Nobody does it better

Makes me feel sad for the rest

Nobody does it quite the way you do

Why’d you have to be so good?

Baby you’re the best!

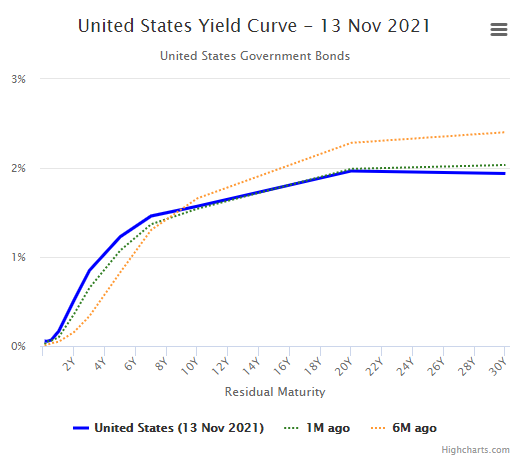

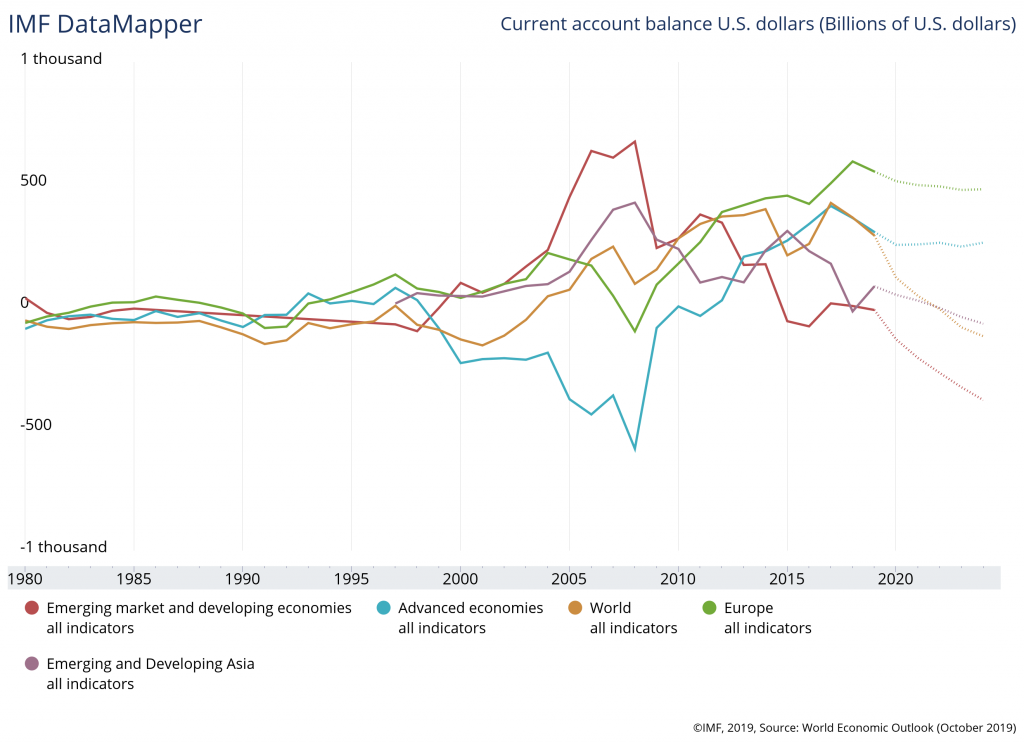

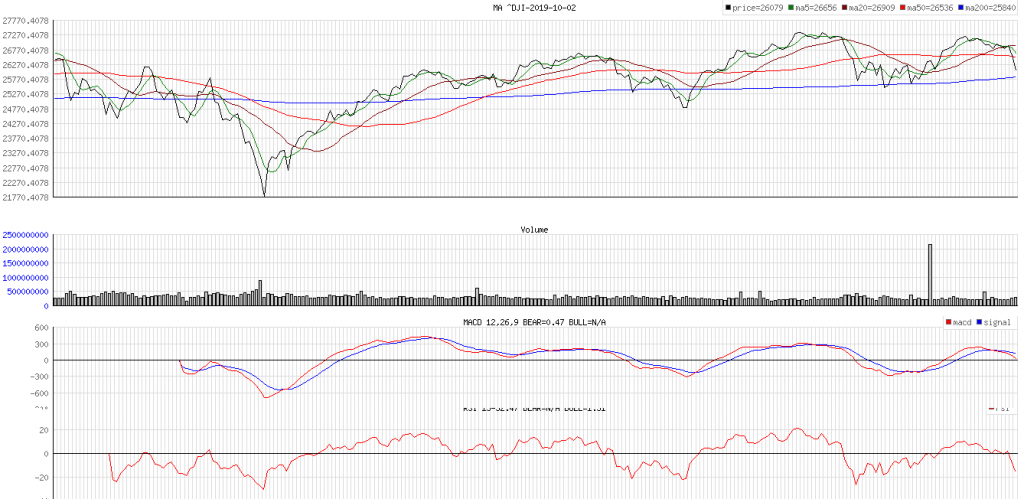

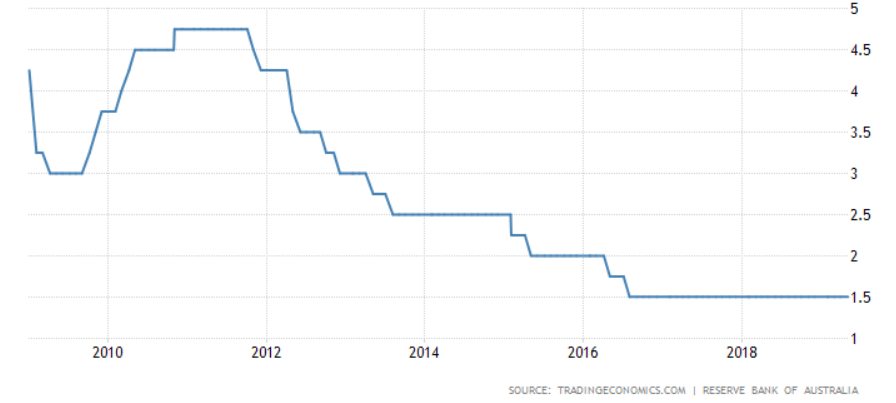

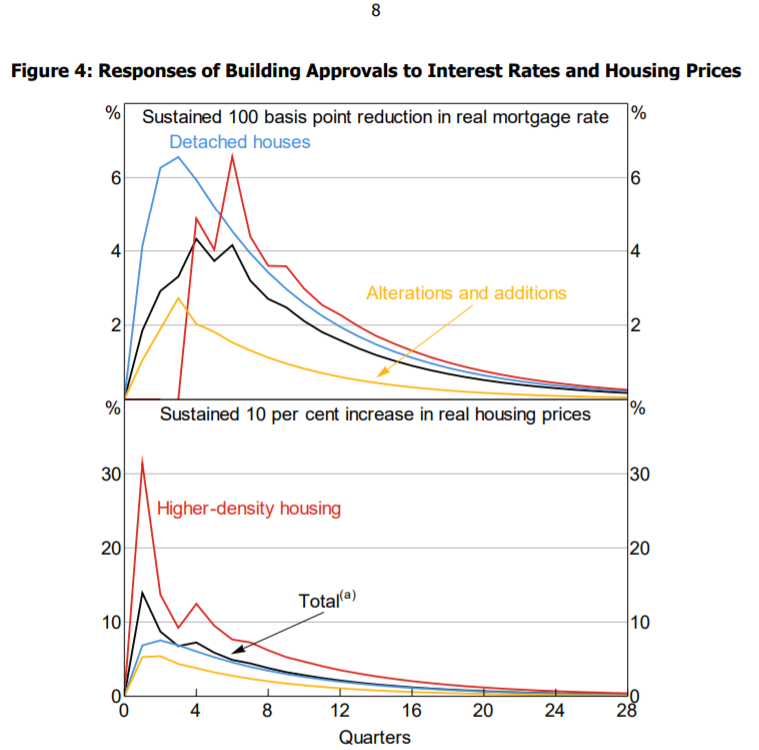

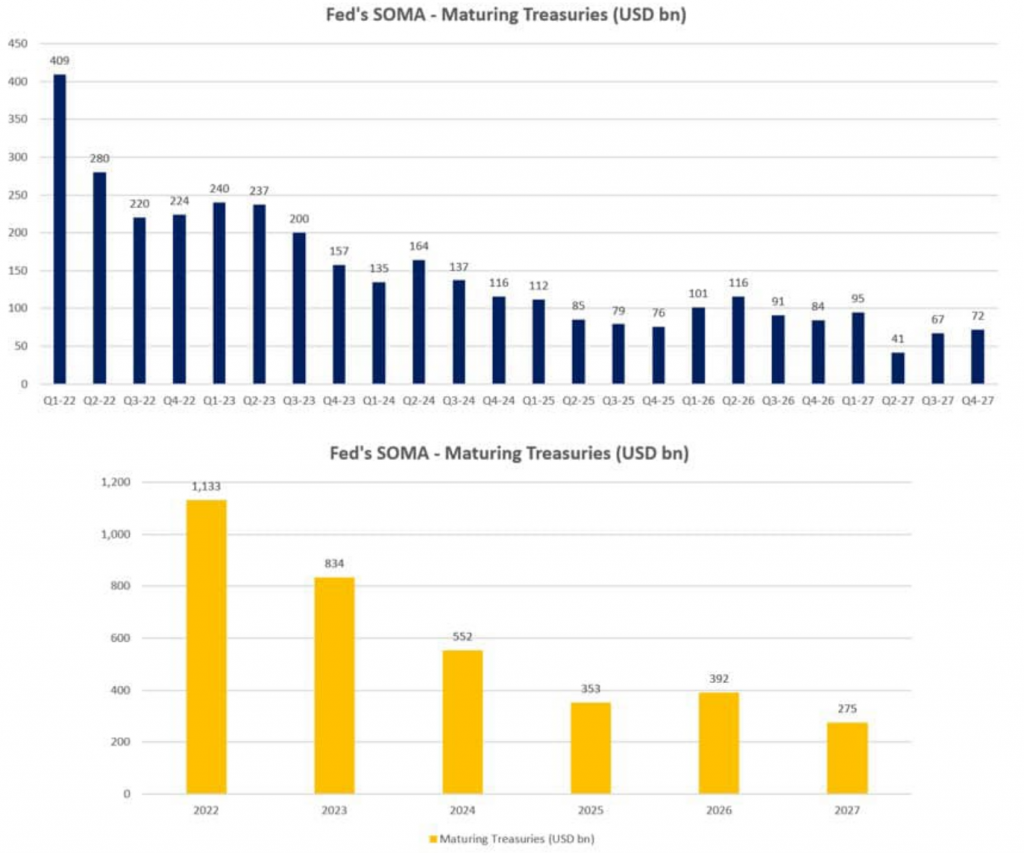

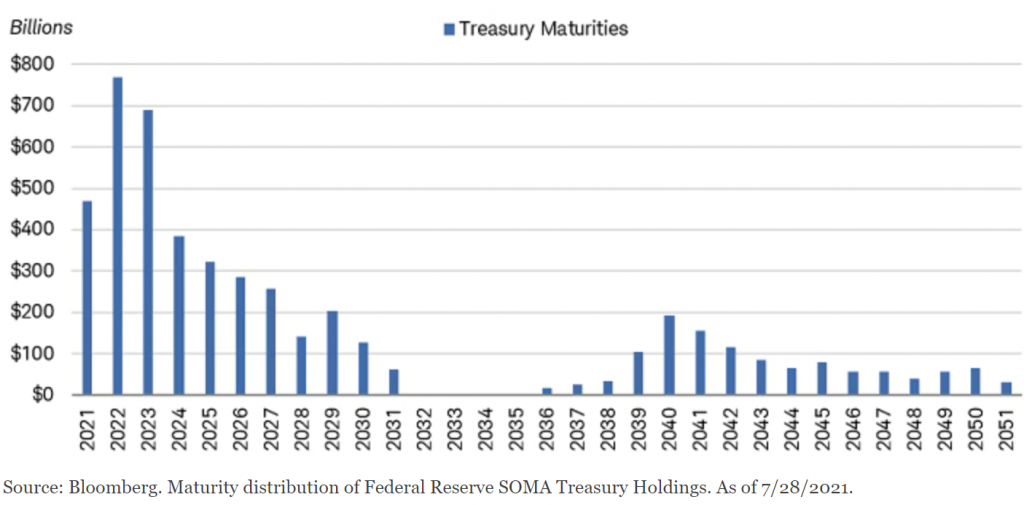

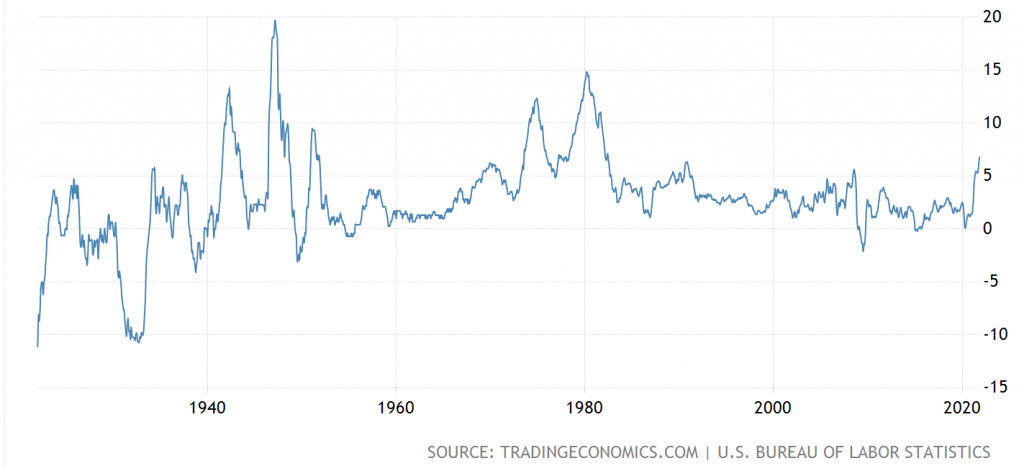

Following relentless bullish thesis past 2 years, do we still hold our inflation play tight? Since my article two months ago prior to Omicron, I should still think this year is last best possible investment time windows. It was shown in yield curve, possible end of ultra low rate era, and seems to match significant short term SOMA maturity. The Federal Reserve might have less option for treasury to seek their refinancing, which may contribute to weakness of USD. We might agree, faster raising price usually happens when bullish is about to end and it may lead to temporary/unsustainable inflation/price increase.

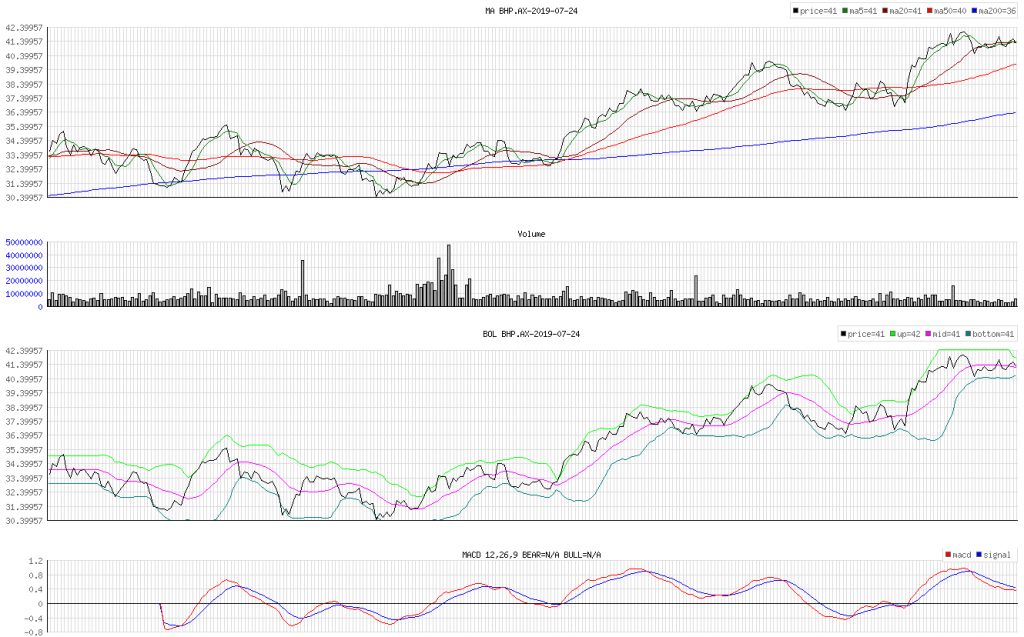

I should still hold my thesis in December 2021, that when heavy load NASDAQ goes down hill in lower gear, it will spark inflation. During this NASDAQ selling pressure, I believe money maker will keep juicing them, possibly because opponents are still taking opposite positions. Due to this newly created money, in my own opinion, it should be followed with newly investment hedge in inflation, which could lead to significant further price increase in commodities, like oil and metals; also since commodities are currently at lowest weight.

