“World without money, there is no economy, no economist.”

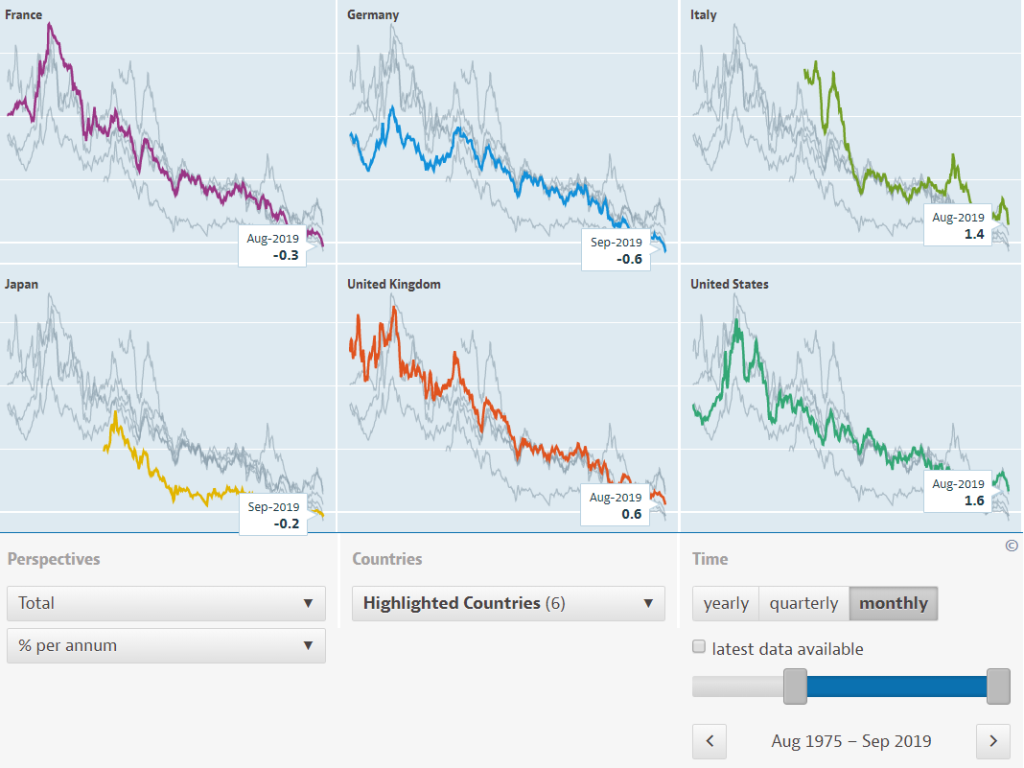

I’m still a fan of inflation since 2015 and I will keep my view intact. Please show me evidence that recent effort of normalization is working beautifully? It didn’t, it doesn’t. Recent bloomberg article shows a world awash with $8.6 trillion in negative-yielding debt, is still easily flipped when central bank blinks. The number is staggering, enough tail-wind.

