“Escape for your life. Do not look back or stop anywhere in the valley.

Escape to the hills, lest you be swept away.”

Genenis 19:1-38

Twenty one months ago, my time has come to leave my nest, to embrace reality of harsh world we live in. As always, like a little bird, afraid to leave their comfortable lullaby of 9 to 5 nest. I had to fly into jungle of personal enterprise world. There were many butterflies flying around. Didn’t we hear them buzzing, “life time opportunity”, “things to do before you die”, and “go big or go home”?

I was born into a very humble (excuse me to make poor word better) family, who could never afford to have overseas study, let alone overseas travel. It’s still very vivid in my eyes, US university brochures, my father brought back home. In that silent, heart touching moment, my eyes could hear well, and stored the image safely in my brain vault. My parents only left me persistence and perseverance, no capital, but that’s more than I needed. Due to that persistence, Norwegian government invited me to come and experience Scandinavian life. It’s my next important stepping stone, confidence.

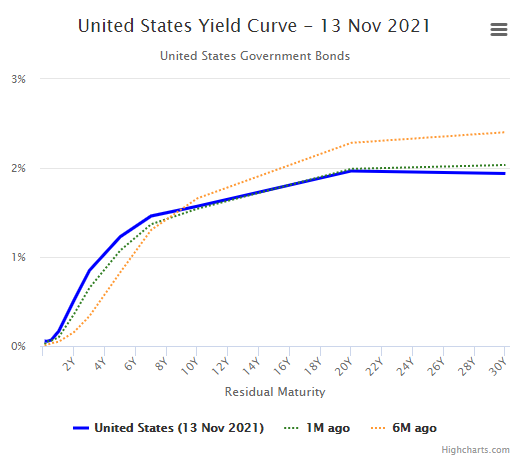

Twenty twenty, what a year of resident evil moment. Many asked, was it the end of human race when streets were so empty, puny human race was jailed to their own home, and stock index was falling? My persistence and experience told not to discourage, but took that opportunity. I might still believe the influenza that turned into Covid name event, is a man made. I’m talking about a coordinated orchestra event, at the end of financial curve inversion, after failing with ominous overnight rate spike in September 2019, not the virus. If it’s true, how powerful is financial could take a grip of human life. We do realize though, none of us is immune to any virus, nor the curse of death, nor possibly we can escape from them.

Entering reality of my own personal corporate world and competition is never been darker and colder. Very sure, rhodopsin, dark adaption, is never be a pleasant experience. I had to close my eyes, looked into my heart, what is my best mutant ability? X-MEN is never be a 1-MAN, everyone has their own unique and incomparable skill. The easiest way to look for is what interested us most, not our one year interest but our many decades of interest(s).

I surely know myself. Even though I can do very well, it’s not Information Technology that I interested most. What should people look from well known university brand name in their resume? I disbelieve it’s skill from that palace. It’s rarely economy books and theories can be used to make money from market competition. However it’s still important knowledge. Without knowing how economy theory works, we can’t make a lie about them, nor get fooled from it. It’s all about opportunity, to enter higher ladder corporate, for then to experience real cruel world in comfortable chair of salary to pay bill of liability, and take opportunity to build more confidence experience. Luckily the information technology gave me entry opportunity point to the ladder. There were many great leaders and they will always be my unforgettable mentors to me. In 2020, I’s drawing a line. I’m flying with my own wings, nothing can stop me now, no superiority, nor woke barrier, not even any sky can limit.

Let me summarized, what I needed were persistence/perseverance, confidence and opportunity. Year 2020, was the year of my opportunity. I forced myself to run as fast as I can. It’s never be perfect. I still missed lots of opportunities, hit many road blocks, that is life. Persistence, go fall and rise stronger, there is no way back.

Here is what I like most, The United States. The country has made me great, I owed them, and I think they will make me greater again.