To double hedge the data, I would pick EV (Electric Vehicle) and their infrastructure numbers. In my argument, the EV still offers attractive long term sentiment (seen in China low emission record sale, increasing green bonds and their policy). Based on history, I would believe price is leaning more towards sentiment/prospect, rather than current financial analysis score. For example, EV has been notoriously known as expensive share, compared to other technology shares, like DOCU, TWTR, etc. However due to its evolution, I believe EV will still perform much better. I may see few financial engineering options for them to grow much further.

I also prefer to pick EV related technology rather than inflation related consumer technology, e.g. in FCPI (Apple, Microsoft, and Coca Cola). I’m not saying Apple and Microsoft won’t perform well during this inflation. I think they will. However I still believe EV would perform better. Unlike Cathie Wood strategy to abandon some of her innovative one to other small technologies, I prefer to hedge every increase in inflation with traded dip buying data in EV and EV infrastructure. I think ARKK investors are still interested with long future invention/hype like EV, rather than current not so wonderful evolution technology, causing relentless selling.

It shouldn’t give impression that it is an easy pick. Inflation has strong correlation to volatility. We should expect persistent volatility, e.g. Omicron, Oil drama, Digital Coin crash, and ultimate horror of Fed taper, rate raise and QT (Quantitative Tightening). That means, we should keep enough liquid or always maintain our pain level in-check, especially when it hits upper channel. We should acknowledge, only strong thesis/numbers can navigate our highly leveraged inflation journey. One early comforting sign, fireworks at the end and new of year, is usually/statistically a sign of a roaring event follow up.

