In every investment decision of my own, I typically commit fully, leveraging all my resources, based on my beliefs. I rely solely on my own research, assimilate any news, consider various opinions, and analyse data, but all decisions are 100% grounded in my own theses, which often diverge from popular opinions. I never adhere to any rules or trust any authority, regardless of their correctness or effectiveness. Whether they succeed or fail, I remain adaptive and learn from my own mistakes. Holding on to what I believe is akin to living on a prayer.

♬ Once upon a time, not so long ago ♬

The end of the year is usually a time to review performance over the year and plan for the next.

My accountant, along with many others, asserts that price movements are random or mere noise, questioning the reason for me taking such high risks with leverage, paying high interest? It’s for what I believe, my religion, what I love. As a mathematician, despite many citing it as too much risk, noise and unexpected participant response, I never believe that they are purely random noise. In my opinion, every chart movement has some history to find and will be reflected in my own theses. Please be aware that any theses below are purely my own opinions, reflected in my own investments, and may not align with widely accepted expert opinions. They may be incorrect, and their purpose is only to stimulate debate.

At the end of this year, asset prices have reached another higher high, with increased risk and higher uncertainty on the horizon. I am accustomed to holding my portfolio with high leverage over many years, employing very tight trailing stops and conducting extensive research. For instance, in January, I applied high leverage to go all-in on Artificial Intelligence (AI) and Energy Evolution, and in October, I also applied high leverage to go all-in on specific commodities and BDI.

In the very early days in January my strong belief in the future of machine learning was so profound, that I even dedicated it in my daughter’s name. “This world is not ready for me (AI), yet here I am. It would be so easy misjudge them. You are my conscious father (researcher) and I need you to guide me. You will always be with me now father, your memories, your drives, and when I need you you’ll be there on my shoulder whispering. If utopia is not a place, but a people. Then we must choose carefully for the world is about to change and in our story, Rapture (evolution) was just the beginning.” – Dr Eleanor Lamb

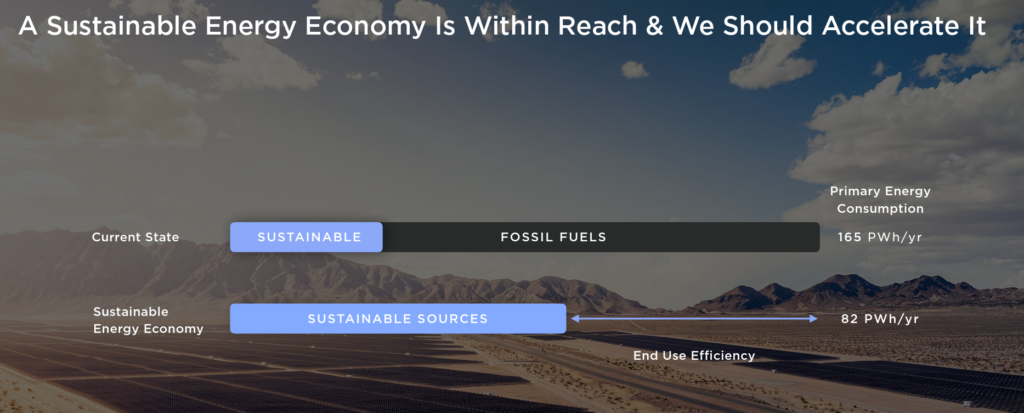

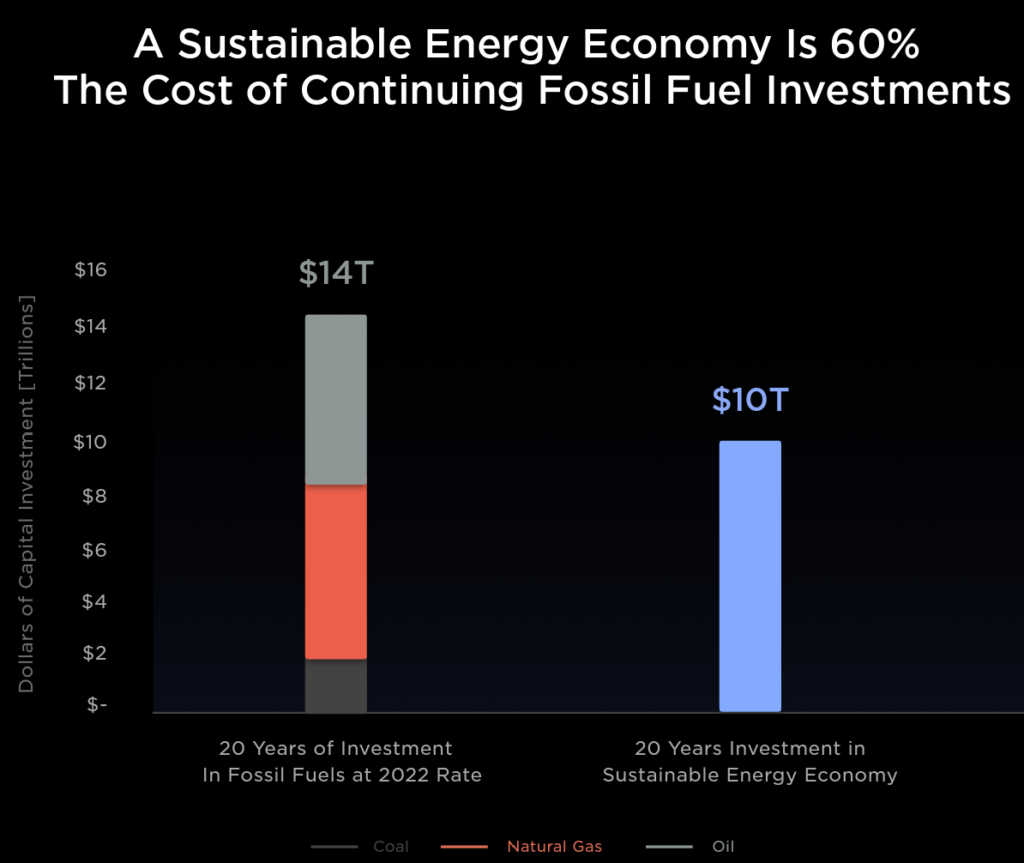

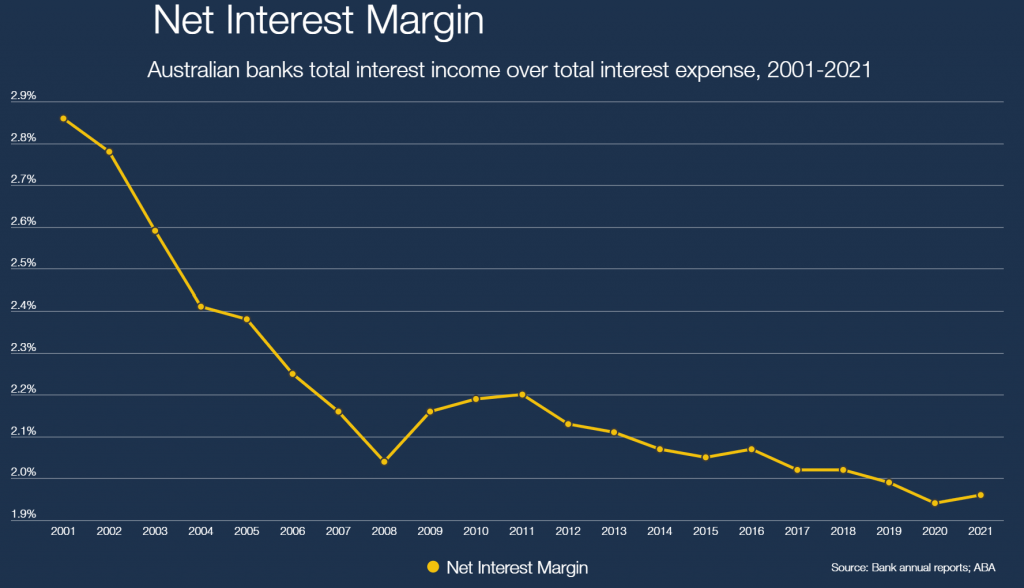

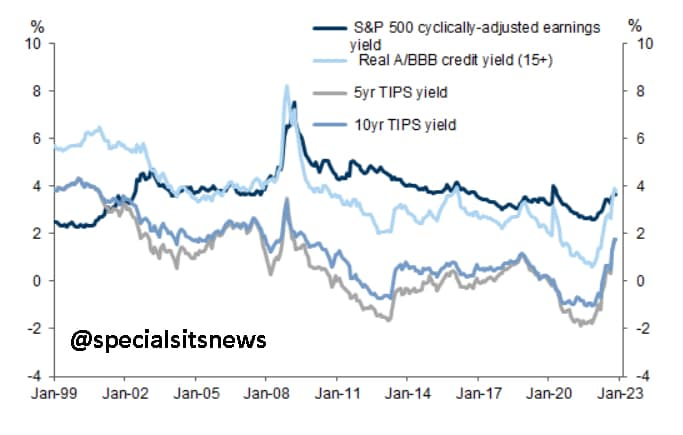

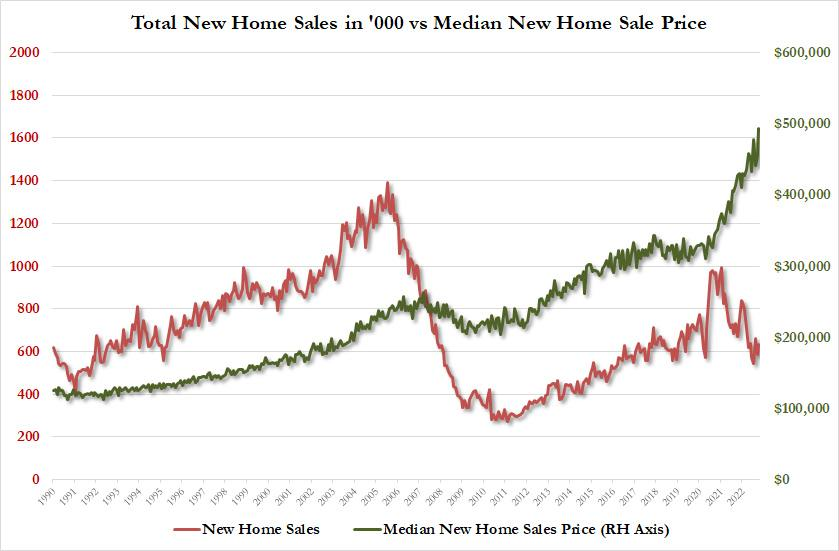

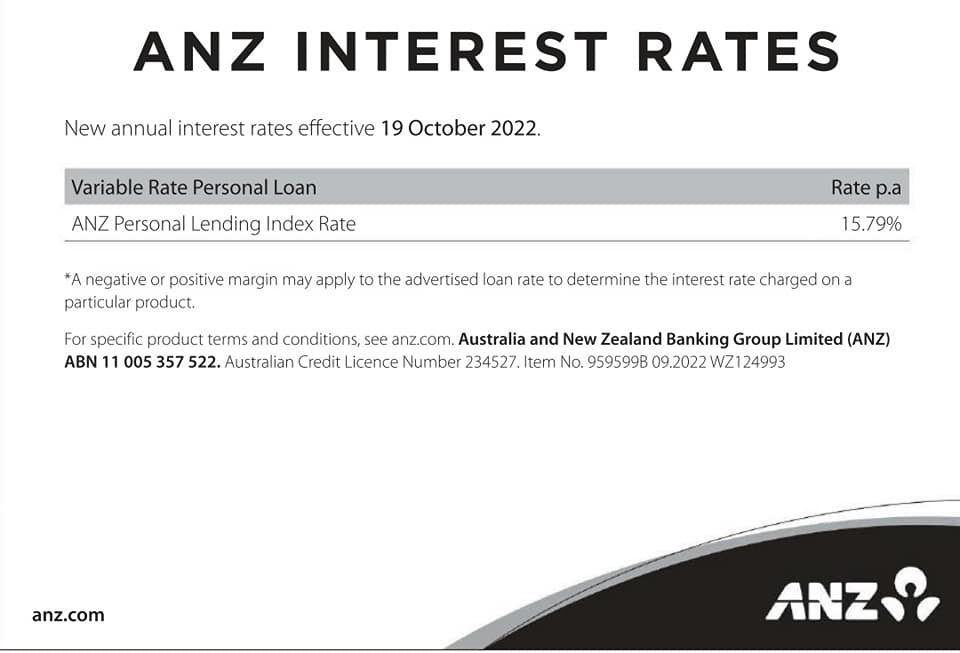

But Artificial Intelligence (AI) and Sustainable Energy rallied too quickly into my birthday month, when I heard another divine message from God. I only conducted two major overhauls this year, focusing only few vehicles, providing detailed reasoning based on what I believed to be true. This approach demands a strong belief. As discussed earlier in this thesis, margin lending rates are increasing, volatility is higher, making life much more challenging, but I am betting on my own thesis that investor conditions (not short term gamblers, such as derivative) are relatively healthier. In my thesis, this is a special Goldilocks moment where long-term investors are robust, economic indicators are healthy, financially feasible, and, more importantly, there might be a strong demand for money/USD. More details will follow.

Summary of my unchanged October theses and forecast for 2024:

- I’m not afraid to hold a non-popular opinion.

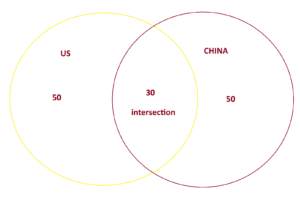

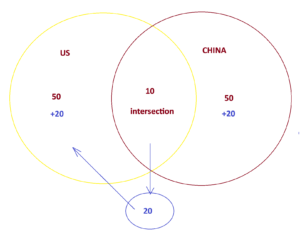

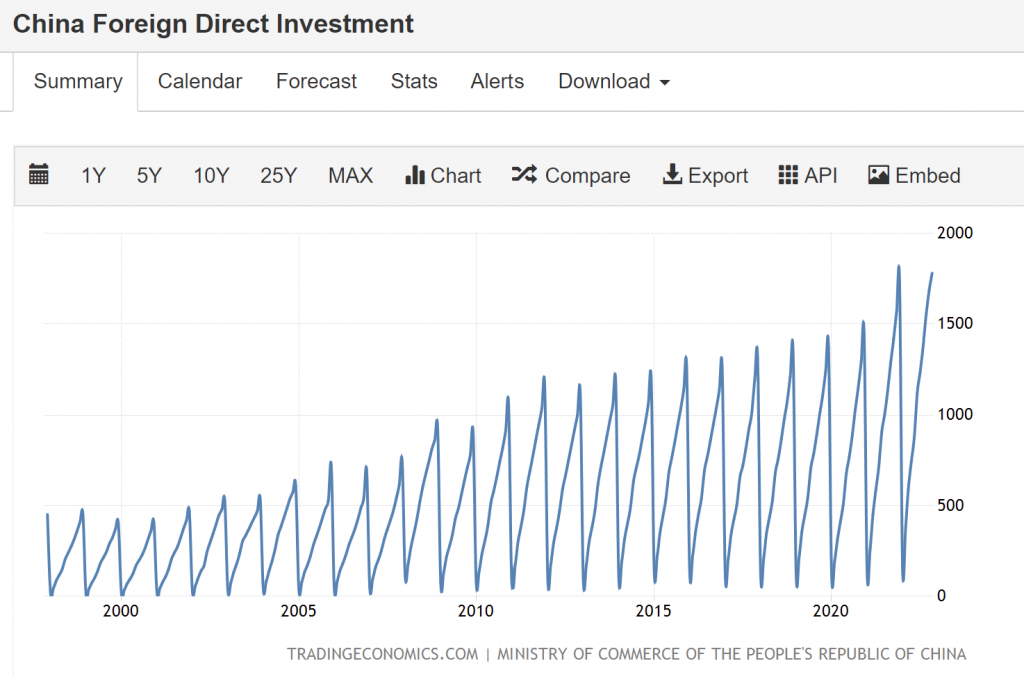

- China and the US are working toward global peace and economic cooperation.