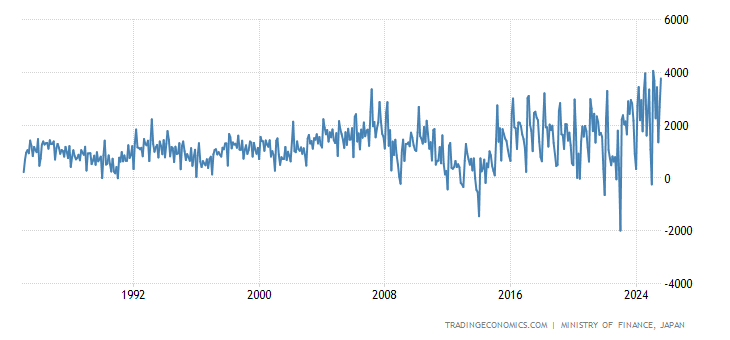

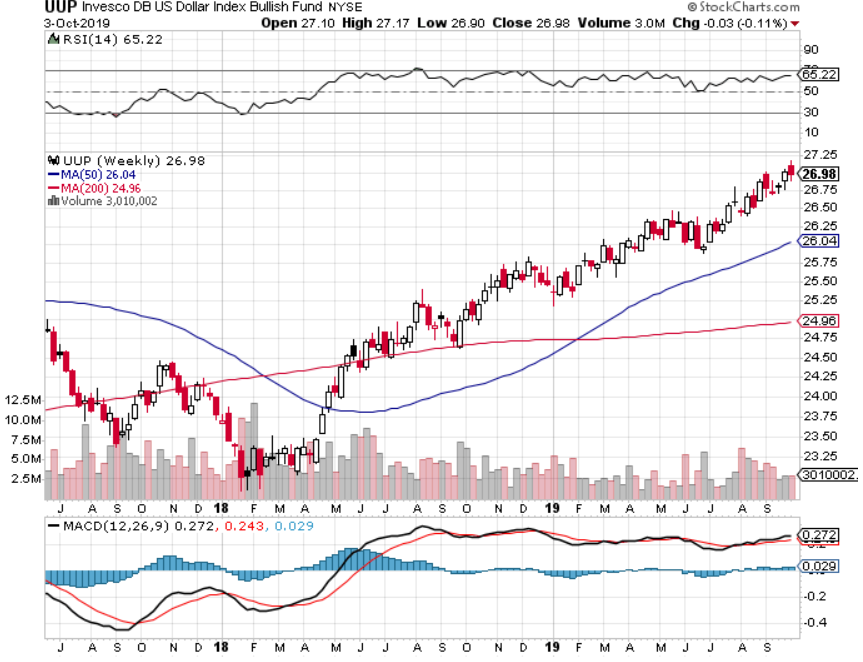

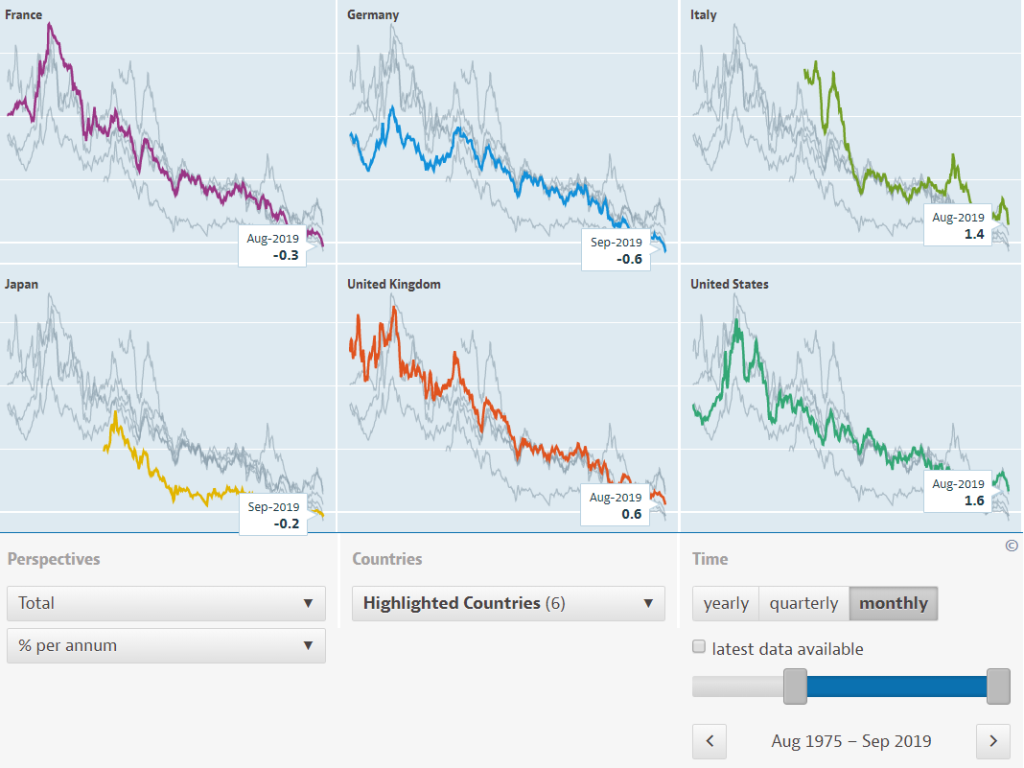

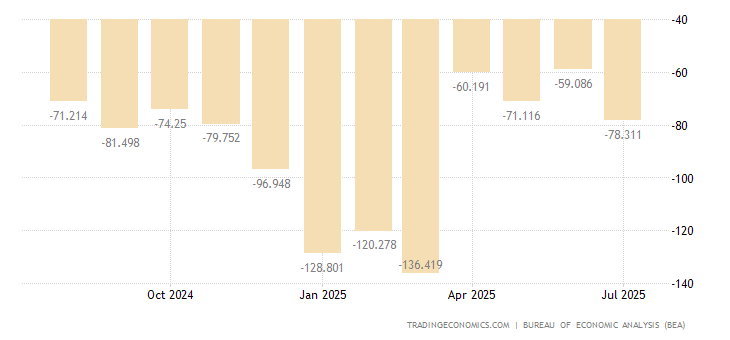

The United States (especially their 10 years debt) is still the most liquid asset on earth. Its hegemony spell prohibits their front end from increasing to next 2 years, without crashing everything, and wasting their costly momentum effort.

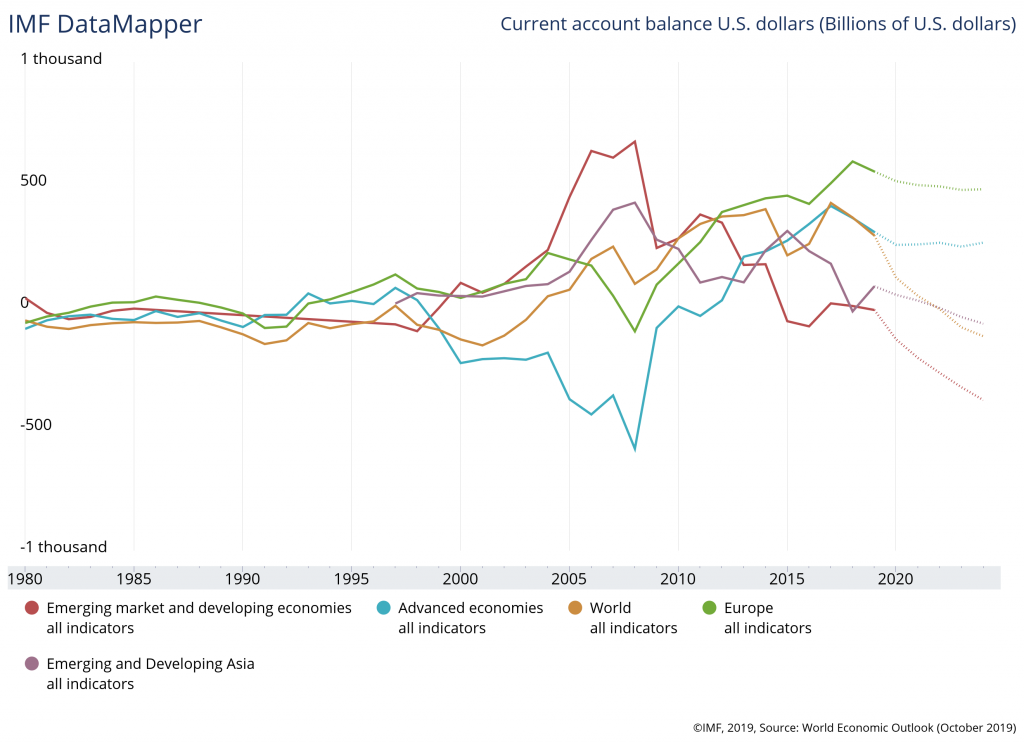

This game is not complicated. White collar like banks, are just buying front end (mostly 2 years) and invest it back to longer end (mostly 10 years). Due to their leveraged greed, less liquid and certain 30 years, is currently getting hurt most, inversing the 10. What can fail them is USD bankruptcy but that should never be an option at this moment. Even China will blink, and continuously lie with their 3 red-lines from transferring their surplus into their current not-so-much troubled Real Estate sector. This asset changing moment cycle must be protected at all cost.