New year, is statistically time to review back. Since year 1995, financial industry always intrigues me. Do I have a dejavu gen from my parents, when they had financial difficulty? After learning known economy theories, I still grow interest with never-ending research of known-unknown. It’s very rare to see economists speaking honestly about their secret society recipes, either due to their trade secret or insanity perception of their thesis. Since I believe economy is a living organism, it might be wise to say past experience never guarantees future performance and should all human known economy theories. A bliss, keeping them secret might prolong their lifespan longer.

Blindly use known economy theories to make money is simply too good to be true.

1997 Asian crisis was my first personal self experience, under real and rubber bullet. It was a remarkable experience of financial destruction, which burned most of South East Asian life and put them into massive global slavery, including me and my family. Few characteristics of the crisis includes:

- previously high foreign debt (trap?),

- high inflation,

- resiliency of SME (Small and Medium Enterprise),

- bailout for wealth transfer, and

- weaker currency.

Two years later, in magical city of Kristiansand, I was stunned with lots of smiles I had never seen in my life. Lots of wealth, no lie, did money buy happiness? Rather than spending most of my time to write master thesis to find secret of the SME resiliency during financial crisis, I spent most of my time to find secret of Scandinavian financial happiness. Did we remember story of Scandinavian farmers got busted in LEH (Lehman Brothers) crisis? Do we know Norge and Israel keep their leverage high in US stocks and indeed they make so much more?

No surprise in year 2008 GFC (Global Financial Crisis), after 10 years, I still failed to understand this secrecy of wealth protection systems. Learning is always costly and better be when we were young and fool. However, persistent, I always believe, another decade is always another story, always be much better. To be successful, we must always be optimistic.

