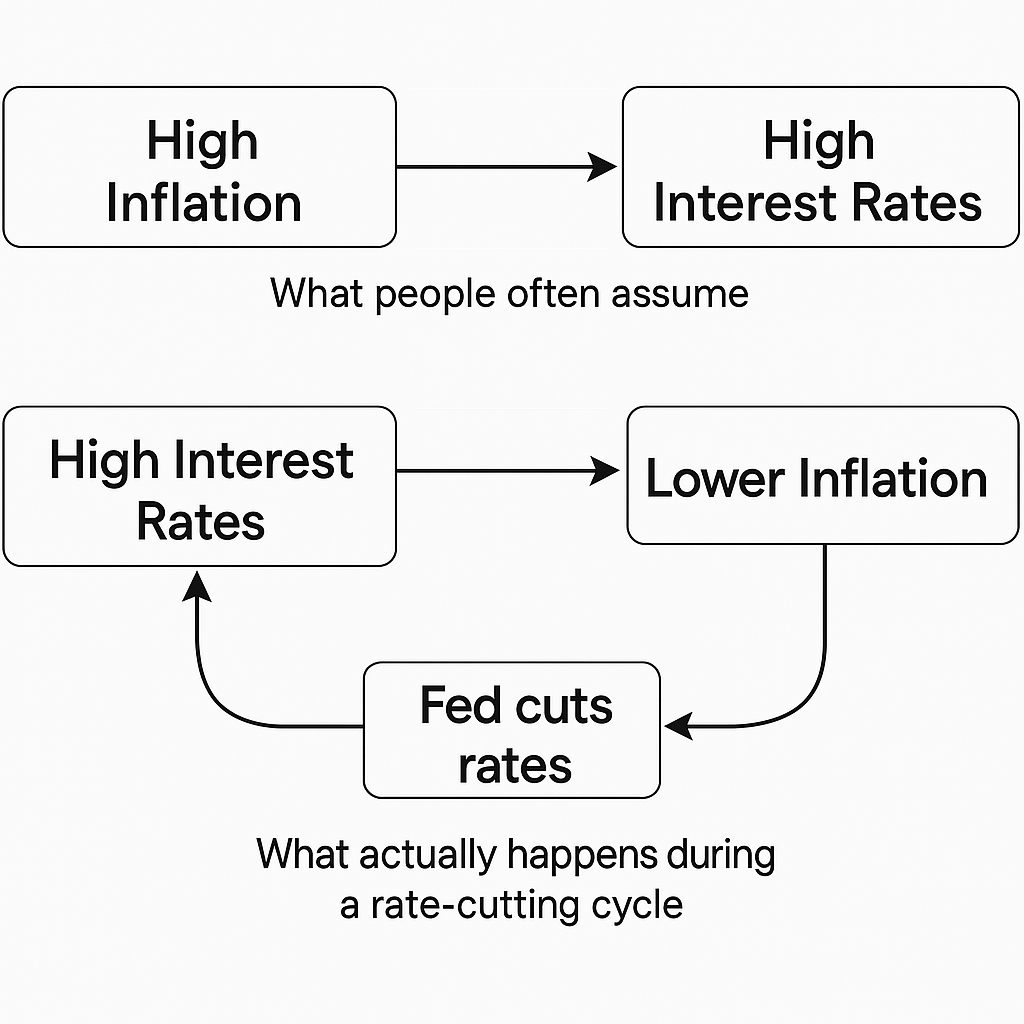

In October 2024, I posted: “For some reason, rates may not go down more than 2% (no ZIRP) to warm/fire the coldest de/disinflation winter; therefore, we are stamping our feet in rhythm to stay warm, until we die.” Based on my calculations, I didn’t believe the Fed’s rate cuts could easily go lower than 2% from 5.5%, or below 3.5%. This would mean we would experience a very cold, shivering disinflation (restrictive) winter, despite market expectations that inflation would remain high or even rebound. I couldn’t understand the market’s perspective at that time because, obviously, inflation was very high and in my numbers, very high likely to continue its decline over long months or years due to NOT related to the inflation itself, but due to mainly sticky high rate, thing that markets may mistakenly understand until today. I also didn’t understand why the market did recognize that the Fed was being very loose, while my view remains consistently restrictive or better said moderately restrictive. I repeatedly suggest looking at real businesses and customers rather than focusing solely on the less dirty shirt official numbers and policies, as these have widely long used, especially in EM, to led many economists to become delusional to read real issue from the consumers side.