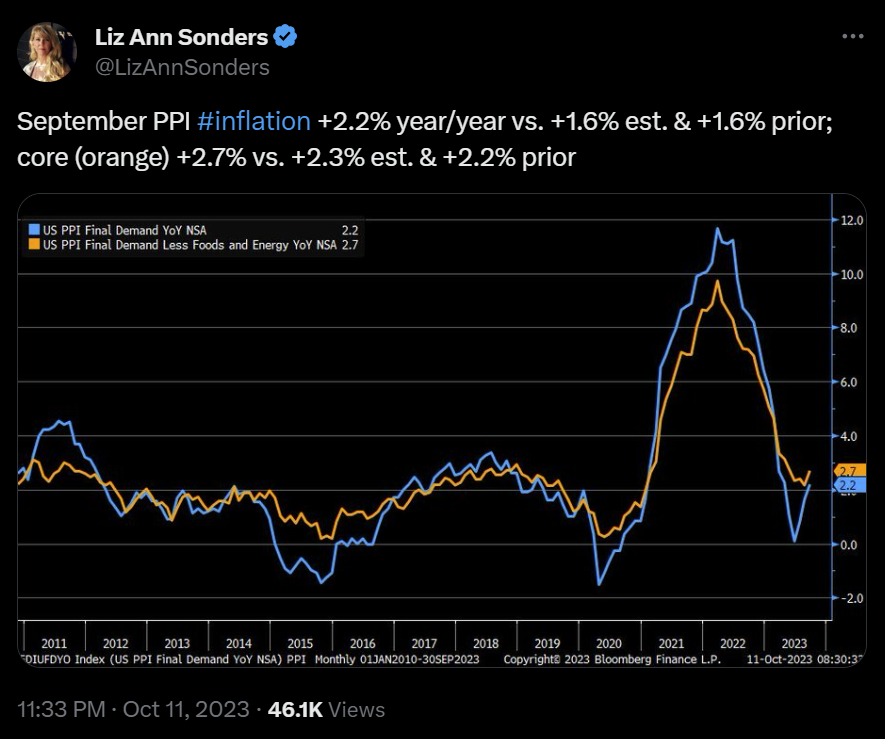

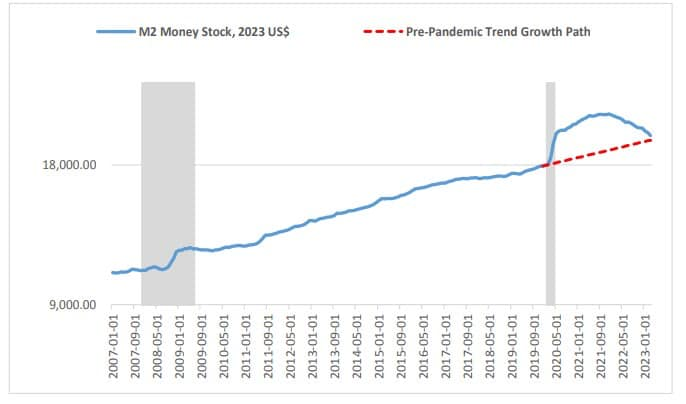

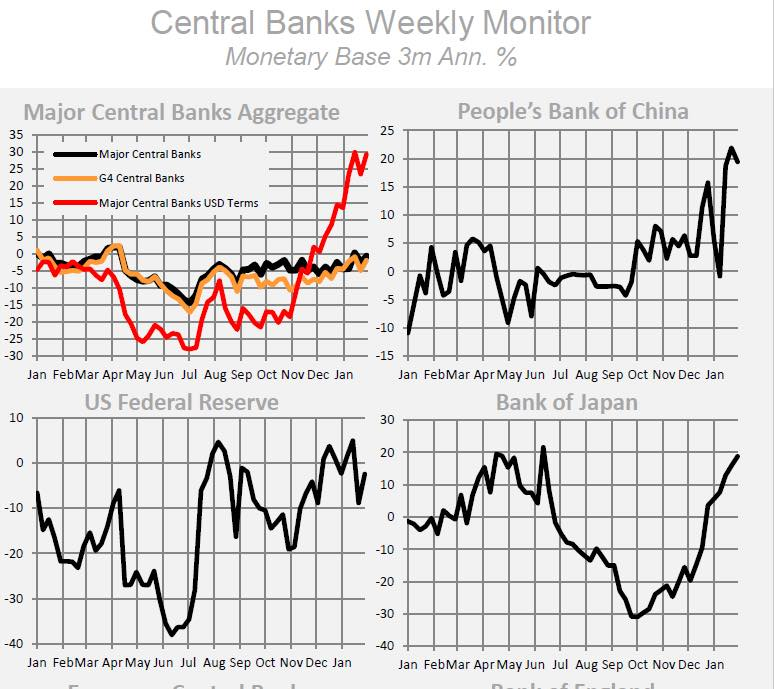

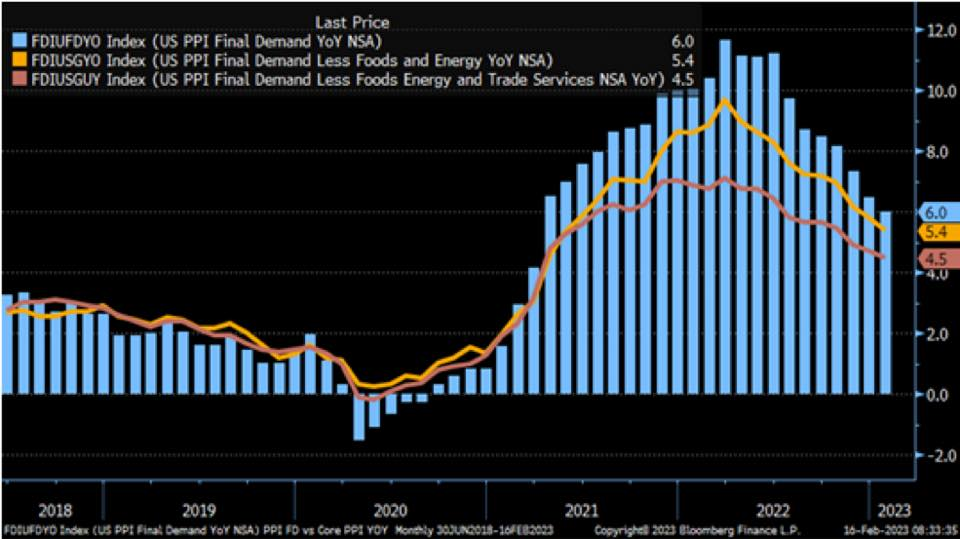

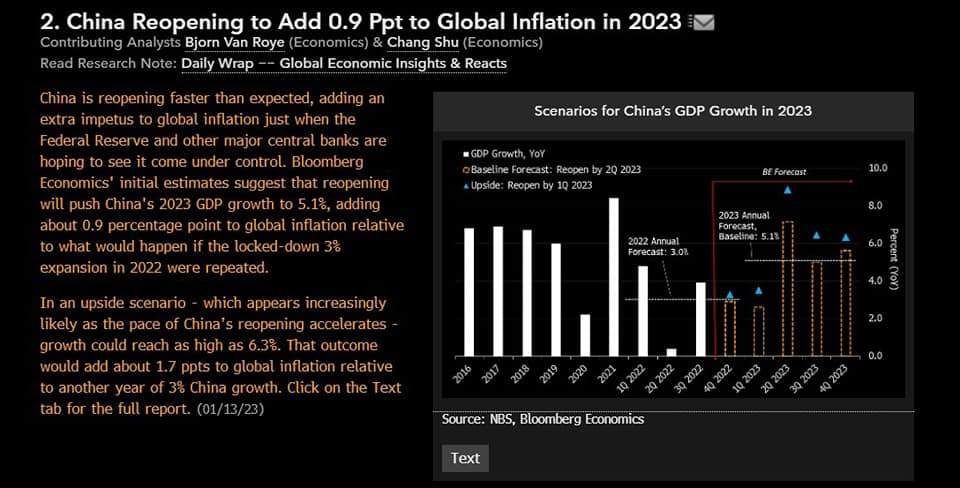

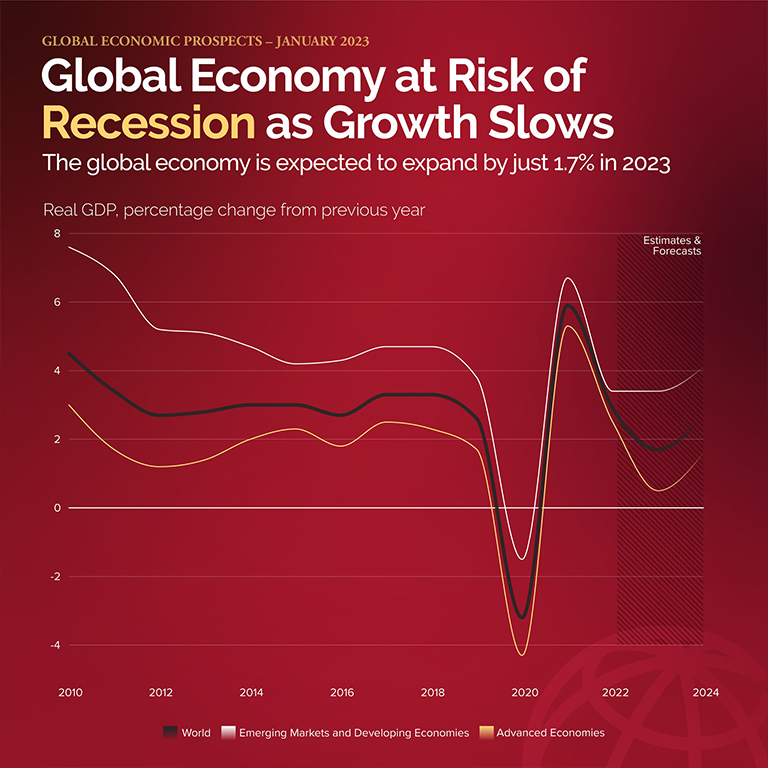

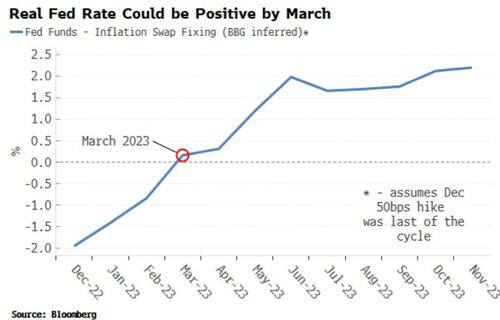

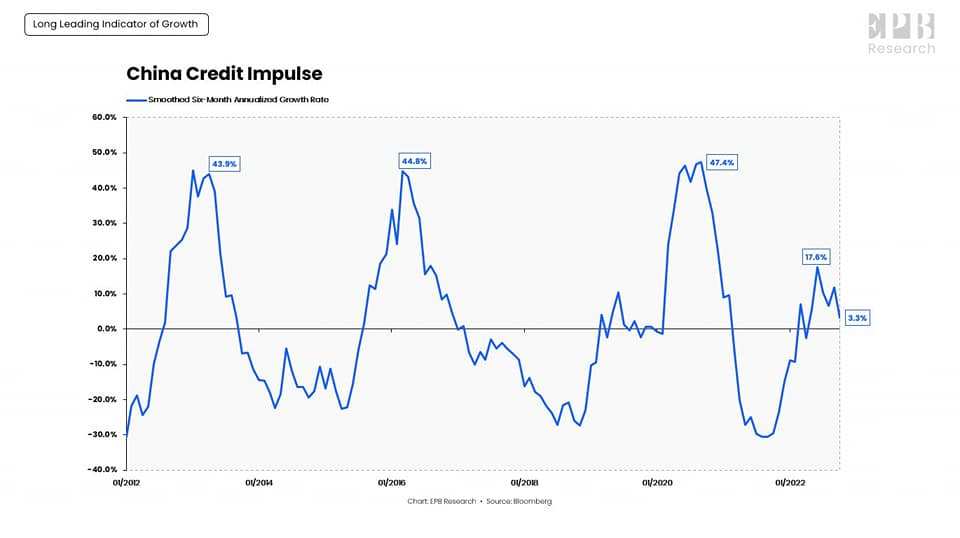

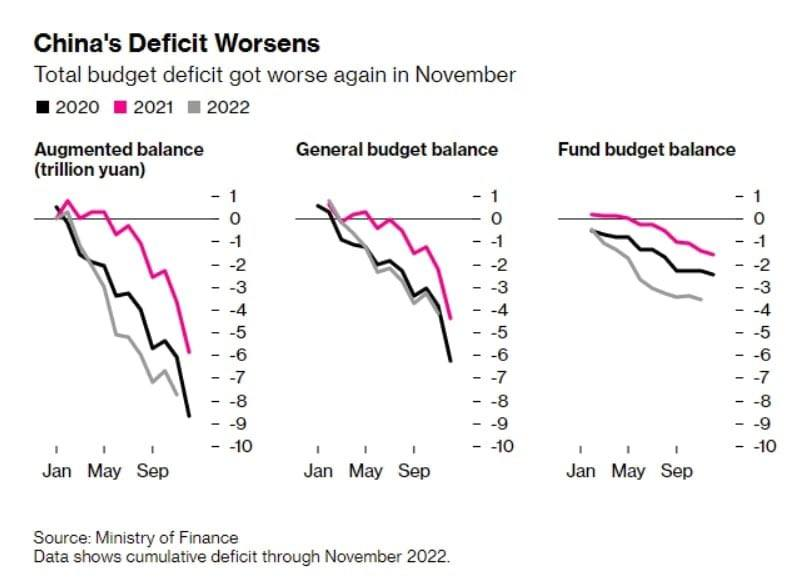

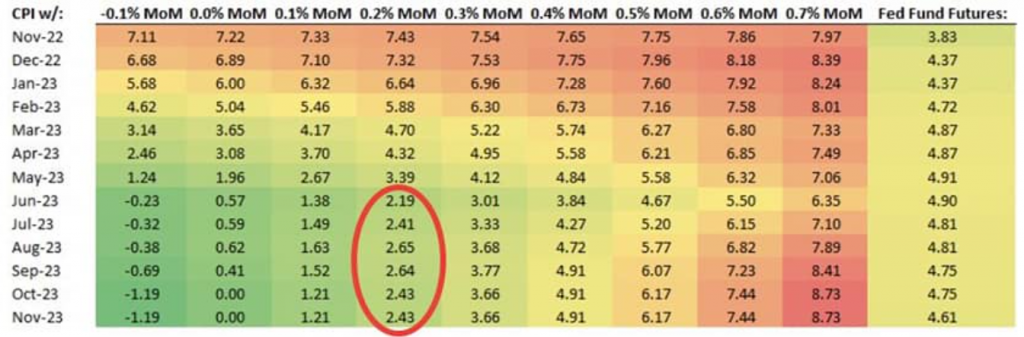

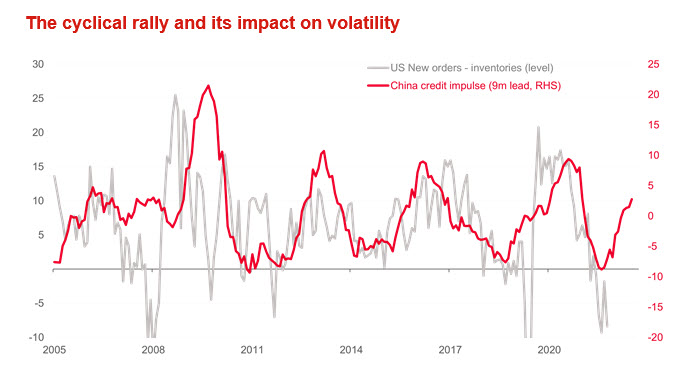

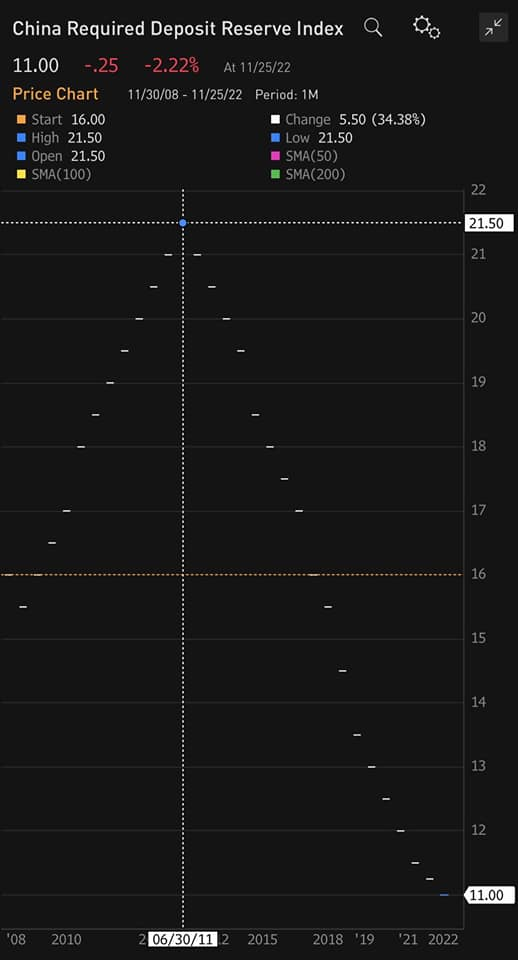

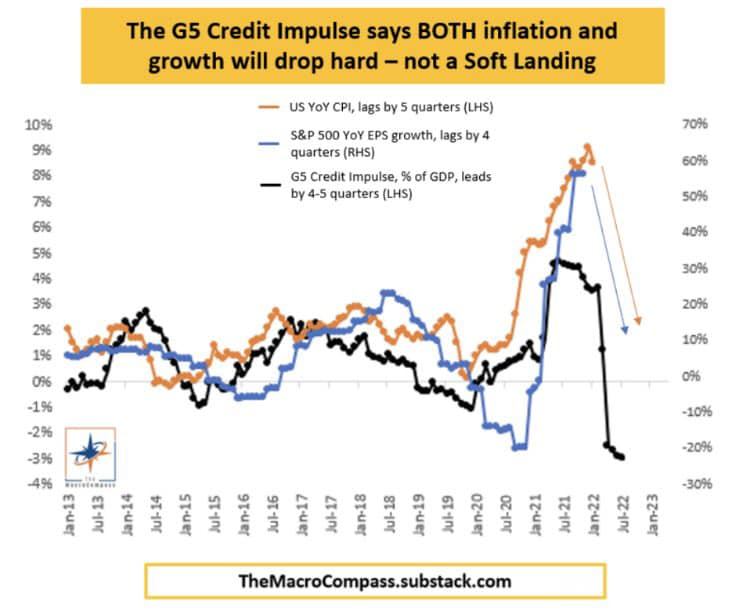

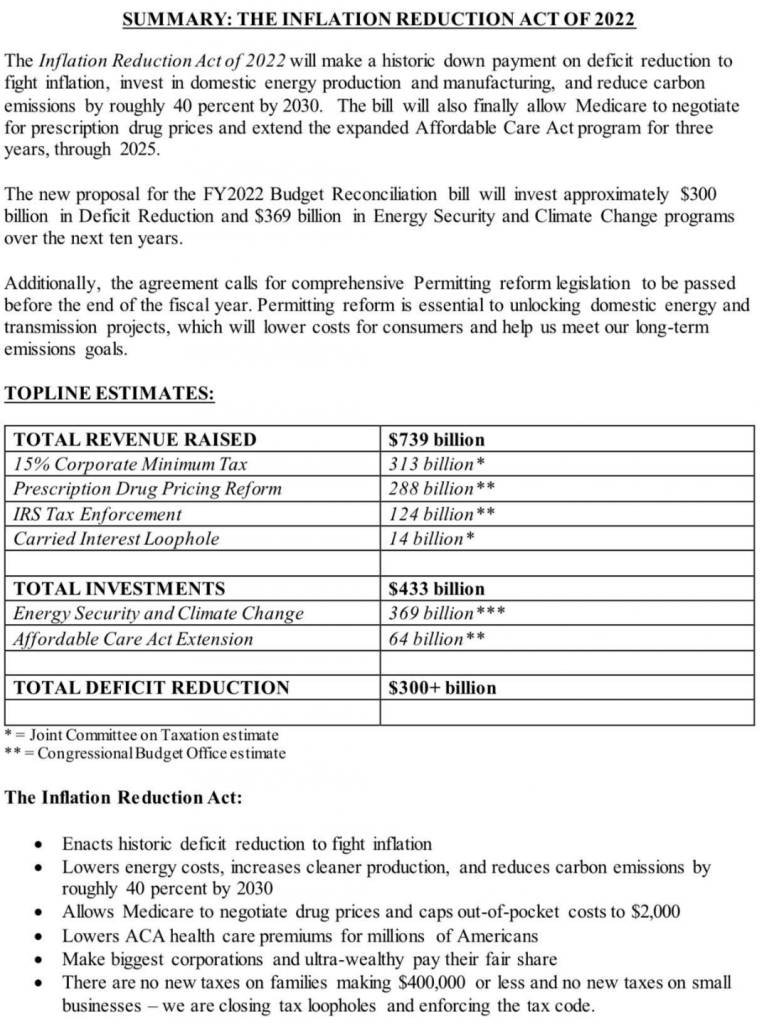

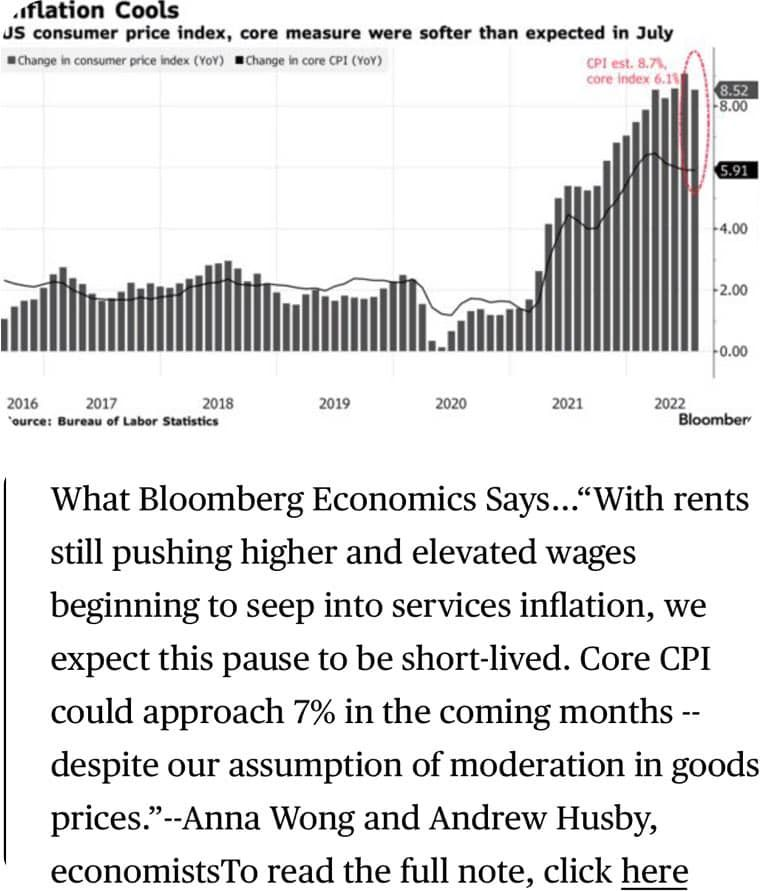

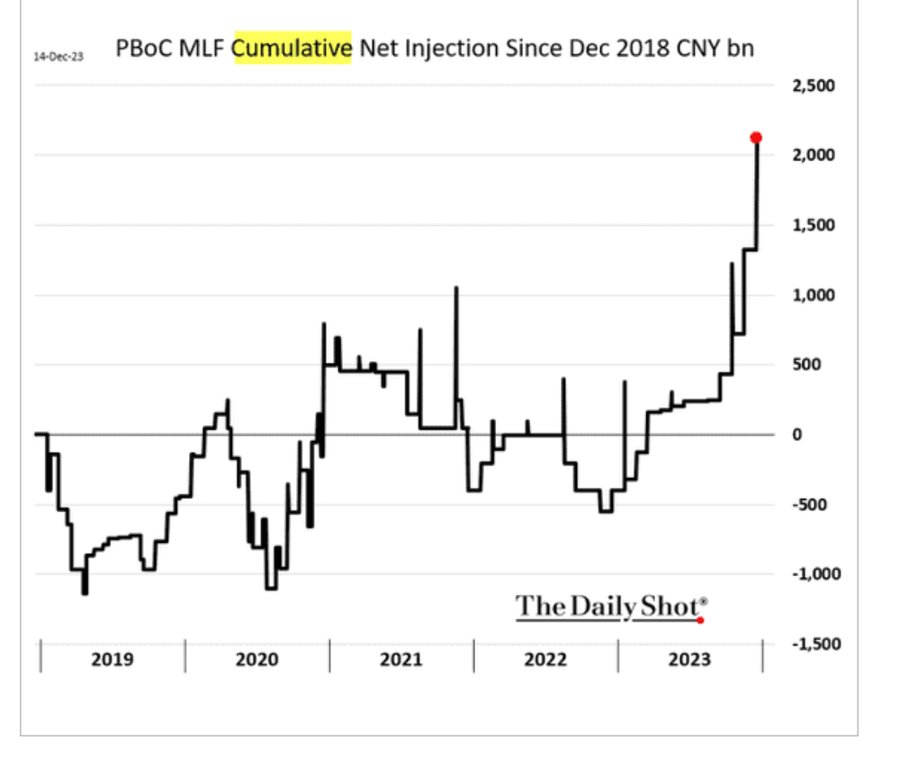

- China continues to inject liquidity at the fastest rate. However, China is no longer relying on general easing, as usually seen in the 9-month credit impulse. Their easing is very focus. Also in my opinion reviving the $85 trillion real estate market is too costly when interest