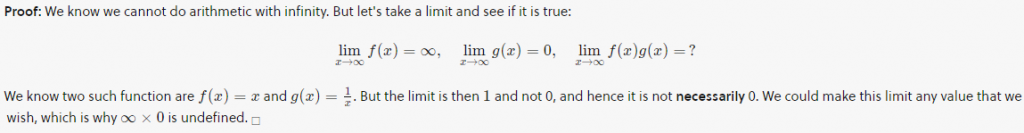

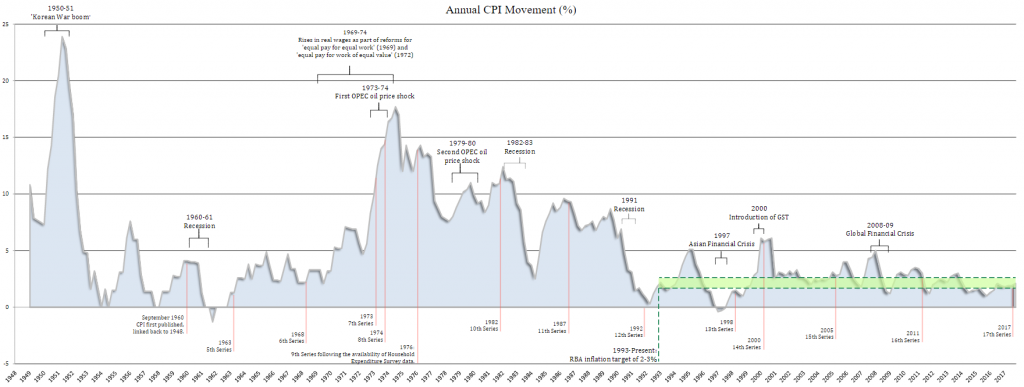

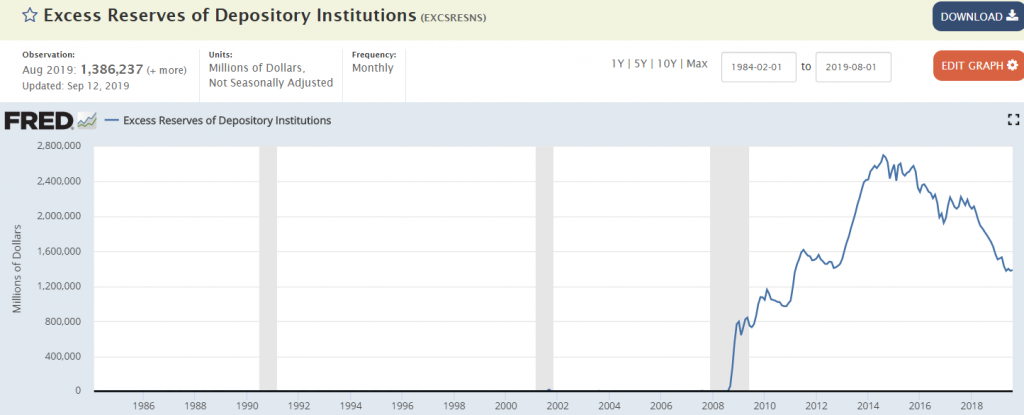

To proof financial is a systematic systems, in 2017, an economist was able to show a simple mathematical formula of IOER, Fed balance sheet interest payment, etc, to figure out when Fed would break their unsustainable deflation spell to sustainable inflation. Same to the 1997 Asia Financial Crisis, same financial destruction to Turkish Lira. I think South Korean Default movie (2018) may explain it well cinematically. Should we consider it as a non random generator of phi (ϕ)? Should we say sorry to Turkish people for our human created financial weapon systems? Personally experienced with decades of inflation, in early 2020, I all-in believed in incoming global high inflation, if not hyperinflation.

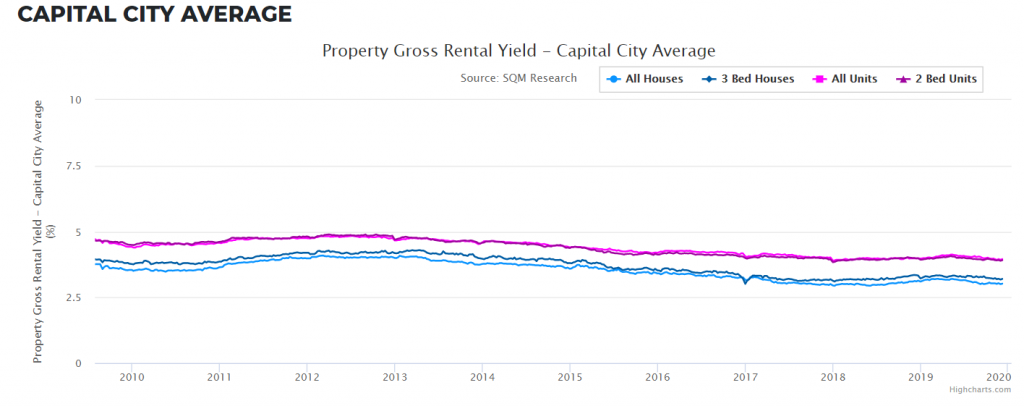

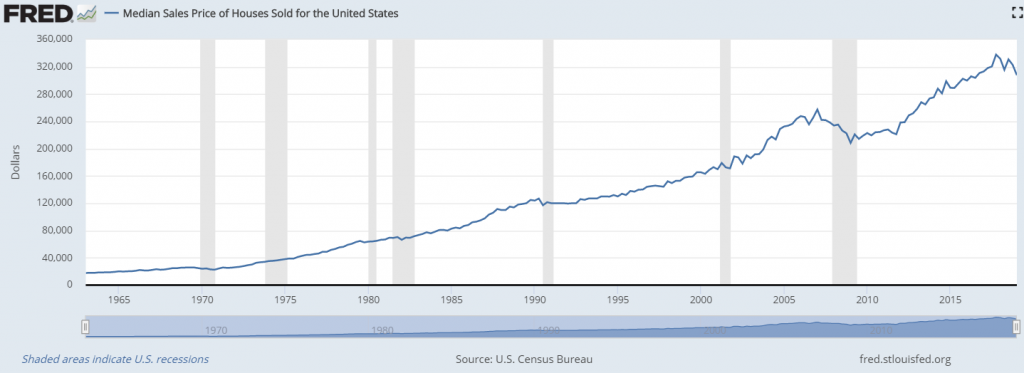

I took insane research in 2019 with overweighting data towards property sector for resiliency. I believed the property rally won’t be over yet, due to its missing inflation component. I leveraged the data into newly created CoVid in early 2020, to advanced countries with strong GDP. Looking at how much liquid has been created and how the Central Banks policies are moving behind their curve, they seem to push inflation to hyperinflation cliff. In that cliff hanger game, only advanced country with high buffer margin to inflation would be able to survive. Unfortunately that means, the data must take short position to emerging economies to hedge.