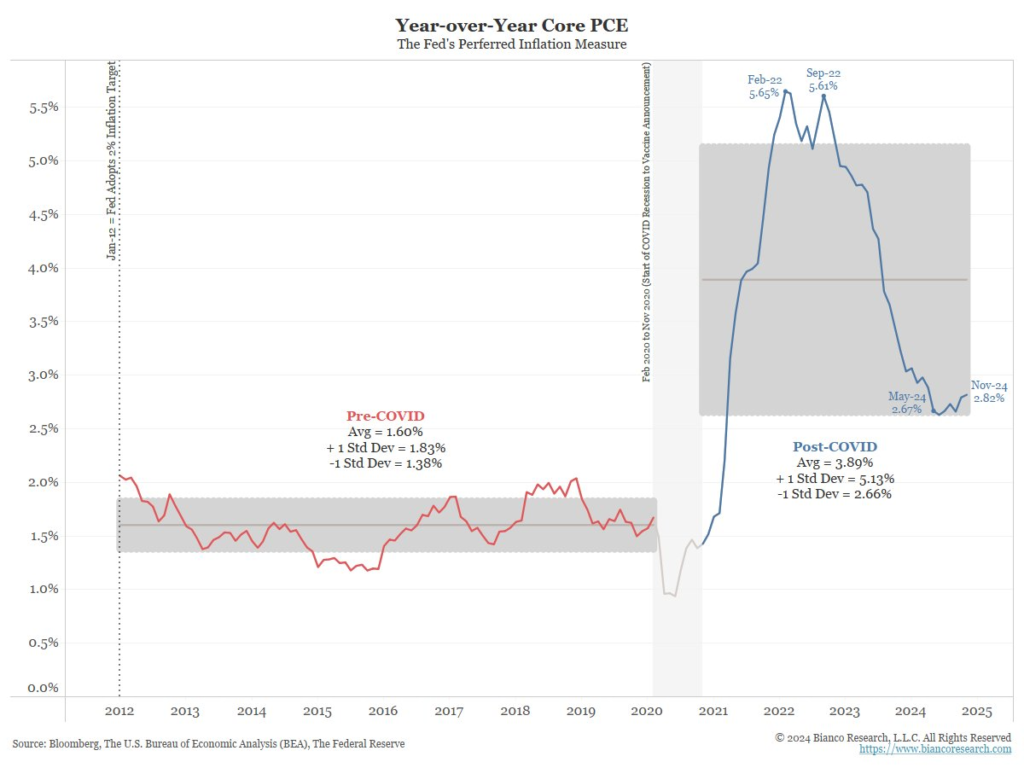

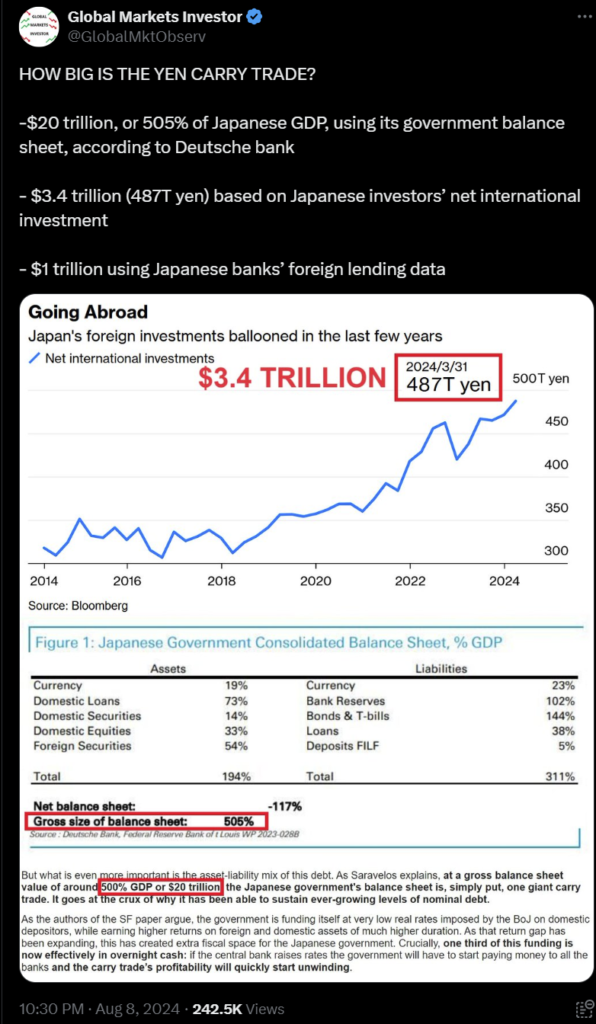

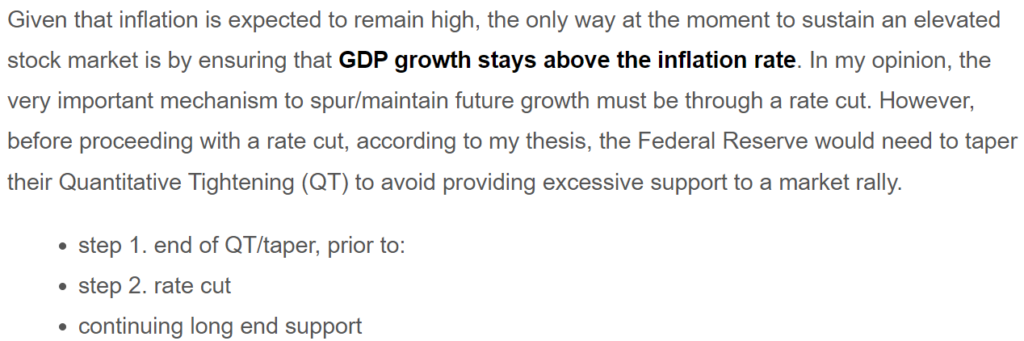

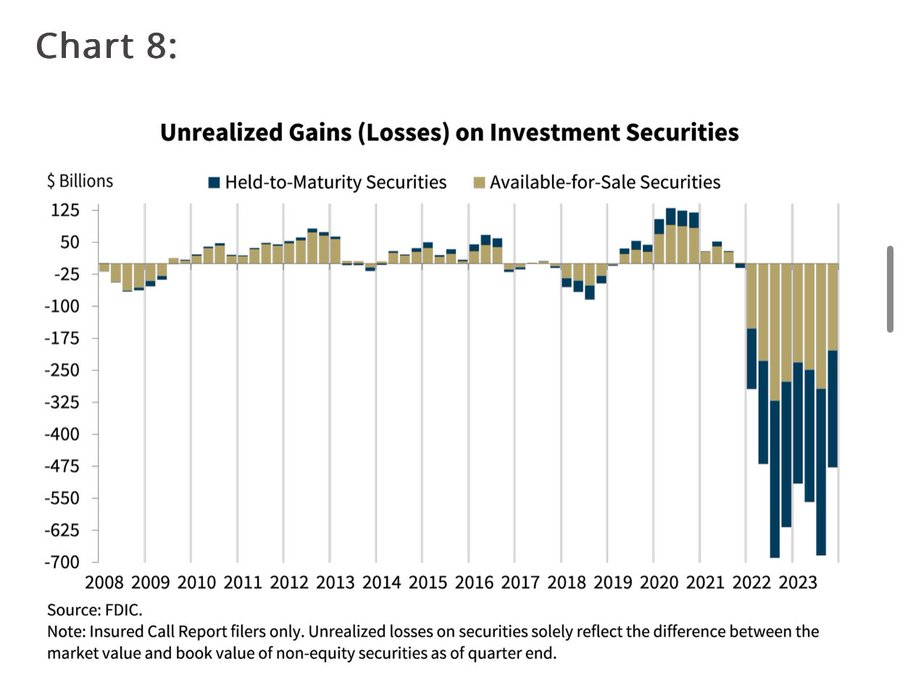

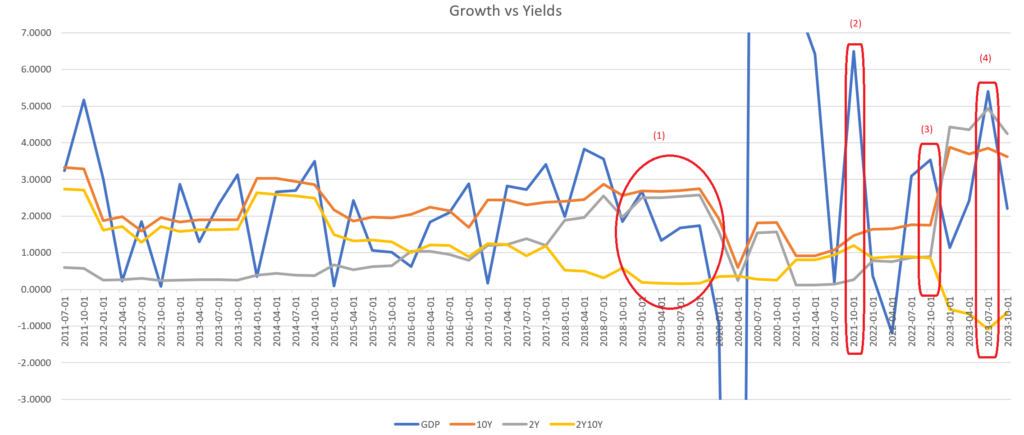

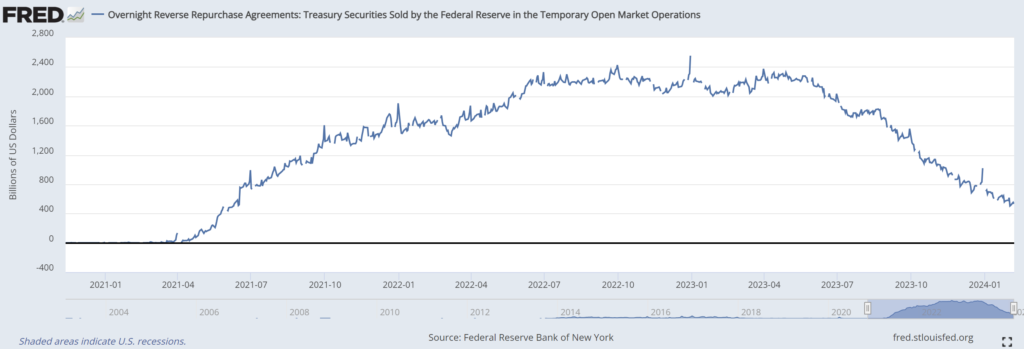

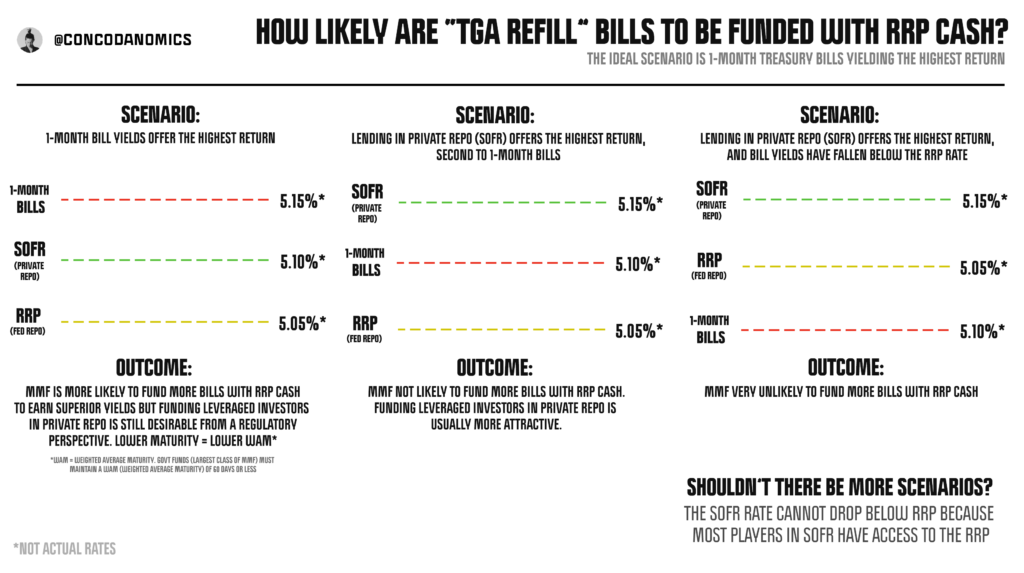

The reasoning behind persistently high rates is complex, but the most important aspect—forming the basis of my broader and my main idea of the Paradox thesis—is that the Fed will be unable to cut rates deeply because deep cuts is going to paradoxically absorb large amount of not so much left over undeployed short term liquidity. Again, in my view, this is not due to sticky inflation, but rather for the sake of financial liquidity stability, and in my thesis, this issue is mostly due to fiscal bailout during high inflation in 2022, which I will explain down below. Yes, I agree that inflation will be sticky high. In fact, based on my 2023 calculations, I think inflation should remain around 2.6% for a very long time. But that’s not the main point. This is the most critical aspect of the thesis and explains why markets will continue to misinterpret the bigger picture. Markets keep relying on economic literature solely to justify high rates based on sticky high inflation and that’s where they are wrong, while my principle uses a monetary perspective to justify the necessity of high rate to avoid short term liquidity shortening, in which from the monetary point of view is historically working much better, and also to explain the fiscal bailout in 2022.

