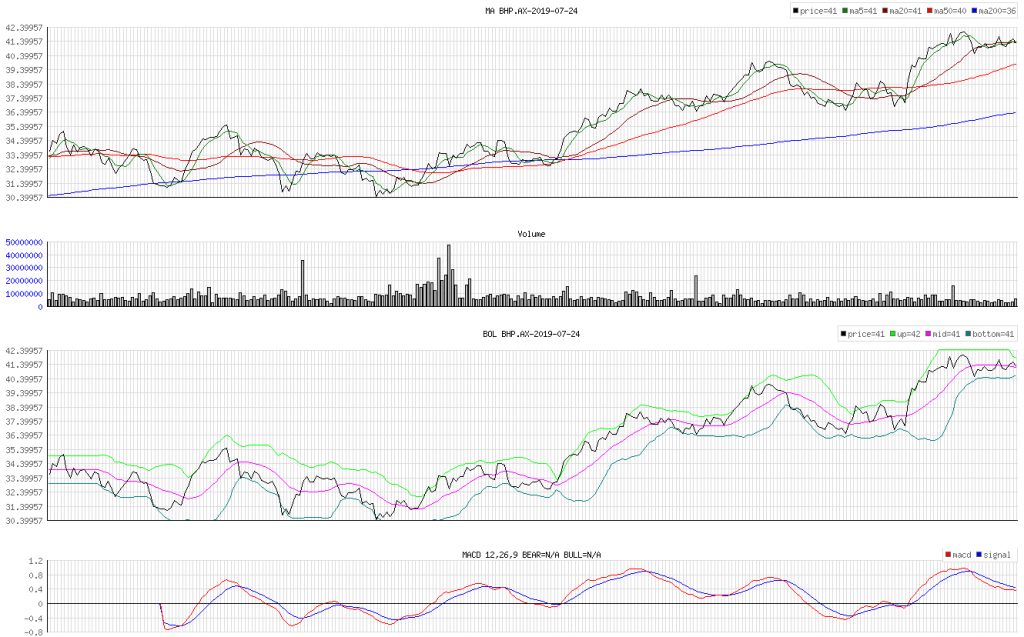

Season may change, but its behavior should remain same.

We might hear that Australia property may have been rebounded from its correction. My big question is not whether it is rebounding or not, but should investors keep investing in Australia property? If we consider price has been corrected after long decades of bull run, do we see any correction sign other than their price in AUD? I don’t. I would have to use my argument from 5 years ago, that if Australia property would start to turn, Australia was still having big saving from its strong currency, reaching as high as 1.1 to USD.