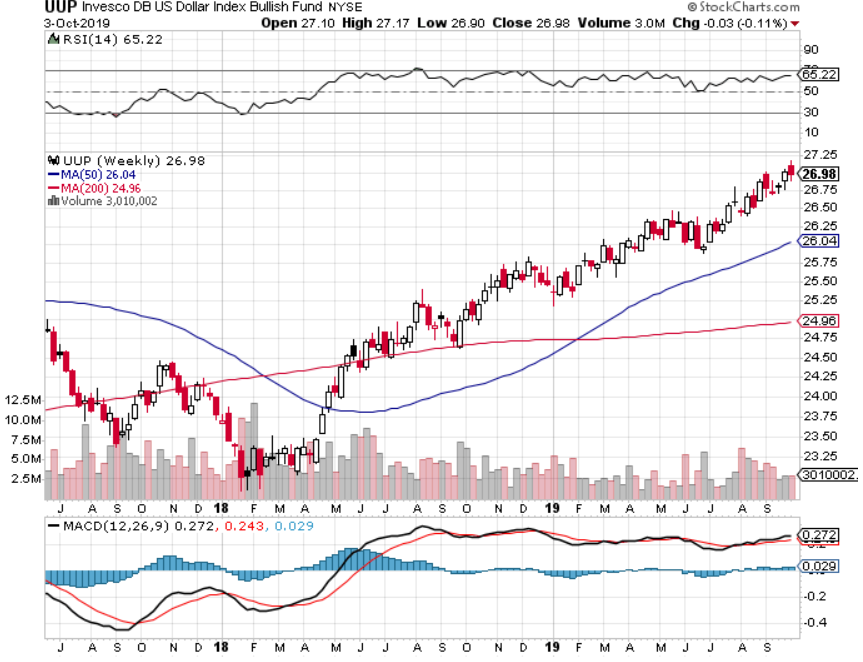

Since Federal Reserve rapidly increased rate, USD was getting stronger than ever. PBOC at same time was tightening and China economy is slowing down, we can ensure PBOC is injecting big amount of liquidity since 2015 and for sure is growing faster than previous decades. However, is China the greatest easing after all TODAY? Bloomberg recently reports China injects huge amount of money, indeed USD is still weaken against CNY. Is it enough to raise our eyebrows?

People may question 2 policies that may seem to contradict to each other. History shows that financial navigation/auto-pilot always needs 2 ‘contradicting’ policies. After crisis, they may push long term and raise short term bank reserve rate, a different time frame. Same like driving, policies need gas and break, to better control market to their path.

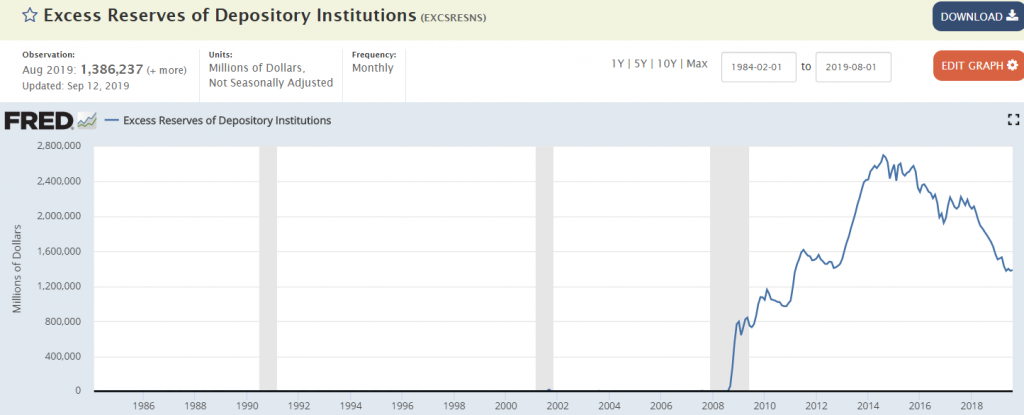

Trump tax cut injection and deficit in 2018 is also greatest in history. At the same time, asset under Federal Reserve balance is starting to mature their belly since 2015. Once matured, the principal is transferred back to treasury. It’s treasury, who is now issuing more debt to roll them over. It’s Trump. It’s just unfortunate that recently Trump doesn’t have much support from Democrat (politics in regard to next election), already shown in a small thing like border wall. Both are still stubbornly enough to make a compromise, to inflate the world, to keep modern economy alive!

Pinocchio: I can move! I can talk! I can walk. I’m alive!

If China manipulates currency, why USDCNY is unable to break 7.0 during USD supremacy era? If Fed Balance sheet was greater than in 2008, why USDCNY fails to break 7.0 with PBOC injecting money bigger than ever. An argument may say PBOC is manipulating exchange rate. Question to this argument, can we manipulate currency in past 2 decades? Does this argument think that global market (intertwined currency) is smaller than PBOC? It doesn’t make sense. China is still second largest and itself is not big enough to put world under their knees.