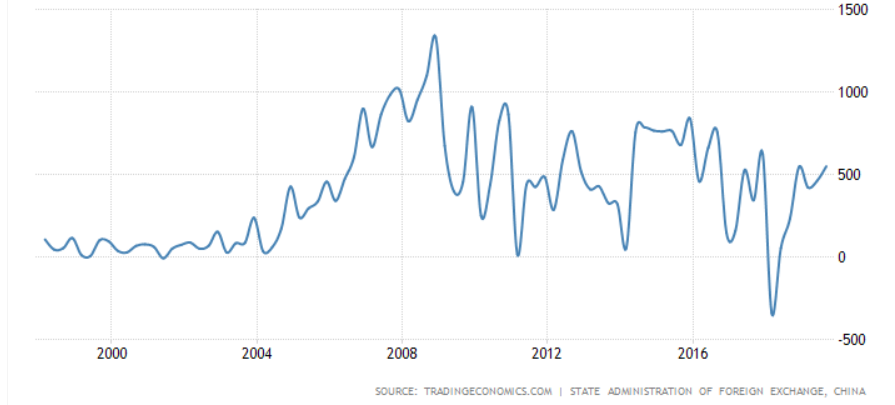

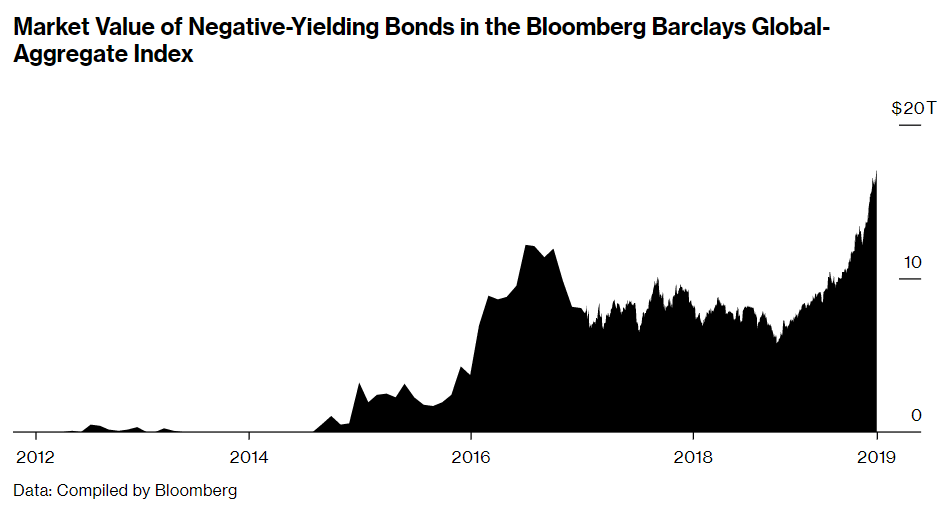

We shouldn’t be surprised with a possibility of commodity deflation moment before their run. Thanks God, it seems to be timid. When money is invested into long term, its long term yield will be under pressure, which will beg for long term support of central bank and short term rally in US golden child, FAT ANG. However to hedge their long term investment, they should go against USD risk or do investment in inflation protection like TIPS, estate or commodity. My thesis is supported with recent PBOC net buying and continuous growth of their mortgage book, rather than their 3 red lines. Please forgive China for their lying of everything, for having inflation death threat, it may not be a sin.

