♬ First things first, I’ma say all of this are just the words inside my own head. ♬

As I conclude week 8 of my “degen” commodities bets on “The Greatest Commodities Showman” series, I couldn’t be more excited to see what comes next. My portfolio remains the same, with minor reshuffling among the assets as they fluctuate. There have been no significant additional purchases in the past 8 weeks, but I have started to re-accumulate again electric vehicle (EV) stocks.

♬ The commodities greatest showman been blindin’, outshinin’ anythin that you know.

Don’t you agree? Don’t you agree?

Let’s start to diversify. Lights out, follow the noise ♬

Despite all of the odds, I hope this rally continues. I often criticize economists, experts, and textbooks, not just because these are my personal battles, but because I am a firm believer in my own theories, execution, and strategies. I can be very wrong but absolutely I take my own risks.

♬ Second thing second

Don’t you tell me what you think that I could be

I’m the one at the sail, I’m the master of my sea, oh-ooh

The master of my sea, oh-ooh ♬

There have been no major changes; everything is unfolding as anticipated in my previous theories.

♬ Can you imagine what’s about to happen?

It’s Weezy the Dragon, I link with the Dragons

And we gon’ get ratchet, no need for imaginin’ ♬

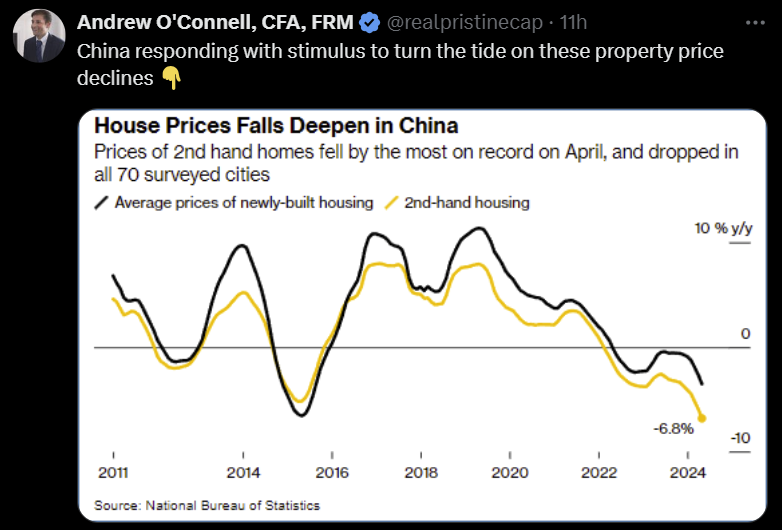

- China Dragon is beginning to recover from their property market downturn.

- Coincidentally, this is occurring at the same time that the Federal Reserve’s balance sheet is bottoming.

I expected the SHCOMP Dragon index to soar, following the HSI Dragon.

♬ This dragon don’t hold his breath, don’t need no breather ♬

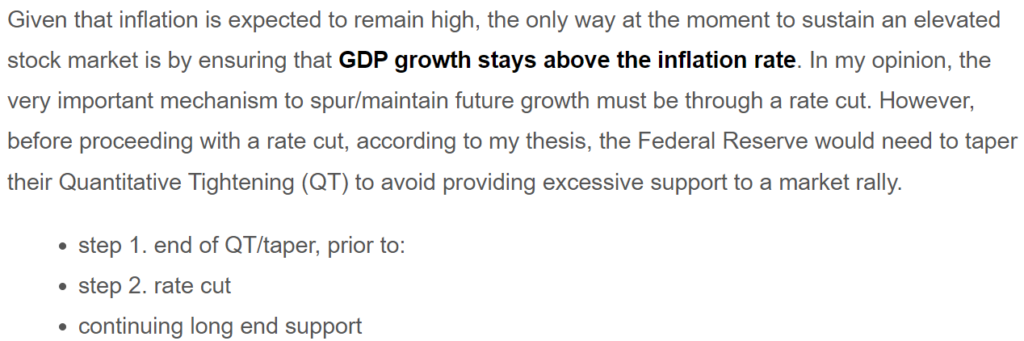

Will there be more tightening? Given good economic numbers, debt under pressure, taper, competition, and government intervention, I believe it’s highly likely the answer is no.

Will inflation decrease soon? I think it’s highly likely the answer is no. Since mid-2022, my thesis has been that 5.5% interest rates cannot and will not lower inflation anytime soon. Only the naive believe that 5.5% can curb this inflation. Only a very painful solution can. I have learned a lot from the Asian financial crisis of 1997 and my master’s degree thesis detailing the causes and survival strategies.

Is easing happening now? IMO No, targeting 2% inflation is good for America. Capital is flowing into America from around the world. While 2% is somewhat El Erian said arbitrary, the Fed might need to revert to my December thesis and apologize for not raising the target above 2%. However, there is unlikely any policy changes to the theory anytime soon.

Should there be a rate cut? In my opinion, at current condition, rate cuts benefit low-income earners but do not significantly impact the overall economy and should not be based solely on inflation. While most people and economists have been expecting a cut since January 2024, my analysis, which is not personal, suggests there will be no cut.

What if there is a rate cut? It could be due to an excessive global rally needing support, deteriorating economic numbers, the Fed abandoning the 2% target, or China pulling back. And I might…

In 2008, I lost all due to highly leveraged commodity investments, which was the most painful. Since then, never again, successfully skipped COVID-19, and fighting hard on developing more robust thesis. It’s never easy to build a thesis and apply it to real leveraged investments. How strongly do we believe in own thesis, as much as betting them like a “Degen”? Of course “Degen” in this never certain industry, is not a good example of metaphor.

♬ Singing from heartache from the pain

Taking my message from the veins

Speaking my lesson from the brain

Seeing the beauty through the…

Pain!

You made me a, you made me a believer, believer

Pain!

You break me down and build me up, believer, believer

Pain!

Oh, let the bullets fly, oh, let them rain

My life, my love, my drive, it came from…

Pain!

You made me a, you made me a believer, believer

And I believe in myself ♬

Please note that all ideas expressed in this blog and website are solely my personal opinions and should never be considered as financial advice.