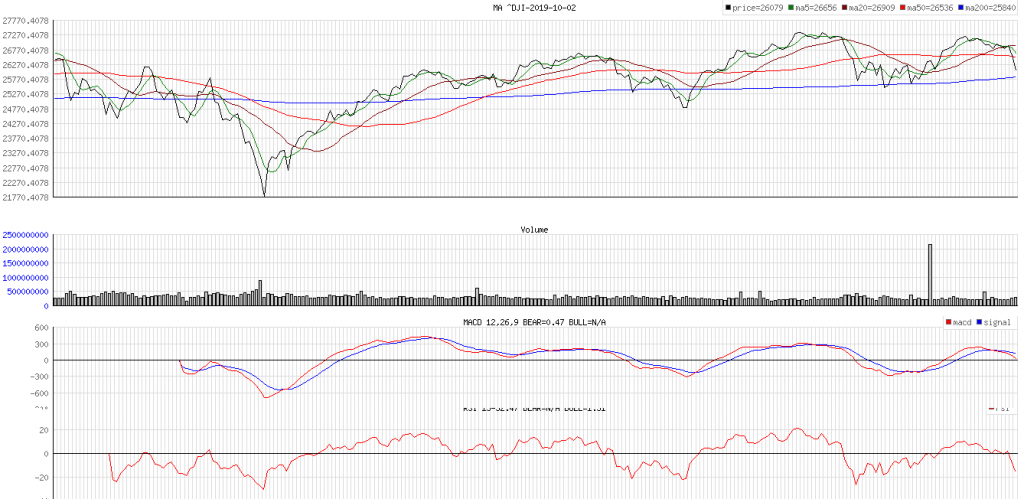

Everytime USDCNY is back to what it WAS in 2008 around 7.0, with China and world injecting more than ever in history, Wall Street is still loosing ground, seen in Q4 2018. USD was too strong, causing Wall Street to ask for help. 1y bond is recently flashing inversion alert, everytime USD is too strong. It shows that if USD is too strong, financial suffers. I still think that if this burden is not cleared yet, probably with some correction next year, financial and most likely property issue may not get cleared/perform yet.