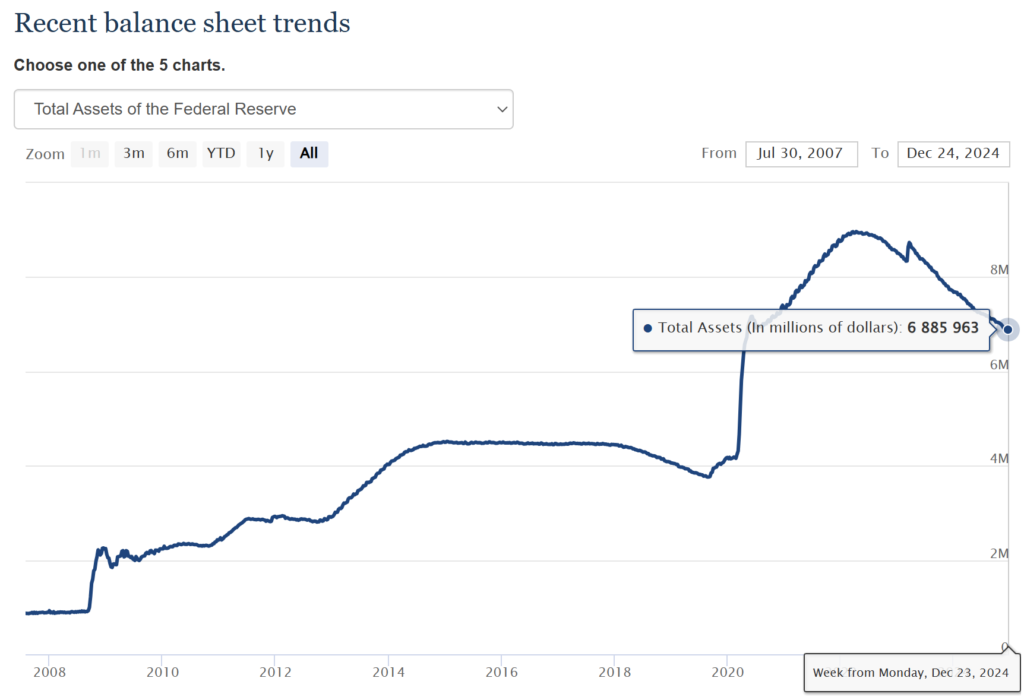

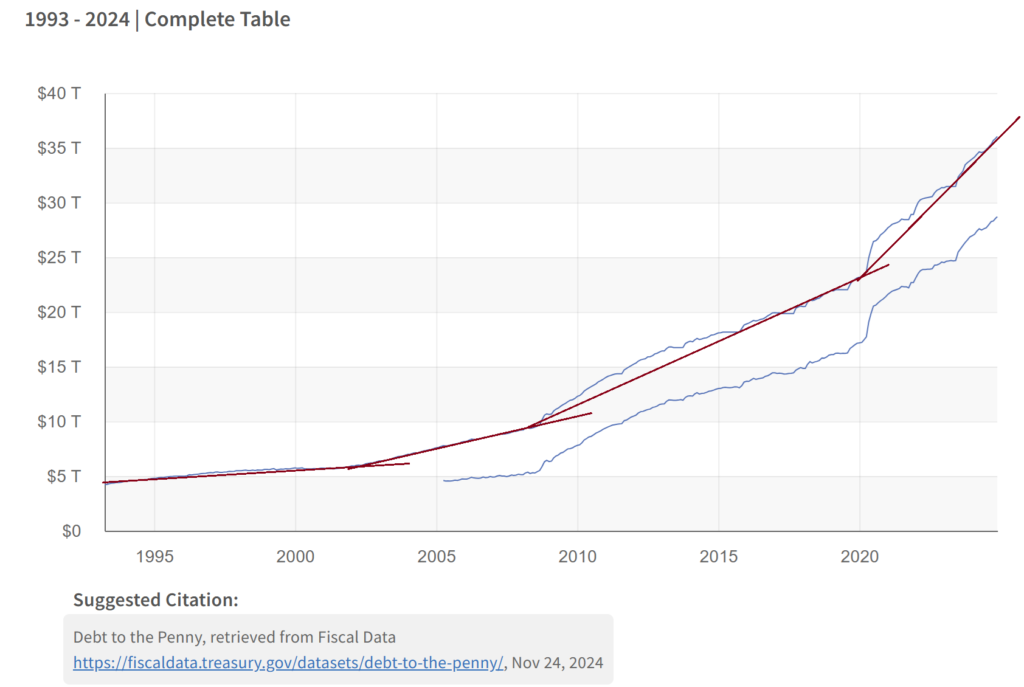

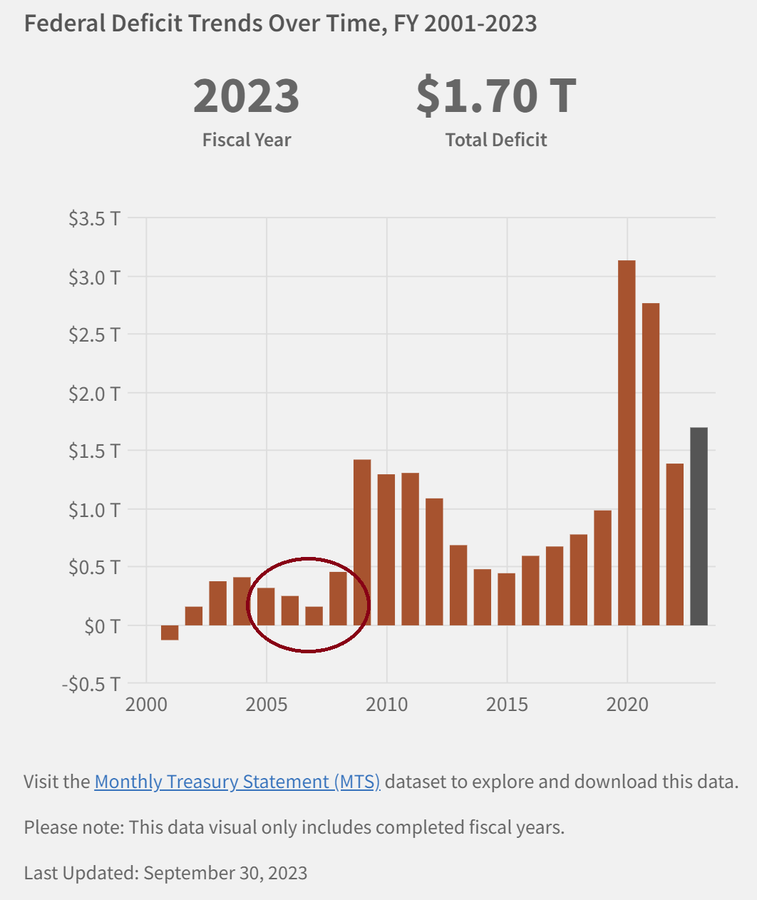

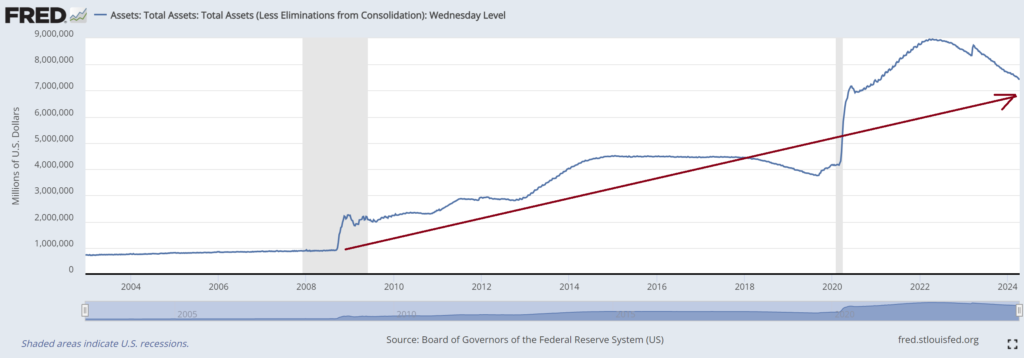

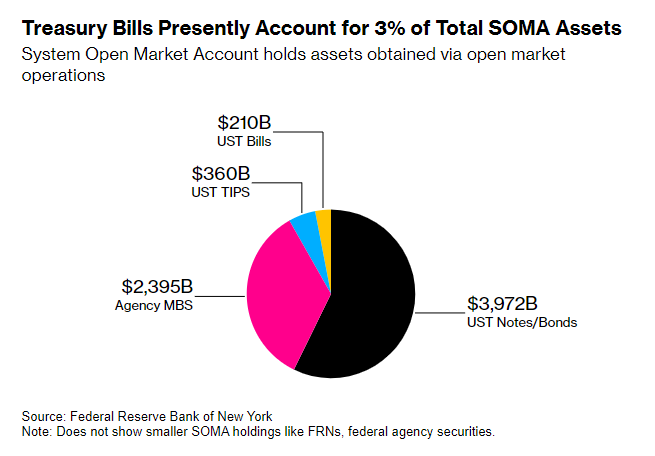

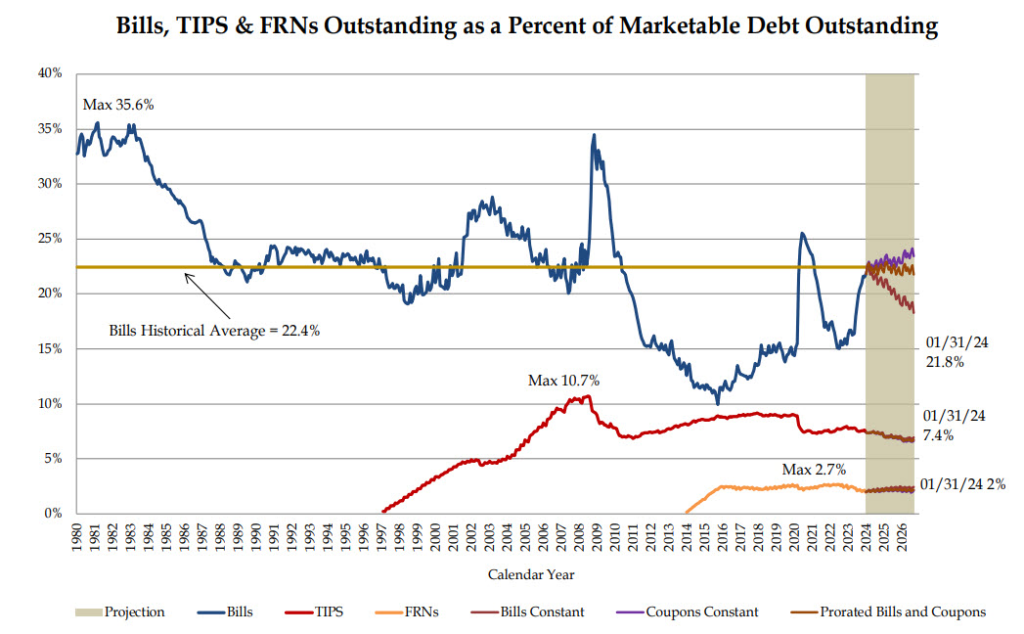

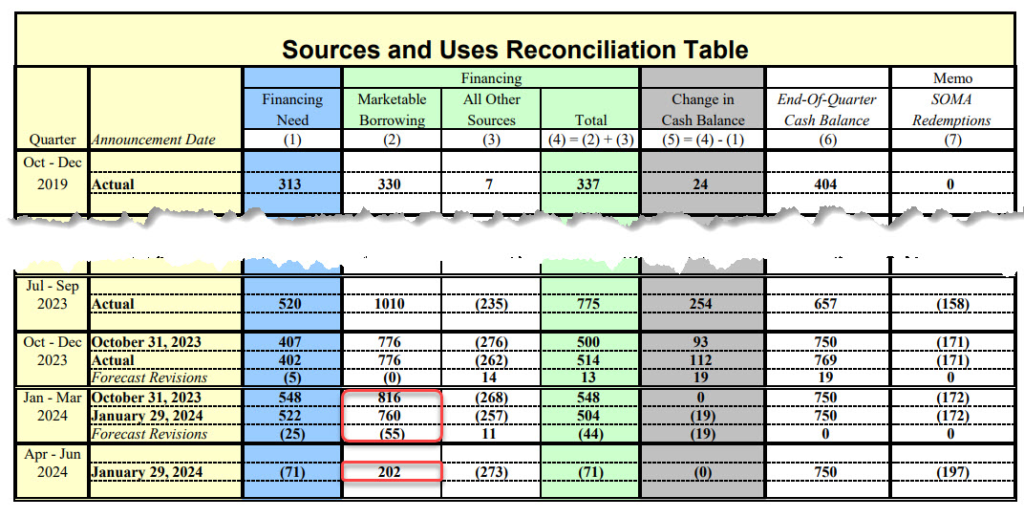

In 2022, the equilibrium of the financial system was corrupted. The financial system has long operated like a vehicle—requiring both a force (short term interests) and a brake (long term interests), yin and yang, expansion and correction/sanitation. However, due to the high inflation and rapid rate hikes at the time (due to excessive printing and expansion in 2020), policymakers removed/bailed out the braking mechanism (long-term profile) and bailed its pain out by shifting it into the force side via fiscal measures. Just look at the QRA, the Fed’s balance sheet, and their related policies. Yes I understand that Treasury should seek lowest cost available in the market, but that would also lead to more support to break the vehicle. The bailout can be explained with my delta theory from a few years back, where if funds are shifted into extremely short-term instruments, they become immune to high inflation, low inflation, and even deflation dynamics.

It’s obvious that avoiding the painful part of the cycle only postpones the problem—essentially kicking the can down the road. As a result, in 2023 and 2024, the system ran purely on force without brakes, leading to unsustainable fiscal debt and their interest payments dependency and the crazy run of the ‘Magnificent.’ This is the problem we face now, how to normalise the systems back?

We can’t just reintroduce the brake to equilibrium after deliberately avoiding the pain without another pain—it’s like a scene from Final Destination. I see only three possible solutions:

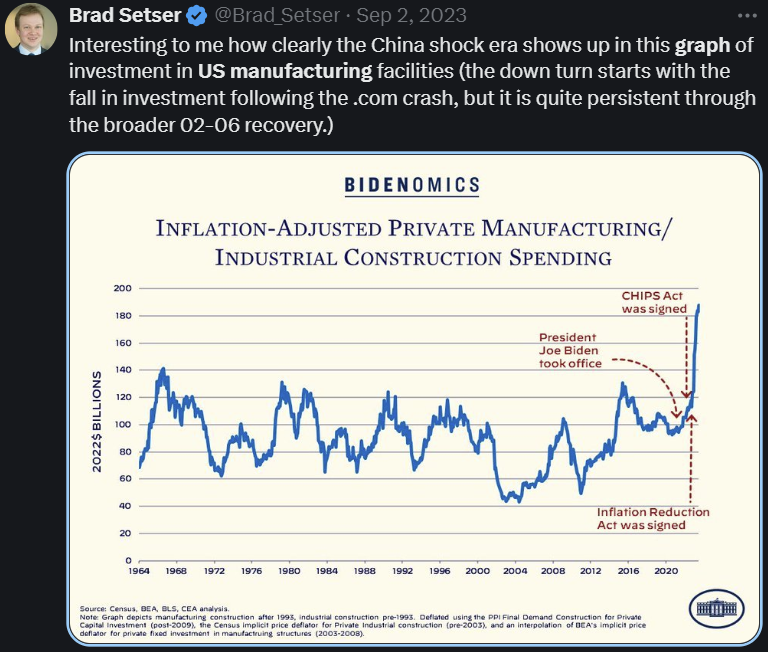

- A long-term approach of massive high-growth investments.