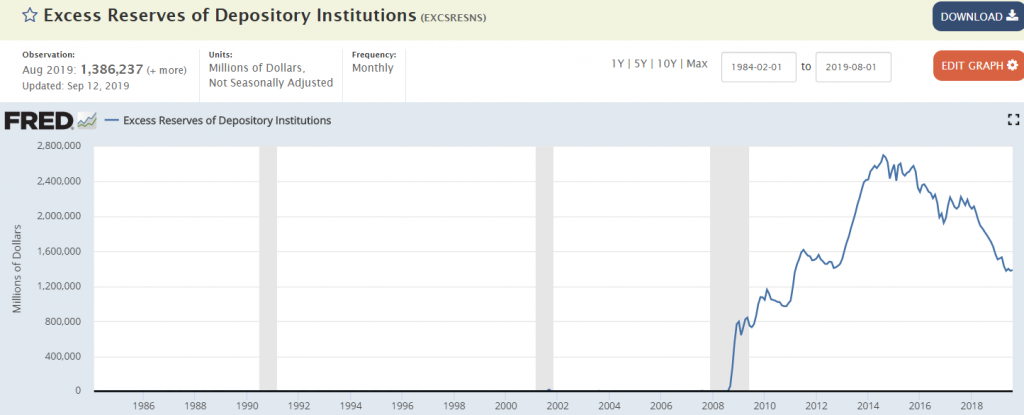

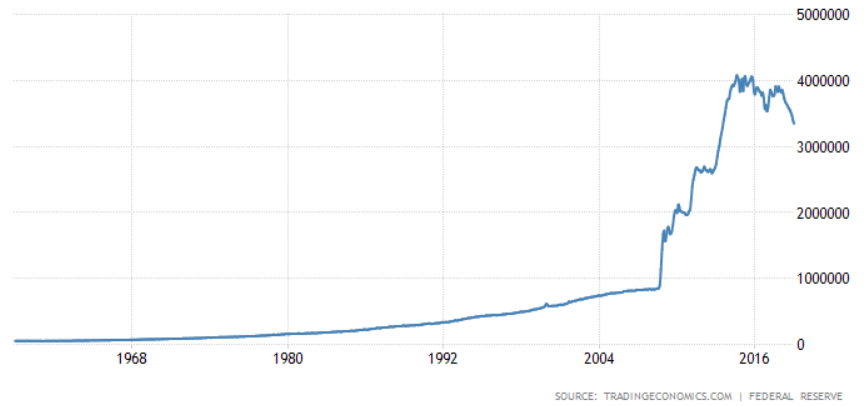

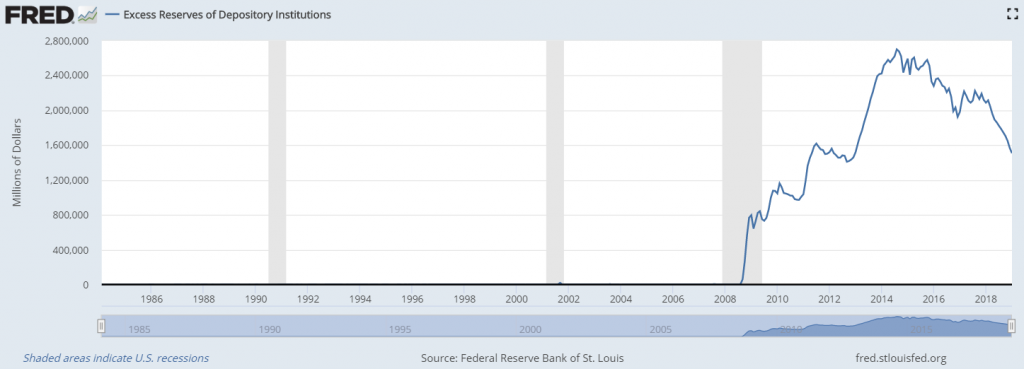

I believe taper is less worrying with existing support of RRP:

Have a look back into yield curve picture, arching and moving to front end, shorter term rate, even its very long term 30 years is hardly able to follow. For me, I think it’s obviously a beautiful front end steepening indeed. Houston, we don’t have a problem, our mission after 12 years of easing trick, seems to start being fruitful. People are now starting to enter our trigger baits. We’ll keep baiting them to next 8 years, before we claim our mission to mars is successful.

Without having to explain detail of this math, I’d summarize my humble thesis and vision, before happening, in my own English version:

