Human endures many different paths of society, democracy, oligarchy, communism, etc. They do try to create a stable society in their own way and to preserve wealth.

Central banks have been long doing monopoly. They are monopolizing money printing. Local banks also have been long doing monopoly. They are the only ones can draw money from the central banks.

In public company, we do see many examples, Google and Adobe have been monopolizing their industry. Google search engine is no match to any. Adobe Photoshop is also no match to any other. We also do see merger and acquisition strategy which is simply an effort to create money from thin air after having bigger monopoly, 1+1=3. At the end, the monopoly can decide their price and PER ratio is no longer much working to them.

Monopoly may create higher PER/Price Earning Ratio

In technology, 5G, should also be in monopoly of the “greats” since they are a strategic global infrastructure. I mentioned in my article from early this year, we should just follow 5G monopoly. It simply works. Even in current high momentum of Telstra share price movement, we can clearly see a-not-so-invisible hand on play with the 5G monopoly, even though their NAS (Network and Application Services) is quite interesting to watch. Eventhough current technical may start to show a potential correction, previous strong hand plays is already detected and may surprise in future.

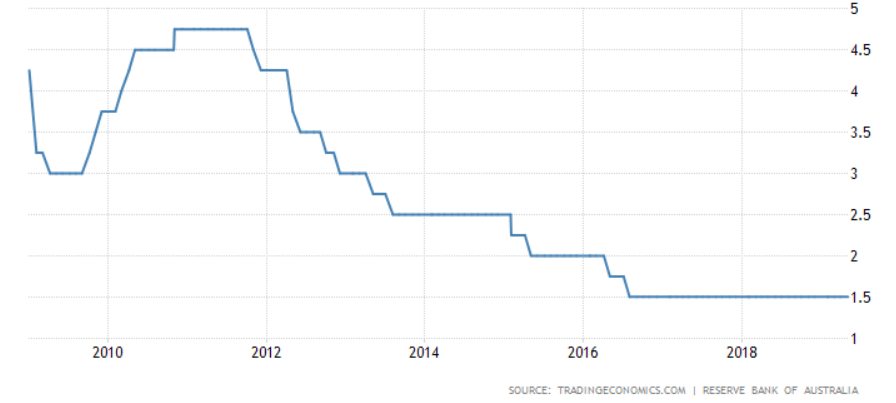

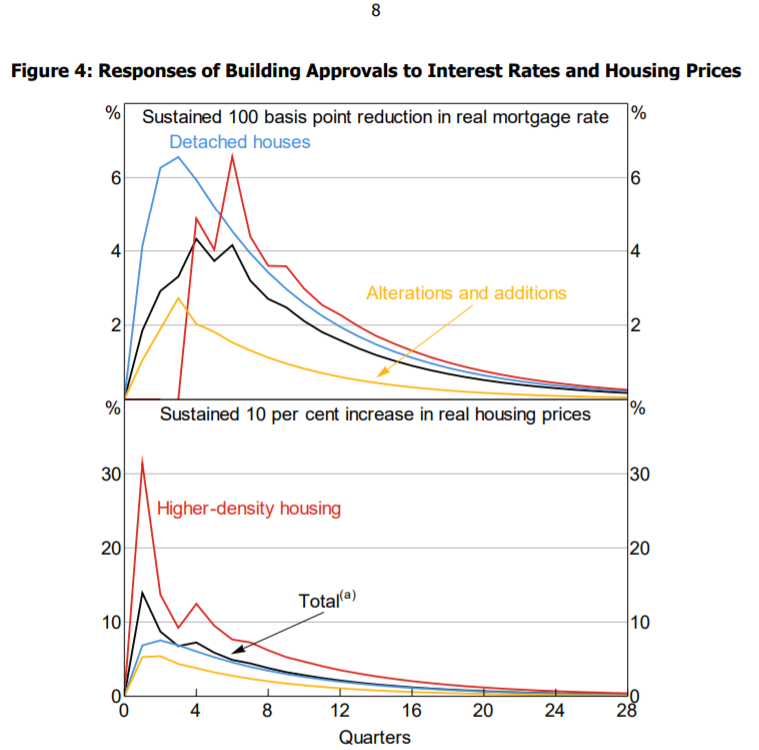

In Australia property, we should see big banks are starting to lower rate BUT something unique is being detected. We do see all big banks who has direct access to the currency monopoly, has been reluctant to pass full rate cut. In the mean time, currency supply from big banks and reverse carry trade should flood the market. We clearly see so many non confirming lenders are now offering 0.5% lower or more than big banks and attracts migrations from big banks to non-conforming lenders. It raises a question to me, why big banks who are monopolizing the currency access offers higher rate than the ones which can’t do monopoly. It should be clear that there are currently a lot of liquidity at the moment. I would have my own theory that they, who can do monopoly, should see profit margin and strength from property is deteriorating. Therefore they start to sell weak assets with help of their “grandfather”, in which in future they can simply make a policy change by orchestrating liquidity out from the market when good time for property comes back. In a normal action respond, it’s part of bounce back similar to death cat bounce.