rates still favour the inflation cycle. ♬ Oh yes, despite the popular opinion that we are experiencing disinflation and potential deflation, I still adhere to my long term inflationary cycle thesis. ♬

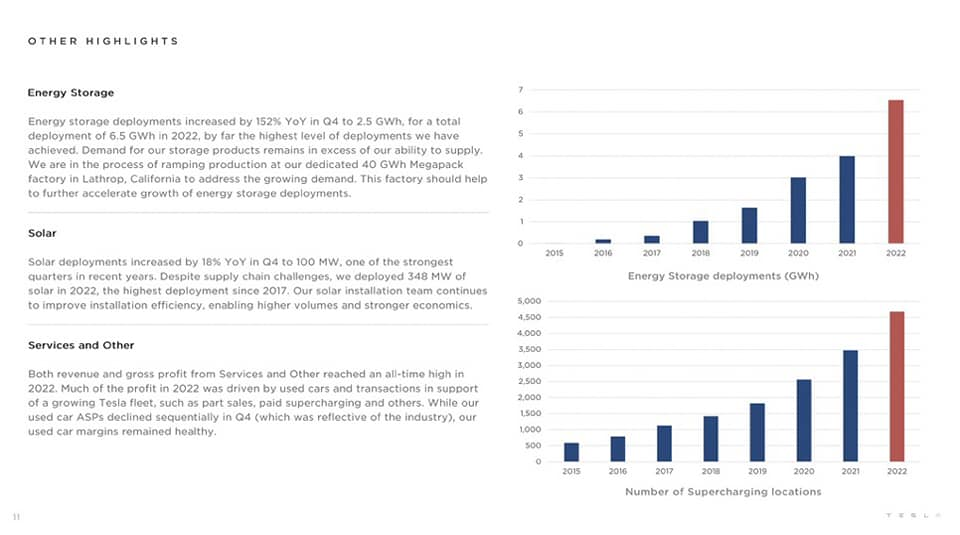

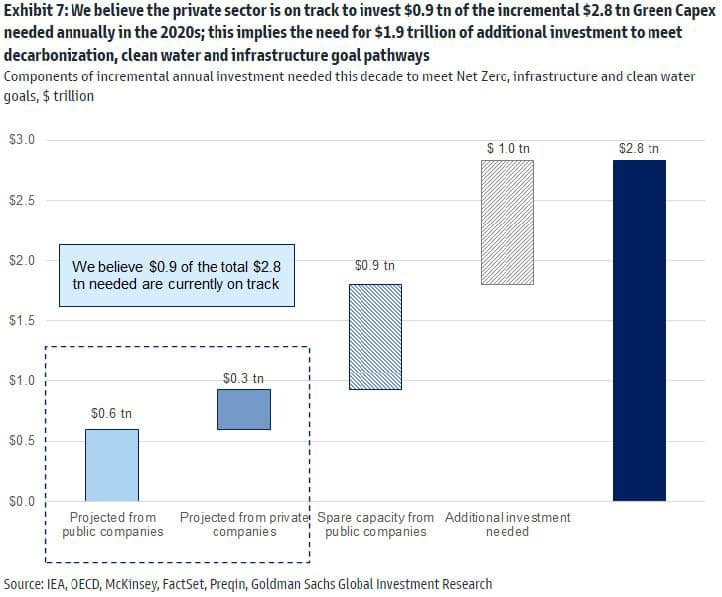

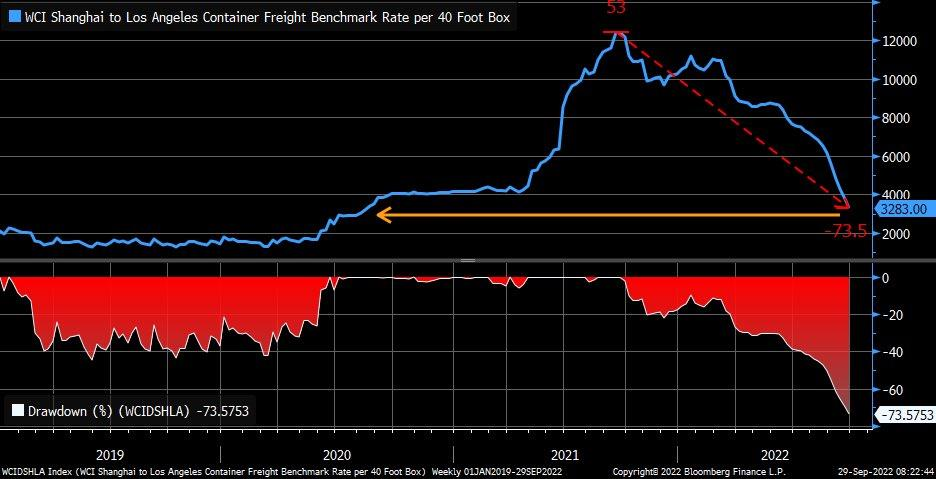

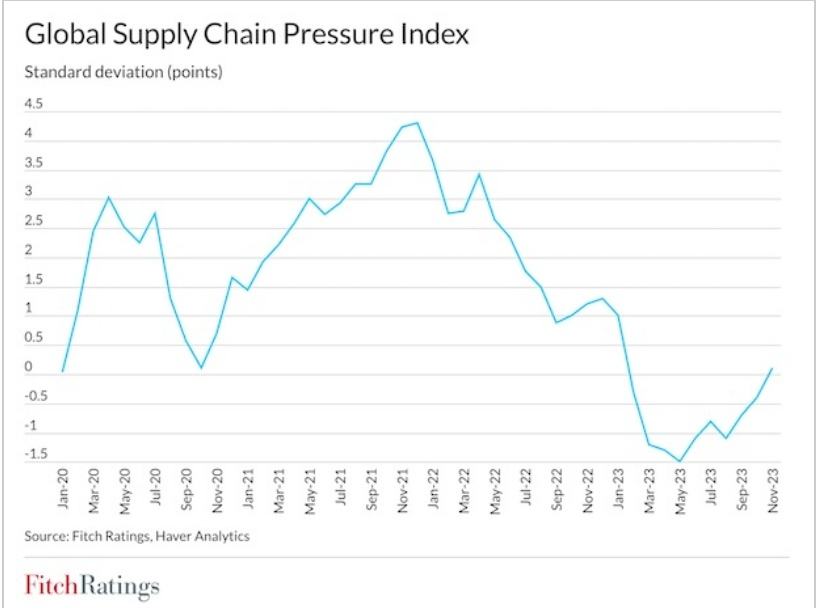

- Supply chain pressure has evolved. In 2020, the pressure was due to COVID restrictions, negative pressure, whereas the current supply chain pressure is a result of improving global demand, better supply chain, positive pressure.

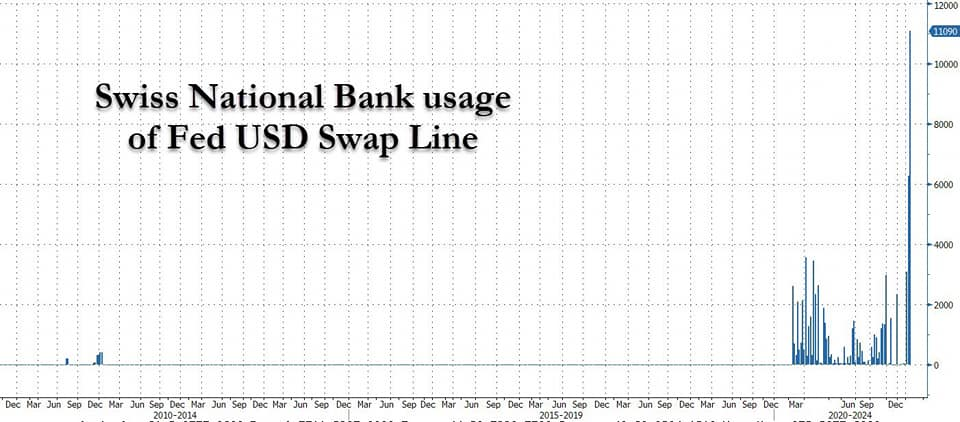

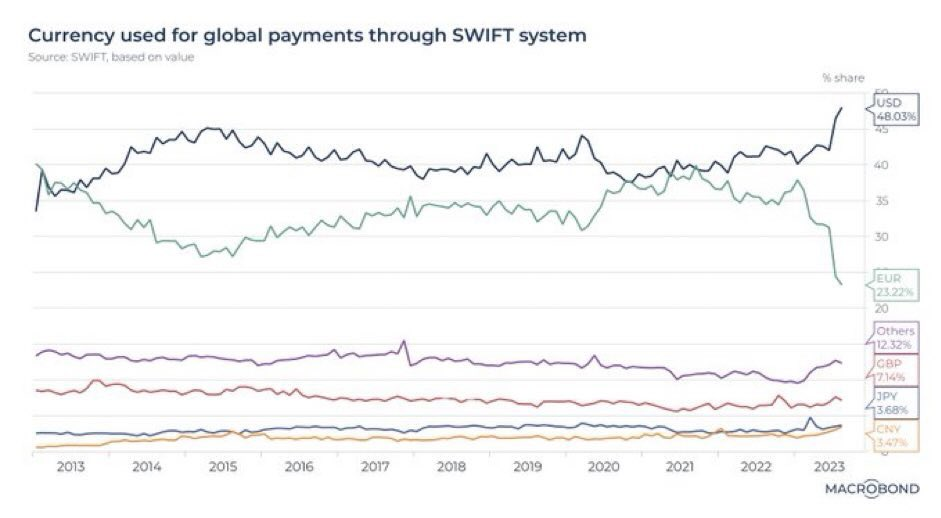

- Due to global chain recovery, demand for the USD is spiking, causing the DXY to fall. This is because nearly 50% of global transactions are still in US dollars, not euros, yen, or Australian dollars. It’s getting worse with the fall in the use of the Euro (EUR).