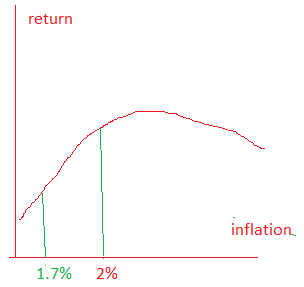

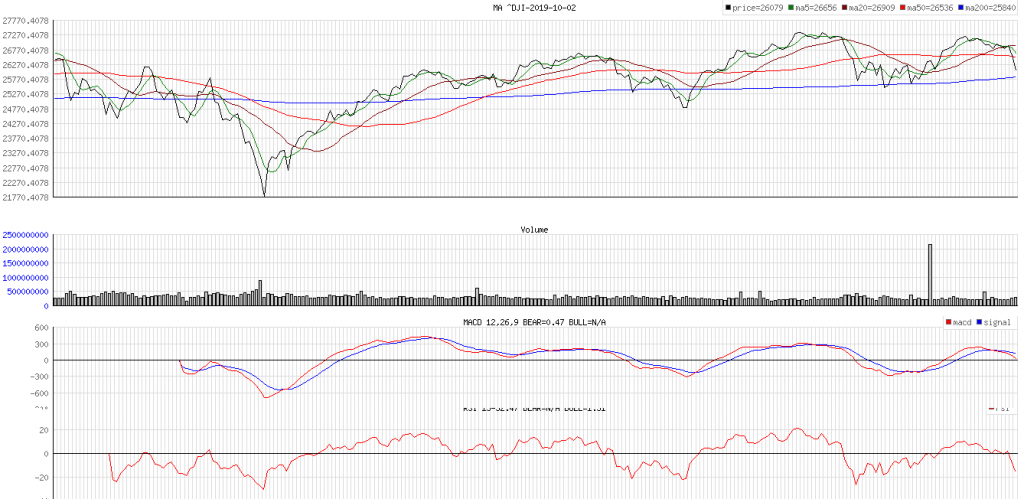

- Next year is probably last average windows time to take big investment. It’s still able to raise to next 5-8 years, but they should never be better investment compared to ones taken from year 2020-2022. Last overshoot is always possible but that doesn’t justify better risk and return profile.

- In 2 years something big will come and I don’t believe it’s a Minsky moment.

- The Federal Reserve taper should help to transition RRP/negative yield with fiscal deadline to market upside and not allowing front end rate to raise. However even if inflation force would be uncontrolled, we should still have about enough 6 points until the rate could hit their long term downtrend.

The market rally screams same music:

I’m floating around in Ectasy, so don’t stop me, don’t stop me now…

I’m a shooting star leaping through the sky

Like a tiger defying the laws of gravity

I’m a racing car passing by like Lady Godiva

I’m gonna go, go, go

There’s no stopping me

I’m burnin’ through the sky, yeah 200 degrees

That’s why they call me Mister Fahrenheit

I’m travelling at the speed of light

I wanna make a supersonic man out of you

Like an atom bomb about to

Oh, oh, oh, oh, oh, explode!!!

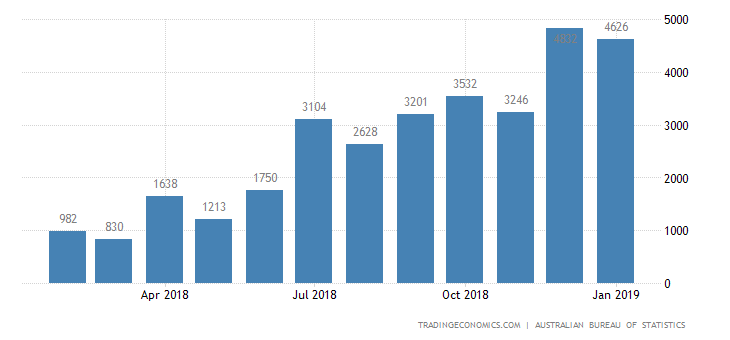

What is the world thinking at the moment? My vision of current decade evolution is with Electric Vehicle (EV) infrastructure, not just the EV itself. Hundred millions of Electric (not-gas) stations grid to build, all over the world in 10 years. Low rate weapon to protect uncompetitive low growth of advanced countries, turns into climate change cooperative initiative to protect high margin business to survive and to end low margin uncompetitive fossil fuel. This effort to leave fossil fuel has hit their competitor most, no less than China. Economy growth related copper and nickel, as their similar industry had lack of capital expenditure, would then be their hidden Cleopatra. Other scarcity of cheap electricity and cheap food may also have to get censored from their expected 100% growth for every 3-5 years. I hardly believe copper, nickel, energy and food will undergo transitory theme, while US steel is hinged under protection from entering transitory.