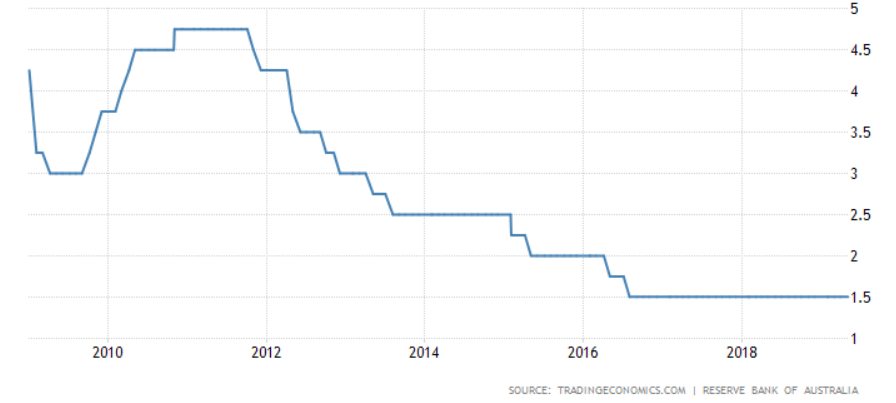

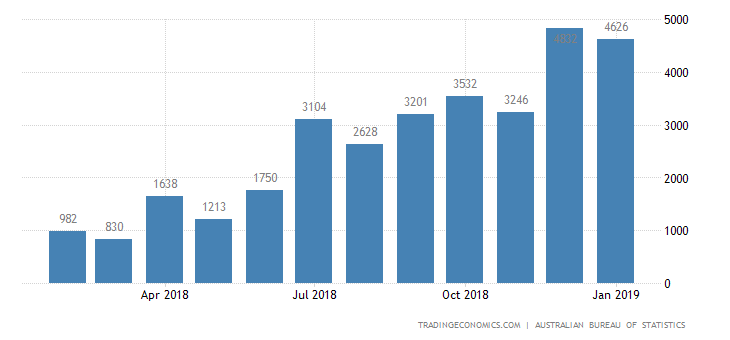

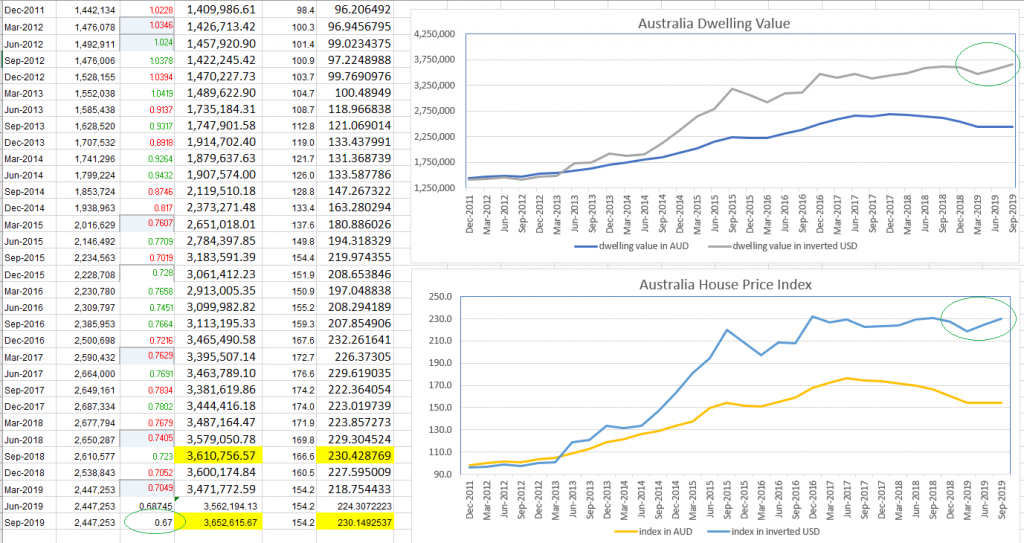

Below is some numbers from few weeks ago. Property price index and dwelling value in inverted USD are not showing any correction, indeed dwelling value reached higher high. It’s quite clear that when AUDUSD was at its lowest few weeks ago, 0.67, the dwelling value and median price are still trying to deflect deflation gravity after big run from 2009 to 2015, significantly seen near to 2015 when AUD was starting to fall. Using this view, I still don’t see any correction in Australia property. It’s no surprising that RBA and APRA put break between 2015 to 2018 to avoid inflation and were still trying to help in 2019, simply because they are still able to help. Correction in local currency is recently near to 15% and it’s too close to a sacred 20%.