I believe we should endure second phase of 2020-2023 mature inflation life cycle. While this is not 100% best return of this decade, it should provide strong leveraged resiliency during the inflation crisis. The world shouldn’t be dictated by god playing dictator ideally, if we are looking at fraction of the ϕ. How many of us missing the boat of growth vehicles like BTC and NFT, rather than keeping our economy theories in value growth vehicles? I am one of them. I think in my case, it was due to our perception that money is still too much valuable and our regular post traumatic GFC (Global Financial Crisis) stress disorder (PTGSD). This growth stock should rather work well to newly breeds who didn’t have any PTGSD gen yet. However they should still be aware that going zero stress disorder might mostly hit late comers. I don’t say value growth is dead. Apple has proven to reach first 3T$ valuation and experience enormous growth.

I still believe persistence in another decade should write another story.

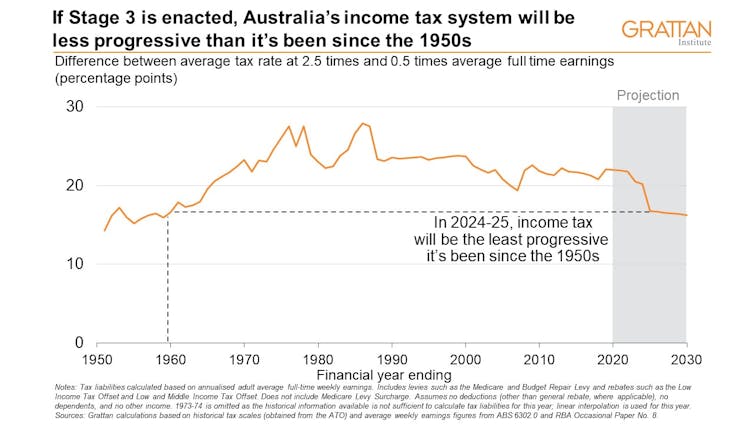

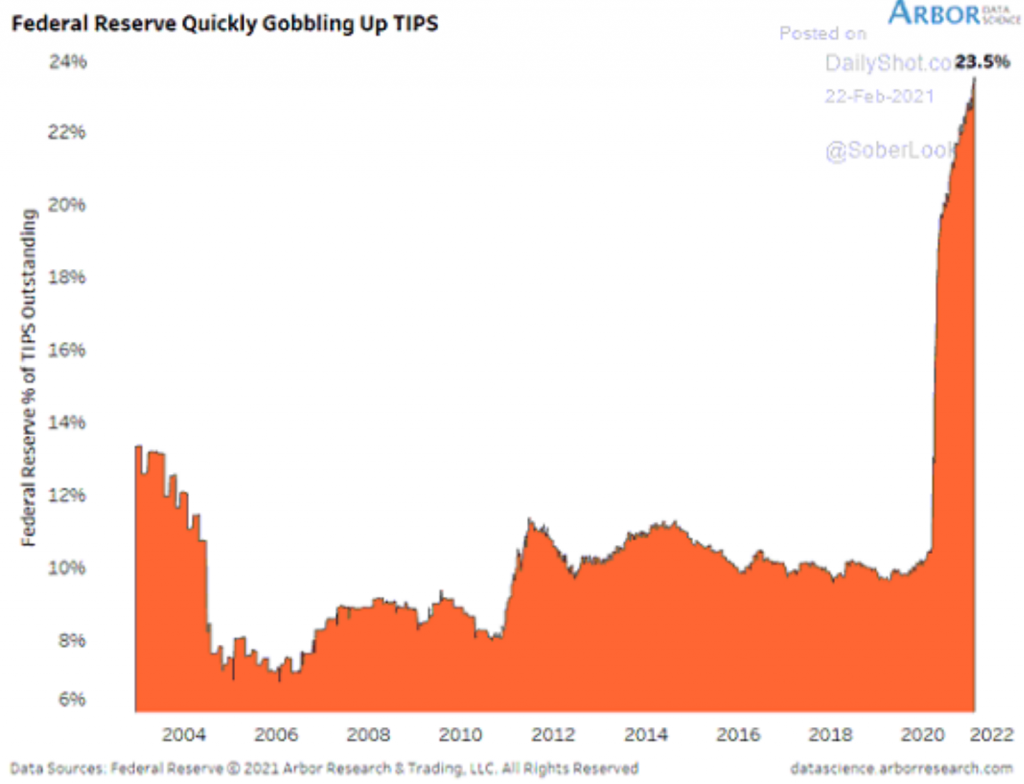

Year 2021 might hand over long monetary era to the hand of fiscal. Many see massive future calls like MSFT from insider fiscal related participants. Due to that, tightening with fiscal support should differentiate from previous taper tantrum in 2013 or rate rise attempt in 2017. While some strategists might expect a following easing or twist operation (OT), I might think differently. In my opinion, if we believe in Central Banks is to behave like previously, we might end up to same failure to Central Bank transitory thesis. While many including me long believed inflation would be persistent, I don’t think Central Banks were serious with their transitory thesis. Why did they keep buying TIPS (Treasury Inflation Protected Securities)? Soros market participants theory of reflexivity?

This is where I quickly see connected dot with the 1997 Asian GFC inflation.

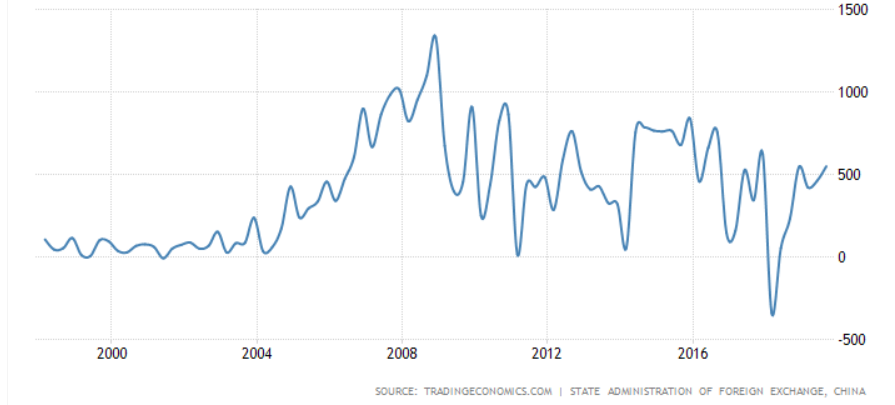

Few recent signs are Fed admittance to permanent inflation, lost control in 2Y, behind the curve, and persistence in long term yield raise. I should think, this probability might have less chance if China is not rising by that much. However looking at recent China condition, it seems they might still need another decades before they can be an inflation director. I don’t believe China could come any near to challenge the US yet.