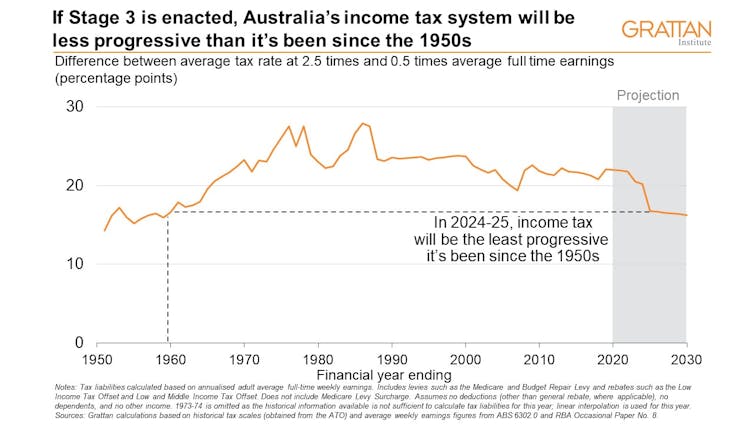

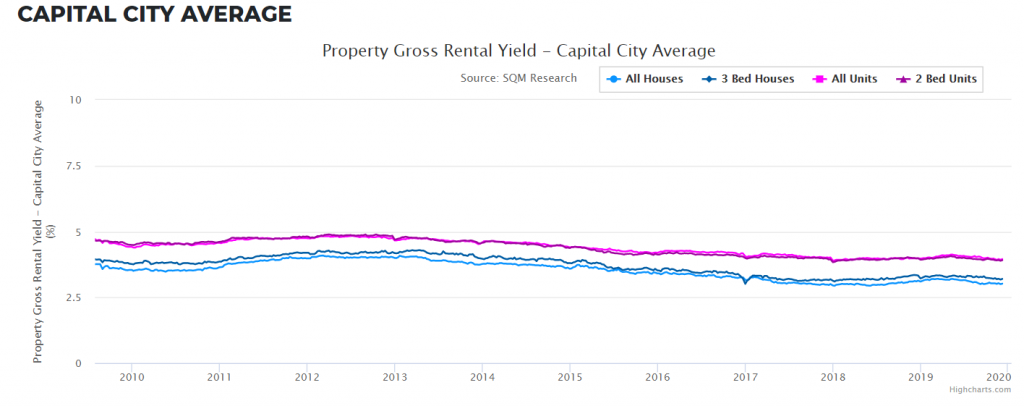

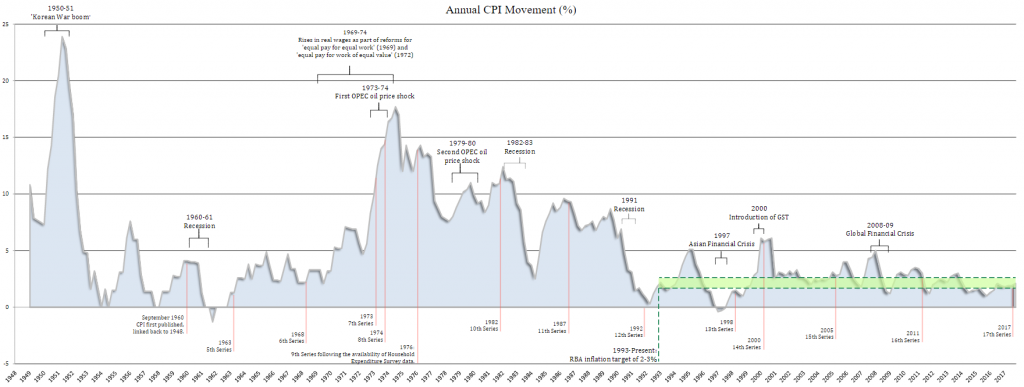

In this squid game, life and death, profit or loss, I should start with my escape plan, not to quit the squid game because it’s always be my interest, but to start planning their golden parachute plan, before the game is even starting to plan their end, in which I believe so much temptation of greed will be happening in next following years. Why I think is important? We may work and accumulate income well for rest of life, however at the end of the day, it’s our competitiveness to keep them growing that will matter most. A stable 20-30% per year (or faster return) is enough to catapult into billion mark in long run. A sudden 50% drop at the start of retirement means 50% loss of whole life wealth accumulation. Do we know soon-to-see high inflation is a hidden harsh of regressive tax? Our best effort, even with real estate portfolio, is always prone to these thieves. Have a look at how RRP should survive and take wealth from their pension funds. I would also expect we will see a lost decade between year 2030 to 2040, when Sodom and Gomorrah sky may be most likely being turned dark for 10 years. Welcome to reality of financial squid game, win big, survive, or die. My x-ray lobster-eye satellites keep scanning them, stay tuned.

Disclaimer: opinion is my own and never become any financial advise.