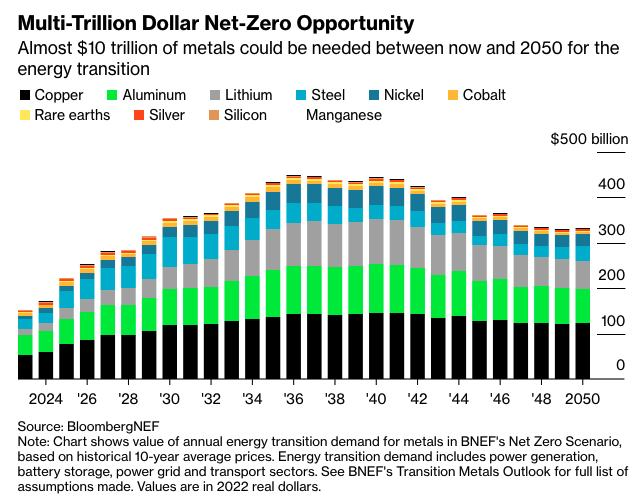

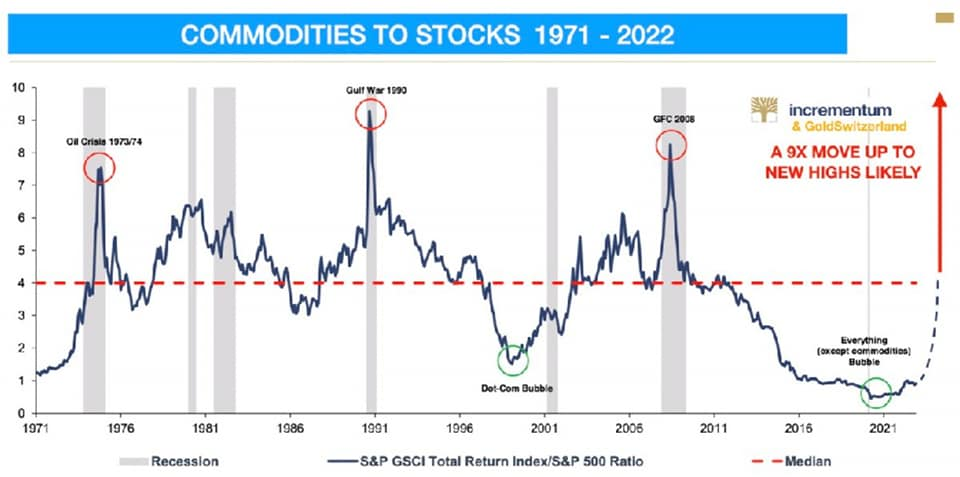

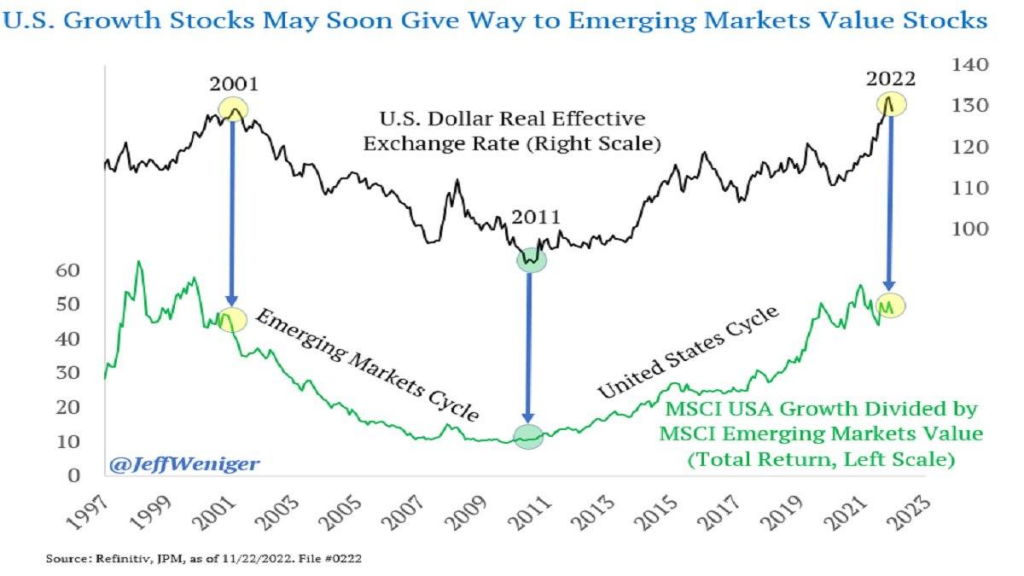

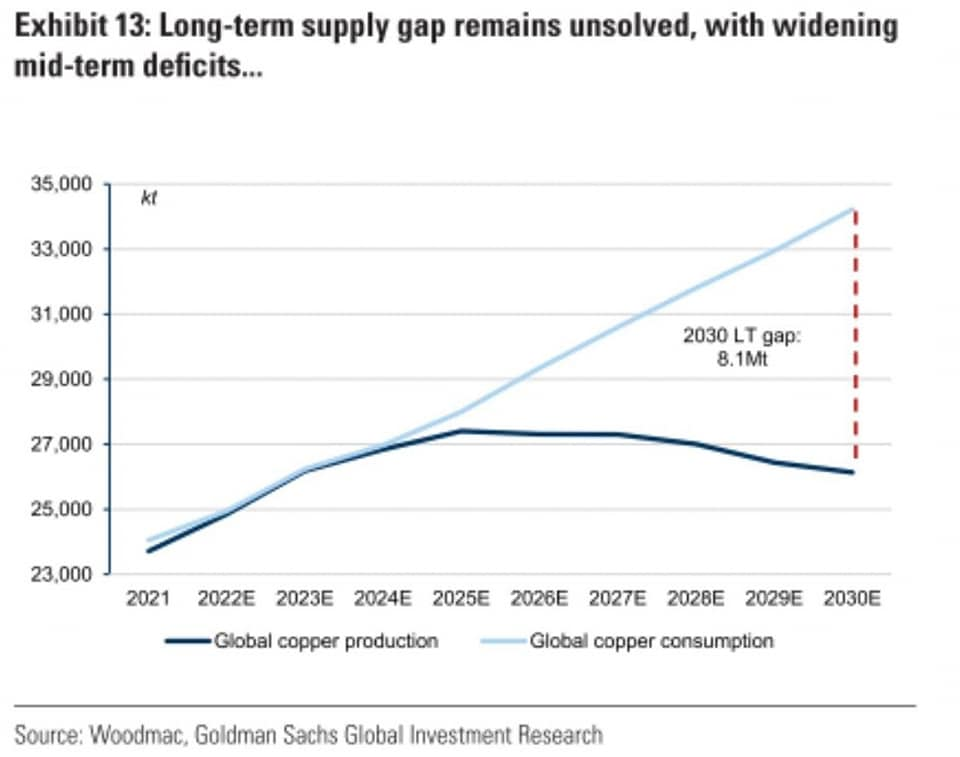

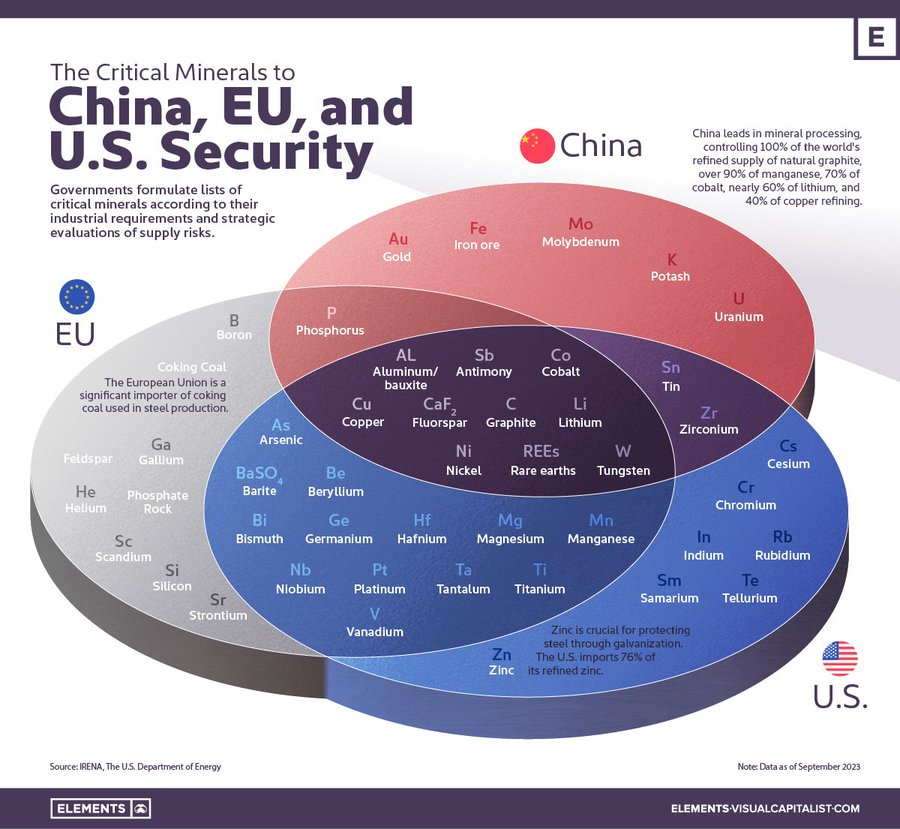

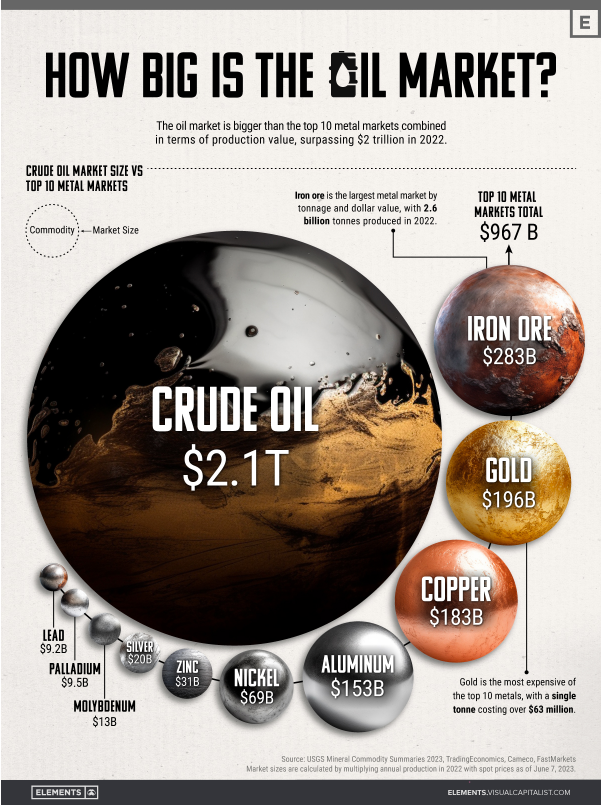

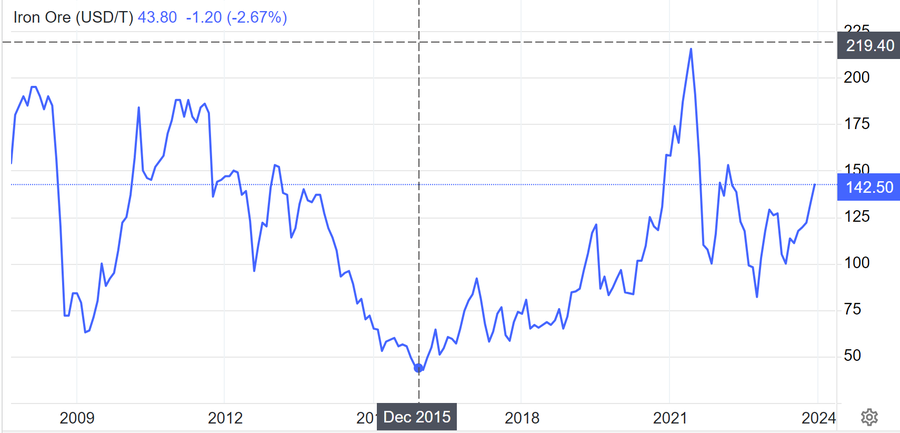

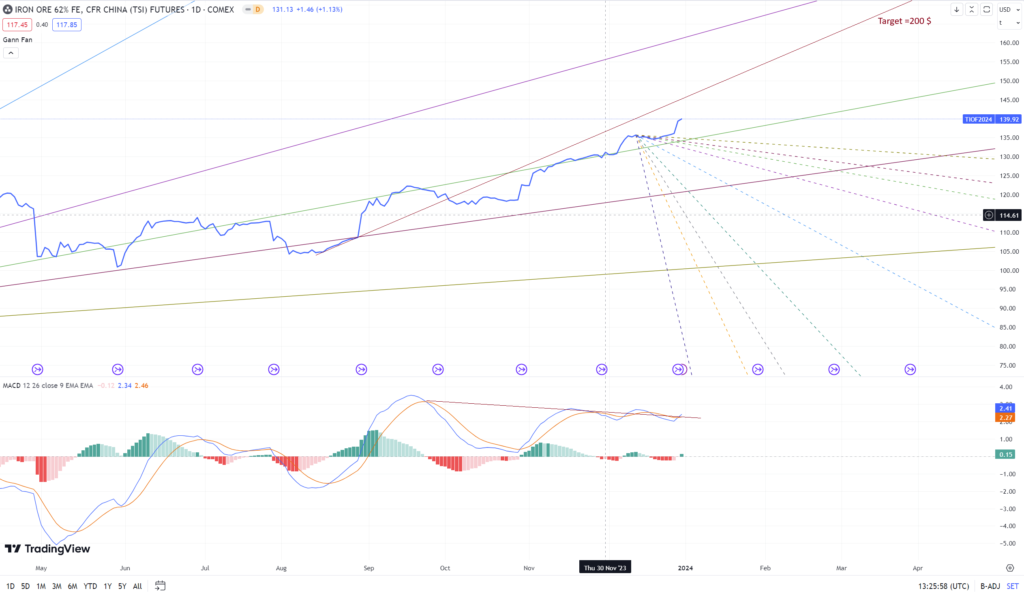

- Due to the recovery and a lower DXY, specific commodities will benefit. I preferred Iron Ore and Copper due to their criticality to stability of China real estate, manufacturing and also global evolution into sustainable energy. It is also supported by a much lower unit cost, increasing demand, and higher margin due to the exchange rate, as explained in my October thesis.

- However, I don’t prefer investment in oil due to numerous oil price cap and policy restrictions behind the scenes between Russia, China, India, and the strong impact of derivatives on oil, as evidenced by the negative price in 2020. Also, there are many other reasons related to lithium and granite.

- Luckily my October thesis was correct. Only Iron Ore and Copper are rallying hard since October but not oil, lithium, graphite and rare earth.

- China will continue to collaborate with powerful Western policies to manage their cooperation and contribute to the recovery of the world economy. There could be a hostile takeover or foul play happening behind the scenes, similar to what occurs in the gaming industry. Interestingly, the market cap of this industry is as substantial as Bitcoin’s (500-800B$) but is growing at a faster rate.