How far monopoly can push their price before introducing too much competitors? In theory, Marginal Cost (MC) is equal to Marginal of Revenue (MR) and which is above Average of Total Cost (ATC). In property, marginal of revenue should have run down faster than decreasing of marginal of cost. For example when central banks cut rate from 1.5 to 1, the market rate should also decrease 4 to 3.5. While the profit margin is relatively same, the revenue and their profit margin should have gone down with fixed cost remains same. Therefore I believe it’s more profitable for big banks to run market rather than holding assets since cost to run market is lower. The other way around should happen when long term rate is starting to rebound or inflation is starting to kick in. That’s when I believe the big bank monopoly will start to reduce oxygen from the market.

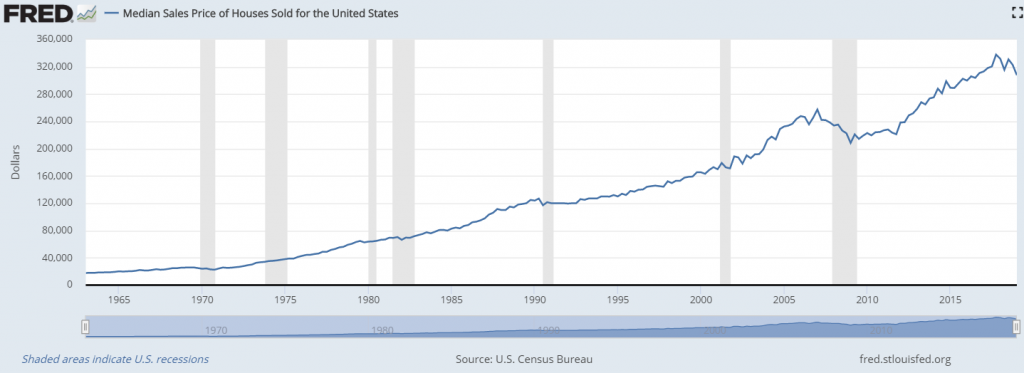

We would then think bigger picture. When will inflation starts to kick in? We do know US is having benefit from monopolizing their strength of currency and enjoy this benefit while other countries like Europe and China are still having issue. I would have to agree with Fed, as long as they are still the only one monopolizing one biggest strong currency, they should be reluctant to cut rate like other countries. I would believe, when reversal time is coming, other countries could no longer do currency war and may start to increase rate. I would think that’s the time when Fed will start to do the other way around. With negative yield exceeds 13T$, there could be a big spike of inflation during the reversal. Market may fall, but inflation sensitive may then recover quicker than the other.

In the meantime, as predicted before, as the strongest currency, they can maintain Wall Street to continue their trend and slowly destroy global money value, unseen. This is what I describe as a stable currency where magic is happening and binary is formed. Inflation should be still far away because it broke MA200 ($TNX). As long as USD is strong, inflation should be in control. I don’t think we would see the reversal and market crash in next year or two. It’s simply because central banks currently demonstrate their habit of monopolizing money destruction and ample of liquidity is everywhere.

Monopoly is to make money. Money follows the monopoly.

My money theory is not in any case of financial advise.

]]>