- A short-term approach of a massive bailout.

- Transferring the pain to another vehicle—most likely the ‘Magnificent.’

The first one is the best solution but it requires lots of hard work and time. The second one is the common solution to the crisis. Last but not the least, I really hope they don’t choose solely the last option because it would bring enormous pain to the Magnificent shareholders who jumped on this bandwagon since 2022 and still hold them at high price, because if they choose solely this solution, Magnificent may come back to 2022 or lower, which will drag down all other things into crisis. I think they may distribute among the three.

In my grand thesis, I have repeatedly referred to this as my two years of paradoxical winter inferno. In summary, this September thesis has been explaining well, the entire concept of real disinflation/lower growth, engineered sticky high financial inflation, and persistently high rates, based on liquidity dynamics above The rest of its strategy is just straightforward.

For me, it was clear: the rate would remain restrictive. Over the decades, the average return of US companies has been around 5%. In my view, if the Fed holds rates at 5%, it would likely result in 0% growth.

And this has proven to be true: to maintain financial liquidity stability, the central bank has found it difficult to bring rates below 4.3%. Be mindful of each word above—they carry significant meaning that markets consistently misunderstand. Surprisingly, if we re-read all central bank statements, they fully align with this, but readers keep interpret them incorrectly and showing disagreement with the central bank statements. The readers have simply misunderstood the statements and misinterpreted the situation.