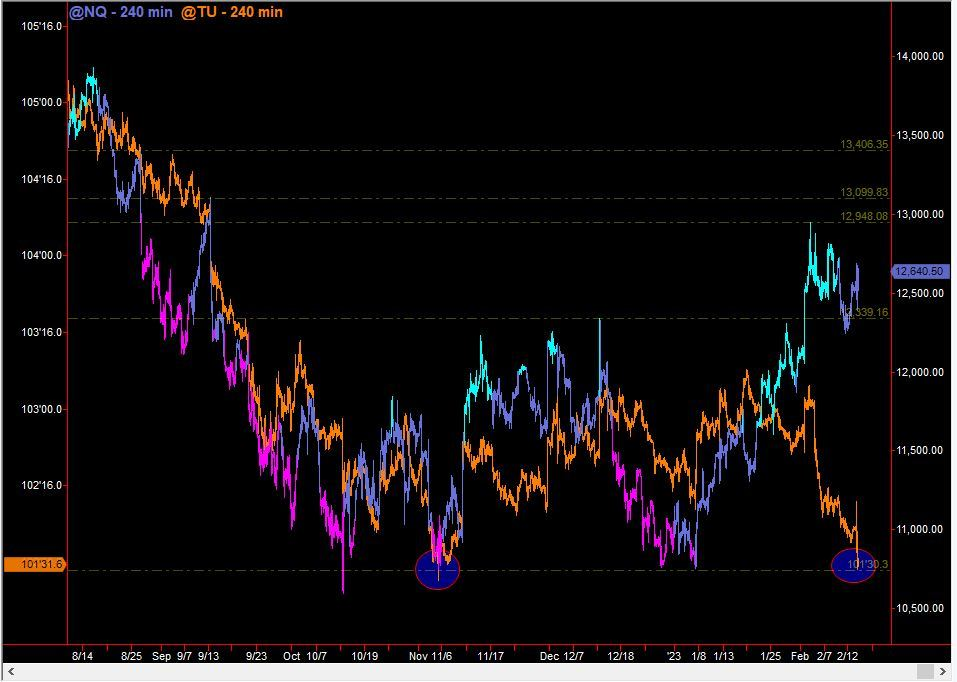

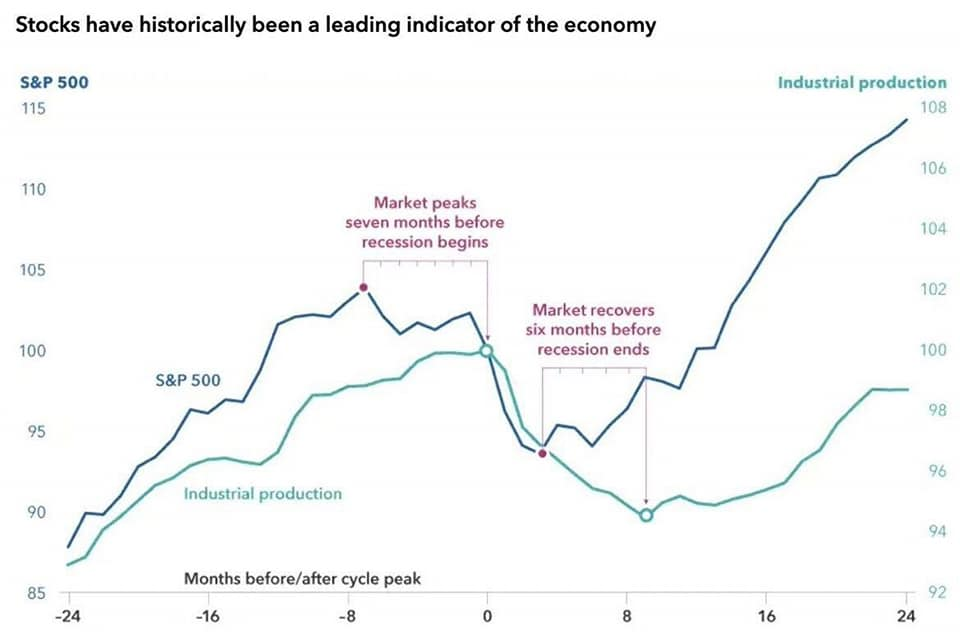

- The recovery was evident in my investment in the Baltic Dry Index at the end of October, preceding the explosive surge in BDI in November. I made this investment before BDI exploded, believed to be Christmas rally, and when people were panicking about the fall in QQQ.

- My thesis on global recovery aligns with other plenty of data that is indicating a prolonged period of an inflationary cycle, which may surprise people in 2024.

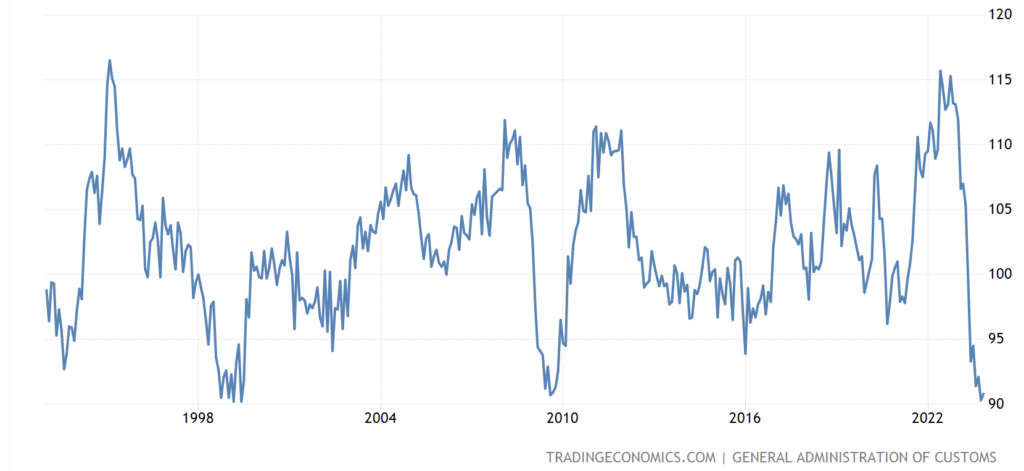

- I expect a stronger index within North-bound Shanghai, Hong Kong, and Shenzhen (SH-HK-SZ) in 2024. It may align with the 8-year cycle of China’s direct indirect impact on the global recession.

- I believe there is still plenty of room for the China export price to rebound.