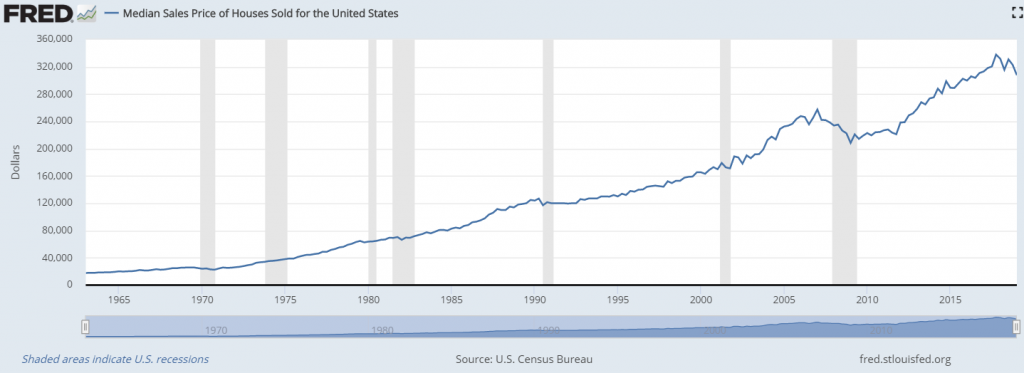

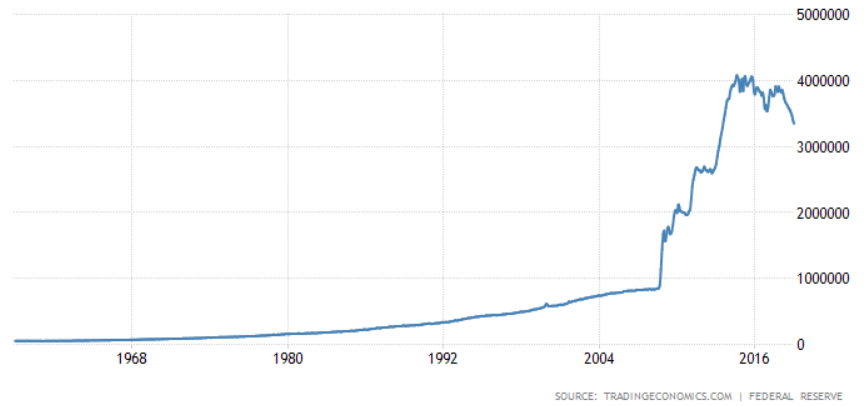

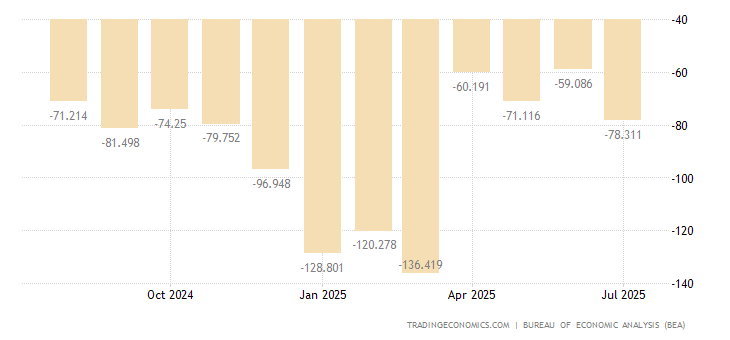

Why do I think inverted USD is very important? It’s because global property is still increasing. There’s no particular reason Australia and Canada should undergo correction, other than they are exposed to commodity price, their main foreign income.