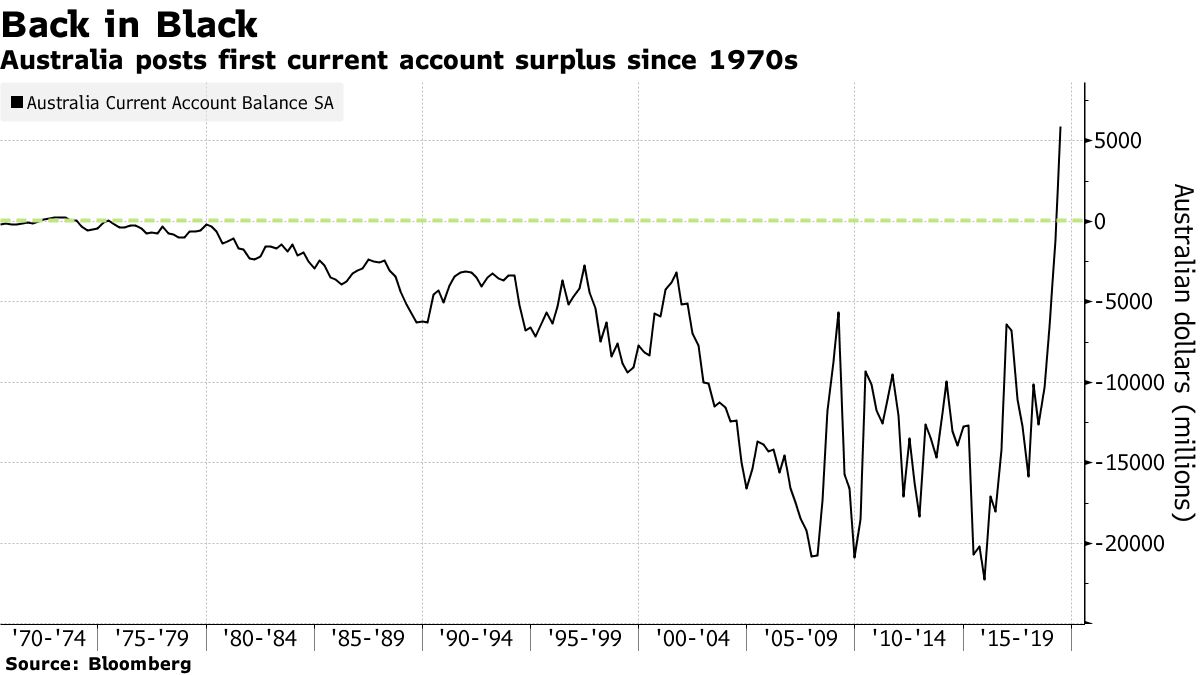

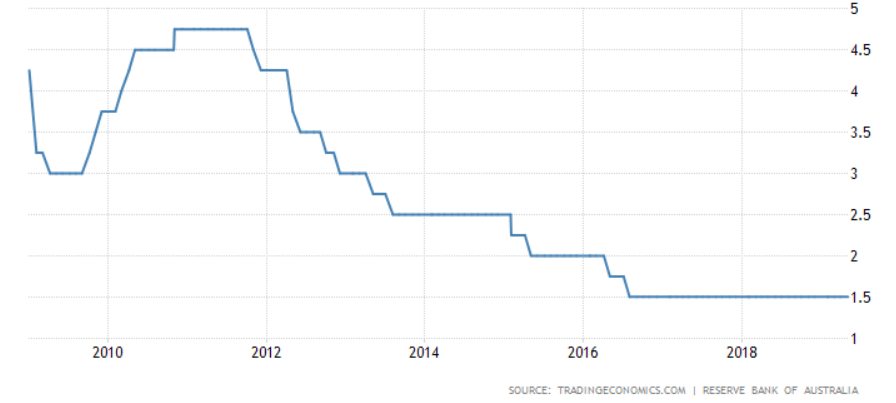

Global growth is also unable to handle strong USD and oil was crashing. Everything is now going well AFTER Federal Reserve blinks to the market and not to their own numbers. It follows by many other central banks. Australia is also considering cutting rate and AUD was down. Typical currency war is still here today.

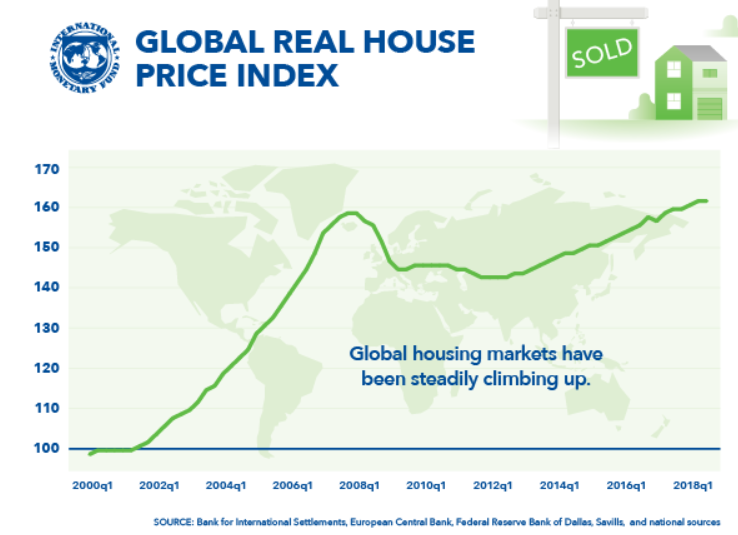

Since human is greedy and hunger of money, USD shouldn’t be allowed from going too strong, that what Wall Street is. World shouldn’t stop issuing more easing. China shouldn’t stop injecting liquidity, or else they will see all of those printed money since 2015 goes waste to drain. At the end, there must be inflation rather than slow down, to support my inflation theory since 2014/2015. Isn’t everyone working to push weak global economy growth UP? It’s not without risk that global slowdown could create next global crisis. However we are human who created the systems, can decide when is the next crisis. It’s easy for each of us to keep party rolling, very easy, since we all have common interest, MONEY. However it’s strange that it’s just too hard to make compromise between US vs China and between Trump vs Democrat, INTEREST.

Before October 2018, we used to hear a beautiful world normalization, and stronger US economy. Few months before October, I was arguing that in this intertwined economy, this hegemony shouldn’t last long. US is starting to slow down together with the global world slow down. It actually raises a question. Is US really the strongest economy in the world at the moment? If it’s, please explain to me USDCNY in past 2 decades and why it’s too hard to pass through 7.0?

I’m not saying that PBOC is cleaner. They both have their own agenda and their own defense. PBOC numbers also have a lot of irregularities. Communism is a living creature which can provide financial stability in expense of social pains. We are just a tiny molecule here who is just trying to study their behavior in seeking the truth. Indeed today, we are questioning central bank in-dependency from fiscal policy. My deep learning sometimes gets confused with too many contradicting signals. It definitely needs to weight down the contradictions.