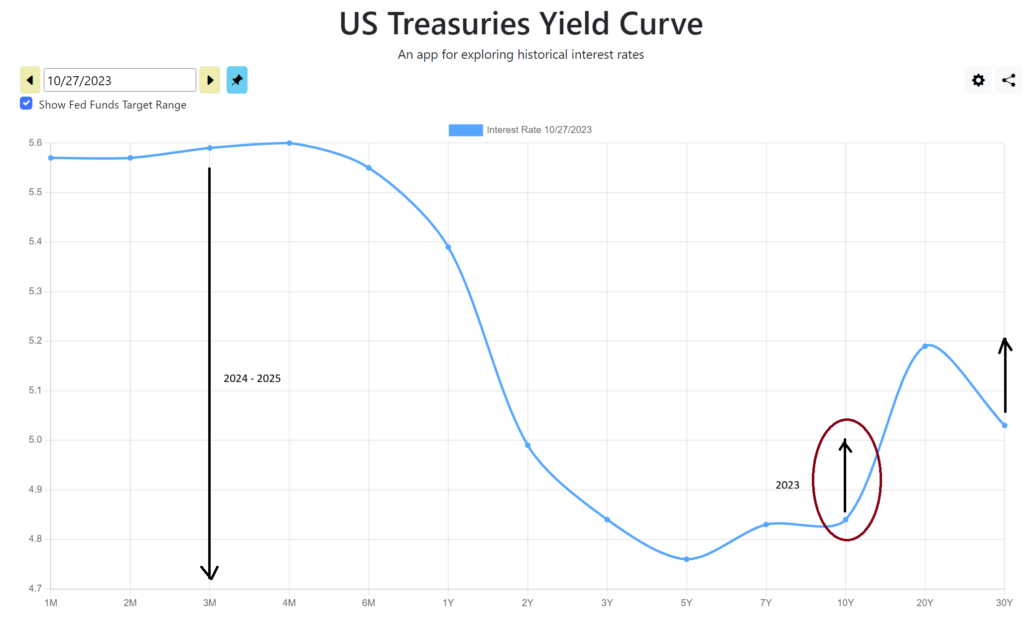

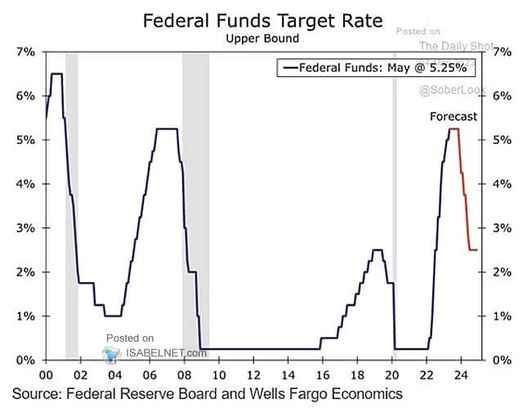

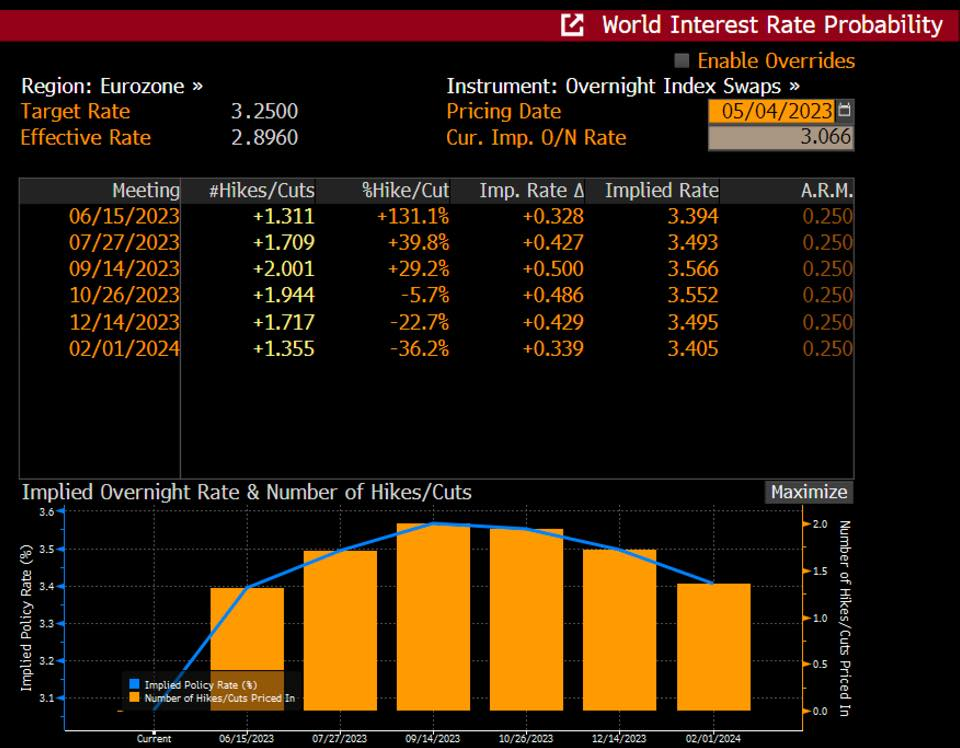

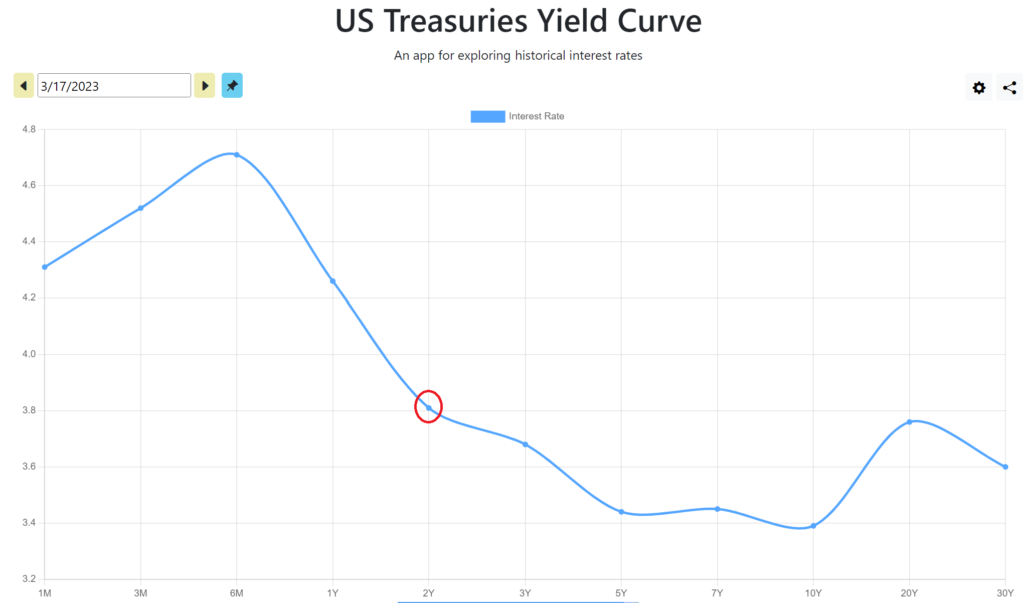

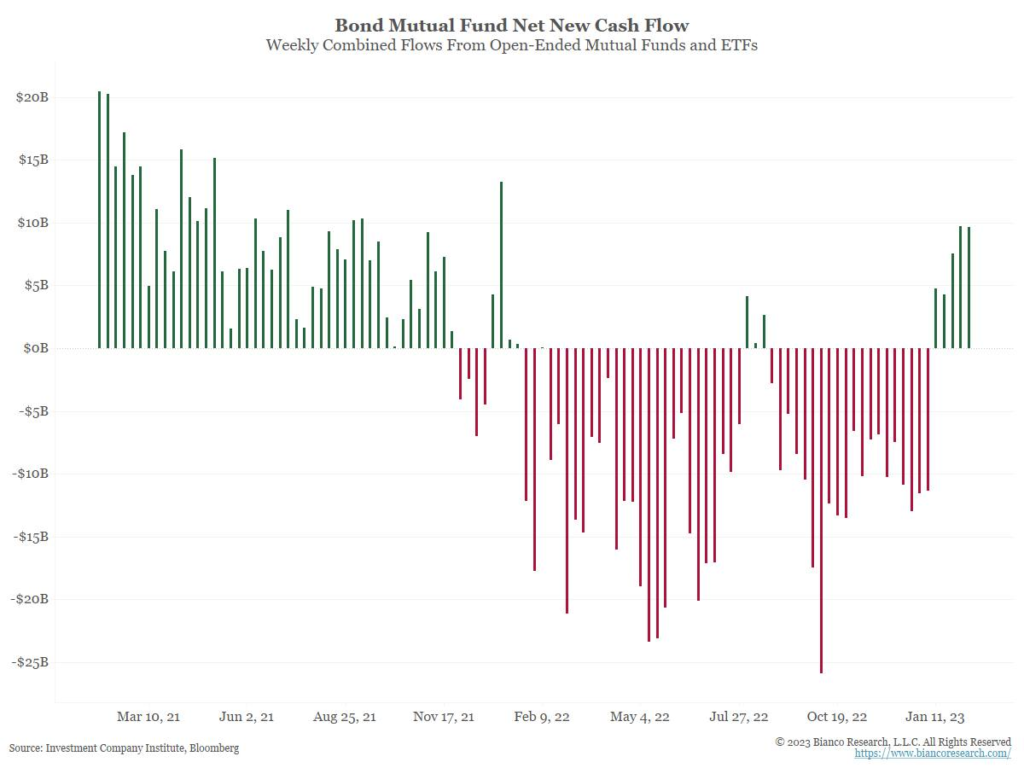

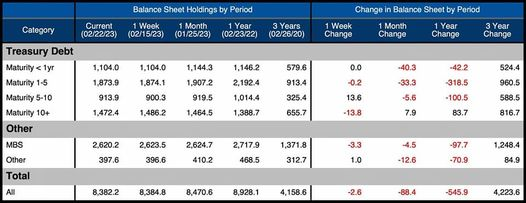

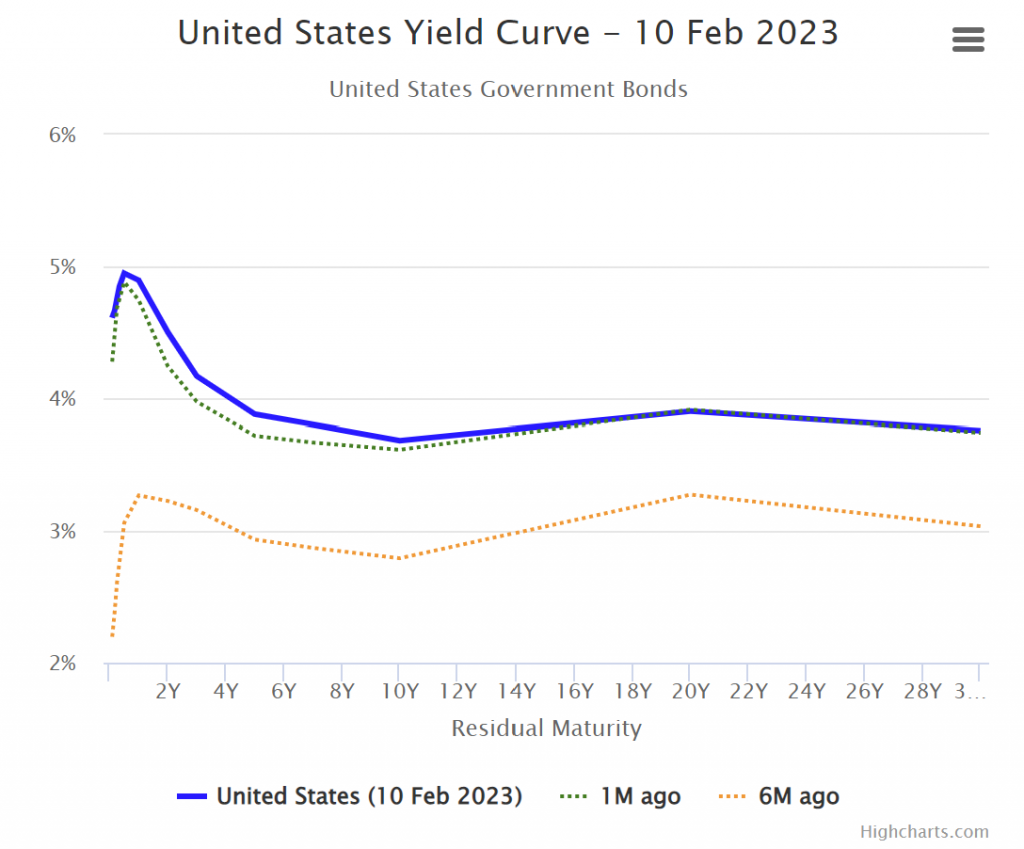

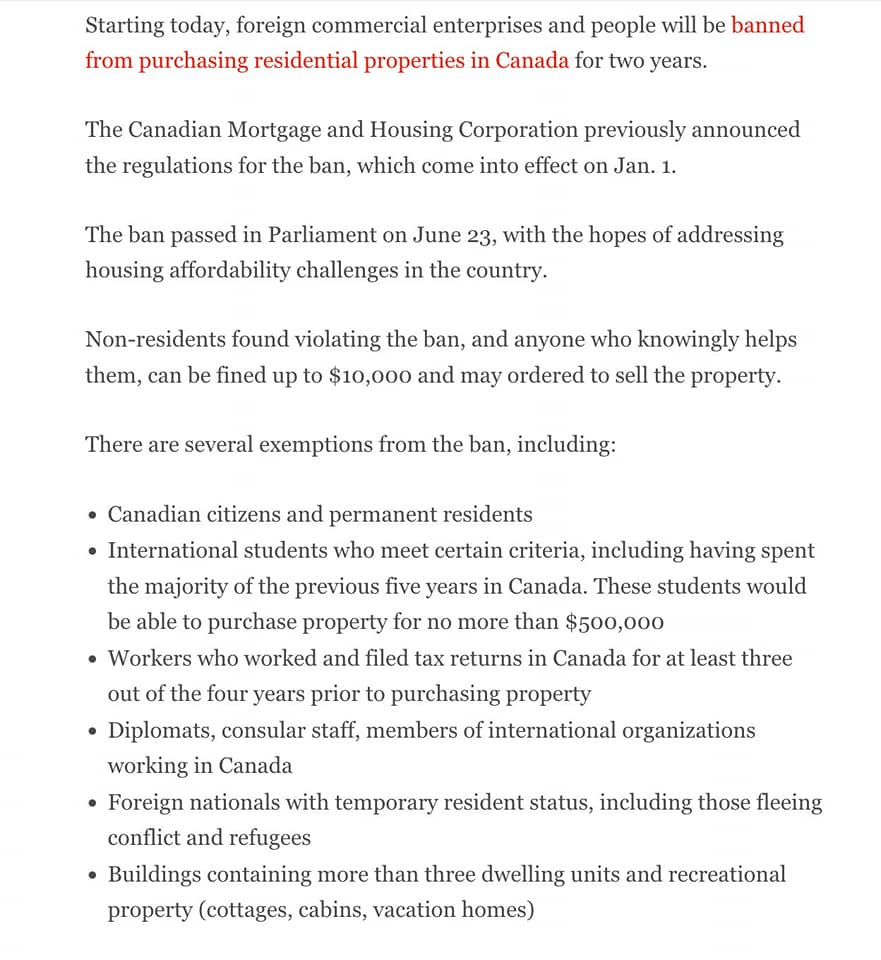

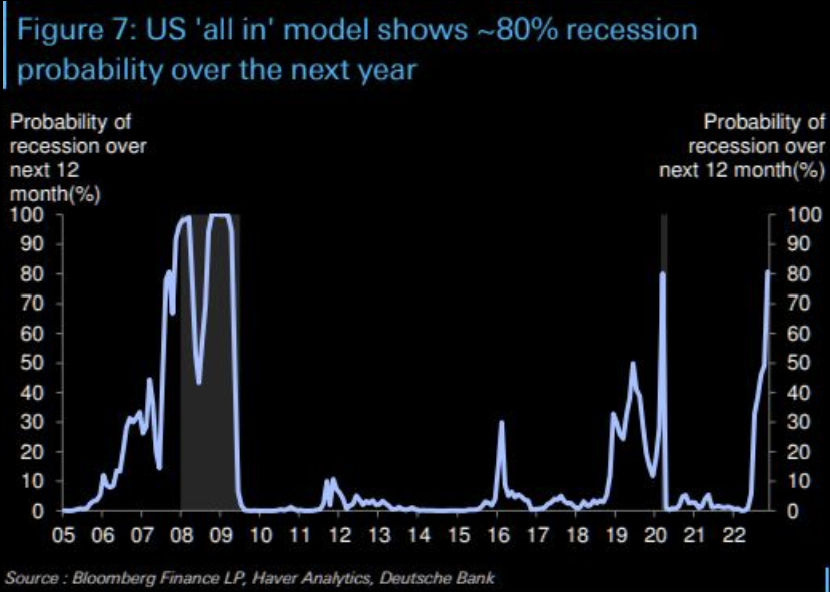

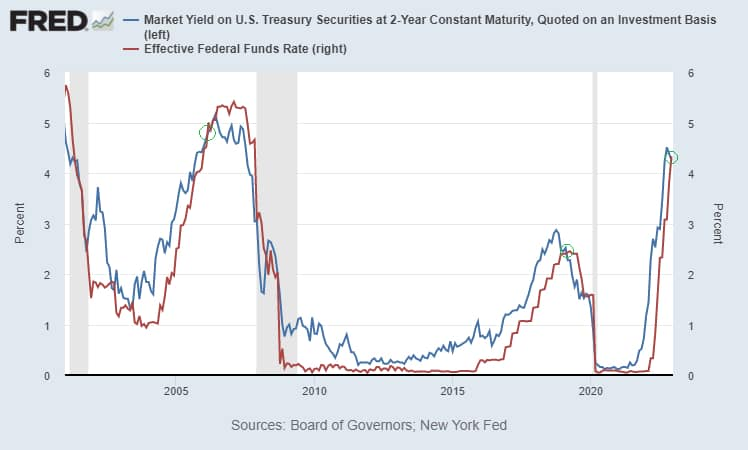

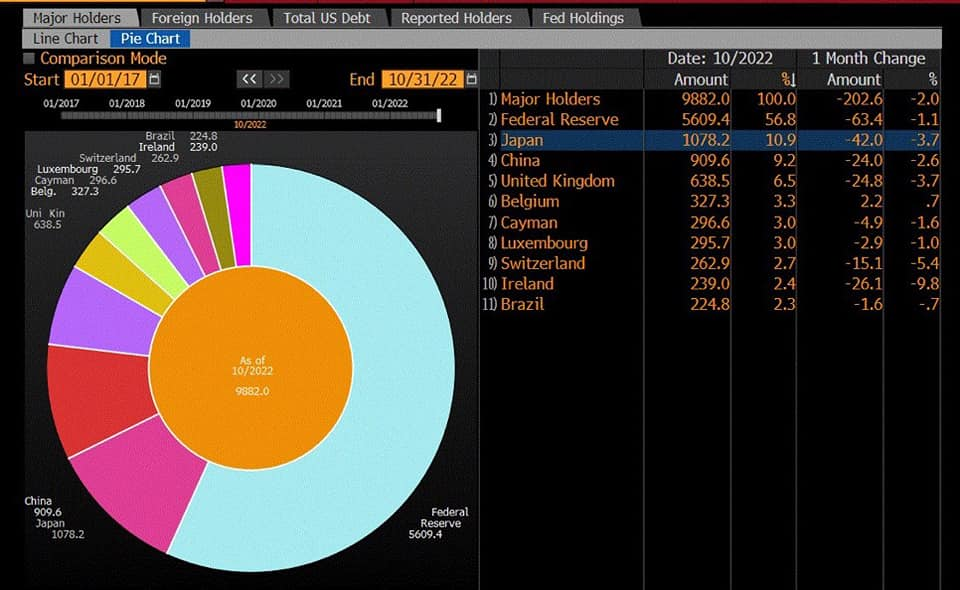

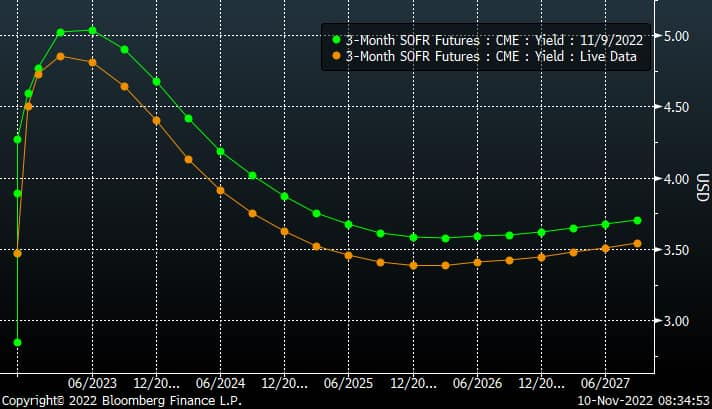

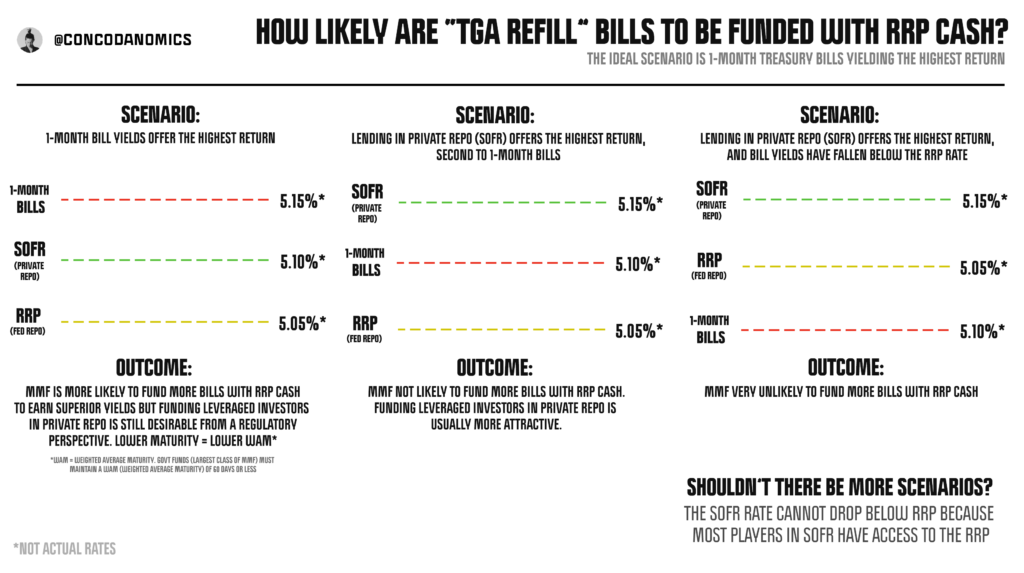

- The US economy remains supportive of global demand for the USD. Unemployment remains low, and credit tightening, such as SOFR and bond profiles, would be manageable through RRP, debt ceiling, supply duration, and buyback programs.