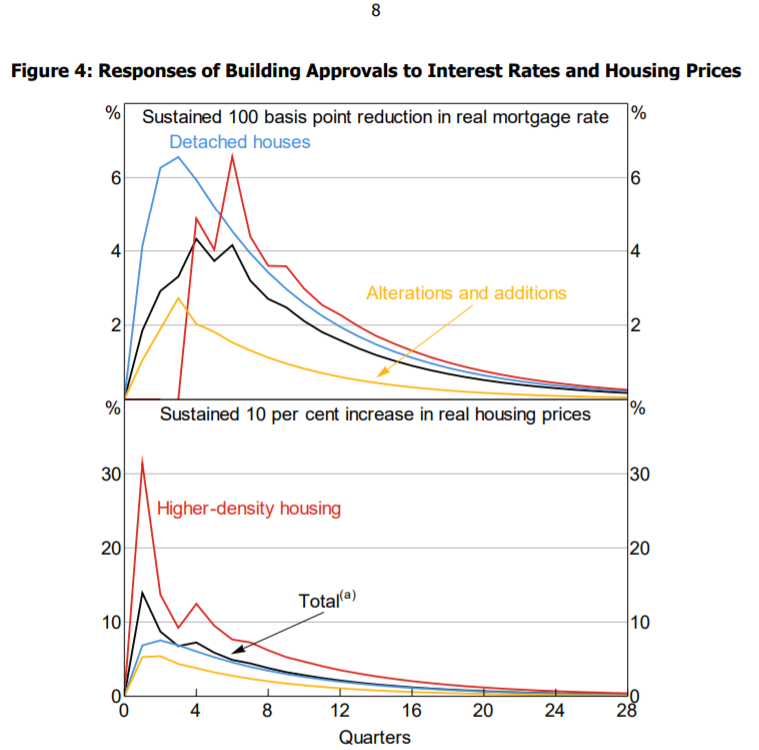

It may also explain why property price across Australia had correction between 2017-2019 after increasing uncertainty due to significant drop in currency in 2015-2017 due to commodity correction (Australia is sensitive to commodity price). In order to maintain this inverted trend, RBA should maintain currency competitiveness and it’s proven with 2 more rate cuts. When knife is falling, we would just need to wait until it drops on the floor, wouldn’t we?

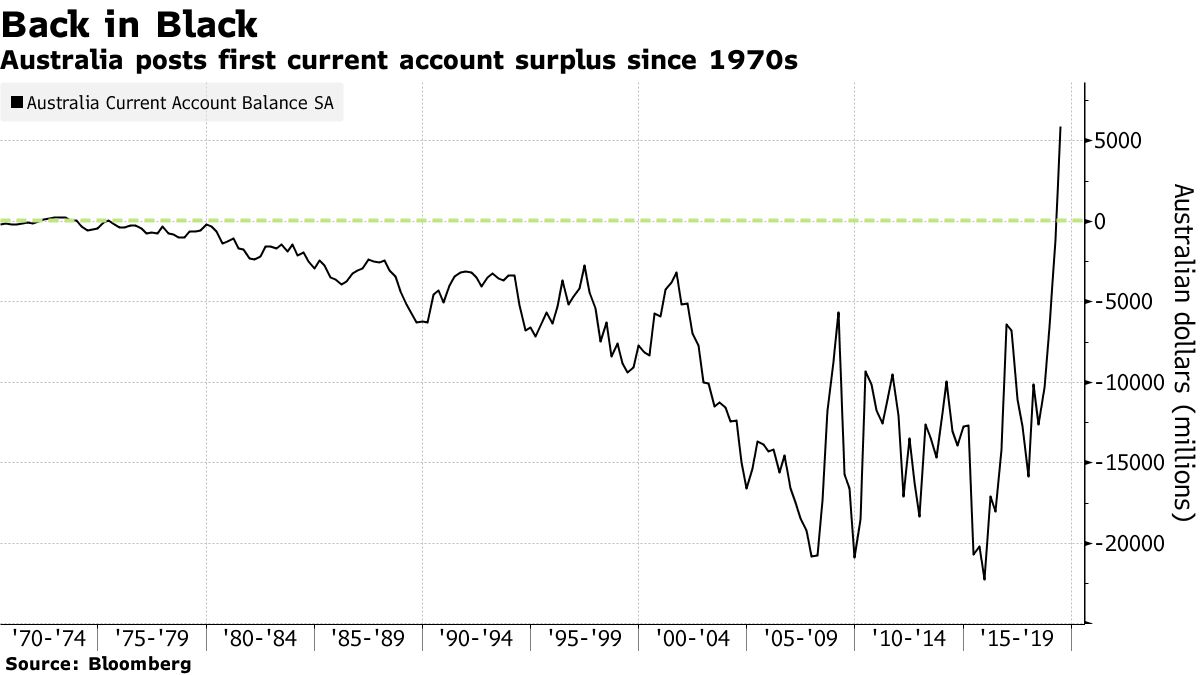

One of very obvious signs that the knife has fallen down, is Australia current account surplus. Australia indeed records significant current account surplus when commodity had a hit from recent inflation and yield crash. It’s no surprising. AUD has been discounted more than 30% in 4 years. It should bring attention to foreigners and start to raise capital inflow.