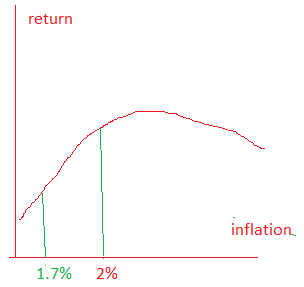

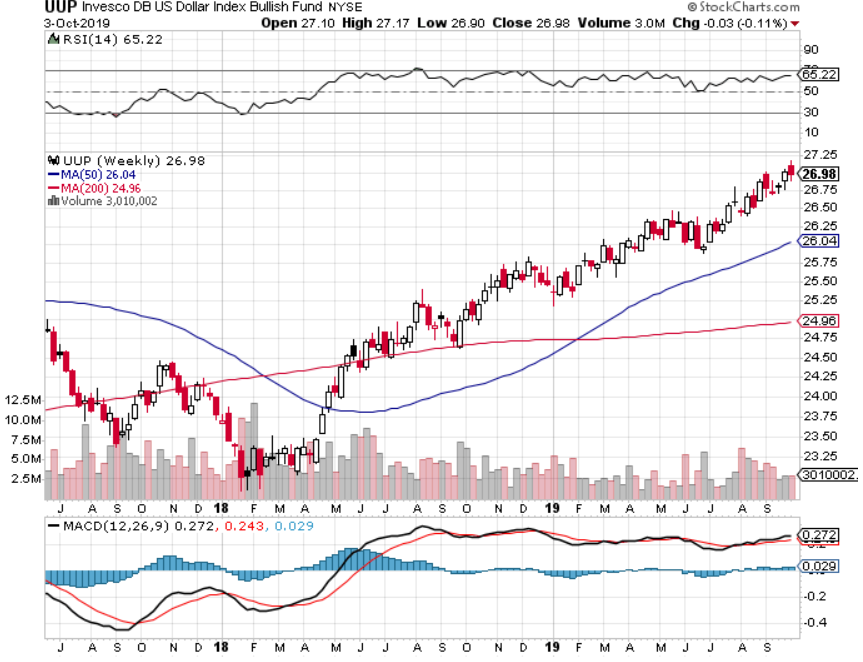

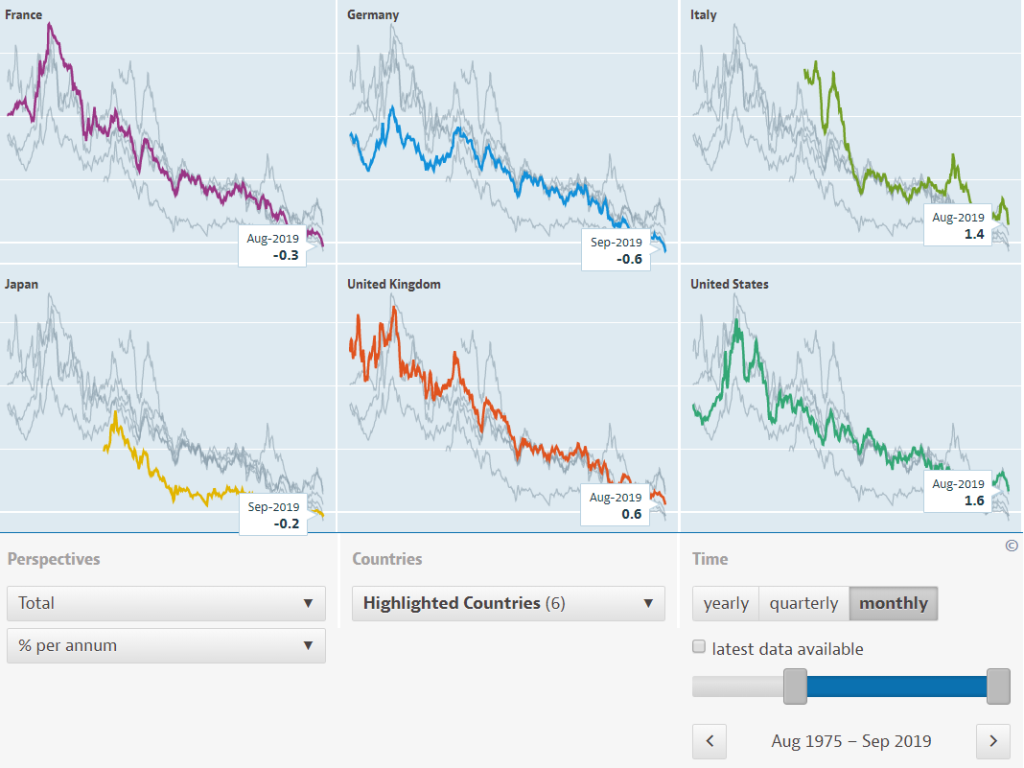

To explain in simple number, why none is able to take advantage of the US, which has 8% inflation (going to be market expected 10%) and only gives 1.6% return from their most liquid asset on this planet, the 10Y? US debt investors are loosing their money more than 6.4% every year. They might think inflation to drop and or looking possibility of USD appreciation to compensate. However back to Fed SOMA and Treasury refinancing theory, I think they may not be able to catch up of their potential loss, depending on spectrum of their maturity. There should be a limit to where USD could appreciate, before it triggers either too high inflation loss or global M&A account transfer. This leads to my next theory.

In my theory, when US was in deflation, Federal Reserve took the loss. It should be similar to when US is above high inflation range. In my previous theory RRP is Central Bank subsidy to inflation loss to take over from their octopus, with many front runners as usual. This is where magic of global currencies/coin may work. If the Fed takes the loss, other weaker countries will take over the loss.

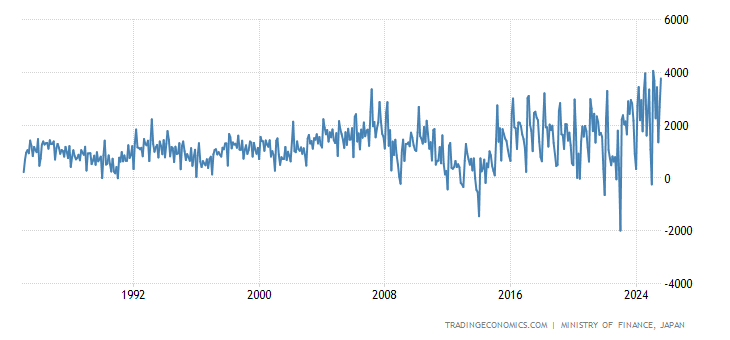

We should see DXY starting to break their lower channel to support the inflation thesis. I would watch Japan (JPY/USD) and Europe (EUR/USD) for possible main drivers. Being superior in their negativity/deflation might come to an end.

Don’t be confused with the US inflation in 1980 and 1945. Current 10 year yield is only 1.5%, vs 16% in 1980. This is another proof that China is still much weaker to challenge US as world biggest economy. Only US and advanced economies can navigate this high inflation well, unlike Asia in 1997 and probably China today. This should validate my strategy to leverage advanced countries and taking opposite to emerging numbers.