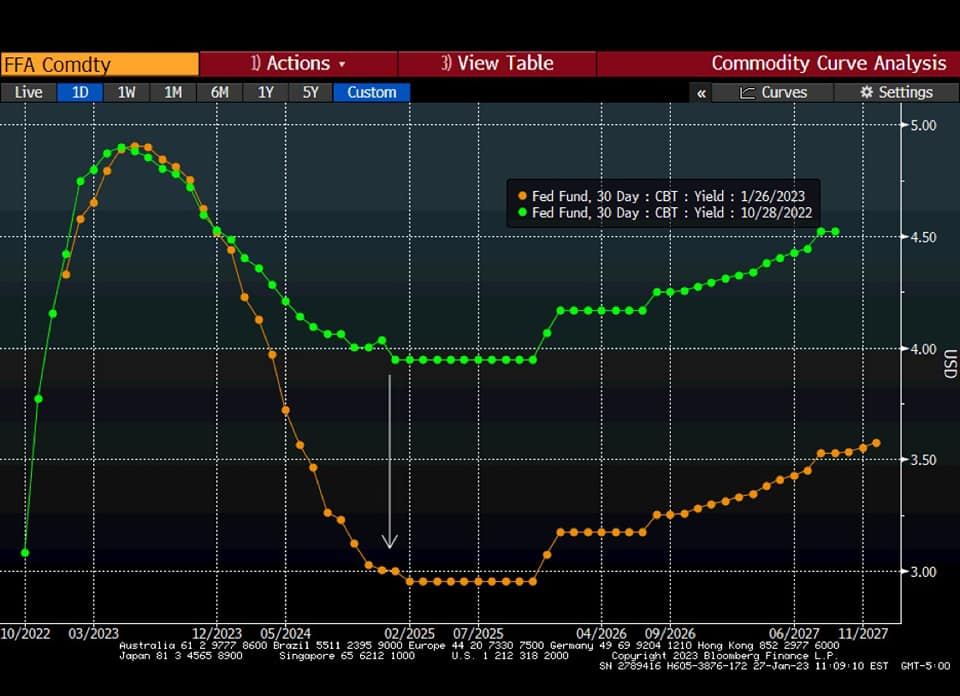

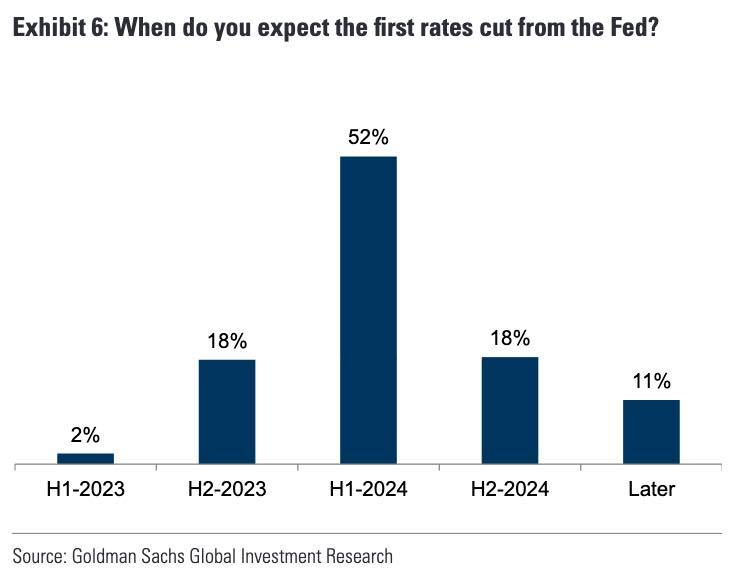

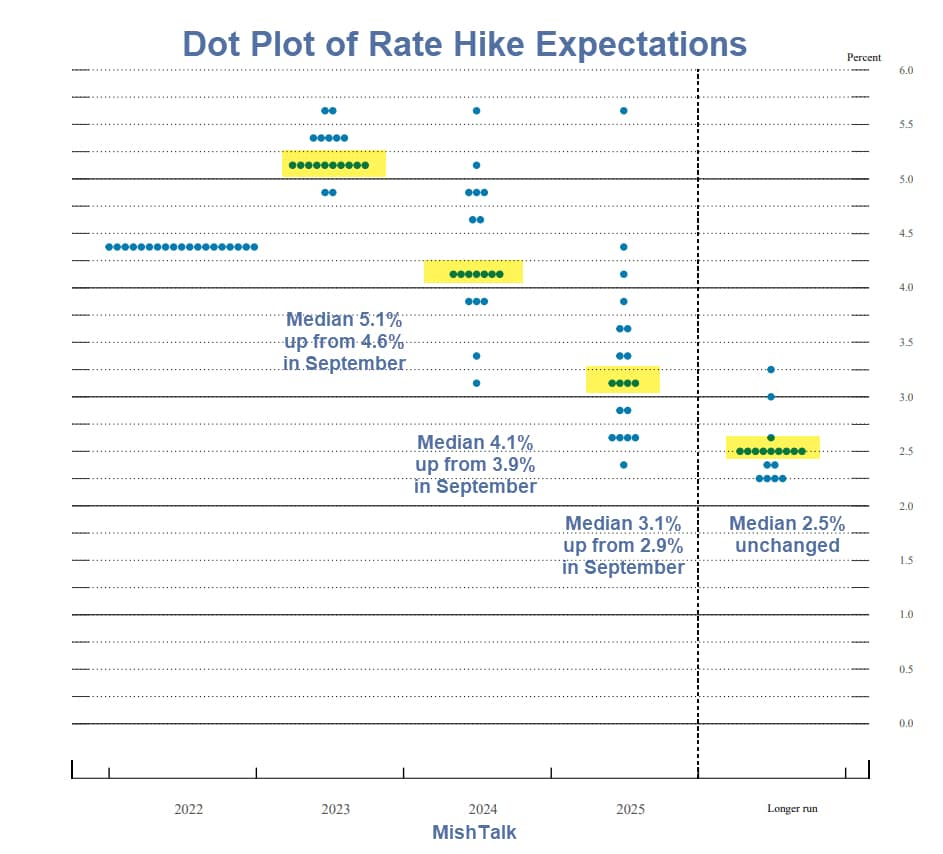

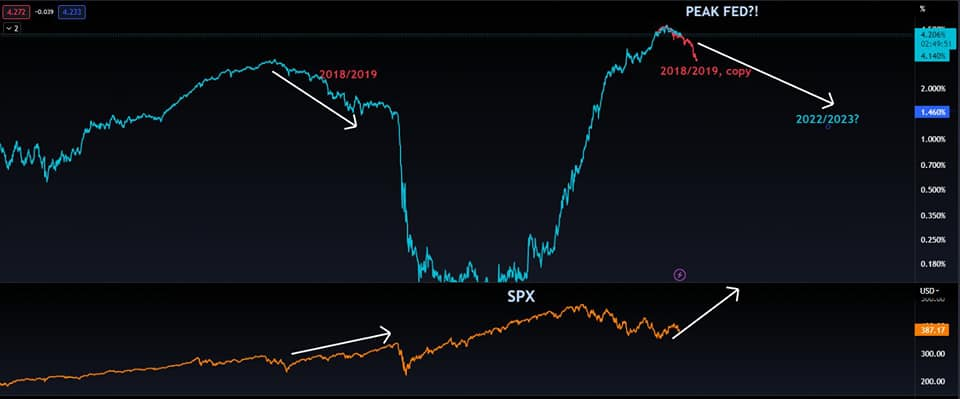

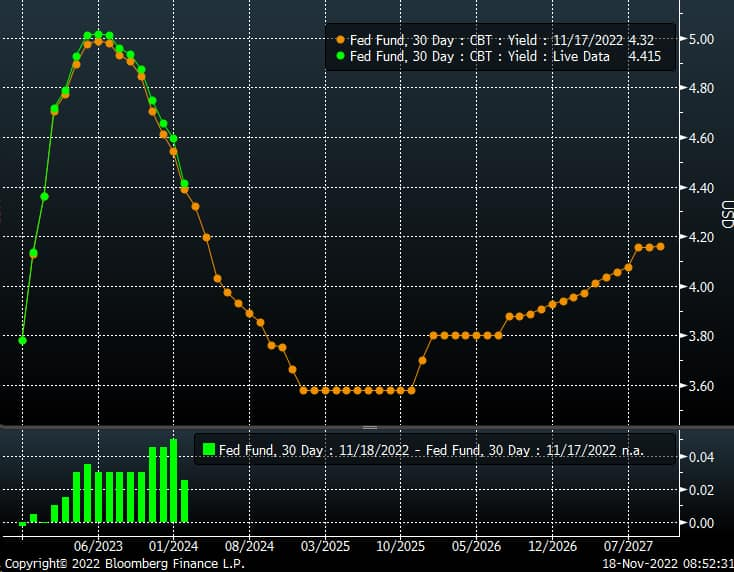

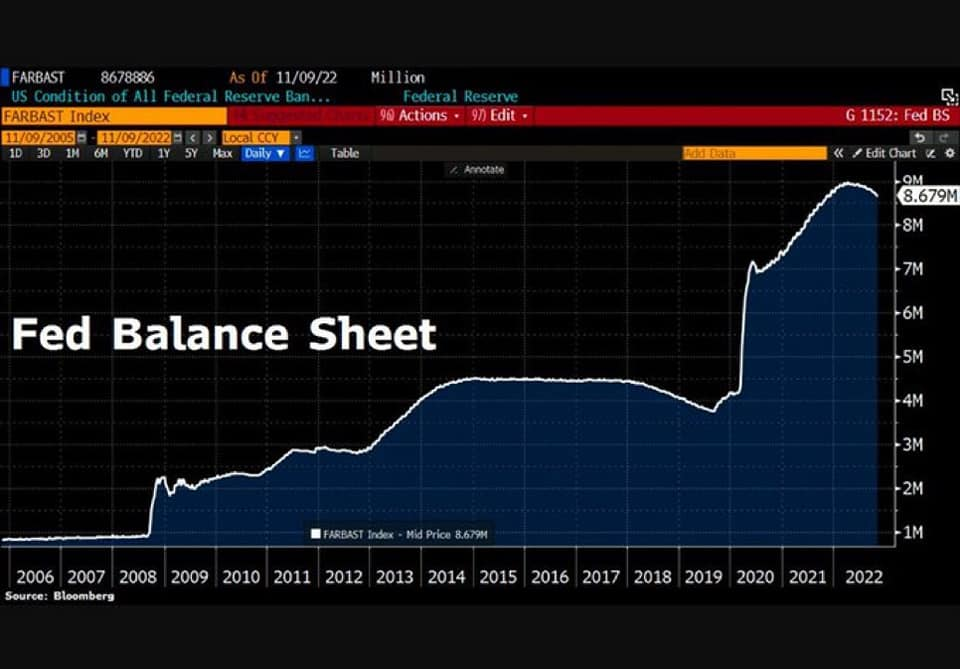

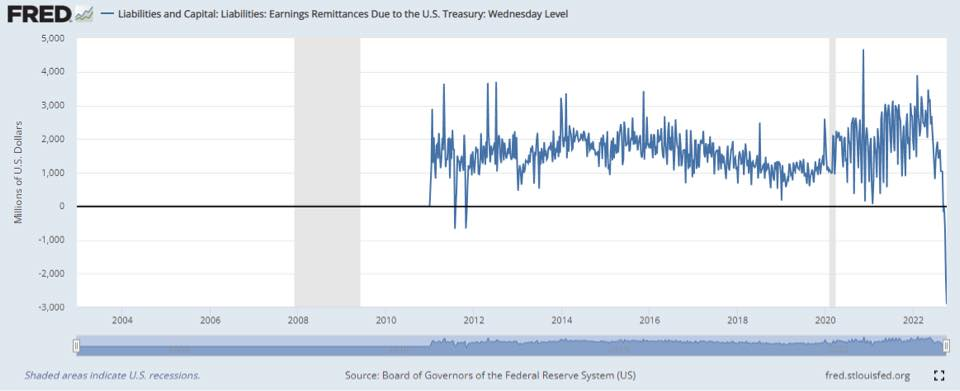

- Due to this, in my very private own opinion, the Fed and Treasury had to provide easing to their banking system, reflected in their surprise in November Quarterly Refunding Announcements (QRA) and December dot-plot.

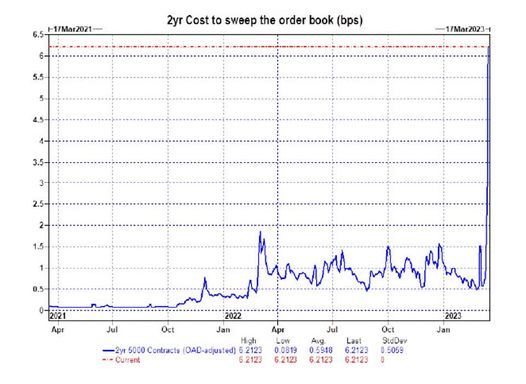

- We recently witnessed a spike in SOFR, resembling a credit crunch in September 2019. However, in my opinion, with TGA (Treasury General Account) sufficient at around 800 billion, causing less bill supply and supported by a lower Fed rate in 2024, the 800 billion RRP (reverse repurchase agreements) and Bank Reserves may flow into SOFR, LIBOR, and the market in 2024. This scenario continues to support the thesis of market demand for liquidity or USD.

- Healthier investor may likely continue to expect higher return.

- Due to easing and Fed policies, the use of BTFP (Bank Term Funding Program) might continue to increase with their consequences of arbitration easing due to their use of parity and likely to be extended.

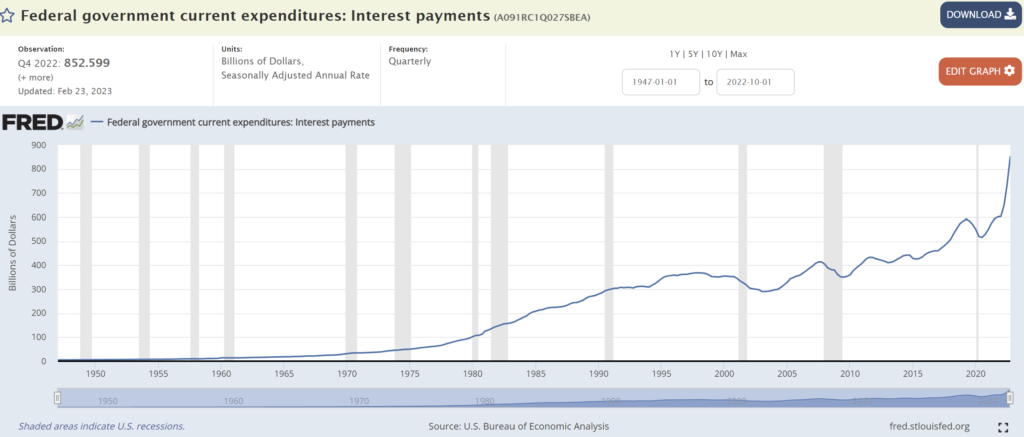

- Despite the TGA is full and Fed will cut, I believe U.S. debt will be inevitably accumulated at a 5.5% rate, fostering complacency in the supply, especially when the Treasury General Account (TGA) is sufficient. I may suspect the additional increase is for a buyback program.

- However, should global USD demand and the global economy be too strong or change in EUR usage, perhaps within a year or so, it may prompt a change in global policy to tighten.