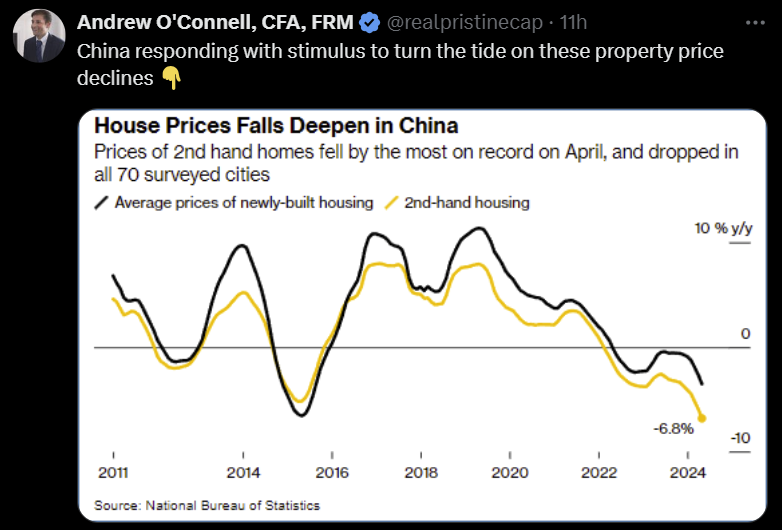

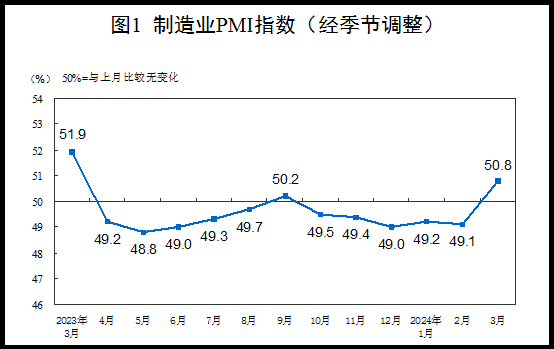

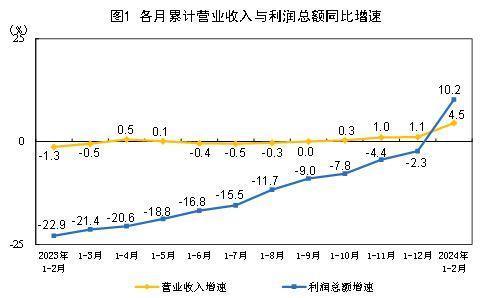

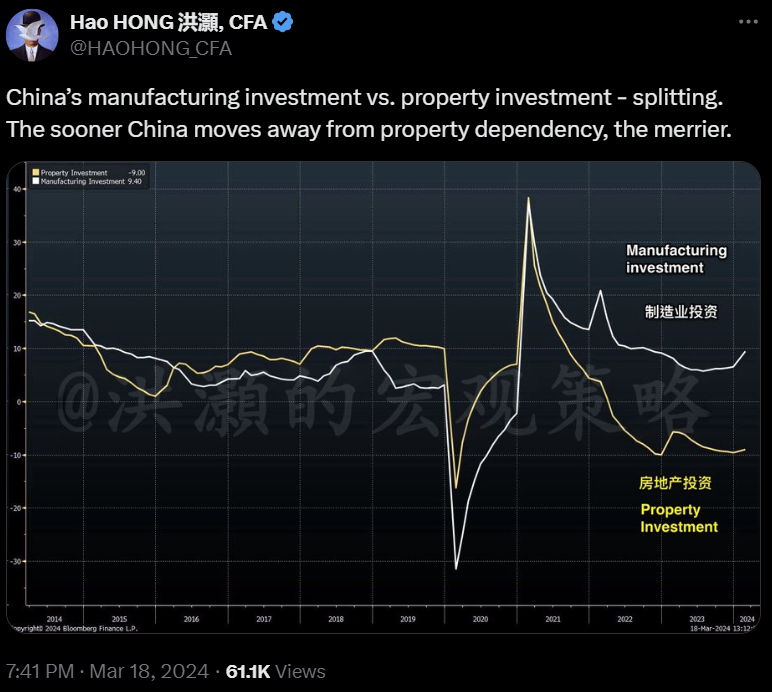

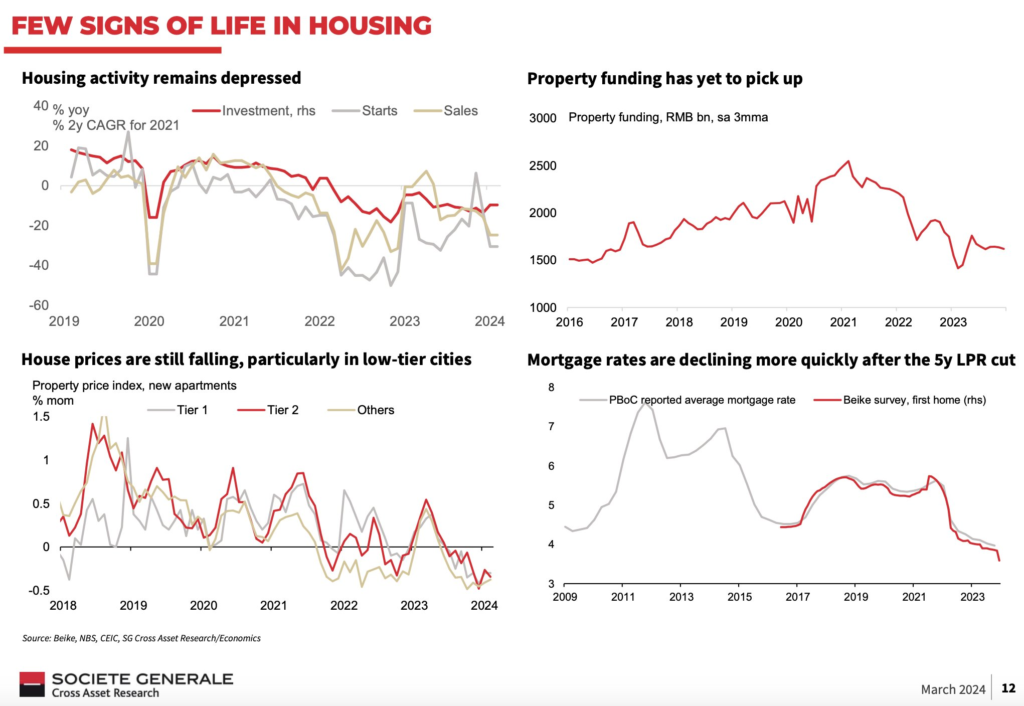

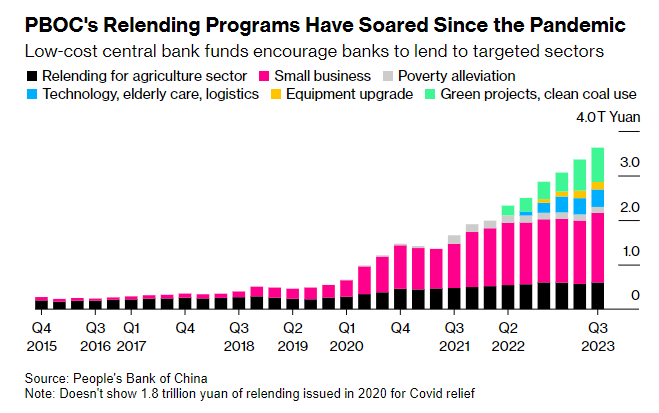

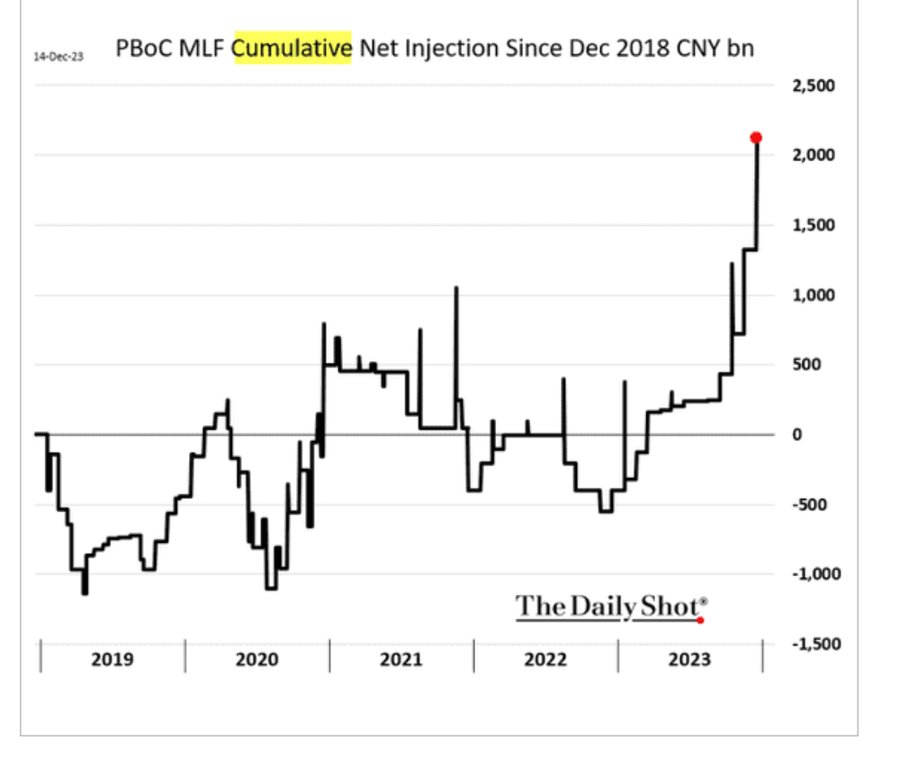

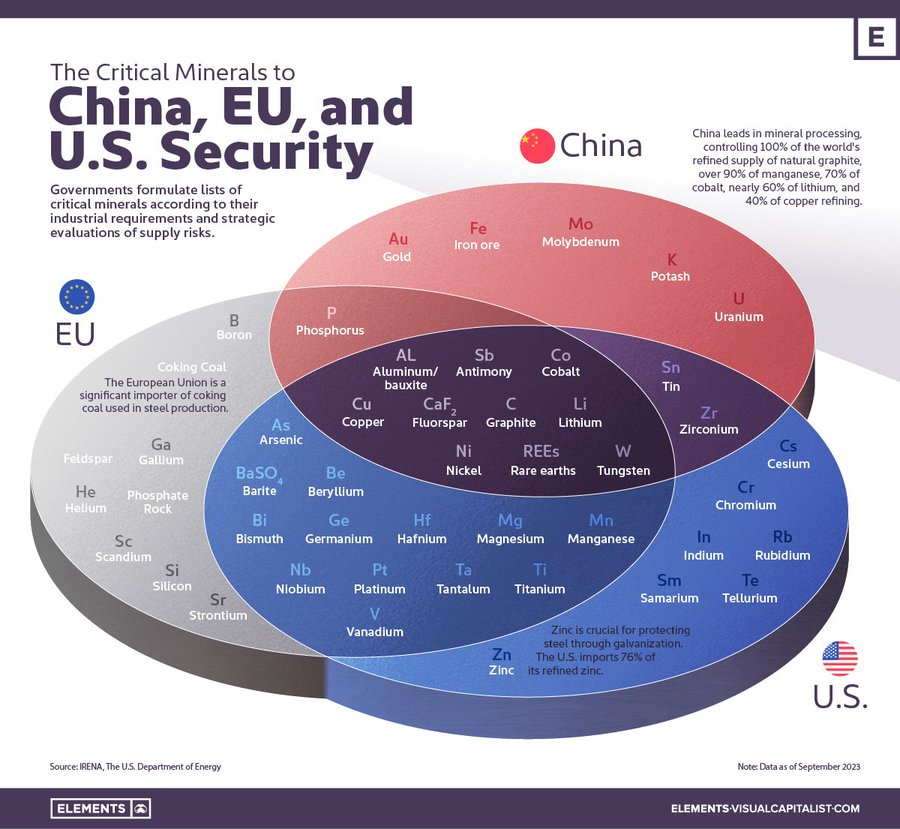

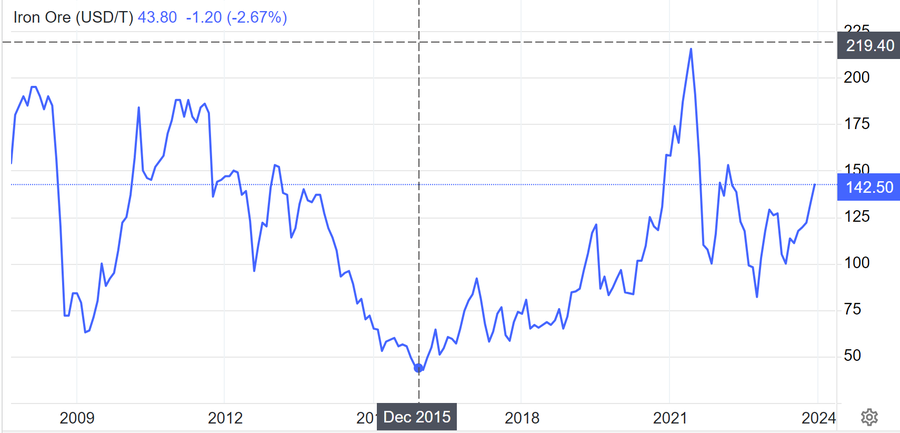

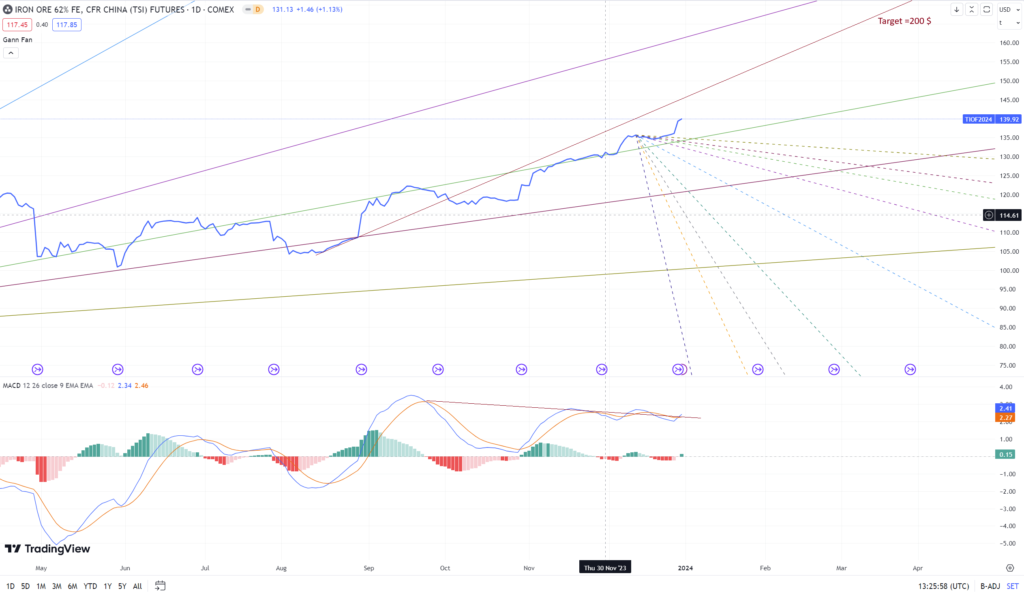

I further detailed the result of my computation, which indicated that this phase could last around 750 days, or roughly two years. In my expectation, after that, the winter inferno may pass. In my thesis, the easiest solution is a hard landing, but I leaned more towards the possibility of a FIGHT. We could then see China starting to take action, beginning in Q4, following by Europe in Q1, notice the fighting patterns? This would also lead to the application of my long-standing Emerging Market (EM) strategy and understanding, in which I believe China will continue to outperform since September.