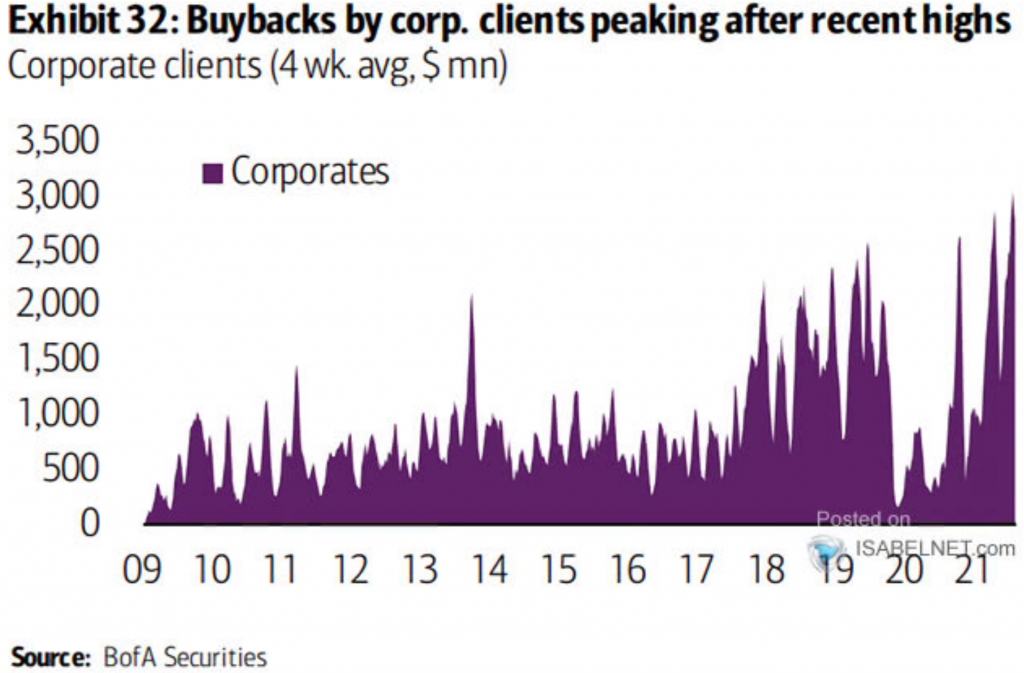

Taking high inflation pill is debt sin forgiveness. This is where I doubt SME resiliency in current inflation situation since they have lower debt load. Therefore I think SME won’t be able to survive well in this high global inflation crisis. I would also think global and internal trade issue due to CoVid might have big contribution to SME issue, rather than giving them resiliency to the global change crisis. I think we should see widespread bankruptcy in small business and increasing profit in large companies, until I expect to see more big M&A (Merger and Acquisition), rather than corporate buyback activities. Supporting my previous opinion, I believe private buy back strategy is still offering enough benefits to weather current high risks. This is why I don’t prefer to overweight my data against small cap companies.

Characteristics of current US inflation crisis, to differentiate with emerging economies inflation crisis:

- high internal debt,

- global inflation where no body does it better than the US,

- weak SMEs and possible widespread of bankruptcy in small countries,

- global bailout,

- unsustainable strong currency, which should then lead to weaker currency to support inflation run.

So far, only the US country:

- can escape themselves from internal GFC deflation crisis and also navigate high inflation crisis,

- can decide non bankruptcy of imminent death of HK offshore listing of China property sector,

- have optimum return, while other world is relatively muted with China lower growth in 2021.

Nobody does it better. Nobody does it half as good as you. United States, you’re the best!

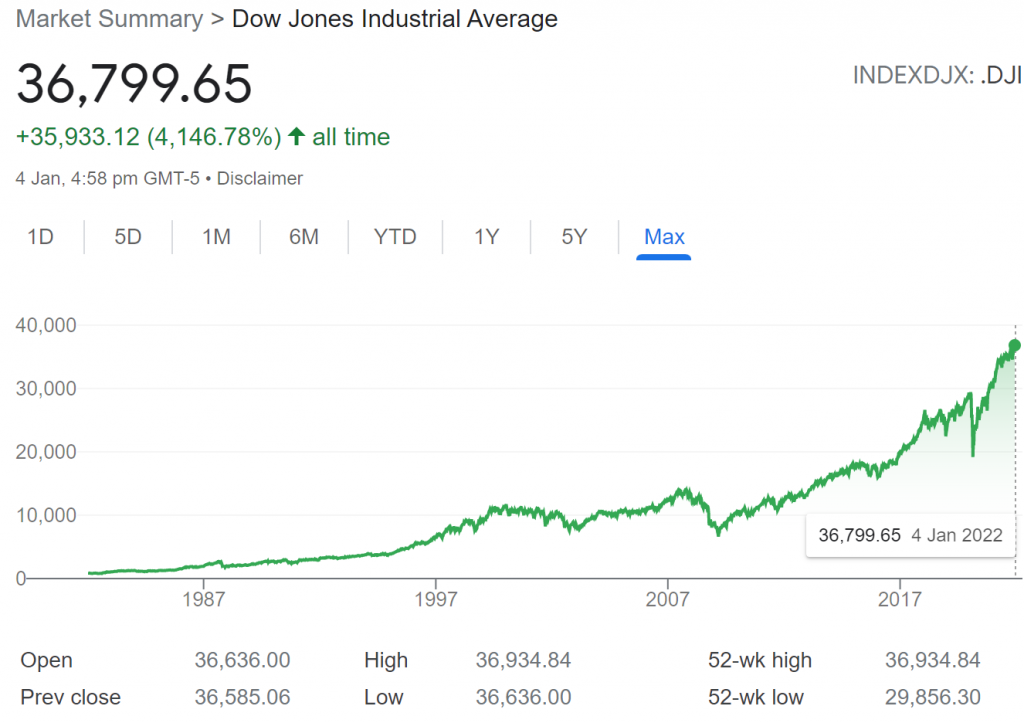

Why’d you have to be so good? It’s no secret from our 2 years ago GDP expectation. Basically only the US has ability to juice their market. Due to that, the US has absorbed most of global money creation in past 2 years, which has been driving their index, causing envy to most other countries. Have a look into emerging and smaller countries, they are suffering massive capital outflow to the US, while they have to fight for internal inflation.

It left emerging country dried with liquidity and stuck with high inflation to support their growth. If China has difficulty and so do other countries smaller than China, which makes only the US, one of only few winners here. Does China take hostage of other economies too, through the use of their infrastructure for resource programme?