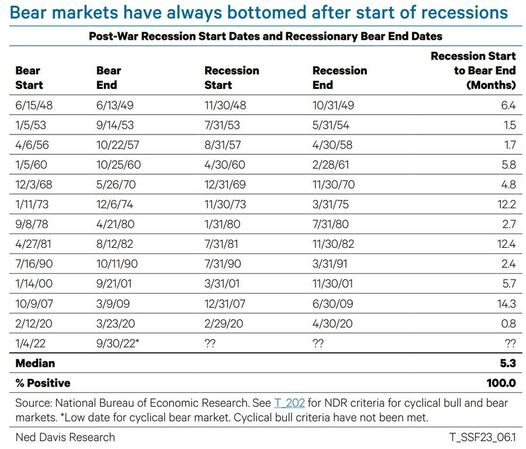

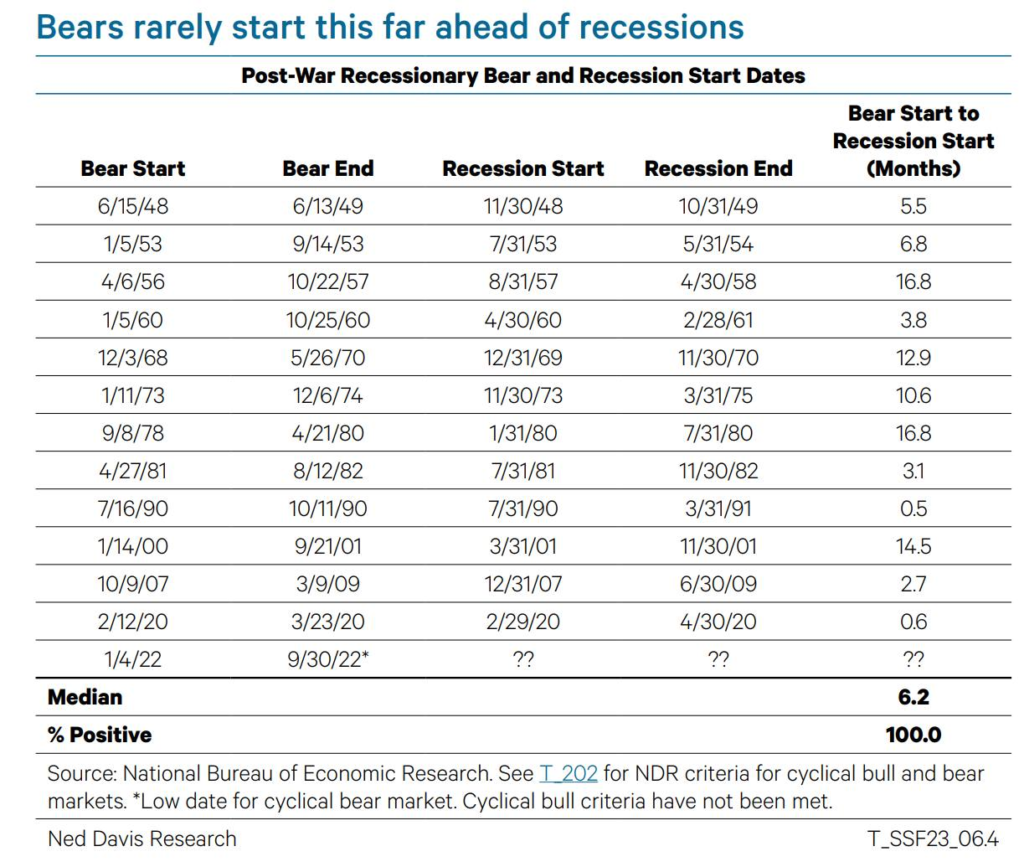

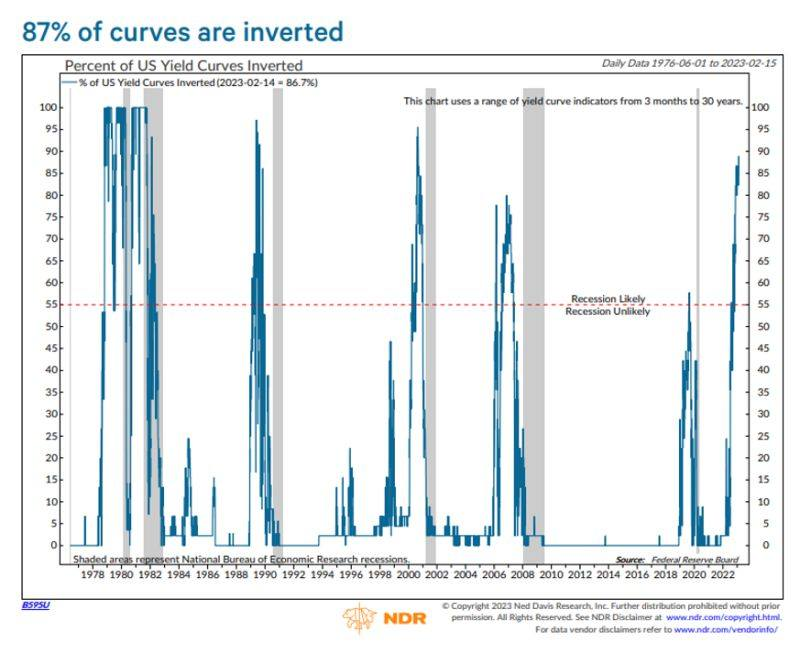

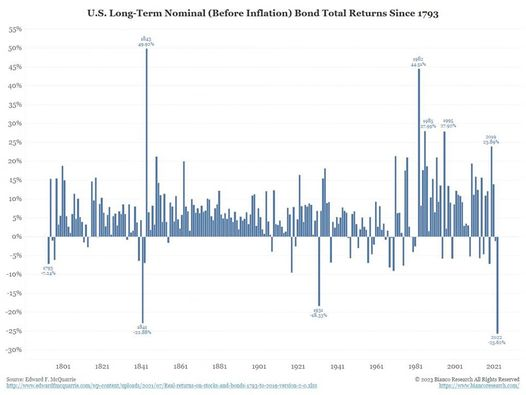

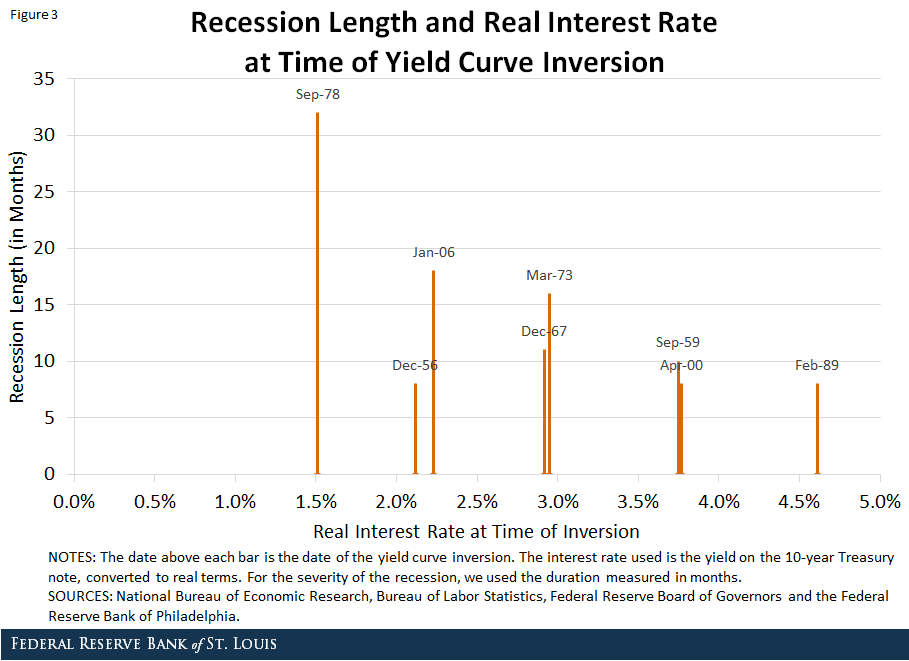

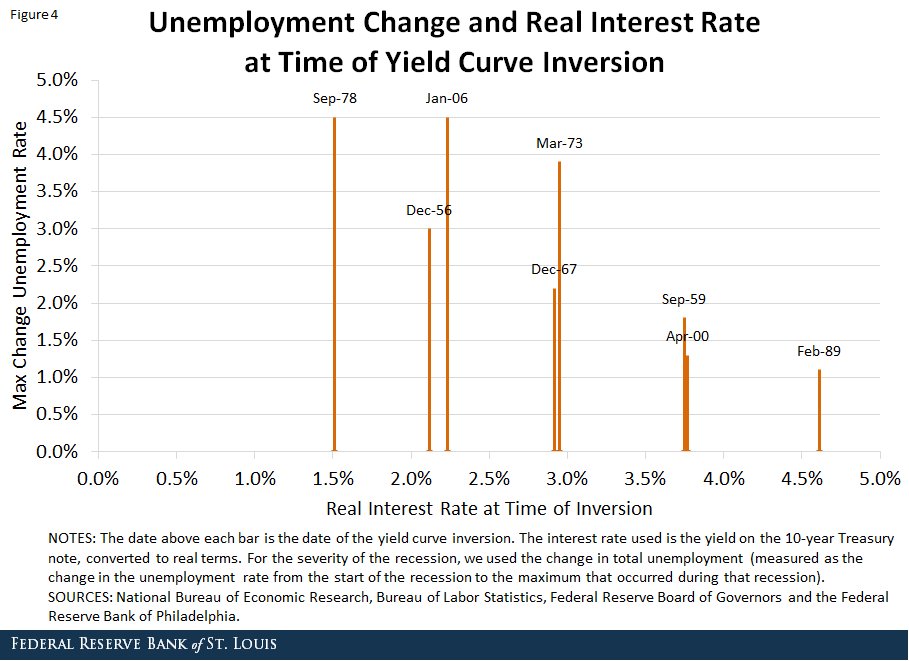

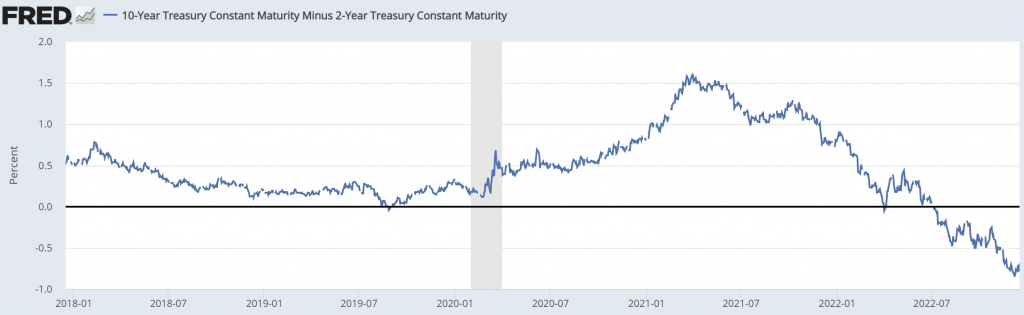

- This potential change carries multiple risks, such as un-inverted yield curves, sudden liquidity crunch, and ultra-long debt. I am still studying this scenario further.

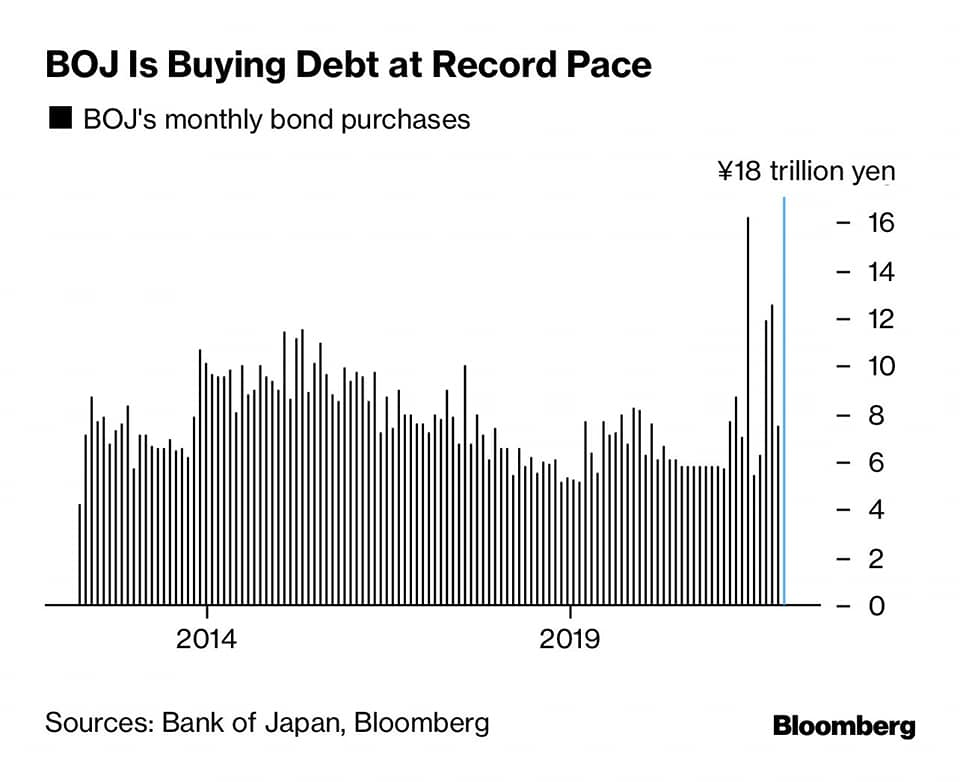

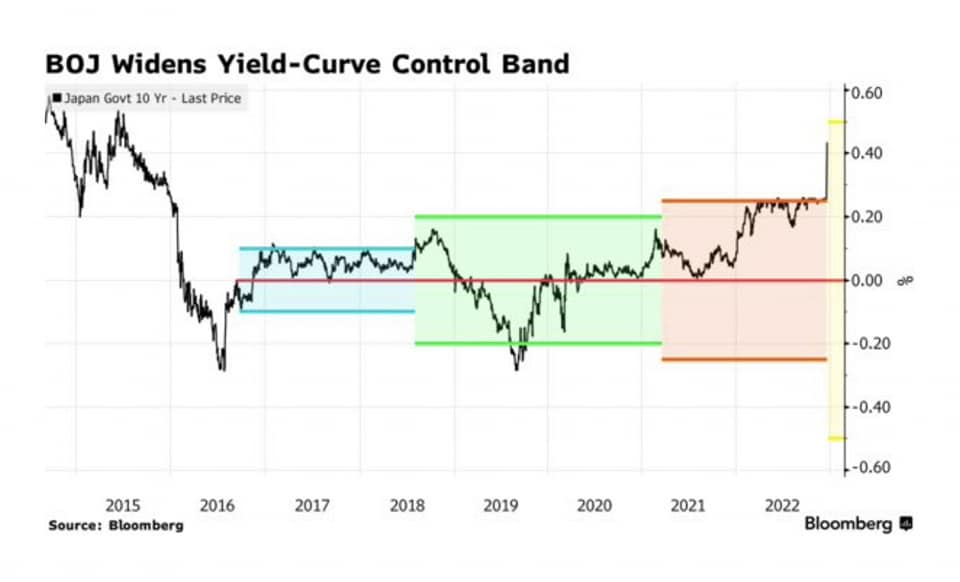

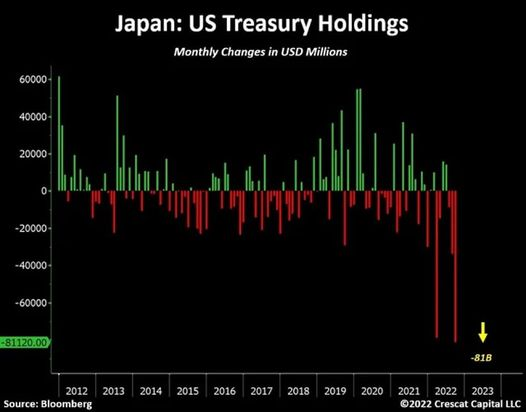

- The Bank of Japan (BOJ) may further exit its easing policy, resulting in the fall of USDJPY.

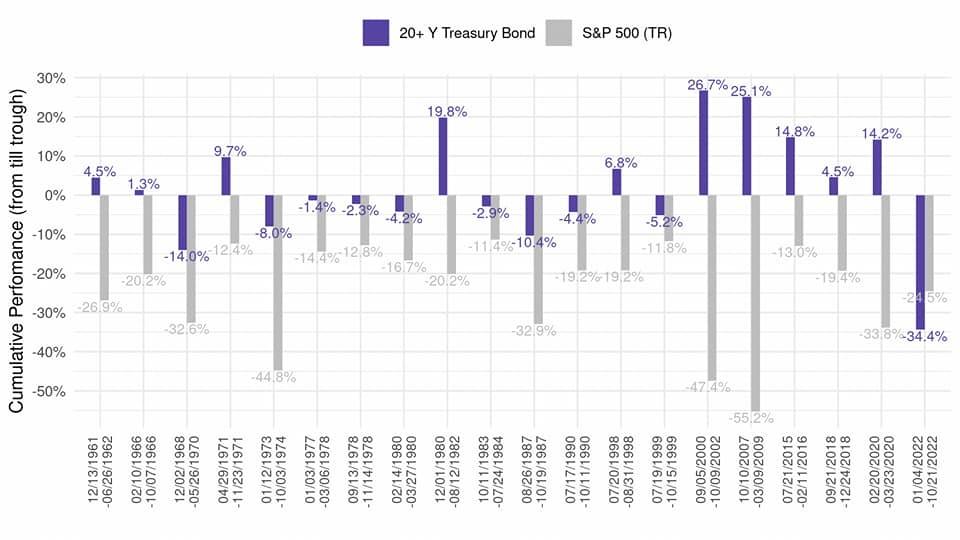

- In my thesis, US policy will likely remain loose. However a future change in global policy might lead to yield un-inversion and a shift towards focusing more on long duration which I suspect could become my second act ♬ Into the Bond ♬ thesis, following the first act, ♬ Into the Bill ♬ thesis. This is potential to be my rug pull end game thesis.

Currently Commodities and the Baltic Dry Index (BDI) make up 90% of my portfolio. Despite the negative divergence, I must try to hold on to my Fe $200 target. Reiterated many times, I don’t directly invest in indexes. I only challenge a general idea and never prefer to explicitly specify which vehicle to use. Use your own investment strategy that you believe is right and assume your own risks.

Despite economists and news attributing the movement of commodities and BDI to geopolitical issues, I do not believe in that thesis. I entered the commodity and BDI shipping markets at the end of September, due to my own strong theses above, before any geopolitical issues (mid-October) and the drama involving the Suez Canal (November) unfolded. Also despite persistent concerns about the Chinese economy, which I’ve addressed in my previous theses over several months, I have consistently observed increasing economic cooperation between China and the US. It seems that people are often blinded by feelings of animosity and a sense of national superiority, which hinders the pursuit of genuine economic analysis.

♬ Divergence is negative, liquidity is depleting, inflation is higher, risk is rising

I’m down on my luck, it’s tough, so tough

Margin lending is full, interest is high, gotta work hard 2nd job all day, working to pay the portfolio

Sometimes I have to accumulate lending interest into my debt, for portfolio love, mmm, for love ♬

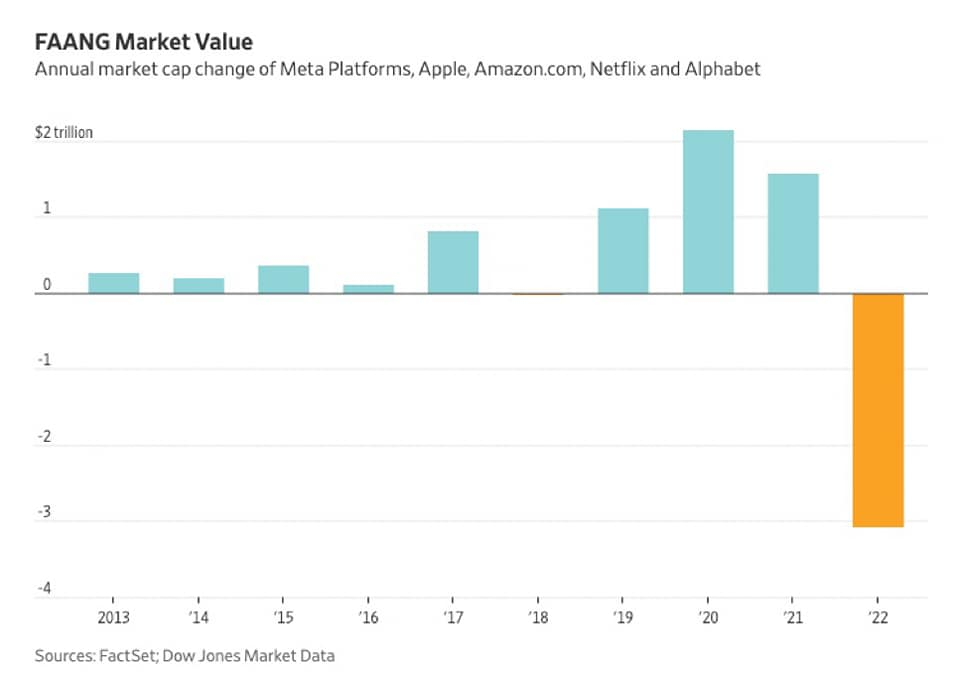

Magnificent 7 (10%) – difficult time, half way.

♬ We’ve gotta hold on to what portfolio and theses we’ve got

It doesn’t make a difference if we make them rally to the end or not

We’ve got Iron Ore, Copper, BDI, and Magnificent 7 each other and that’s a lot for love

I gave it a shot !!! ♬

Investing with high leverage for many years has never been easy. It’s tough, so tough. In periods of high share price volatility, interest expenses can consume a significant portion of profits, even when the thesis is correct, with tax benefits often being the only saving grace. At times, I find myself needing to engage in daily trading just to navigate through the challenges of leverage. It’s undeniably tough, relying on high leverage based on news or economist opinions is a strategy bound to fail. The key lies in trusting self own beliefs and theses, continuous learning to failures, and a significant amount of perseverance over decades. Also, the fear of losing everything from past failures is always haunting and often puts so much pressure, even when nothing is happening. I lost everything in 2008; fortunately, I was very small. Remember Bill Hwang?

♬High leverage stress dreams of sell and running away

When she cries in the night, Tommy whispers

“Baby, it’s okay, someday”♬

The level of leverage chosen reflects one’s confidence in their theses. Given the intense competition in the market, successful strategies often deviate from popular opinions. Many of my recent theses are original creations, acknowledging that they may be incorrect. However, being wrong is not a deterrent; rather, it’s a signal to update and adapt. The ability to adapt is paramount in my guiding principle. This adaptability aligns with the core concept of machine learning and pattern recognition, which was the focus of my bachelor’s degree. The study of adaptive machine learning has always been a source of inspiration for me.

♬ Whoa, we’re half way there

Whoa oh, livin’ on a prayer

I take my own risk and I’ll make it, I swear ♬

While there are still some uncertainties regarding support for the theses, all I can do now, for the past few months, is a lot of prayer. I will continue to monitor and am willing to remain adaptive, adjusting my portfolio as global policies may change.

Please note that all ideas expressed in this blog and website are solely my personal opinions and should never be considered as financial advice.