Heaven is all around us if we have the senses to perceive its simple basiC-major truth.

♬ She said, “There is no reason

And the truth is just plain to see” ♬

For some heavenly reason, the C-major notes from this piece of music have stayed deeply in my mind for decades. The magic of its notes lies in their simplicity—using the most basic and commonly used elements of C-major, climbing from C to C and back again like steps on a staircase. These basic cycles have been around, defining frequency, and as shown in Fourier transform mathematics, frequency defines time—fundamental aspects of our lives, all rooted in C-major.

Similar to our basic C-major investments, which include major financial assets and major foreign exchanges, I’d like to focus on basic stocks and FX. The C-major players here are the DJIA and three major currencies: the USD, EUR and JPY.

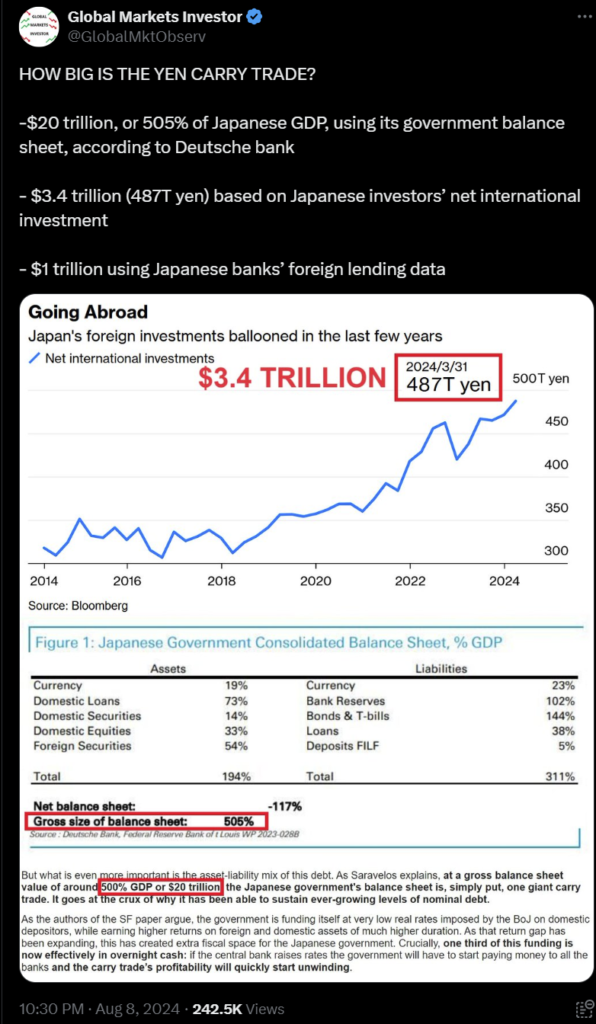

Recently, the JPY triggered one of the biggest VIX shockwaves, which might indicate that the JPY cycle has shifted. This isn’t entirely new; the Bank of Japan (BOJ) has been signaling changes since last year, with the move from 0.1% to 0.25% being just a part of the plan’s execution. However, as usual, the jump from 0.1% to 0.25% seems more significant before it continues toward the 1.00% target. Yet, as we saw in 2015, the EUR can have an even greater impact than the JPY.

While the Carry Trade might seem like the primary culprit, after conducting various correlation analyses, I have my doubts that it’s the main issue, even though the numbers involved are quite significant. It would essentially be C-Major: Return leading to policy support and then their FX.

In July, when the market was celebrating the rise of IWM and small caps, I had my doubts about whether it was a good C-major move. Some argued—mainly financial houses marketing their strategies—that small caps offered better prospects, promising potential capital gains for shareholders. But to me, shifting away from the basic major assets during such a critical time and taking this small bait of share price potential rather than their return, felt like the behaviour of a drunken sailor, especially with interest rates remaining high and a rate cut on the horizon. At that time, every question I asked led me to say “big no.” Perhaps the reality won’t become clear until everything has settled, though by then, it might be too late.

Notes for myself:

- Over the next few months, we should focus on settling the dust from the shockwave. As the “drunken sailors” indulge further and the market sentiment becomes more exuberant, a rebound is highly probable. A continued rally to break all-time highs (ATH) is also still within the realm of possibility.

♬ We skipped the light fandango

Turned some cartwheels across the floor

I was feeling kind of seasick

When the crowd called out for more

The room was humming harder

And the ceiling flew away

When I called out for another drink

The waiter brought a tray ♬

- I haven’t yet observed other significant C-major damages with the USD and EUR, as these two stronger currencies are holding steady.

- Regarding the momentum of the DJIA, even if it experiences a drop in the coming months, there’s still a potential for a rebound to higher levels. However, I won’t factor this possibility into my strategy until the situation becomes clearer, or as I put it, until “the God decides.”

- The third raptor engine has been confirmed off for landing, and similarly, I must be reducing all of my leverages.

- There’s still a chance for a soft landing, though I believe the probability is not greater than 50%.

- Regardless of everything, my basic-major assumption remains that a rate cut signals a slowing economy.

♬ When the miller told this tale

He said that her face at first just ghostly

And then turned a whiter shade of pale ♬

- Even though it might not make complete sense, I still believe the Fed could accompany a rate cut with the end of quantitative tightening (QT), provided that the C-major DXY/USD can move much lower. This scenario would be music to everyone’s ears.

Please note that all ideas expressed in this blog and website are solely my personal opinions and should never be considered as financial advice.