I stuck to my China thesis, even as the markets grew skeptical after the small dips in November and December. I was determined to prove them wrong again—not just about their wrong China bullish stance in 2023 (while I was super bearish), but also their overly bearish stance in Q4 (while I’m super bullish) including their skepticism in November and December. Overall, everything remains on track and continues to align with my predictions. I simply raised a straightforward question: how long and how practical is their involvement in the EM markets? I bet many of them have neither experience nor exposure.

I normally make only a few changes per year and remain mostly stubborn with my thesis because I have numbers to support my reasoning. The decision, though made in September to November to exit them almost entirely with all of their high leverage and unable to capture the peak in January, is not disappointing to me because the market surged at the early of the year, only to obviously return to or drop below this October thesis call. It’s impossible to always catch the top, and in my experience, that’s unnecessary. The most important thing is the numbers or the reasoning behind the thesis, as that determines how aggressively we take on leverage, reduce it, or even go entirely to cash if necessary.

In July 2024, I disagreed with the bond call because I didn’t think the timing was right. In my view at that time, money was undergoing a value destruction phase, which would put pressure on bonds. However, in my January call, I finally decided to start the second act of my five-year grand strategy—switching from Act 1, “Into the Bill” in 2022/2023, to Act 2, “Into the Bond” from 2025 onward. In my view, this forms the backbone of my new financial defence. Regardless of whether growth can be revived or not, in my thesis, this act will be crucial in navigating future uncertainty. There’s a big reason why I chose Bond, because it will show development of my thesis above in real time until next year.

I don’t care much if this bond price is no longer moving up, but there’s a bigger story beyond just being right or wrong about bonds. I have strong conviction that bond movements this year and next will reveal the full picture—something the markets currently fail to grasp and are likely to misinterpret, including their inability to understand the essence of my thesis above and central bank statements. I can tell there are hidden messages that go beyond economic reasoning, and for that reason, we may need to re-read them very carefully, my advise, don’t just read them literally with economy literature lense.

My thesis above could also explain what will happen with real inflation, financial inflation, and growth. But first, what are real inflation and financial inflation?

Real inflation is almost impossible to measure—not only because different parts of the ecosystem carry different weights, but also because it is highly volatile and unsuitable as a financial stability benchmark or anchor. On the other hand, financial inflation has long been engineered and tailored to align with debt growth (spectrum of debt interests), making it far more stable. A clear example of this is Core PCE, which consistently moves the market—not because it is very accurate (as the market often misinterprets it) but because it is upheld as the anchor for the largest pools of liquidity. Whether one agrees with this number or not, the biggest liquidity always prevails, hence the well-known Wall Street saying: Don’t fight the biggest liquidity.

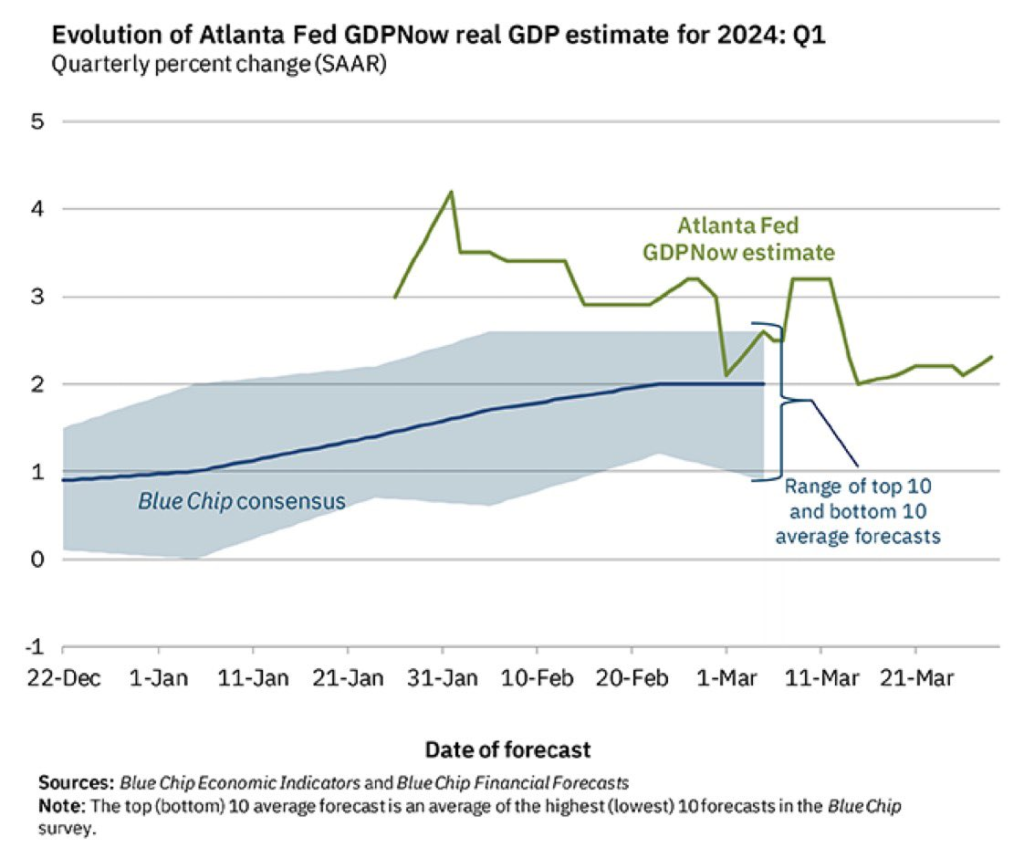

First, regarding growth: As I calculated six months ago, the maximum normal growth rate (without financial distortions) was 2%. The Fed has already cut rates by 1%, leaving only 1% remaining. Currently, the Fed rate is 4.5%, just 0.5% away from 5%. Therefore, in a rough estimate, growth may increase to 1.5-2% if the fed continues to cut the rate whenever possible. While we still have growth momentum, the two-year estimate would be around 1.5-2%.

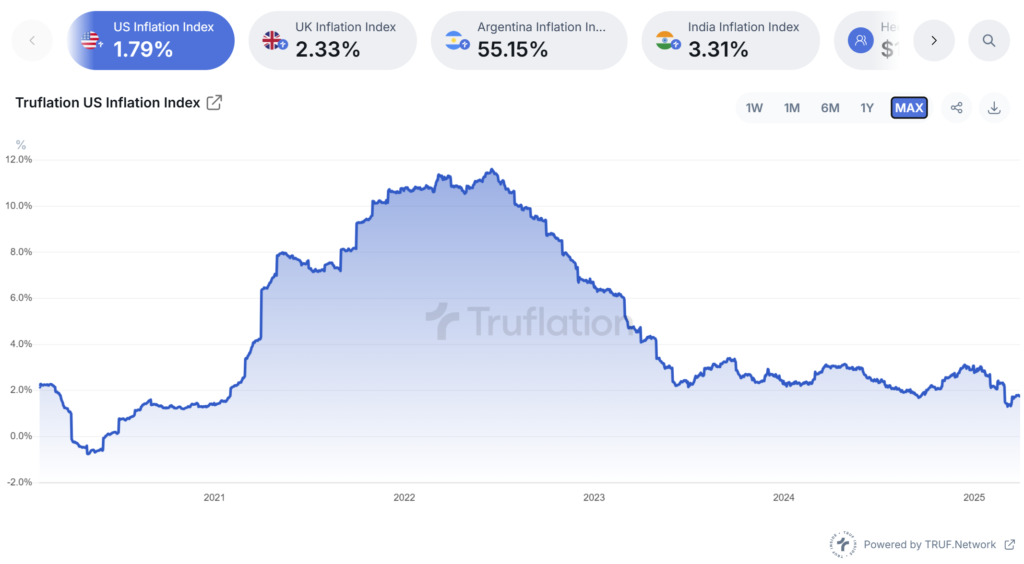

Second, real inflation: I prefer to use Truflation, which stands at 1.8% and briefly dipped to 1.4% in March. This aligns with the growth estimate above, suggesting that we continue approaching a real stagflationary period, but not yet as bad, due to more time needed to justify remaining of the momentum. I think the Fed may continue their rate cut path, regardless of financial inflation 2.6%, as long as the Truflation remains below 2%.