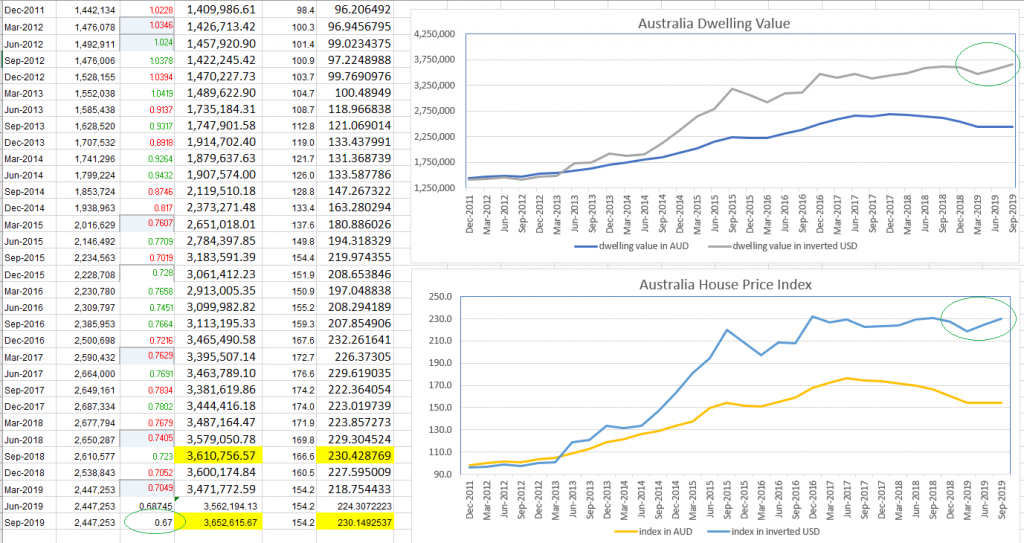

Regardless of those human disagreements, let’s use numbers because that matters most here. Let’s look back in year 2000 when a dot com bubble burst which marked a start of IT evolution, the FANG. PBOC couldn’t hold USDCNY peg at 8.27 and greed had never been higher until year 2007 when PBOC tried again to hold USDCNY at 6.82. For sure PBOC (and no other central banks) could no longer again peg USDCNY at 6.82 when Fed conducted massive QEs. During that time in 2007, China GDP was still far very small compared to US GDP. As a simple rule, smaller GDP shouldn’t be able to strengthen their currency higher than higher GDP. It’s still raising a question, if China GDP was lower that time, why CNYUSD is getting stronger? Many argues trade surplus but why not considering account deficit? The issue is, trade surplus keeps going higher while account deficit can’t go lower. It causes the imbalance.

Between 2017 and October 2018, USD is loosing value much faster despite spectacular USD economy performance and USD divergence. Indeed world condemned some country and actually the rest of the world, to continue conducting biggest currency manipulation. USD has been loosing value in past 2 decades until today at same pace, despite spectacular USD divergence and beautiful normalization story. The intertwined credit of today is much higher than world trade balance between US and China. The value added product made in China is still far less than created trade account balance/deficit. The fact is Wall Street was unable to continue rally when USD was going stronger in October 2018.

Let’s read to this financial article from The New York Times. From all of its long story, I only can find that the writer argues from 2000 to 2014, China bought dollar and add 4T$ to reserve. None in this world could stand of not printing money when Fed did incredible ballooning 300% balance with QEs between 2009 to 2014. None can be crazier than issuing greatest CDS (Credit Default Swap) between 2000 and 2008. A simple theory is, whoever did first is always the biggest. Not just China, most countries in this world followed Fed printing during QEs, 2009 to 2014. Emerging countries (Asia, India, Venezuela, etc) are even worst than China and surprisingly they are not currency manipulators. They later got trouble with inflation, and not China. China is still smaller. China can’t just add 4T$ without US doing it first. It doesn’t support currency weakening effort. The writer then argues that in 2015, Chinese government kept pegged renmimbi to the dollar. Does the writer know that PBOC starts massive easing, injecting money greatest in their history and keep cutting rate since 2015 until today? At same time in 2015, Fed keeps raising rate faster than ever? It doesn’t make sense PBOC to keep renmimbi pegged against dollar to stop it FROM strengthening. It’s indeed should be an effort to stop it FROM weakening because inflation is very SENSITIVE to their 3 billion of society. This is the main reason of not allowing currency from weakening. Eventhough that massive efforts, China still fails to fight currency war from USD. At same time Wall Street is also part of symbiosis that requires China to help racing money value destruction.

Pinocchio, Pinocchio, please tell me the real truth!?

China for sure can’t compete the pace of information transmission. There should have been decades of efforts to make financial benefit. Don’t be surprised that most normal economist relying on these Pinocchio economy numbers usually fails. It’s no surprise that in decades China is building information wall. No chance to break out world dominance, no chance for HuaWei. It could be a no brain to collect few depressed 5G provider in the wake up of world monopoly, just some small side dish to inflation bet.

It doesn’t matter how hard number can explain, it won’t even be able to satisfy every part of human INTEREST. When I expand my deep learning to longer view or decades of numbers, it seems to be less prone from the irregularities because as the fairy said, “a lie keeps growing and growing until it’s as clear as the nose on your face.” At the end, Pinocchio said “I’d rather stay smart than be an actor“.

It’s my own opinion and not in any case of financial advice.

]]>