How do we compare Australia to HongKong which can be a benchmark of China property to global property? HongKong property price continues to increase and they are pegged to USD. I won’t be surprised that HKMA may have been interested with many tier-1 properties like in Wynyard and Barangaroo. These properties which Australian think is most expensive, is now 70% cheaper (=30%[HK property appreciation]+30%[AUDUSD]+10%[local panic]) for HKMA.

Just like countries who experience crisis (Australia with commodity crisis in 2015 following with tightening in lending), local might feel housing price is very expensive in 2017-2018. However it’s actually getting cheaper to the eyes of increasing global properties. This wound will heal when policies untighten their tight lending, following with global economy bailout, possibly from 2019. If my above theory is true, as long as global properties continue to increase and local policies support lending, I may expect Australia property price to reach at least 20% above their highest high in 2017.

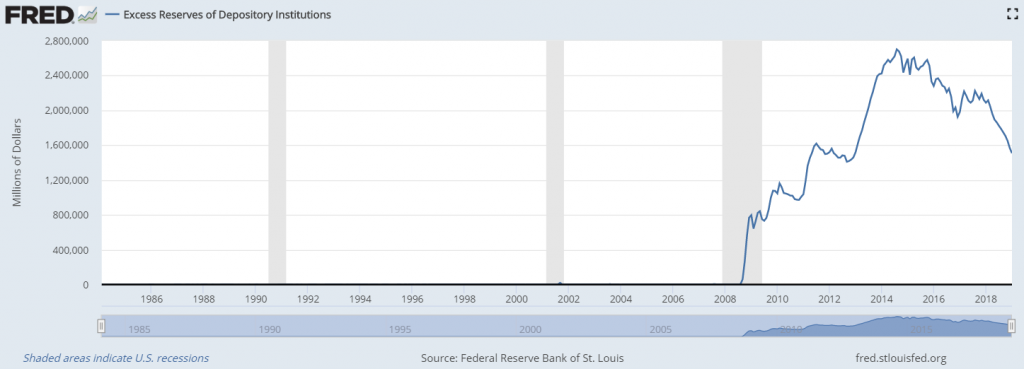

It’s almost impossible to change how nature will behave. However I quite believe something is about to spring. I would have to rely on my theory that normalization couldn’t work beautifully yet. When season is to back easing, we should expect same behavior. Spring water should start flowing from their resource into their monopoly of banks/finance. We shouldn’t be surprised that big 4 banks, CBA, WBC, NAB, and ANZ may have sprung well. My learning machines keep alerting me from couple months ago. This sign is now quite obvious to disclose, after I see recent bounce back in Australia inverted yield.

If property is obviously bottomed or starting to continue its trend, relative high rental income with significant drop in interest should double support price. Indeed tax benefit for investment property is free from equation, supporting even more. Clearance rate is also another leading indicator of price.

It might be a bit clear now that some non-bank lenders are trying to capture some market share to next 2 years with some low rate funding. We could see from 2 years fix rate competition among lenders.

At the same time, even though clearance rate jumps, its volume is still quite low. Real estate agents are now trying to invite sellers to participate. I may think low volume is because sellers don’t want to sell at current low price and expect higher. If that happens, it may show that market is quite strong and not in panic yet.

At the end, it may give few years of opportunity to unload during predicted good economy. We haven’t seen global pro-growth initiatives yet but Australia has started quite big infrastructure spending. Without pro-growth initiatives, it’s almost impossible to transfer asset to risk market and negative yield may be here to stay a bit longer. It means Australia may be one of many which leads pro-growth and risk asset cycle.

I may already have interest/position in this article, therefore it’s not in any case of financial advise.