In my opinion, with financial inflation remaining sticky at 2.6% and growth potentially declining to maximum 2%, we could soon experience stagflation from a financial perspective. I won’t be surprised if media will declare stagflation soon, but indexes are not yet falling. However, some real growth may actually persist as long as Truflation stays below 2% and the Fed continue to aim lower rate. While large market players (the “whales”) may continue to focus on financial inflation in public/media, I believe they will pay much closer attention to real inflation in their private meeting room.

We do, then, know what happens if Truflation surges and policymakers have no room to act, such as volatility, lower purchasing power, government intervention like yield curve and stimulus, or even an effort to push asset price higher with economic issue beneath the surface.

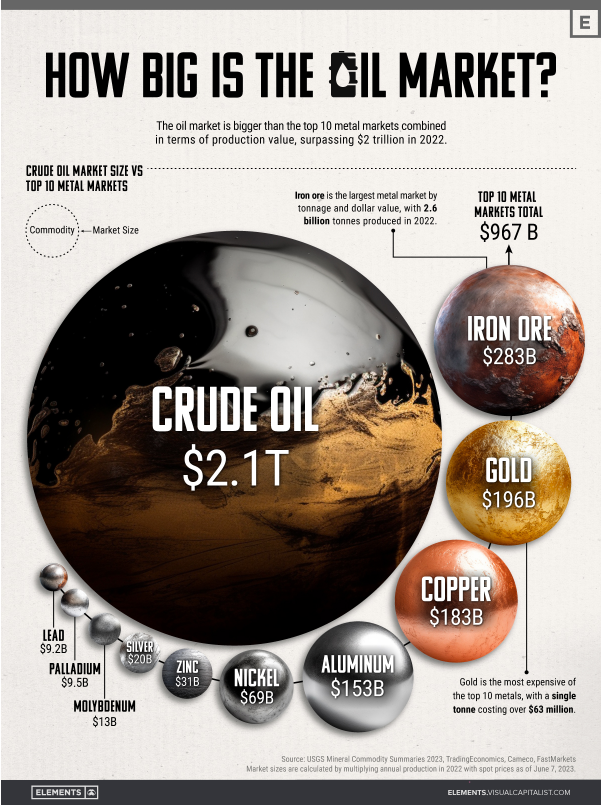

Since October 2024, I have been constructing a new accommodative thesis based on the ‘Fantastic Four,’ which consists of four main components. Each of these has a long history with me, they serve as key pillars to address the challenges of my grand thesis. Of course, while my four main picks remain largely the same, I may adjust their weightings relative to each other depending on oversold and overbought conditions. However, the big picture should remain unchanged for me, as my number one investment principle is to stay adaptive (the core idea behind learning and AI) rather than being stubborn.

- Bd = Bond

- Au = Gold

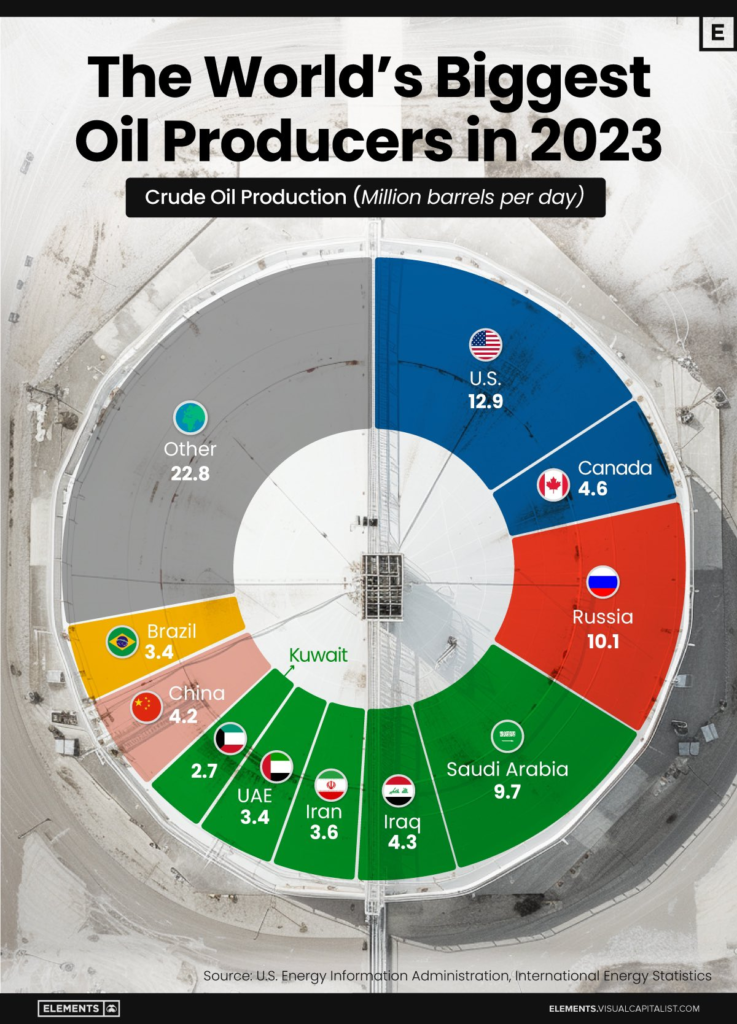

- Em = EM and China in particular

- Cu = Copper

Now, let’s step back into the grand thesis from October. It follows three major phases, much like a musical composition:

- Allegro Non Molto

- Largo

- Allegro

Phase One: Allegro Non Molto

So far, we’ve witnessed disinflation and lower growth pressures weighing heavily on the investment world. Participants have had to keep moving—stamping their feet just to stay warm. The music of this phase was almost magical for me, much like A Whiter Shade of Pale—a heavenly substance flowing through my mind as I constructed and computed all the numbers.

- To shiver in the icy cold of restrictive rates and disinflation,

- In the harsh breath of a dreadful wind,

- To run, stamping one’s feet at every moment.

- Teeth chattering in extreme cold.

Phase Two: Largo (Where We Stand Now)

This is the phase I believe we are in at the moment—a time when fear creeps back into the market, when sharp declines send chills down the spines of participants. It’s amusing, really—investors were euphorically bullish in Q4 while I had already turned completely bearish. Now, as they panic over bleeding losses, I start to see signs of stabilization or even a potential smaller continuing decline. Note that I haven’t turned bullish again like in 2023—I’m simply remaining relatively defensive at the moment.

It’s the perfect time to test my thesis—at the very moment when sentiment swings to extremes. In my recent newsletter, I anticipated this scenario: the index getting knocked back down from the 200-day moving average. And while the market may be gripped with fear, I still sense relief—something almost serene, like the music of this phase. In my thesis, this stage could last for the next few months.

- Let us pass our days at home in peace, contented,

- While the rain pours outside. Do you see red rain on Wall Street since early year?

Phase Three: Allegro (The Final Act)

As I mentioned last year, predicting more than a year ahead is always a challenge in terms of accuracy. I have gathered plenty of numbers since then, but everything remains subject to change depending on policy shifts. Still, without revealing too much about the final act of this unfolding drama, the music captures my mindset perfectly:

- To walk the icy path slowly and cautiously,

- For fear of tripping and falling.

- To move vigorously—only to slip and crash to the ground,

- Then rise again and run hard,

- Until the ice cracks and shatters.

- To hear, beyond the iron gates,

- The desert wind, the north wind,

- And all the winds at WAR.

This is indeed Winter—but a winter that may bring not just hardship, but also opportunity. It could be hectic, or even a frightening crash—something that leaves a lasting mark on our investment journey. The path forward remains uncertain, but within the storm, something stirs.

For now, let’s stay adaptive, navigating each development as it comes. The long view can wait—its time will come.

Please note that all ideas expressed in this blog and website are solely my personal opinions and should never be considered as financial advice.