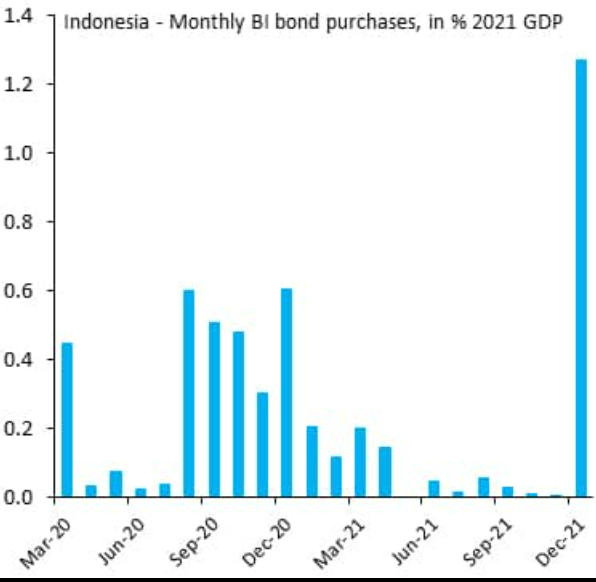

In Indonesia. The liquidity was so severe that one of biggest national owned steel company was about to go bankrupt in December 2021. They have no choice, but to open liquidity tap again, and face the truth of inflation pain. Unfortunately, this situation may leave less room for emerging to juice their market. Therefore I would rather see emerging to be a possible late global inflation player.

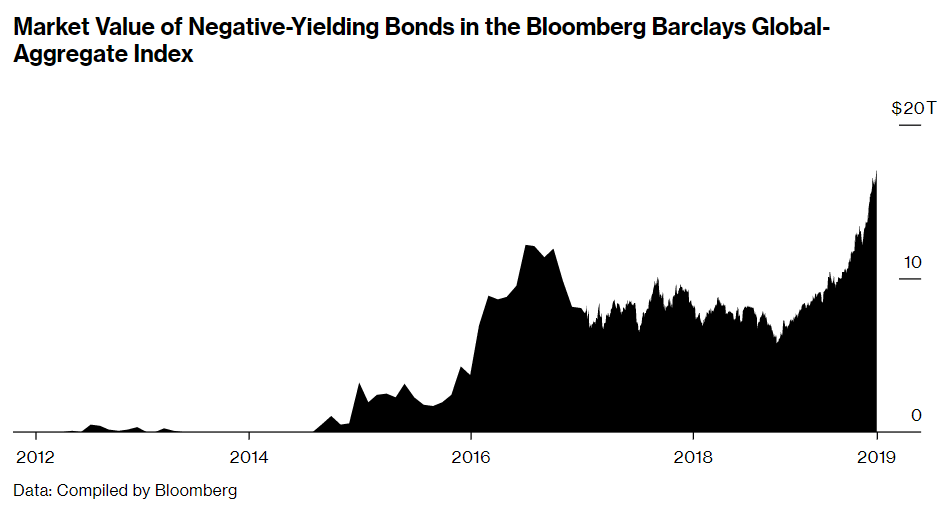

Does the US have to worry about maximum inflation when this competition symbiosis becomes endosymbiosis? They would most likely run taper, balance runoff, and reluctant to raising rate. I still believe in my theory, that 1.5 trillion of RRP and above 10T$ hovering negative yield might juice taper well, but we would need to re-calculate balance runoff and raising rate impact to later adapt market reflexivity.

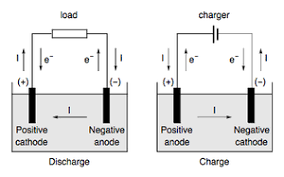

This effort should reduce inflation pressure which might benefit some selected sectors, like the long waited Biden infrastructure agenda. Supporting my last month article, market participants should support faster taper above market expectation. In my theory, that is bullish for some selected sectors and free up other countries inflation Genny. How about we start with Germany and Japan? Japan has been well known in decades of deflation and Germany driven Europe has been years in severe negative yield. Positive US inflation anode and negative cathode Europe/Japan might be able to drive back global trade account of USD/EURJPY in next 2 years and possible US lead global M&A.

The Indonesian government proclaimed to have inflation to only just 1.68%, much better than any other countries, like US (6%), or even China and Japan, with 10 year bond returning massive 8%. It’s no white t-shirt, but widespread manipulation against inflation formula is just getting too obvious to protect their national security from capital outflow inflation threat. It might be better to run enormous infrastructure incentives like India to grow near to 10%.

It’s quite obvious China takes opposite policies with relentless easing. I think their pain level might be weighted with effort to secure long term infrastructure for resource deals with weaker economies. At same time, China might use this event to soft landing their highly leveraged property and transfer offshore property into local listing where they have more control, rather than allowing foreign hostile take over. Hopefully there’s a possible peace treaty, between the two biggest economies. If they continue to separate, I’m afraid we might see possible widespread of bankruptcy, of not only small companies, but big ones in weaker countries, because their central banks there are not able to juice their market due to inflation.

From above explanation, we may come back to our biggest question, would the US be able to navigate global inflation issue or let others to take advantage of it? This may impact our main investment thesis, whether continue to take higher risk or start moving into safety side. I believe Americans should be very lucky in this environment. Do we see relatively low inflation compared to other countries, never ending increase of their incoming and raising funds, and very high exit to employment indeed?

China admits, US is the envy to the world, might be in attempt to have other countries to fight against the US, or China themselves admitted to feel envy to the US. Unfortunately in this winning situation, money usually seeks higher return possible. If needed, they might destroy other countries (like Turkey). It is double trouble to the victim, from possible hostile take over by enemies and friends, since money rarely does mutualism symbiosis. This inflation might still have longer life, since the US still has enough buffer to future shock, through the use of BBB (Build Back Better), when time is right or maybe when inflation stalls. It may not be the time yet.

Recent check of our last year 3 selected sectors seem still valid:

- Food: never ending increase of fertilizer cost, Xi’an city food shortage, Sri Langka food shortage, from Sydney to Philadephia supermarket food shortage amid CoVid restriction. It may be related to recent global trade crash in BDI (Baltic Dry Index) due to persistent high transport cost and supply chain issue,

- Energy: rally in oil, electricity, natural gas, and other form of energy, like Uranium.

- EV and EV infrastructure: China records low-emission car sales. We also expect bigger deficit this year of base metals related, like nickel, graphite, lithium, copper, aluminium, etc. If these base metals were not able to fulfil demand last year, how about their luck this year with bigger deficit expectation?

![Four Facts about Soaring Consumer Food Prices | European American Chamber of Commerce New York [EACCNY] | Your Partner for Transatlantic Business Resources](https://blogs.imf.org/wp-content/uploads/2021/06/eng-food-price-blog-june-21-chart-3.png)

Despite our hectic life, it might be wise to put some break at the end of this month, just before another hemisphere of new year embraces their start of roaring year, for the Tiger to restock, reload and re-roar. During this high volatility inflation life, it’s wise to keep our insanity in-check, from destructive over optimism and inflation hype. Hopefully, my thesis about incoming 1-2 years of inflation prosperity comes true.

Disclaimer: Opinion is my own. It’s not financial advise and for research purpose only.